Telangana TSBIE TS Inter 1st Year Economics Study Material 8th Lesson Theories of Employment and Public Finance Textbook Questions and Answers.

TS Inter 1st Year Economics Study Material 8th Lesson Theories of Employment and Public Finance

Long Answer Questions

Question 1.

Critically examine the classical theory of employment.

Answer:

The theory of output and employment developed by economists such as Adam Smith, David Ricardo, Malthus is known as classical theory. It is based on the famous “Law of markets” advocated by J.B. Say. According to this law “supply creates its own demand”. The classical theory of employment assumes that there is always full employment of labour and other resources. The classical economists ruled out any general unemployment in the long run. These views are known as the classical theory of output and employment.

The classical theory of employment can be three dimensions.

C. Equilibrium of the labour market (Pigou wage cut policy)

A) Goods market equilibrium :

The 1st part of Say’s law of markets explains the goods market equilibrium. According to Say “supply creates its own demand”. Say’s law states that supply always equals demand. Whenever additional output is produced in the economy, the factors of production which participate in the process of production. The total income generated is equivalent to the total value of the output produced. Such income creates additional demand for the sale of the additional output. Thus there could be no deficiency in the aggregate demand in the economy for the total output. Here every thing is automatically adjusting without need of government intervention.

The classical economists believe that economy attains equilibrium in the long run at the level of full employment. Any disequilibrium between aggregate demand and aggregate supply equilibrium adjusted automatically. This changes in the general price level is known as price flexibility.

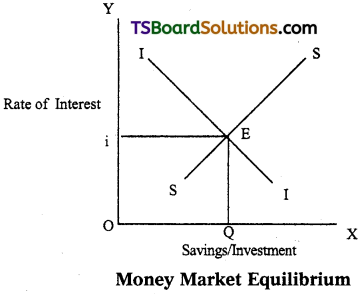

B) Money market equilibrium :

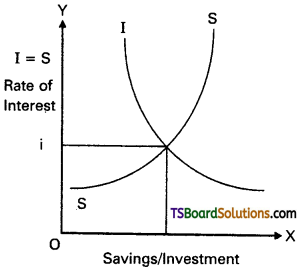

The goods market equilibrium leads to bring equilibrium of both money and labour markets. In goods market, it is assumed that total income spent the classical economists agree that part of the income may be saved. But the savings is gradually spent on capital goods. The expenditure on capital goods is called investment. It is assumed that equality between savings and investment is brought by the flexible rate of interest. This can be explained by the following diagram.

In the diagram savings and investment are measured on the ‘X’ axis and rate of interest on Y axis. Savings and investments are equal at ‘Oi’ rate of interest. So money market equilibrium can be automatically brought through the rate of interest flexibility.

C) Labour market equilibrium :

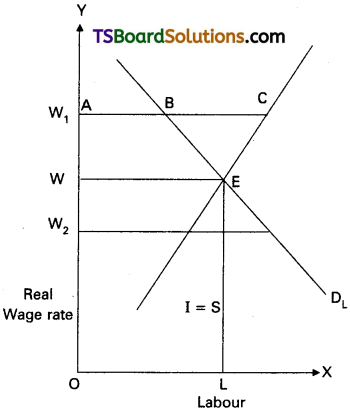

According to the classical economists, unemployment may occur in the short run. This is not because the demand is not sufficient but due to increase in the wages forced by the trade unions. A.C. Pigou suggests that reduction in the wages will remove unemployment. This is called wage – cut policy. A reduction in the wage rate results in the increase in employment.

According to the classical theory supply of and demand for labour are determined by real wage rate. Demand for labour is the inverse function of the real wage rate. The supply of labour is the direct function of real wage rate. At a particular point real wage rate the supply of and the demand for labour in the economy become equal and thus equilibrium attained in the labour market. Thus there is full employment of labour. This can be explained with the help of diagram.

In the above diagram supply of and demand for labour is measured on the X – axis.

The real wage rate is measured on the Y axis.

If the wage rate is OWp the supply of labour more than the demand for labour. Hence the wage rate falls. If the real wage rate is 0W2, the demand for labour is more than supply of labour. Hence the wage rate rises. At OW, real wage rate the supply and demand are equal. This is equilibrium.

Assumptions :

- There is no interference of government of the economy.

- Perfect competition in commodity and labour market.

- Full employment.

![]()

Question 2.

Explain the Keynesian theory of employment. [Man’17, ’16]

Answer:

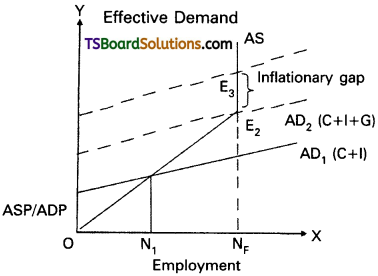

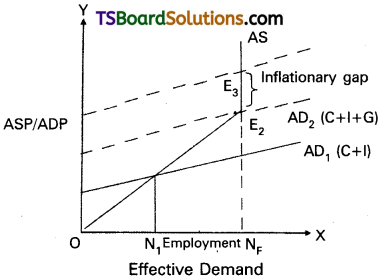

Keynes theory of employment is the principle of effective demand. He called his theory, general theory because it deals with all levels of employment. Keynes explains that lack of aggregate demand is the cause of unemployment. He used the terms aggregate demand, aggregate supply. It means total. The term effective demand is used to denote that level of aggregate demand which is equal to aggregate supply.

According to Keynes where aggregate demand and aggregate supply are intersected at that point effective demand is determined. This effective demand will determine the level of employment.

Aggregate supply schedule :

The aggregate supply schedule shows the various amounts of the commodity that will be offered for sale at a series of price. As the level of output increases with the level of employment. The aggregate supply price also increases with every increase in the level of employment. The aggregate supply curve slopes upwards from left to right. But when the economy reaches the level of the full employment, the aggregate supply curve becomes vertical.

Aggregate demand schedule :

The various aggregate demand prices at different level of employment is called aggregate demand price schedule. As the level of employment rises, the total income of the community also rises and therefore the aggregate demand price also increases. The aggregate demand curve slopes upward from left to right.

Equilibrium level of income :

The two determinants of effective demand aggregate supply and aggregate demand prices combined schedule is shown in the following table.

| Level of employment (in lakhs of workers) |

Aggregate supply price (in crores of ₹) |

Aggregate demand price (in crores of ₹) |

| 20 | 200 | 175 |

| 30 | 250 | 225 |

| 40 | 300 | 300 AD = AS |

| 50 | 350 | 325 |

| 60 | 400 | 425 |

The table shows that so long as the demand price is higher than the aggregate supply price. The level of employment 40 lakh workers aggregate demand price is equal to aggregate supply price i.e., 300 crores. So effective demand in the above table is ₹ 300 crores. This can be shown in the following diagrams.

In the diagram ‘X’ axis represents the employment and Y axis represents price. A.S is aggregate supply curve A.D is aggregate demand curve. The point of intersection between the two ‘E1‘ point. This is effective demand where all workers are employed at this point the entrepreneurs expectation of profits are maximised. At any other points the entrepreneurs will either incur losses or Employment earn sub-normal profits.

Question 3.

Discuss the concept of public finance. Describe the sources of public revenue.

Answer:

Public finance deals with the income and expenditure of public authorities (government). The word public is used to denote state or government: central, state and local bodies. According to Prof. Hugh Dalton “it is concerned with the income and expenditure of public authorities and with the adjustment of one to another”.

Modem governments play a major role in creating economic and social infrastructure. They spend lots of money on construction of roads, railways, on creating communication systems, education and health, on providing irrigation facilities and electricity etc. Of late modem governments have been spending huge amounts on various welfare measures to ameliorate the difficulties of poor and downtrodden sections of their population.

Public Revenue:

As explained in the previous paragraphs, a modem government has many functions to perform. It needs huge revenue for the performance of all its functions efficiently. Therefore it collects revenue by imposing taxes and also receives money from the people in many other forms. Revenue received by the government from different sources is called public revenue. Public revenue is broadly classified into two kinds :

- Tax revenue and

- Non-Tax revenue.

1) Tax Revenue :

Revenue received through collection of taxes from the public is called tax revenue. Both the central and state governments collect taxes as per their allocation in the Constitution.

Broadly taxes are divided into two categories : a) direct taxes, b) indirect taxes.

a) Direct Taxes :

i) Taxes imposed on individuals and companies based on income and expenditure.

Ex : Personal income tax, corporate tax, interest tax and expenditure tax.

ii) Taxes imposed on property and capital assets of individuals and companies.

Ex : Wealth tax, gift tax, estate duty.

b) Indirect Taxes :

Taxes levied On goods and services. Ex : Excise duty, customs duty, service tax.

2) Non – Tax Revenue :

Government receives revenue from sources other than taxes and such revenue is called the non-tax revenue. The sources of non-tax revenues are as follows:

a) Administrative Revenue :

Government receives money for certain administrative services. Ex : License fee, Tuition fee, Penalty etc.

b) Commercial Revenue :

Modern governments establish public sector units to manufacture certain goods and offer certain services. The goods and services are exchanged for the price. So such units earn revenue by way of selling their products.

Some of the examples of the public sector units are Indian Oil Corporation, Bharath Sanchar Nigam Ltd, Bharath Heavy Electricals, Indian Railways, State Road Transport Corporations, Air India etc.

c) Loans and Advances :

When the revenue received by the government from taxes and from non-tax sources is not sufficient to meet the needs of government expenditure, it may receive loans from the financial institutions operating within the country and also from the public. Modem government can also obtain loans from foreign government and international financial institutions.

d) Grants-in-Aid :

Grants are amounts received without any condition of repayment. They are not repaid. State governments receive such grants from the central government. The central government may receive such grants from foreign governments or any international funding agency.

Grants are of two types.

1. General Grants :

When a grant is given to meet shortage of funds in general without specifying a purpose, it is called general grant.

2. Specific Grants :

When a grant is given for a specific purpose it is called a specific grant. It cannot be spent on any other purpose. Ex : education grant and family planning grant etc.

![]()

Question 4.

Explain the concept of public debt Describe the various methods of redemption of public debt

Answer:

When the government’s expenditure exceeds its revenue one option it has is to go for public debt. A government can borrow funds from sources within the country or from abroad. This creates public debt.

Types of Public Debt:

On the basis of the sources, public debt is classified into two categories :

i) Internal debt :

Internal debt is the debt raised from the sources such as banks, financial institutions and private individuals within the country.

ii) External debt :

The borrowings of the government from the sources outside the country are called external debt. A government can raise external debt from the governments of other countries, international financial institutions like World Bank and International Monetary Fund (IMF) and other funding agencies.

Redemption of public debt means repayment of public debt. All government debts should be rapid promptly. There are various methods of repayment which may be discussed under the following heads.

1) Surplus budget :

Surplus budget means having public revenue in excess of public expenditure. If the government plans for a surplus budget, the excess revenue may be utilized to repay public debt.

2) Refunding :

Refunding implies the issue of fresh bands and securities by government so that the matured loans can be used for repayment of public debt.

3) Annuities :

By this method, the government repays past of the public debt every year. Such annual payments are made regularly till the debt is completely cleared.

4) Sinking fund :

By this method, the government creates a separate fund called Sinking fund’ for the purpose of repaying public debt. This is considered as the best method of redemption.

5) Conversion :

Conversion means that the existing loans are changed into new loans before the date of their maturity.

6) Additional taxation :

Government may resort to additional taxation so as to raise necessary funds to repay public debt under this method new taxes are imposed.

7) Capital levy :

Capital levy is a heavy one time tax on the capital assets and estates.

8) Surplus Balance of payments :

This is useful to repay external debt for which foreign exchange is required surplus balance of payment implies exports in excess of imports by which reserves of foreign exchange can be created.

Question 5.

Analyse the central, state financial relations in India.

Answer:

The financial relationship between the centre (union) and the states is provided in the constitution. The constitution gives a detailed scheme of distribution of financial resources between union and the states. The constitution makes a broad distinction between the power to levy a tax and the power to appropriate the proceeds of a tax. Thus the legislature which levies a tax is not necessarily the authority which retains the proceeds of a tax levied.

The constitution grants the union parliament exclusive power to levy taxes on several items. The state legislatures enjoy similar power with regard to several other specified items. In general, the union parliament levies taxes on items mentioned in the union list while the state legislatures levy taxes on items mentioned in the state list.

1) Exclusive Powers of Union Government:

The subjects on whom the union government has the exclusive powers to levy taxes are :

a) Customs duty, b) Corporation tax, c) Capital gains, c) Surcharge on income tax and c) Railway fares etc.

2) Exclusive Powers of State Governments :

State’s exclusive powers to tax include : a) Land revenue, b) Stamp duty, c) Estate duty, d) Entry tax, e) Sales tax and f) Taxes on vehicles and Luxuries etc.

The residuary power of taxation belongs to the centre. It means that the subjects which have not been included either in the union or in the state list may be taxed only by the union government. In the matter of taxation, the constitution recognizes no concurrent jurisdiction. Hence there is no subject who may be taxed both by the union and the state governments.

Besides the exclusive power of taxation of the union and the state governments, there are 3 other categories of taxes. They are :

a) Taxes levied by the union government but collected and appropriated by the states. Stamp duties on bills of exchange, excise duties on medicinal and toilet preparations fall in this category.

b) Certain duties are levied and collected by the union but the net proceeds of such taxes are distributed among the states. Each state gets that amount of the tax as is collected with in its territory. Succession duty, estate duty on property other than agricultural land, taxes on railway fares and freights, taxes on news paper sales and advertisements etc., fall in this category.

c) Certain taxes are levied and collected by the union but the proceeds are distributed between the centre and the states. Taxes on non-agricultural income (Art. 270) and excise duties on items in the union list except medicinal and toilet preparations fall in this category.

3) Miscellaneous Powers:

i) After 73rd and 74th Amendment of the Constitution, a provision is made for the constitution of the consolidated fund of state from which resources are to be provided to the village panchayats and municipalities.

ii) According to Article 360, during the proclamation of financial emergency, the President can give financial directives to the states. The union government supplements the financial resources of the states by two other means besides distribution of tax revenues. There are : a) Advancement of central loans and b) Grants-in-aid given to the states.

![]()

Question 6.

Write an essay on Federal Finance.

Answer:

Federal finance means the finance of the central government as well as the state governments and the relationship between the two. In a federal system of finance, all items of revenue and expenditure are divided among the central, state and local governments. All the three forms of government are free to make expenditure on their respective heads and to get revenue from their respective sources.

Characteristics of a Federal Finance :

The following are some of the important characteristic features of federal finance :

- In the federal finance, the sources of income and heads of expenditure are distributed between the central and state governments according to the constitution. Their jurisdiction and rights are clearly defined in the constitution.

- In the federal system the central government provides financial aid to states.

- Although the state government have administered autonomy, yet they remain subordinate to the centre. No state is free to fall apart from central government on its own.

- In case of any financial dispute arising between the central and the state governments, the solution there of is sought according to the constitutional provisions. India with a federal form of government has a federal finance system.

The essence of the federal form of government is that the central and state governments should be independent of each other in their respective spheres of action. The constitution should spell distinctly and separately the functions to be performed by respective governments. Once the functions of the governments have been spelt out, it becomes equally important that each of the governments should be provided with competent sources of raising adequate revenue to discharge the functions entrusted to it. Thus, for the successful operation of the federal form of government, two important conditions are essential, viz.

- Each government should have independent sources of revenue, and

- Each government should have total command over its resources to meet its needs.

In short, financial independence and adequacy constitute the backbone of the federal

finance system.

Question 7.

Describe the concept, components and types of budget.

Answer:

Budget is an annual statement showing the estimated receipts (revenue) and expenditure of a government for a financial year (April – March). The governments present to the legislature an annual budget every year for its approval. The budget is presented by the finance minister. The government cannot incur any expenditure unless it has the prior approval of the legislature.

Sometimes a vote on account budget is presented by the government when it is not possible to present the full budget. It is an interim budget for a few months. This will facilitate the government to incur expenditure pending approval of the regular budget.

Objectives :

The main purpose of the budget is to obtain approval of the legislature for the tax proposals and allocation of resources to various government activities. The government utilizes the occasion to state its policies and programmes.

Budget Estimates :

In the budget, budget estimates for the ensuing financial year are shown along with the actual expenditure of the preceding financial year, and budget estimates and revised estimates for the current financial year. For a clear understanding of these estimates, budget at a glance for the year 2013-14.

Components of the Budget :

The budget consists of both receipts (income) and expenditure of the government. The budget of the Government of India consists of two main components :

1) Budget Receipts:

a) Revenue Receipts :

This consists of tax revenue and non-tax revenue and

b) Capital Receipts :

This consists of recoveries of loans, other receipts and borrowings and other liabilities.

2) Budget Expenditure :

In the Union budget of India, the budget expenditure is classified into plan expenditure and non-plan expenditure. Each category is further divided into revenue account and capital account. Let us enlist them as hereunder :

i) Plan Expenditure:

a) Plan expenditure on revenue account.

b) Plan expenditure on capital account.

ii) Non-plan Expenditure :

a) Non-Plan expenditure on revenue account.

b) Non-Plan expenditure on capital account.

Again the plan expenditure and the non-plan expenditure is summed up and shown as revenue expenditure and capital expenditure.

Types of Budget:

There are three types of budgets based on the difference between the receipts and expenditure:

1) Surplus Budget :

This refers to the budget in which the total revenue is more than the total expenditure (R>E).

2) Deficit Budget :

This refers to the budget in which the total expenditure exceeds the total revenue (R<E).

3) Balanced Budget :

This refers to the budget in which the total expenditure and the total revenue are equal (R = E).

Short Answer Questions

Question 1.

“Supply creates its own demand”. Explain the statement ofJ.B. Say.

Answer:

Classical theory of employment or the theory of output and employment developed by economists such as Adam Smith, David Ricardo, Robert Malthus etc., it is based on the J.B Say’s law of market’. According to this law “supply creates its own demand”. The classical theory of employment assumes that there is always full employment of labour and other resources.

According to this law the supply always equals to demand it can be expressed as S=D. Whenever additional output is produced in the economy. The factors of production which participate in the process of production. Earn income in the form of rent, wages, interest and profits.

The total income so generated is equivalent to the total value of the additional output produced. Such income creates additionl demand necessary for the sale of the additional output. Therefore the question of addition output not being sold does not arise.

![]()

Question 2.

Enumerate the assumptions and major aspects of classical theory of employment

Answer:

The classical theory of employment is based on the Say’s law of markets. The famous law of markets, propounded by the J.B Say states that “Supply creates its own demand”.

Assumptions :

The Say’s law is based on the following assumptions.

- There is a free enterprise economy.

- There is perfect competition in the economy.

- There is no government interference in the functioning of the economy.

- The equilibrium process is considered from the long term point of view.

- All savings are automatically invested.

- The interest rate is flexible.

- The wage rate is flexible.

- There are no limits to the expansion of the market.

- Money acts as medium of exchange.

Aspects of Classical Theory :

The classical theory of employment can be discussed with three dimensions.

A) Goods Market Equilibrium :

The classical theory of employmet is based on the Say’s Law of Markets. The first part of Say’s market law explains the goods market equilibrium. The famous law of markets, propounded by the J.B. Say states that, “Supply creates its own demand”.

B) Money Market Equilibrium (Saving Investment Equilibrium) :

The goods market equilibrium leads to bring equilibrium of both money and labour markets. In goods market, it is assumed that the total income is spent. The classical economists agree that part of the income may be saved, but the savings is gradually spent on capital goods. The expenditure on capital goods is called investment. It is assumed that equality between savings and investment (S=I) is brought by the flexible rate of interest.

C) Labour Market Equilibrium :

Pigou’s Wage Cut Policy: According to the classical economists, unemployment may occur in the short run. This is not because the demand is not sufficient but due to increase in the wages forced by the trade unions or the interference of government. A.C. Pigou suggested that reduction in the wages will remove unemployment. This is called wage – cut policy. A reduction in the wage rate results in the increase in employment.

Question 3.

Distinguish between aggregate supply price and aggregate demand price.

Answer:

Aggregate supply price: When an entrepreneur gives employment to certain amount of labour. It requires the use of other factors of production or inputs. All these inputs have to be paid remunerations. When all these are added what we get is the value of the output produced or the expenditure incurred to supply employment for a specific number of labourers. By selling the output the entrepreneurs must expect to receive atleast what they have spent. This is known as the “Aggregate supply price” of the output or level of employment. As the level of output increases with the level of employment, aggregate supply price also increases with every increase in the level of employment.

Aggregate demand price :

In Keynes theory the aggregate demand determines the level of employment. The aggregate demand price for a given output is the amount of money which the firms expect to receive from the sale of that output. Then aggregate demand will be equal to the sum of consumption (C) investment (I) and Government expenditure (G) for goods and services.

Therefore, Aggregate demand (AD) = C+ I + G.

As the level of employment rises, the total income of the community also rises and therefore the aggregate demand, price also increases.

Question 4.

Explain the criticism against the classical theory of employment

Answer:

The classical theory of employment came in for severe criticism from J.M. Keynes. The main points of criticism are as follows :

- The assumption of full employment is unrealistic. It is rare phenomenon and not a normal features.

- The wage cut policy is not a practical policy in modem times. The supply of labour is a function of money wage and not real wage. Trade unions would never accept any reduction in the money wage rate.

- Equilibrium between savings and investment is not brought about by a flexible rate of interest. Infact, saving is a function of income and not interest.

- The process of equilibrium between supply and demand is not realistic. Keynes commented the self adjusting mechanism doesn’t always operate.

- Long run approach to the problem of unemployment is also not realistic. Keynes commented, “we are all dead in the long ran”. He considered unemployment as a short-run problem and offered immediate solution through his employment theory.

- It is not correct to say that money is neutral. Money acts not only as a medium of exchange but also as a store of value. Money influences variables like consumption, investment and output.

![]()

Question 5.

Explain the concept of effective demand.

Answer:

Effective demand means where aggregate demand equals the aggregate supply. When aggregate demand is equal to aggregate supply the economy is in equilibrium. This can be shown in the table.

| Level of employment | Aggregate supply price | Aggregate demand price |

| 10 | 500 | 600 |

| 11 | 550 | 625 |

| 12 | 600 | 650 |

| 13 | 650 | 675 |

| 14 | 700 | 700 AD = AS |

| 15 | 750 | 725 |

| 16 | 800 | 750 |

In the table when the level of employment is 14 lakh workers, aggregate demand price is equal to aggregate supply price i.e., 1700 crores. This can be shown in the following diagram.

In the above diagram aggregate demand price curve (AD) and the aggregate supply price curve (AS) interest each other at point Er It shows the equilibrium point. The equilibrium has been attained at ON1 level of employment. It is assumed that ON1 in the above diagram does not indicate full employment as the economy is having idle factors of production. So it is considered as under-employment equilibrium.

According to Keynes, to achieve full employment an upward shift of aggregate demand curve is required. This can be possible through government expenditure on goods and services supplied in the economy, whenever private entrepreneurs may not show interest to invest. With this the AD1 curve (C + I) shift as AD2 (C + I + G) at new point of effective demand E2, where the economy reaches full employment level i.e., ONF.

Question 6.

What are the sources of public revenue? [Mar. ’16]

Answer:

Revenue received by the government from different sources is called public revenue. Public revenue is classified into two kinds.

- Tax revenue

- Non-Tax revenue.

1) Tax Revenue :

Revenue received through collection of taxes from the public is called tax revenue. Both the state and central government collect taxes as per their allocation in the constitution.

Taxes are two types.

a) Direct taxes:

- Taxes on income and expenditure. Ex : Income tax, Corporate tax etc.

- Taxes on property and capital assests. Ex: Wealth tax, Gift tax etc.

b) Indirect taxes :

Taxes levied on goods and services. Ex: Excise duty, Service tax.

2) Non – tax revenue :

Government receives revenue from sources other than taxes and such revenue is called non-tax revenue. They are :

a) Administrative revenue :

Government receives money for certain administrative services. Ex : License fee, Tuition fee etc.

b) Commercial revenue :

Modern governments establish public sector units to manufacture certain goods and offer certain services. The goods and services are exchanged for the price. So such units earn revenue by way of selling their products. Ex: Indian Oil Corporation, Bharath Sanchar Nigam Ltd, Bharath Heavy Electricals, Indian Railways, State Road Transport Corporations, Indian Air lines etc.

c) Loans and advances :

When the revenue received by the government from taxes and from the above non-tax sources is not sufficient to meet the needs of government expenditure, it may receive loans from the financial institutions operating within the country and also from the public. Modem government also taken loans from international financial institutions.

d) Grants-in-aid :

Grants are amount received without any condition of repayment. They are not repaid.

These are two types. 1. General grant, 2. Specific grant.

Question 7.

List out various items of public expenditure.

Answer:

Public expenditure is an important constituent of public finance. Modem governments spend money from various welfare activities. The expenditure incurred by the government on various economic activities is called public expenditure.

Governments incur expenditure on the following heads of accounts.

- Defence

- Internal security

- Economic services

- Social services

- Other general services

- Pensions

- Subsidies

- Grants to state governments

- Grants to foreign governments

- Loans to state governments

- Loans to public enterprises

- Loans to foreign governments

- Repayment of loans

- Assistance to states on natural calamities etc.

![]()

Question 8.

Point out the redemption methods of public debt. [Mar,’17]

Answer:

Repayment of debt by government is called redemption of public debt. Internal debt can be repaid in the domestic currency but foreign exchange is necessary to repay external debt.

Redemption of Public Debt:

The following are the methods of redemption of public debt.

1) Surplus Budgets :

Surplus budget means having public revenue in excess of public expenditure. If the government plans for a surplus budget, the excess revenue may be utilized to repay public debt.

2) Refunding :

Refunding implies the issue of fresh bonds and securities by the government so that the matured loans can be used for repayment of public debt.

3) Annuities :

By this method the government repays part of the public debt every year. Such annual payments are made regularly till the debt is completely cleared.

4) Sinking Fund :

By this method, the government creates a separate fund called ‘Sinking fund’ for the purpose of repaying public debt. A part of the public revenue is deposited into this fund every year so that public debt is repaid from the sinking fund. This is considered as the best method of redemption.

5) Conversion :

Conversion means that the existing loans are changed into new loans before the date of their maturity. This method is advantageous when the rate of interest charged on the new loans is less than the rate of interest to be paid on the existing loans.

Question 9.

What are the characteristics of federal finance? [Mar. ’17]

Answer:

Federal finance means the finance of the central government as well as the state governments and the relationship between the two. In a federal system of finance, all items of revenue and expenditure are divided among the central, state and local governments. All the three forms of government are free make expenditure on their respective heads and to get revenue from their respective sources.

Characteristics of a Federal Finance :

The following are some of the important characteristic features of federal finance :

- In the federal finance, the sources of income and heads of expenditure are distributed between the central and state government according to the constitution. Their jurisdiction and rights are clearly defined in the constitution.

- In the federal system the central government provides financial aid to states.

- Although the state government have administered autonomy, yet they remain subordinate to the centre. No state is free to fall apart from central government on its own.

- In case of any financial dispute arising between the central and the state governments, the solution thereof is sought according to the constitutional provisions. India with a federal form of government has a federal finance system.

Question 10.

Write a note on Finance Commission and its functions. [Mar. ’16]

Answer:

The Finance Commission of India came into existence in 1951. It was established under Article 280 of the Indian Constitution by the President of India. It was formed to define the financial relations between the centre and the state. As per the Constitution, the commission is appointed for every five years and consists of a chairman, secretary and four other members. The first finance commission submitted its report in 1952.

The finance commission advises the President, what percentage of the income tax should be retained by the centre, and what principles should be adopted to distribute the divisible pool of the income tax among the states. Since the institution of the first finance commission, stark changes have occurred in the Indian economy causing changes in the macro economic scenario. This has led to major changes in the finance commission’s recommendations over the years. Till date, fourteen finance commissions have submitted their reports.

Functions of Finance Commission :

The functions of the finance commission can be explicitly stated as :

- Distribution of net proceeds of taxes between centre and the states, to be divided as per their respective contributions to the taxes.

- Determine factors governing grants-in aid to the states and the magnitude of the same.

- To make recommendations to President as to the measures needed to augment the consolidated fund of a state to supplement the resources of the panchayats and municipalities in the state on the basis of the recommendations made by the finance commission.

![]()

Question 11.

Explain the budget deficits.

Answer:

Generally speaking, budget deficit arises when the total expenditure in the budget exceeds the total receipts (income). Technically there are four types of deficits with reference to a budget:

1) Revenue Deficit :

Revenue deficit arises when revenue expenditure exceeds revenue receipts.

Revenue deficit = revenue receipts – revenue expenditure.

2) Budget Deficit :

Budget deficit is the difference between the total receipts and the total expenditure.

Budget deficit = Total receipts – Total expenditure.

3) Fiscal Deficit :

Fiscal deficit is the difference between the total expenditure and the total revenue plus the market borrowings.

Fiscal deficit = (Total revenue – Total expenditure) + Market borrowings & Other liabilities.

(or)

Fiscal deficit = Budget deficit + Market borrowings and Other liabilities.

4) Primary Deficit :

Primary deficit is the fiscal deficit minus interest payments.

Primary deficit = Fiscal deficit – Interest payments.

Modem governments have been resorting to deficit budgets in order to meet the growing expenditure needs to finance for economic development. But it is not desirable to have large deficits, particularly fiscal deficit as it would have adverse effects on the economy.

Very Short Answer Questions

Question 1.

How do you explain the term classical economics?

Answer:

The term classical economics refers to the body of economic group which held their influence from the letter half of the 18th century to the early part of the 20th century. The most important principle of classicism are personal liberty. Private property and freedom of private enterprise.

Question 2.

What is Money Market Equilibrium?

Answer:

Money Market Equilibrium (Savings Investment Equilibrium) :

The goods market equilibrium leads to bring equilibrium in both money and labour markets. In the goods market, it is assumed that the total income is spent. The classical economists agree that part of the income may be saved, but the savings are gradually spent on capital goods. The expenditure on capital goods is called investment. It is assumed equality between savings and investment (S=I) is brought by the flexible rate of interest. This is explained in the Fig.

In diagram, savings and investment are measured on the OX axis and rate of interest is shown on the OY axis. Savings and investments are equal at Oi rate of interest where the curves intersect each other. Hence, Oi is the equilibrium rate of interest which will come to stay in the market. If any change in the demand for investment and supply of savings comes about, the curves will shift accordingly, and the equilibrium rate of interest will also change and further it brings savings and investment into equality. Thus, money market equilibrium can be automatically brought through the rate of interest flexibility.

![]()

Question 3.

What is Say’s law of markets?

Answer:

J.B Say a French economist advocated the famous ‘Law of markets’ on which the classical theory of employment is based. According to this law “supply creates its own demand”. According to this law whenever additional output is created. The factors of production which participate in that production receive incomes equal to that value of that output. This income would be spent either on consumption goods or on capital goods. Thus additional demand is created matching the additional supply.

Question 4.

Explain the functioning of market mechanism in the economy.

Answer:

Market mechanism is often interpreted as a ‘free’ market system. Productive efficiency, while allocate efficiency is only a feature of perfect competition. A mechanism is a mathematical structure that models institutions through which economic activity is guided and coordinated. They seek to do so in ways that economize on the resources needed to operate the institutions, and that provide incentives that induce the required behaviors.

- No governmental intervention.

- Consumer’s sovereignty : In market economy, consumers are sovereign.

- Personal freedom and motives.

- Personal property.

- Perfect competition.

Question 5.

What do you mean by full employment?

Answer:

Full employment is a situation in which all those who are willing to work at the existing wage rate are engaged in work.

Question 6.

What is an Aggregate Demand Function?

Answer:

The schedule showing aggregate demand prices at different levels of employment in the economy is called as aggregate demand function.

Question 7.

What is the relationship between level of employment and Aggregate supply price?

Answer:

The schedule showing the aggregate supply price at different levels of employment is called the aggregate supply price.

Question 8.

What is Effective Demand?

Answer:

Effective demand is that aggregate demand which becomes equal to the aggregate supply. This refers to the aggregate demand at equilibrium.

![]()

Question 9.

What do you mean by Wage – cut policy? [Mar. ’17]

Answer:

Wage cut policy is one of the assumption of classical theory of employment which was started by “AC Pigou” who defended the classical theory and its full employment assumption. To Pigou and others the wage fund is given. The wage rate determined by dividing the wage fund with the number of workers. Pigou advocated a general cut in money wages in times of depression to restore full employment.

If there is a problem of unemployment in the economy. It is possible to solve this problem by reducing the money wages of the workers. This is known as “wage cut policy”.

Question 10.

Define public finance.

Answer:

It deals with the income and expenditure of the public authorities. (Central state and local government.

Question 11.

Differentiate tax revenue and non – tax revenue.

Answer:

Tax Revenues: Revenue received through collection of taxes from the public is called tax revenue. Both the central and state governments collect taxes as per their allocation in the constitution.

Broadly taxes are divided into two categories : (a) direct taxes, (b) indirect taxes.

2. Non – Tax revenue :

Government also receives revenue from sources other than taxes and such revenue is called the non – tax revenue. The sources of non – tax revenues are as follows :

a) Administrative Revenue

b) Commercial Revenue

c) Loan and advances

d) Grants – in – AID.

Question 12.

What is meant by Public expenditure?

Answer:

Public expenditure is an important constituent of public finance. Modem governments spend money perform various financiers. The expenditure incurred by the government on various economic activities is called public expenditure. For example, defence, internal security and economic services.

Question 13.

What is Public Debt?

Answer:

Public Debt :

When the government’s expanding expenditure on various activities exceeds its revenue it has one option i.e., is to go for public debt. A government can borrow funds rom various sources within the country or from abroad. This creates public debt. The instruments of public debt are in the form of various types of government bonds and securities.

Question 14.

What are the Debt Redemption methods.

Answer:

Redemption of Public Debt:

The following are the methods implemented for the redemption of public debt:

- Surplus Budgets

- Refunding

- Annuities

- Sinking Fund

- Conversion

- Additional taxation,

- Capital Levey

- Surplus in Balance of Trade.

![]()

Question 15.

What is capital levy?

Answer:

Capital Levy is a heavy one time tax on the capital assets and estates over and above a minimum limit of value. This means acquiring funds for debt redemption all at a time.

Question 16.

What is Federal Finance?

Answer:

Federal finance means the finance of all central government as well as the state governments and the relationship between the two. In a federal system of finance, all items of revenue and expenditure are divided among the central, state and local governments. All the three forms of government are free to make expenditure on their respective heads and to get revenue from their respective sources.

Question 17.

Mention the functions of Finance commission.

Answer:

The functions of the finance commission can be explicitly stated as :

- Distribution of net proceeds of taxes between centre and the states, to be divided as per their respective contributions to the taxes.

- Determine factors governing grants in aid to the states and the magnitude of the same.

- To make recommendations to President as to the measures needed to augment the consolidated fund of a state to supplement the resources of the panchayats and municipalities in the state on the basis of the recommendations made by the finance commission.

Question 18.

What is budget?

Answer:

Budget is the annual statement showing the estimated receipts and expenditure of the government for a financial year in the budget. The budget estimates and revised estimates of the current financial year and actual expenditure of the preceding financial year are shown. .

Question 19.

What are the components of a budget?

Answer:

Components of the Budget :

The budget consists of both receipts (income) and expenditure of the government. The budget of the Government of India consists of two main components :

1. Budget Receipts :

a) Revenue Receipts :

This consists of tax revenue and non – tax revenue and

b) Capital Receipts :

This consists of recoveries of loans, other receipts and borrowings and other liabilities.

2. Budget Expenditure :

In the Union budget of India, the budget expenditure is classified into plan expenditure and non – plan expenditure. But, Central Government through its Union Budget 2017 – 18 abondoned plan and non – plan expenditure and replaced these items with Revenue Expenditure and Capital Expenditure.

Persual of the budget at a glance gives a vivid pitcture of the structure of the budget and its components as followed by the government of India in actual practice.

![]()

Question 20.

Distinguish between revenue account and capital account.

Answer:

Revenue account consists of the current transactions and includes value of transactions relating to export import travel expenses, insurance, investment, income etc. The capital account refers to the transactions of capital nature such as borrowing and lending of capital repayment of capital sale and purchase of shares and securities etc.

Question 21.

What is meant by Primary deficit?

Answer:

Primary deficit is the fiscal deficit minus the interest payments.

Question 22.

In deficit Budget desirable?

Answer:

Budget deficit is the difference between the total receipts and total expenditure.

Question 23.

What are the exclusive powers of union Government?

Answer:

Exclusive Powers of Union Government:

The subjects on whom the union government has the exclusive powers to levy taxes are : (a) customs duty, (b) corporation tax, (c) capital gains, (d) surcharge on income tax and (e) railway fares etc.

Question 24.

What is Fiscal deficit?

Answer:

Fiscal deficit is the difference between total revenue and total expenditure plus the market borrowings.

Fiscal deficit = (Total revenue – total expenditure) + Other borrowing and other liabilities.

Question 25.

What is the significance of vote on account budget?

Answer:

Vote on account is an interim budget presented for a few months pending presentation at the regular budget.

Question 26.

Write about Fourteenth Finance Commission.

Answer:

Fourteenth Finance Commission :

The First Finance Commission submitted its report in 1952. The Finance Commission advises the President about what percentage of the income tax should be retained by the centre, and what principles should be adopted to distribute the divisible pool of the income tax among the states. Since the institution of the First Finance Commission, stark changes have occurred in the Indian economy causing changes in the macroeconomic scenario. This has led to major changes in the Finance Commission’s recommendations over the years.

Hence, it has become necessary to have a glance at the Fourteenth Finance Commission’s (2015-2020) recommendations. The Committee specifically suggested the suitable measures so as to maintain a stable and sustainable fiscal environment in the country. The 14th Finance Commission was appointed on 2nd January 2013 under the Chairmanship of Y.VReddy, it has submitted its report 15th December 2014.

Question 27.

Write about Fifteenth Finance Commission.

Answer:

Fifteenth Finance Commission :

The Government of India appointed the Fifteenth Finance Commission on November 27, 2017 with N.K. Singh as Chairman. The recommendations of the Commission will cover the five year period 2020 – 25. The Commission has been asked to submit its report by October 30, 2019.

The Commission has been instructed to use the population data of 2011 census as the base for calculating the expenditure needs of various states. This is the first Commission which is required to present its recommandations in the post GST era.

![]()

Question 28.

Write in brief, about GST.

Answer:

GST :

Goods and Services Tax (GST) is an Indirect Tax which has replaced many Indirect Taxes in India. The Goods and Service Tax Act was passed in the Parliament on 29th March 2017. the Act came into effect on 1st July 2017; GST is a comprehensive, multistage, destination-based tax that is levied on every value addition. In simple words, GST is an indirect tax levied on the supply of goods and services. Under this system four slabs are fixed for GST rates i.e., 5%, 12%, 18% and 28%.