Telangana TSBIE TS Inter 1st Year Economics Study Material 9th Lesson Money, Banking and Inflation Textbook Questions and Answers.

TS Inter 1st Year Economics Study Material 9th Lesson Money, Banking and Inflation

Long Answer Questions

Question 1.

Discuss the evolution of money. Explain its types.

Answer:

Money occupies a unique place in any economic system. Society needs money for a variety of transactions undertaken by the people and the government in the day to day life. Now-a-days, we cannot imagine a society without a role for money.

Evolution of money:

The term ‘money’ was derived from the name of goddess Juno Moneta of Rome. Prior to the introduction of money, the barter system was in vogue. In that system one commodity was exchanged for another commodity. Money was coined in order to overcome the difficulties of the barter system. In the initial stages, animal was used in place of money. Gradually metallic money in the form of gold, silver, bronze and nickel replaced it. In the third stage coins came into use. That was followed by paper money. The latest stage is the credit money in the form of drafts, cheques, debit cards, credit cards etc. Thus, money has undergone different stages in the process of evolution.

Types of money:

1) Commodity Money and Representative Money :

Commodity money includes metallic coins whose face value and intrinsic value are same. It is also called as full-bodied money. Representative money includes coins and paper money whose intrinsic value is less than their face value.

2) Legal Tender Money and Optional Money :

On the basis of legality, money is divided into legal tender money and optional money. Legal tender money is the money which is accepted as per the law by everyone in payment for commodities and services. Credit creation by the commercial banks in the form of drafts, cheques etc., are called as optional money.

3) Metallic Money and Paper Money :

Metallic money is made up of metals such as silver, nickel, steel etc. All coins are metallic money. Paper money is money printed on paper. Currency notes in the form of ₹ 1,000, ₹500, ₹ 100, ₹ 50 and ₹ 10 are paper money

4) Standard Money and Token Money :

Standard money is the money whose face value and intrinsic value are same. Token money is money or unit of currency whose face value is higher than the intrinsic value, e.g. 50 paisa, 1 rupee coins etc.

5) Credit Money :

This is also called as bank money. This is created by commercial banks. This refers to the bank deposits that are repayable on demand and which can be transferred from one individual to the other through cheques.

Question 2.

Define money and explain the functions of money.

Answer:

Money plays a vital role in modern economy. A modem economy is rightly known as monetary economy because of the crucial position that money occupies.

- According to ‘Robertson’ – “Anything which is widely accepted in payment for goods or it discharges of other kinds of business obligations”.

- According to ‘Seligman’ – “One that possesses general acceptability”.

- According to Waker’ – “Money is what money does”.

Functions of money:

1. Primary functions :

a) Medium of exchange :

Money serves as a medium of exchange. It removes the inconveniences of the barter system in which exchange of goods was possible if only there was double coincidence of wants. But money facilitates exchange of commodities without double coincidence wants. Any commodity can be exchanged for money. People can exchange goods and services through the medium of money.

b) Measure of value :

Money serves as a measure of value of goods and services. As common measure of value it has removed the difficulty of the barter system and has made transactions simple and easy. The value of each commodity is expressed in the units of money We call it as price.

2. Secondary functions :

a) Store of value :

The value of commodities and services can be stored in the form of more. Certain commodities are perishable. If they are exchanged for money before they perish, their value be preserved in the form of money.

b) Standard of deferred payments :

Money serves as a standard of deferred payments. In the modern economies most of the business transactions take place on the basis of credit. An individual consumer or a business man may now purchase a commodity and pay for it in future. As this function makes it possible to express future payments in terms of money.

c) Transfer of money :

Money can be transferred from one person to another at any time at any place.

3. Contingent functions :

a) Measurement and distribution of National income : National income of a country be measured in money by aggregating the value of all commodities. This is not possible in a barter system similarly national income can be distributed to different factors of production by making them payment in money.

b) Money equalizes marginal utilits / productivities :

The consumers can equalize marginal utilities of different commodities purchased by them with the help of money. We know how consumers equalize the marginal utility of the taste rupee they speed on each commodity. Similarly firms can also equalize the marginal productivities of different factors of production and maximize profits.

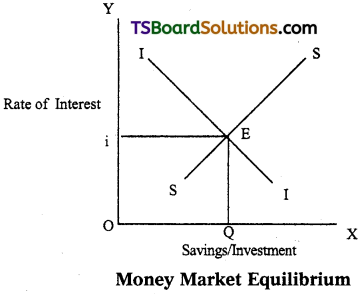

c) Basis of credit :

Credit is created by banks from out of the primary deposits of money supply of credit, in an economy it is dependent on the supply of nominal money.

d) Liquidity :

Money is the most important liquid asset. Interms of liquidity, it is superior than other assets. Money is centpercent liquid.

Question 3.

Describe the functions of the commercial banks.

Answer:

Functions of commercial banks :

Primary functions :

a) Accepting deposits :

The commercial bank is just like any other money lender doing money lending business, bank receives public money in the form of deposits. The deposits mainly are of the following steps.

1) Current deposits :

These deposits have two characteristics. One, there are no restrictions with regard to the amount of withdrawal and number of withdrawals. Banks normally do not pay any interest on current account deposits.

2) Savings deposits :

The sole aim of banks in receiving these deposits is to promote the habit of thrift among low income groups. They have the following characteristics : 1) two or three withdrawals per week are permitted 2) banks pay 4 to 5% interest (nominal) per annum or savings deposits.

3) Recurring deposits :

People will deposit their money in these deposits as monthly installments for a fixed period of time. The bank after expiry of the said period will return the total amount with interest thereon. The rate of interest will be higher than the savings deposits.

4) Fixed deposits :

Deposits received on fixed accounts are called fixed or time deposits. They are left with the bank for a fixed period. The following are the characteristics.

- The amount cannot be withdrawn before the expiry of the fixed period.

- Banks pay high rate of interest than any other deposits.

b) Advancing loans :

Commercial banks release funds so collected for productive purposes by way of loans and advances. Commercial bank usually lend money by way of loans, cash credits, overdrafts, and by discounting bills of exchange.

1) Cash credit :

In this case, the borrower is given a loan. The amount of the loan is deposited in his account in the bank. The loan is not normally paid in cash. The borrower can draw money out of his account as per his needs.

2) Overdraft :

It means allowing the depositor to overdraw his account upto a previous agreed limit. Banks allow overdrafts only to those persons who have their accounts in the bank. The overdraft is granted only for short period for customers.

3) Loans :

Usually a loan is granted against the securities of assets or the personal security of the borrower bank loans and advances carry a high rate of interest. In addition, banks grant call loans for every short period, term loans for longer period and also grant consumer credit for buying durable goods.

4) Discounting bills of exchange :

The banks facilitate trade and commerce by discounting the bills of exchange. This is the most popular form of bank lending.

Secondary functions :

a) Agency services :

Banks act as agents, correspondents and representatives of their customer. As an agent a commercial bank collects and pay cheques, drafts, bills and pay insurance premium subscriptions, rent, income tax etc., as per the instruction of their customers. Banks also act as trusties executors and attorneys.

b) General utility services :

Banks provide some general utility services like :

- Locker facility for safe custody and valuables.

- Issue traveller’s cheques and drafts.

- Transfer of funds.

- Acting a referee to the financial standing of customers.

- Issue letters of credit.

- Finance foreign trade by discounts foreign bills of exchange.

Question 4.

What are the functions of Reserve Bank of India?

Answer:

The Central Bank of our country is Reserve Bank of India. It was established in April 1935, with a share capital of ₹ 5 crores. It was originally owned by private shareholders but was nationalised by the government of India in 1949. It performs all its activities under the Reserve Bank of India Act 1934.

The main aim of RBI is to achieve the monetary stability and to control the credit system of an economy. It performs the following functions.

1) Note issue :

Reserve Bank of India enjoys the monopoly of note issue in the country. It maintains a minimum ₹ 200 crores of gold and foreign exchange reserves of which gold should be ₹ 115 crores. It issue notes in the denominations of ₹ 1,000, ₹ 500, ₹ 100, ₹ 50, ₹ 20, ₹ 10, ₹ 5 and ₹ 2. One rupee note and coins are issued by the finance department of the Government of India. Reserve Bank of India prints all the currency notes in the security press of the Government of India.

2) Banker to Government :

Reserve Bank of India acts as the banker, agent and adviser to the Government of India. It receives money and make payments on behalf of the government and gives temporary advances to the government. It advises the government in all financial matters.

3) Banker’s Bank :

Reserve Bank serves as a banker not only to the government but also to the banks. It provides financial assistance to the commercial banks by giving loans and rediscounting the bills of exchange. It helps the banks by acting as a clearing house for settlement of inter bank transactions and controls the supply of money in the economy through cash reserve ratio.

4) Lender of last resort :

It acts as lender of last resort by granting loans and advances to the commercial banks against some securities viz., treasury bonds, treasury bills and other approved securities. It also provides financial help to banks by rediscounting the eligible bills of exchange.

5) Custodian of foreign exchange reserves :

Reserve Bank of India as a member of the International Monetary fund. It regulates all foreign exchange transactions in the country. It controls and regulates the purchase and sale of foreign exchange through restrictions on exports and imports to maintain the official rate of exchange.

6) Credit controller :

Reserve Bank of India controls the volume of credit in the country. It controls the credit through different methods by appropriate monetary or fiscal policies. It announces credit policy for every six months based on the credit needs of the country. Through this it controls the inflation and deflation.

7) Promotional and development functions :

Reserve Bank of India in order to achieve economic development performs certain promotional and developmental functions.

They are :

- Promoting various financial institutions to provide industrial finance.

- It takes steps for establishment of banks throughout the country and expansion of their branches.

- Encourage the financial institution to provide financial help to agriculture and rural credit.

Question 5.

Define Inflation. Explain the types and effect of Inflation.

Answer:

In a broader sense, the term inflation refers to persistent rise in the general price level over a long period of time. Some of the important definitions are given below :

According to Pigou, “Inflation exists when money income is expanding more than in proportion to increase in earning activity”.

Crowther defined inflation as, “a state in which the value of money is falling, that is the prices are rising.

Types of Inflation:

Inflation is divided into different types based on its pace or rate of inflation and the causes of inflation. They are detailed below :

A) Based on the Rate of Inflation :

On the basis of the rate of inflation, it may be classified into four types.

1) Creeping Inflation :

When rise prices is very slow and small (from 0 to 2 percent), it is called creeping inflation. It helps the economy to grow. It is depicted through O to A in the graph.

2) Walking Inflation :

This is the second stage of inflation. The inflation rate will be between 2% and 4%. It also helps the economy to progress (A to B in the graph).

3) Running Inflation :

When the rate of inflation is in the range of 4-10 percent per annum, it is called running inflation (B to C in the graph). It needs to be controlled.

4) Galloping Inflation or Hyper Inflation :

If the inflation rate exceeds 10 percent, galloping inflation occurs. It may also be called hyper inflation (C to D). It damages the economy.

B) Based on the Cause of Inflation :

On the basis of the cause of inflation, it can be classified into two types :

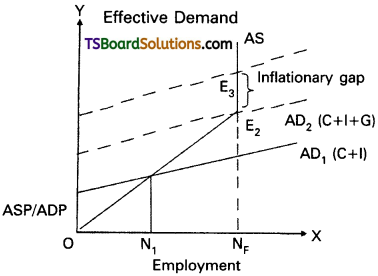

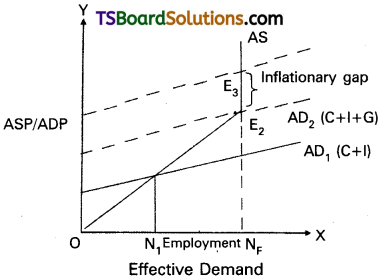

1) Demand-Pull Inflation :

If inflation is caused by an increase in the aggregate demand for commodities over aggregate supply, it is called demand-pull inflation.

2) Cost-Push Inflation :

Prices of the commodities may increase due to increase in the cost of production. Inflation caused by the rise in cost of production is called cost-push inflation. It can again be viewed from two angles : i) wage push and ii) profit push.

Effect of Inflation:

Inflation refers to a persistent upward movement in the general price level rather than once for all rise in it.

The effects of inflation can be divided into two sub-heads.

- Effects of production

- Effects of distribution

It will affect all economic activities in the economy.

A) On production:

a) Mild inflation stimulates production and it increases the profit margin of entrepreneurs.

b) High inflation rate hinders production.

c) Inflation discourages savings. This affects the capital formation which in turn affects production.

B) On distribution:

Inflation produces a deep impact on the distribution of income and wealth of society. A prolonged period of inflation results in the distribution of wealth in favour of rich and affluent classes of society. The concrete effects of inflation on various groups of society are as follows.

Effects on distribution :

Inflation produces a deep impact on the distribution of income and wealth of society. A prolonged period of inflation results in the distribution of wealth in favour of inflation on various groups of society are as follows.

1) Debtors and creditors :

During inflation, debtors are generally the gainers while the creditors are the losses. The reason is that the debtors had borrowed when the purchasing power of money was high and now return the loans when the purchasing power of money is low due to rising prices.

2) On fixed income groups :

Those who get fixed income lose from inflation. Salaried persons people living on past savings, pensioners, interest earners are the worst suffers during inflation because their income remain fixed.

3) On working class :

During inflation working class also suffers worst because wages do not rise as much as the prices of commodities. In addition there is a time lag between the rise in prices and rise in wages. If the trade unions are strong they may get equal increase in money incomes compared to rise in prices.

4) Entrepreneurs :

They experience windfall gains as the prices at their stocks suddenly go up. Inflation thus re-distributes income and wealth in such a way as to harm the interest of creditors, labours, fixed income groups and favours the businessmen, traders and debtors. By meaning the rich richer and poor poorer, inflation is socially undesirable.

C) Social impact :

Economic inequality leads to unequal opportunities in matters of health, education and employment. This results in social injustice.

D) Political effect :

Inflation widens social and economic disparities. It leads to political movements and if government is not responsive. This movement may threaten the stability of governments.

Question 6.

What are the causes of Inflation? Suggest remedial measures to control inflation.

Answer:

Inflation means a rise in the general price level over a long period of time. It occur due to the following reasons.

- Increase in the aggregate demand of commodities.

- Inadequate supply of commodities.

- Increase in the cost of production.

I. The factors that effect the increase in demand :

- Heavy pressure of population.

- Increase in economy’s money supply.

- More public expenditure towards various welfare schemes.

- Reduce in rates of direct taxes.

- Increase in the income levels of individuals.

- Deficit financing by government.

- Conspicuous spending by the people having black money.

- Production in direct tax rates.

II. Factors that increase the cost of production :

- Increase in costs of various factors of production.

- Increase in tax rates.

- Increase in the prices of technology.

- Devaluation of domestic currency.

- Inefficient management and no control on expenditure.

- Lack of optimum allocation of resources.

- Devaluation of domestic currency.

III. Factors that cause inadequate supply :

- Irregular monsoons, floods, interior seeds in agriculture.

- Non-availability of scarcity of inputs and raw materials.

- Under-utilisation of productive capacity.

- Shortage of investment due to non-availability of institutional credit.

- Artificial scarcity due to black-marketing.

- Exports at the cost of domestic supply.

- Long gestation period of certain industries.

Remedial Measures :

Government has to take several steps to control inflation. Some of them are enlisted hereunder:

- Importing the goods which are in short supply in the country.

- Introducing rationing and quota system in case of mass consumption goods whose supply in inadequate to improve their distribution among all the needy sections of the people.

- Controlling prices and eliminating black markets.

- Taking steps to increase production of consumer goods.

- Reducing the supply of money and credit by way of implementing appropriate monetary and fiscal policies.

Short Answer Questions

Question 1.

What is Barter system? What are its difficulties?

Answer:

Barter system means exchange of goods. This system was followed in olden days. But the population and its requirements are increasing, the system became very complicated. The difficulties of barter system are :

1) Lack of coincidence of wants :

Under the barter system, the buyer must be willing to accept the commodity which the seller is willing to offer in exchange. The wants of both the buyer and the seller just coincide. This is called double coincidence of wants. Suppose the seller has a good and he is willing to exchange it for rice. Then the buyer must have rice and he must be willing to exchange rice for goat. If there is no such coincidence direct exchange between the buyer and the seller is not possible.

2) Lack of store value :

Some commodities are perishables. They perish within a short time. It is not possible to store the value of such commodities in their original form under the barter system. They should be exchanged before they actually perish.

3) Lack of divisibility of commodities :

Depending upon its quantity and value, it may become necessary to divide a commodity into small units and exchange one or more units for other commodity. But all commodities are not divisible.

4) Lack of common measure of value :

Under the barter system, there was no common measure value. To make exchange possible, it is necessary to determine the value of every commodity interms of every other commodity.

5) Difficulty is making deferred payments :

Under barter system future payments for present transaction was not possible, because future exchange involved some difficulties. For example suppose it is agreed to sell specific quantity of rice in exchange for a goat on a future date keeping in view the recent value of the goat. But the value of goat may decrease or increase by that date.

Question 2.

Explain the definitions of money.

Answer:

Money plays a vital role in modem economy. A modem economy is rightly known as monetary economy because at the crucial position that money occupies. In the olden days goods were exchanged for goods. Such system is called barter system. However when economics grew there was a tremendous increase in the wants of the people as well as in the number of transactions then barter system became more difficult, in order to eliminate the difficulties in the barter system money came into existence.

Definition of money :

Several economists have defined money in several ways. Some of the prominent definitions are given below.

According to ‘Waker’ – “Money is what money does”.

According to ‘Robertson’ – Money as” anything which is widely accepted in payment for goods or in discharge of other kinds of business obligations”.

According to ‘Seligman’ – Money as “one that possesses general acceptability”.

According to “Crowther” – Money as “anything that is generally acceptable as a medium of exchange and which at the same time acts as a’ measure and store of value”.

It may be found from the above definitions that the main focus is on general acceptability. Anything that used as money should have the general acceptance of the public as medium of exchange because it is for direct exchange of commodities money is fundamentally required. It acts as a common measure of value. However its suitability as a store of value is equally important. Therefore we can consider Crowther’s definition as relatively more comprehensive. It is elaborate and covers the most important functions of money.

Question 3.

Discuss money related concepts.

Answer:

Money was invented to overcome the difficulties of the barter system. Several economists have given definitions for money. Some of them are listed hereunder :

- Robertson defined money as ‘anything which is widely accepted in payment for goods or in discharge of other kinds of business obligations”.

- According to Seligman’s definition, ‘money is one that possesses general acceptability”.

Related Concepts of Money :

When we discuss about money, we come across certain terms like currency, liquidity and near-money. They have different meanings. These concepts are related to money. It is necessary to know them clearly without any conceptual ambiguity.

i) Currency :

Currency is the form in which money is circulated in the economy by the monetary authority i.e., the government and the central bank. Currency includes coins and paper notes. It is only one component of money. Money comprises of not only currency but demand deposit and time deposits also.

ii) Liquidity :

The ability of an asset to be converted into money is termed as liquidity. In other words, conversion takes place with ease. Hence, liquidity may be defined as the ability of any asset to act as a direct medium of exchange.

Money acts as a direct medium of exchange. Hence money is considered as the perfect liquid asset. Other assets are not as liquid as money because they are not accepted by the public as medium of exchange. They have to be converted into money to facilitate exchange to take place. They have liquidity but the degree of liquidity varies from asset to asset.

iii) Near Money :

The term near-money refers to those highly liquid assets which are not accepted as money, but can be easily converted into money within a short period.

Here are some examples of near money :

- savings deposits and time deposits in the commercial banks,

- savings deposits in the post offices, and post office bonds,

- stock and shares of joint stock companies.

- units of UTI.

- savings bonds and certificates.

- treasury bills, and

- bills of exchange and government securities and securities guaranteed by the government.

These assets are close substitutes of money. Hence, they are called near money or quasi-money.

Question 4.

Distinguish between different types of money.

Answer:

Money can be grouped into various items based on the value, material used and the legal status. They are :

1) Commodity money and representative money :

Money is classified into commodity money and representative money on the basis of the intrinsic value it possess.

If the intrinsic value is equal to the face value of coin is called commodity money and if the value is less than the face value, it is called representative money.

2) Legal tender money and optional money :

On the basis of legality money is divided into legal tender money and optional money. If money is accepted as per law by every one is called legal tender money If the acceptance is optional and not according to law is called optional money.

Ex: Cheques.

3) Metallic money and paper money :

Based on the material used money can be divided into metallic and paper money. If money is made up of metals such as silver, nickel, steel etc., all coins are metallic money and if money is printed on papers is called paper money.

4) Standard money and token money :

If the face value and intrinsic value are same, then the money is called standard money and if the face value is higher than the intrinsic value is called token money.

5) Credit money :

It is also called as bank money. This is created by commercial banks. This refers to the bank deposits that are repayable on demand and can be transferred from one person to other through cheques.

Question 5.

Explain the primary and secondary functions of money. [Mar. ’17, ’16]

Answer:

Money has many important functions to perform. These functions may be classified as :

i) Primary functions, ii) Secondary functions, iii) Contingent functions, and iv) Static and dynamic functions.

1. Primary Functions of Money :

The primary functions of money are really as the technical and important functions of money. They are two types :

i) Medium of Exchange :

Money serves as a medium of exchange. It removes the inconveniences of the barter system in which exchange of goods was possible if only there was double coincidence of wants. But money facilitates exchange of commodities without double coincidence wants. Any commodity can be exchanged for money. People can exchange goods and services through the medium of money.

ii) Measure of value :

Money serves as a measure of the value of goods and services. As common measure of value it has removed the difficulty of the barter system and has made transactions simple and easy. The value of each commodity is expressed in the units of money. We call it as price. In view of this function of money, the values of different commodities can be compared and the ratios between the prices of different commodities can be determined easily.

2. Secondary Functions of Money :

Money has two secondary functions which are stated hereunder :

i) Store of value :

The value of commodities and services can be stored in the form of money. Certain commodities are perishable. If they are exchanged for money before they perish, their value be preserved in the form of money. Otherwise they perish and their value is lost forever. Even in the case of durable commodities, their value may diminish over a period of time. But their value can be stored, without any decline, in the form of money by exchanging them for money.

ii) Standard of Deferred Payments :

Money serves as a standard of deferred payments. In modem economies, most of the business transactions take place on the basis of credit. An individual consumer or a business man may now purchase a commodity and pay for it, in future as this function makes it possible to express future payments in terms of money. Similarly one can borrow certain amount of money now and repay it in future.

iii) Transfer of money :

Money can be transferred from one person to another at any time at any place.

Question 6.

State the contingent, static and dynamic functions of money.

Answer:

Money plays a vital role in modem economy.

According to Waker’ – “Money is what money does”.

According to ‘Robertson’ – “Anything which is widely accepted in payment for goods discharge of other kinds of business obligations”.

Contingent functions :

a) Measurement and distribution of National income :

National income of a country be measured in money by aggregating the value of all commodities. This is not possible in a barter system similarly national income can be distributed to different factors of production by making payment then in money.

b) Money equalizes marginal utilises / productivities :

The consumers can equalize marginal utilities of different commodities purchased by them with the help of money. We know how consumers equalize the marginal utility of the taste rupee they speed on each commodity. Similarly firms can also equalize the marginal productivities of different factors of production and maximize profits.

c) Basis of credit :

Credit is created by banks from out of the primary deposits of money supply of credit, in an economy is dependent on the supply of nominal money.

d) Liquidity :

Money is the most important liquid asset. Interms of liquidity it is superior than other assets. Money is cent percent liquid.

Static and Dynamic Functions of money :

Paul Engig classified functions of money as static and dynamic functions.

i) Static Functions :

We have learnt the medium of exchange, measure of value, store of value and standard of deferred payment are the traditional or technical functions of money. Engig called them static functions. These functions facilitate emergence of price mechanism. They do not show any effect on the economic development.

ii) Dynamic Functions :

The functions of money which influence output, consumption, distribution and general price level are called dynamic functions. They make the entire economy dynamic. The functions shown as contingent functions come under dynamic functions.

Question 7.

Explain different kinds of deposits accepted by the commercial banks.

Answer:

Commercial banks pay a very important role in the economic growth of a country. Commercial banks are the most important source of institutional credit in the money market. Banks attract savings from the people and encourage investment in industry, trade and commerce. Bank is a profit seeking business firm dealing in money and credit.

The word bank is derived from the “German” word “bankco” which means joint stock or joint fund. Banking in Britain originated with the lending of money by wealthy individuals to merchants who wished to borrow.

According to ‘Richard Sydney’ sayers – “Banks are institutions whose debts usually referred to as “Bank deposits” are commonly accepted in final settlement of other people’s debts”.

Accepting deposits :

The commercial bank just like any other money lender is doing money lending business. Bank receives public money in the form of deposits. The deposits mainly are of the following types.

a) Current deposits :

These deposits have two characteristics.

1) There are no restrictions with regard to the amount of withdrawal and number of withdrawals.

2) Banks normally do not pay any interest on current account deposits.

b) Savings deposits :

The sole aim of banks in receiving these deposits is to promote the habit of thrift among low income groups. They have the following characteristics :

- Two or three withdrawals per week are permitted.

- Banks pay 4% to 5% interest per annum on savings deposits.

c) Recurring deposits :

People will deposit their money in these deposits as monthly installments for a fixed period of time. The bank after expiry of the said period will return the total amount with interest thereon. The rate of interest will be higher than the saving deposits.

d) Fixed deposits :

Deposits of fixed accounts are called fixed or time deposits they are left with the bank for a fixed period. The following are the characteristics.

- The amount cannot be withdrawn before expiry of fixed period.

- Bank pay high rate of interest than any deposits.

Question 8.

Explain different types of loans and advances paid by the commercial banks.

Answer:

According to “Crowther”- “A bank is a dealer in debts his own and other people”.

Banking means the accepting for the purpose of lending or investment of deposits of money from the public repayable or demand or otherwise and withdrawable by cheque, draft or otherwise.

Advancing loans :

Commercial banks release funds so collected for productive purposes by way of loans and advances. Commercial bank usually lend money by way of loans, cash credit, overdrafts and by discounting bills of exchange.

a) Cash credit :

In this case, the borrower is given a loan is deposited in his account in the bank. The loan is not normally paid in cash. The borrower can draw money out of his account as per his needs.

b) Overdraft :

It means allowing the depositor to overdraft his account upto a previously agreed limit. Banks allow overdraft only to those persons who have their accounts in the bank. The overdraft is granted only for a short period for customers.

c) Loans :

Usually a loan is granted against the securities of assets or personal security of the borrowed bank loans and advances carry a high rate of interest. In addition, banks grant call loans for every short period. Term loans for longer period and also grant consumer credit for buying durable goods.

d) Discounting bills of exchange :

The bank facilitates ‘trade and commerce’ by discounting the bills of exchange. This is the most popular form of bank lending.

Question 9.

Point out the agency and general utility functions of commercial banks.

Answer:

The following are agency functions and general utility functions.

Agency Function :

Commercial banks perform certain agency functions also. On certain occasions they act as agents of the customers. Some of the important agency functions are :

- Collection of cheques, drafts, bills of exchange etc., of their customers from other banks.

- Collection of dividends and interest from business and industrial firms.

- Purchase and sale of securities, shares, debentures, government securities on behalf of the customers.

- Acting as trustees and keeping their funds in safe custody.

- Making payments such as insurance premium, income tax, subscriptions etc., on behalf of their customers as per their request.

General Utility Functions :

Besides the agency functions, commercial banks provide certain utility services to their customers. They are :

- Provision of locker facility for the safe custody of the silver, gold ornaments and important and valuable documents for which service rent is collected.

- Transfer of money of the customers from one bank to the other by way of demand drafts, mail transfer by collecting commission from them.

- Provision of online transfer facility of money from one bank to the other.

- Issue of letters of credit to enable the customers to purchase commodities on the basic of credit.

- Endorsing and providing guarantee to the shares issued by the joint stock companies.

- Issue of traveler’s cheques to customers to avoid the risk of carrying of cash.

- Providing foreign exchange to the customers for exports and imports in connection with their business.

- Conveying information on behalf of their customers to the businessmen operating in other places and also collecting information of such businessmen and provide it to the customers. Thus they act as ‘referees’.

Question 10.

State any three major (general) functions of a central bank.

Answer:

Central bank is the apex institution of the banking system of a country. It controls, regulates, and activities of the country’s banking system. Reserve Bank of India (RBI) is our central bank. It was established on 1st, April 1935 with a share capital of ₹ 5 crore. It was originally owned by private shareholders but was nationalized by the Government of India in 1949. It performs all important functions of the central bank under the Reserve Bank of India Act, 1934.

Reserve Bank of India performs the following functions:

General Functions :

a) Note issue :

Reserve Bank of India has the monopoly of note issue in the country. It maintains gold and foreign exchange reserves of a minimum ₹ 200 crores of which gold should be worth ₹ 115 crores. There is a separate issue department to issue currency notes. At present Reserve Bank of India issues currency notes of the denomination ₹ 1,000, ₹ 500, ₹ 100, ₹ 50, ₹ 20, ₹ 10, ₹ 5. One rupee note and coins are issued by the Finance Ministry of the Government of India but circulated by the Reserve Bank of India.

2) Banker to Government :

Reserve Bank of India acts as the banker, agent and adviser to the Government of India. It acts as an agent of the Government of India and all the state governments except the Government of Jammu and Kashmir. It receives money and makes payments on behalf of the government and keep the cash balances as deposits without any interest. It assists the government in floating new loans and the management of public debt. It gives temporary advances to the Government in all financial matters.

3) Banker’s Bank :

Reserve Bank serves as a banker not only to the government but also to the banks. According to Banking Regulation Act, 1934 all the scheduled banks are bound by the law to maintain with the Reserve Bank of India a part of their total deposit amount as cash balances. This ratio is called the Cash Reserve Ratio (CRR).

Question 11.

Define inflation and explain its types. [Mar. 17]

Answer:

Inflation, we mean a general rise in the prices in the ordinary language it is rapid upward movement of prices in a broader sense. The term inflation refers to persistent rise in the general price level over a long period of time.

According to Prof.Hawtrey : “Issue of too much currency”

According to ‘Dalton’:

Defined inflation as Too much Money is chasing too few goods”.

According to ‘Pigou’:

“Inflation exists when money income is expanding more than in proportion to increase in earning activity”.

According to Irving Fisher :

“Inflation occurs when the volume of money increases faster than the available supply of goods”.

According to Samuelson :

“Inflation denotes a rise in the general level of prices”. Types of Inflation:

1) Creeping inflation :

When rise in the prices is very slow and small, it is called creeping inflation.

2) Walking inflation :

This is the second stage of inflation. The inflation rate will be between 2% and 4%.

3) Running inflation :

When the rate of inflation is in the range of 4-10% per annum, it is called running inflation.

4) Galloping inflation or hyper inflation :

If the inflation rate exceeds 10%, galloping inflation occurs. It may also called hyper inflation.

Question 12.

Identify the causes of Inflation.

Answer:

In a broader sense, the term inflation refers to persistent rise in the general price level! over a long period of time. Some of the important definitions are given below :

According to Pigou, “inflation exists when money income is expanding more than in j proportion to increase in earning activity”.

Crowther defined inflation as, “a state in which the value of money is falling, that is the prices are rising.

Causes of Inflation :

Broadly speaking, inflation may occur due to the following reasons. Inflation is caused either by excess demand or supply shortage or increased cost of production.

I. Factors Causing Increase in the Aggregate Demand of Commodities :

- High rate of population growth.

- Increase in non-plan and plan expenditure of the government.

- Rise in the per capita income of the people due to economic development.

- Increased spending by the government on employment programmes and welfare schemes.

- Heavy investment on development projects with long gestation period.

- Increase in the money supply in the economy.

- Liberal availability of credit for unproductive economic activities.

- Deficit financing by the government.

- Conspicuous spending by the people having black money.

- Reduction in direct tax rates.

II. Factors that Increase the Cost of Production :

- Increase in costs of lands, rents, wage rates and interest rates.

- Rise in the price of capital equipment and raw materials due to their shortage.

- Increase in indirect tax rates.

- Excessive wear and tear of machinery and lack of modernization.

- Import of machinery and equipment at higher prices.

- Lack of optimum allocation of resources.

- Devaluation of domestic currency.

- Inefficiency in management and lack of control over wasteful expenditure.

III. Factors Causing Inadequate Supply:

- Failure of monsoons, floods, pests, use of spurious seeds etc., in agriculture.

- Shortage of investment due to inadequate availability of institutional credit.

- Non-availability or inadequate availability of inputs and raw materials.

- Underutilization of productive capacity due to power shortage, labour unrest etc.

- Long gestation period of certain industries.

- Exports at the cost of domestic supply.

- Artificial scarcity due to black-marketing.

Question 13.

Explain the effects of inflation. [Mar. 16]

Answr:

In a broader sense, the term inflation refers to persistent rise in the general price level over a long period of time. Some of the important definitions are given below :

According to Pigou, “inflation exists when money income is expanding more than in proportion to increase in earning activity”.

Crowther defined inflation as, “a state in which the value of money is falling, that is the prices are rising.

Effects of Inflation:

Inflation affects economic activities such as production, distribution, social and political relations in an economy adversely.

A) On Production:

- Mild inflation stimulates production as it increases the profit margin entrepreneurs.

- High inflation rate of hyper inflation hinders production.

- Inflation discourages savings. This affects the capital formation which intum affects products.

B) On Distribution:

The impact of inflation is not uniform on all sections of people. It affects certain sections of the people adversely while certain other sections gain because of inflation. This can be elaborated as follows :

1) Fixed Income Groups :

People belonging to fixed income groups suffer due to inflation because their incomes do not increase as prices of commodities rise.

2) Working Class :

Workers and wage earners in the informal sector normally work for subsistence living. Even otherwise their wages do not rise as and when prices rise. Such people suffer because of inflation.

3) Debtors and Creditors :

Inflation results a decline in the value of money. Therefore, creditors lose as the value of money is higher when they have lent and less when they are repaid. But debtors gain because the value of money is high when they borrowed but low when they repay.

4) Consumers and Entrepreneurs :

Consumers lose but entrepreneurs gain because of inflation.

C) On Social Justice Front :

Economic inequality leads to unequal opportunities in matters of health, education and employment. This results in social injustice.

D) On Political Front:

Inflation widens social and economic disparities which cause frustration among the sufferers. This provides opportunity for political movements and if the government is not responsive, the movements may threaten the stability of governments.

Question 14.

What are the Components of Money Supply.

Answer:

Money supply includes all money in circulation in the economy. The components of money supply may vary from country to country. Broadly speaking, money supply consists of the following:

1. Currency Issued by the Central Bank :

In any country the central bank issues currency. Currency consists of paper notes and coins. In India Reserve Bank of India, which is the central bank of the country, issues notes in the denominations of 2,000, 500, 100, 50, 20 and 10 rupees. The one rupee note (which is not in circulation in practice) and coins are issued by the Finance Ministry of the Government of India.

2. Demand Deposits Created by Commercial Banks :

Bank deposits are a prominent component of money supply. Commercial banks create credit from the primary deposits of money received from the public. Credit is created in the form deposits called derived or secondary deposits. In developed countries they constitute nearly 80 per cent of money supply.

Very Short Answer Questions

Question 1.

What is Barter System? [Mar. ’16]

Answer:

Prior to the introduction of money, the barter system was in vogue. In the system on commodity was exchanged for another commodity. Under this system, no one was able to produce all goods at their disposal. As a consequence, they used to exchange commodities among themselves. For instance, a producer for paddy used to exchange paddy for clothes from the producers of cloths. Thus, this system was beset with several difficulties.

Question 2.

What are the functions of money?

Answer:

Money has many important function to perform. These functions may be classified as

i) Primary functions, ii) Secondary functions, iii) Contingent functions and iv) Static and dynamic functions. .

Question 3.

What is paper money?

Answer:

Paper money is made of paper. Currency notes in the form of ₹ 2,000, ₹ 500, ₹ 100, ₹ 50, ₹ 20, ₹ 10 are printed on paper in India.

Question 4.

What do you understand by stone of value of money?

Answer:

By this functions money preserve the value of perishable commodities in the form of money if they are exchanged before they prism. It stores the value of durable commodities also.

Question 5.

What is token money?

Answer:

Token money is money or unit of currency whose face value is higher then the intrinsic value. Ex. 1, 2 and 5 rupees coins, etc.

Question 6.

What are the Monetary Aggregates of RBI?

Answer:

Monetary Aggregates :

In India money supply is measured in terms fo the following monetary aggregates by RBI at present.

M0 = Currency in circulation + Banker’s deposits with the RBI + Other deposits with the R.B.I.

M1 = Currency with the public + demand deposits with the banking system + Other deposits with the R.B.I.

M2 = M1 + time liability portion of saving deposits with banking system + Certificates of deposits issued by banks + term depostis maturing within one year. [Excludes CD’s] .

M3 = M2 + term deposits over one year maturity + call/term borrowings of banks.

Question 7.

Distinguish between Saving deposits and Time deposits.

Answer:

Savings deposits :

These are the deposits made into the savings account of a bank. The public with small savings fund it safe to keep their money in the savings account of the banks. They encourage savings habit among the public. They are most convenient savings habit among the public. They are most convenient to the small businessmen, salaried employees, artisans and people belonging to the low and middle income groups. The interest paid on these deposits is comparatively low and is around 4% per annum.

Time deposits :

These are also called fixed deposits because the money is deposited with the bank for a fixed period of time. The deposit can be withdrawn only after the expirty of maturity period. However, the depositor has an option to borrow against the security of these deposits. These deposits carry more interest than the savings deposits. The rate of interest varies from 6% per annum to 12% per annum, depending on the period of deposit.

Question 8.

Explain creation of Credit.

Answer:

This is also called bank money. This is created by commercial banks. This refers to the bank deposits that are repayable on demand and which can be transferred from one individual to the other through cheques.

Question 9.

What are the uses of credit cards in the modern economy?

Answer:

Credit Cards :

Now-a-days banks have devised new methods of giving loans to the customers. One such popular method is issuance of the credit card. A credit card holder can use his/her card to purchase goods on credit from specified firms and shops subject to certain regulations. The firms collect the amount of the bills from the banks which issued the credit card. The card holder pays the amount to the bank on a later date with or without interest. Each credit card has a credit limit. The card holder can draw cash also subject to the limit specified by the bank. The credit cards have become very much popular. Certain sections of the population are given specific cards like Kisan cards.

Question 10.

What is Net Banking? Explain the merits of it. [Mar. ’17, ’16]

Answer:

Net banking also called internet or online banking. It is the process of conducting banking transactions over the internet. Viewing bank statements and the status of a bank account online comes under the definitions of net banking.

Question 11.

Write about the main objectives of Central Bank.

Answer:

Central Bank is the apex institution of the banking system in a country. It controls, regulates and supervises the activities of the country’s banking system. The Reserve Bank of India works to achieve the following objectives :

- Regulating the issue of currency notes.

- Achieving the monetary stability in the economy.

- Controlling the credit system.

- Providing guidance to commercial banks.

- Evolving and implementing uniform credit policy throughout countiy.

Question 12.

What is Clearance House.

Answer:

Businessmen and other customers issue cheques towards payment for their transactions. A businessman or customer may get a cheque issued on a bank in which he has no account. He has to deposit it in his bank and which collects the amount from the bank on which the cheque is issued. This happens on a large scale everyday and calls for inter-bank settlement of accounts. Since all the commercial banks maintain deposit accounts with the Reserve Bank of India, it all cheques to settle the inter-bank transactions by making appropriate entries in the accounts of the commercial banks. For this purpose the Reserve Bank established clearing houses at different places.

Question 13.

Explain the Types of Inflation.

Answer:

Inflation is divided into different bases on its pace or rate of inflation and the causes of inflation. They are detailed below :

1) Based on the Rate of Inflation :

On the basis of the rate of inflation, it may be classified into four types. :

- Creeping inflation

- Walking inflation

- Running inflation

- Galloping inflation

2) Based on cause of inflation :

- Demand pull inflation

- Cost push inflation

Question 14.

Who are affected by the inflation?

Answer:

Inflation affects economic activities such as production, distribution, social and political relation in an economy adversely.

Question 15.

What are the uses of overdrafts?

Answer:

Overdraft: This is a facility allowed by the bank to the current account holders. They are allowed to withdraw money, with or without security, in excess of the balance available in their account, up to a limit. This facility is available as a temporary measure to the borrowers to meet their short needs in case of shortage of regular funds. Interest is charged on the amount of actual withdrawal.

Question 16.

Which Bank is called as bankers bank and why?

Answer:

Banker’s Bank :

Reserve Bank serves as a banker not only to the government but also to the banks. According to Banking Regulation Act, 1934 all the scheduled banks are bound by the law to maintain with the Reserve Bank of India a part of their total deposit amount as cash balances. This ratio is called the Cash Reserve Ratio (CRR). Reserve Bank provides financial assistance to the commercial banks in times of their financial stringency by giving loans or rediscounting the bills of exchange. It acts as clearing house for Settlement of inter bank accounts.

Question 17.

What are the dynamic functions of money?

Answer:

The function of money which influence output consumption, distribution and the given price level are known as dynamic functions. They make the entire economy into dynamic. The contingent function explained about under the perview of dynamic functions.

Question 18.

What is currency?

Answer:

Currency is the form in which money is circulated in the economy by the monetary authority. Currency includes coins and paper notes. It is only one component of money.

Question 19.

What is cash credits?

Answer:

Cash credit is a type of loan given by the commercial bank which facilitaties with drawal of loan amount in instalments as and when necessary.

Question 20.

What is meant by discounting of bills of exchange?

Answer:

Bills of exchange are undertakings written by the buyers and given to sellers when the transaction is made on credit basis. The buyer undertakes to make payment after a specified period or on a specified future date. The traders who posses such bills of exchange with them may approach the banks for discounting of the bills of exchange when they need money. The commercial banks pay advances by discounting the bills of exchange with or without security.

![]()