Telangana TSBIE TS Inter 2nd Year Economics Study Material 10th Lesson Telangana Economy Textbook Questions and Answers.

TS Inter 2nd Year Economics Study Material 10th Lesson Telangana Economy

Essay Questions

Question 1.

Write an essay on the structure of Telangana State.

Answer:

The historical background as a backdrop for the birth of Telangana is discussed here under. It was on 1st November 1956, the former A.R state (that existed upto 1st June, 2014) was formed by merging the Hyderabad state with the former Andhra state.

Former Hyderabad State :

Hyderabad state was a princely state ruled by the Nizams for more than two centuries (1724-1948). It had its own currency, administrative system, transport and communication network including railways and postal services. Urdu was not only the official language, but also the medium of instruction at all levels of education.

When India became independent on 15th August 1947, the then ruler of Hyderabad state, Mir Osman Ali khan, the Seventh Nizam, preferred to retain the state as an independent entity. All the other princely states agreed to amalgamate with the Indian union and the Hyderabad state continued to remain as a separate unit outside the purview of the Indian sovereignty. During that period, internal unrest generated in the state and the people of the state particularly peasants, revolted against the feudal regime. This is known as the Telangana armed struggle. Under those circumstances, the Government of India compelled the Nizam for the merger of the Hyderabad state with Indian union though an armed intervention which was recorded in history as police action. This merger took place on 17th September 1948. In the year 1952, general elections were held to the state assembly and a popular government assumed the power with Dr. Burgula Ramakrishna Rao as the Chief Minister.

Six Decades Struggle for Separate Telangana State :

The promises and safeguards to Telangana region made at the time of formation of Andhra Pradesh state were not fulfilled, they were neglected and the resources were exploited. Notable among those safeguards that were flouted are :

- The Gentlemen’s Agreement of 1956

- The All Party Accord of 1969.

- The Eight Point Formula and Five Point Formula of 1969 & 1970, repsectively.

- The Judgement of Supreme Court of India in 1972.

- The Six Point Formula and the Presidential Order of 1974.

- G.O. No. 610 of 1985 and Girglani Commission Report.

As a consequence of this, the Telangana region had lagged behind Seemandhra area in all the vital sectors, contributing to serious imbalances in all the levels of development between Telangana and Seemaandhra. This situation emerged as the root cause for recurring agitations and causing enormous loss of life.

Though, earlier struggles, especially the struggle in 1969 had revived the demand for separate Telangana state it was intensified in the recent decade and in particular from 2009, the decade old struggle has taken place in the form of mass strikes, bandhs, rail roko, blocking national highways, strikes by students, closure of universities and educational institutions, “sakala janula samme” by government employees, open suicides and the unto death hunger strike of Sri K. Chandra Sekhar Rao, TRS President, the then M.P At last, the UPA government declared the .Telangana as 29th state.The “appointed day” was notified as 2nd June 2014 for bifurcation and formation of Telangana as a separate state with existing 10 districts of Telangana region and the remaining 13 districts of Seemaandhra as A.P. state.

Telangana Topography :

Telangana is situated on the Deccan plateau of Indian peninsula. The region is drained by two major rivers, Godavari with about 79% catchment area and Krishna with about 69% catchment area and several minor rivers such as Bhima, Manjeera, Musi, Pranahita and other smaller rivulets. The annual rainfall is between 900 mm to 1,500 mm in northern Telangana and 700 to 900 mm in southern Telangana from the south west. monsoons. Various soil types exist in the state. About 45% of the forest area of united A.P. is located in 5 districts of Telangana. The state of Telangana is spread over 1,14,840 square kilo meters and consists of 10 districts. It is the 12th largest state in terms of area and size of the population in the country.

Question 2.

What is GSDP? Explain the trends in GSDP and per capita income in Telangana.

Answer:

Gross State Domestic Product (GSDP) :

Gross state domestic product (GSDP) or state income is the most important indicator for measuring the economic growth of a state. Gross state domestic product may be defined as “the sum of total volume of all goods and services produced in a year within the geographical boundaries of a state accounted without duplication”.

Trends of GSDP in Telangana Economy :

Growth rate of GSDP indicates the performance of a state economy and the sectoral performance reflects the change in the magnitude and composition of different sectors out of GSDP of the state economy over a time.

GSDP, in Telangana it increased from Rs. 3.59 lakh crore to Rs. 9.69 lakh crores in current prices and from Rs. 3.59 lakh crores to Rs. 6.63 lakh crores between 2011-12 and 2019-20 in constant prices. In the same period, the GDP of All – India increased from Rs. 87.36 lakh crores to 203.8 lakh crores in current prices and from Rs. 87.36 crores to Rs. 146.83 lakh crores in constant prices. With regard to year to growth rates in Telangana, the growth rate of GSDP in 2012-13 was 11.7 percent and it increased to 14.3 percent in 2018-19 and 12.6 in currect prices by 2019-20 while in the same period, the growth rate of GDP in all-India decreased from 13.8 percent to 11 per cent and 7.5, respectively, in current prices. Except in 2012-13 and 2013-14, the Telangana state out performed in respect of its GSDP growth rate over GDP growth rate of all India in between 2011-12 to 2019-20.

In constant prices the growth rate of GSDP of Telangana increased from 3 percent to 8.2 percent during 2012-13 to 2019-20. The growth rate of GDP of all India increased from 5.5 percent in 2012-13 to 8.3 percent by 2016-17 then after it decreased to 5 percent by 2019-20. The GSDP growth rate of Telangana when compared to GDP growth rate of all India is less than all India during 2012-13 to 2014-15, but then after it is more than the growth rate of all India.

With regard to the share of Telangana in all India GDP both in current prices, and constant prices ranged in between 4.11 percent to 4.5 percent during 2011-12 to 2019-20.

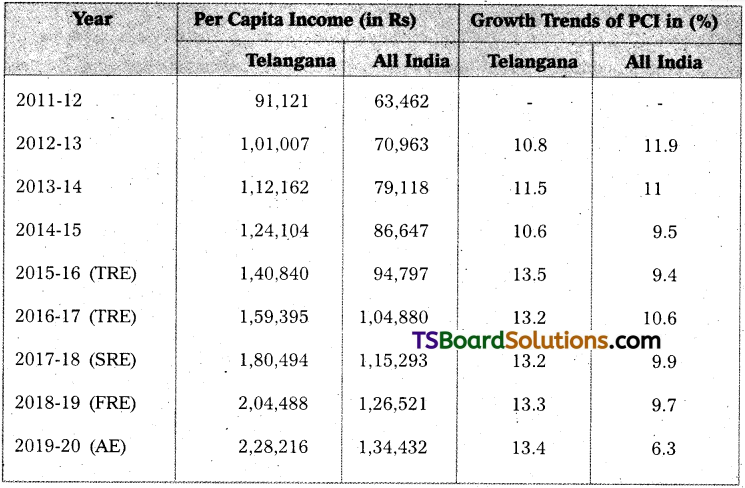

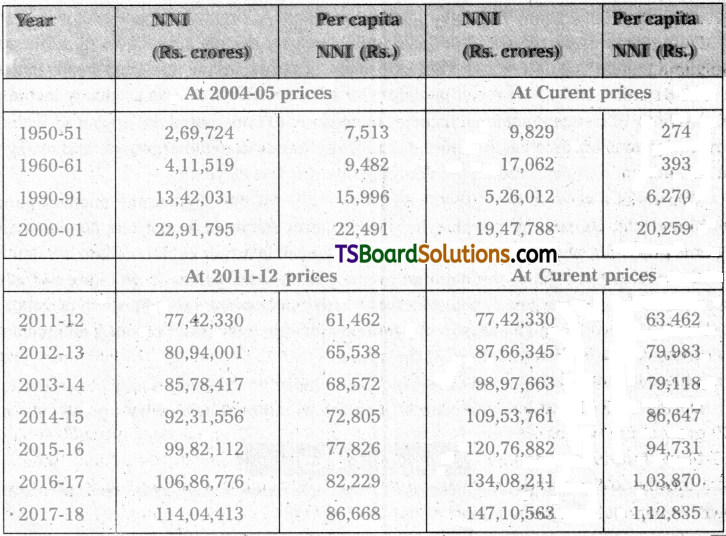

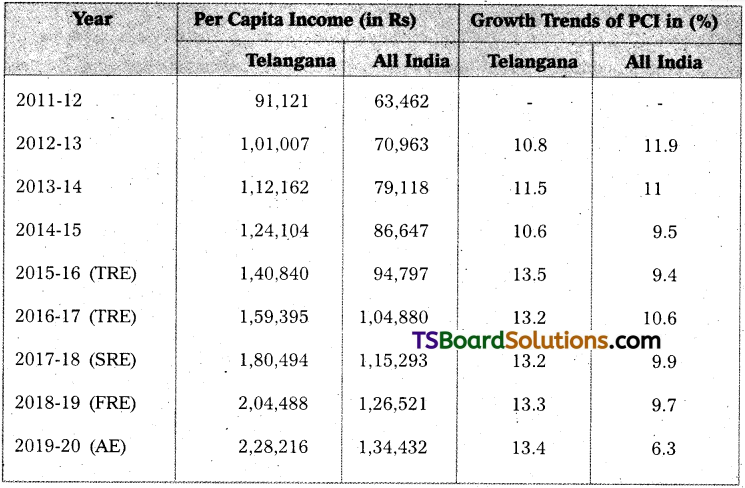

Per Capita Income at Current Prices in Telangana and All India : The per capita income (PCI) is obtained by dividing the net state domestic product by mid year population of the state/country in the respective year. The per capita income of Telangana vis-a-vis all India and their growth trends at current prices are shown in Table.

The Per Capita Income of Telangana vis-a-vis All India and Their Growth Trends at Current Prices

From the above table it is evident that, the per capita income (PCI) of Telangana is much higher than the all India over the years. There is a steup rise in the PCI of the state from Rs. 91,121 in the year 2011-12 to Rs. 2,28,216 in the year 2019-20(AE), registering a growth rate of 150 percent over 2011-12. Whereas the PCI of all India was Rs. 63,462 in the year 2011-12, and it increased to Rs. 1,34,432 in the year 2019-20(AE), registering a growth of 111 percent over 2011-12. This implies that the PCI of the state grew much faster than the All-India PCI.

Question 3.

Write an essay on sectoral contribution of gross state value added of Telangana Ecoriomy.

Answer:

Annual Average Sectoral Growth Rates in GSVA of Telangana State :

The growth rates of primary, secondary and tertiary sectors will be measured in terms of Gross Value Added (GSVA) at basic prices. The constituents of these sectors include :

a) Primary Sector :

This sector consists of sectors like crops,’livestock, forestry and logging, fishing and acquaculture and mining and quarrying.

b) Secondary Sector :

This sector comprise of the sectors such as manufacturing, electricity, gas, water supply and other utility services and construction.

c) Tertiary Sector :

This sector include sectors, namely, trade and repair services, hotels and restaurants, transport (including railways, road, water, air and services incidental to transport), storage, communication and services related to broadcasting, financial services, real estate, ownership of dwellings and professional services, public administration and other services.

The sectoral analysis provides an outline about how well the sectors have performed in the previous years and are expected to perform in the current year.

If we look at the annual average growth rates of these sectors in current prices, in respect of primary sector its growth rate decreased from 21.9 percent (8.6% in constant prices) in 2012-13 to just 2.2 percent (-58% in constant prices) in 2015-16 then after it increased to 17.1 percent in 2016-17, but again it decreased 15.8 percent (10.7% in constant prices) by 2019-20 (AE). Thus, we observe a mixed trend in the growth rate pattern of this sector.

As regards secondary sector, it experienced a negative growth rate in 2012-13 and 2014-15. A highest growth rate of 20.3 percent (21.4% in constant prices) in 2015-16 and a lowest of just 1.6 per cent (0.1% in constant prices) in 2016-17 and a moderate growth of 5.3 per cent . (1.7% in constant prices) by 2019-20 (AE).

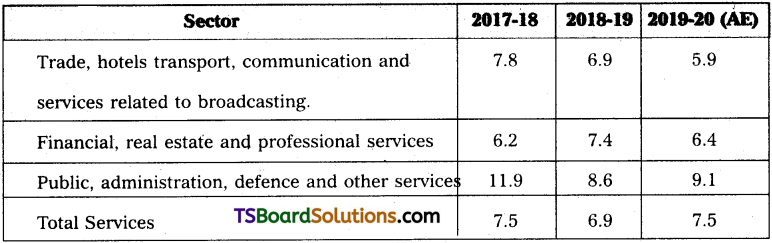

The growth rate of tertiary sector ranged between 18.4 percent to 14.1 percent (8.4% to 9.6% in constant prices) during 2012-13 to 2019-20. Overall, we can see a mixed trend, both in current and constant prices, in the growth rates of sectoral GSVA in Telangana state during 2012-13 to 2018-19.

Sectoral Contribution to over all Gross State Value Added (GSVA) in Telangana :

In current prices, the share of tertiary sector is growing at a higher rate (from 52.8 percent in 2011-12 to 65.2 percent in 2019-20AE) while the shares of primary (from 19.6 percent in 2011-12 to around 18.6 percent in 2019-20AE) and secondary (from 27.6 percent in 2011-12 to around 16.2 percent in 2019-20 AE) are declining during the period 2011-12 to 2018-19 in Telangana. We can observe instability in the growth pattern of shares of both primary , and secondary sectors. In contrast to his, we find a gradual and stable increase in the share of services sector during 2011-12 to 2019-20.

Question 4.

Describe the demographic profile of Telangana State.

Answer:

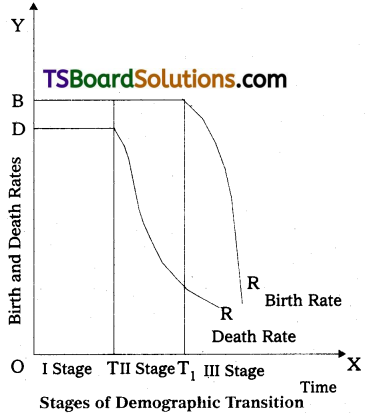

Telangana State through changes in quantity and quality of population. As the size and quality of population shape human resource endowment. They have an angle bearing both on demand generation and supply creation aspects of goods and services. There are significant changes in the size of the population and other demographic features during seven census decade years from 1951 to 2011. The total population of Telangana more than doubled from 1.1 crore in 1951 to over 2.6 crores by 1981, climbing to 3.52 crores by 2011.

In total geographical area of India, the share of Telangana is 3.5% according to 2011 census. Ranga Reddy stands at the top with 52.97 lakhs population as against this Nizamabad stands at bottom with 25.51 lakhs population. Population density is defined as an average number of persons living per square kilometer area compared to all India Telangana is less densely populated. Hyderabad district being the capital city is highly populated with 18,172 persons living her square km.

Population growth rate of Telangana state is marked lower than the growth rate at all India level. In the recent census decade, while Telangana registered and annual growth rate of 1.4%.

The age group consisting of 0-6 years denote child population. In Telangana, the share of child population marginally decreased from 14.2% in 2001 to 10.5% in 2011.

As per 2011 census, the percentage of SC population to total population is 15.44% as against to this, the percentage of S.T population to total population is 9.34% in Telangana state. Among Sc’s, the highest percentage of population is to be found in Karimnagar district with 18.80% of the total and the lowest in Hyderabad district with 6.29% of the total. As far as ST’s are concerned, the highest percent of their population is found in Khammam district with 27.37% of the total ST population.

As per the 2011 census, the sex Ratio is 990 females per 1,000 males in Telangana, where as it is 940 females per 1,000 male population in India. Thus, Telangana state has relatively more female population than that is recorded at the national level.

Share of Immigrants in Telangana Population : The higher growth of urban population in Telangana state is mainly due to migration of population from Andhra and partly from other states. The share of Telangana in the erstwhile Andhra Pradesh was 42 percent in 2011. From 1961 to 2011, total migration of population is 62 lakh. Rangareddy district stood top in urban-ization with 70% people living in towns, which is mainly due to development of towns and suburban areas around Hyderabad that fall in Rangareddy district.

Question 5.

Describe the status of education and Health sectors in Telangana State.

Answer:

Education in Telangana :

Education is a crucial element in strengthening the human resources and economic development of a country. Education helps in creating more productive labour force. The 45th Article of the Indian Constitution has laid the responsibility on the states to provide free and compulsory education to both boys and girls of the age group of 6 tb 14 years.

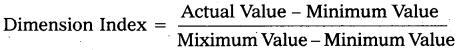

Literacy Rates in Telangana :

According to the Population Census, 2011 the literacy rate of Telangana is 66.54 per cent. However considerable variations are observed in literacy rates among different groups like rural and urban, within districts, age groups, social groups and male and female.

As far as literacy levels in districts are concerned, among 33 districts of the state, Hyderabad stands at top with 83.25 percent literacy rate and Jogulamba Gadwal district stands at the bottom with 49.87 per cent.

1. Education Profile of the State :

a. Enrolment :

During the year 2017-18, about 58.71 lakh children were enrolled in all the schools, of them 53 percent were enrolled in private schools, 47 percent in government schools including the schools run by the centred government, local bodies and aided schools.

b. Gross Enrolment Ratio (GER) :

In 2017-18, the gross enrolment rate among children in primary schools was 98.76 for boys and 98.05 for girls and in upper primary schools, it was 87.32 for boys and 88.47 for girls. Overall, the GER for girls was higher than boys in upper primaiy schools in Telangana.

c. Pupil – Teacher Ratio (PTR) :

During 2018-19, the pupil-teacher ratio observed was 18.90, 14.12, and 17.85 for primary, upper primary and secondary schools respectively. The overall PTR is 17.67 for the year 2018.19.

2. School Education :

a. Samagra Shiksha Abhiyan :

Hitherto the state government implemented the centrally sponsored schemes (a) ‘Sarva Siksha Abhiyan’ (SSA) to universalise elementary education; and (b) ‘Rashtriya Madhyamik Shiksha Abhiyaan’ programme (RMSA) to improve the access and quality of secondary education.

b. Kasturba Gandhi Balika Vidyalaya (KGBV) :

There were 391 KGBVs at the time of formation of the state and this number increased to 475 by 2017-18. Government of India supports only classes VI to VIII under KGBVs, however, state government extended the scheme by adding IX and X classes to facilitate continuation of girls’ education upto Class-X and to avoid dropouts.

e. Model Schools :

194 model schools were started in the academic year 2013-14 in the state, with an objective to provide quality education in English medium by highly qualified teachers. As the scheme was terminated by the centre, the government of Telangana took over the responsibility of running model schools from the year 2015-16 onwards.

3. Intermediate Education :

The Department of Intermediate Education administers intermediate education system in the state. There are 2,558 junior colleges with a total enrolment of 7.18 lakh students. The department also offers 23 vocational education courses at intermediate level in junior colleges in the state with special focus on job oriented courses.

4. Higher Education:

a. Collegiate Education :

The objective of Department of Collegiate Education is to provide access, equity and quality in higher education. Towards this direction, state government is making all efforts with government of India funds under Rashtriya Uchchatar Shiksha Abhiyan (RUSA).

b. Degree Online Services, Telangana (DOST) :

The government of Telangana has introduced online admissions for under graduate courses (BA/BCom/BSc/BBA/etc) in the state of Telangana in the year 2016 through web based system called Degree Online Services, Telangana (DOST). In the year 2018-19, a total of 2,00,472 students were admitted in all degree colleges through DOST. Out of which 42,688 were admitted in government degree colleges.

c. Technical Education :

The department manages the government polytechnics and monitors the private unaided polytechnics and professional colleges. At present there are 820 diploma and degree level professional institutions in the state with a total intake of 1,36,805.

5. Social Welfare Educational Institutions :

To bring social equity and improve access to education for children of SCs, STs, BCs, minorities and differently-abled children, the state has been providing hostel and residential school facilities, supply of books and other provisions at free of cost.

a. Scheduled Castes Residential Schools :

Telangana Social Welfare Residential Educational Institutions Society (TSWREIS) is running 268 (out of which 175 meant only for girls) residential educational institutions (from 5th standard to undergraduate level) in the state for Scheduled Caste (SC) children. Of the 268 institutions, 134 were sanctioned after formation of the state.

b. Schedule Tribes Residential Schools :

(a) Telangana Tribal Welfare Residential Educational Institutions Society (TTWREIS) (Gurukulams) : There are 175 Gurukulams in the state (b) Ashram Schools : There are 321 ashram schools in the state, (c) Government Primary Schools (GPS) : Tribal Welfare Department is running 1,427 government primary schools with 1st to 3rd or 5th classes and around 22 thousand students.

c. Backward Classes Welfare Residential Schools :

Mahatma Jyothiba Phule Telangana Backward Classes Welfare Residential Education Institutions Society (MJPTBCWREIS) is es-tablished to facilitate access to quality education for the students of backward classes (BCs) and economically backward classes (EBCs).

d. Minority Residential Institutions :

Telangana Minorities Residential Educational Institutions Society (TMREIS) established with the objective of providing a high quality education A total of 216 minority residential institutions including 12 colleges with 79,424 students are functioning in the state.

Health Sector in Telangana :

In order to reach the goal of “Health for All” of World Health Organization (WHO), Government of Telangana is implementing different programmes like National Maternity Benefit Programme, Integrated Child Development Programme and Supplementary Nutrition Programme for the women in reproductive age group and the programme of Balika Samrudhi Yojana for children.

As per SEO – 2020, in Telangana state, there are 4,797 health sub-centres, 633 primary health centres, 249 urban primary health centres, 90 community health centres, 19 area hospitals, 29 district hospitals, 9 medical college hospitals, 12 speciality hospitals and 2 super speciality hospitals.

Health Sector related Programmes of Telangana :

After formation of the state, Telangana government initiated several health related programmes. Some of them are presented here under :

a) Kanti Velugu :

People mostly tend to live with eye problems or postpone until it is too late. Particularly, the women and elderly persons neglect eye vision problems. To address this problem, the government has launched Kanti velugu programme with a vision to build avoidable blindness free Telangana through simple pair of glasses and cataract surgery.

b) Basti Dawakhana :

Basti Dawakhana is an initiative to offer quality health services to urban poor. One basti dawakhana caters to 5000 – 10000 population. The basti dawakhana is located within the urban slum. Currently 104 basti dawakhanas are functioning in the state.

c) Health and Wellness Centres :

Health and Wellness centres will provide comprehensive health care, including for non-communicable diseases and maternal and child health services. These centres will also provide free essential drugs and diagnostic services. Currently 636 PHCs, 86 sub-centres, 104 Basti dawakhanas and 227 UPHCs have been converted as Health and Wellness Centres.

d) Telangana Vaidya Vidhana Parishad (TWP) Hospitals :

These hospitals (107) functioning under the control of TWP mainly cater to the maternity and child health care services, besides general medicine, general surgery, ophthalmology, paediatrics, orthopaedics, dermatology, ENT, etc.

e) AYUSH (Ayurveda, Yoga, Naturopathy, Unani and Homoeopathy) :

The Telangana government along with the National AYUSH Mission (NAM) is encouraging the AYUSH system of medicine. Presently 860 dispensaries and institutions are functioning under the AYUSH department.

f) Aarogyasri Health Care Trust :

Aarogyasri Scheme (AS) is a unique government sponsored health insurance scheme being implemented by Aarogyasri Health Care Trust in the state, with the objective of assisting below poverty line families. The scheme provides end-to-end cashless medical services for identified diseases.

g) KCR Kit :

The Telangana state government launched a new programme called KCR Kit on 2 June 2017 to provide compensation to pregnant women (pre and post natal periods) living below poverty line, who are receiving health services from public health institutions in the state, @ Rs. 12,000 (for a male child) and Rs. 13,000 (for a female child) for wage loss.

Question 6.

Explain the irrigation facilities available in Telangana State.

Answer:

Irrigation Sources in Telangana :

According to Arthur Lewis, “the revolutionary change in the farm sector can be obtained only through the provision of adequate irrigation facilities and agricultural inputs”. Since, water is an important factor in agricultural production; government should ensure adequate and timely supply of water.

The main sources of irrigation in Telangana state can be classified into four categories, viz. (i) canals, (ii) wells, (iii) tanks and (iv) other sources.

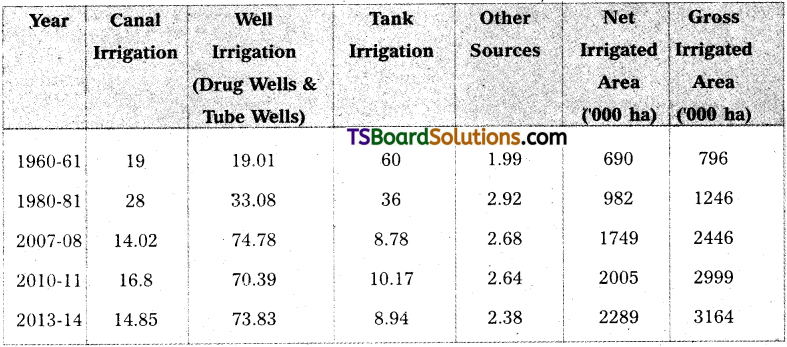

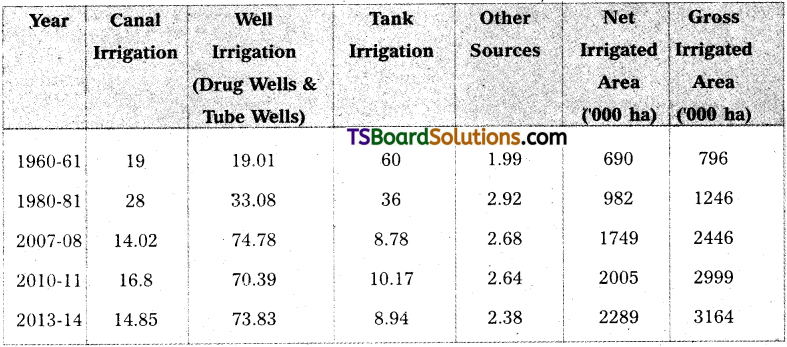

Source – wise Irrigation in Telangana (in percentage)

The above table shows gross irrigated area under different sources from 1960-61 to 2013-14. From the table, it can be seen that tank irrigation which had a higher share of 60 percent in 1960-61, gradually declined to 8.94 percent in 2013-14, whereas the share of well irrigation increased from 19.01 percent to 73.83 percent during the same period.

The present status of irrigation projects in Telangana state is as follows :

A. Godavari River Basin :

i) Kaleshwaram Project :

Kaleshwaram Project has been conceived from the erstwhile Dr. B.R. Ambedkar Pranahita – Chevella Sujala Sravanthi project. Originally, Dr. B.R. Ambedkar

Pranahita – Chevella Sujala Sravanthi was proposed to utilize 160 TMC of allocated water of Godavari basin as per Godavari Water Dispute Tribunal (GWDT) award.

The original project has been divided into two components viz., Kaleshwaram and Dr. B.R. Ambedkar Pranahita Project (Adilabad) as follows :

(a) Dr. B.R. Ambedkar Pranahita Project :

To divert 20 TMG of water by constructing a barrage across river Pranahita near the confluence of Wainganga and Wardha rivers at Tummidihetti (V), Koutala (M), Kumram Bheem district for irrigating an ayacut of 2,00,000 acres in East Adilabad district against the original proposed 56,500 acres in the district.

(b) Kaleshwaram Project :

Construction of one barrage across river Godavari at Medigadda near Kaleshwaram and two more barrages between Medigadda (Lakshmi barrage) and Sripada Yellampally Project at Annaram and Sundilla and to convey water from Sripada Yellampally Project to the command area spread over in 7 districts of Telangana.

(ii) Alisagar Lift Irrigation Scheme :

Through this it is intended to supplement irrigation facilities to the gap ayacut of the Nizam Sagar Project in Navipet, Renjal, Yedapally, Nizamabad, Dichpally and Makloor mandals of Nizamabad district to the extent of 53,793 acres. The scheme proposes lifting 720 cu secs of water from right bank of Godavari rivesr near Kosli village.

(iii) Argu 1 a Raj a ram Guthpa Lift Irrigation Scheme :

Through this it is intended to supplement the irrigation facilities to the gap ayacut of the Nizam Sagar Project in Nizamabad district to the extent of 38,792 acres lying under the distributaries D74 to D82 of the Nizam Sagar Project.

(iv) Choutpally Hanmanth Reddy Lift Irrigation Scheme :

Through this it is proposed on the Shetpally tank, which is fed by Distributary D4 of Sri Rama Sagar Project – Laxmi canal, is taken upto provide irrigation facility to an ayacut of 11,625 acres in 18 villages.

(v) Lendi Interstate Project :

This is an interstate major irrigation project between Telangana and Maharashtra. The head works are loqated in Nanded district of Maharashtra. This project proposes to irrigate 49r000 acres, out of which the irrigation*potential would be 22,000 acres in Telangana and 27,000 acres in Maharashtra.

(vi) M. Baga Reddy Singur Project :

The Singur project has been constructed across river Manjeera, a tributary of the river Godavari near Singur village, Sangareddy district, with a gross capacity of 29.91 TMC.

(vii) J. Chokka Rao Devadula Lift Irrigation Scheme :

This scheme contemplates for lifting of water from Godavari river near Gangaram (V), Eturunagaram (M), Jayashankar district to irrigate 6.21 lakh acres in upland drought-prone areas of Warangal Urban.

(viii) Lower Penganga Project :

This is a joint project between the states of Maharashtra and Telangana on the river Penganga, which is a tributary of the river Godavari. The headworks are located near Tadsoali village in Ghatanji taluk of Yavathmal district of the Vidharbha region in Maharashtra state. The net available yield is estimated to be 42.67 TMC and shared in the ratio of 88:12.

(ix) Sita Rama Lift Irrigation Scheme :

After formation of Telangana state, the government has takenup this duly combining both Rajiv Dummugudem and Indira Sagar Rudramkota Ayacut and uncovered an ayacut of about 1.00 lakh acres totalling to 5.00 lakh acres in Bhadradri Kothagudem, Khammam and Mahabubabad districts.

(x) Thupakulagudem Barrage (Sammakka Barrage) :

The government had taken up construction of barrage at Kanthanapalli, Mulugu district. The project envisages lifting of 50 TMC of water from Godavari river at Kanthanpalli. The government approved the proposals to shift the barrage location from Kanthanapally (V) to Thupakulagudem (V) Warangal rural. Telangana government proposed to rename this project as “Sammakka Barrage”.

(xi) Sri Kumuram Bheem Project :

This is a medium irrigation project proposed across Peddavagu stream near Ada (V), Asifabad (M) and (Dist). The project is proposed to irrigate an ayacut of (18,421 Ha) 45,500 acres covering 69 villages in 4 mandals i.e., Asifabad, Wankidi, Kagaznagar and Sirpur (T) of Asifabad district.

(xii) Palemvagu Project :

This is a medium irrigation project across Palemvagu stream, a major tributary of river Godavari. It is located near Mallapuram village, Venkatapuram mandal of Jayashankar Bhupalapally district. It provides irrigation facilities to 4,100 Ha. (10,132 acres) kharif wet and 1250 Ha ID rabi ayacut and drinking water supply.

(xiii) Sri Ramsagar Project :

It was constructed on the Godavari river at Pochampadu village in Nizamabad. The districts covered under this project are Karimnagar, Warangal, Adilabad, Nalgonda and Khamam. Area irrigated under this project is 4 lakh acres.

(xiv) Nizamsagar Dam :

It is a reservior constructed across the Manjeera river, a tributary of the Godavari river between Achampet and Banganpalle villages of Nizamabad district. It provides irrigation facilities to the area of 2.31 lakh acres.

(xv) Kadem Project :

It is located in Adilabad district on kadem river. Area irrigated under this project is 25,000 areas in Adilabad district.

B. Krishna River Basin :

i) Mahatma Gandhi Kalwakurthy Lift Irrigation Project :

This project is proposed to provide irrigation facilities to an extent of 4.10 lakh acres and to supply drinking water to chronically drought-prone upland areas in the erstwhile Mahabubnagar district. Fourty TMC of water is proposed to be lifted in the three stages from the foreshore of Srisailam reservoir.

ii) Rajiv Bhima Lift Irrigation Scheme :

This scheme envisages lifting of water from the Krishna river at two different places : One at Panchadevpad, the foreshore of the Jurala Project and another at the foreshore of the Ookachetty vagu project at Ramanpad for irrigation in the chronically drought-affected upland areas in part of 15,mandals and to provide drinking waer to the enroute 196 villages of Mahabubnagar district.

iii) Jqwahar Nettempadu Lift Irrigation Scheme :

This scheme ewisages the lifting of 21.425 TMC of water from the forehsore of Priyadarshini Jurala project reservoir to provide irrigation facilities to 2 lakh acres in the drought-prone upland areas of Gadwal and Alamput constituencies, covering about 148 viollages in eight mandals.

iv) Priyadarshini Jurula Project :

This is a multi purpose project across the river Krishna, near .Revulapally village in Jogulamba-Gadwal district. The project is intended to irrigate an ayacut of 1.02 lakh acres under the left main canal (NTR canal) and right main canal (Nalla Somanadri canal) in drought prone mandals of Atmakur, Kothakota, Pebbair of Wanapathy district.

v) Rajoli Banda Diversion Scheme :

The construction of anicut was started in 1946 and completed by 1958. The water whs supplied to the 143 km long Rajolibanda diversion scheme (RDS) canal to benefit a drought area of 15 villages in Manvi taluk of Karnataka, and eight villages in Gadwal taluk, 67 villages of Alampur taluk in erstwhile Mahabubnagar district.

vi) Koilsagar Lift Irrigation Scheme :

This project was constructed at Bollaram village of Devarakaddra mandal, Mahaboobnagar district in 1955 to irrigate an ayacut of 12,000 acres in Amarchintha constitutency in Mahaboobnagar district.

vii) Palamuru-Rangareddy Lift Irrigation Scheme :

This scheme envisages irrigating an ayacut of 12.30 lakh acres in upland areas of Nagarkumool (1 lakh acres), Mahabubnagar (4.14 lakh acres), Rangareddy (3.34 lakh acres), Vikarabad (3.22 lakh acres) and Nalgonda (0.30 lakh acres) districts and drinking water requirement to en-route villages, GHMC and industrial water requirements from the foreshore of Srisailam reservoir during flood season.

viii) Ghattu Lift Irrigation Scheme :

It envisages irrigating an ayacut of 28,000 acres in upland areas of Ghattu, Dharur and K.T. Doddi mandals of Jogulamba Gadwal district.

ix) Dindi Lift Irrigation Scheme :

The upland areas of Nalgonda district are endemi- cally drought prone besides large areas are in grip of fluoride. The only source of water that can be brought to this area to mitigate the above problems is the river Krishna. The Dindi LIS envisages providing irrigation facilities to 3.61 lakh acres and drinking water to four districts, i.e., Nagarkurnool, Nalgonda, Yadadri-Bhuvanagiri and Rangareddy.

x) Udayasamudram LIS :

This scheme envisages lifting of 6.70 TMC of water from the foreshore of Udayasamudram balancing reservior of AMR SLBC project for irrigating 1 lakh acres of ayacut in chronically drought-affected upland areas of Nakrekal, Nalgonda; Munugode. Thungathurthy assembly constituencies of Nalgonda district.

xi) Nagarjuna Sagar Project :

The biggest in the world constructed on the river Krishna in the border of Nalgonda and Guntur districts. Its right canal irrigates 1.11 million acres to Andhra and 0.32 million acres in Telangana.

xii) Srisailam Project :

This project was constructed on Krishna river in the border of Mahabubnagar and Kumool districts. Area irrigated under this canal is 4.20 lakh acres.

Question 7.

Assess the growth and perspectives of IT and ITeS sectors in Telangana state.

Answer:

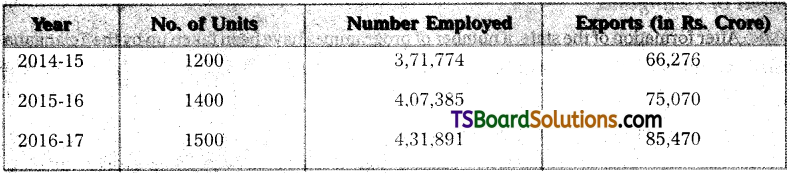

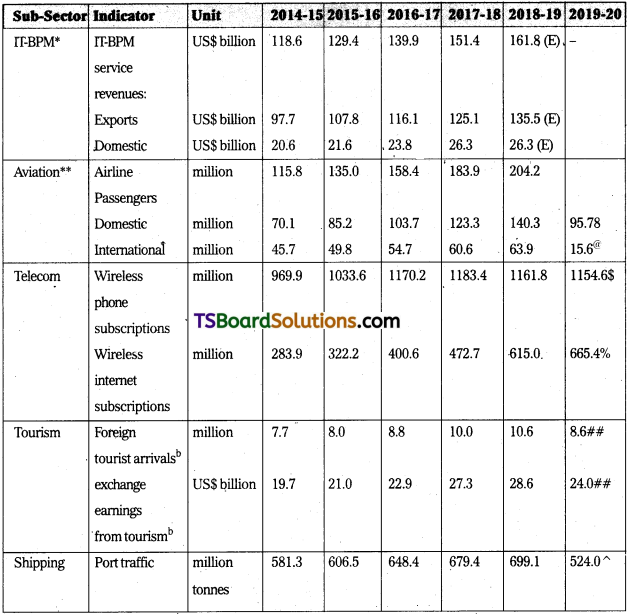

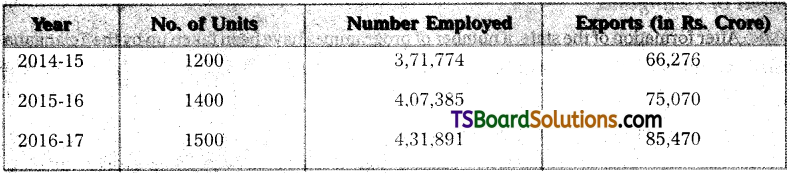

FT and HfeS Sectors in Telangana; The state holds a leading position in IT and information technology enabled services (ITeS) in the country in terms of production and exports. Rapid changes in technology in the IT sector gave rise to new opportunities, especially in big data analytics, cyber security; cloud computing, animation and gaming, etc. Hyderabad, the capital of Telangana, is now recognised as one of the leading IT hubs globally. It houses over 1500 iT/ITeS companies, both large and small, which together employ over 4.3 lakh professionals, besides providing indirect employment to over 7 lakh people. There has been robust growth in the performance of the IT/ITeS sectors in the state, since 2014-15. It can be witnessed from the given table. There has been a sharp increase in all parameters i.e., in ritunber of units, employment and exports of IT&ITeS in Telangana during 2014-15 to 2016-17.

Growth of IT and ITeS in Telangana

In 2018-19, the total value of software and IT Product exports of the state accounted for Rs. 1,09,219 crore (US$ 15.6 billion). Telangana state contributes over 11% share ofthe country’s IT, exports and Hyderabad ranks 2nd in terms of total revenues from IT sector in the country.

IT Policy Rrame work :

Government of Telangana, in order to augment the growth in IT/ ITeS sector and attract investments and employment generation, has framed an ICT policy with an objective to make the state the most preferred technology investment destination in the country. The following are some important initiatives of IT and ITeS :

i) IMAGE Tower :

Government is establishing a dedicated work place for development of animation, gaming and VFX industry i.e., IMAGE Tower with state of the art infrastructure and services. IMAGE Tower is being developed in an area of 10 acres (in Raidurgam village,

E.R. district) with a project cost of Rs. 1,000 crore on a public private partnership (PPP) mode

ii) Telangana Fiber Grid (T-Fibre) Project :

Government of Telangana has initiated this project in 2015. Its vision is to establish a state-of-the-art network infrastructure that would facilitate the realization of Digital Telangana to 10 Zones (33 districts).

iii) Electronic Services Delivery (BSD) :

Electronic Services Delivery (ESD), Department of ITE&C, government of Telangana is the nodal agency for delivery of government services to citizens and business with focus on improving efficiency, transparency and accountability for the government service delivery. The obejctive is to provide smart, citizen centric, ethical efficient and effective governance facilitated by technology towards Digital Telangana.

iv) Telangana Academy for Skill and Knowledge (TASK) :

Government of Telangana has creaed a unique institution called Telangana Academy of Skill and Knowledge (TASK) to develop a skilled work force in IT and ITeS, life sciences, healthcare, aerospace, banking and financial services. It is setup as a non-profit organisation in partnership with academia and industry. TASK strengthens the quality of graduates coming out of degree and engineering colleges by imparting industry-ready skills, both technical and non-technical (soft skills).

A part from the above, the government of Telangana is developing IT incubation centres in Warangal, Karimnagar, Khammam and Nizamabad districts to ensure technology oriented jobs for youth.

Question 8.

Briefly explain the development and welfare programmes of the government of Telangana.

Answer:

After formation of the state, a number of programmes have been taken up by the Telangana Government to improve the living standards of poor people. These progress can be categorised as under.

A) Development Welfare Progermme for All:

1) Aasara Pensions Scheme :

‘Aasara’ pensions scheme is meant to protect the most vulnerable sections of society in particular the old and infirm, people with HIV-AIDS, widows, incapacitated weavers and toddy tappers, who have lost their means of livelihood with growing age, in order to support their day to day minimum needs required to lead a life of dignity and social security.

This Scheme was launched at Kothur in Mahabubnagar district on Nov 8,2014. The state government enhanced the Aasara monthly pension from Rs. 200 to Rs. 1000 for the old aged, widows, weavers, toddy tappers and AIDS patients and Rs. 500 to Rs. 1500 for disabled persons.

ii) Aarogya Lakshmi :

With ah aim to enhance the levels of nutrition in pregnant and lactating women, Telangana government is providing one nutritious meal everyday to pregnant women and the children below the age of six, living below poverty line, through Anganwadi centers. The scheme was launched on January 1,2015.

iii) Amma Vodi :

The government introduced this scheme with an objective to reduce infant and maternal mortality rates in state. Through this programme, financial as well as medical assistance and transport facility is provided to pregnant women before and women who deliver their babies in the government hospitals.

iv) Mission Bhagiratha :

It was launched on Aug 7,2016 in Komati Banda (V) Gajwel, Medak District. This programme was conceived to provide 100 litres per capita per day (LPCD) of treated and piped water in rural areas, 135 LPCD in municipalities, and 150 LPCD in municipal corporations.

v) Housing for Poor :

Through this programme the Telangana government is intending to provide quality and respectable housing to the poor. The ‘housing for the poor1 plan provides for two and three storied buildings with the 2 BHK flats in Hyderabad and other urban areas while they are to be built as independent houses in rural areas.

vi) Bice Distribution :

This programme was launched from 1st January, 2015. Telangana state Civil Supplies Corporation in supplying rice under PDS @ 6 kgs per person at Rs. 1 per kg without any ceiling on the number of members in the family. To arrive at the eligibility of the BPL families, the family income limit in rural areas has been increased to Rs. 1.50 lakh and in urban areas to Rs. 2 lakh.

B, SC/STi Development and Welfare Programmes :

1) SC and ST Special Development Fund: Through SC/STs special development fund (SDF) Act, 2017, government has formulated two budget heads, namely:

i) ‘SC Special Developoment Fund (SCSDF); and

ii) ‘ST Special Development Rind (STSDF)’.

2) Scheduled Castes Welfare :

In Telangana, the Scheduled Castes Development De-partment co-ordinates and monitors the implementation of the following SC welfare schemes.

a) Kalyana Lakshmi for SCs :

The government launched this scheme on 2nd October, 2014. A one-time financial assistance of Rs. 51,000/- was being provided to the brides family at the time of marriage to meet the marriage related expenses of a Telangana resident girl of over 18 years of age belonging to SC community with a parental income not exceeding Rs. 2 lakh, and further to Rs. 1,00,116 in 2018.

b) Ambedkar Overseas Nidhi Scheme : Under this scheme the students belonging to SC community are provided with a scholarship grant for overseas study to the tune of Rs. 20 lakh subject to parental annual income limit up to-Rs.’5’lakh. During 2018-19, 101 students have been selected under this scheme.

c) Land Purchase Scheme :

The government of Telangana launched this programme for the benefit of the poorest of the poor SC women families. Under this scheme, an extent of 15,044.35 acres of land has been purchased and distributed to 5,930 beneficiaries at a cost of Rs. 657.71 crore from 2014-15 to 2019-20.

3) Scheduled Tribes Welfare :

The government of Telangana launched the following schemes for the integrated development of the scheduled tribes :

(a) Kalyana Lakshmi for STs :

This programme was launched on 2nd October 2014. A one-time financial assistance of Rs. 1,00,116/- shall be granted at the time of marriage to each ST girl who attains the age of 18 years.

(b) Economic Support Schemes :

Under this scheme, financial assistance to tribal population is provided in the fields of agriculture, horitculture, fisheries, minor irrigation, animal husbandry and self-employment.

(c) Forest Rights Act, 2006 :

Under this Act, individual titles were distributed to 93,494 forest dwellers (tribals) covering an extent of 3,00,092 acres. The forest and right holders have right for self-cultivation and the land is non-transferable, inalienable, but heritable. During the year 2018-19, 91,927 farmers were distributed with an extent of 2.99 lakh acres under Rythu Bandhu scheme.

C. BCs Development and Welfare Programmes:

The welfare schemes launched by the state government for the welfare of BCs include:

1. Kalyana Lakshmi Scheme for BCs :

The government extended the scheme of Kalyana Lakshmi to backward classes (BCs) and economically backward classes (EBCs) in the year 2016-17.

2. Most Backward Classes Development Corporation :

It was established in 2017 to with a sharp focus on improving the social, educational and financial conditions of most backward classes (MBQ among BCs. Rs. 1,000 crore has been allocated in the financial year 2018-19 and 13,367 beneficiaries were identified.

D. Minorities Development and Welfare Programmes :

In order to improve the socioeconomic conditions of minorities the state government has formulated several schemes. Some of them sire as follows :

a) Bank Linked Subsidy Scheme :

The scheme is being implemented for minorities to setup viable self-employment business units. The financial assistance from the Telangana State Minorities Finance Corporation is by way of subsidy, which is linked to the credit component from banks.

b) Training, Employment and Skill Development :

The minorities department extends training and skill development and arranges self-employment for minority youth through the Minorities Finance Corporation. New schemes for training have been introduced in collaboration with NAC, department of youth affairs and SETWIN.

c) Shaadi Mubarak Scheme :

Under this scheme, the government gives a one-time .grant of Rs. 1,00,116/- to the eligible minority bride’s family at the time of marriage.

Short Answer Questions

Question 1.

Explain about sectoral growth rate trends of Telangana economy.

Answer:

Answer:

Annual Average Sectoral Growth Rates in GSVA of Telangana State :

The growth rates of primary, secondary and tertiary sectors will be measured in terms of Gross Value Added (GSVA) at basic prices. The constituents of these sectors include :

a) Primary Sector :

This sector consists of sectors like crops,’livestock, forestry and logging, fishing and acquaculture and mining and quarrying.

b) Secondary Sector :

This sector comprise of the sectors such as manufacturing, electricity, gas, water supply and other utility services and construction.

c) Tertiary Sector :

This sector include sectors, namely, trade and repair services, hotels and restaurants, transport (including railways, road, water, air and services incidental to transport), storage, communication and services related to broadcasting, financial services, real estate, ownership of dwellings and professional services, public administration and other services.

The sectoral analysis provides an outline about how well the sectors have performed in the previous years and are expected to perform in the current year.

If we look at the annual average growth rates of these sectors in current prices, in respect of primary sector its growth rate decreased from 21.9 percent (8.6% in constant prices) in 2012-13 to just 2.2 percent (-58% in constant prices) in 2015-16 then after it increased to 17.1 percent in 2016-17, but again it decreased 15.8 percent (10.7% in constant prices) by 2019-20 (AE). Thus, we observe a mixed trend in the growth rate pattern of this sector.

As regards secondary sector, it experienced a negative growth rate in 2012-13 and 2014-15. A highest growth rate of 20.3 percent (21.4% in constant prices) in 2015-16 and a lowest of just 1.6 per cent (0.1% in constant prices) in 2016-17 and a moderate growth of 5.3 per cent . (1.7% in constant prices) by 2019-20 (AE).

The growth rate of tertiary sector ranged between 18.4 percent to 14.1 percent (8.4% to 9.6% in constant prices) during 2012-13 to 2019-20. Overall, we can see a mixed trend, both in current and constant prices, in the growth rates of sectoral GSVA in Telangana state during 2012-13 to 2018-19.

Sectoral Contribution to over all Gross State Value Added (GSVA) in Telangana :

In current prices, the share of tertiary sector is growing at a higher rate (from 52.8 percent in 2011-12 to 65.2 percent in 2019-20AE) while the shares of primary (from 19.6 percent in 2011-12 to around 18.6 percent in 2019-20AE) and secondary (from 27.6 percent in 2011-12 to around 16.2 percent in 2019-20 AE) are declining during the period 2011-12 to 2018-19 in Telangana. We can observe instability in the growth pattern of shares of both primary , and secondary sectors. In contrast to his, we find a gradual and stable increase in the share of services sector during 2011-12 to 2019-20.

Question 2.

Write about demographic features of Telangana state.

Answer:

Telangana State through changes in quantity and quality of population. As the size and quality of population shape human resource endowment. They have an angle bearing both on demand generation and supply creation aspects of goods and services. There are significant changes in the size of the population and other demographic features during seven census decade years from 1951 to 2011. The total population of Telangana more than doubled from 1.1 crore in 1951 to over 2.6 crores by 1981, climbing to 3.52 crores by 2011.

In total geographical area of India, the share of Telangana is 3.5% according to 2011 census. Ranga Reddy stands at the top with 52.97 lakhs population as against this Nizamabad stands at bottom with 25.51 lakhs population. Population density is defined as an average number of persons living per square kilometer area compared to all India Telangana is less densely populated. Hyderabad district being the capital city is highly populated with 18,172 persons living her square km.

Population growth rate of Telangana state is marked lower than the growth rate at all India level. In the recent census decade, while Telangana registered and annual growth rate of 1.4%.

The age group consisting of 0-6 years denote child population. In Telangana, the share of child population marginally decreased from 14.2% in 2001 to 10.5% in 2011.

As per 2011 census, the percentage of SC population to total population is 15.44% as against to this, the percentage of S.T population to total population is 9.34% in Telangana state. Among Sc’s, the highest percentage of population is to be found in Karimnagar district with 18.80% of the total and the lowest in Hyderabad district with 6.29% of the total. As far as ST’s are concerned, the highest percent of their population is found in Khammam district with 27.37% of the total ST population.

As per the 2011 census, the sex Ratio is 990 females per 1,000 males in Telangana, where as it is 940 females per 1,000 male population in India. Thus, Telangana state has relatively more female population than that is recorded at the national level.

Share of Immigrants in Telangana Population : The higher growth of urban population in Telangana state is mainly due to migration of population from Andhra and partly from other states. The share of Telangana in the erstwhile Andhra Pradesh was 42 percent in 2011. From 1961 to 2011, total migration of population is 62 lakh. Rangareddy district stood top in urban-ization with 70% people living in towns, which is mainly due to development of towns and suburban areas around Hyderabad that fall in Rangareddy district.

Question 3.

Discuss the Agricultural economy of Telangana.

Answer:

Agricultur sector is mainly rainfed and depends to a significant extent on the depleting gorund water resources. As nearly 55.49% percent of the state’s population is dependent on farm activity for livelihood. The share of agriculture sector in Gross State Value Added (GSVA) is 18.1% in current prices (15.6% in constant prices) of 2018-19 (FRE) and 18.6% (16% in constant prices) of 2019-20 (AE).

Telangana is the 12th largest State in India in terms of geographical area with 112.08 lakh hectares of which about 60% of the area is arable. In the year 2018-19, about 48.98 lakh hectares area was under net cropped area and 60.59 lakh hectares was gross cropped area. Forest occupies 26.98 lakh hectares, accounting for 24.07% of the total geographical area. About 8.34 lakh hectares of land is put to non-agricultural uses, 15.78 lakh hectares is kept follow, 6.07 lakh hectares area is not fit for cultivation and the remaining 5.94 lakh hectares area is classified as of permanent pastures etc.

1. Net and Gross Area Sown :

The net area sown in 2018-19 was 46.60 lakh hectares representing 41.50 percent of geographical area spread across the districts.

2. Area under food and Non-food-Crops in Telangana :

Food crops broadly consist of cereals, millets, pulses and non-food crops include cotton, oil seeds, flowers etc. The food crops were cultivated in an area of 37.14 lakh hectares during the year 2017-18. The non-food crops were cultivated in an area of 23.45 lakh hectares during the year 2017-18.

Food crops account for lion’s share in total cropped area of the State. The share food and non-food crops in total cropped area was 53% and 47% respectiely in 2015-16 and it is 61.2% and 38.8%, resectively in the year 2018-19. In Telangana, there has been a gradual decline in

food crops from 70.8% in 2001-02 to 61.2% in 2018-19 mainly on account of decline in area under coarse grains.

3. Area under Food and Non-Food Crops in 2018-19 :

Gross area sown in Telangana during 2018-19 under kharif and rabi seasons was 57.75 lakh hectares. 45.0 lakh hectares area cultivated in kharif season in 2018-19, about 53.9 percent was under food crops and the rest 46.1 percent was under non-food crops. However, the share of food-crops was 87 percent with a cultivated area of 11.07 lakh hectares, out of the total cultivated area of 12.75 lakh hectares during rabi season.

4. Operational Landholdings :

The average size of the operational landholding in the state is 1.00 hectare (2.47 acres) in 2015-16 which is less than the national average size of 1.08 hectares and declined from 1.12 hectares in 2010-11.. It is noteworthy that the operational landholding size of marginal and small farmers constitutes about 80% of the total operational holdings in the state. There had been a decline in landholding size of semi-medium, medium and large categoreies in the year 2015-16, when compared with 2010-11.

5. Agricultural Sector Flagship Programmes of Telangana :

a) Rythu Bandhu :

Rythu Bandhu scheme is aimed at empowering the farmers of the state of Telangana by providing them with an investment support to relieve them from the burden of debt. It was launched on May 10th 2018. The government provides investment support for agriculture and horticultue crops by way of gmat of Rs. 4,000/- per acre to all farmers (pattadars) each season (Rs. 8,000 per annum) for purchase of inputs like seeds, fertilizers, pesticides, labour and other investments in the field operations of farmer’s choice for the crop season.

b) Rythu Bhima :

The government of Telangana launched Rythu Bima scheme on August 15, 2018. Its objectives is to provide financial relief and security to the family members/ dependents of the deceased farmer incase of his/her death. The scheme provides an insurance cover of Rs. 5 lakh to every farmer.

Question 4.

Explain the industrial development in Telangana.

Answer:

Industrial Sector in Telangana :

The state is one among the major industrial states in the country and it is ranked 6th in terms of industries and ranked 8th in terms of gross value added.from industries. The share of industrial sector contribution to GSVA at current prices was 17.4% (19.9% at constant prices) in 2018-19 (FRE) and it declined to 16.2% (18.7%) at current prices) in 2019-20 (AE).

As per Annual Survey of Industries data, in Telangana state the number of industries increased from 7,357 in 2008-09 to 10,279 in 2012-13, 11,068 in 2013-14, 11,995 in 2014-15 and 12,353 in 2015-16, registering a growth rate of 68 percent in number of factories during over 2008-09 and 3 percent ovef 2014-15 in the state. The total Gross Value Added (GVA) of manufacturing units in the state was Rs. 24,117 crore in 2008-09, which increased to Rs. 34,322 crore in the year 2014-15 and Rs. 44,840 crore in 2015-16 indicating a growth of about 85 percent over 2008-09 and about 31 percent over 2014-15.

1. MSME Sector in Telangana :

Micro, Small and Medium Enterprises (MSME) provides complementary products to large industries as ancillary units arid contribute enormously to inclusive growth and region balanced development of the state. This sector plays a pivotal role in providing employment opportunities at comparatively lower capital cost to those who are low skilled.

There has been a steady growth in the number of MSME registrations over the years in Telangana. As many as 8,435 units have commenced their operations since formation of the state, with an investment of about Rs. 11,847 crore by providing additional employment opportunities to about 1.59 lakh persons in all micro, small and medium units durint 2015-19.

2. New Industrial Policy of Telangana :

Telangana state, after emerging as the 29th state of the country, unveiled its new ‘Industrial Policy Framework, 2014’. The vision for iindustrialization of the state is “Research to Innovation; Innovation to Industry Industry to Prosperity”. The industrial policy framework is driven by the goal of “Innovate, Incubate, and Incorporate”., The core objective of this policy framework is to prpvide a business regulatory environment for ease of doing business in the State.

Question 5.

Write a note on TSGENCO are TRANSCO.

Answer:

a) Telangana State Power Generation Corporation Limited (TSGENCO) : The con-tracted capacity of Telangana state, including Generation Corporation of Telangana Limited (TSGENCO) and other plants as on 01.07.2019. is 16,201 MW, which includes the contracted capacity of private sector 7,739 MW, the state sector 5,825 MW, central sector 2,536 MW, inter-state 76 MW and joint sector 25 MW TSGENCO’s installed capacity of 5,825.26 MW comprises of thermal (3,282.50 MW), hydel (2,441.76 MW) and solar (1 MW).

Keeping in view the growing demand for power in Telangana state, TSGENCO has un-dertaken capacity addition programme by establishing two new thermal power projects of 5,080 MW and they are : Bhadradri Thermal Power Station (4 x 270 MW to be commissioned in 2019-20 and Yadadri Thermal Power Station (5 x 800 MW to be commissioned in 2020-21).

b) Transmission and Distribution of Energy in Telangana Transco :

After formation of the state, the Telangana state Transmission Corporation of Telangana Limited (TSTRANSCO) was constituted to take care of transmission needs of the state. A years after formation of the state, 112 numbers EHT substations, 833 numbers 33/11KV substations are comissioned and 2.54 lakh of distribution transformers are added (SEO-2020, GOT).

The state had a power deficit of around 2,482 MU during 2013-14. The energy requirement was 47, 428 MU. But available energy was only 44,946 MU. During 2014-15, the energy requirement was 50,916. MU and the available energy in the state was 48,788 MU from all the sources.

There are two distribution companies in the state namely, Telangana state Southern Power Distribution Company Limited (TSSPDCL) and Telangana State Northern Power Distribution Company Limited (TSNPDCL) that supply electricity to consumers in Telangana. As on 01-12-2019, there were a total of 1.53 crore service connections in the state. About 73 percent of energy consumption in Telangana is in the form of domestic consumption.

Question 6.

Write brief note on education profile of the state.

Answer:

According to the population Census, 2011 the literacy rate of Telangana is 66.54 percent. However, considerable variations are observed in literacy rates among different groups like rural and urban, within districts, age groups, social groups and male and female. The literacy gap between rural (57 percent) and urban (81 percent) areas is 24 percentage points and the literacy gap between male (75 percent) and female (58 percent) population is 17 percentage points. The literacy rates for the age groups of 7-14 years and 15-24 years in the state are higher than the national average. In the remaining age groups, the national averages are higher than that of state averages.

Education Profile of the state :

According to Socio Economic Outlook-2020 document of Telangana government, a total number of 40,597 schools are functioning in the state. Out of these 26,050 are run by state government, 3,269 are welfare/residential schools, 678 are aided schools, 10,369 are in the private sector, 180 are madarsas and the remaining 51 schools are run by central government in the State.

a) Enrolment :

During the year 2017-18, about 58.71 lakh children were enrolled in all the schools, of them 53 percent were enrolled in private schools, 47 percent in government schools including the schools, run by the central government, local bodies and aided schools.

b) Gross Enrolment Ratio (GER) :

Gross enrolment ratio determines the number of students enrolled in educational institutions i.e., schools, colleges, universities etc. In 2017-18, the gross enrolment rate among children in primary schools was 98.76 for boys and 98.05 for girls and in upper primary schools, it was 87.32 for boys and 88.47 for girls. Overall, the GER for girls was higher than hoys in upper primary schools in Telangana.

c) Pupil-Teacher Ratio (PTR) :

It indicates average number of pupils per teacher at a specific level of education in a given school-year. During 2018-19, the pupil-teacher ratiio observed was 18.90, 14.12 and 17.85 for primary, upper primary and secondary schools respectively. The overall PTR is 17.67 for the year 2018-19.

Question 7.

Discuss the status and prospects of residential institutions of Telangana state.

Answer:

To bring social equity and improve access to education for children of SCs, STs, BCs, minorities and differently-abled children, the state has been providing hostel and residential school facilities, supply of books and other provisions at free of cost.

A) Scheduled Castes Residential Schools :

Telangana Social Welfare Residential Edu-cational Institutions Society (TSWREIS) is running 268 (out of which 175 meant only for girls) residential educational institutions (from 5th standard to under graduate level) in the state for Scheduled Caste (SQ children. Of the 268 institutions, 134 were sanctioned after formation of the state.

B) Schedule Tribes Residential Schools :

a) Telangana Tribal Welfare Residential Educational Institutions Society (TTWREIS) (Gurukulams) :

There are 175 Gurukulams in the state, out of which 153 are residential schools and junior colleges and 22 are residential degree colleges for boys and girls. The total strength of the institutions is about 52 thousand students. The medium of instruction in these institutions is English,

b) Ashram Schools :

There are 321 ashram schools in the state with a total strength of about 92 thousand students; and

c) Government Primary Schools (GPS) :

Tribal Welfare Department is running 1,427 government primary schools with 1st to 3rd or 5th classes and around 22 thousand students are getting primary education as day scholars in these schools.

C) Backward Classes Welfare Residential Schools :

Mahatma Jyothiba Phule Telangana Backward Classes Welfare Residential Education Institutions Society (MJPTBCWREIS) is established to facilitate access to quality education for the students of backward classes (BCs) and economically backward classes (EBCs). The Society and the BC Welfare Department are running residential schools (261), residential junior colleges (19) for boys and girls and one residential degree college. The total sanctioned strength of all these institutions is 93,360.

D) Minority Residential Institutions :

Telangana Minorities Residential Educational Institutions Society (TMREIS) established with the objective of providing a high quality education for children belonging to the minority communities through residential schools. A total of 216 minority residential institutions including 12 colleges with 79,424 students are functioning in the state.

Question 8.

Describe health sector initiatives of Telangana state.

Answer:

Answer:

Education in Telangana :

Education is a crucial element in strengthening the human resources and economic development of a country. Education helps in creating more productive labour force. The 45th Article of the Indian Constitution has laid the responsibility on the states to provide free and compulsory education to both boys and girls of the age group of 6 to 14 years.

Literacy Rates in Telangana :

According to the Population Census, 2011 the literacy rate of Telangana is 66.54 per cent. However considerable variations are observed in literacy rates among different groups like rural and urban, within districts, age groups, social groups and male and female.

As far as literacy levels in districts are concerned, among 33 districts of the state, Hyderabad stands at top with 83.25 percent literacy rate and Jogulamba Gadwal district stands at the bottom with 49.87 per cent.

1. Education Profile of the State :

a. Enrolment :

During the year 2017-18, about 58.71 lakh children were enrolled in all the schools, of them 53 percent were enrolled in private schools, 47 percent in government schools including the schools run by the centred government, local bodies and aided schools.

b. Gross Enrolment Ratio (GER) :

In 2017-18, the gross enrolment rate among children in primary schools was 98.76 for boys and 98.05 for girls and in upper primary schools, it was 87.32 for boys and 88.47 for girls. Overall, the GER for girls was higher than boys in upper primaiy schools in Telangana.

c. Pupil – Teacher Ratio (PTR) :

During 2018-19, the pupil-teacher ratio observed was 18.90, 14.12, and 17.85 for primary, upper primary and secondary schools respectively. The overall PTR is 17.67 for the year 2018.19.

2. School Education :

a. Samagra Shiksha Abhiyan :

Hitherto the state government implemented the centrally sponsored schemes (a) ‘Sarva Siksha Abhiyan’ (SSA) to universalise elementary education; and (b) ‘Rashtriya Madhyamik Shiksha Abhiyaan’ programme (RMSA) to improve the access and quality of secondary education.

b. Kasturba Gandhi Balika Vidyalaya (KGBV) :

There were 391 KGBVs at the time of formation of the state and this number increased to 475 by 2017-18. Government of India supports only classes VI to VIII under KGBVs, however, state government extended the scheme by adding IX and X classes to facilitate continuation of girls’ education upto Class-X and to avoid dropouts.

e. Model Schools :

194 model schools were started in the academic year 2013-14 in the state, with an objective to provide quality education in English medium by highly qualified teachers. As the scheme was terminated by the centre, the government of Telangana took over the responsibility of running model schools from the year 2015-16 onwards.

3. Intermediate Education :

The Department of Intermediate Education administers intermediate education system in the state. There are 2,558 junior colleges with a total enrolment of 7.18 lakh students. The department also offers 23 vocational education courses at intermediate level in junior colleges in the state with special focus on job oriented courses.

4. Higher Education:

a. Collegiate Education :

The objective of Department of Collegiate Education is to provide access, equity and quality in higher education. Towards this direction, state government is making all efforts with government of India funds under Rashtriya Uchchatar Shiksha Abhiyan (RUSA).

b. Degree Online Services, Telangana (DOST) :

The government of Telangana has introduced online admissions for under graduate courses (BA/BCom/BSc/BBA/etc) in the state of Telangana in the year 2016 through web based system called Degree Online Services, Telangana (DOST). In the year 2018-19, a total of 2,00,472 students were admitted in all degree colleges through DOST. Out of which 42,688 were admitted in government degree colleges.

c. Technical Education :

The department manages the government polytechnics and monitors the private unaided polytechnics and professional colleges. At present there are 820 diploma and degree level professional institutions in the state with a total intake of 1,36,805.

5. Social Welfare Educational Institutions :

To bring social equity and improve access to education for children of SCs, STs, BCs, minorities and differently-abled children, the state has been providing hostel and residential school facilities, supply of books and other provisions at free of cost.

a. Scheduled Castes Residential Schools :

Telangana Social Welfare Residential Educational Institutions Society (TSWREIS) is running 268 (out of which 175 meant only for girls) residential educational institutions (from 5th standard to undergraduate level) in the state for Scheduled Caste (SC) children. Of the 268 institutions, 134 were sanctioned after formation of the state.

b. Schedule Tribes Residential Schools :

(a) Telangana Tribal Welfare Residential Educational Institutions Society (TTWREIS) (Gurukulams) : There are 175 Gurukulams in the state (b) Ashram Schools : There are 321 ashram schools in the state, (c) Government Primary Schools (GPS) : Tribal Welfare Department is running 1,427 government primary schools with 1st to 3rd or 5th classes and around 22 thousand students.

c. Backward Classes Welfare Residential Schools :

Mahatma Jyothiba Phule Telangana Backward Classes Welfare Residential Education Institutions Society (MJPTBCWREIS) is established to facilitate access to quality education for the students of backward classes (BCs) and economically backward classes (EBCs).

d. Minority Residential Institutions :

Telangana Minorities Residential Educational Institutions Society (TMREIS) established with the objective of providing a high quality education A total of 216 minority residential institutions including 12 colleges with 79,424 students are functioning in the state.

Health Sector in Telangana :

In order to reach the goal of “Health for All” of World Health Organization (WHO), Government of Telangana is implementing different programmes like National Maternity Benefit Programme, Integrated Child Development Programme and Supplementary Nutrition Programme for the women in reproductive age group and the programme of Balika Samrudhi Yojana for children.

As per SEO – 2020, in Telangana state, there are 4,797 health sub-centres, 633 primary health centres, 249 urban primary health centres, 90 community health centres, 19 area hospitals, 29 district hospitals, 9 medical college hospitals, 12 speciality hospitals and 2 super speciality hospitals.

Health Sector related Programmes of Telangana :

After formation of the state, Telangana government initiated several health related programmes. Some of them are presented here under :

a) Kanti Velugu :

People mostly tend to live with eye problems or postpone until it is too late. Particularly, the women and elderly persons neglect eye vision problems. To address this problem, the government has launched Kanti velugu programme with a vision to build avoidable blindness free Telangana through simple pair of glasses and cataract surgery.

b) Basti Dawakhana :

Basti Dawakhana is an initiative to offer quality health services to urban poor. One basti dawakhana caters to 5000 – 10000 population. The basti dawakhana is located within the urban slum. Currently 104 basti dawakhanas are functioning in the state.

c) Health and Wellness Centres :

Health and Wellness centres will provide comprehensive health care, including for non-communicable diseases and maternal and child health services. These centres will also provide free essential drugs and diagnostic services. Currently 636 PHCs, 86 sub-centres, 104 Basti dawakhanas and 227 UPHCs have been converted as Health and Wellness Centres.

d) Telangana Vaidya Vidhana Parishad (TWP) Hospitals :

These hospitals (107) functioning under the control of TWP mainly cater to the maternity and child health care services, besides general medicine, general surgery, ophthalmology, paediatrics, orthopaedics, dermatology, ENT, etc.

e) AYUSH (Ayurveda, Yoga, Naturopathy, Unani and Homoeopathy) :

The Telangana government along with the National AYUSH Mission (NAM) is encouraging the AYUSH system of medicine. Presently 860 dispensaries and institutions are functioning under the AYUSH department.

f) Aarogyasri Health Care Trust :

Aarogyasri Scheme (AS) is a unique government sponsored health insurance scheme being implemented by Aarogyasri Health Care Trust in the state, with the objective of assisting below poverty line families. The scheme provides end-to-end cashless medical services for identified diseases.

g) KCR Kit :

The Telangana state government launched a new programme called KCR Kit on 2 June 2017 to provide compensation to pregnant women (pre and post natal periods) living below poverty line, who are receiving health services from public health institutions in the state, @ Rs. 12,000 (for a male child) and Rs. 13,000 (for a female child) for wage loss.

Question 9.

Analyse poverty and unemployment situations in Telangana.

Answer:

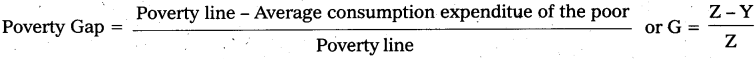

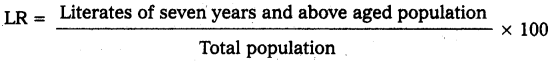

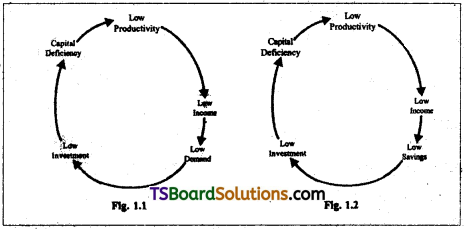

Poverty is a multi-faceted phenomenon and is influenced by social, economic, political and partly by external factors. Poverty can be defined as a social phenomenon in which a section of the society is unable to fulfill even it basic necessities of life and thus deprived of the minimum level of living.

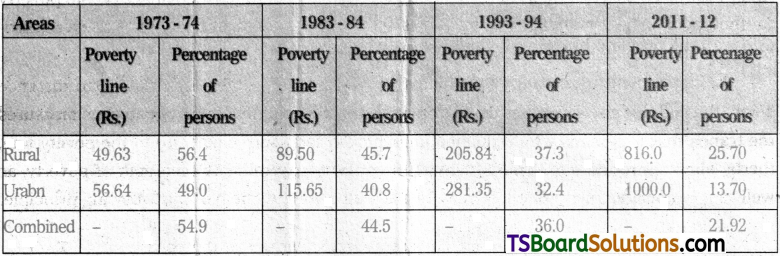

a) Tendulkar Expert Group Poverty Estimates :

In 1993-94 for poverty line estimation, annual per capita was assumed as Rs. 244 for rural and Rs. 282 for urban population for Telangana. Similarly, in 2011-12 the annual per capita for poverty line was assumed as Rs. 860 for rural and Rs. 1009 for urban population. The rural and urban poverty in Telangana between 1993-94 and 2011-12 were 49% and 30.5% respectively.

b) Rangarajan Committee Report on Poverty Estimates :

The poverty in Telangana is much lower than the Indian average. The percentage of poor in rural Telangana is 9.3 whereas the corresponding figure for India is 30.9% and the percentage of urban poor in Telangana is 11.1, where as it is 26.4 in India.

Unemployment in Telangana :

Unemployment may be defined as a situation in which the person is capable of working both physically and mentally at the existing wage rate, but does not get employment to work. It means a person who is willing to work at the existing wage rate does not get a job. It indicates a situation where the total number of jobs is less than the total number of unemployed in the country. It is a kind of situation where the unemployed persons do not find any gainful employment inspite of having willingness and capacity to work. In Telangana, agriculture sector provides employment to over 60 percent of work force. A moderate portion of population in the state gets livelihood and employment from, allied activities such as livestock and fishing.

Further, the presence of industries in the state are not widespread large amount of industrial units are located in and around Hyderabad and Rangareddy districts. The other districts in the state have no or little industrial presence and therefore, a limited qualified, skilled and semi-skilled work force are absorbed by industry. Rest, of the labour force including semi-skilled workers rely on primary sector for income generation. Though, urbanization opened up window of opportunities for workers in the state, there are hitches for urban sector to absorb all work forces. On the contrary, growth in tertiary sector nonetheless created increased number of employment particularly for skilled professionals.

Unemployment Rates in Telangana :

Unemployment rate in the state is below the national average rate of unemployment in 2011-12. Unemployment on the whole is more prevalent among females than males. The similar sort of pattern could be seen across urban and rural areas.

Question 10.

Discuss the importance of Kaleswaram project.

Answer:

Kaleshwaram Project: Kaleshwaram Project has been conceived from the erstwhile Dr. B.R. Ambedkar Pranahita-Chevella Sujala Sravanthi project. Originally, Dr. B.R. Ambedkar Pranahita-Chevella Sujala Sravanthi was proposed to utilize 160 TMC of allocated water of Godavari basin as per Godavari Water Dispute Tribunal (GWDT) award. A barrage was proposed at Tummidihetti (V) to divert 160 TMC of water to irrigate 16.40 lakh acres in the rstwhile 7 districts of Telangana state viz., Adilabad, Nizamabad, Karimnagar, Medak, Warangal, Nalgonda and Rangareddy, besides drinking water and industrial uses.

Further, it also planned to provide 10 TMC of drinking water to the villages enroute, 30 TMC of drinking water to twin Cities of Hyderabad and Secunderabad and 16 TMC of water for industrial use. The entire project works are divided into 7 links and 28 packages. Agreements concluded for all 28 packages during 2007-08 and 2008-09.

Construction of one barrage across river Godavari at Medigadda near Kaleshwaram, and two more barrages between Medigadda (Lakshmi barrage) and Sripada Yellampally Project at Annaram and Sundilla and to convey water form Sripada Yellampally Project to the command area spread over in 7 districts of Telangana (now 13 districts after re-organization of districts in the state) through components such as canals, tunnels, lift systems, reservoirs and sitributory network for irrigating an ayacut of 18,25,700 acres against the original proposed acres against the original proposed ayacut of 16,40,000 acres.

Further, it is proposed to stabilize the existing ayacut i other major projects viz., SRSP Stage-I, SRSP Stage-II, Flood Flow Canal, Singur and Nizamsagar projects to an extent of 18,82,970 acres (new ayacut 18,25,700 plus stabilisation ayacut 18,82,970=37,08,670 acres). Besides irrigation, drinking water (30 TMC for twin cities and 10 TMC for enroute villages) and water for industrial use (16 TMC) were also proposed.

The total estimated cost of Kaleshwaram Project is Rs. 80,000 crore and the total expen-diture incurred till 31-07-2019 is Rs. 51,434 crore.

Question 11.

Write about various sources of energy in Telangana.

Answer:

Energy Sector in Telangana :

Telangana being agriculture dependent economy, is one of the highest power intensive states in India, with a per capita power consumption of over 1,727 units (as per 2017-18) by recording 13.62 percent annual growth rate in power consumption, Telangana stands first in the country as against an All India per capita power consumption of 1,181 units (as per 2018-19). With regard to power consumption, Telangana consumption was 53,017 million units (MU) in 2016-17 and it rose to 60,237 MU in 2017-18. Similarly, per capita consumption in 2016-17 was 1,551 units while it was increased to 1,727 units in 2017-18.

The total installed capacity of erstwhile Andhra Pradesh was divided between the suc-ceeding states in the proportion of 53.89 percent (to Telangana) and 46.11 percent (to Andhra Pradesh). Accordingly Telangana’s installed capacity as on December 2016, was at 12,295.75 MW which includes state, central and private sectors. As per Power Sector, Jan.2018, Gol, report as on 31-01-2018, the installed capacity of Telangana state was 14,689.46 MW, which includes state (7572.65 MW), central (2036.85MW) and private (5079.96 MW) sectors.

The major power projects in Telangana state are :

National Thermal Power Corporation (NTPC) located in Ramagundam (Karimnagar district), Kothagudem Thermal Power Corporation (KTPC) situated in Palvoncha (Khammam district), Kakatiya Thermal Power Corporation located in Bhupalapally (Warangal district) while some of the major hydroelectricity power plants are located at Nagarjunasagar, Pochampadu, Singoor, Nizamsagar and Pulichintala.

Question 12.

Write about SC/ST welfare programmes of Telangana.

Answer:

SC/STs Development and Welfare Programmes : These programmes are discussed as under.

1) SC and ST Special Development Fund :

Through SC/STs special development fund (SDF) Act, 2017, government has formulated two budget heads, namely :

i) ‘SC Special Development Fund (SCSDF); and