Telangana TSBIE TS Inter 2nd Year Economics Study Material 8th Lesson Foreign Sector Textbook Questions and Answers.

TS Inter 2nd Year Economics Study Material 8th Lesson Foreign Sector

Essay Questions

Question 1.

Examine India’s trade balance and balance of payments.

Answer:

Balance of Payment, (BOF) is a statistical record in the form of a balance sheet comprising all its transactions with rest of the world during any given period of time.

India’s Trade Balance and Balance of Payments : This can be studied under following heads.

I. Trade Balance :

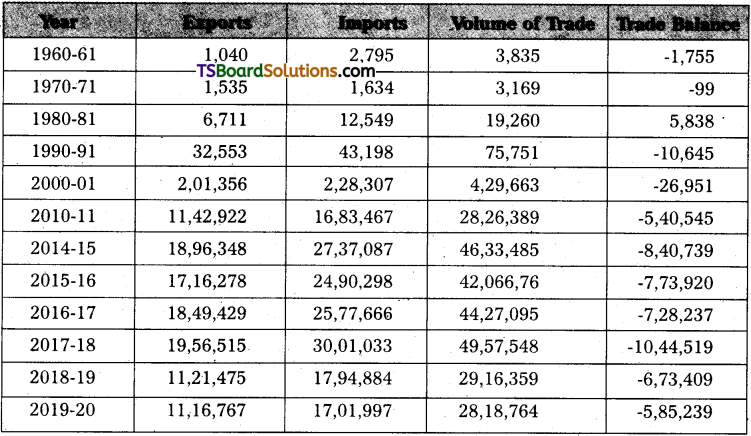

India experienced a negative balance or deficit in its balance of trade in almost all five year plans. The annual average trade deficit in First plan was Rs. 108 crore. It was Rs. 467 crore in Second plan. During Third plan it was Rs. 477 crore and it was Rs.36,363 crore and Rs. 1,49,841 crore during Ninth and Tenth plans respectively.

Value of foreign trade over the years focuses on the trends in India’s foreign trade. Value of foreign trade is equal to the value of imports plus exports.

a. Decadal Variation in the Value of Foreign Trade :

Value of imports and exports are added to account for the total value of foreign trade as stated earlier. As per the figures presented in Table-volume of foreign trade was Rs. 3,835 crore in 1960-61. It increased from Rs. 3,169 crore in 1970-71 to Rs. 19,260 crore in 1980-81. From then onwards, the value of trade increased at a higher pace to Rs. 75,751 crore in 1990-91 to Rs. 4,29,663 croere in 2000-01 and to Rs. 28,26,389 crore in 2010-11. It touched the peak level of Rs. 46,33,485 crore in 2014-15 and marginally decreased to Rs. 42,06,676 crore in 2015-16 and then increased to Rs. 49,57,548 crore in 2017-18 and again declined to Rs. 28,18,764 crore during the year 2019-20.

It is clear that in the two decades between 1960-61 and 1980-81 value of foreign trade rose by 579.4 percent. In other word, the increase in 1980-81 is 608 times to the value in 1960-61. Decadal increases during 1980-81 – 1990-91 was 293 percent while the increase during 1990-91 – 2000-01 was 467 percent. The increase in the following decade ending with 2010-11 was 558 percent. Increase in the value of foreign trade in 2015-16 by 9.2 percent. A marginal increase at 12 percent was recorded in 2017-18 over 2016-17 and again there was a decline at 41 percent in the year 2018-19 over 2017-18 and again declined to 3 percent in the year 2019-20 over the year 2018-19. Therefore, it can be stated that the value of foreign trade in India has been increasing at a higher rate over the years since 1960-61.

2) Decadal Growth of Imports :

Another significant feature of India’s foreign trade is the every growing imports. The total value of imports inl960-61 was Rs. 2,795 crore and it had increased to Rs. 12,549 crore in 1980-81 by 349 percent. Value of imports rose to Rs. 43,198 crore in 1990-91 and to Rs. 2,28,307 crore in 2000-01. The percentages of growth for these two decades were 244 and 428 respectively. Imports further rose to Rs. 16,83,467 crore in 2010-11 recording a growth of 637 percent over 2000-01. Value of imports touched the peak in 2014-15 at Rs. 27,37,087 crore and then marginally decreased in 2015-16 and 2016-17 and again declined to Rs. 17,01,997 crore in the year 2019-20 and the percent decline was 5 over the year 2018-19.

3) Decadal Growth of Exports :

The growth rate of exports has been sluggish in India over the years. The value of exports was Rs. 1,040 crore in 1960-61 and it had increased to Rs. 6,711 crore in 1980-81. The growth rate was 545.3 percent for the two decades. Value of exports increased to Rs. 32,553 crore in 1990-91 and then to Rs. 2,01,356 crore in-2000-01 and the decadal growth rates were 385 and 518 percent respectively. Value of exports increased to Rs. 11,42,922 crore by 468 percent in 2010-11 over 2000-01.

Exports in 2017-18 were the highest at Rs. 19,56,515 crore and then decreased to Rs. 11,16,767 crore in the year 2019-20. Indian exports recorded some increase with the export promotion policies of the government since the devaluation of rupee in 1966. But, the growth in the exports was inadequate when compared to the growth in imports. This disparity between exports and imports widened the trade deficit from year to year.

Unfavourable terms of trade for Indian agro-based goods, inadequate exportable surplus in the economy, protection policies of the developed countries, the long period of recession in the developed countries and regular depreciation of the exchange value of the rupee were the main factors responsible for the low growth of Indian exports.

4) Deficit in the Balance of Trade :

Higher growth of imports and sluggish growth of exports have led to mounting deficits in the balance of trade over the years in India. The country has recorded a small surplus only two tifties, 1972-73 and in 1976-77, ever since 1951. Deficit in the balance of trade was Rs. 1,755 crore in 1961 and it rose to Rs. 5,838 crore in 1980-81. The increase was 673 percent. The increase had been regular in 1990-91 and 2000-01. The deficit in 2010-11 was Rs. 5,40,545 crore recording a growth of 191 percent over 2000-01.

It reached the maximum level of Rs. 10,44,545 crore in 2017-18 and then decreased to Rs. 5,85,230 crore in 2019-20. The average annual deficit in the balance of trade during the First plan was Rs. 108 crores and it gradually increased to Rs. 7,720 crore during the Seventh plan. The years of deficits in the balance of trade in 2018-19 and 2019-20 had declined when compared to the deficit in 2017-18.

The trend in the decrease in the deficit due to import compression and export promotion during the Fourth plan could not be sustained and economy faced growing deficits in the balance of trade. Recurring depreciation of the rupee in terms of dollar has resulted in enhancing the value of imports due to which deficits are widening of late; the share of China in India’s trade deficit has increased from 20.3 per cent in 2012-13 to 43.2 percent in 2017-18 as most of the Chinese goods are dumped into the Indian markets. The Indian government is seriously thinking to levy anti-dumping taxes to counter the Chinese imports.

II. Balance of Payments :

It can be seen that the current account BoP deficit for First plan was Rs. 42 crore. During Second plan the deficit in BoP was Rs. 1,725 crore. The highly unfavourable BoP in this plan was due to heavy imports of capital goods to develop heavy and basic industries and the failure of agricultural production. India adopted the policy of import substitution as one of the instruments to achieve the objective of self-reliance. Accordingly, the government managed to restrict imports and succeeded in expanding exports. The net result was a surplus in the BoP for the first time to the tune of Rs. 100 crore due to a sharp increase in net invisibles. After that India experienced a deficit in all plan periods.

![]()

Question 2.

Describe the status of foreign direct Investment in India.

Answer:

Foreign Direct Investment in India :

It can bes said that the FDI, which was only US$ 129 million in the year 1991 increased to US$ 3557 million in 1997-98, but then it decreased to US$ 2155 million in the year 1999-2000. The said decline could be attributed to the East Asian crisis, which adversely affected capital flows to all emerging markets. During the year 2000-01. the inflows were encouraging. There was a positive increase in the value of FDI inflows which might be attributed to various reasons such as heavy demand of Indian consumers, liberalized government policy, communications facilities.

The FDI inflows increased to US$6130 million in the year 2001-02, but again fell to US$ 5095 million in 2002-03 and further to US$ 4322 million in 2003-04. In the year 2004-05, the inflows again raised to US$ 6052 million and further to US$ 22862 million in 2006-07 showing the global investment trend to the developing countries.

The recessionary slow down had also observed during the latter period and as such the infows fell to US$ 37746 million. Further the inflows increased to US$ 46552 million in the year 2011-12, which signifies the impact of liberalization on economy and gradual opening up of the capital account. At a time when the general outlook on FDI was buoyant, the FDI inflows dipped again to US$ 36,047 million in the year 2013-14. Various reasons have been caused for this sort of downfall like rise in corruption cases, unnecessary procedural delays, environmental related issues, and higher inflation rates during the period.

In addition to this, the issues prevailing domestically may also have an adverse affect on the long-term FDI flows to India. But in the year 2014-15 the FDI inflows once again rose to US$ 45,147 million, and further to US$ 55,559 million in the year 2015-16. But declined in the year 2016-17 and again rose in 2017-18 and 2018-19 to the tune of US$ 42,156 million and US$ 50,553 million respectively.

A major share of 87 percent of FDI inflows was contributed by these ten countries while only 13 percent was contributed by rest of the world. Of the total FDI inflows to India, 32 per cent of the total investment by Mauritius and thus emerged as the dominant source of FDI 20 percent of the total investment was made by Singapore and was the second dominant source of FDI inflows to India. However, Japan and Netherlands backed the third and fourth position by respectively contributing percent each. UK and USA both contributed 6 each percent each followed by Germany by contributing 3 percent. Cyprus, UAE and France with 2 percent each contributed to the FDI inflows.

Further, it can be said that Mauritius and Singapore both together contributed 52 percent of total FDI inflows to India. The reason for this may be that they offer tailor made solutions in offshore banking and low tax rate, and robust privacy. On top of that they also have double tax avoidance agreement (DTAA) with India wherein profits made in India are not subject to any taxes. Therefore, it had also been observed that Mauritius became an excellent route to direct any investment in India, and hence it has a lion’s share in our FDI and this might be due to the fact that money travels from India to Mauritius and then again back to India in the form of FDI.

Though, the total investment by Singapore ranks it at second position, but if we see the inflows in the year 2018-19, this has almost doubled in comparison to the inflows of the 2016-17 year. The reason for this sudden increase could be attributed to the cancellation of DTAA with Mauritius. Before that also the reason for low inflows from Singapore despite of the DTAA Treaty was that it had both objective and subjective restrictions on who gets the benefits of the treaty.

| Year | Foreign Direct Investment | Annual Growth Rate |

| 1991-92 | 129 | |

| 1992-93 | 315 | 144 |

| 1993-94 | 586 | 86 |

| 1994-95 | 1314 | 124 |

| 1995-96 | 2144 | 63 |

| 1996-97 | 2821 | 32 |

| 1997-98 | 3557 | 26 |

| 1998-1999 | 2462 | -31 |

| 1999-2000 | 2155 | -12 |

| 2000-01 | 4031 | 87 |

| 2001-02 | 6130 | 52 |

| 2002-03 | 5095 | -17 |

| 2003-04 | 4322 | -15 |

| 2004-05 | 6052 | 40 |

| 2005-06 | 8962 | 48 |

| 2006-07 | 22862 | 155 |

| 2007-08 | 34844 | 52 |

| 2008-09 | 41903 | 20 |

| 2009-10 | 37746 | -10 |

| 2010-11 | 36047 | -5 |

| 2011-12 | 46552 | 29 |

| 2012-13 | 34298 | -26 |

| 2013-14 | 36047 | 5 |

| 2014-15 | 45147 | 25 |

| 2015-16 | 55559 | 23 |

| 2016-17 | 39904 | -28 |

| 2017-18 | 42156 | 6 |

| 2018-19 | 50553 | 20 |

An analysis of the recent trends in FDI flows at the global level as well as across regions/ countries suggest that India has generally attracted higher FDI flows in the line with its robust domestic economic performance and gradual liberalisation of the FDI policy as part of the cautious capital account liberalisation process. Even during the recent global crisis, FDI inflows to India did not show as much moderation as was the case at the global level as well as in other emerging market economies (EMFs). However, when the global FDI flows to EMEs recovered during 2010-11, FDI flows of global recovery. A panel exercise for 10 major EMEs showed that FDI is significantly influenced by openness, growth prospects, macro economic sustainability (International Investment Position), labour cost and policy environment.

Question 3.

What are the provisions of GATT?

Answer:

The first and second world wars badly affected the world economies and therefore, various countries imposed several restrictions on imports. As a result, international trade among the nations deteriorated significantly. So the allied powers thought of having a plan for new, more viable relations in the international economy. The Bretton Woods conference held in 1944 was the starting point for a new order. The International Monetary Fund (IMF), International Bank for Reconstruction and Development (IBRD) and International Trade Organisation (ITO) were thought of towards this end.

Although, a conference, held in Havana in 1947-48, established a charter for the ITO, it never came into existence. Instead, the General Agreement on Tariffs and Trade (GATT) came into being. The GATT came into force on January 1, 1948.

Objectives of GATT :

The major objectives of GATT are as follows :

- To follow unconditional most favoured nations (MFN) principle;

- To grant protection to domestic industry through tariffs only;

- To carry on trade on the principle of non-discrimination, reciprocity and transparency; and

- To liberalise tariff and non-tariff measures through multilateral negotiations.

Functions/Provisions of GATT :

1. Most Favoured Nations (MFN) Clause :

Article I of GATT deals with the most favoured nations arid forbids the contracting parties from granting any new preference. It means a county agrees not to give special treatment to any single nation than it gives to all the contracting parties. The MFN clause rules out any preferential treatment among nations as far as trade \ policy is concerned ie., concessions must be extended immediately to all other countries, so that all contracting parties benefit to the same extent. In the same way, if an action is taken by any country to protect domestic industry then it must be applied to all contracting parties.

2. Tariff Concessions :

Article H deals with basic tariffs, incorporating schedules of tariff concessions. The tariff concessions contained in GATT usually known as ‘bound’ rates came into force in 1948 for 3 years until the end of 1950.

3. Elimination of Quantitative Restrictions (QRs) :

According to Article XI, the contracting parties are prohibited from imposing the QRs, subject to the principal exception that a country might, in certain defined circumstances which a restricter for the developed countries, apply restrictions with the objective of protecting its external balance of payments. In general, such restrictions must be applied in non-discriminatory manner.

4. Safeguard Code :

Article XIX of the GATT provided emergency safeguard code. Under this, a country could impose a tariff or quota to restrain imports which caused or threatened serious injury to domestic producers.

5. Exceptions :

Article XX and XXI provided general and security exceptions towards the prohibitions of import quotas by contracting parties.

6. Subsidies and Countervailing Duties :

The rule on subsidies and countervailing duties were incorporated in a separate code negotiated in the Tokyo round of 1970s. Under these rules, export duties on manufacturing products were banned except in developing countries. Export subsidies for primary products were restricted only on the condition that they should not lead to the acquisition of more than an equitable share of world export trade. The agreement also contained provisions that authorised importing countries to take compensating action against trading partners found to be dumping goods in their markets of increasing rates through export subsidies.

7. Settlement of Disputes :

The greatest success of the GATT had been in the field of settlement of disputes among its members. Any member having complaint against the other member on the issue of violating the rules of the organisation brings its complaint to the annual meetings for settlement.

![]()

Question 4.

What are the provisions of Final Act of WTO?

Answer:

The final act prepared in December, 1993 was finally signed by member nations of GATT in April, 1994 and this paved way for the setting up of WTO. The WTO agreement was signed by 104 member nations of GATT and it came into force from January 1, 1995 and India became a founder member of the WTO by signing the WTO agreement on December 30, 1994. Its head quarter is in Geneva, Switzerland.

WTO Agreements for Provisions of Final Act :

1. Agreement on Agriculture (AoA) :

It is related to commitments in the area of market access, domestic support and export promotion. The members have to transform their nontariff barriers like quotas into equivalent tariff measures.

The WTO Agreement on Agricultural contains provisions in 3 broad areas of agriculture and trade policy:

a) Market access-abolishment of all non-tariff barriers such as quotas, variable levies, minimum import prices etc.

b) Domestic support reduction by 20 percent in developed and 13.3 percent in developing countries; and

c) Export subsidies-reduction of subsidy expenditure by 36% and volume by 21% in 6 years, in equal instalments for developed and developing countries by 24% and 14% respectively in equal annual instalments over 10 years.

2. Agreement on Trade in Textiles and Clothing (Multi-Fibre Arrangements) :

This provides for phasing out the import quotas on textiles and clothing in force under the multifibre agreement since 1974, over a span of 10 years i.e., by the end of the tranisition period on January 1, 2005.

3. Agreement on TRIMs :

The main provisions provided in the TRIMs text ensure that government shall not discriminate against foreign capital. In other words, the TRIMs text compels member countries to give national treatment to foreign capital.

4. Trade Related Intellectual Property Rights (TRIPs) :

Agreement on Trade Related Aspects of Intellectual Property Rights (TRIPS) is an international agreement between the member nations. TRIPS agreement is aimed at harmonizing the intellectual property (IP) related laws and regulations worldwide. The TRIPS agreement accomplishes this motive by setting minimum standards for protection of various forms of IP. The nations that are signatory to the TRIPS agreement have to abide by these minimum standards in their national laws related to IP. The TRIPS agreement generally sets out the minimum standards regarding the grant of rights to the owner of IP, enforcement requirements in the national laws,and settlement of disputes and remedies to those whose IP rights get infringed.

5. General Agreement on Trade in Services (GATS) :

For the first time, trade in services like banking, insurance, travel, marine transportation, mobility of labour etc., was brought within the ambit of negotiations in the Uruguay round. The GATS provides a multilateral frame-work of principles and services which should govern trade in services under conditions of transparency and progressive liberalisation. It spells out certain obligations like grant of MFN’ status to the other member nations with regard to trade in services, maintenance of transparency and also a commitment for liberalisation in general terms.

6. Disputes Settlement Body (DSB) :

One of the unique features of WTO is its provision relating to dispute settlement mechanism. Settlement of disputes under GATT was never ending process. There was ample scope for procedural delays, objections could be raised at each stage of the dispute settlement process and final reports could be rejected by the offending party. The DSB setup under WTO, seeks to plug these loopholes and thus, provide security and predictability to the multilateral trading system. It has now been made to settle a dispute within 18 months.

Question 5.

Explain the impact of WTO on Indian Economy. How it is different from GATT?

Answer:

Impact of WTO on Indian Economy :

Being a founder member of the World Trade Organisation country, India would get immense benefits. At present, only just 5 percent of our tariff lines remain bound. With the finalization of the Uruguary round, about 68 percent of India’s tariff lines covering basically raw materials, components and capital goods, but excluding consumer goods, petroleum and fertilizers and some non-ferrous metals would have been bound. The expert view is that it is in the long term interest of India to have low duties on raw materials, components and capital goods since they satisfy the productive needs of the economy.

However, regarding the threat arising out of TRIPS, India has pointed out that exclusive marketing rights to be provided for patent holders would in no way has pointed out that exclusive marketing rights to be provided for patent holders would in no way dilute the national interest in such crucial areas as agriculture, drugs and pharmaceuticals as enough safe grounds had been built into the system to take care of the concern voiced by developing countries including India.

It is expected that dur country would stand to gain immensely from the membership of WTO. By and large, it can be said that there are different opinions over advantages and. disad-vantages for India joining WTO.

Advantages :

India is likely to derive the following benefits by joining WTO :

1) It is believed that India will obtain large gains in agricultre, forestry, fishery products and processed food and beverages.

2) India’s share in world exports may increase from 0.5 to 1 percent.

3) It is believed that India can gain US$ 2.7 billion extra in its exports per year.

4) The phasing out of multi fibre arrangement (MFA) by 2005 will benefit as its exports of textile and clothing will increase.

5) Improved prospects for agricultural export prices due to reduction of subsidies and tariffs.

6) India has the advantage of trade links with all other member countries without the need for bilateral agreements due to multilateral agreements provision of WTO.

7) By being a member of the WTO, India can benefit from International Trade centre jointly operated by WTO and UNO.

8) GATS is the another area where India can gain immensely in banking, insurance, telecommunications and shipping. There is ample of scope for global job opportunities.

Disadvantages :

The following are the major disadvantages for India by joining WTO :

- The claim of increase in India’s exports due to expansion of world trade is not acceptable to many. They feel that flow of goods and services across the globe depends not much on trade restrictions, but on factors like infrastructure, technology, assured supply of exportable goods etc.

- Critics state that the benefits due to reduction of trade barriers and expansion of market and world trade will accrue more to developed countries only.

- WTO agreements relating to steep hike in prices of drugs and agricultural inputs will hamper the growth of these sectors in India.

- The IPRs protection is anticompetition and anti-liberalisation and which may lead to monopoly of MNCs.

Short Answer Questions

Question 1.

Assess the role of international trade on Indian-economy.

Answer:

The role of international trade in economic development is highly significant. It plays a vital role for the development of world economies. It provides the urge to develop the knowledge and experience that makes development possible. The classical and neo-classical economists attached so much importance to international trade in a country’s development that they regarded it as an engine to economic growth.

1. Comparative Cost Advantage :

Foreign trade helps to produce those commodities which have comparatively cheaper cost than others. It results in less cost of production in producing a commodity. If all the countries adopt this procedure and produce those goods in which they have less comparative cost, will lead to availability of goods at a lower price. India also specialised in the production of those commodities in which it has comparative cost ad-vantages.

2. Market Expansion :

Foreign trade increases the scope of market because of domestic demand and foreign demand for the product. If the production of goods increases, average cost declines and price of goods declines as a result consumers will get different varieties of goods both in quantitative and qualitative terms.

3. Agricultural Development :

Agricultural development is the backbone of our economy. Foreign trade has played very imporant role for the development of our agriculture sector. Every year India exports rice, cotton, fruits and vegetables to other countries. The export of goods makes our farmers more prosperous. It inspires the spirit of development in them.

4. Competition :

International trade discourages the formation of local monopolies. The local producers cannot exploit the consumers because of fear of cheap imports. In the absence of imports, some local firms may create monopoly and charge very high prices.

5. Trade Policy :

Trade and commerce have been the backbone of the Indian economy right from the ancient times. Textiles and spices were the first products to be exported by India. From 1950s to the late 1980s, the country followed socialist policy resulting in protectionism and heavy regulations on foreign companies conducting trade with India. Average tariffs were more than 200 percent, extensive quantitative restrictions were imposed on imports, and stringent restrictions wre imposed on foreign investments. However, the country began to reform the economy since 1990s, through adoption of LPG policy.

6. Foreign Capital :

As part of economic reforms, India opened up its economy and allowed MNCs in the core sectors such as power and fuel, electrical equipments, transport etc. to allow foreign invesment upto 74 percent stake in Indian firms and even 100 percent stake in some firms.

Question 2.

Distinguish balance payments and balance of Trade.

Answer:

Balance of Trade Vs Balance of Payments :

Balance of trade (BoT) takes into account nly those transactions arising out of the exports and imports of the visible items, it does not consider the exchange of invisible items such as the services rendered by shipping, insurance, banking, payment of interest and dividend, and expenditure by tourists. Therefore, balance of trade is nothing, but the difference between the value of goods exported and imported. A crucial point to pote is both goods and services are counted for exports and imports, as a result of which a nation has balance of trade for goods (also known as the merchandise trade balance) and a balance of trade for services.

In equation form, the balance of payments (BoP) is Y = C + 1 + G + (X – M) which includes all transactions which give rise to or exhaust national income. The expression in the above equation denotes the balance. If the difference between exports and imports is zero, the balance of trade is balanced. If exports are greater than imports, the balance of trade is favourable, or there is surplus balance of trade. Favourable balance of trade indicates the good economic condition of the economy. On the other hand, if exports are less than imports, the balance of trade is in deficit or unfavourable. The difference between BoP and BoT are as follows :

Balance of Payments Vs Balance of Trade

| Balance of payments (BOP) | Balance of liade (BoT) |

| 1. It is a broad and comprehensive concept. | 1. It is narrow concept. |

| 2. It includes all transactions related to visible, invisible and capial transfers. | 2. It includes only visible items. |

| 3. It always balances itself. | 3. It can be favourable or unfavourable. |

| 4. BoP = Current Account + Capital Account + or – Balancing item (errors and omissions) | 4. BoT = Net earnings of Exports- Net payments for imports. |

![]()

Question 3.

Distinguish current account and capital account.

Answer:

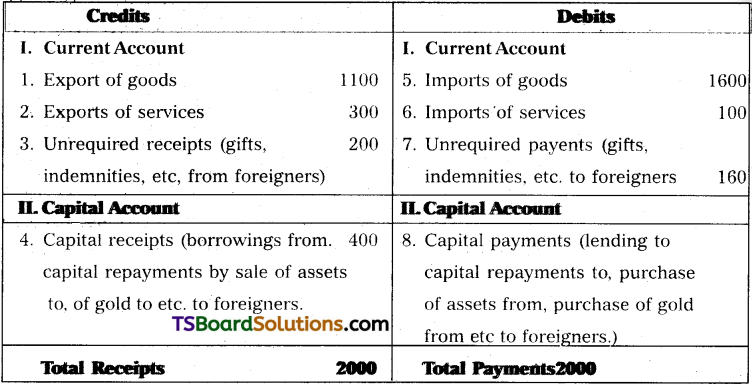

The balance of payments denotes a record of a country’s total money receipts received from and payments made to abroad,the difference betweeen the receipts and payment is the surplus or deficit. If total receipts are greater than total payments, there will be surplus; and if total receipts are lesser than total payments, there would be deficit in balance of payments.

Components of Balance of Payments :

A country’s balance of payments is merely a way of listing international receipts and payments. In this sense, it is an application of double-entry book-keeping. Usually a country’s balance of payments consists of two accounts : a) current account and b) capital account. A simplified example is given in the following Table, to understand items of balance of payments of a country in much better way.

Cbnqponeiits of Balance off Payments

The right side of Table-shows how the foreign currency is spent. The row 1 of the table indicates that the country has exported goods to a value of 1,100 and analogously row 5 shows that the country has imported goods to a value of 1,600. These two rows describe the country’s visible trade.

Row 2 indicates the receipts of the country from the sale of services to foreigners during the period in question. These may be in the form of shipping services, interest and dividends which citizens of the country earn on investment abroad, income through tourism. Such payments are regarded as payments made by foreigners. These payments are registered under exports of services or invisible exports. In a completely analogous way, row 6 denotes payments which residents of the country in question make to foreigners for similar services. The net difference between row 2 and row 6 is called as invisible trade balance.

The items under row 3 include unrequired receipts i.e., the receipts which the residents of a country receive for free without having to make any present or future payment in return. Examples of this kind are : Gifts which residents receive from foreigners, money sent by emigrants to their relatives indemnities, payments from developed to developing countries. In a purely analogous way, row 7 describes payments which the country in question makes as gifts, assistance, indemnities, etc.

Items under 1, 2, 3, 5, 6 and 7 enumerate all the payments and receipts made for the current period of time where items 4 and 8 refer to capital receipts and payments. The items of 4 include loans taken by the government of a country from other foreign governments, sale of stocks abroad, sale of gold to other countries etc. In all these instances, the country in question will acquire foreign currency. Similarly, if residents of the country in their turn were to acquire foreign assets, for instance in the form of land abroad or foreign shares, or if the government were to acqire foreign assets, for instance in the form of land abroad or foreign shares, or if the government were to lend money to a foreign government, this would give rise to an outflow of foreign currency and comes as a capial transfer under row 8.

Question 4.

Describe the functions of GATT.

Answer:

The general agreement on tariffs and trade (GATT) came into force on January 1, 1948.

1) Most Favoured Nation Clause :

The basic principle of GATT is that of non-discrimination, confined in article – I. Contracting parties accept the so-called most favoured nation clause. The MFN clause rules out any preferrential treatment among nations as far as trade policy is concerned.

2) Tariff Concessions :

Article II deals with basic tariffs, incorporating schedules of tariff concessions. The tariff concessions contained in GATT known as band rates came into force in 1948 for 3 years until the end of 1950.

3) Elimination of quantitative restrictions (QRS) :

According to article XI, the contracting parties are prohibited from imposing the QRs, subject to the principal exception that a country might, in certain defined circumstances which are stricter for the developed countries, apply restrictions with the objective of protecting its external BOP. In general, such restrictions must be applied in a non-discriminatory manner.

4) Safeguard code :

Article XIX of the GATT provided emergency safeguard code under this, a country could impose a tariff or quota to restrain imports which caused or threatened serious injury to domestic producers.

5) Exceptions :

Article XX and XXI provided general and security exceptions towards the prohibitions of import quotas by contracting parties.

6) Subsidies and countervailing duties :

The rule on subsidies and countervailing duties were incorporated in a separate code negotiated in the Tokyo round of 1970’s. Under these rules, export duties on manufacturing products were banned except in developing countries.

7) Settlement of disputes :

The greatest success of the GATT had been in the field of settlement of disputes among its members. Any member having compliant against the other member on the issue of violating the rules of the organisation brings its complaint to the annual, meetings for settlement.

Question 5.

Discuss the rounds of GATT.

Answer:

Eight rounds of negotiating conference took place between the participating countries from 1947 to the last year of GATT. This can be shown in the following table.

Chart : Rounds of GATT

In the table first six rounds of conference were related to curtailing tariff rates whereas the seventh was related to non-tariff issues. The eight round was entirely different and it was popularly known as Uruguay round.

Question 6.

Explain the objectives of WTO.

Answer:

WT.O. came into force from Ist January, 1995. It’s head quarter is Geneva, Switzerland.

Objectives :

- Raising standard of living and income, promoting full employment, expanding production and trade and optimum utilisation of world resources.

- Introduce Sustainable development – a concept which envisages the development.

- Taking positive steps to ensure that developing countries, secure a better share in world trade.

- Promote trade flows by encouraging nations to adopt non discriminatory and predictable trade practices.

- Establish procedures for solving trade disputes among members.

Question 7.

Analyse the differences between GATT and WTO :

Answer:

Difference between GATT and WTO

The major differences between GATT and WTO are as follows :

| GATT | WTO |

| 1) It has no institutional foundation. | 1) It is a permanent institution with its secretariat. |

| 2) Its commitments were devised on a provisional basis. | 2) Its commitments are full and permanent. |

| 3) Its rules were applied to merchandise goods only. | 3) In addition to merchandise its rules . are applied to services also. |

| 4) The agreement provisions were multilateral with selective in nature and were not binding by members. | 4) The agreement provisions are multilateral and binding on all members. |

| 5) The dispute system was dilatory and not binding. | 5) The dispute settlement mechanism is faster, automatic and binding on the parties. |

![]()

Question 8.

Write a note on Agreement on Agriculture (AoA)

Answer:

It is related to commitments in the area of market access, domestic support and export promotion. The members have to transform their non-tariff barriers like quotas into equivalent tariff measures. The tariffs resulting from this transformation, as well as other tariffs on agricultural products are to be reduced on an average by 36 percent in the case of developed countries and 24 percent incase of developing countries. The reductions were required to be undertaken over 6 years in case of developed countries and 10 years incase of developing countries.

The W.T.O. agreement on Agriculture contains provisions in 3 broad areas of agriculture and trade policy:

a) Market access – abolishment of all non-tariff barriers such as quotas, variable levies, minimum import prices etc.

b) Domestic support – reduction by 20 percent in developed and 13.3 percent in developing countries, and

c) Export subsidies – reduction of subsidy expenditure by 36% and volume by 21% in 6 years, in equal instalments for developed and developing countries by 24% and 14% respectively in equal instalments over 10 years.

Very Short Answer Questions

Question 1.

FDI.

Answer:

It is a form of a long term international capital movement made for the purpose of productive activity and accompanied by the intention of managerial control or participation in the management of foreign firm.

Question 2.

Balance of Trade.

Answer:

A country’s balance of trade refers to the net difference between the value of exports and value of imports of merchandise only a given period.

Question 3.

Invisibles.

Answer:

The receipts of the country from the sale of services to foreigners during the period. These may be in the form of shipping services, interest and dividends, which citizens of the country earn on investment abroad.

Question 4.

GATT objectives.

Answer:

- To follow unconditional most favoured nations principle.

- To grant protection to domestic industry through tariffs.

- To carry on trade on the principle of non discrimination, reciprocity.

- To liberalise tariff and non tariff measures through multilateral negotiations.

Question 5.

WTO objectives.

Answer:

- Raising standard of living and income and employment,

- Introduce sustainable development.

- Iaking positive steps to ensure that developing countries.

- Promote trade flows by encouraging nations to adopt non discriminatory.

- Establish procedures for solving trade disputes among members.

Question 6.

MFN.

Answer:

Any concession given to any nation was automatically extended to all the members countries of the GATT. MFN means Most Favoured Nations.

Question 7.

TRIP’S.

Answer:

It means Trade Related Intellectual Property Rights. It legally protects the intellectual property of an individual (or) a business firm (or) a nation against illegal usage by others.

![]()

Question 8.

TRIMS.

Answer:

The main provisions provided in the TRIM’S text ensure that government shall not dis-criminate against foreign capital. TRIM’S refers to Trade related investment measures. The TRIMs text compels member countries to give national treatment to foreign capital.

Question 9.

GATS.

Answer:

(General Agrement on Trade in Services) : It provides a multilateral frame work of principles and services which should govern trade in services under conditions of transparency and progressive liberalisation. ;

Question 10.

Export subsidies.

Answer:

It means a country may encourage its exports to foreign countries by granting subsidies on goods exported. A combination of tariffs against imports and countries for exports may elimination external deficit facing a country.

Question 11.

Balance of payments (BoP).

Answer:

It is a statistical record in the form of a balance sheet comprising all its transactions with rest of the world during any given period of time.

![]()

Question 12.

Dunkel Proposals.

Answer:

The Uruguay round negotiations were expected to complete in four years, but it took more than eight years of complex negotiations. Mr. Arthur Dunkel, the Director General of GATT compiled a very detailed document at this round popularly known as Dunkel proposals. This proposal culminated to the Final Act on December 15, 1993. This act led to formation of WTO. Some of the important areas contained in these proposals include; tariff and non-tariff measures, textile and clothing, agriculture, subsidies, multi trade agreements, trade related intellectual property rights (TRIPs), trade related investment measures (TRIMs) and general agreement on trade and services (GATS).