Telangana TSBIE TS Inter 2nd Year English Study Material 9th Lesson The Religion of the Forest Textbook Questions and Answers.

TS Inter 2nd Year English Study Material 9th Lesson The Religion of the Forest

Annotations (Section A, Q.No. 1, Marks: 4)

Annotate the following in about 100 words each.

a) The ideal of perfection preached by the forest-dwellers of ancient India runs through the heart of our classical literature and still dominates our mind (Revision Test – IV)

Reference: These lines are extracted from the essay “The Religion of the “Forest writter. by Rabindranath Tagore

Context: Indian civilization has been distinctive in locating its source of regeneration, material and intellectual, in the forest, not the city. India’s best ideas have come where man was in communion with trees and rivers and lakes, away from the crowds. The peace of the forest has helped the intellectual evolution of man.

Meaning: The idea! of perfection preached by the forest dwellers of ancient India run through the heart of our classical literature and still dominates our mind”. The forests are sources of life and they are the storehouse of biodiversity.

ప్రాచీన : `రతదేశంలోని అటవీ నివాసులు బోధించిన పరిపూర్ణత యొక్క ఆదర్శం మన సాంప్రదాయ సాహిత్యం యొక్క గుండా నడుస్తుంది మరియు ఇప్పటికీ మన మనస్సును ఆధిపత్యం చేస్తుంది

సూచన : ఈ పంక్తులు రవీంద్రనాథ్ ఠాగూర్ రాసిన “ది రిలిజియన్ ఆఫ్ ది ఫారెస్ట్” వ్యాసం నుండి సంగ్రహించబడ్డాయి.

సందర్భ౦ : భారతీయ నాగరికత తన పునరుత్పత్తి మూలాన్ని, భౌతిక మరియు మేధావిని, అడవిలో, నగరంలో కాకుండా గుర్తించడంలో విలక్షణమైనది. భారతదేశం యొక్క ఉత్తమ ఆలోచనలు జనసమూహానికి దూరంగా చెట్లతో, నదులతో మరియు సరస్సులతో మనిషిగా ఉండే చోటికి వచ్చాయి. అడవిలోని శాంతి మనిషి మేధో పరిణామానికి తోడ్పడింది.

అర్థం : ప్రాచీన భారతదేశంలోని అటవీ నివాసులు బోధించిన పరిపూర్ణత యొక్క ఆదర్శం మన సాంప్రదాయ సాహిత్యం యొక్క గుండె గుండా నడుస్తుంది మరియు ఇప్పటికీ మన మనస్సుపై ఆధిపత్యం చెలాయిస్తుంది. అడవులు జీవనాధారాలు మరియు అవి జీవవైవిధ్య భాండాగారం.

b) The view of this world which India has taken is summed up in one compound Sanskrit word, Sacchidananda.

Reference: These lines are extracted from the essay “The Religion of the “Forest written by Rabindranath Tagore

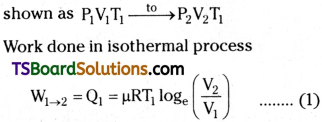

Context: The first is sat, it is the simple fact that things are, the fact which relates us to all things through the relationship of common existence. The second is chit-, it is the fact that we know, which relates us to all things through the relationship of knowledge. The third is ananda. It is the fact that we enjoy, which unites us with all things through the relationship of love.

Meaning: Sat-chit-ananda is a Sanskrit term that describes the nature of reality as it is conceptualized in Hindu and yogic philosophy. Some consider sat-chit-ananda to be the same as God or Brahman (Absolute Reality). Others use it as a term to describe the experience of realizing the unity and wholeness of all existence.

రిఫరెన్స్: పంక్తులు రవీంద్రనాథ్ ఠాగూర్ రాసిన “ది రిలిజియన్ ఆఫ్ ది ఫారెస్ట్” అనే వ్యాసం నుండి సంగ్రహించబడ్డాయి.

సందర్భ౦ : మొదటిది సత్, ఇది విషయాలు అనే సాధారణ వాస్తవం, ఉమ్మడి ఉనికి యొక్క సంబంధం ద్వారా అన్ని విషయాలతో మనకు సంబంధం కలిగి ఉంటుంది. రెండవది చిత్-, ఇది మనకు తెలిసిన వాస్తవం, ఇది జ్ఞాన సంబంధం ద్వారా మనకు అన్ని విషయాలతో సంబంధం కలిగి ఉంటుంది. మూడవది ఆనందము. ఇది మనం ఆనందించే వాస్తవం, ఇది ప్రేమ సంబంధం ద్వారా అన్ని విషయాలతో మనల్ని ఏకం చేస్తుంది.

అర్థం: సత్-చిత్-ఆనంద అనేది సంస్కృత పదం, ఇది హిందూ మరియు యోగ తత్వశాస్త్రంలో సంభావితం చేయబడిన వాస్తవికత యొక్క స్వభావాన్ని వివరిస్తుంది. కొందరు సత్ చిత్ ఆనందాన్ని భగవంతుడు లేదా బ్రహ్మంగా భావిస్తారు (సంపూర్ణ వాస్తవికత). ఇతరులు అన్ని ఉనికి యొక్క. ఐక్యత మరియు సంపూర్ణతను గ్రహించే అనుభవాన్ని వివరించడానికి ఒక పదంగా ఉపయోగిస్తాడు

c) Nature stands on her own right, proving that she has her great function, impart the peace of the eternal to human emotions. (Revision Test – IV)

Reference: These lines are extracted from the essay “The Religion of the “Forest written by Rabindranath Tagore

Context: Harmony and unity in diversity is the nature of the forest, whereas being monotonous is the nature of industrialism based on a mechanical world view.

Meaning: The forest also teaches us enormousness as the principle of equity, enjoying the gifts of Nature without exploitation and accumulation. In The Religion of the Forest Tagore quotes from the ancient texts written in the forest. Know all that moves in this moving world as enveloped by God; and find enjoyment through renunciation, not through greed of possession.

రిఫరెన్స్: ఈ పంక్తులు రవీంద్రనాథ్ ఠాగూర్ రాసిన “ది రిలిజియన్ ఆఫ్ ది ఫారెస్ట్” అనే వ్యాసం నుండి సంగ్రహించబడ్డాయి.

సందర్భ౦ : భిన్నత్వంలో సామరస్యం మరియు ఏకత్వం అనేది అడవి స్వభావం, అయితే మార్పులేనిది యాంత్రిక ప్రపంచ దృష్టికోణంపై ఆధారపడిన పారిశ్రామిక స్వభావం.

అర్థం: దోపిడీ మరియు సంచితం లేకుండా ప్రకృతి యొక్క బహుమతులను ఆస్వాదిస్తూ సమత్వ సూత్రంగా అడవి మనకు తగినంతగా బోధిస్తుంది. ది రిలిజియన్ ఆఫ్ ది ఫారెస్ట్లో ఠాగూర్ అడవిలో వ్రాసిన పురాతన గ్రంథాల నుండి ఉల్లేఖించారు. భగవంతునిచే ఆవరింపబడిన ఈ కదులుతున్న ప్రపంచంలో కదిలేవన్నీ తెలుసుకోండి; మరియు త్యజించడం ద్వారా ఆనందాన్ని కనుగొనండి, స్వాధీనం యొక్క దురాశ ద్వారా కాదు.

d) These poems contain the voice of warnings against the gorgeous unreality of that age, which, like a Himalayan avalanche, was slowly gliding down to an abyss of catastrophe

Reference: These lines are extracted from the essay “The Religion of the “Forest written by Rabindranath Tagore

Context: Indians in ancient India loved and practised simplicity. Unfortunately this noble virtue broke up in Kalidasa’s time. The reasons were obvious. The Hindu kings forgot their duties.

Meaning: They, indulged in pleasure seeking. Frequent attacks from the Scythians destroyed our vitals. Material progress and luxury blinded people. They took that unreal magnificence for things of lasting value. Kalidasa was worried. He sent word of warnings through his poems. The fall was abysmal. It was time they corrected themselves. Tagore emphasises the value of Kalidasa’s service.

రిఫరెన్స్: ఈ పంక్తులు రవీంద్రనాథ్ ఠాగూర్ రాసిన “ది రిలిజియన్ ఆఫ్ ది ఫారెస్ట్” అనే వ్యాసం నుండి సంగ్రహించబడ్డాయి.

సందర్భ౦ : ప్రాచీన భారతదేశంలోని భారతీయులు సరళతను ఇష్టపడేవారు మరియు ఆచరించారు. దురదృష్టవశాత్తు ఈ గొప్ప ధర్మం కాళిదాసు కాలంలో విడిపోయింది. కారణాలు స్పష్టంగా కనిపించాయి. హిందూ రాజులు తమ విధులను మరచిపోయారు.

అర్థం: వారు, ఆనందాన్ని వెతుక్కునే పనిలో మునిగిపోయారు. సిథియన్ల నుండి తరచుగా జరిగే దాడులు మన ప్రాణాధారాలను నాశనం చేశాయి. మెటీరియల్ పురోగతి మరియు లగ్జరీ బ్లైండ్ ప్రజలు. వారు ఆ అవాస్తవమైన గొప్పతనాన్ని శాశ్వత విలువ కలిగిన వస్తువుల కోసం తీసుకున్నారు. కాళిదాసు కంగారుపడ్డాడు. తన కవితల ద్వారా హెచ్చరికలు పంపాడు. పతనం దారుణంగా ఉంది. వారు తమను తాము సరిదిద్దుకునే సమయం వచ్చింది. ఠాగూర్ కాళిదాసు సేవ విలువను నొక్కి చెప్పారు.

Paragraph Questions & Answers (Section A, Q.No.3, Marks: 4)

Answer the following Questions in about 100 words

a) To make the spirit of the religion of the forest clear to readers Tagore presents some sets of contrasts. Explain them.

Answer:

Rabindranath Tagore (1861-1941) was a psychologist and social realist. He wrote a number of essays in both English and Bengali. “The Religion of the Forest” is one of his most famous essays. It represents the author’s perspective on an individual’s relationship with the forest and nature. “Indian civilization has distinguished itself by locating its source of regeneration, both material and intellectual, in the forest rather than the city” Away from the crowds, India’s best ideas have come from places where man can commune with trees, rivers, and lakes. The peace of the forest has aided in the intellectual development of man.

The forest culture has fueled the culture of Indian society. The culture that has resulted from The forest has been influenced by the various processes of life renewal that are always at work in the forest. “varying in sight, sound, and smell from species to species, season to season.” The principle of life in diversity, of democratic pluralism, thus became the foundation of Indian civilization.” This “unity in diversity” is the foundation of both environmental sustainability and democracy.

రవీంద్రనాథ్ ఠాగూర్ (1861-1941) మనస్తత్వవేత్త మరియు సామాజిక వాస్తవికవాది. అతను ఇంగ్లీష్ మరియు బెంగాలీ రెండింటిలోనూ అనేక వ్యాసాలు రాశాడు. “ది రిలిజియన్ ఆఫ్ ది ఫారెస్ట్” అతని అత్యంత ప్రసిద్ధ వ్యాసాలలో ఒకటి. ఇది అడవి మరియు ప్రకృతితో ఒక వ్యక్తి యొక్క సంబంధంపై రచయిత యొక్క దృక్పథాన్ని సూచిస్తుంది. “భారత నాగరికత తన పునరుత్పత్తి మూలాన్ని, భౌతికంగా మరియు మేధోపరంగా, నగరం కంటే అడవిలో గుర్తించడం ద్వారా తనకంటూ ప్రత్యేకతను చాటుకుంది.”

జనసమూహానికి దూరంగా, చెట్లు, నదులు మరియు సరస్సులతో మనిషి కమ్యూనికేట్ చేయగల ప్రదేశాల నుండి భారతదేశం యొక్క ఉత్తమ ఆలోచనలు వచ్చాయి. అడవిలోని శాంతి మనిషి మేధో వికాసానికి తోడ్పడింది. అటవీ సంస్కృతి భారతీయ సమాజ సంస్కృతికి ఆజ్యం పోసింది. అడవి ఫలితంగా ఏర్పడిన సంస్కృతి, అడవిలో ఎల్లప్పుడూ పని చేసే వివిధ జీవిత పునరుద్ధరణ ప్రక్రియల ద్వారా ప్రభావితమైంది. – “దృష్టి, ధ్వని మరియు వాసనలో విభిన్నంగా ఉంటుంది

జాతుల నుండి జాతులకు, సీజన్ నుండి సీజన్ వరకు.” వైవిధ్యంలో జీవన సూత్రం, ప్రజాస్వామ్య బహుళత్వం, తద్వారా భారతీయ నాగరికతకు పునాది అయింది.” ఈ “భిన్నత్వంలో ఏకత్వం” పర్యావరణ సుస్థిరత మరియు ప్రజాస్వామ్యం రెండింటికీ పునాది.

b) This aspect of truth cannot be ignored; it has to be known and mastered. What is that aspect of truth, according to Tagore? Who has mastered it? (Revision Test – IV)

Answer:

Rabindranath Tagore (1861-1941) was a psychologist and social realist. He wrote a number of essays in both English and Bengali. “The Religion of the Forest” is one of his most famous essays. It represents the author’s perspective on an individual’s relationship with the forest and nature. The truth of our life depends upon our attitude of mind towards it–an attitude which is formed by our habit of dealing with it according to the special circumstance of our surroundings and our temperaments. It guides our attempts to establish relations with the universe either by conquest or by union, either through the cultivation of power or through that of sympathy. And thus, in our realisation of the truth of existence, we put our emphasis either upon the principle of dualism or upon the principle of unity.

రవీంద్రనాథ్ ఠాగూర్ (1861-1941) మనస్తత్వవేత్త మరియు సామాజిక వాస్తవికవాది. అతను ఇంగ్లీష్ మరియు బెంగాలీ రెండింటిలోనూ అనేక వ్యాసాలు రాశాడు. “ది రిలిజియన్ ఆఫ్ ది ఫారెస్ట్” అతని అత్యంత ప్రసిద్ధ వ్యాసాలలో ఒకటి. ఇది అడవి మరియు ప్రకృతితో ఒక వ్యక్తి యొక్క సంబంధంపై రచయిత యొక్క దృక్పథాన్ని సూచిస్తుంది. మన జీవిత సత్యం దాని పట్ల మన మనస్సు యొక్క దృక్పథంపై ఇది మన పరిసరాల యొక్క ప్రత్యేక పరిస్థితులకు మరియు మన స్వభావాలకు అనుగుణంగా వ్యవహరించే మన అలవాటు ద్వారా ఏర్పడిన వైఖరి. విజయం ద్వారా లేదా యూనియన్ ద్వారా, శక్తి పెంపకం ద్వారా లేదా సానుభూతి ద్వారా విశ్వంతో సంబంధాలను ఏర్పరచుకునే మన ప్రయత్నాలకు ఇది మార్గనిర్దేశం చేస్తుంది. అందువల్ల, ఉనికి యొక్క సత్యాన్ని గ్రహించడంలో, మేము ద్వంద్వవాదం యొక్క సూత్రంపై లేదా ఐక్యత సూత్రంపై దృష్టి పెడతాము.

c) The hermitage shines out in all our ancient literature, as the place where the chasm between man and the rest of creation has been bridged. Explain this statement of Tagore.

Answer:

Rabindranath Tagore (1861-1941) was a psychologist and social realist. He wrote a number of essays in both English and Bengali. “The Religion of the Forest” is one of his most famous essays. It represents the author’s perspective on an individual’s relationship with the forest and nature. A poet of a later age, while describing a hermitage in his Kadambari, tells us of the posture of salutation in the flowering lianas as they bow to the wind; of the sacrifice offered by the trees scattering their blossoms; of the grove resounding with the lessons chanted by the neophytes, and the verses repeated by the parrots, learnt by constantly hearing them; of the wild- fowl enjoying vaishva-deva-bali-pinda (the food offered to the divinity which is in all creatures); of the ducks coming up from the lake for their portion of the grass seed spread in the cottage yards to dry; and of the deer caressing with their tongues the young hermit boys. It is again the same story. The hermitage shines out, in all our ancient literature, as the place where the chasm between man and the rest of creation has been bridged.

రవీంద్రనాథ్ ఠాగూర్ (1861-1941) మనస్తత్వవేత్త మరియు సామాజిక వాస్తవికవాది. అతను ఇంగ్లీష్ మరియు బెంగాలీ రెండింటిలోనూ అనేక వ్యాసాలు రాశాడు. “ది రిలిజియన్ ఆఫ్ ది ఫారెస్ట్” అతని అత్యంత ప్రసిద్ధ వ్యాసాలలో ఒకటి. ఇది అడవి మరియు ప్రకృతితో ఒక వ్యక్తి యొక్క సంబంధంపై రచయిత యొక్క దృక్పథాన్ని సూచిస్తుంది. తరువాతి కాలానికి చెందిన ఒక కవి, తన కాదంబరిలో ఒక ఆశ్రమాన్ని వర్ణిస్తూ, పుష్పించే లియానాలలో గాలికి నమస్కరిస్తున్నప్పుడు నమస్కరించే భంగిమ గురించి చెబుతాడు; చెట్లు తమ పుష్పాలను వెదజల్లుతూ అర్పించే త్యాగం; నవయువకులు పఠించిన పాఠాలతో ప్రతిధ్వనించే తోపు, మరియు చిలుకలు పునరావృతమయ్యే పద్యాలు, వాటిని నిరంతరం వింటూ నేర్చుకుంటాయి; వైశ్వ-దేవ – బలి-పిండా (అన్ని జీవులలో ఉన్న దైవత్వానికి అందించే ఆహారం) ఆనందించే అడవి-కోడి; సరస్సు నుండి పైకి వచ్చే బాతులు వాటి భాగానికి గడ్డి గింజలను కుటీర యార్డులలో ఆరబెట్టడానికి విస్తరించాయి; మరియు జింకలు తమ నాలుకలతో యువ సన్యాసి అబ్బాయిలను ముద్దాయి. మళ్లీ అదే కథ. మన ప్రాచీన సాహిత్యాలన్నింటిలోనూ, మనిషికి, మిగిలిన సృష్టికి మధ్య ఉన్న అగాధాన్ని తొలగించిన ప్రదేశంగా ఆశ్రమం ప్రకాశిస్తుంది.

d) Explain how the old simplicity of Hindu life had broken up in Kalidasa’s time.

Answer:

Rabindranath Tagore (1861-1941) was a psychologist and social realist. He wrote a number of essays in both English and Bengali. “The Religion of the Forest” is one of his most famous essays. It represents the author’s perspective on an individual’s relationship with the forest and nature. When Vikramaditya became king, Ujjayini a great capital, and Kalidasa its poet, the age of India’s forest retreats had passed. Then we had taken our stand in the midst of the great concourse of humanity.

The Chinese and the Hun, the Scythian and the Persian, the Greek and the Roman, had crowded round us. But, even in that age of pomp and prosperity, the love and reverence with which its poet sang about the hermitage shows what was the dominant ideal that occupied the mind of India; what was the one current of memory that continually flowed through her life.

In Kalidasa’s drama, Shakuntala, the hermitage, which dominates the play, overshadowing the king’s palace, has the same idea running through it the recognition of the kinship of man with conscious and unconscious creation.

రవీంద్రనాథ్ ఠాగూర్ (1861-1941) మనస్తత్వవేత్త మరియు సామాజిక వాస్తవికవాది. అతను ఇంగ్లీష్ మరియు బెంగాలీ రెండింటిలోనూ అనేక వ్యాసాలు రాశాడు. “ది రిలిజియన్ ఆఫ్ ది ఫారెస్ట్” అతని అత్యంత ప్రసిద్ధ వ్యాసాలలో ఒకటి. ఇది అడవి మరియు ప్రకృతితో ఒక వ్యక్తి యొక్క సంబంధంపై రచయిత యొక్క దృక్పథాన్ని సూచిస్తుంది. విక్రమాదిత్యుడు రాజు అయ్యాక, ఉజ్జయిని ఒక గొప్ప రాజధాని, మరియు కాళిదాసు దాని కవి అయినప్పుడు, భారతదేశం యొక్క అటవీ తిరోగమనాల యుగం గడిచిపోయింది. అప్పుడు మేము మానవత్వం యొక్క గొప్ప సమ్మేళనం మధ్యలో మా స్టాండ్ తీసుకున్నాము.

చైనీయులు మరియు హున్, సిథియన్ మరియు పర్షియన్, గ్రీకు మరియు రోమన్, మా చుట్టూ గుమిగూడారు. కానీ, ఆడంబరం మరియు శ్రేయస్సు యొక్క ఆ యుగంలో కూడా, దాని కవి సన్యాసం గురించి పాడిన ప్రేమ మరియు గౌరవం భారతదేశ మనస్సును ఆక్రమించిన ఆధిపత్య ఆదర్శం” ఏమిటో చూపిస్తుంది; ఆమె జీవితంలో నిరంతరం ప్రవహించే ఒక స్మృతి ప్రవాహం ఏమిటి. కాళిదాసు నాటకంలో, శకుంతల, రాజు యొక్క రాజభవనాన్ని కప్పివేస్తూ, నాటకంలో ఆధిపత్యం చెలాయించే ఆశ్రమం, చేతన మరియు అపస్మారక సృష్టితో మనిషి యొక్క బంధుత్వాన్ని గుర్తించడం ద్వారా ‘ అదే ఆలోచనను కలిగి ఉంది.

The Religion of the Forest Summary in English

About Author

Rabindranath Tagore (7 May 1861 – 7 August 1941) was a Bengali polymath who worked as a poet, writer, playwright, composer, philosopher, social reformer and painter. He reshaped Bengali literature and music as well as Indian art with Contextual Modernism in the late 19th and early 20th centuries. Author of the “profoundly sensitive, fresh and beautiful” poetry of Gitanjali, he became in 1913 the first non-European and the first lyricist to win the Nobel Prize in Literature. Tagore’s poetic songs were viewed as spiritual and mercurial; however, his “elegant prose and magical poetry” remain largely unknown outside Bengal.

A Bengali Brahmin from Calcutta with ancestral gentry roots in Burdwan district and Jessore, Tagore wrote poetry as an eight-year-old. At the age of sixteen, he released his first substantial poems under the pseudonym Bhānusilha (“Sun Lion”), which were seized upon by literary authorities as long-lost classics.

Rabindranath Tagore was born on 7th May 1861, in the Jorasanko mansion in Calcutta, India. He was the man who rejuvenated Bengali music and literature in the late 19th and early 20th century and them their recognition into this world. He was the first non-European to win Noble Prize for his work in Literature. He is the person who gave the national anthem of India and Bangladesh. Gitanjali (Song Offerings), Gora (Fair- Faced) and Ghare-Baire (The Home and the World) are some of his best known works.

The ideal of perfection preached by the great sages of ancient India in their hermitage still dominates the minds of the Indian people. The legends in our great epics bore all through their narratives the message of the forest dwellers.

The history of the Northmen or Norsemen of Europe is a resonance with the music of the sea. The sea plays a significant role in their life. It represents some ideals of life which still guide their history and inspire the creations of that race. Nature represents herself through the sea, her aspect of danger and obstacles which imbibes the spirit of fight into the soul of men. The man fought and won and this spirit of fight still inspires a man to fight against disease and poverty, the tyranny of matter and of man. This is true to the life of the people who live by the sea.

But in the plain land of Northern India men had no barrier between their life and Nature. Forests came into a close living relationship with men in their work and leisure, in their daily necessities and meditation. So the view of the truth of the life of these men did not manifest the difference but the unity of all things in Nature. When the world seems alien to us, then its mechanical aspect becomes prominent in our mind. The machine also has its place in the world. Human beings may be used as machines and made to yield powerful results.

The view of this world is explained through the Sanskrit word ‘Sachchidananda’ which states that Reality has three phases. The first phase is ‘Sat’ which states the fact that things exist and the fact that relates us to all things through the relationship of common existence. The second phase is ‘Chit’ which states that we know and this relates to all things through knowledge. The third phase is ‘Ananda’ which is the fact that we enjoy and this unites us with all things through love.

According to the true Indian view, our consciousness of the world merely as the sum total of all things that exist is imperfect. It becomes perfect when our consciousness realises all things as spiritually one with it. During the reign of Vikramaditya, the age of India’s forest retreats passed. But even in that age of pomp and prosperity the love and reverence with which poet Kalidasa sang about the hermitage show the dominant ideal of India. In Kalidasa’s “Shakuntala” the hermitage overshadowed the magnificence of the king’s palace and it clearly expressed the idea of recognition of the relationship of man with the conscious and unconscious creation alike.

While describing the hermitage in ‘Kadambari’ Bana tells of the postures of salutation in the flowering creepers while bowing in the wind, of the sacrifice offered by the trees by scattering their flowers, of the grove resonance with the lessons chanted by the learners and of the wild-fowl enjoying their food. All these descriptions tell us that the hermitage was the place where the wide difference of feelings of man and the rest of the creation had been bridged.

In the western dramas, Nature is almost always a trespasser but in all our famous Sanskrit dramas Nature has always an important function to impart the peace of the eternal to human emotions.

‘Ritu-Samhara’ is obviously a work of Kalidasa’s immaturity. The youthful love- song in it does not reach the sublime reticence found in ‘Shakuntala’ and ‘Kumara- Sambhaba’. But the tune of sensual outbreaks is set to the varied harmony of Nature’s symphony. In the third canto of ‘Kumara-Sambhaba’ the violent outbreaks of passion caused by Madana, the god of love, to set free a sudden flood of desire in the serenity of the ascetics’ meditation, was shown against the background of universal life. The whole of the ‘Kumara-Sambhaba’ poem, portrayed on a vast canvas tells of the eternal wedding of love, its wooing and sacrifice, its fulfilment and the birth of the brave one (Kartikeya) who destroyed the evil demon.

In Kalidasa’s time, the kings became self-seeking epicureans. At that time India reached the pinnacle of glory. But it is evident from Kalidasa’s poems that the very magnificence of wealth and enjoyment worked against the idea that sprang forth from the sacred serenity of the forest. These poems contain the voice of warnings against the gorgeous unreality of the age. The poet yearned for the purity and simplicity of India’s past age of spiritual striving.

Kalidasa opens his poem ‘Raghuvamsa’ amid the scenes of simplicity and self- denial. In the end, we find the palace of magnificence and the extravagance of self- enjoyment. With a calm restraint of language, the poet tells of the kingly glory crowned with purity. He begins his poem in the serenity of sunrise and he describes the end in the background of evening brightened with the splendour of the sun which at last fades into the darkness of night. In this beginning and in this ending there lies hidden the message of the forest. All through the narrative there runs the idea that the future would be glowed gloriously only when there would be in the atmosphere the calm of self-control, purity and renunciation.

The Religion of the Forest Summary in Telugu

Note: This summary is only meant for Lesson Reference, not for examination purpose

రవీంద్రనాథ్ ఠాగూర్ 1861 మే 7వ తేదీన భారతదేశంలోని కలకత్తాలోని జోరాసాంకో భవనంలో జన్మించారు. అతను 19వ శతాబ్దం చివరలో మరియు 20వ శతాబ్దం ప్రారంభంలో బెంగాలీ సంగీతం మరియు సాహిత్యాన్ని పునరుద్ధరించిన వ్యక్తి మరియు ఈ ప్రపంచంలో వారి గుర్తింపు. సాహిత్యంలో చేసిన కృషికి నోబుల్ బహుమతిని గెలుచుకున్న మొదటి యూరోపియన్యేతర వ్యక్తి. భారతదేశం మరియు బంగ్లాదేశ్ జాతీయ గీతాన్ని అందించిన వ్యక్తి. గీతాంజలి (పాటల సమర్పణలు), గోరా (ఫెయిర్-ఫేస్డ్) మరియు ఘరే- బైరే (ది హోమ్ అండ్ ది వరల్డ్) అతని ప్రసిద్ధ రచనలలో కొన్ని.

ప్రాచీన భారతదేశంలోని గొప్ప ఋషులు తమ ఆశ్రమంలో బోధించిన పరిపూర్ణత యొక్క ఆదర్శం ఇప్పటికీ భారతీయ ప్రజల మనస్సులలో ఆధిపత్యం చెలాయిస్తోంది. మన గొప్ప ఇతిహాసాలలోని ఇతిహాసాలు తమ కథనాల ద్వారా అరణ్యవాసుల సందేశాన్ని అందించాయి.

ఐరోపాలోని నార్త్ మెన్ లేదా నార్మెన్ చరిత్ర సముద్రపు సంగీతంతో ప్రతిధ్వనిస్తుంది. వారి జీవితంలో సముద్రం ముఖ్యమైన పాత్ర పోషిస్తుంది. ఇది ఇప్పటికీ వారి చరిత్రకు మార్గనిర్దేశం చేసే మరియు ఆ జాతి సృష్టికి స్పూర్తినిచ్చే కొన్ని జీవిత ఆదర్శాలను సూచిస్తుంది. ప్రకృతి తనను తాను సముద్రం ద్వారా సూచిస్తుంది, ఆమె ప్రమాదం మరియు అడ్డంకులు, ఇది పురుషుల ఆత్మలో పోరాట స్ఫూర్తిని నింపుతుంది. మనిషి పోరాడి గెలిచాడు మరియు ఈ పోరాట స్ఫూర్తి ఇప్పటికీ వ్యాధి మరియు పేదరికం, పదార్థం మరియు మనిషి యొక్క దౌర్జన్యానికి వ్యతిరేకంగా పోరాడటానికి మనిషిని ప్రేరేపిస్తుంది. సముద్రం ఒడ్డున నివసించే ప్రజల జీవితానికి ఇది నిజం.

కానీ ఉత్తర భారతదేశంలోని మైదాన భూమిలో పురుషులకు వారి జీవితానికి మరియు ప్రకృతికి మధ్య ఎటువంటి అవరోధం లేదు. అడవులు పురుషులతో వారి పని మరియు విశ్రాంతి సమయంలో, వారి రోజువారీ అవసరాలు మరియు ధ్యానంలో సన్నిహిత జీవన సంబంధంలోకి వచ్చాయి. కాబట్టి ఈ మనుష్యుల జీవిత సత్యం యొక్క దృక్పథం భేదాన్ని కాదు, ప్రకృతిలోని అన్ని విషయాల ఐక్యతను వ్యక్తం చేసింది. ప్రపంచం మనకు పరాయిగా అనిపించినప్పుడు, దాని యాంత్రిక అంశం మన మనస్సులో ప్రముఖంగా మారుతుంది. యంత్రం కూడా ప్రపంచంలో తన స్థానాన్ని కలిగి ఉంది. మానవులను యంత్రాలుగా ఉపయోగించుకోవచ్చు మరియు శక్తివంతమైన ఫలితాలను ఇవ్వడానికి తయారు చేయవచ్చు.

ఈ ప్రపంచం యొక్క దృక్పథం ‘సచ్చిదానంద’ అనే సంస్కృత పదం ద్వారా వివరించబడింది, ఇది వాస్తవికత మూడు దశలను కలిగి ఉంటుంది. మొదటి దశ ‘సత్’, ఇది విషయాలు ఉనికిలో ఉన్నాయనే వాస్తవాన్ని మరియు ఉమ్మడి ఉనికి యొక్క సంబంధం ద్వారా అన్ని విషయాలతో మనకు సంబంధం కలిగి ఉన్న వాస్తవాన్ని తెలియజేస్తుంది. రెండవ దశ ‘చిత్’, ఇది మనకు తెలుసునని మరియు ఇది జ్ఞానం ద్వారా అన్ని విషయాలకు సంబంధించినదని పేర్కొంది. మూడవ దశ ‘ఆనంద’, ఇది మనం ఆనందించే వాస్తవం మరియు ఇది ప్రేమ ద్వారా అన్ని విషయాలతో మనల్ని ఏకం చేస్తుంది.

నిజమైన భారతీయ దృక్పథం ప్రకారం, ప్రపంచం గురించి మన స్పృహ కేవలం ఉనికిలో ఉన్న అన్ని వస్తువుల మొత్తంగా అసంపూర్ణమైనది. మన స్పృహ అన్ని విషయాలను ఆధ్యాత్మికంగా దానితో ఒకటిగా గుర్తించినప్పుడు అది పరిపూర్ణమవుతుంది. విక్రమాదిత్యుని పాలనలో, భారతదేశం యొక్క అటవీ తిరోగమనాల యుగం గడిచిపోయింది. కానీ ఆ ఆడంబరం మరియు శ్రేయస్సు యొక్క యుగంలో కూడా కవి కాళిదాసు సన్యాసం గురించి పాడిన ప్రేమ మరియు గౌరవం భారతదేశం యొక్క ఆధిపత్య ఆదర్శాన్ని చూపుతాయి. కాళిదాసు యొక్క “శకుంతల”లో ఆశ్రమం రాజు యొక్క రాజభవనం యొక్క వైభవాన్ని కప్పివేస్తుంది మరియు ఇది చేతన మరియు అపస్మారక సృష్టితో మనిషి యొక్క సంబంధాన్ని గుర్తించాలనే ఆలోచనను స్పష్టంగా వ్యక్తం చేసింది.

‘కాదంబరి’ బాణలోని ఆశ్రమాన్ని వర్ణిస్తూ, గాలికి నమస్కరిస్తూ పుష్పించే లతలలో నమస్కరించే భంగిమలను, చెట్లు తమ పువ్వులను చల్లి అర్పించే బలిని, నేర్చుకునే పాఠాలతో తోపు ప్రతిధ్వనిని గురించి చెబుతుంది. అడవి కోడి తమ ఆహారాన్ని ఆస్వాదిస్తోంది. ఈ వర్ణనలన్నీ మనిషికి, మిగిలిన సృష్టికి గల భావాల విస్తృత వ్యత్యాసానికి వారధిగా నిలిచిన ప్రదేశం ఆశ్రమమని మనకు తెలియజేస్తున్నాయి.

పాశ్చాత్య నాటకాలలో, ప్రకృతి దాదాపు ఎల్లప్పుడూ అతిక్రమించేది కానీ మన ప్రసిద్ధ సంస్కృత నాటకాలన్నింటిలో మానవ భావోద్వేగాలకు శాశ్వతమైన శాంతిని అందించడానికి ప్రకృతి ఎల్లప్పుడూ ఒక ముఖ్యమైన విధిని కలిగి ఉంటుంది.

‘ఋతు-సంహారం’ స్పష్టంగా కాళిదాసు యొక్క అపరిపక్వత యొక్క రచన. ఇందులోని యవ్వనమైన ప్రేమగీతం ‘శకుంతల’ మరియు ‘కుమార సంబాబా’లలో కనిపించే ఉత్కృష్టమైన నిశ్చలతను చేరుకోలేదు.. కానీ ఇంద్రియ సంబంధమైన వ్యాప్తి యొక్క ట్యూన్ ప్రకృతి యొక్క సింఫొనీ యొక్క విభిన్న సామరస్యానికి సెట్ చేయబడింది. ‘కుమార సంభబా’ యొక్క మూడవ ఖండంలో, సన్యాసుల ధ్యానం యొక్క ప్రశాంతతలో అకస్మాత్తుగా కోరికల వరదను విముక్తి చేయడానికి ప్రేమ దేవుడు మదన వల్ల ఉద్రేకం యొక్క హింసాత్మక విస్పోటనాలు సార్వత్రిక జీవిత నేపథ్యానికి వ్యతిరేకంగా చూపించబడ్డాయి. విశాలమైన కాన్వాస్ పై చిత్రీకరించబడిన ‘కుమార సంబాబా’ పద్యం మొత్తం ప్రేమ యొక్క శాశ్వతమైన వివాహం, దాని వోటింగ్ మరియు త్యాగం, దాని నెరవేర్పు మరియు దుష్ట రాక్షసుడిని నాశనం చేసిన ధైర్యవంతుడు (కార్తికేయ) పుట్టుక గురించి చెబుతుంది.

కాళిదాసు కాలంలో రాజులు స్వయం శోధించే మహాకవిగా మారారు. ఆ సమయంలో భారతదేశం కీర్తి శిఖరాలకు చేరుకుంది. కానీ సంపద మరియు ఆనందం యొక్క గొప్పతనం అడవి యొక్క పవిత్రమైన ప్రశాంతత నుండి ఉద్భవించిన ఆలోచనకు వ్యతిరేకంగా పనిచేశాయని కాళిదాసు పద్యాల నుండి స్పష్టంగా తెలుస్తుంది. ఈ కవితలు యుగపు బ్రహ్మాండమైన అవాస్తవానికి వ్యతిరేకంగా హెచ్చరికల స్వరాన్ని కలిగి ఉన్నాయి. భారతదేశం యొక్క ఆధ్యాత్మిక కృషి యొక్క గత యుగం యొక్క స్వచ్ఛత మరియు సరళత కోసం కవి ఆరాటపడ్డాడు. కాళిదాసు తన ‘రఘువంశ’ కావ్యాన్ని సరళత మరియు స్వీయ-నిరాకరణ దృశ్యాల మధ్య తెరుస్తాడు. చివరికి, మేము అద్భుతమైన రాజభవనాన్ని కనుగొంటాము.

The Religion of the Forest Summary in Hindi

Note: This summary is only meant for Lesson Reference, not for examination purpose

रवीन्द्रनाथ टैगोर का जन्म 7 मई 1861 को भारत में कलकत्ता के जोरासांको हवेली में हुआ था । वे 19 वी सदी के अंत और 20 वी सदी की सुरूआत में बंगाली संगीत और साहित्य का कायाकल्प करने वाले व्यक्ति थे और इस संसार में उनकी पहचान मिली। वे साहित्य में अपने काम के लिए नोबल पुरस्कार जीतनेवाले पहले गैर – यूरोपिया थे । उन्होंने भावत और बंगलादेश का साष्ट्रगान दिया । गीतांजली (गीतार्पण), गोरा (सुंदर वदन), घरे – बैरे (द होम एंड द वर्ल्ड) उनकी सब से प्रसद्धि सरनाएँ हैं ।

प्राचीन भारत के महान संतों द्वारा अपने आश्रम में दिए गए उपदेश के पूर्णत्व के आदर्श आजभी भारतीयों के मन पर हावी हैं। हमारे महान महाकाव्यों की किंवदंतियाँ अपने आख्यानों के माध्यम से वनवासियों का संदेश देती हैं।

यूरोप के नॉर्थमेन या नॉर्समेन का इतिहास समुद्र के संगीत के साथ एक प्रतिध्वनि है । समुद्र उनके जीवन में एक महत्वपूर्ण भूमिका निभाता है। यह जीवन के कुछ आदर्शों का प्रतिनधित्व करता है, जो अभी भी उनके इतिहास का मार्गदर्शन करता है और उस जाति की रचनाओं को प्रेरित करता है। प्रकृति समुद्र के माध्यम से खुद का प्रतिनिधित्व करती है। खतरे और वाधाओं का उसका पहलू मनुष्यों की आत्मा में संदर्ष की भावना को आत्माशंत करता है । आदमी लड़ा और जीता और संघर्ष की यह भावना अभीभी आदमी बीमरी और गरीबी, अत्याचार और आदमी आदमी के खिलाफ लड़ने के लिए प्रेरित करती है । यह उनलोगों के जीवन के लिए सही है जो समुद्र के किनारे रहते हैं ।

लेकिन उत्तरी भारत की मैदानी भूमि में मनुष्यों के जीवन और प्रकृति के बीच कोई बाधा नहीं है । काम और फुरसत में, अपनी दैनिक आवश्यकताओं और ध्यान में, वन मनुष्यों के साथ धनिष्ठ संबंध में आगए । इन लोगों के जीवन के सत्य के दृष्टिकोण ने अंतर को ही नहीं, बलिक प्रकृति में सभी चीजों की एकता को प्रकट किया है । जब संसार हमें पराया – सा लगने लगता है, तब उसका यांत्रिक पहलू हमारे मन में प्रमुख हो जाता है। मशीन का भी दुनिया में अपना स्थान है । मनुष्य को मशीनों के रूप में इस्तमाल किया जाता है और शक्तिशाली परिणाम प्राप्त करने के लिए बनाता जा सकता है । इस दुनिया के दृष्टिकोण को संस्कृत शब्द ‘सच्चिदानंद’ के माध्यम से समझाया गया है जिस में कहा गया है कि वास्तविकता के तीन चरण हैं। पहला चरण ‘सत्’ है, जो इस तथ्य को बताता है कि चीजें मौजूद हैं और वह तथ्य जो हमें सामान्य अस्तित्व के संबंध के माध्यम से सभी चीजों से जोड़ता है । दीसरा चरण ‘चित’ है, जिस में कहा गया कि हम जानते हैं और इस ज्ञान के माध्यम से सभी चीजों से संबंधित है। तीसरा चरण ‘आनंद’ है, जिसका हम आनंद लेते हैं और यह हमें प्यार के माध्यम से सभी चीजों से जोड़ता है ।

सच्चे भारतीय दृष्टिकोण के अनुसार, हमारे जगत् की चेतना मात्र के रूप में विद्यमान सभी वस्तुओंका कुल भोग अपूर्ण है । यह पूर्ण हो जाता है जब हमारी चेतना सभी चीजों को आध्यात्मिक रूप से इसके साथ एक रूप में महसूस है । विक्रमादित्य के शासनकाल के दौरान, भारत के वनों के पीछे हटने का युग बीत गया। लेकिन उस वैभव और समृद्धि के युग में भी कविदास ने जिस प्रेम और श्रद्धा के साथ आश्रम के बारे में गया, वह भारत के प्रमुख आदर्श को दर्शाता है । कालिदास के काव्य ‘शकुंतला’ में आश्रम ने राजा के महल की भव्यता को झायांकित किया और यह स्पष्ट रूप से चेतन और अचेतन रचना के साथ मनुष्य के संबंध को समान रूप से मान्यता देने के विचार को व्यक्त करता है ।

आश्रम का वर्णन करते हुए, ‘कादंबरी’ में बाण लताओं को प्रणाम करने की मुद्रा के बारे में बताते हैं, जो वृक्षों द्वारा उनके फूलों को सहलाते हुए बलिदान में झुकते हैं, शिक्षार्थियों द्वारा गाए गए पाठों की गूंज और उनके भोजन का आनंद लेनेवाले पक्षियों के बारे में बताते हैं । ये सभी विवरण हमें बताते हैं कि आश्रम ही वह स्थान था जहाँ मनुष्य की भावनाओं का व्यापक अंतर था और शोष सृष्टि को पाटा गया था ।

पश्चिमी नाटकों में, प्रकृति एक अतिचारी है, लेकिन हमारे सभी प्रसिद्ध संस्कृत नाटकों में प्रकृति का हमेशा से ही मानवीय भावनाओं की शांति प्रदान करने के लिए एक महत्वपूर्ण कार्य है ।

‘ऋतु संहार’ जाहिर तौर पर कालिदास की अपरिपक्वता का काम है। इसमें युवा प्रेम-गीत ‘शकुंतला’ और ‘कुमार-संभव’ में विद्यमान उदात्त मौन तक नहीं पहुँचता है । लेकिन कामुक प्रकोपों की धुन प्रकृति की सिम्पनी के विविध सामंजस्य के लिए निर्धारित है । ‘कुमार संभव’ के तीसरे सर्ग में तपस्वियों की शांति में अचानक इच्छा की बाढ़ को मुक्त करने के लिए, प्रेम के देवता मदन द्वारा किए गए जुनून के हिंसक प्रकोप को सार्वभौमिक जीवन की पृष्ठभीमि के खिलाए दिखाया गया था । एक विशाल केनवास पर चित्रित पूरी ‘कुमार संभव’ कविता प्रेम का शाश्वत विवाह, उसकी लुभाने और बलिदान, उसकी पूर्ति और उस बहादुर ( कार्तिकेय) के जन्म के बारे में बताती है जिसने दुष्ट राक्षस को नष्ट कर दिया था ।

कालिदास के समय में, राजा स्वयंभू महाकाव्य बनगए । उस समय भारत गौरव के शिखर पर पहुँच गया था । लेकिन कालिदास की कविताओं से यह स्पष्ट है कि धन और भोग की भव्यता ने उस विचार के खिलाफ काम किया जो वन की पवित्र शांति से निकला था। इन कविताओं में युग की भव्य असत्यता के खिलाफ चैतावनी की आवाज है । कवि भारत के आध्यात्मिक प्रयास के गत युग की पवित्रता और सादगी के लिए तरह रहे थे ।

कालिदास ने सादगी और आत्मत्याग के दृश्यों के बीच अपनी कविता ‘रघुवंश’ की शुरूआत की। अंत में हमें वैभव महल और आत्म-सुख का अव्यय मिलता है । भाषा के शांत संयम के साथ, कवि पवित्रता के साथ वाज पहनाए गए राजसी गैरव के बारे में बताता है । वे सूर्योदय की शांति में अपनी कविता शुरू करते हैं और वेशाम की पृष्टभूमि में अंत का वर्णन करते हैं, जो सूर्य के तेज से रोशन होता है जो अंत में रात के अंधेरे में फीका पड़जाता है । इस शुरूआत में और इस अंत में वन का संदेश ध्विपा है । कहानी के माध्यम से यह विचार चलता है कि भविष्य तभी शानदार ढंग से आगे बढ़ा है जब वहाँ वातावरघ आत्म संयम, पवित्रता और त्याग की शांति थी । जब पतन निकट था, तो सौ अलग अलग बिंदुओं पर जलती हुई इच्छा की भूख की आग ने सभी देखनेवालों की आँखों को चकाचौंध कर दिया ।

Meanings and Explanations

hermitage(n) / (హర్మిటిజ్)/ ‘h3:.mɪ.tɪdʒ : a house where sages live in Isolation, away from, సాధారణ మానవ సహవాసానికి దూరంగా, ఋషులు ఒంటరిగా నివసించే ఇల్లు, जिस घर में साधु रहते हैं । एकांत में, सामान्य इंसान संगटन से दूर

our two greatest classical dramas : Tagore refers to Kalidas’s Abljnana Sakuntalam and Bhava bhuti’s Uttara-Ramacharitha, ఠాగూర్ కాళిదాస్ యొక్క అబ్లజ్ఞాన శాకుంతలం మరియు భవ భూతి యొక్క ఉత్తర రామచరితలను సూచిస్తాడు, गूर कालिदास के अभिज्ञान शाकुंतलम और भवभूति के उत्तर – राम चरित को सूचित करता है ।

permeated (v-pp)/ (ప(ర్)మిఎఇటిడ్) /’p3:mi.eɪt ɪ/ : spread; pervaded, వ్యాప్తి; వ్యాపించి ఉంది, व्याप्र

topographical (adj)/(ట్రాపగ్రాఫికల్ ) /tɒp.ǝ’græf.ɪ.kǝl/ : relating to the arrangement of the physical features of an area,

ఒక ప్రాంతం యొక్క భౌతిక లక్షణాల అమరికకు సంబంధించినది, किसीक्षेत्र की भौतिक विशेषताओं की व्यवस्था से संबंधित

resonant (adj) / (రెజనన్ ట్) ‘rez.ǝn.ǝnt/ : resounding, echoing, ప్రతిధ్వనించే, ప్రతిధ్వనించే गूँजनेवाला, गूँजनेवाला

indomitable (adj) / (ఇన్డెమిటబల్) / In’dɒm.ɪ.tə.bǝl/ : that cannot be overcome, defeated అది అధిగమించబడదు, ఓడిపోయింది जिसे दूर नहीं किया जा सकता, पराजित किया जासकता है

champing (v+ing-adj)/ (చ్యాంపింగ్) /tfæmpin/ : biting, chewing, eating noisily కొరికే, నమలడం, శబ్దంతో తినడం चबाना, शोर से खाना

mane (n) / (మెఇన్) / meɪn/ : longer hair growth on the back of the neck of animals like a horse or lion, గుర్రం లేదా సింహం వంటి జంతువుల మెడ వెనుక భాగంలో జుట్టు పొడవుగా పెరగడం, छोड़े या शेर जैसे जानवरों की गर्दन की पीठ पर लंबे बाला उगनां

antagonism (n)/ (యాంట్యాగనిజమ్) /æn’tæg.ən.ɪ.zəm : a strong natural dislike or hatred,antipathy బలమైన సహజ అయిష్టం లేదా ద్వేషం: వ్యతిరేకత एक मजबूत प्राकृतिक ना पसंदगी या नफरत

reconciliation (n)/ (రెకన్సిలిఎఇషన్) / rek.ǝnsɪl.i’eɪ.ʃǝn : the re-establishment of friendly relations స్నేహపూర్వక సంబంధాల పునఃస్థాపన मैत्रीपूर्ण संबंधों की बहाली

inimical (adj) / (ఇనిమికల్ ) / I’nɪm.ɪ.kǝl / : unfriendly, hostile, స్నేహపూర్వకంగా లేని, ప్రతికూలమైన, अमित्र, विरोधी

manifest (v) / (మ్యానిఫెస్ట్) /’mæn.ɪ.fest / : demonstrate, show clearly, ప్రదర్శించు, స్పష్టంగా చూపించు, प्रदर्शित करना, स्पष्ट रूप मे दिखाना

consciousness (n)/ (కొన్ షస్నస్) / ‘kɒn.ʃas.nas : awareness, the state of being awake to one’s surroundings, అవగాహన, ఒకరి పరిసరాల పట్ల మెలకువగా ఉండే స్థితి जागरूकता, अपने परिवेश के प्रति जागरूक होने की स्थिति

retreats (n-pl) / (రీట్రీట్స్) / rı’tri:ts : peaceful and quiet places affording privacy and security, గోప్యత మరియు భద్రతను కల్పించే శాంతియుత మరియు నిశ్శబ్ద ప్రదేశాలు

concourse (n) / (కొన్కో(ర్)స్) /’kɒŋ.kɔ:s / : a large group of people; a huge crowd the Chinese, the Hun, the Scythian(Shakas), names of races the Greek, the Roman, పెద్ద సమూహం; భారీ గుంపు చైనీస్, హున్, సిథియన్ (షకాస్), గ్రీకు, రోమన్ జాతుల పేర్లు लोगों का बड़ा समूह

Vikramaditya (prop n) : Emperor Chandragupta II (380-413 AD) చక్రవర్తి చంద్రగుప్త II (380-413 AD) కాదంబరి: బానాచే ఒక కవితా శృంగారం

Kadambari : a poetical romance by Bana, బానాచే ఒక కవితా శృంగారం

lianas (n-pl) li / (లియానాజ్)/ li’a:nə : creepers: woody climber tropical climates బానాచే ఒక కవితా శృంగారం, उष्ण कटिन धीया व्यकरवाघु में लकड़ी के पढकारे है ।

neophytes (n-pl)/ (నీఅఫైట్స్) /ni:ə.faɪts/ : beginners, novices, persons are new to a subject, ప్రారంభకులు, అనుభవం లేనివారు, వ్యక్తులు ఒక సబ్జెక్ట్ కి కొత్తవారు, एक विषय के लिए नए हैं

chasm (n)/ (క్యజమ్) : a gap, కేజం, ఖాళి, शुख आती, नौशिखिए, व्यक्ति जौ,

vortex (n)/ (వో(ర్)టెక్స్)/ ‘kaæz.əm : whirlwind, anything that inevitably draws surrounding things into fold, సుడిగాలి, అనివార్యంగా చుట్టుపక్కల వస్తువులను ముడుచుకునే ఏదైనా, कुछ भी जोअनिवार्य रूप से आसपास की चीजों को अपनी तह में खीच लेता है

trespasser (n) / (ట్రెస్పస(ర్) ‘tres.pə.sər / : one who comes into a place outsider, బయటి ప్రదేశానికి వచ్చేవాడు మృత్-శకటిక : శూద్రకు ఆపాదించబడిన నాటకం वह जो किसी स्थान पर बाहरी व्यक्ति के रूप में आता है

Mrit-Shakatika : a play ascribed to Shudraka శూద్రకు ఆపాదించబడిన నాటకం, शूदक का नाटक

reticence (n) / (రెటసన్స్)/ /’ret.ɪsəns/ : a silent and reserved nature, ఒక నిశ్శబ్ద మరియు రిజర్వు స్వభావం एक चुप और आरक्षित प्रकृति

voluptuous (adj) / (వలప్ చుఅస్) /və’lʌp.tʃu.əs/ : generous; attractive, ఉదారమైన; ఆకర్షణీయమైన, आकर्षक

glistening (v+ing) / (గ్లిసనింగ్)/ /’glɪs.ǝn ɪŋ/ : sparkling; reflecting light, మెరుపు; కాంతి ప్రతిబింబిస్తుంది, चमकदार : जगमगाता हुआ परावर्तक प्रकाश

serenity (n)/ (సరెనటి)/ sǝ’ri:n / : peacefulness; calmness, శాంతియుతత; ప్రశాంతత शांति, शांति

boisterous (adj) / (బొఇస్టరస్) ‘bɔɪ.stər.əs : full of energy, పూర్తి సామర్థ్యంతో, ऊर्जा से भरा हुआ

wooing (v+ing)/(పూ ఇంగ్)/wu: Iŋ : persuading the other to love ప్రేమించమని మరొకరిని ఒప్పించడం, दूसरे को प्यार करने के लिए राजी करना

vanquish (v)/(వ్యాంక్విష్) / ‘væn.kwɪʃ : defeat; conquer, ఓటమి; జయించు, हार, जीत

epicureans (n-pl) / (ఎపిక్యుఆరీఅన్ జ్) / ep.ɪ’kʊə.ri.əns : pleasure seekers, ఆనందం, కోరేవారు, सुख चाहने वाले

devastated (v-pt) / (డెవస్టెఇటిడ్) ‘dev.ə.steɪ.tɪd : attacked; destroyed, దాడి; ధ్వ౦సమైంది हमला किया, नष्ट किया

zenith (n)/ (జెనిత్)/’zen.ɪθ : the highest point, అత్యధిక పాయింట్, उच्चतम बिंदु

abyss (n)/(అబిస్) / ə’bɪs : bottomless pit; hell, అడుగులేని గొయ్యి; నరకం, अथाह गड्ढे, नरंक

devouring (v+ing-adj) / (డివౌఅరింగ్) / dɪ’vaʊa.riŋ : engulfing; absorbing, చుట్టుముట్టడం, గ్రహించుట, निगलना : प्रवशोषित करता

imminent (adj)/(ఇమినంట్) / ‘ɪm.ɪ.nǝnt / : about to happen : definite to occur, జరగబోతున్నది: ఖచ్చితంగా జరగాలి, होनेवाला – निशिचत रूप से घटित होता

![]()

![]()

![]()

![]()

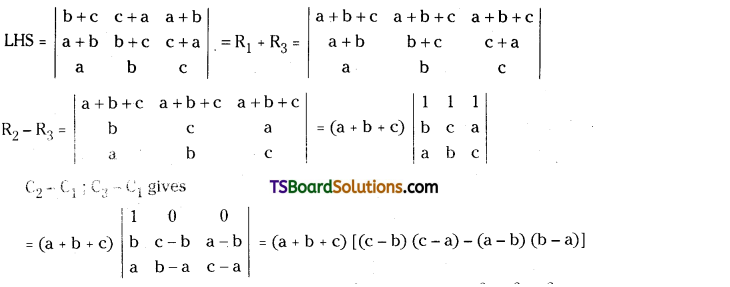

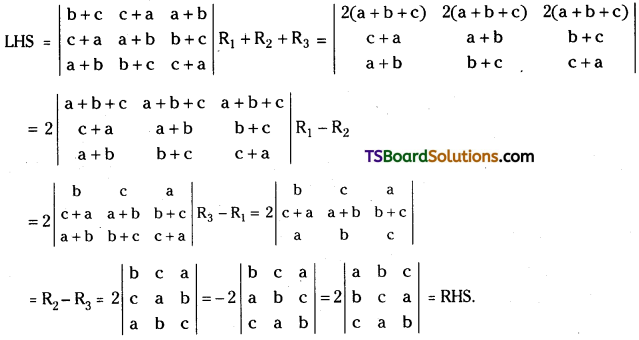

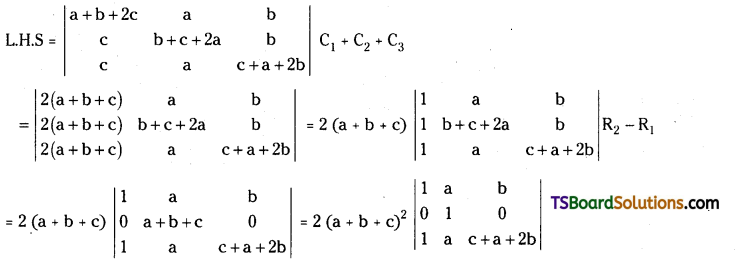

= 2 (a + b + c)2 [1{(c + a + 2b) – 0} – a (0 – 0) + b (0 – 1)]

= 2 (a + b + c)2 [1{(c + a + 2b) – 0} – a (0 – 0) + b (0 – 1)]