Telangana TSBIE TS Inter 2nd Year Commerce Study Material 1st Lesson Financial Markets Textbook Questions and Answers.

TS Inter 2nd Year Commerce Study Material 1st Lesson Financial Markets

Long Answer Type Questions

Question 1.

What is money market? Explain it s functions.

Answer:

Meaning :

- Money market is market for short term funds which deals with monetary assets whoes period of maturity is upto one year.

- Money market is a credit market, where short term debt instruments, having high liquidity, .unsecured and at low risk are traded between the parties.

- The sort term funds are raised to manage temporary shortage of cash and obligations, that the savers are to invest on them to earn returns.

Introduction :

Money market is a credit market, where short-term debt instruments, having high liquidity, unsecured and at low risk are being traded actively between the parties. In other words money market supply short-term funds to the industry.

Definitions. :

“The centre for dealing mainly of a short-term character, in monetary assets, it meets the short-term requirements of borrowers and provides liquidity or cash to the. lenders.

Functions of Money Market : (Main functions) :

- It is an equilibrating mechanism to even out demand for the supply of short-term funds.

- It provides a focal point for central bank intervention and influencing liquidity and the general level of interest rates in the economy.

- It enables a reasonable access to providers and users of short-term funds.

- Money market fulfill providers and users borrowing and investment requirements at an efficient and market clearing price.

Other functions :

- It provides short-term credit to the business to meet the working capital requirements.

- It funds the Government by issuing shor-term instruments to the savers.

- It deals with credit instruments.

- It enables the savers of the funds and investors to transact with each other.

- It helps trade and commerce to develop in a better manner, by issue of bills.

- It helps in promoting the saving habit in the people.

- It provides valuable and accurate information to the transacting parties to save money time and efforts.

![]()

Question 2.

Explain the functions of capial market.

Answer:

Introduction :

- Capital market means, it is the market where long-term finance is provided to the business firms through the sale of securities.

- The capital market participants are private sector manufacturing industries, government, specialised financial institutions and individual savers.

- The capital market is classified as primary market and secondary market.

Functions of Capital Market :

1. Mobilisation of the resources :

It mobilizes the resources from surplus areas to deficit and productive areas, it increasing the productivity and economic growth of the country.

2. Encourages savings :

It encourages savings motive among the people as they get returns in the form of interest, dividends and bohus.

3. Encourages investments :

It encourages investment by mobilising more capital through financial institutions.

4. Reduces the fluctuation in prices :

It stabilises the prices of securities and reduces the fluctuation in prices to the minimum.

5. Reduce unproductive activities :

It facilitates the reduction in speculation and unproductive activities.

6. Economic development :

It promotes the economic growth and development of the country.

7. Proper allocation of surplus funds :

It helps proper allocation of funds in public and private sectors. Improve the growth of the economy.

Question 3.

What are the differences between money market and capital market?

Answer:

Introduction :

Money Market :

The centre for dealing mainly of a short term character, in monetary assets, it meets the short term requirements of funds.

Capital Market :

It is the market where long term finance is provided to the business firms through the sale of securities.

Differences :

| Concept | Money Market | Capital Market |

| 1. Nature | It deals with the short term credit instruments not exceeding one year. | It deals with long term finance more than one year. |

| 2. Participants. | The major players are Commercial Banks, RBI, LIC, GIC and UTI etc. | The major players are merchant bankers, financial institutions, foreign investors and individual investors. |

| 3. Dealing Instrument | It deals with the credit instruments like Treasury bills, Commercial papers, Call money etc. | It deals with shares, debentures,, bonds and Government securities. |

| 4. Object | It is engaged in the supply of working capital requirement for short period. | It is engaged on the supply of fixed capital requirements of business and Government. |

| 5. Liquidity | Its instruments enjoy high liquidity. | Its instruments enjoy low liquidity when compared to the money market. |

| 6. Risk level | Its instruments are much safer and the risk level is low. | Its instruments are not safe with regard to returns and repayment of principal amount. |

| 7. Returns | Investor cannot expect higher returns. | Investors can have higher returns in the form of dividends. |

| 8. Value of instruments | Instruments are of high value. | The face value of securities may be low. |

| 9. Location of Transactions | Transactions will take place over phone, internet etc. | Initial and secondary issues are done through a market. |

| 10. Regulator | RBI regulates the market. | SEBI regulates the market. |

![]()

Question 4.

Explain the different money market instrumetns?

Answer:

The various money market instruments ae tresury bill, commercial paper, call money, certificate of deposit and commercial bill.

1. Treasury Bill :

- A Treasury Bill, or zero-coupon bond, is a promissory note issued by RBI, on behalf of central government, to meet the requirement of short – term funds.

- Treasury bills are issued at a lower price than their face value and repaid at par. The difference between the purchase price and the amount paid on maturity is the interest earned and called as “discount”.

- At present the Government of India issues three types of treasury bills thorugh auctions namely 91 days, 182 days and 364 days. Treasury bills are avilable for a minimum amount of rs. 10,000 and in multiples there of. Banks, individuals, HUF, financial institutions and corporations normally participate in the treasury bill market.

2. Commercial paper :

- Commercial paper is a short-term unsecured promissory note issued by creditworthy companies and are negotiable by endoursement at a discount value.

- A commercial paper tenure ranges from 1 day to 270 days. Commercial papers are issued for the purpose of financing of accounts receivable, inventory and meeting short-term liabilities.

- The returns on commercial paper are high when compared to Treasury Bills but less secured.

3. Call Money :

- Call money is an inter-bank transaction for short-term funds repayable with interest called as call rate to meet their cash reserve requirements on demand.

- The maturity call money is of 1 day to 14 days.

- Commercial banks require to maintain minimum cash balance known as Cash Reserve Ratio. The banks with cash reserve below the statutory requirement borow from such banks having surplus cash reserves. For the services rendered by the lending bank, interest is paid which is known as call rate. The call rate varies from day to day and even hour to hour.

4. Certificate of Deposit :

- Certificate of Deposit is an unsecured promisssory note, negotiable short-term in-strument issued by the commercial banks in the form of a certificate authorising the bearer to receive interest along with the face value.

- Certificate of Deposits can be issued to individuals, NRI’s corporations and compa-nies.

- These certificates are available for the term of 3 ,pmtjs to 5 years.

5. Commercial Bill :

- Commercial Bill is a negotiable instrument drawn by the drawer (seller) on the drawee (buyer) for acceptance to pay the amount of credit sales indebted to him at a future date.

- Once it is accepted by the drawer it becomes a legal document and it can be discounted with a bank when the drawer is in need of cash.

- The bank receives the face value from drawee on the due date. These trade bills can be rediscounted by the banks with RBI and can be considered as liquid assets.

Question 5.

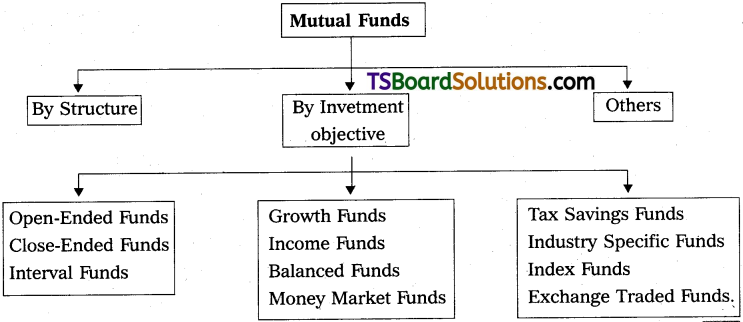

What is Derivative? Explain the various products of Derivatgives.

Answer:

- Derivative is a financial contract whose value is dependent on an underlying asset or group of assets.

- The commonly used assets are stocks, bonds, currencies commodities and market indices, the value of the underlying asset keeps changing according to market conditions.

- According to John C.Hall “A derivative can be defined as a financial instrument who value depends on the values of other, mole basic underlying variables”.

Derivative Products :

The most common types of derivatives are given below :

A) Forwards

B) Futures

C) Options and

D) Swaps

A) Forwards contracts :

- A forward contract is a customized contract (Non standardized contract) between two parties to buy or sell an asset at a specified date in future at a price agreed upon today.

- Forward contracts are self-regulated and no collecteral is required for the same.

B) Futures contracts :

- A futures contracts is a standardized contract between two parties to buy or sell an asset at a certain time in the future at a certain price.

- Futures contracts ae special type of forward contracts which are regulated by the stock exchange and being standard in nature, these contracts can not be modified.

C) Optipm contracts :

- Option contracs are those contracts that give the right but not the obligation to buy or sell on underlying asset.

- There are two types of options call and put in call option, the buyer has the right but not the obligation to buy an underlying asset at a price determined while entering the contract.

- In put option, the buyer has the right but not the obligation to sell an underlying asset at a price determined while entering the contract.

D) Swaps contracts :

- Swaps contracts are private agreements between two parties to exchange their cash flows in the future according to pre-arranged formula.

- Swap contracts are risky and they can be regulated as port folios of forward con-tracts.

Question 6.

Discuss the various debt market instruments.

Answer:

The following ae the important debt market instruments that are issued by the Central and State Governments, Municipal Corporations, Government bodies and commercial entities like Financial Institutions, Banks, Public Sector Units and Public Ltd. companies.

1. Debentures :

1) It is a type of Debt instrument which offers a fixed rate of interest for a specified tenure. Companies or governments use debentures to borrow money.

2) Debentures are simply loans taken by he companies and do not provide the ownerwhip in the company.

2. Bonds :

- Bonds are the fixed-income securities that are issued by corporations and governments to raise capital. The bond issuer borrows capital frim the bondholder and makes fixed payments to them at a fixed interest rate for a specified period.

- The different types of bonds that are traded in the debt market includes Zero Coupon Bonds, Coupon Bearing Bonds, Government Guaranteed Bonds, Public Sector Units (PSUs) Bonds, Private Sector Bonds, Floating Rate Bonds, etc.

3. Government Securities :

1) Government Securities or G-Secs are issued by the Reserve Bank of India on behalf of the Government of India.

2) These securities have a maturity period of 1 to 30 years. Securitites offer fixed interest rate, where interests are payable semi annually.

4. Treasury Bills :

Treasury Bills or T-Bills, which are issued by the RBI for 91 days, 182 days and 364 days. They are also called zero coupon bonds.

5. Certificate of Deposit :

- Certificate of Deposits (CDs) is issued by the bank to depositors of funds that remain with the bank for a specified period of time.

- CDs are similar to the traditional term deposits but are negotiable and tradable in the short-term money market.

6. Commercial Papers :

- Commercial paper, also called CP. It is a short-term debt instrument issueb by companis to raise funds.

- It is an unsecured money market instrument issued in the form of a promissory note and was introduced in India for the first time in 1990.

![]()

Question 7.

Explain the equity market instruments.

Answer:

The different equity market instruments are common shares, preferred shares, private equity, mutual funds and derivatives.

1. Common shares :

- Common stock shares respresent ownership capital, and holders of common shares are receive dividends out of the company’s profits.

- Common shareholders have a residual claim to the company’s income and assets.

- They are entitled to a claim in the company’s profits only after the preferred shareholdes and bondholders have been paid.

2. Preferred Shares :

- Preferred shares are a hybrid security because they combine some features of com-mon equity stock and debentures.

- They are like debentures as they have a fixed rae of dividend, have a claim to the company’s income and assets before equity.

- They do not have a claim in the company’s residual income, and do not confer voting rights to shareholders.

3. Private Equity :

- Equity investments made through private placements are known as private equity.

- Private equity is raised by private limited enterprises and partnerships, as they cannot trade theri shares publicly. Typically, start-up and small/medium-sized companies raise capital through this route from institutional investors and wealthy individuals.

4. Mutual Funds :

- Mutual funds are an investment tool that pools money from several investors and invests it in company stocks, bonds, government instruments, etc. in order to generate a profit for investors.

- This profit may be paid out as dividends to investors or reinvested by the fund for capital appreciation.

5. Derivatives :

- These are financial contracts whose value is dependent on an underlying asset or group of assets.

- The commonly used assets ae stocks, bonds, currencies, commodities and market indices. The value of the underlying assets keeps changing according to market condidtions.

Question 8.

Define Mutual Fund and explain its objectives.

Answer:

Meanings :

1) A Mutual Fund is a Financial Service Organisation that pools the savings of a number of investors who share a common financial goal. The money collected from investors is then invested by the fund manager in different types of securities; these could range from shares to debentures based upon the scheme’s stated objectives.

2) The income earned through these investments and the capital appreciation realised is shared by its unit holders in proportion to the number of units owned by them.

Objectives of Mutual Fund Investments :

a) Goal-Based Investing :

This is the top investment objective of Mutaul funds. It offers different types of mutual funds in order to suit the needs of the various investors. The fund manager invests according to target asset mix suitable for investors after looking at his/her risk profile and liabilities etc.

b) Investment Growth :

Investors who are looking for aggressive returns can do so by taking some extra risk. Mutual Funds on this objective invest money in fast-growing companies.

c) Tax Savings :

Tax Savings is also one of the important investment objectives of Mutual fund. Mostly wealthy clients, Institutional investors, and corporates have an objective to minimize the tax burdern. Mutual funds offer investors with a variety of funds which will reduce the tax.

Question 9.

What are the different types of mutaul funds? Explain.

Answer:

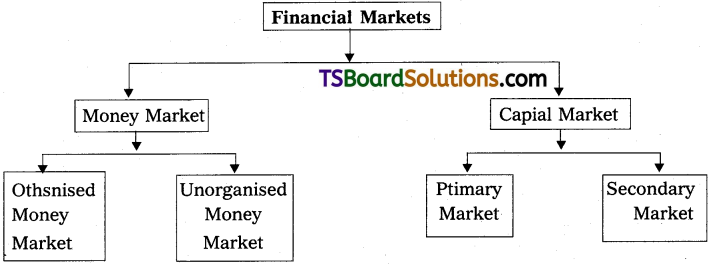

Mutual Fund schemes may be classified on the basis of its structure and investment objective.

I. Based on Structure :

a) Open – ended Funds :

- An open-ended fund is one that is available for subscription and repurchase on a continuous basis i.e. throughout the year.

- These funds do not have a fixed maturity period.

- Investors can conveniently buy and sell units at Net Asset Value (NAV) related prices. The key feature of open-end schemes is liquidity.

b) Close-ended Funds :

- closed-ended funds have a stipulated maturity period which generally ranges from 3-15 years.

- These funds are open for subscription only during a specified period.

- Investors can invest in the scheme at the time of the initial public issue and thereafter they can buy or sell the units of the scheme on the stock exchanges where they are lised.

c) Internal Funds :

Internal funds combine the features of open-ended and close- ended schemes. They are open for sale or redemption during pre-determined intervals at NAV related prices.

II. Based on Investment Objectives :

a) Growth Funds :

- The funds which are aimed at appreciation in the value of the underlyhing in-vestments through capital appreciation are called growth funds.

- Grwoth funds invest in growth oriented securities i.e., in shares of companies which can appreciage in long run.

- Growth funds are also known as Nest Eggs or Long Haul Investments.

b) Income Funds :

- The aim of income funds is to provide regulare and steady income to investors.

- Such schemes generally invest in fixed income securities such as bonds, corporate debentures and Government securities.

- Income Funds are ideal for capital stability and regular income.

c) Balanced Funds :

- The aim of balanced funds is to provide both growth and regular income.

- Such schemes periodically distribute a part of their earning and invest both in equities and fixed income securities in the proportion indicated in their offer documents.

d) Money Market Funds :

- The aim of money market funds is to provide easy liquidity, preservation of capital and moderate income.

- These schemes generally invest in safer short term instruments such as treasury bills, certificates of deposit, commercial paper and interbank call money.

- The returns on these schemes may fluctuate depending upon the interest rates prevailing in the market.

III. Others :

a) Tax Savings Funds :

These schemes offer tax rebates to the investors under specific provisions of the Indian Income Tax laws, as the Government offers tax incentives for investment in specified avenues to encourage the investors.

b) Industry Specific Funds :

- Industry Specific Schemes invest only in the industries specified in the offer document.

- The investment of these funds is limited to specific industries like Info Tech, Fast Moving Consumer Goods (FMCG), Pharmaceuticals, etc.

c) Index Funds :

Index Funds attempt to replicate the performance of a particular index such as the BSE Sensex or the NSE.

d) Exchange Traded Funds :

Exchange Traded Funds (EFT) provide investors with combined benefits of a closed-end and open-end mutual fund. Exchange traded funds follow stock market indices and are traded on stock exchanges like a single stock at index linked prices.

Short Answer Type Questions

Question 1.

Differentiate between indigeneous bankers and money lenders.

Answer:

| Concept | Indigenous Bankers | Money Lenders |

| 1. Meaning | Indigenous bankers are part of unorganised money market in rural area. | Money lender is also part of unorganised money market spread through out the country. |

| 2. Financing | Indigenous bankers finance the trade and commerce. | Money lenders are finance for consumption rather than trade. |

| 3. Interest rate | Indigenous bankers charge interest rate lower than money lenders. | Money lender charge interest rate more than indigenous bankers. |

| 4. Security | Indigenous bankers require security for giving loans. | Money lenders donot insist on securities for giving loans. |

![]()

Question 2.

What is the role of organised money market?

Answer:

The institutions functioning under this organized money market are regulaed by RBI and other regulating agency like NABARD.

Commercial banks, Indian and foreign, public sector and privae sectors are treated as organized sector. All these institutions participate on the demand side along with central government business entities and individuals.

The role of organised Money market:

Organised money market fulfil the requirement of finance

- for the government arise because of deficit.

- For the firms to meet their working capital needs.

- For the banks to maintain cash reserve ratio.

This money market deals with credit instrument like treasury bills, commercial paper, call money, certificae of deposits, and mutual funds.

Question 3.

What are the differences between primary market and secondary market.

Answer:

| Concept | Primary Market | Secondary Market |

| 1. Nature | It is concerned with issue of new shares. | It is concerned with marketing of existing shares. |

| 2. Sale of Securities | It enables the company to sell securities to the investors directly or through intermediaries. | It helps the holders of securities to exchange their securities. |

| 3. Capital formation | It is directly connected with the promotion of capital formation. | It is indirectly connected with the promotion of capital formation. |

| 4. Securities dealing | It deals with the buying of securities. | It enables both buying and selling of securities. |

| 5. Value of securities | It enables the management of the company to decide the value of the securities. | It enables the demand and supply to determine the price of securities. |

| 6. Location | It has no fixed geographical location. | It is located at specific places. |

![]()

Question 4.

What is Treasury bill?

Answer:

- A Treasury bill is also called zero coupon bond, it is a promissory note issued by RBI, on behalf of Central Government, for a discount to meet the requirement of short term funds. Treasury bills were first issued by the Government of India in 1917.

- It is one of the safe money market instruments and the returns are not that attractive. But they are zero risk instruments having assured earnings.

- Treasury bills are issued at a lower price than their face value and repaid at par (face value). The difference between these two are called as discount.

- These are circulated in primary market and secondary markets. At present the Government of India issues three type of treasury bills. They are

a) 91 days treasury bills

b) 182 days treasury bills

c) 364 days treasury bills - Treasury bills are available for a minimum amount of ₹ 25,000 and in multiples there of. Banks and financial institutions are participate in the treasury bill market.

Question 5.

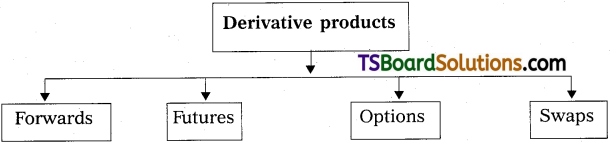

How financial markets are classified?

Answer:

Financial market is the market in which financial assets are created and transferred. On the basis of tenure of credit needs, the financial markets are classified into money market and capital market.

A) Money market is the market where shorterm debt instruments are traded and money market is divided as organised money market and unorganised money market.

B) Capital market is the market where long term finance is provided to the business firm with new issues of shares.

Capital market is divided into primary market and secondary market.

Question 6.

What do you mean by Certificate of Deposit?

Answer:

- Certificate of deposit is an “unsecured promissory note”, negotiable short – term instrument issued by the commercial banks in the form of a certificate authorising the bearer to receive interest along with the face value.

- Certificate of deposits can be issued to individuals, NRI’s, corporations and companies.

- They are issued during the period of high liquidity when the percentage of deposits are low compared to demand for loans. These certificates are available for the term of 3 months to 5 years.

- The return on certificate of deposit are higher than the T – Bill as the rate of risk is high.

Question 7.

What is meant by commercial paper?

Answer:

- Commercial paper is a short – term unsecured promissory note issued by credit worthy companies and are negotiable by endorsement at a discount value.

- A commercial paper tenure ranges from T day to 270 days. Commercial papers are issued for the purpose of financing of accounts receivable inventory and meeting short-term liabilities.

- The returns on commercial paper are high when compared to treasury bills but less secured. These securities are actively traded in secondary market also. A non-resident can also invest in commercial paper on non – repartition basis.

Question 8.

What is call money?

Answer:

Call Money :

- Call money is an inter-bank transaction for short-term funds repayable with interest called as call rate to meet their cash reserve requirements on demand.

- The maturity of call money is of 1 day to 14 days.

- Commercial banks require to maintain minimum cash balance known as Cash Reserve Ratio. The banks with cash reserve below the statutory requirement borow from such banks having surplus cash reserves. For the services rendered by the lending bank, interest is paid which is known as call rate. The call rate varies from day to day and even hour to hour.

Question 9.

What is Bond market?

Answer:

Bond Market :

- The bond market is a market place where investors buy debt securities that are brought to the market by either governmental entitie or publicly-traded corporations.

- This is also called as Fixed-income Market, or Credit Market.

- Governments typically issue bonds in order to raise captial to pay down debts or fund infrastructural improvements. Publicly traded companies issue bonds when they need to finance business expansion projecs or maintain on going operations.

- The general bond market can be segmented into Corporae bonds, Government bonds, Municipal bonds, Mortgaged backed bonds and Emerging market bonds.

![]()

Question 10.

What is Debit Market?

Answer:

- Debit market deals with those securities which yield fixed income. The debt market is any market situation wherer trading of debt instruments takes place.

- The debit instruments include mortages, promissory notes, bonds, and Certificates of Deposit.

- A debt market establishes a structured environment where these types, of debt can be traded with case between interested parties.

- Debt market provides greater funding avenues to both public sector and private sector projects and reduces the pressure on institutional financing.

Question 11.

What is equity market?

Answer:

- It is the place where buyers and sellers meet to trade in listed companies shares.

- An Equity Market also known as the Stock Market or Share Market, is a platform for trading in company shares.

- An equity market is not a physical facility or discrete entity. A stock exchange is a physical entity and a designated place. Two major Indian Stock exchanges BSE (Bomnay Stock Exchange) and NSE (National Stock Exchange) provide real-time trading information on the listed securities.

- In simple terms, an equity market can be viewed as a market where the buyer and sellet of a stock meet.

Question 12.

What is Forex Market?

Answer:

- The foreign exchange market or the ‘forex market’ is a system which establishes an international network allowing the buyers and sellers to carry out trade or exchange of currencies of different countries. It simply means buying one currency and selling the other.

- The objective of forex trader is to make profits from these fluctuations in prices, speculating on which way the foreign exchange rates ae likely to move in the future.

- The forex market is made up of banks, commercial companies, central banks, investment management firms, hedge funds, and retail forex brokers and investors.

- The forex market is a network of institutions, allowing for trading 24 hours a day, five days per week, with the exception of when all markets are closed because of a holiday.

- Forex transactions are generally quoted in pairs because when one currency is bought, the other is sold. The first currency is called the ‘base currency’ and the second currency called he ‘quote currency’.

Question 13.

What is close ended fund?

Answer:

Close-ended Funds :

- closed-ended funds have a stipulatd maturity period which generally ranges from 3-15 years.

- These funds are open for subscription only during a specified period.

- Investors can invest in the scheme at the time of the initial public issue and thereafter they can buy or sell the units of the scheme on the stock exchanges where they are listed.

![]()

Question 14.

What is convertible bond.

Answer:

- A convertible bond is a regular corporate bond that has the added feature of being convertible into a fixed number of shares of common stock.

- Convertible bonds are debt instruments because they pay interest and have a fixed maturity date.

- The conversion ratio is determined at the time of issuance, and typically can be acted upon by the holder at any time.

Very Short Answer Type Questions

Question 1.

Financial Market.

Answer:

- Financial market is the market in which financial assets are creaed and transferred.

- Financial market facilitate the transfer of savings to investment.

- On the basis of tenure of credit needs, the financial markets are classified into money market and capital market.

Question 2.

Money Market.

Answer:

- Money market is a market for short term funds which deals with monetary assets whose period of maturity is upto one year.

- Money market is a credit market, where short-term debt instrument, having high liquidity unsecured and at low risk are traded between the parties.

Question 3.

Capital Market.

Answer:

- Capital market denotes the market where long-term finance is provided to the business firms through the sale of securities.

- The capital market participants are private sector manufacturing industries, government, specialized financial institutions, and individual savers.

- Capital market is divided as primary market and secondary market.

Question 4.

Organised money market?

Answer:

- Financial institutions functioning under this organized money market are regulated by eithe the RBI or other regulating agency like NABARD.

- Comercial banks, Indian, foreign, public, private government entities are participate in organised money market.

- Organised money market deals with creditg instruments like treasury bills, commercial paper, call money etc.

Question 5.

Unganised money market?

Answer:

- Unorganised money market is not regulated by any specific authority.

- It is continuing in the country inspite of development of banking system in rural ayeas through indigenous bankes and money lenders.

Question 6.

Primary market.

Answer:

- Primary market is also known as “new issues market”.

- The company issuing securities may be new or old in the primary market.

![]()

Question 7.

Secondary market.

Answer:

- Secondary market is also called as stock exchange

- The listed securities (shares) are bought and sold in the secondary market.

Question 8.

Price in Financial Markets.

Answer:

- For financial asset or securities, the most recent price at which it was traded is considered as financial market price.

- In primary market, management decide the price / value of the securities, and in secondary market, the demand and supply determine the price of securities.

Question 9.

Business Finance.

Answer:

- The requirement of funds to carryout its various activities is called business finance.

- Finance is needed for the business for fixed capital reqirements and for working capital require.

Question 10.

Instruments of money market.

Answer:

Instruments of money market are

- Treasury Bill

- Commercial paper

- call money

- certificate of deposit

- commercial bill

Question 11.

Terms of certificate of Deposit.

Answer:

- certificate of Deposit is an unsecured promissory note, negotiate short-term instrument issued by the commercial banks in the form of a certificae authorising the bearer to receive interest along with the face value.

- Certificate of deposits can be issued to individuals, NRIs, corporations and companies

- These certificates are available for the trm of 3 months to 5 years.

Question 12.

Commercial bill.

Answer:

- Commercial Bill is negotiable instrument drawn by the drawer (seller) on the drawee (buyer) for acceptance to pay the amount of credit sales indebted to him at a future date.

- Once it is accepted by the drawer it becomes a legal document and it can be discounted with a bank when the drawer is in need of cash.

- The bank receives the face value from drawee on the due date. These trade bills can be rediscounted by the banks with RBI and can be considerd as liquid assets.

![]()

Question 13.

Discount on T-Bill.

Answer:

Treasury bills are issued at a lowe price than their face value and repaid at par. The difference between the purchase price and maturity value is the interest earned and it is called as discount on T – Bill.

Question 14.

call rate.

Answer:

- commercial banks require to maintain minimum cash balance the banks with cash reserve below he statutory requirement it borrows from such banks having surplus cash reserve.

- For the services rendered by the lending bank, interest is paid which is known as “call rate”.

Question 15.

Derivates.

Answer:

- These ae financial contracts whose is dependent on an underlying asset or group of assets.

- The commonly used assets are stocks, bonds, currencies, commondities and market indices. The value of the underlying assets keeps changing secording to market conditions.

Question 16.

Forwards.

Answer:

- A forward contract is a customized contract (Non standardized contract) between two parties to buy or sell an asset at a specified date in future at a price agreed upon today.

- Forward contracts are self regulated and no collecteral is required for the same.

Question 17.

Features.

Answer:

- A futures contracts is a standardized contract between two parties to buy or sell an air et at a certain time in the future at a certain price.

- Futures contracts ae special type of forward contracts which are regulated by the stock exchange and being standard in nature, these contracts can not be modified.

Question 18.

Option.

Answer:

- Option contracs are those contracts that give the right but not the obligation to buy or sell on underlying asset.

- There are two types of options call and put in call option, the buyer has the right but , not the obligation to buy an underlying asset at a price determined while entering the contract.

- In put option, the buyer has the right but not the obligation to sell an underlying asset at a price determined while entering the contract.

Question 19.

Swap.

Answer:

- Swaps contracts are private agreements between two parties to exchange their cash flows in the future according to pre-arranged formula.

- Swap contracts are risky and they can be regulated as portfolios of forward contracts.

Question 20.

Structured product

Answer:

- A standard product is tailored investment solution, using a combination of traditional financial instruments, and derivatives.

- This combination allows investors to adjust the level of risk to their optimal acceptable leel, while benefiting from movements in the underlier (for example, a stock, an exchange rate, etc.

- These products are usually long-term in nature requiring a lock-in of at least year and an investment horizon of 2-3 years to gain maximum return.

Question 21.

Mutual fund.

Answer:

- Mutual funds are an investment tool that pools money from several investors and invests it in company stocks, bonds, government instruments, etc. in order to generate a profit for investor.

- This profit may be paid out as dividends to investors (dividend plans) or reinvested by the fund for capial appreciation (growth plan).

Question 22.

Open ended fund.

Answer:

- An open-ended fund is one that is available for subscription and repurchase on a continuous basis i.e. throughout the year.

- These funds do not have a fixed maturity period.

- Investors can conveniently buy and sell units at Net Asset Value (NAV) related prices. The key feature of open-end schemes is liquidity.

![]()

Question 23.

Grwoth fund.

Answer:

- The funds which are aimed at appreciation in the value of the underlying investments through capital appreciation are called growth funds.

- Growth funds invest in growth-oriented securities i.e., in shares of companies that can appreciate in long run.

- Growth funds are also known as Nest Eggs or Long Haul Investments.

Question 24.

Industry-specific fund

Answer:

- Industry Specific Schemes invest only in the industries specified in the offer document.

- The investment of these funds is limited to specific industries like info Tech, Fast Moving Consumer Goods (FMCG), Pharmaceuticals, etc.)