Telangana TSBIE TS Inter 2nd Year Economics Study Material 5th Lesson Agricultural Sector Textbook Questions and Answers.

TS Inter 2nd Year Economics Study Material 5th Lesson Agricultural Sector

Essay Questions

Question 1.

Explain the importance of agriculture in Indian Economy.

Answer:

Importance of Agriculture in I nidian Economy :

1. Share of Agriculture in GDP or GVA :

At the time of the First World War, agriculture contributed two-thirds of national income. After the initiation of planning in India, the share of agriculture has declined due to the development of the secondary and tertiary sectors. In 1950-51 the share of agriculture and alllied activities in gross domestic product (GDP) was 56.5% and it declined to 24.7% in 2000-01 and further to 13.9% in 2012-13.

The value of GVA of agriculture and allied sectors increased from Rs. 20.94 lakh crore in 2014-15 to Rs. 30.47 lakh crore in 2019-20(PE). The share of agriculture sector as percentage of GVA decreased from 18.2 percent in 2014-15 to 16.5 percent in 2019-20 (PE). Further during the same period, the share of crops dec reased from 11.2 percent to 10 percent, the share of livestock increased from 4.4 percent to 4.9 per cent, the share of forestry & logging decreased from 1.5 percent to 1.2 percent while the share of fishing marginally increased from 1.0 per cent to 1.1 percent. In developed countries like USA and the UK around 2% of GDP only is derived from agriculture sector.

2. Providing Employment :

The number of people engaged in agriculture increased from 98 million in 1951 to 235 million in 2001. In terms of percentage, people working on land came down from 70 in 1951 to 59 in 2001. During the period 2008-11, agriculture provided employment to 46% of the male workers and 65% of the female workers. Overall, 49 percent workforce engaged in agriculture by the year 2011. Employment in agriculture in India was reported at about 43% in 2019.

3. Providing Raw Materials to Industries :

Agricullture provides raw materials to various leading industries. Sugar, jute, cotton textiles, vanaspati, flour mills, plantations and food processing industries depend on agriculture directly. Many other industries depend on agriculture indirectly. Many small scale and cottage industries depend upon agriculture for their raw materials.

4. Market for Industrial Products :

Since more population of developing economies live in rural areas, increased rural purchasing power is a stimulus to industrial development. If measures are taken to expand agricultural output and productivity, the income of the rural sector will increase. Hence, the demand for industrial produts increases and the process of industrial development will get a boost up.

5. Capital Formation :

Unless the rate of capital formation increases to a higher level, economic development cannot be achieved. As agriculture sector happens to be is the largest sector in developing countries, it will play an important role in pushing up the rate of capital formation. If it fails to do so, whole process of economic development will suffer. Generation of surplus from agriculture will ultimately depend on the agricultural productivity.

6. Provision of Food Security and Poverty Reduction :

According to the Food and Agriculture Organization (FAQ) and the United Nation.s Organization (UNO), hunger, malnutrition and under weight are main problems in India. To overcome these issues, development of agriculture sector is required. Since agriculture continues to be a source of livelihood and food security for a majority of low income poor and vulne rable sections of the society, its role in poverty reduction is self-evident. The experience indicates that 1% growth in agriculture is at least 2 to 3 times more effect in reducing poverty than the same growth in non-agricultural sectors. A growing surplus of agricultural produce is needed even to control inflation.

7. Agriculture Exports :

India occupies a leading position in global trade of agricultural products. However, its total agricultural export basket accounts for a little over 2.15 per cent of the world agricultural trade. What is note worthy is that since the economic reforms began in 1991, India has remained consistently a net exporter of agri-products, touching Rs. 2.7 lakh crore exports and imports at Rs. 1.37 lakh crore in 2018-19. Agricultural products such as tea, sugar, oil seeds, tobacco, spices, etc. are the main iterns of exports of India in 1950-51, the proportion of agricultural goods exported comes to 50% of our exports and exports with agricultural content contribute another 20%.

![]()

Question 2.

Describe the causes for low productivity in agriculture.

Answer:

There are many causes for low productivity in Indian agriculture which can be explained under general causes, institutional causes and technical causes.

1) General Causes :

1) Social Environment :

The social environment of villages is an obstacle in agricultural development. Majority of india farmers are illiterates, superstitious, conservative and non – responsive to new agricultural techniques. But the fact is with in their limitations, the indian farmers use their resources efficiently.

ii) Population Pressure on Land :

Population pressure is heavy on land, non – agricultural sectors are unable to absorb the total workers. So, pressure on land is increasing continuously. In 2011, out of 349 millions rural working populaton 263 million workers were employed in agricultural sector. Increasing population pressure on land is parthy responsible for subdivision and fragmentation of holdings, productivity is small uneconomic land holdings is low.

iii) Land Degradation :

Nearly half of the country’s land (329 millions hectares) is de-graded. 43% of the land suffers from high degradation resulting in 33-67 percent yield loss. 5% of the land is so damaged that it is unusable. Soil degradation is a major foctor for low agricultural productivity in many regions of the country.

iv) Inadequate Infrastructure :

Inadequate infrastructural facilities such as roads, communications, marketing, credit, power and drainage will lead to low agricultural productivity.

2) Institutional Causes :

i) Land Tenure System :

Highly exploitative zamindari system drained out the capacity willingness and enthusiasm of the farmers to increase production and productivity. Regulation of rent, security of tenure, ownership rights for tenants did not change the position of tenants better. In this situation productivity cannot be increased.

ii) Size of Holdings :

The average size of land holdings in india is very low. In 2010-11, 85% of total land holdings had a size of less them 2 acres, so, the cultivation on them can be only by labour intensive techniques, and scientific cultivation with improved implements, seeds etc., may not be possible. The existance of uneconomic land holdings is also the cause for low agricultural yield.

iii) Lack of Entrepreneurship :

Agricultural sector is devoid of full entrepreneurship and competition in their agricultural operations. All the developed nations have the enterprise system.

iv) Deficiency of Investment: It is another problem in the agricultural sector. The CSO (Central Statistical Organization) does not consider investment as the essential component of rural infrastructure. Electrification, development of roads, investment in storages and tele-communications are excluded.

3) Technical Causes :

i) Poor Techniques of Production :

Most of the India farmers are using outdated production techniques. Use of fertilisers and new high yielding varieties of seeds is also limited. Still, agriculture is traditional and there, productivity is low.

ii) Inadequate Irrigation :

Among the various inputs, the most important is irrigation to which the modem agricultural technology is closely tied. In india in 2010-11, out of 199 million hectares of gross cropped area only 89 million hectares of land had irrigation facilities. Thus, 45% of gross cropped area had irrigation facilities.

iii) Environmental Factors :

Severe soil erosion, degradation due to heavy rains, floods and deforestation, water logging, improper drainage, ground water depletion, drought and global warming reckless use of fertilizers and pollution of soil water and air are also contributing to low productivity in agriculture.

Question 3.

Write about the main components of land reforms in India.

Answer:

Components of Land Reforms :

The three main constituents of land reforms are explained as follows :

1) Abolition of Intermediaries :

There were mainly three forms of land relations in pre-independence India. They are : zamindari system/jagirdaiy system, mahalwari system and rytwary system which were initiated and implemented by Britishers. Except rytwary system in which there is direct relation between farmer and state all other systems are intermediary systems in which middle men in the form of zamindar/jagirdar are present in between cultivator of land and state. These middle men used to exploit farmer as well as they used to cheat state also. Because of this middle men system in land relations, agriculture became an exploitative ground. Accordingly, all state governments were instructed to enact the laws to abolish the intermediaries.

2) Tenancy Reforms :

A tenant is a person who cultivates land of the land owner owing portion of production to owner of land. But the owing portion called rent was very high and sometimes/ in some areas it was even two third of the total production. There was no security to tenant from the landlord. The continuation of tenancy is left to the mercy of land owner. To reform this land relation system, the following measures were suggested to the state. The sug-gested measures were regulation of rent, security of tenure and ownership rigents to tenents.

3) Ceilings on Land Holdings :

Fixing a statutory limit on the maximum land that a family can have under its ownership is called ceiling. Surplus over the ceiling is taken by the government for redistribution to the landless and marginal farmers. Ceiling on land holdings act has been initiated in different states since 1960.

The following are some of them :

- Ceiling limit is to be lowered to 18 acres of wet land and 54 acres of land without irrigation facilities.

- Family with 5 members is taken as a unit to determine the ceiling. Extra land is allowed for extra members.

- Exemption from the ceiling are to be reduced.

- The related Acts to be kept out of the purview of the civil courts.

- Scheduled Castes and Scheduled Tribes are to be given priority in the distribution of surplus land.

- Lands under plantation crops like tea, rubber and coffee are exempted from the Ceiling.

4) Consolidation of Land Holdings :

The government has encouraged consolidation to solve this problem. Under this reform Punjab, Haryana and Maharashtra states could provide economic holdings to a considerable number of farmers with small and fragmented holdings. By September 2001, only 1,633 lakh acres were consolidated. Farmers in many states have not come forward to co-operate and therefore the consolidation has been slow.

5) Co-operative Farming :

This is not a reform and depends on voluntary spirit. Farmers in an area join their small holdings by pooling lands. Co-operative farm is managed by an elected body and it has the advantages of large scale farming with government support. However, co-operative farming has not been effective due to different reasons like lack of motivation, dominant natur role of the big farmers, inefficient administration, improper distribution of produce and the treatment of small farmers as wage labourers.

![]()

Question 4.

Explain Self-Sufficiency in food grains and Food Security in India.

Answer:

The Indian planners, right from the beginning, realized the need to attain self-sufficiency in food grains as one of the important goals of planning.

When India suffered very severe droughts during 1965 and 1966, the then American President, Lyndon Johnson, restricted food aid to monthly basis under the Public Law (PL) – 480 Programme. The government of India under Prime Minister, Mrs. Indira Gandhi went in for seed – water – fertilizer policy popularly known as the green revolution. This policy ushered in a revolution in food production in India and dispensed with food grains imports altogether. India achieved self-sufficiency in food grains by the year 1976 and since then, Indian imports of cereals have remained neglibible. India’s food grains production reached to 285 million tons in 2018-19 from 50 million tons in 1950-51.

Though, India has achieved self-sufficiency in food grains, as per the Expert Group headed by SD Tendulkar, the percentage of poor living below poverty line for the year 2011-12 was 21.9 and as per the Expert Group headed by Dr. C. Rangarajan (2014) the population living below the poverty line was 454 million in 2009-10 and 363 million in 2011-12. Thus, in India though there is physical availability of food grains at national level the economic access is missing.

Question 5.

Assess the impact of New Agricultural Strategy in India.

Answer:

Impact of New Agriculture Strategy / HYVP on Indian Economy

Though, green revolution is the ultimate result of new agriculture strategy / HYVP, we can find out some other impliations of this process too as follows :

i) Increase in Agriculture Productivity / Production :

Due to new agriculture strategy, an enormous increase in agriculture productivity and production took place in India due to the adoption of modem agriculture inputs and which is termed as green revolution. We have seen this increase under the heading of increase in agriculture produc-tivity/production of major crops in India. By the year 1976. India became self-suffi-cient in food grain production.

ii) Employment :

The adoption of new agricultural strategy has led to substantial increase in area under crops, production of food grains and agricultural productivity. This technology has given a boost to agricultural employment because of diverse job opportunities created by multiple cropping. Labour intensive crops like rice, sugarcane, potato, vegetables, and fruits have increased the job opportunities in agricultural sector. The agriculture-retailing is developed into a big business now.

iii) Improvement in Farmer’s Income :

Farmers especially, in Kerala, Madhya Pradesh, Andhra Pradesh, Tamil Nadu, Gujarat, Punjab, Haryana and Himachal Pradesh had good chances of improving their incomes. Green revolution facilitated the farmers to follow simple but scientific and technical ways like grading the product in the field itself. Selling directly to the retail companies by avoiding middlemen also helped to increase in farmer’s income after new agricultural strategy as organized retailers have provided better remuneration to the farmers.

iv) Improvement in Exports :

India used to import huge basket of food grains prior to green revolution which became the rare case in post – green revolution period. Agriculture exports increased with green revolution. The value of exports of agriculture and allied products was Rs. 284 crores in 1960-61 and it increased to Rs. 2.7 lakh crore by 2018-19.

Question 6.

Examine the sources of agricultural credit in India.

Answer:

Sources of Agricultural Credit :

The sources of agricultural credit available to Indian farmers can be classified into two types :

A. Non-Institutional Sources :

Non-institutional sources include money lenders, land lard, traders, commission agents, relatives, friends etc. In 1951-52, non-institutional sources contributed 93 percent of financial requirements of farmers whereas the government could contribute only 7 percent. The money lenders and landlords supplied credit for both productive and unproductive purpose. They are easily accessible to farmers at any point of time. But this source has many defects in it. Interest rates are not uniform and exorbitant (18 to 50 percent). Often small farmers are cheated and their lands are appropriated. The landless labourers are forced to become bonded slaves.

B. Institutional Sources :

Since the private / non-institutional source of credit is defective and exploitative, the government followed a multiagency approach consisting of co-operatives, commercial banks and regional rural banks which knwon as institutional credit to provide cheaper and adequate credit to farmers. The basic objectives of this approach are :

- to ensure timely and adequate flow of credit to the farming sector;

- to reduce and gradually eliminate the money lenders from the rural scene; and

- to make available credit facilities to all regions of the country.

i) Co-operatives :

The co-operative movement was initiated way back in 1904 through the establishment of co-operative credit societies to relieve rural people from their indebtedness. The co-operative credit societies in India have been organized into short-term and long-term structures. The short-term co-operative credit structure is based on a three tier structure. At the lowest tier are the Primary Agricultural Credit Societ-ies (PACS) and these are organized at village level.

At the second tier, the District Co-operative Credit Banks (DCCBs)-are organized at the district level. At the third and at apex tier, the State Co-operative Banks (SCBs) are organized at the state level. The SCB coordinates the extension of short and medium term loans to farmers through DCCB and PACS. In addition to short and medium term loans, the long term credit requirements of the farmers are provided through PCARDBs and SCARDBs.

ii) Commercial Banks :

The share of commercial banks in the provision of agricultural credit was very meager in 1950s. It was just 0.9 percent in 1951-52 and 0.7 percent in 1961-62. The advances to agriculture by commercial banks aggregated to only Rs. 162 crores in 1969. But after nationalization of banks in 1969 and later in 1980, not only the number of branches of commercial banks increased at rural level but also the amount of advances to agriculture increased massively. The share of public and private sector commercial banks put together at present accounted for more than 70 percent of the institutional credit provided to agriculture.

iii) Regional Rural Banks (RRB):

As the commercial banks failed to fill the geographical gap in the availability of credit not covered by the co-operatives, the Working Group on Rural Banks headed by Sri M. Narasimham recommended for the establishment of RRBs to bridge the gap in the provision of loans to small and marginal farmers, landless labourers, artisans and other rural residents of small means. Consequent upon the recommendations of the working group, 5 RRBs were set up initially on 2nd October, 1975.

In the recent past, government of India fixed institutional credit flow target to agri-culture sector in respect of all of the above stated institutions in our country. The agricultural credit flow target for 2019-20 has been fixed at Rs. 13,50,000 crore.

iv) National Bank for Agriculture and Rural Development (NABARD) :

Reserve Bank of India had set up the Agricultural Refinance Development Corporation (ARDQ to provide refinance support to the banks to promote agricultural development. With the widening of the role of bank credit from agricultural development to rural development, the government proposed to have a broad-based organization at the apex level to support and guide the credit extending institutions. Accordingly, NABARD was set up in July, 1982 by subsuming ARDC.

![]()

Question 7.

What are the defects in agriculture marketing? Explain measures taken by the government to overcome the defects of agriculture marketing.

Answer:

Defects of Agricultural Marketing in India Due to inadequate storage facilities farmers are forced to sell their agriculture surplus immediately after harvesting irrespective of supply/demand position in market. Further, due to inadequate transportation facility, the farmer is forced to sell the goods to local traders/money lenders, commission agents with lower than market prices. In the mandis, the farmers are deceived by the use of wrong weights and rriea- sures. They are also cheated by brokers and traders. The farmer has to pay wighing charges, unloading charges, charges for separation of impurities in the produce and many other miscellaneous undefined and unspecified charges. Due to lack of proper grading system farmer is not getting remunerative price.

Government Measures :

The measures taken by the government of India to overcome the defects of agriculture’marketing.

1) Regulated Markets :

In order to eliminate unhealthy market practices and to protect the interests of the farmers by ensuring remunerative prices, State Agricultural Produce Marketing Act was enacted for the establishment of regulated markets. Accordingly, in 1951 more than 200 regulated markets were established in India and at present about 7,246 regulated markets are functioning in the country. Regulated markets aim at the development of the market structure to :

- Ensure remunerative prices to the producer of agricultural commodities;

- Narrow down the price spread between the producer and the consumer,and

- Reduce non-functional margins of the traders and commission agents,

2) Grading and Standardization :

Improvements in agricultural marketing system cannot be expected unless grading and standardization of agricultural produce is made. The government has done much to grade and standardize many agricultural goods. Under the Agricultural Produce Act, 1937, the government has set up grading stations. The graded goods are stamped with the seal of the Agricultural Marketing Department AGMARK and these goods will have a wider market and command better prices.

3) Warehousing Facilities :

The Central Warehousing Corporation (CWQ was setup in 1957 for the storage of agricultural produce. The states have setup the state warehousing corporations for the same. Food Corporation of India (FCI) was also setup at the national level. As on 31.12.2018 the total storage capacity available with Food Corporation of India (FCI), Central Warehousing Corporation (CWC) and state agencies is 851.54 lakh metric tonnes (LMT) comprising 724.79 LMT in covered godowns and 126.75 LMT in cover and plinth (CAP) storage.

4) Market Information :

The government has initiated a number of steps to provide the information about the prices prevailing in different markets to farmers. The prices prevailing in markets are broadcast daily by All India Radio. Trends in market prices are reviewed weekly in special programmes and talks are organized by AIR and Doordarshan. A kisan cedi center (KCC) with toll free no. 1800-180-1551 was set-up to help the fanners in all aspects.

5) Support Prices :

The government announces minimum support prices and procurement prices for various agricultural commodities from time to time in a bid to ensure fair returns to farmers. These prices are fixed in accordance with the recommendations of the Commission for Agricultural Costs and Prices (CACP).

6) Other Measures :

The following measures are also necessary to make agricultural marketing beneficiary to the farmers :

- Improving the physical connectivity (roads and communications).

- Improving the economic connectivity (banks and financial institutions)

- Improving the electronic connectivity (pohfme, internet cables etc).

- Restriction on sale of produce outside the regulated markets.

- Reducing the cost of transportation.

- Encouraging Rythubazaars (A Center for Direct Sale to Consumer by Farmer).

- Promoting the use of standard weights and measures.

- Development of warehousing facilities in villages and rural areas.

Question 8.

Examine the causes of rural indebtedness and its remedial measures in India.

Answer:

Rural Indebtedness :

In India about 70 percent of the people are living in villages. It is found that these people spend higher proportion of their borrowed money for unproductive purposes. Consequently they are unable to repay the old debts. Whenever there is a little or no access to institutional sources. They go to usurious money lenders, who are immediately avail-able in their villages. They borrow money at higher rate of interest at the cost of their assets and get caught in the evil clutches of the money lenders. .

Estimations of Rural Indebtedness :

Many institutions and individuals have estimated the magnitude of indebtedness in rural areas. In 1951-52, the amount indebted by the rural households was estimated at Rs. 913 crores. All India Debt and Investment Surveys have estimated that it was Rs. 3,848 crores in 1971, Rs. 6,193 crores in 1981, Rs. 22,211 crores in 1991 and Rs. 1,11,468 crores in 2002 (NSSO 59th Round). According to this survey the total indebted amount both in rural and urban put together was Rs. 1,76,795 crores in 2002. The NSSO conducted All India Debt and Investment Survey from January 2013 to December 2013.

Causes of Rural Indebtedness :

The following are the causes of rural indebtedness :

- The main cause of indebtedness of the farmers is their poverty, low level of savings and crop failures.

- Borrowed funds for making improvements on land.

- Borrowed funds for unproductive activities / purposes.

- Debt inheritance of the parents.

- Dependence on nOn-institutional sources.

- Inadequate support prices for the crops.

- Increasing cost of cultivation.

Remedial Measures to Reduce Rural Indebtedness :

Rural indebtedness with its magnitude and dimensions is causing many problems in rural areas. It is breeding poverty. It is also leading to distress sales of agricultural products and the farmers are left with food insecurity. Therefore, rural indebtedness should be reduced by adopting the suitable remedial measures. The following remedial measures are suggested to reduce rural indebtedness.

- To enact appropriate legislations to scale down the old debts / ancestral debts of small farmers.

- To increase the network of co-operatives, commercial banks and RRBs to reduce the dependence of the rural people on money lenders.

- To provide timely and adequate credit to small, marginal farmers and rural artisans.

- To give due importance to rural poor under priority sector lending by banks.

- Consumption loans should be provided by the public sector commercial banks to weaker sections.

- Mortgaging the lands to money lenders must be avoided.

- Rebate for one Jime settlement of dues may be enhanced.

- Coverage of women farmers under micro finance methodology should be increased.

Union government and state governments are frequently implementing loan waiver schemes to address the problem of rural indebtedness. State government of Telangana introduced Rytu Bandhu scheme under which an amount of Rs. 10,000 (initially it was Rs. 8,000) is given per acre per year in two installments to all types of land owners. Union government of India is also implementing the Pradhan Mantri Kisan – Samman Nidhi to (PM – KISAN) farmer families under which Rs. 6,000 is given per acre per year in three equal installments as minimum income support.

![]()

Question 9.

Write about the main elements of agricultural price policy.

Answer:

The Agricultural Prices Commission was setup in January, 1965 to advise the govem- ment on price policy of major agricultural commodities. It kept a view of evolving a balance and integrated price structure in the perspective of the overall heeds of the economy and with due regard to the interests of the producer and the consumer. Since March 1985, the Commission has been known as Commission for Agricultural Costs and Prices (CACP).

Main Features of Agricultural Pricing Policy

The salient features of the agricultural pricing policy are as follows :

1) Institutions :

The government has set uyp two institutions to implement the price policies. They are:

i) Agriculture Price Commission (1965) :

This commission advices the government regarding agriculture price policy, also determines minimum support prices (MSP) and procurement prices of agriculture products. Since March 1985, the Commission has been known as Commission for Agricultural Costs and Prices (CACP).

ii) Food Corporation of India (1965) :

It organizes procurement of food grains at prices determined by government and their sale through public distribution system.

iii) Fixation of Minimum Support Prices (MSP) :

The government determines minimum support prices of many agriculture products such as wheat, rice, maize, every year based on recommendations made by Commission for Agricultural Costs and Prices (CACP).

2) Maximum Price Fixation :

Government also determines maximum prices for certain agriculture products. The government sells many agriculture products such as grain, sugar, rice etc., through fair price shops under public distribution system (PDS).

3) Procurement Prices :

The prices at which government, procures food grains for the purpose of public distribution system and to maintain buffer stocks are called procurement prices. To prevent change in prices of agriculture products beyond a certain limit, government maintains buffer stock of goods. This is done by Food corporation of India (FCI). When price of food grains starts increasing, government starts selling food grains from buffer stock at spe-cific prices. As a result, increase in price of food grain can be checked. Fbrther, buffer stock operations aim at eliminating unduly low prices consequent to bumper crops.

Question 10.

Write the measures to provide food security in India.

Answer:

Measures to Provide Food Security in India

To tackle the quantitative and qualitative aspects of the food security problem, the govemment of India has relied on the following three food-based safety nets :

i) Public Distribution System (PDS):

Under PDS, food grains are provided with fair prices through fair price shops. Now it is Targeted PDS under which targeted poorest of the , poor first served.

ii) Integrated Child Development Services (ICDS):

Under ICDS, pre-school children are given free food through pe-school centers (Anganwadi).

iii) Mid-Day Meals (MDM):

Under MDM, school going children are gien free lunch.

iv) Food Security Legislation :

As an integrated approach in providing food security in India, government of India enacted National Food Security Act (NFSA) in July, 2013 which gives legal entitlement to 67% of the population to receive highly subsidized food grains. Under the Act, food grain is allocated @ 5 kg per person per month for priority households category and @ 35 kg per family per month for Antyodaya Anna Yojana (AAY) families at a highly subsidized prices of Rs. 1/-, Rs. 2/- and Rs. 3/- per kg for nutri-cereals, wheat and rice respec-tively. Coverage under the Act is based on the population figures of Census, 2011.

The Act is now being implemented in all 26 State/UTs and covers about 81.35 crore persons. The annual ‘ allocation of food grain under National Food Security Act and Other Welfare Schemes is about 610 Lakh Metric Tons. Pregnant ladies would be entitled to get free food from Anganwadi during the pregnancy period and six months after the delivery and would also be entitled to get a maternity’benefit of Rs. 6,000. Children from six month to six years of age would also be entitled to get free food from Anganwadi. Children in the age group of 6-14 years studying up to middle class would be given free lunch. If the government fails to provide food grains to the eligible people it will have to provide food security allowance.

Short Answer Questions

Question 1.

Explain the growth pattern in agricultural sector.

Answer:

Growth of Agriculture :

This concept can be studied under two heads as follows :

i) Pattern of Growth in Agriculture :

At the time of independence, India’s agriculture was in a State of backwardness, Farmers were in heavy debt and they did not have the knowledge to use proper equipment, good seeds and chemical manures. Except in certain irrigated areas, they were dependent on rain fall and monsoons. Productivity per hectare and per worker was extremely low. The country was not self-sufficient ih food grains and had to depend on imports of food grains. Over 70% of our working population was engaged in cultivation.

India had adopted planning process to develop the economy. First Five Year Plan (1951-56). Third Five year Plan (1961-66) and Fourth Five Year Plan (1969-1974) gave priority to agriculture sector by allocating highest percentage of resources to agriculture sector. India also implemented the land reforms to develop the agriculture. India has adopted New Agriculture Strategy in the year 1966-67 by supplying new agriculture inputs like high yielding variet-ies of seeds, chemical fertilizers, pesticides etc., due to which India became the self-sufficient in food grain production by the year 1976.

At an average, India’s agriculture growth remained at around 3.5% during low growth period (1950-51 to 1969-70; around 3.5 percent/per annum and termed as Hindu Rate of Growth), and at around 5% during medium growth period and at around 7% high growth period of Indian economy (1991-92 to 2019-20 around 7 per annum) High growth rate of Indian economy during reforms is being pooled by service sector’s growth and mainly due to information technology (IT) revolution.

ii) Growth in Productivity and Production of Major Crops :

Though productivity and production level of major crops were very low immediately after independence, it increased by seventies due to “new agriculture strategy” adopted during sixties which is termed as Green Revolution.

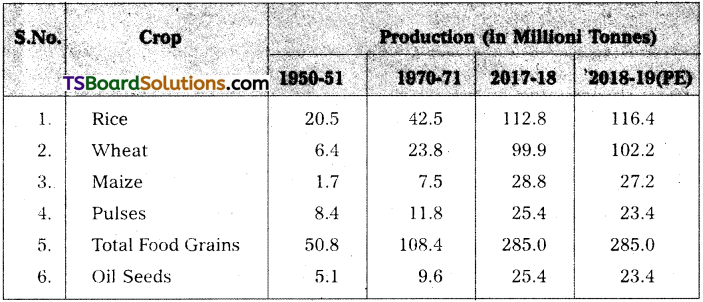

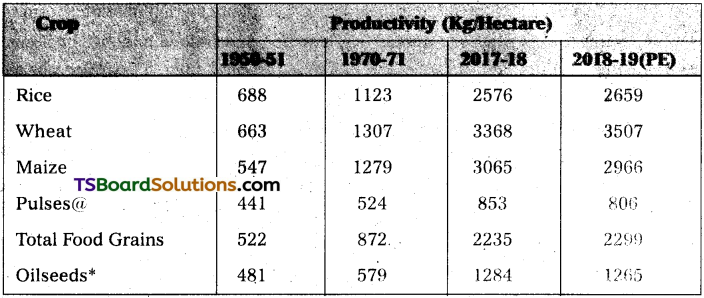

If we take food grains production, its productivity increased from 522 kg per hectare in 1950-51 to 2299 kg per hectare in 2018-19(PE). During the same period rice productivity increased from 688 kg to 2659 kg, wheat productivity increased from 663 kg to 3507 kg, maize productivity increased from 547 kg to 2966 kg. Pulses productivity increased from 441 kg to 806 kg. Oil seeds productivity increased from 481 kg to 1265 kg. Overall, during the period 1950-51 to 2018-19, wheat productivity increased nearly 6 folds whereas pulses productivity registered a two fold growth. If we look at the trends in production during the period from 1950-51 to 2018-19, food grains production increased from 50.8 million tonnes to 285 million tonnes.

Rice production increased from 20.5 million tonnes to 116.4 million tonnes. Wheat production increased from 6.4 million tonnes to 102.2 million tonnes. Maize production increased from 1.7 million tonnes to 27.2 millioni tonnes. Pulses productioni increased from 8.4 million tonnes to 23.4 million tonnes. Oil seeds productioni increased from 5.1 million tonnes to 23.4 million tonnes. Again in production of major crops too, highest increase took place in wheat production whereas lowest increase took place in pulses production.

![]()

Question 2.

Write about trends in production of major agricultural crops in India.

Answer:

Trends in production of major agricultural crops :

Though productivity and production level of major crops were very low immediately after independence, it increased by seventies due to “new agriculture strategy” adopted during sixties which is termed as Green Revolution.

This can be studied with help of the table given below.

If we look at the trends in production during the period from 1950-51 to 2018-19, food grains production increased from 50.8 million tonnes to 285 million tonnes. Rice production increased from 20.5 million tonnes to 116.4 million tonnes. Wheat production increased from 6.4 million tonnes to 102.2 million tonnes. Maize production increased from 1.7 million tonnes to 27.2 million tonnes. Pulses production increased from 8.4 million tonnes to 23.4 million tonnes. Oil seeds production increased from 5.1 million tonnes to 23.4 million tonnes. Again in production of major crops too, highest increase took place in wheat production whereas lowest increase took place in pulses production.

Various initiatives of central and state governments like land reforms, new agriculture strategy (green revolution), technology missions of pulses, oil seeds, free and subsidized inputs distribution such as electricity, seeds, fertilizers, water (irrigation), machinery and strengthening marketing and financing infrastructure etc., helped to achieve this agriculture growth.

Question 3.

What are the trends in agricultural productivity in India? Explain.

Answer:

Productivity needs average production per hectare. India’s agriculture productivity is still low where compare. India’s productivity with same advanced country. The trends relating to agricultural productivity in India can be studies as under with the help of the following table.

The table shows the growth pattern of India’s agriculture productivity and production. If we take food grains production, its productivity increased from 522 kg per hectare in 1950-51 to 2299 kg per hectare in 2018-19 provisional estimates (PE). During the same period rice productivity increased from 688 kg to 2659 kg, wheat productivity increased from 663 kg to 3507 kg, maize productivity increased from 547 kg to 2966 kg. Pulses productivity increased from 441 kg to 806 kg. Oil seeds productivity increased from 481 kg to 1265 kg. Overall, during the period 1950-51 to 2018-19, wheat productivity increased nearly 6 folds whereas pulses productivity registered a two fold growth.

Question 4.

What are the reasons for inadequate implemention of land reforms in India?

Answer:

Land Reforms :

Government’s direct intervention to bring about the changes in agrarian structure is called land reforms. Land reforms facilitate the redistribution of land with a view to safeguard the interests of land less households, small and marginal farmers. It brings about the introduction of economic and non-economic changes relating to land and the development of agriculture. After independence the Government of India has introduced land reforms for the reconstruction of rural economy with equity and social justice.

Poor implementation of land reforms are as follows :

1) Loop holes in the Acts :

There are loopholes in the land reform acts. Big landlords with their financial and political power are able to retain their ownership on land by using the loopholes.

2) Lack of political Will :

The political parties in power have not evinced real interest in the implementation of theV acts as they did not want to annoy the big landlords and therefore diluted the acts.

3) Passive Nature of the Beneficiaries :

Marginal and small farmers and landless labourers don’t aware of their rights and ongoing process. Most of them are illiterates and ignorant. They have little awareness about reforms which benefit them, Their failure to de-mand their due is one of the main causes for poor implementation of land reforms.

4) Bureaucracy :

Indian bureaucracy, trimmed and trained under the colonial rule, has been apathetic to the land reforms and cause of the rural poor. They have-not shown keen interest in implementing the reforms.

5) Legal Hurdles :

Some of the big landlords have approached the courts of law by taking advantage of the loopholes in the law.

6) Non-Availability of Land Records :

For decades, land records have not been main-tained property in India. Implementation without land records has become a difficult task.

7) As a State Subject :

Agriculture is a state subject. Different states responded with different degree to implement land reforms. No uniformity in their action to the issue. National Council for Land Reforms was established in 2008 but no positive change in the process has been seen.

8) Delay in the Followup Action :

There has been enourmous delay in taking follow up action. All the land declared surplus was not taken by the government and whatever land taken under the ceiling act was not distributed in total. Further, the beneficiaries have not been provided other ancillary help like credit and other inputs, though ownershp rights have been conferred on them.

Question 5.

What are defects of Nan-Institutional sources of agricultural credit?

Answer:

The financial requirements of the Indian farmers can be classified into three types depending upon the period and purpose for which they need funds : (a) They may need funds for a short period of less than 15 months for the purpose of cultivation. This may include purchase of seeds, fertilizers, fodder etc. (b) They may require finance for medium term period ranging from 15 months to 5 years for making improvement on land, buying cattle, agricultural implements etc. (c) They may also require finance for long term period for more than five years to develop the land to provide irrigation facility, to purchase heavy machinery etc.

The financial requirements of the Indian farmers can further be classified into productive and unproductive purposes. The productive loans include for purchase of seeds, fertilizers, buying cattle and agricultural implements, digging wells/tube wells, whereas unproductive loans include for performing marriages, social ceremonies, religious functions, festivals etc.

Non-institutional Sources :

Non-institutional sources include money lenders, land lords, traders, commissioni agents, relatives, friends etc. In 1951-52, non-institutional sources contributed 93 percent of financial requirements of farmers whereas the government could contribute only 7 percent. The money lenders and landlords supplied credit for both productive and unproductive purposes. They are easily accessible to farmers at any point of time. But this source has many defects in it. Interest rates are not uniform and exorbitant (18 to 50 percent).

Often small farmers are cheated and their lands are appropriated. The landless labourers are forced to become bonded slaves.

Question 6.

What are the causes of rural indebtedness?

Answer:

Rural Indebtedness :

In India about 70 percent of the people are living in villages. It is found that these people spend higher proportion of their borrowed money for unproductive purposes which can give them any income. Consequently they are unable to repay the old debts. Whenever there is a little or no access to institutional available in their villages. They borrow money at higher rates of interest at the cost of their assets and get caught in the evil clutches of the money lenders. The indebtedness increases year by year and makes the rural people permanently indebted.

Causes of Rural Indebtedness :

The following are the causes of rural indebtedness.

- The main cause of indebtedness of the farmers is their poverty, low level of savings and crop failures.

- Borrowed funds for marketing improvements on land.

- Borrowed funds for unproductive activities / purposes.

- Debt inheritance of the parents.

- Dependence on non-institutional sources.

- Inadequate support prices for the crops.

- Increasing cost of cultivation.

![]()

Question 7.

Explain are functions of NABARD.

Answer:

National Bank for Agriculture and Rural Development (NABARD) :

Reserve Bank of India had set up the Agricultural Refinance Development Corporation (ARDQ to provide refi-nance support to the banks to promote agricultural development. With the widening of the role of hank credit from agricultural development to rural development, the government proposed, to have a broad-based organization at the apex level to support and guide the credit extending institutions. Accordingly, NABARD was setup in July, 1982 by subsuming ARDC.

Functions of NABARD :

NABARD performs the following functions :

a) Refinancing the banks for extending loans for investment and production purpose in rural areas.

b) Provides loans to state governments, non-government organizations (NGOs), panchayat raj institutions for the development of rural infrastructure.

c) Supports credit innovations of NGOs and other non-formal agencies.

d) Extension of formal banking services to the unreached rural poor by self-help groups (SHGs).

e) Promoting participatory watershed development for enhancing productivity and prof-itability of rain fed agriculture in a sustainable manner.

f) Preparation of credit plans for identification of exploitable potentials under agriculture and other activities available of development through bank credit, g) Inspectioni of RRBs arid co-operative banks other than PACS.

Question 8.

What are the defects of agriculture marketing in India?

Answer:

Due to non-availability of storage facilities about 10 to 20 percent of agricultural produce is eaten away by rats and insecticides further, due to inadequate transportation facility, the farmer is forced sell the goods to money lenders, commission agents in mandis; and could not get fair price. The existence of more number of intermediaries betweeri the farmer and the ultimate consumer is another chronic problem where by intermediaries could realize more money.

In the mandis the farmers are deceived by the use of wrong weights and measures. They are also cheated by brokers and traders. The farmer has to pay weighing charges, unloading charges, charges for separation of impurities in the produce and many other miscellaneous undefined and unspecified charges. There is no proper grading system and hence the farmer is not getting fair price.

Government Measures :

1) Regulated Markets :

In order to eliminate unhealthy market practices and to protect the interests of the farmers by ensuring fair prices, the government proposed the state agricultural produce marketing Act for the establishment of regulated markets. Accordingly, in 1951 more than 200 regulated markets were established in India and at present about 7,246 regulated markets are functioning in the country. Regulated markets aim at the development of the market structure to:

- Ensure remunerative prices to the producer of agricultural commodities;

- Narrow down the price spread between the producer and the consumer; and

- Reduce non-functional margins of the traders and commission agents.

2) Grading and standardisation :

Improvements in agricultural marketing system cannot be expected unless grading and standardization of agricultural produce is made. The government has done much to grade and standardize many agricultural goods. Under the agricultural produce Act, 1937 the government has setup grading stations. The graded goods are stamped with the seal of the agricultural marketing department AGMARK and these goods will have a wider and command better prices.

3) Ware housing facilities :

To prevent distress sale by the farmers, particularly by the small and marginal farmers godowns have been setup in villages and towns. The Central Ware-housing Corporation (CWC) was setup in 1957 for the storage of agricultural produce. The states have setup the state warehousing corporations for the same purpose Food Corporation of India (FCIJ was also setup at the national level.

4) Market Information :

The government has initiated a number of steps to provide the information about the prices prevailing in different markets to farmers. The prices prevailing in markets are broadcast daily by all India Radio – Trends in market prices are reviewed weekly in special programmes and talks organized by AIR and Doordarshan.

5) Support prices :

The government announces minimum support prices and procurement prices for various agricultural commodities from time to time in a bid to ensure fair returns to farmers. These prices are fixed in accordance with the recommendations of the Commission for agricultural Gosts and Prices (CACP).

6) Other Measures :

The following measures are also necessary to make agricultural marketing beneficiary to the farmers :

- Improving the physical connectivity (roads and communications).

- Improving the economic connectivity (banks and financial institutions).

- Improving the electronic connectivity (Phone, internet cables etc).

- Restriction on sale of produce outside the regulated markets.

- Reducing the cost of transportation.

- Encouraging rythu bazars.

- Promoting the use of standard weights and measures.

- Development of warehousing facilities in village and rural areas.

Question 9.

State the objectives of agricultural pricing policy.

Answer:

Objectives of Agricultural Pricing Policy :

The objectives of agricultural pricing policy vary from country to country depending upon the place of agriculture in national economy. Generally, in developed countries, the major objective of price policy is to prevent drastic fall in agricultural income, but in developing economies, it is multi-task oriented as mentioned below:

- to meet the domestic consumption requirements;

- to provide price stability in the agricultural product;

- to ensure reasonable relation between the prices of food grains and non-food grains;

- to ensure reasonable relationship between the prices of agricultural commodities and manufactured goods;

- to smooth seasonal and cyclical fluctuations of prices of agricultural commodities;

- to remove price differences between the regions; .

- to make available food to consumers at the time of shortage;

- to increase the production and exports of agricultural products;

- to provide raw materials to the industries at reasonable prices;

- to prevent exploitation of farmers from intermediaries, who may purchase products at a very low price in the absence of price policy.

Very Short Answer Questions

Question 1.

Share of agriculture in the National Income.

Answer:

After independence the share of agriculture has declined due to the development of the secondary and tertiary sectors. In 1950-51 the share of agriculture and allied activities in gross domestic product was 56.5% and it declied to 24.7%. In 2000-01, and furniture to 13.9% in 2012-13, again it was inversted to 16.5 in 2019-20 (provisional estimates).

![]()

Question 2.

Share of agriculture in Employment.

Answer:

The number of people engaged in agriculture was increased from 98 millions in 1951 to 236 millions in 2001. Agriculture provide employment to 46% of the male workers and 65% of the female workers.

Question 3.

Relation between Agriculture and industry.

Answer:

Agriculture provides raw materials to various leading industries. Sugar, jute, cotton tex-tiles, vanaspati, flour mills, plantations and food processing industries depend on agriculture directly. Many other industries depend on agriuclture indirectly. Many small scale and cottage industries depend upon agriculture for their raw materials.

Question 4.

Irrigation.

Answer:

Irrigation infrastructure is a must to increase the agriculture productivity as irrigation facilitates nearly three-fold increase in agriculture productivity per annum and per hectare. Irrigation along with improvement in power supply largely contributes to increase in productivity.

Question 5.

Agricultural Productivity

Answer:

Productivity of a crop is measured by the average production.of that crop per hectare of the cropped area. However India’s agriculture productivity is still veiy low when we compare India’s productivity with same.

Question 6.

Land degradation.

Answer:

Land Degradation: Nearly half of the country’s land (329 millions hectares) is degraded. 43% of the land suffers from high degradation resulting in 33-67 percent yield loss. 5% of the land is so damaged that it is unusable. Soil degradation is a major foctor for low agricultural productivity in many regions of the country.

Question 7.

Abolition of interference.

Answer:

There were mainly three forms of land relations in pre-independence India. They are : zamindari system/jagirdary system, mahalwari system and rytwary system which were initiated and implemented by Britishers, Except rytwary system in which there is direct relation between farmer and state all other systems are intermediary systems in Which middle men in the form of zamindar/jagirdar are present in between cultivator of land and state. These middle men used to exploit farmer as well as they used to cheat state also. Because of this middle men system in land relations, agriculture became an exploitative ground. Accordingly, all state governments were instructed to enact the laws to abolish the intermediaries. „

Question 8.

IAOP.

Answer:

It means intensive Agriculture District Programme. This was introduced in the year 1964. This programme was introduced in 7 districts. This programme is also known as package programme.

Question 9.

Green Revolution.

Answer:

Green Revolution :

This programme was introduced in the year 1965. Acheiving high produce and productivity in the farm sector, by using hybrid seeds, fertilizers, pestisides and machines etc is called green revolution. At first this term was used by William S. Gand.

![]()

Question 10.

PACS.

Answer:

The Co-operative credit societies in India have been organised into short-term and long term structures. At the lowest level the primary agriculture co-operative credit soceiteis (PACS) and these are organised at village level. There are 92.432 primary Agriculture Credit societies for short term credit structure.

Question 11.

Regional Rural Banks. (RABs)

Answer:

RRB’s are set up on 2nd October, 1975. If is bridge the gap in the provision of loans to small and marginal farmers, landless labourers, etc. 2012-13 it provided 10%.

The agricultural credit flow target for 2019-20 has been fixed as Rs. 13,50,000 crore.

Question 12.

Micro Finance.

Answer:

Micro Finance is’the provision of financial services to low income clients pr solidarity lending groups including consumers and self employed, who rationally lack access to banking , end related services. It lovers a wide range of credit, savings, insurance, remittance and also non financial services like training and counselling.

Question 13.

Self help groups (SHG’s)

Answer:

This is the bank led micro finance changed which was initiated by NARARD in 1992.

Under the self help group model, the numbers usually women in villages are encouraged to the form groups of around 10-15. The numbers contribute their savings in the group periodically, and from these savings small loans are provided to the members.

Question 14.

Grading

Answer:

The government has done much to grade and standardize many agricultural goods. Under the agricultural produce Act 1937. The government has set up grading stations. The graded goods are stamped with seal of AGMARK.

Question 15.

Warehousing facilities.

Answer:

The central ware housing corporation was set up in 1957 for the storage of agricultural 1 produce. The states have set up the state ware housing corporations and at nartional level food . corporation of india setup.

Question 16.

CACP. (Commission for Agricultural Costs and Prices)

Answer:

This commission was established in the year 1985. This commission advices the govern-ment regarding agriculture price policy, also determines MSP and procurement prices of agri-cultural products.

Question 17.

Minimum suport prices. (MSP)

Answer:

Minimum support prices (MSP) for major agricultural products are fixed by Government every year prior to sowing season to assure the remunerative prices to farmers. MSP for major agricultural products are fixed by the government each year, after taking into account the recommendations of CACP.

Question 18.

Maximum Price Fination.

Answer:

Government determines maximum prices for certain agricultural products. The govern-ment sells many agricultural products such as grain, sugar, rice at fair prices under public distribution system.

Question 19.

Butterstock.

Answer:

It is a reserve Of a commodity that can be used to offset price fluctuatives and in case of natural disaster or unsourcessness energies. It is an attempt to use commodity storage for the purpose of stabilising prices in an entire economy or an individual or commodity market. It is generally maintained for essential commodities and necessities like foodgrains, pulses.

Question 20.

Food Security.

Answer:

World Development Report (1986) defined food security as access by all people at all times to enough food for an active, healthy life. Food and Agriculture organiation (FAO, 1983) defiend the food security as ensuring that all people at all times have both physical and economic access to basic food they need.

![]()

Question 21.

Food Security legislation.

Answer:

Government of india issued on ordinance on july 5, 2013 guaranteeing food security to the people of india. The new low could provide a legal entitlelent to subsidized food grains ot the people as par the law, the beneficiaries would be provided food grains at subsidised prices.

Question 22.

Food Corporation of India. (FCI)

Answer:

Food Corporation of India was established in the year 1965. This commission organises procurement of food grains of prices determined by government and their sale through public distribution system.