Telangana TSBIE TS Inter 1st Year Economics Study Material 6th Lesson Theories of Distribution Textbook Questions and Answers.

TS Inter 1st Year Economics Study Material 6th Lesson Theories of Distribution

Long Answer Questions

Question 1.

Explain critically the marginal productivity theory of distribution.

Answer:

This theory was developed by J.B. Clark. According to this theory, the remuneration of a factor of production will be equal to its marginal productivity. The theory assumes perfect competition in the market for factors of production. In such a market, average cost and marginal cost of each unit of factor of production are the same as they are equal to the price or cost of a factor of production.

For example, if four tailors can stitch ten shirts in a day and five tailors can stitch thirteen shirts in a day, then the marginal physical product of the 5th tailor is 3 shirts. If stitching charge for a shirt is ₹ 100/-, then the marginal value product of three shirts is ₹ 300/-. According to this theory, the 5th person will be remunerated ₹ 300/-. Marginal physical product is the additional output obtained by using an additional unit of the factor of production. If we multiply the additional output by market price we will get marginal value product or marginal revenue product.

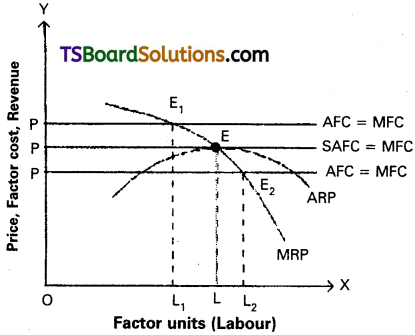

At first stage when additional units of labour are employed the marginal productivity of labourer increases up to certain extent due to economies of scale. If additional units’ of labour are employed beyond that point the marginal productivity of labour decreases. This can be shown in the given figure.

In the figure, OX axis represent units of labour and OY represent price/revenue/cost. At a given price, OP the firm will employ OL units of labour where price OP = L. If it employs less than ‘OL’ i.e., OL1 units, MRP will be E1L1, which is higher than the price OR If firm employs more than OL units upto OL2, price is OP is more than E2L2. So the firm decreases employment until price = MRP till OL. At that point ‘E’ the additional unit of labour is remunerated equal to his marginal productivity.

![]()

Question 2.

Define rent and explain the Ricardian Theory of Rent.

Answer:

David Ricardo was a 19th century economist of England, who propounded a systematic theory of rent. Ricardo defined rent as “that portion of the procedure of earth which is paid to the landlords for the use of the original and indestructible powers of soil”. According to Ricardo, rent arises due to differential in surplus occurring to agriculturists resulting from the differences in fertility of soil of different grades of land.

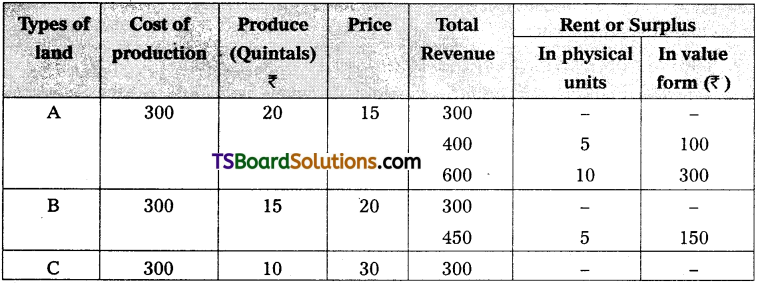

Ricardian theory of rent is based on the principle of demand and supply. It arises in both extensive and intensive cultivation of land. When land is cultivated extensively, rent on superior land equals the excess of its produce over that of the inferior land. This can be explained with the following illustration.

We can imagine that a new island is discovered. Assume a batch of settlers go to that Island. Land in this Island is differ in fertility and situation. We assume that there are three grades of land A, B, and G. With a given application of labour and capital superior lands will yield more output than others. The difference in fertility will bring about differences in the cost of production, on the different grades of land. They first settle on A’ grade land for cultivation of com. A’ grade land yields say, 20 quintals of com with the investment of ₹ 300. The cost of production per quintal is ₹ 15 (300/20). The price of com in the market has to cover the cost of cultivation. Otherwise the farmer will not produce corn. Thus, the price in the present case should be atleast ₹ 15 per quintal.

As time passes, population increases and demand for land also increases. In such a case, people have to cultivate next best land, i.e., ‘B’ grade land. The same amount of ₹ 300 is spent on B’ grade land gives only 15 quintals of com as ‘B’ grade land is less fertile. The cost of cultivation on B’ grade land risen to ₹ 20 (300/15) per quintal of com. If the price of corn per quintal in the market is then ₹ 20, the cultivator of ’B‘ grade land will be not cultivate. Therefore, the price has to be high enough to cover the cost of cultivation on ’B’ grade land. Hence, the price also rises to ₹ 20. There is no surplus on ‘B’ grade land. But on A’ grade land, the surplus is 5 quintals or ₹ 100 (5 × 20).

Further, due to growth of population demand for land and corn increased. This necessitates, the cultivation of ‘C’ grade land with ? 300 investment cost. It yields only 10 quintals of com. Therefore, the per quintal production cost rises to 30 (300/10). Then the price per quintal must be atleast ? 30 to cover the cost of production. Otherwise C’ grade land will be withdrawn from cultivation. At price ? 30 C’ grade land yield no surplus or rent. But A grade land yields still layer surplus of 10 quintals or ? 300 (10 x 30). But surplus or rent on ‘B’ grade land has 5 quintals or ? 150 (5 x 30). But there is no surplus or rent on ‘C’ grade land. It covers just the cost of cultivation. Hence, ‘C’ grade land is a marginal land which earns no rent or surplus.

This can also be explained with the following table.

The essence of Ricardian theory of rent.

- Rent is a pure surplus.

- Rent is differential surplus.

- Rent does not determine or enter into price.

- Diminishing returns applies to agricultural production.

- Land is put to only one use, i.e., for cultivation.

Ricardian theory’ of rent can be explained with the help of the above diagram.

In the above diagram, the shaded area represents the rent or differential surplus. The least fertile land, i.e., C does not carry any rent. So it is called marginal land or no rent land.

Question 3.

What is meant by real wages? What are the factors that determine real wages?

Answer:

The amount of goods and services that can be purchased with the money wages at any particular time is called real wage. Thus, real wage is the amount of purchasing power received by worker through his money wage.

Factors Determining the Real Wage :

1. Methods of Form of Payment :

Besides money wages, normally the labourers get some additional facilities provided by their management. Ex : Free housing, free medical facilities etc. As a result, this real wage of the worker will be high.

2. Purchasing Power of Money :

An important factor which determines the real wage is the purchasing power of money which depends upon the general price level. A rise in general price level will mean a full in the purchasing power of money, causes decline in real wages.

3. Nature of Work :

The working conditions also determine the real wages of labourer. Less duration of work, ventilation, fresh air etc., result in high real wages, lack of these facilities then the real wages are low even though if money wages are high.

4. Future Prospects :

Real wage is said to be higher in those jobs where there is possibility of promotions, hike in wages and vice-versa.

5. Nature of Work :

Real wages are also determined by the risk and danger involved in the work. If work is risky wages of labourer will be low though money wages are high. Ex : Captain in a submarine.

6. Timely Payment :

If a labourer receives payment regularly and timely the real wages of the labourer is high although his money wage is pretty less and vice-versa.

7. Social Prestige :

Real wage depends on social prestige. The money wages of Bank officer and judge are equal, but the real wage of a judge is higher than bank officer.

8. Period and Expenses of Education :

Period and expenses of training also affect real wages.

![]()

Question 4.

Explain about the gross interest and net interest.

Answer:

The concept of interest are two types namely, gross interest and net interest.

Gross Interest :

The payment which the lender receives from the borrower excluding the principal is gross interest. It comprises the following payments :

Net Interest :

It is the payment for the service of capital or money only. This is the interest in economic sense.

Keynes’ Liquidity Preference Theory :

Keynes proposed a monetary explanation of the rate of interest. He said that interest is determined by both the demand for and supply of money. According to J.M. Keynes, “Interest is the reward paid for parting with liquidity for the specified period”.

A. Supply of Money :

Supply of money refers to the total quantity of money in circulation. Though the supply of money is a function of the rate of interest to a degree, supply of money is fixed or perfectly inelastic at a given point of time. It is determined by the central bank of a country.

B. Demand for Money :

Keynes coined a new term liquidity preference. People demand money for its liquidity. The desire to hold ready cash is liquidity preference. The higher the liquidity preference, the higher will be the rate of interest to be paid to induce them to part with their liquid assets. The lower the liquidity preference, the lower will be the rate of interest that will be paid to the cash holders. People demand money basically for three reasons : 1) Transactions motive 2) Precautionary motive 3) Speculative motive.

1) Transaction Motive :

People desire to keep cash for the current transactions of personal and business exchanges. The amount kept for this purpose depends upon the income and business motives.

2) Precautionary Motive :

People keep cash in reserve to meet unforeseen expenses like illness, accidents, unemployment etc. Businessmen keep cash in reserve to gain from unexpected deals in future. Therefore, both individuals and businessmen keep cash in reserve to meet unexpected needs.

3) Speculative Motive :

Speculative motive for money relates to the desire to hold cash to take advantage of future changes in the rate of interest and bond prices. The price of bonds and the rate of interest are inversely related. If the prices of bonds are expected to rise then the rate of interest is expected to fall, as businessmen will buy bonds to sell them when their prices rise and vice versa. Low bond prices are indicative of high interest rates, and high bond prices reflect low interest rates.

The demand for money is inversely related to the rate of interest.

The transaction and precautionary motives are relatively interest inelastic, but are highly income elastic. In the determination of rate of interest, these two motives do not have any role. Only the speculative motive is interest elastic and this plays very important role in determining the rate of interest with the given supply of money. When the demand for money and supply of money are equal, along with the equilibrium, rate of interest also be determined.

Question 5.

What is meant by profit? Explain briefly various theories of profit.

Answer:

Profit is the reward paid to the entrepreneur for his services as an organizer in the process of production.

Theories of Profit:

1. Dynamic theory of profit :

This theory was propounded by J.B.Clark. According to Clark, “Profit is the difference between the price and cost of production of commodity”. He viewed that profit as a reward for entrepreneurial dynamism. Dynamic changes like increase in population, new method of production etc., result in increase in profit. In a static economy due to lack of these changes entrepreneurs receive only wages but not profit. Hence, profits are the result of the dynamic changes only.

2. Innovation theory of profit :

This theory was developed by Joseph Schumpeter. According to Schumpeter, “profit is the reward paid to the entrepreneur for his inventive skills”. Because of these inventions profits arise as a difference between prices and costs of production.

According to Schumpeter, entrepreneur must break the circular flow by introducing innovations. They are :

- Introduction of new good.

- Introduction of new method of production.

- Reorganisation of industry.

- Opening up of a new market.

- Discovery of new source of raw materials.

So these innovations, the cost of production remains below its selling price and thus, profit arises.

Thus profit is paid to entrepreneur for innovating but not for risk taking.

3. The risk theory of profit :

This theory was proposed by Prof. Hawley. Profits are the reward for an entrepreneur for risk-taking. So the residual part of income after paying all factors of production goes to the entrepreneur for risk taking. Fluctuations in future prices, demand etc., are involved in risk taking.

According to Prof. Hawley, “those who face risks in business will be able to earn an excess of payment above the actual value of risk in the form of profit”.

4. Uncertainty theory of profit :

This theory was formulated by Prof. Knight. It is a modified version of risk bearing theory of profits. According to him, profit as the reward for bearing uninsurable risks and uncertainties. He classified risks into two types.

- Unforeseen insurable risks like fire, theft.

- Unforeseen non insurable risks like changes in prices, demand and supply. These uninsurable risks cannot be calculated.

According to Prof. Knight, “Profit cannot be treated as the reward for risk taking only for reward for uncertainty bearing”.

5. Walker’s theory of profit :

This theory was developed by Walker. According to Walker, “Profits are a rent paid for the abilities of entrepreneur”. Walker theory states that profits arise due to the differences in efficiency and ability of entrepreneurs. Hence, efficient and able entrepreneurs are paid profits.

Short Answer Questions

Question 1.

Explain the types of distribution in income.

Answer:

Distribution refers to that branch of economies which analyses how the national income of a community is divided among the various factors of production, distribution then refer to the sharing of the wealth that is produced among factors of production. It is the pricing of factors of production. The distribution of income may be personal or functional. Economies is concerned with functional distribution. The distinction between them is briefly explained here.

1. Functional Distribution :

Functional distribution deals with the study of factor incomes. It means the theory of factor pricing. The prices of land, labour, capital and organisation are called rent, wages, interest and profit respectively. Therefore, it is the study and determination of rent, wages, interest and profit. It concerns the pattern of distribution of national income as rent, wage, interest and profits. Thus, it is not concerned with individuals and their individual income, but with the agents of production. The study of functional shares has been carried on both at the macro and micro levels.

Micro-distribution :

The theory of micro-distribution explains how the prices of factors of production are determined.

Ex : Micro-distribution studies how the wage rate of labour is determined.

Macro-distribution :

Macro distribution explains the share of a factor of production in the national income.

Ex : The share of labour in the national income.

2. Personal distribution :

It refers to the distribution of income or wealth of a country among its people. It studies how income or wealth is distributed among individuals or persons. It studies how much income is earned by an individual, but not how it is earned or in how many forms it is earned. The causes of income inequalities can be known by studying personal distribution.

![]()

Question 2.

What are the factors that determine the factor prices?

Answer:

The demand and supply of a factor of production determine its price. The demand for a factor of production depends on the following.

- It depends on the demand for the goods produced by it.

- Price of the factor determines its demand.

- Prices of other factors or co-operative factors determine the demand for a factor.

- Technological changes determine the demand for a factor.

- The demand for a factor increases due to increase in its production.

Factors that determine the supply of a factor of production.

- The size of the population and it’s age composition.

- Mobility of the factor of production.

- Efficiency of the factor of production.

- Geographical conditions.

- Wage also determines the supply of this factor.

- Income.

Question 3.

Point out the assumptions and limitations of marginal productivity theory.

Answer:

Marginal Physical Product (MPP) is the additional output obtained by using an additional unit of the factor of production. If we multiply the additional output by market price we will get Marginal Value Product (MVP) or Marginal Revenue Product (MRP). MRP is the addition made to total revenue by employing one more unit of factor. The marginal revenue productivity of a factor increases initially with the increase in the units of the factor of production, then reaches to maximum and after that it diminishes and will tend to equal the price of the factor service (average factor cost = AFC). This tendency of diminishing marginal revenue productivity follows from the assumption law of variable proportion. Assumptions of the Theory :

The theory is based on the following assumptions :

- There is perfect competition in the factor market and commodity market.

- All the units of a factor are homogeneous.

- The theory assumes full employment of the factors.

- There is perfect mobility of the factors of production.

- Substitution is possible between the factors.

- The entrepreneurs are motivated by the profits.

- Various units of the factors are divisible.

- The theory is applicable in the long run.

- It is based on the law of variable proportions.

- Marginal production of a factor can be measured.

Criticism :

The marginal productivity theory of distribution is based on unrealistic assump¬tions. Hence, it has been criticized.

- There is no perfect competition in the factor market and commodity market.

- All the factor units are not homogeneous.

- Factors are not fully employed.

- Factors are not perfectly mobile.

- Substitution is not always possible between the factors.

- Profit motive is not the main motive.

- All factors are not divisible.

- This theory is not applicable in the short run.

- Production is not the result of one factor alone.

- The sum of factor payments is not equal to the value of product.

The marginal productivity theory is not an adequate explanation of the determination of the pricing of factors of production. Inspite of limitations of the theory, it explains the role of productivity in the determination of factor price.

Question 4.

What are the determining factors of real wages? [Mar. 17, 16]

Answer:

Real wages refer to the purchasing power of money wages received by the labourer. Real wages are expressed in terms of goods and services that a worker can buy with his money wages. The real wage is said to be high when a labourer obtains larger quantity of goods and services with his money income.

Factors Determining Real Wages :

Real wages depend on the following factors :

1) Price Level :

Purchasing power of money determines the real wage. Purchasing power of money depends on the price level. If price level is high, purchasing power of money will be low. On the contrary, if price level is low, purchasing power of money will be high. Similarly, given the price level, if money wage is high real wage will also increase and when money wage decreases real wage also decreases.

2) Method of Payment :

Besides money wages, labourers get certain additional facilities provided by their management. Like free housing, free medical facilities, free education facilities to children, free transport etc. If such facilities are high, the real wages of labourers will also be high.

3) Regularity of Employment :

Real wages depend on the regularity of employment. If the job is permanent, his real wage will be high even though his money wage is low. In case of temporary employment, his real wage will be low though his money wage is high. Thus, certainty of job influences real wages.

4) Nature of Work :

Real wages are also determined by the risk and danger involved in the work. If the work is risky real wages of labourer will be low though money wages are high. For instance, a captain in a submarine, miners etc., always face danger and risk.

5) Conditions of Work :

The working conditions also determine the real wage of a labourer. Less duration of work, ventilation, light, fresh air, recreation facilities etc., certainly result in the high real wages. If these facilities are lacking, real wages are low even though money wages are high.

6) Subsidiary Earnings :

If a labourer earns extra income in addition to his wage, his real wage will be higher. For instance, a government doctor may supplement his earnings by undertaking private practice.

7) Future Prospects :

Real wage is said to be higher in those jobs where there is a possibility of promotions, hike in wage and vice-versa.

8) Timely Payment :

If a labourer receives payment regularly and timely, the real wage of the labourer is high although his money wage is pretty less and vice versa.

9) Social Prestige :

Although money wages of a bank officer and Judge are equal, the real wage of a Judge is higher than the bank officer due to social status.

10) Period and Expenses of Education :

Period and expenses of education also affect real wage. For example, if one person is a graduate and the other is an undergraduate who are working as clerks, the real wage of the undergraduate is high because his period of learning and expenses on education are lower than the graduate labourer.

![]()

Question 5.

Explain the concepts of gross profits.

Answer:

Gross profit is considered as a difference between total revenue and cost of production. The following are the components of gross profit:

- The rent payable to his own land or buildings includes gross profit.

- The interest payable to his own business capital.

- The wage payable to the entrepreneur for his management includes gross profit.

- Depreciation charges or user cost of production and insurance charges are included in gross profit.

Net profits :

Net profits are reward paid for the organiser’s entrepreneurial skills.

Components :

1. Reward for Risk Bearing :

Net profit is the reward for bearing uninsurable risks and uncertainties.

2. Reward for Co-ordination :

It is the reward paid for co-ordinating the factors of production in right proportion in the process of production.

3. Reward for Marketing Services :

It is the profit paid to the entrepreneur for his ability to purchase the services of factors of production.

4. Reward for Innovations :

It is the reward paid for innovations of new products and alternative uses to natural resources.

5. Wind Fall Gains :

These gains arise as a result of natural calamities, wars and artificial scarcity are also included in net profits.

Very Short Answer Questions

Question 1.

What are the determining factors of the demand for a factor?

Answer:

- The demand for the factors of production is derived demand. It depends on the demand for the goods produced by it.

- Price of the factor determines its demand.

- Prices of other factors which will help in the production also determine the demand for a factor.

- Technology determines the demand for the factors. For instance, increase in technology reduces the demand for labourers.

- Returns to scale will determine the demand for the factors of production. The demand for the factors increases due to increasing returns in the production.

Question 2.

What are the determining factors of the surplus of labour ?

Answer:

Supply of labour depends on :

- Size of the population and its age composition.

- Mobility of the factors of production.

- Efficiency of the factors of production.

- Geographical conditions will determine the supply of factors of production.

- Price of the factor determines its supply.

- The supply of a factor depends on its opportunity cost – the minimum earning which it can earn in the next best alternative use.

Question 3.

What is Contract rent?

Answer:

It is the hire charges for any durable good. Ex : Cycle rent, room rent etc. It is a periodic payment made for the use of any material good. The amount paid by the tenant cultivator to the landlord annually may be also called contract rent. Ex. : The rent that a tenant pays to the house owner monthly as per an agreement made earlier or the hiring charges of a cycle ^ 10 per hour is also contract rent.

Question 4.

What is Economic rent?

Answer:

The ordinary use of the term ‘rent’ means any periodic payment for the hire of anything such as garriages, buildings etc. Economic rent is the pure rent payable as a reward for utilising the productivity of land. It is derived by subtracting the elements like interest, wages, profits and depreciation from the gross rent or contract rent. To David Ricardo, it is surplus over costs or expenses of cultivation.

![]()

Question 5.

What are Money wages?

Answer:

Money wages are the remuneration received by the labourer in the form of money for the physical and mental service rendered by him or her in the production process.

Ex : If a labourer is paid ₹ 30/- per day. ₹ 30/- is the money wage.

Question 6.

What are Real wages?

Answer:

Real wage is the purchasing power of money wages in terms of goods and services.

Question 7.

What are Time wages?

Answer:

Time wage is the amount paid for labourers for a fixed period of work i.e., weakly, daily, monthly etc.

Question 8.

What are Piece wages?

Answer:

Piece wage is the amount paid for labourers according to volume of work, done by them.

Question 9.

What is Gross interest?

Answer:

The payment which the lender receives from the borrower excluding the principal is gross interest.

Gross interest = Net interest + [Reward for risk taking + Reward for Inconvenience + Reward for management]

Question 10.

What is Net interest?

Answer:

Net interest is the reward for the service of the capital loan.

Ex : Net interest paid on government bonds and government loans.

Question 11.

What is Gross profit?

Answer:

Gross profit is considered as a difference between total revenue and cost of production.

Gross profit = Net profit + [Implicit rent + Implicit wage + Implicit interest + Depreciation charges + Insurance premium]

![]()

Question 12.

What is Net profit ? [Mar. ’16]

Answer:

Net profit is the reward paid for the organizer’s entrepreneurial skills.

Net profit = Gross profit – [Implicit rent + Implicit wage + Implicit interest + Depreciation charges + Insurance premium]