Telangana TSBIE TS Inter 2nd Year Accountancy Study Material 3rd Lesson Accounting for Not-for-Profit Organisation Textbook Questions and Answers.

TS Inter 2nd Year Accountancy Study Material 3rd Lesson Accounting for Not-for-Profit Organisation

Very Short Answer Questions

Question 1.

Explain the meaning of Non-profit organisation.

Answer:

The organisations, whose main object is not to earn profit, but to render service to their members called as a non-profit organisation. Eg: Education Institutions, Hospitals clubs Religious Institutions, Co-operation societies.

Question 2.

Write the characteristics of Not-for-profit organisation.

Answer:

- Not-for-profit organisations are to serve its members and the society in general.

- These organisations will come into existence to promote Arts, Science, Religion and Spirituality.

- These organisations do not declare and pay any dividend to its members.

- These organisations are managed by elected members.

![]()

Question 3.

What is the differences between Capital expenditure and Revenue expenditure?

Answer:

| Capital expenditure | Revenue expenditure |

| 1. This expenditure is incurred to acquire the assets or to improve the earning capacity or maintaining the life of the existing asset. | 1. This expenditure incurred to meet the day-to-day expenses of the organisation. |

| 2. It is non recurring in nature. | 2. It is recurring in nature. |

| 3. The benefits of this expenditure are available for a longer period. | 3. The benefits of this expenditure are for accounting period. |

| 4. This expenditure will be shown in the Balance sheet. | 4. This expenditure will be shown in the Income and Expenditure account. |

| 5. It is a real account in nature. | 5. It is a nominal account in nature. |

Question 4.

What are the differences between Capital receipts and Revenue receipts?

Answer:

| Capital receipts | Revenue receipts |

| 1. These are obtained from sale of assets concern. 2. It is nonrecurring in nature. 3. These are in Huge or large amount. 4. Capital receipts are shown on the liabilities side of the Balance sheet or deducted from the concerned asset on the assets side of the Balance sheet. |

1. It is obtained from regular activities of the concern. 2. It is recurring in nature. 3. These are in small amount. 4. Revenue receipts are credited to Trading and Profit and Loss account or Income and Expenditure account. |

Question 5.

What is Deferred Revenue Expenditure?

Answer:

- When heavy or unusual expenditure of revenue in nature is incurred in a particular year and the benefit of which extends beyond that year, it is treated as “Deferred Revenue Expenditure.

- In other words the expenditure is revenue in nature, but its benefit is spread over a number of years.

- For example Preliminary expenses, heavy expenditure on the advertisement.

Question 6.

Explain the differences between Payment and Expenditure.

Answer:

- Expenditure includes all expenses incurred during particular period, it may be either paid or to be paid. Payment means actual cash paid. It may be for the current year or for a past period or for a future period.

- Payment may be an expenditure, but an expenditure need not necessarily be a payment.

Question 7.

Explain the differences between Receipt and Income.

Answer:

1. Receipt means actual cash received. It may be for the current year or for a past period or for a future period. Whereas an income relates to a specific period, it may be accrued or earned during that period; it may be either received or receivable.

2. Receipt is different from income. An income may be receipt, but a receipt need not necessarily be an income.

![]()

Question 8.

Explain the following terms.

Answer:

1) Donations :

- Any amount received by the organizations from the individuals and institutions voluntarily is called “Donations”.

- Donations are divided into two types :

A) General Donations. B) Specific Donations

2) Legacy :

- Amount received by the organization as per the “will” of a person is called legacy. It is non-recurring nature and to be treated as capital income.

- Accounting treatments: Legacy is treated as capital income and recorded on the liabilities side of the Balance sheet.

3) Entrance Free:

- The amount/Fee, paid by the new members at the time of joining the organisations is known as Entrance fees.

- It is treated as revenue income and it should be credited to income and expenditure account.

4) Subscriptions: It is an amount paid by the members regularly at periodical intervals. Subscriptions are regular source of income for the organization.

5) Capital fund : Excess of assets over liabilities is called capital fund. It is general fund which is similar to capital account of profit-making organisations.

Capital fund = Assets – Liabilities

6) Specific funds: Specific fund received for specific purposes such as building fund or tournament fund, prize fund etc.

Short Answer Questions

Question 1.

Write the features of receipts and payment Account.

Answer:

- Receipts and Payment account is a real account that records all cash receipts and Payments.

- It is a summary of cash and bank transactions.

Features :

- Receipts and payments account is similar to cash book.

- It is a real account.

- This account reveals opening and closing balances of cash and bank.

- It is maintained and cash basis of accounting.

- Credit transactions are not recorded in receipts and payments account.

- All cash receipts are shown on debit side, all cash payments are shown on credit side of the account.

- This account depicts closing balance of cash and bank at the end of the year.

Question 2.

What is an Income and Expenditure account? Explain its features.

Answer:

- The income and Expenditure account is similar to Profit and Loss account.

- On debit side Revenue expenditure and on the credit side revenue income are recorded to ascertain the financial result of the organization.

Features :

- It is similar to profit and loss account.

- It is a nominal account.

- All revenue expenses are recorded on the debit side and all revenue incomes on the credit side of the income and expenditure account.

- Only revenue items are taken into consideration. Capital items are to be totally excluded.

- There is no closing balance, but the difference between two sides of account shows either surplus or deficit.

- It also records non-cash items like depreciation.

- The surplus/deficit is transferred to capital fund in the balance sheet.

Question 3.

Explain the difference between Receipts and Payments account and Income and Expenditure account.

Answer:

| Basic of Difference | Receipts and payments account | Income and expenditure account |

| 1) Type of account | It is real account. | It is nominal account. |

| 2) Debit and credit side | Receipts are shown on the debit side and payments on the credit side. | Income is shown on the credit side and expenditure on the debit side. |

| 3) Basic structure | It is a summary of cash and bank transactions. | It is a summary or income earned and expenditure incurred during the year. |

| 4) Opening balance | Opening balance which represents cash in hand or at a bank. | There is no opening balance. |

| 5) Object | It is prepared to present a summary of cash transactions for a given period. | It is prepared to ascertain the net results of all revenue transactions for a given period. |

| 6) Closing balance | Closing balance shows cash in hand or at bank. | Closing balance shows either surplus of deficit. |

| 7) Contents | Both revenue and capital items are considered. | Only revenue items are considered. |

| 8) Accrued items | It does not included accrued items, i.e., accrued incomes and expenses. | It includes accrued incomes and expenses. |

| 9)Adjustments | No adjustments are required. | All adjustments relating to current year income and expenditure are taken into consideration. |

![]()

Question 4.

What is donation? Explain the types of donations.

Answer:

Donations are the amount received by organizations from individuals and institutions as a gift.

Donations are two types :

a) General donations

b) Special donations (or) specific donations.

a) General donations: General donations is the amount given by the individuals without mentioning the purpose. So that the amount can be utilised for any purpose by the not-for- profit organizations.

b) Special donations (or) specific donations: A donation received by the organization for a specific purpose is called specific donations. For example: Donation for buildings.

Question 5.

Bring out the difference between Capital and Revenue items by giving suitable examples.

Answer:

I. Capital Items :

1) Capital Expenditure: Capital expenditure is the expenditure which incurred for the acquisition assets for the expenditure incurred to increase the earning capacity of the existing assets.

For Example Purchases of assets like buildings, machinery, furniture, investments, books, installation of assets etc.

2) Capital Receipts: Capital receipts of business consist of capital contributed by the members, special donations and sale of fixed assets.

Capital receipts is non-recurring nature.

For Example Legacies, Government grants, Life membership fees.

II. Revenue Items:

1) Revenue Expenses: These expenses are incurred in the day-to-day operations of the organizations. For Eg. Salaries, wages, transport, rent paid, postage, printing and stationery, newspapers, interest paid etc. and also includes expenditure on maintenance of fixed assets such as repairs, depreciations etc.

2) Revenue Receipts: These receipts are generally obtained from the day-to-day operations of the organizations. Eg: Subscriptions, rent received, interest received, proceeds from entertainment, lectures etc.

Textual Problems

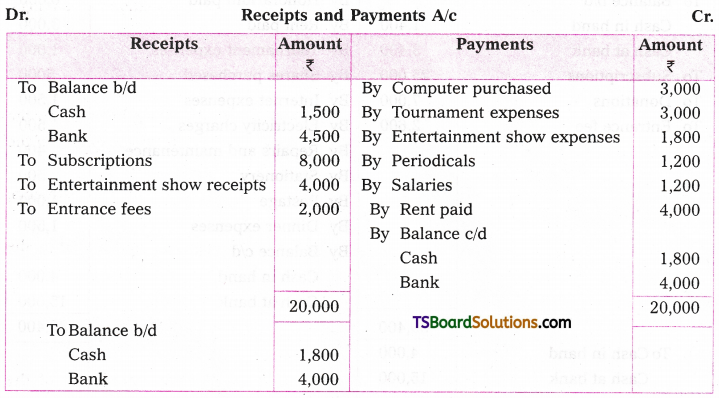

Question 1.

From the following details, prepare Receipts and Payments account.

Opening balance of cash — 1,500

Opening bank balance — 4,500

Subscriptions collected — 8,000

Entertainment show receipts — 4,000

Entrance fees received — 2,000

Computer purchased — 3,000

Tournament expenses — 3,000

Entertainment show expenses — 1,800

Opening balance of cash — 1,500

Opening bank balance — 4,500

Subscriptions collected — 8,000

Entertainment show receipts — 4,000

Entrance fees received — 2,000

Computer purchased — 3,000

Tournament expenses 3,000

Entertainment show expenses 1,800

Answer:

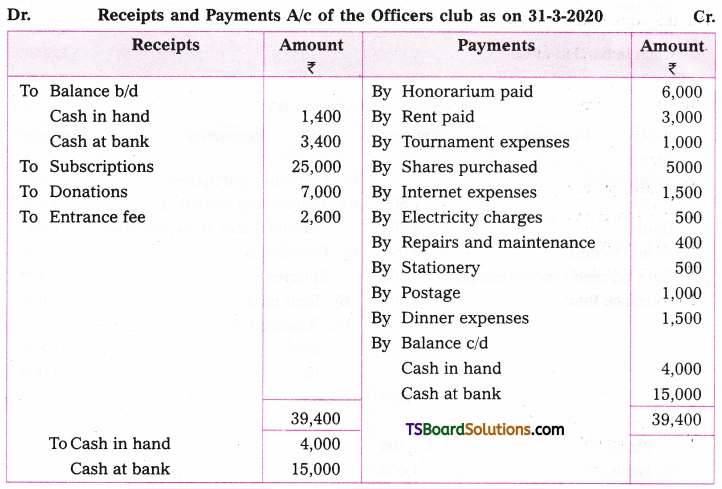

Question 2.

From the following details, prepare the Receipts and Payments account of the Officers club for the year ending 31st March 2020.

Opening cash in hand — 1,400

Opening cash at bank — 3,400

Subscriptions received — 25,000

Donations collected — 7,000

Honorarium paid — 6,000

Rent paid — 3,000

Tournament expenses — 1,000

Shares purchased — 5,000

Entrance fee received — 2,600

Paid for internet connection — 1,500

Electricity charges — 500

Repairs and maintenance — 400

Stationery — 500

Postage — 1,000

Dinner expenses — 1,500

Cash in hand at the end — 4,000

Answer:

![]()

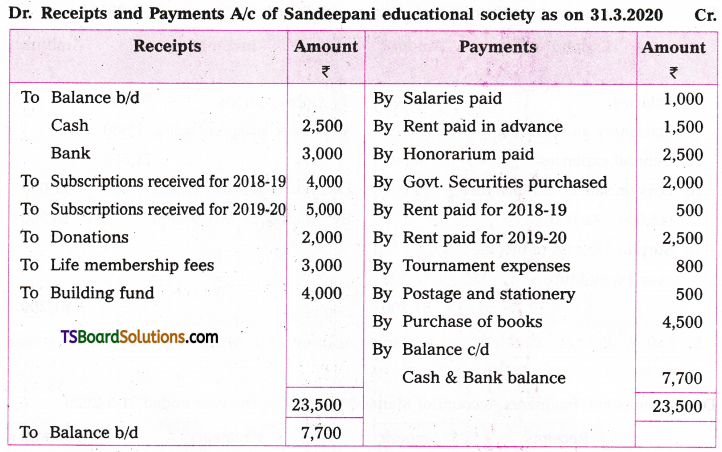

Question 3.

Prepare Receipts and Payments account of Sandeepani Educational society’ for the year ended 31-3-2020.

Balance of cash — 2,500

Bank balance — 3,000

Subscriptions received for 2018-19 — 4,000

Subscriptions received for 20 19-20 — 5,000

Donations received — 2,000

Salaries paid — 1,000

Life membership fees received — 3,000

Rent paid in advance — 1,500

Honorarium paid — 2,500

Govt. Securities purchased — 2,000

Rent paid for 2018-19 — 500

Rent paid for 20 19-20 — 2,500

Building fund received — 4,000

Tournament expenses — 800

Postage and stationery — 500

Purchase of books — 4,500

Answer:

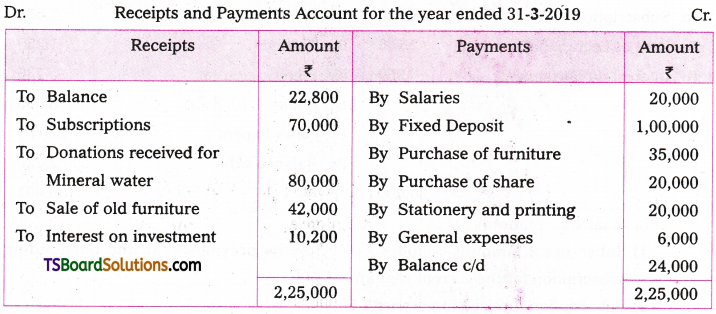

Question 4.

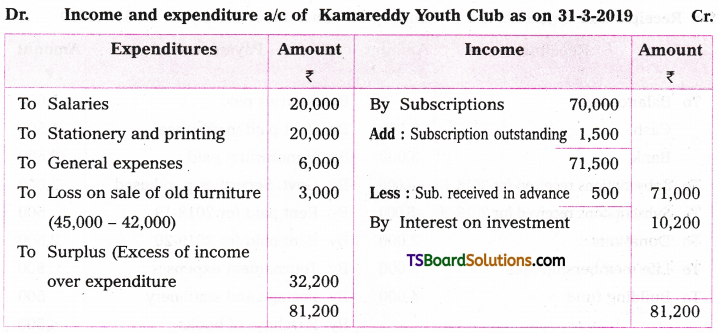

Kamareddy Youth Club gives you their receipts and payments account and other information and requests you to prepare their income and expenditure account for the year ended 31-3-2019.

Additional Information :

- Outstanding subscriptions on 31-3-2019 Rs. 1,500.

- Subscriptions received in advance on 31-03-2019 Rs. 500.

- Value of old furniture sold is Rs. 45,000.

Answer:

Question 5.

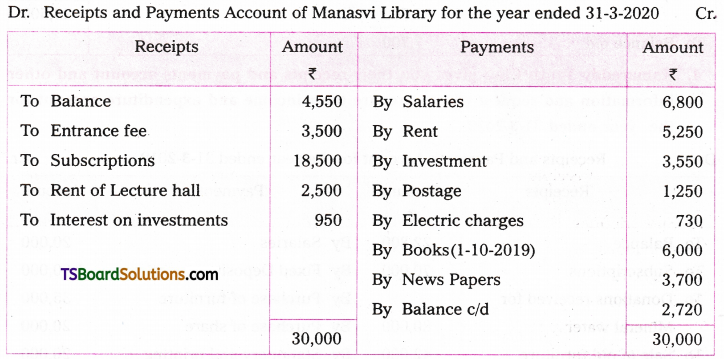

Following is the Receipts and Payments Account of a “Manasvi Library” for the year ended 31st March, 2020.

Additional Information :

- The subscription amount includes Rs. 500 for the previous year and outstanding subscriptions for the current year are Rs. 1,500.

- Subscription received in advance Rs. 500.

- Capitalize half of the entrance fee.

- Books are to be depreciated at 5% per annum.

You are required to prepare income and expenditure account.

Answer:

![]()

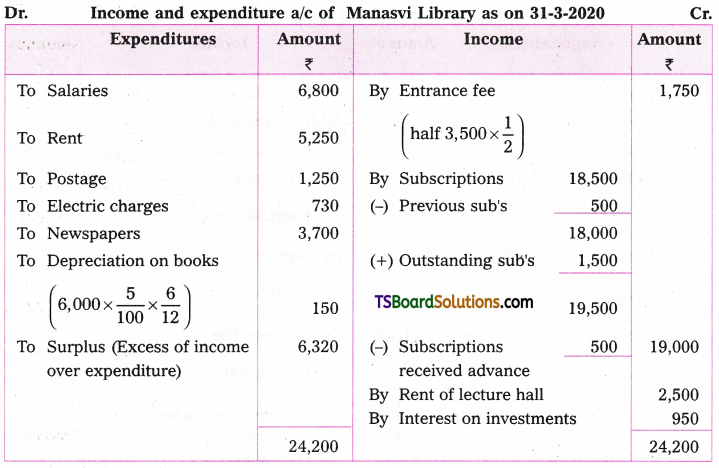

Question 6.

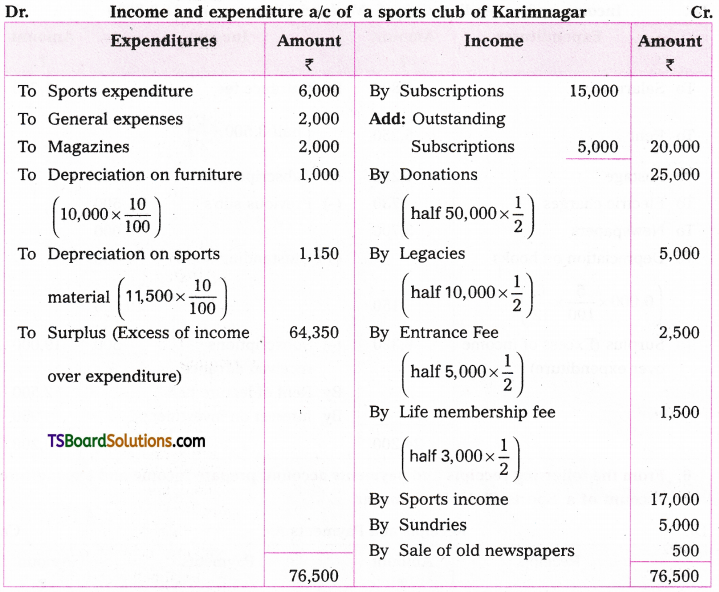

From the following receipts and payments account, prepare income and expenditure account of a Sports Club’, Karimnagar.

Additional Information :

- Capitalize 50% of the donations, legacies, entrance fee and life membership fee.

- Subscriptions still outstanding amount to Rs. 5,000.

- Depreciate sports material and Furniture 10%.

Answer:

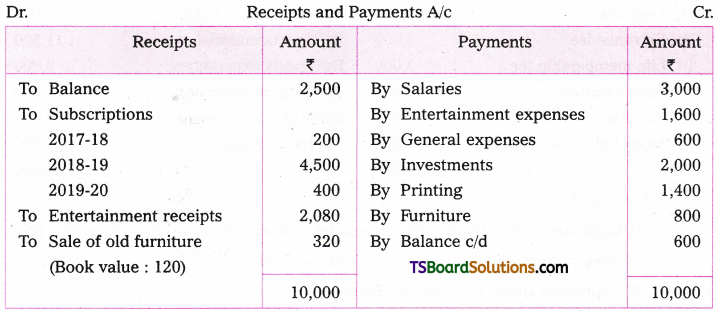

Question 7.

From the following receipts and payments account of Sri Kala Nilayam, Nirmal for the year ended 31-03-2019, prepare income and expenditure account.

Additional Information:

- Outstanding salaries Rs. 500.

- Subscriptions outstanding for 2018-19 Rs. 1,000.

- Depreciate furniture by 10%.

Answer:

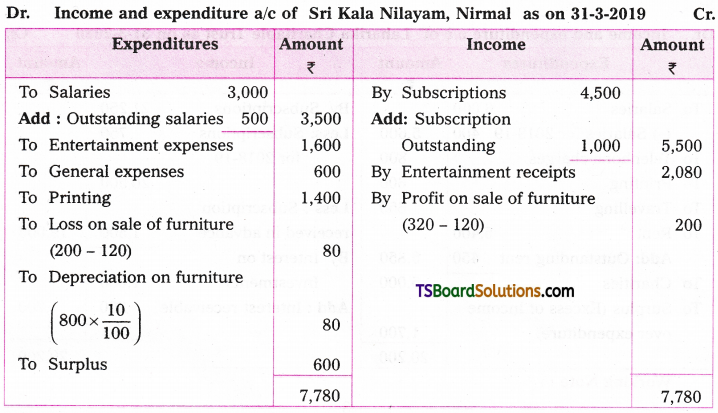

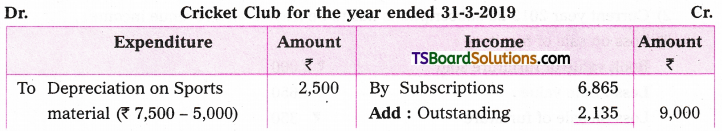

Question 8.

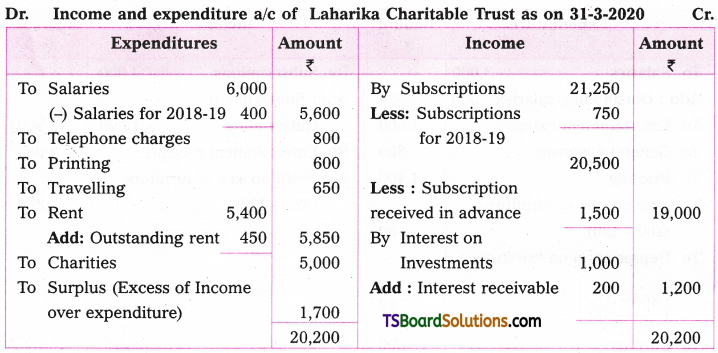

From the following receipts and payments account and other details of “Laharika Charitable Trust”. Prepare Income and Expenditure account for the year ended 31-03-2020.

Additional Information :

- Subscriptions received in advance Rs. 1,500.

- Outstanding rent Rs. 450.

- The value of investments Rs. 40,000 and rate of interest is 3%.

- Donations are received for a prizes to be awarded by the trust.

Answer:

Working Note :

Total Interest on Investment = 40,000 x 3/100 = 12,000

We already received = 1000

The remaining receivable interest on investment is 200

![]()

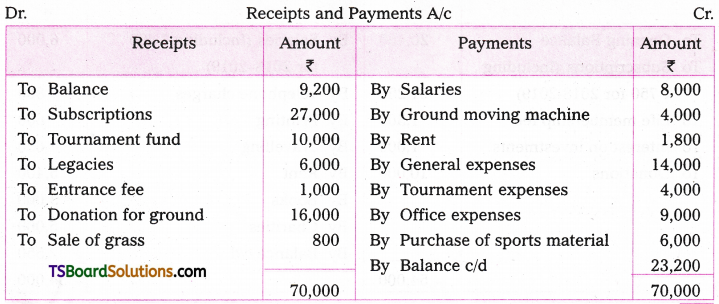

Question 9.

From the following information, prepare the income and expenditure account for the year ended 31-03-2020 of Kamareddy Cricket Club’.

Additional Information :

- Subscriptions received included amount Rs. 2,200 related to the previous year.

- Outstanding subscription Rs. 1,000.

- Provide Rs. 300 depreciation on ground moving machine.

- Sports material opening balance Rs. 4,000 and closing balance Rs. 7,500.

Answer:

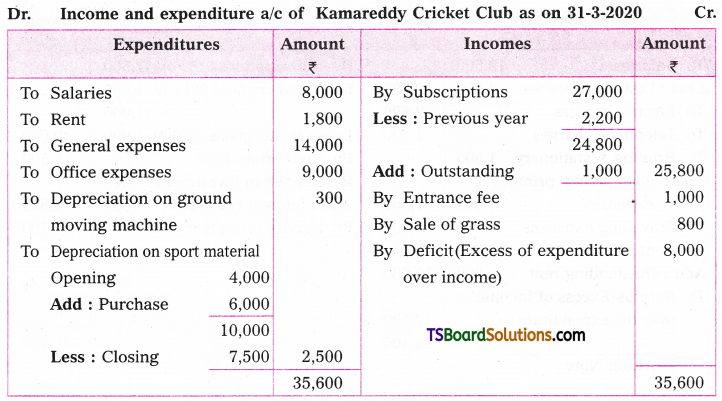

Question 10.

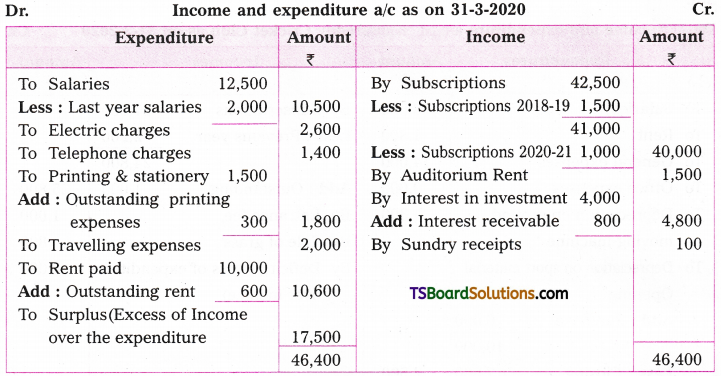

The following is the receipts and payments account for the year ended 31st March, 2020.

Additional Information :

- The subscription received amount includes Rs. 1,000 for the year 2020-2021.

- Outstanding rent Rs. 600 and printing Rs. 300.

- The value of investments Rs. 60,000 and rate of interest 8%.

You are required to prepare income and expenditure account.

Answer:

Working Note :

Total Interest on Investment = 60,000 x 8/100 = 4,800

We already received Interest = 4,000

Remaining interest receivable = 800.

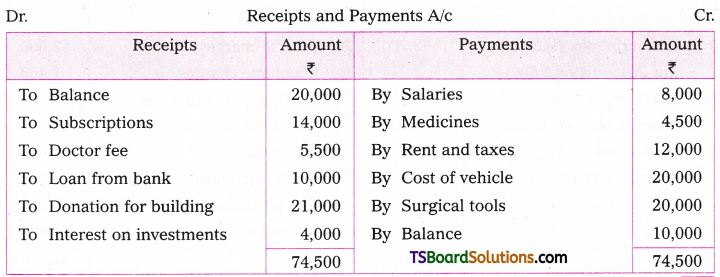

Question 11.

Prepare income and expenditure account and balance sheet from the following Receipts and Payments account of “Supreetha” nursing home for the year ended 31-03-2019.

Additional Information :

- Nursing home had investment value of Rs. 8,000 and Capital fund of the nursing home was Rs. 30,000.

- Medicine opening balance as on 01.04.2018 is Rs. 2,000. Closing balance as on 31.03.2019 is Rs. 1,500.

Answer:

Balance Sheet of Supreetha Nursing home as on 31-3-2019

![]()

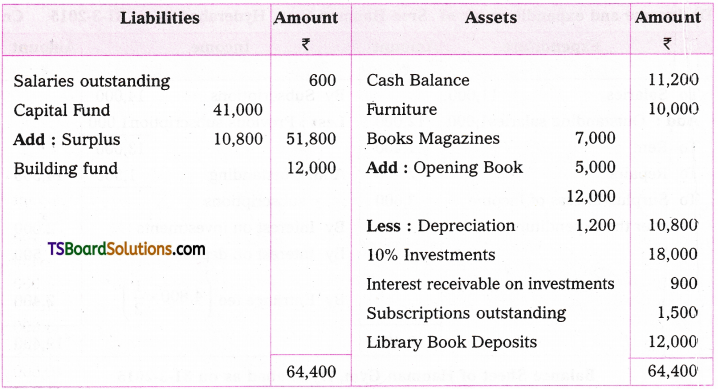

Question 12.

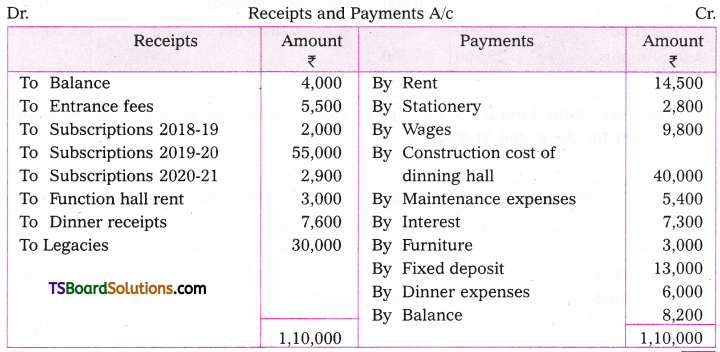

The following is the Receipts and Payments account of “Ashok Nagar Welfare Association’ for the year ended 31st December 2020.

Additional Information :

- Capital fund of the association is Rs. 7,000.

- Hall rent Rs. 1,000 related to last year and Rs. 600 received in advance.

- Outstanding subscriptions for current year Rs. 3,600.

Prepare Income and expenditure account and Balance sheet from the above information.

Answer:

Balance Sheet of Ashok Nagar Welfare Association as on 31-12-2020

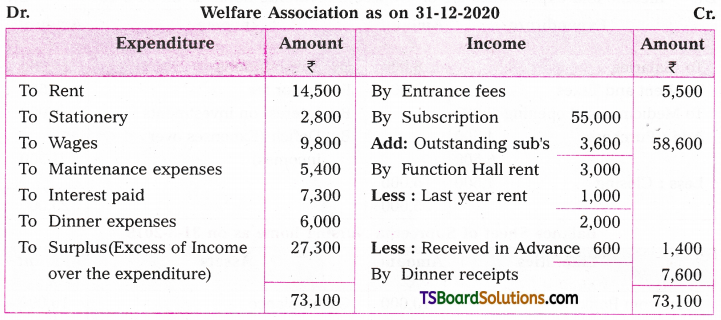

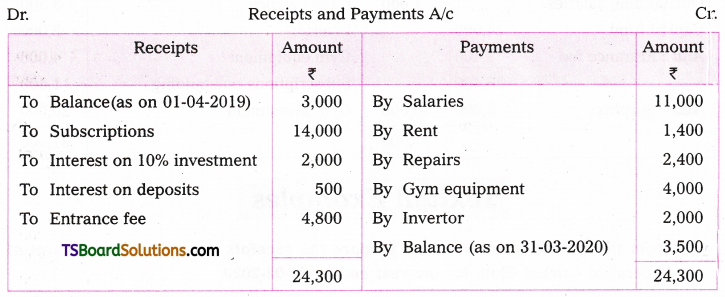

Question 13.

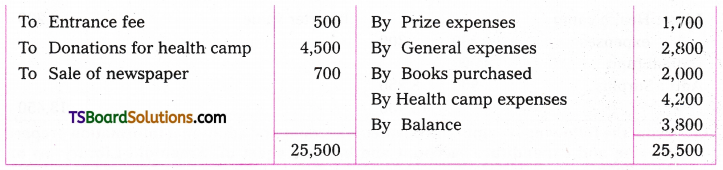

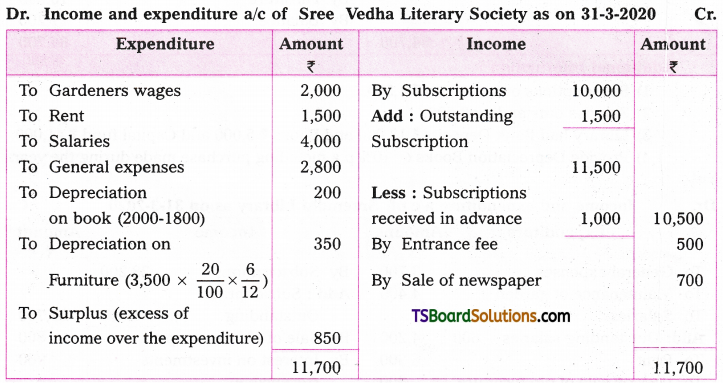

The ‘Sree Vedha Literary Society’ gives you the following Receipts and Payments account for the ended 31-03-2020.

Additional Information :

- Outstanding subscriptions for current year Rs. 1,500.

- Subscriptions received in advance Rs. 1,000.

- Value of books on 31-03-2020 Rs. 1,800.

- The furniture was purchased on 1.10.2019 and is to be depreciated by 20%.

- Society had the inverter values of Rs. 3,200 and the capital fund of society Rs. 8,000.

- Entrance Fee not to be capitalised.

Prepare Income and Expenditure account and Balance sheet from above information.

Answer:

Balance Sheet of Sree Vedha literary society as on 31-3-2020

![]()

Question 14.

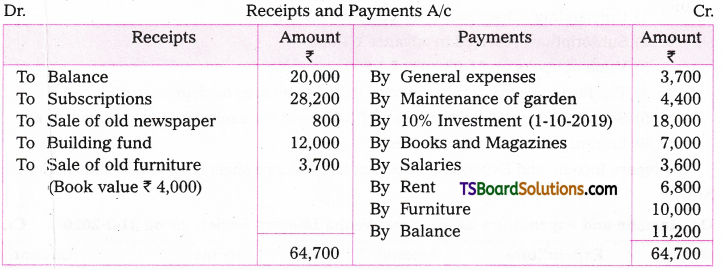

From the following receipts and payments account and additional information prepare income and expenditure account and balance sheet of “Sreenidhi Library” as on 31.3.2020.

Additional Information :

- Subscriptions outstanding Rs. 1,500.

- Salaries outstanding Rs. 600.

- Library had Bank Deposits Rs. 12,000 and Books Rs. 5,000 and Capital fund Rs. 41,000.

- Provide Depreciation Books @ 10% p.a including purchase made during the year.

Answer:

Balance Sheet of Sreenidhi Library as on 31-3-2020

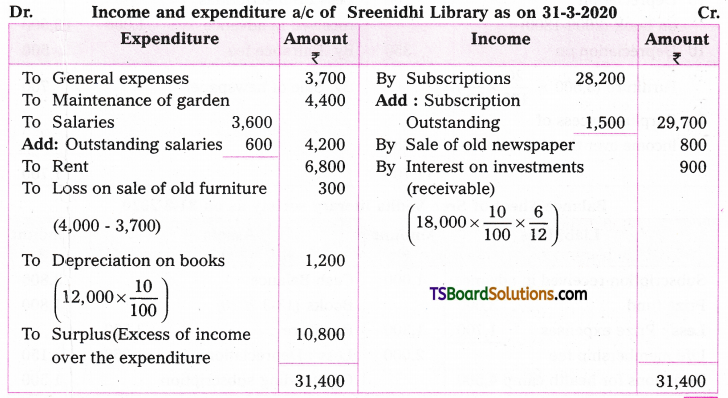

Question 15.

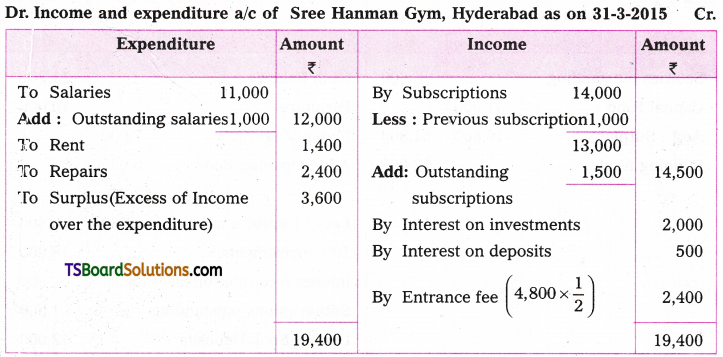

Sree Hanman Gym, Hyderabad gives you the following Receipts and Payments account for the ended 31-03-2020.

Additional Information :

- Subscriptions received included Rs. 1,000 for the previous year.

- Subscriptions outstanding for the current year Rs. 1,500.

- Outstanding salaries t 1,000.

- Half of the Entrance fee has to be capitalised.

- Gym has investments worth 120,000 and total Capital fund of the Gym is Rs. 24,000. Prepare Income and Expenditure account and Balance sheet from the above information.

Answer:

Balance Sheet of Hanman Gym, Hyderabad as on 31-3-2015

![]()

Textual Examples

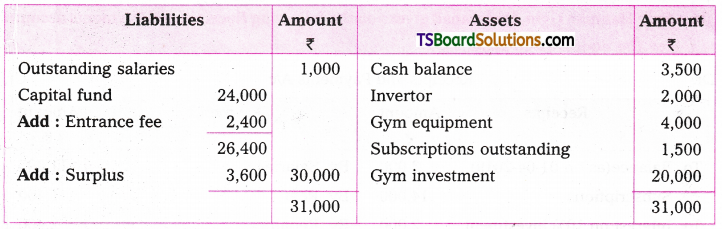

Question 1.

From the following information prepare the receipts and payments account of Hyderabad Cricket Club, for the year ending 31-03-2020.

| As on 01-04-2014 | Bank balance | 6,000 |

| Cash balance | 4,000 | |

| As on 31-03-2020 | Subscriptions | 20,000 |

| Entrance fees | 5,000 | |

| Salaries | 8,650 | |

| Rent paid | 4,500 | |

| Furniture purchased | 9,200. | |

| Cricket bats and balls | 5,300 | |

| Sale of old cricket bats | 1,200 | |

| Life membership fee | 7,500 | |

| Electricity charges | 2,800 | |

| Postage | 1,750 | |

| Wages | 2,000 | |

| Printing and stationeiy | 2,800 | |

| Tournament fund | 7,500 | |

| Tournament expenditure | 8,500 |

Answer:

Receipt and Payments a/c of Hyderabad Cricket Club

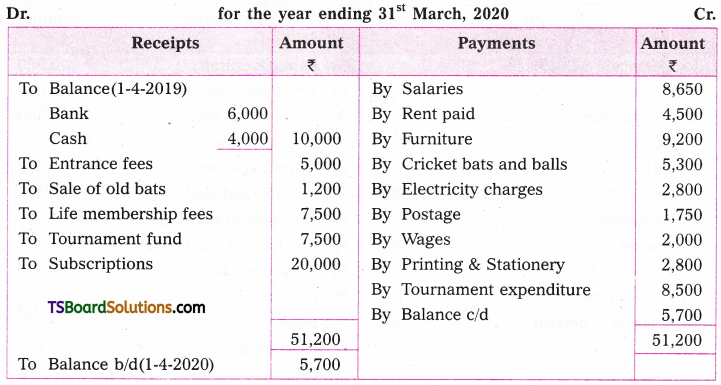

Question 2.

From the following information prepare the receipts and payments account of “Nirmal Sports club for the year ended 31st March 2020.

| Bank overdraft (As on 01-04-2019) | 2,000 |

| Cash Balance (As on 01-04-2019) | 12,500 |

| Subscription received for the year 2019-2020 | 14,000 |

| Subscription received for the year 2018-2019 | 2,000 |

| Subscription received for the year 2020-2021 | 3,000 |

| Donations | 5,400 |

| Locker’s rent | 1,200 |

| 8% Investments purchased | 5,000 |

| Sale of grass | 700 |

| Salaries and Wages | 7,500 |

| Rent & Taxes | 3,200 |

| Office expenses | 550 |

| Entrance fee | 2,400 |

| Interest of Deposits | 800 |

| Printing and Stationery | 450 |

| Tournament expenditure | 1,000 |

| Purchase of sports material | 1,200 |

| Furniture purchased | 6,500 |

| Closing of Bank balance | 4,800 |

Answer:

Receipt and payments A/c of Nirmal Sports Club

![]()

Question 3.

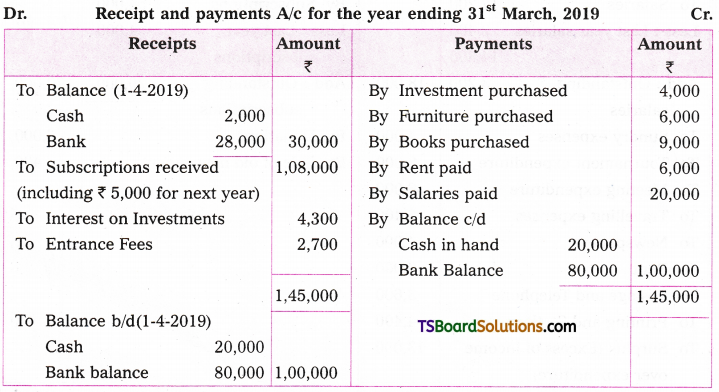

From the following particulars prepare the receipts and payments account year 31 March 2019.

Cash in hand ( 01-04-2019) — 2,000

Cash at bank (01-4-2019) — 28,000

Investments purchased — 4,000

Subscriptions received — 1,08,000

(including Rs. 5,000, Next financial year)

Subscriptions outstanding (for Last year) — 10,000

Furniture purchased — 6,000

Interest received on investments — 4,300

Books purchased — 9,000

Rent paid — 6,000

Rent due on 31-03-2019 — 400

Entrance fee — 2,700

Salaries paid — 20,000

Outstanding salaries — 3,000

Cash in Hand — 20,000

Answer:

Question 4.

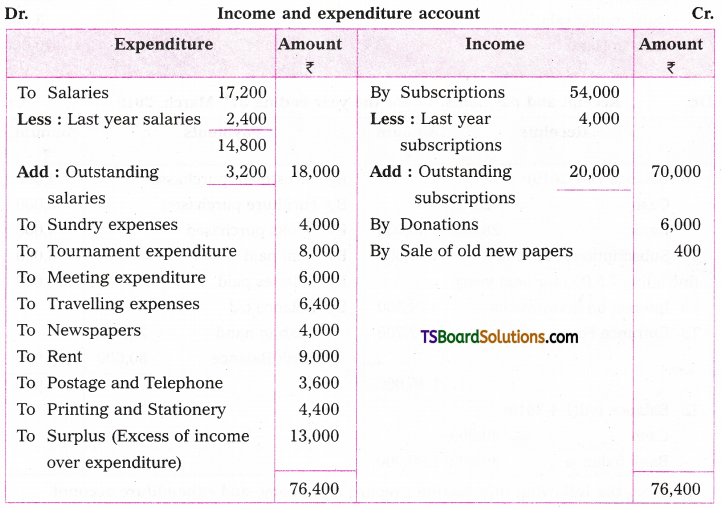

From the following information prepare the income and expenditure account

Subscriptions received — 54,000

(including last year subscriptions Rs. 4,000)

Outstanding subscriptions — 20,000

Salaries (including last year salaries Rs. 2,400) — 17,200

Outstanding salaries — 3,200

Sundry expenses — 4,000

Tournament expenditure — 8,000

Meeting expenditure — 6,000

Traveling expenses — 6,400

Books purchased — 18,000

Newspapers — 4,000

Rent — 9,000

Postage and Telephone etc. — 3,600

Printing and Stationery — 4,400

Donations — 6,000

Sale of old newspaper — 400

Answer:

Note :

- The purchase of books is capital expenditure and hence not considered in income and expenditure account.

- Small amount of donations treated as a revenue income and taken as income on the credit side of income and expenditure account.

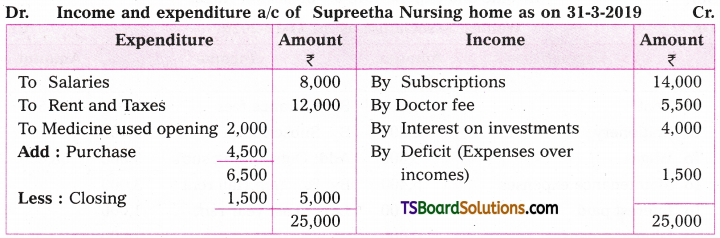

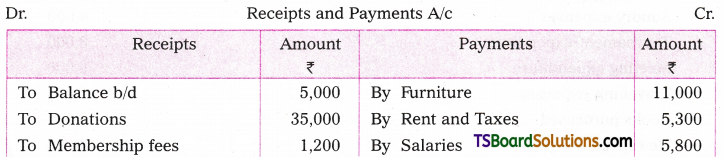

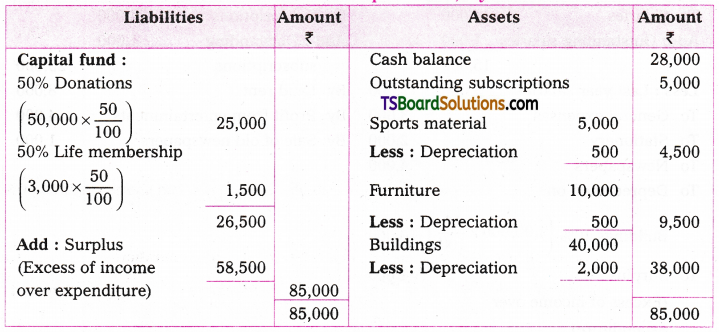

Question 5.

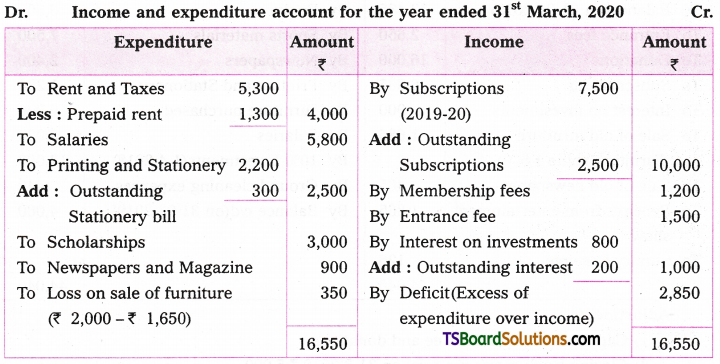

From the following receipts and payments account prepare the income and expenditure account for the year ended 31st March 2020.

Other Information :

- Outstanding subscriptions for the year 2019-20 Rs. 2,500.

- Prepaid Rent Rs. 1,300.

- Outstanding Stationery bill Rs. 300.

- Cost of Investments Rs. 10,000. Interest rate 10%

- Capitalize the donations.

Answer:

Working Notes :

1) Purchase of furniture, Govt. Bonds are capital expenditures these are to be recorded in balance sheet as assets.

2) Current year 2019-20 subscriptions has to be treated as a revenue income.

3) Loss on sale of furniture :

Book value of furniture sold Rs. 2,000

Less: Sale value Rs. 1,650

Loss on sale of furniture Rs. 350

Loss on sale of furniture is revenue expenditure. It is shown in income and expenditure account debit side.

4) Outstanding interest on investments

Interest on Investments for the year = 10,000 x 10/100 = Rs. 1,000

Interest on Investment = Rs. 1,000

Less: Interest received = 800

Less: Outstanding interest on investments 200

Outstanding interest on Investments Rs. 200/- to be added to interest received credit side of income expenditure account.

5) Membership fees and entrance fees are small amounts treated as revenue incomes shown in credit side of income and expenditure account.

![]()

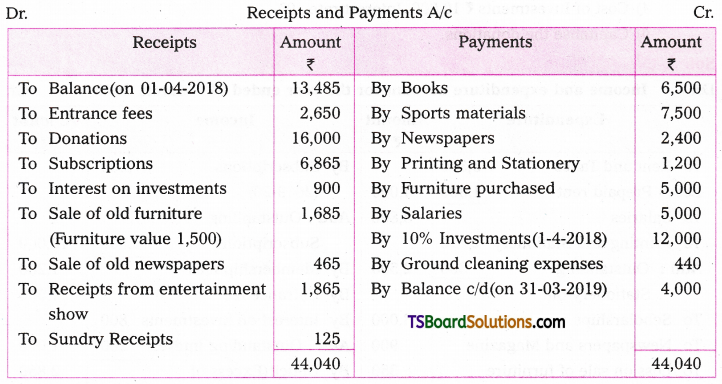

Question 6.

From the following receipts and payments account prepare the income and expenditure account of Kama Reddy Cricket Club for the year ending 31-03-2019.

Adjustments :

- Capitalize the entrance fee and donations.

- Closing stock sports material on 31-3-2019 t 5,000.

- Outstanding subscriptions Rs. 2,135 for the year 2018-19.

Answer:

Working Notes :

1) Purchase of furniture Govt. Bonds are capital expenditure. These are to be recorded in the balance sheet as assets.

2) Calculation of depreciation on sports material :

Sports material purchased = Rs. 7,500

Less: Closing stock of sports material = Rs. 5,000

Depreciation on sports material = 2,500

It is shown in income and expenditure account debit side

3) Calculation of Interest on Investments:

Interest on Investments for the year = 12,000

Interest on Investments = Rs. 1,200

Less : Interest on Investments received = 900

Outstanding interest on Investments 300

It will be added credit side of income and expenditure a/c to interest on investments.

4) Profit on sale of old furniture:

Old furniture sale value = 1,685

Less: Old furniture book value = 1,500

Profit on sale old furniture = 185

Profit on sale of old furniture is treated as a revenue income. It is shown on credit side of income and expenditure account.

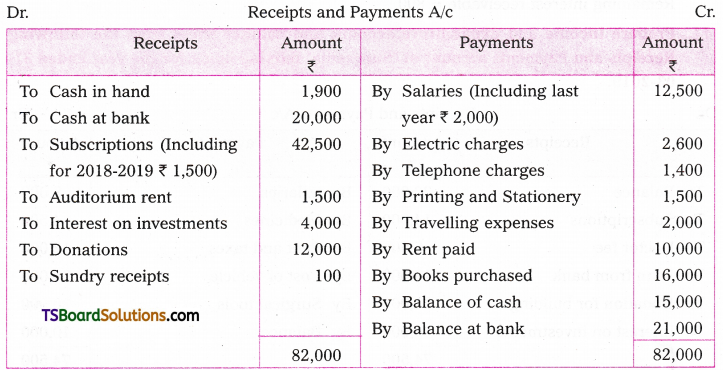

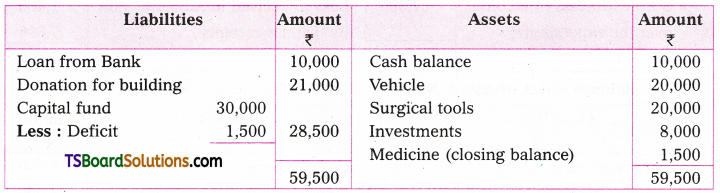

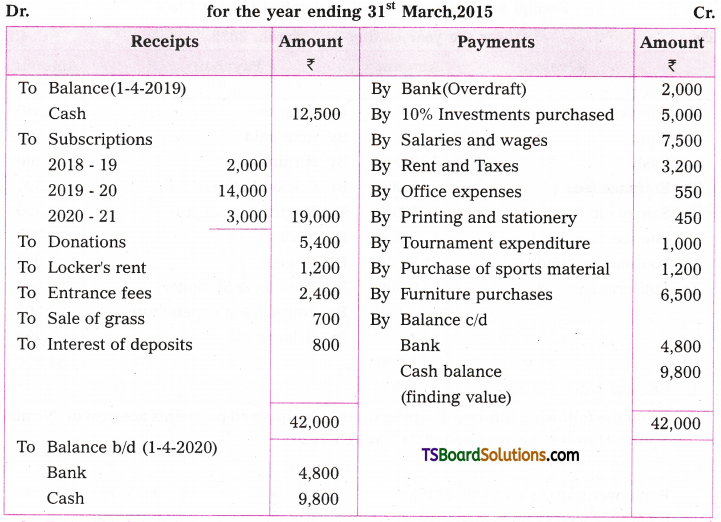

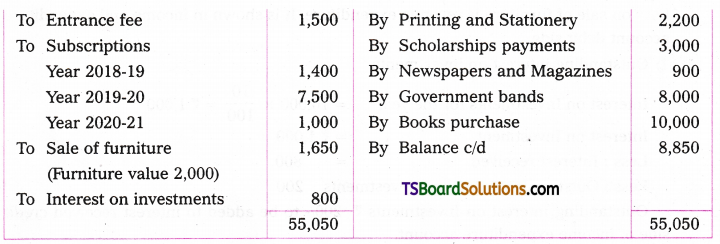

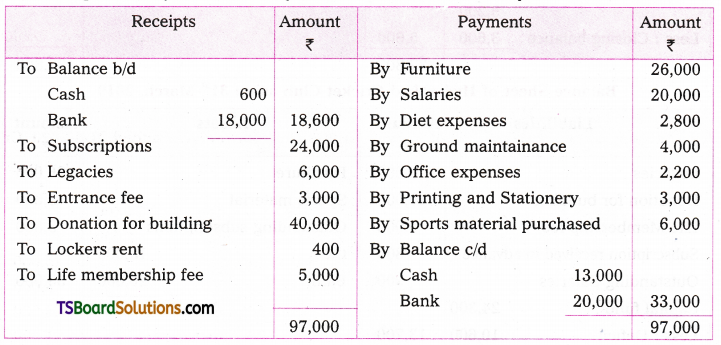

Question 7.

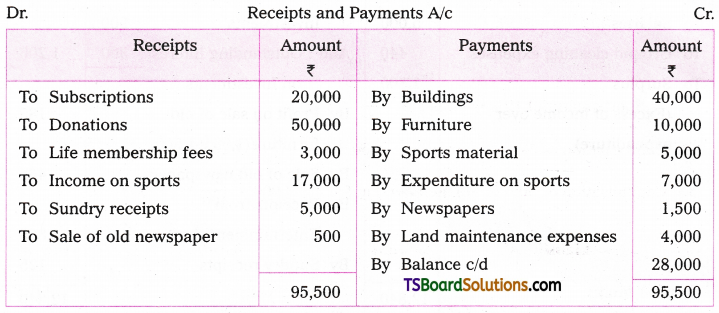

From the following receipts and payments account prepare the income and expenditure account and the balance sheet of Prime Sports Club, Hyderabad.

- Capitalise the 50% of donations and life membership fee.

- Outstanding subscriptions Rs. 5,000.

- Provide for depreciation on furniture and buildings 5% and on sports material 10%.

Answer:

Working Notes :

Calculation of depreciation :

a) Building 5% = Rs. 40,000 x 5/100 = Rs. 2,000

b) Furniture 5% = Rs. 10,000 x 5/100 = Rs. 500

c) Sports material 10% = Rs. 5,000 x 10/100 = Rs. 500

Capitalisation of 50% of donations = Rs. 50,000 x 50/100 = Rs. 25,000

Capitalisation of 50% of life membership fee = Rs. 3,000 x 50/100 = Rs. 1,500

![]()

Balance Sheet of Prime Sports Club, Hyderabad

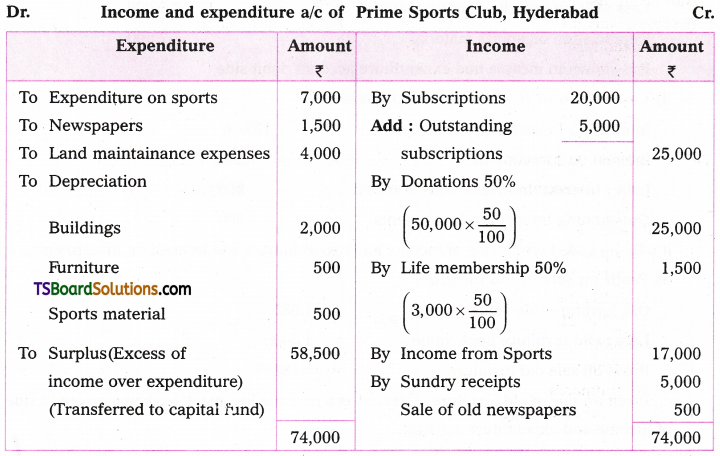

Question 8.

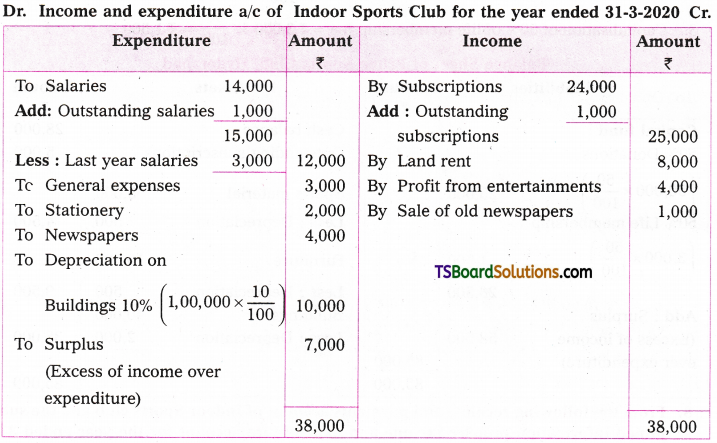

From the following receipts and payments account of Indoor Sports club and the sub joined information prepare income and expenditure account for the year ended 31 March, 2020.

Other Information :

- The club has 50 members each paying an annual subscription of Rs. 500, subscriptions outstanding for the year 2018-19 were Rs. 2,500.

- For the year 2019-20, salaries outstanding amounted Rs. 1,000, the salaries paid during current year include Rs. 3,000 for last year.

- On 01-04-2019, the club owned building valued Rs. 1,00,000, Furniture Rs. 10,000. Books Rs. 10,000, capital fund Rs. 1,33,000.

- Buildings are to be depreciated @ 10%.

Answer:

Indoor Sports Club Balance Sheet as on 31-03-2020

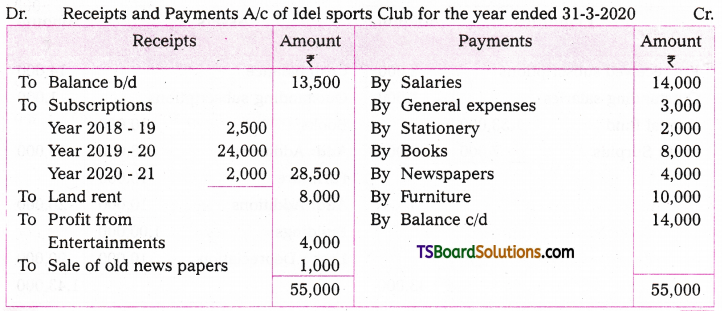

Question 9.

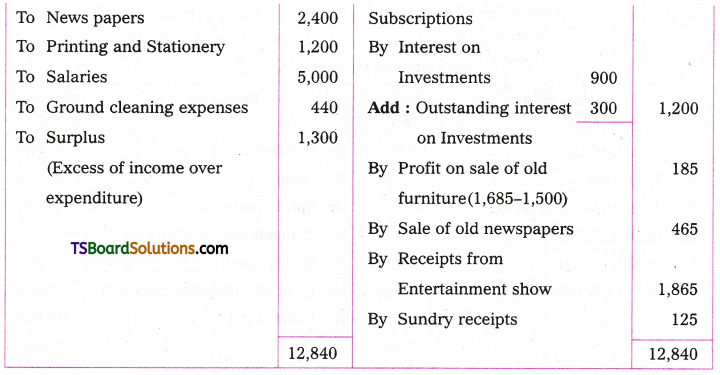

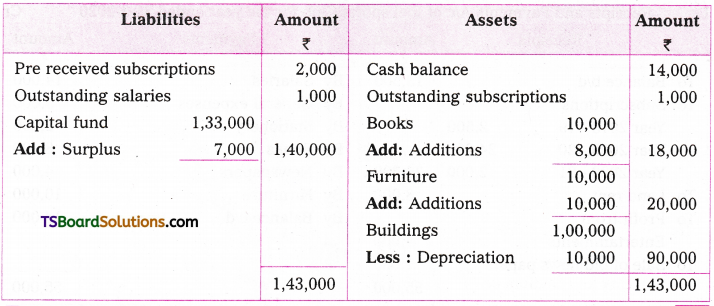

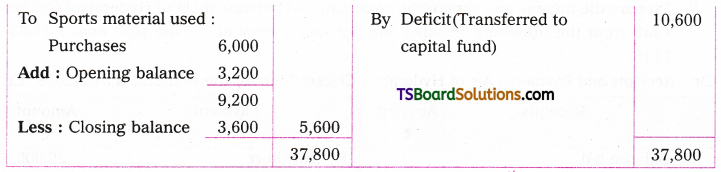

Prepare the income and expenditure account and balance sheet of Hyderabad Cricket Club from the following receipts and payments account for the year ended 31-03-2019.

Subscriptions due on 31-03-2018 — Rs. 3,200

Subscriptions due on 31-03-2019 — Rs. 3,800

Subscriptions received in Advance — Rs. 800

Salaries include Rs. 700 for the year 2017-18

Outstanding for the year 2018-19 — Rs. 900

Sports material on 31-3-2018 — Rs. 3,200

Sports material on 31-3-2019 — Rs. 3,600

Capital fund on 31-3-2018 — Rs. 24,300

Answer:

Balance Sheet of Hyderabad Cricket Club as on 31st March, 2019

![]()

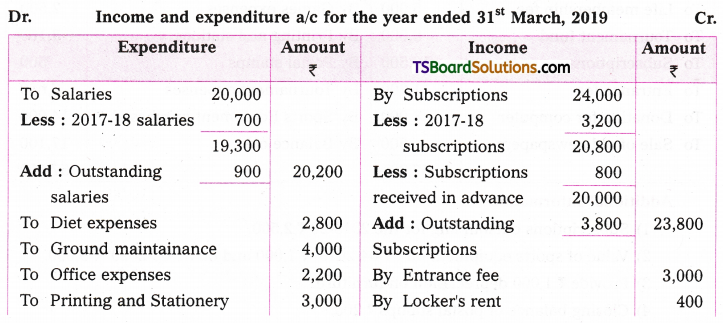

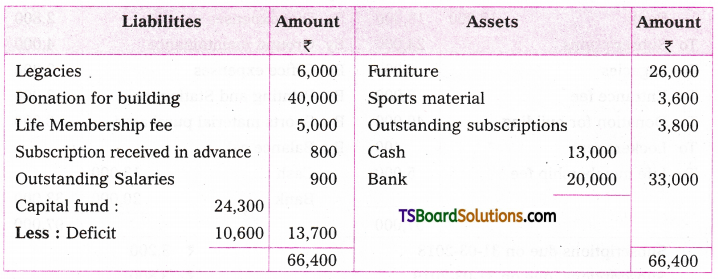

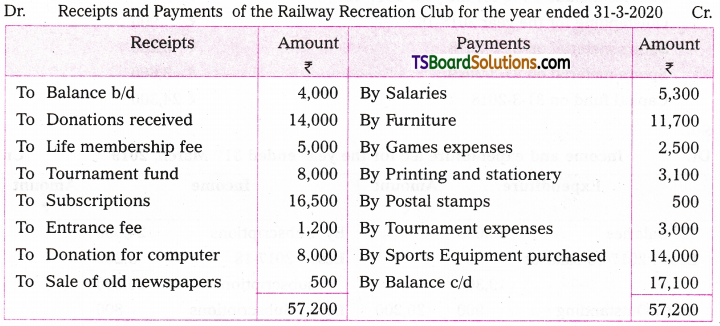

Question 10.

Receipts and payments of the Railway Recreation Club for the year ended 31st March, 2020.

Additional Information :

- Subscriptions outstanding for the 2019-20 Rs. 2,500.

- Value of sports equipment on 01-04-2019 Rs. 1,000 and on 31-03-2020 Rs. 9,000.

- Provide Rs. 1,000 depreciation on furniture.

- Closing balance of postal stamps Rs. 200.

- Capitalise half of the entrance fee

- Capital fund on 01-04-2019 Rs. 5,000.

Prepare the Income and Expenditure account and Balance sheet of the club as on 31-03-2020.

Answer:

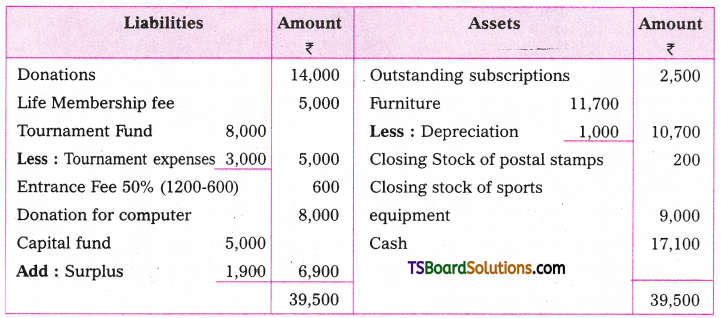

Railway Recreation Club Balance Sheet as on 31st March, 2020

![]()

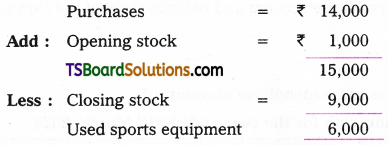

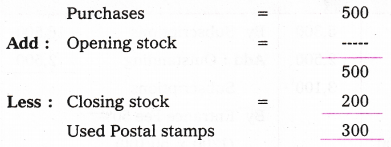

Working Notes :

1. Calculation of Sports equipment used : (Depreciation)

2. Calculation of postal stamps used :

3. Donations received treated as capital income.