Telangana TSBIE TS Inter 2nd Year Accountancy Study Material 6th Lesson Retirement and Death of a Partner Textbook Questions and Answers.

TS Inter 2nd Year Accountancy Study Material 6th Lesson Retirement and Death of a Partner

Very Short Answer Questions

Question 1.

State how a partner may retire from partnership firm.

Answer:

1. An existing partner may retire from a firm due to many factors such as old age, better business prospects elsewhere, differences with other partners, health problems etc.

2. According to Section 32(i) of the partnership Act 1932, a partner may retire

a) With the consent of all other partners,

b) In accordance with an express agreement with the partners.

c) By circulating a written notice among other partners, incase of partnership will.

![]()

Question 2.

What is Ratio of Gaining?

Answer:

- The ratio at which the share of retiring partner is taken by the continuing partners is called Ratio of Gaining.

- Ratio of Gaining = New Profit sharing Ratio – Old profit sharing ratio

Question 3.

Why ratio of gaining is to be ascertained?

Answer:

- Calculation of ratio of gaining is very important because, the share of goodwill to be paid to the retiring partner, shall be contributed by the remaining partners in their respective share of gaining.

- The more the gain, the more the goodwill, one has to contribute. The less the gain, the less the goodwill one has to contribute.

Question 4.

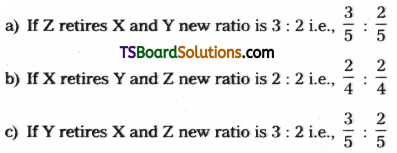

X, Y and Z are partners sharing profits and losses in the ratio of 3: 2: 2. Calculate new profit sharing of;

a) X and Y if Z retires from the business.

b) Y and Z if X retires from the business.

c) X and Z if Y retires from the business.

Answer:

XYZ profit & loss ratio = 3:2:2

Question 5.

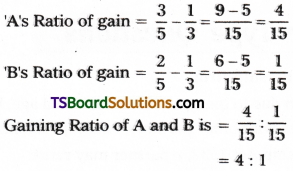

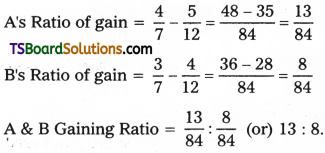

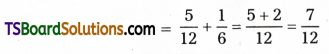

A, B and C are partners sharing profits and losses equally. Mr. C retires from the business A and B decided to continue the business and sharing profits and losses in the ratio of 3: 2 respectively. Calculate the ratio of gaining of A and B.

Answer:

AB & C profit sharing ratio = 1:1:1

A & B new profit sharing ratio = 3:2

Ratio of Gaining = New Ratio – Old ratio.

Question 6.

P, Q and R are partners sharing profits and losses in the ratio of 4: 3: 2 respectively. R retires from the business and his share is purchased by P and Q in the ratio of 2:1. Calculate New Profit sharing ratio of P and Q.

Answer:

P, Q, R old profit sharing ratio = 4:3:2 i.e., 4/9: 3/9: 2/9

R’s share of profit 2/9 being purchased by

New profit sharing ratio of P = P’s old share + proportion of R’s share purchased

![]()

New profit sharing ratio of Q = Q’s old share + proportion of R’s share purchased

![]()

The new profit sharing ratio of P & Q is 16/27: 11/27 (or) 16: 11.

Question 7.

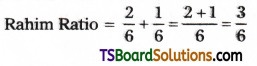

Ram, Rahim and Akbar are partners sharing profits and losses in the ratio of 3: 2: 3 respectively. Akbar retires from the business and Rahim purchased the share of Akbar. Calculate new profit sharing ratio of Ram and Rahim.

Answer:

Ram, Rahim and Akbar profit sharing ratio = 3:2:1 (or) 3/6: 2/6: 1/6

Rahim purchased Akbar shares then

Ram: Rahim New Profit sharing Ratio = 3/6: 3/6 = 3: 3 = 1: 1.

![]()

Question 8.

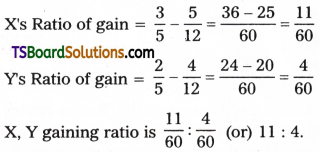

X, Y and Z are partners with profit sharing ratio of 5: 4: 3 respectively. Z retires from the business. X and Y decided to share future profits in the ratio of 3: 2. Calculate the ratio of gaining of X and Y.

Answer:

X, Y and Z profit sharing ratio = 5:4:3

X and Y new (future) profit ratio = 3:2

Gaining ratio = New ratio – Old ratio.

Question 9.

A, B and C are partners sharing profits and losses at the ratio of 5: 4: 3 respectively. C retires from business. A and B decided to continue the business and sharing future profits in the ratio of 4: 3. Calculate the ratio of gaining of A and B.

Answer:

A, B and C profit sharing ratio = 5:4:3

A and B new (future) profit ratio = 4:3

Gaining ratio = New ratio – Old ratio.

Question 10.

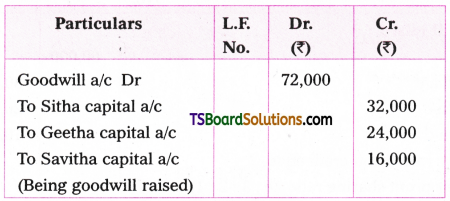

Sitha, Geetha and Savitha are partners sharing profits and losses in the ratio of 4: 3: 2 respectively. Savitha retired from the business. The value of goodwill is estimated at Rs. 72,000. There is no goodwill balance in the books. Create/Raise goodwill account in the books.

Answer:

Sitha, Geetha and Savitha profit sharing ratio = 4:3:2

When the Goodwill raised worth Rs. 72,000.

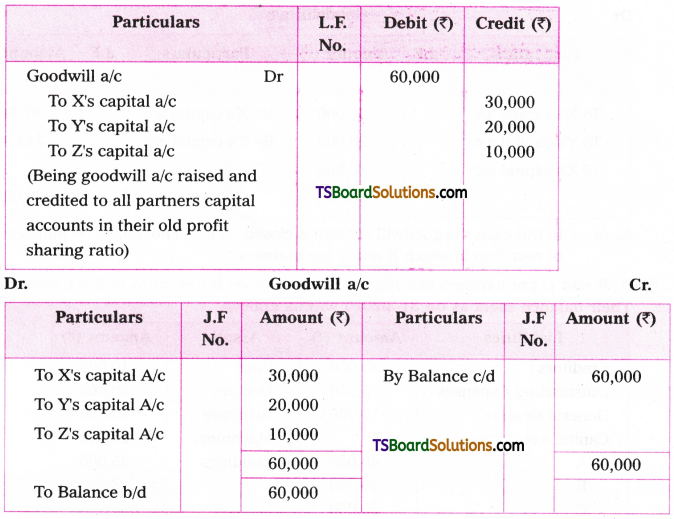

Journal entry when goodwill is raised:

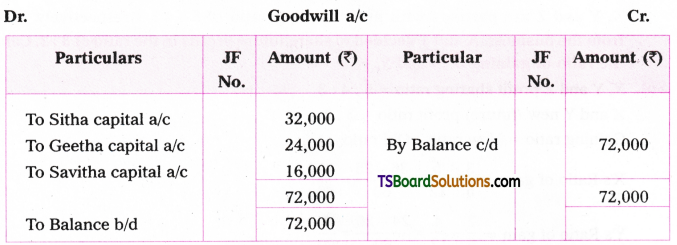

Question 11.

Vani, Rani, Radha are partners sharing profits and losses equally. Radha retires from the business. Goodwill of the firm is valued at Rs. 40,000. Goodwill account showing a balance of Rs. 10,000 in the books. The pass journal entry to raise goodwill in the books.

[Hint: Goodwill to be created is Rs. 30,000 only as goodwill existing in the books is Rs. 10,000].

Answer:

Journal entries when goodwill is raised:

![]()

Question 12.

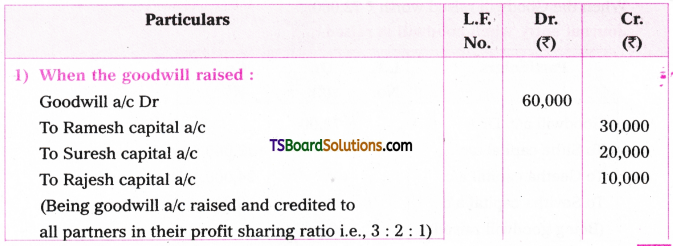

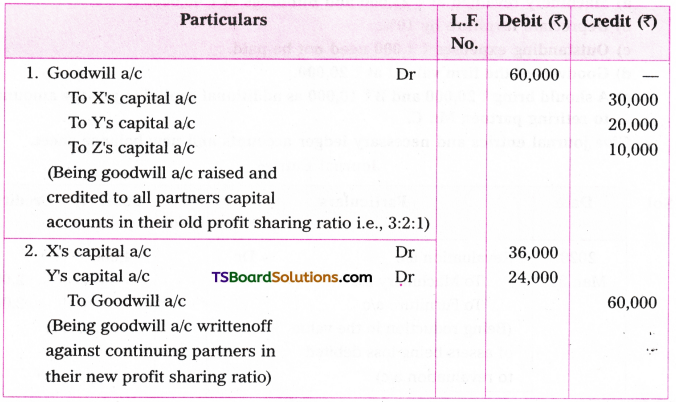

Ramesh, Suresh and Rajesh are partners sharing profits and losses in the ratio of 3:2:1 respectively. Suresh retires from the business. Ramesh and Rajesh decided to continue the business and share future profits in the ratio of 3: 2, goodwill of the firm valued at Rs. 60,000. Give necessary journal entries to create and writeoff goodwill.

Answer:

Journal Entries when goodwill is raised and written-off

Question 13.

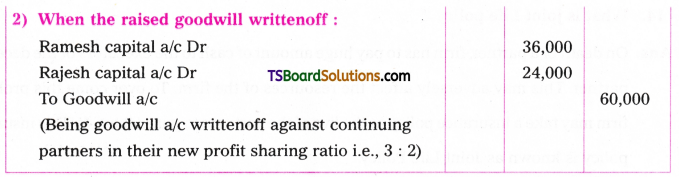

X, Y and Z are partners sharing profits and losses equally. Goodwill of the firm is valued at Rs. 45,000. X retires from the business. Y and Z divided to continue the business by sharing future profits and losses in the ratio of 3: 2 respectively. Give necessary journal entries without raising goodwill account.

Answer:

X, Y, Z’s old profit sharing ratio =1:1:1

Y and Z new profit sharing ratio = 3:2

Ratio of gaining = New ratio – Old ratio

Goodwill of the firm is Rs. 45,000

The share of goodwill payable to ‘X’ is 45,000 x 1/3 = 15,000 Rs. 15,000 payable to ‘X’ will be contributed by Y and Z in their ratio of gaining 4:1.

Journal Entries without raising Goodwill account

Question 14.

What is joint Life policy?

Answer:

On death of a partner, firm has to pay huge amount of cash to the executors of the deceased partner. This may adversely affect the resources of the firm. To over come this problem, firm may take a insurance policy as the live of the partners to guarclthe risk. This insurance policy is known as Joint Life Policy.

In the event of death of any partner, the insurance company pays the sum assured to the firm. In this way the firm add comes the problem of setting the amount due to the decreased partner.

Question 15.

How do you ascertain share of profit/loss payable to deceased partner?

Answer:

- Share of profit/loss payable to deceased partner is ascertain till the date of his/her death during the current financial year.

- Partnership deed contains a provisions for ascertainment of profit in the event of death of partner.

- Accordingly, the share of profit/loss of deceased partner will be ascertained and paid to legal representatives of deceased partner along with another amount due.

Question 16.

What are the amounts payable to deceased partner?

Answer:

The amount payable to deceased partner includes:

- Capital contributed.

- Share in undistributed profits/losses.

- Share in accumulated reserves.

- Share in the goodwill of the firm.

- Share in profit/loss on revaluation of Assets and Liabilities.

- Share in profit/loss of the business till the date of death.

![]()

Question 17.

State the methods of accounting for payment of share of profit to deceased partner.

Answer:

After ascertaining the profit, there are two ways of recording the profit ascertained till the date of death.

1. Distribute the profit among all the partners in their respective old profit-sharing ratio.

2. Record the share of profit payable to decreased partner only in such a case the journal entry is

3. Sometimes, the continuing partners, instead of debiting to profit and loss a/c. They may contribute the share of profit of decreased partner by debiting to their capital accounts in their gaining ratio.

The entry is —>

Textual Problems

When Goodwill is created / Raised:

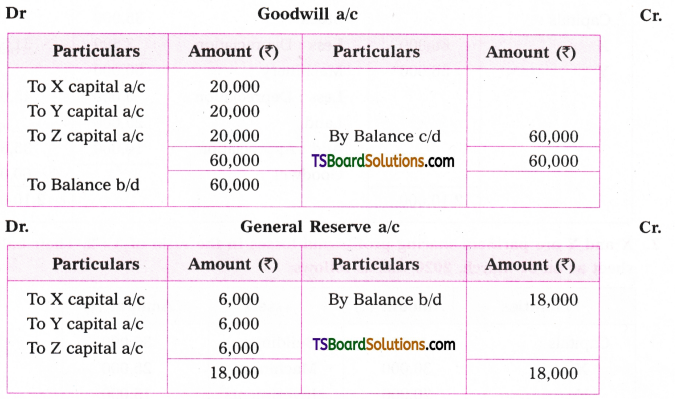

Question 1.

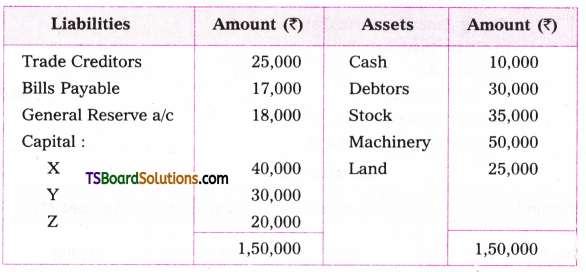

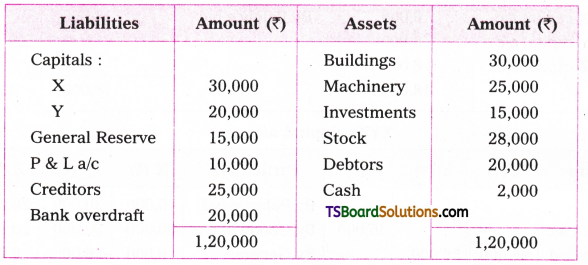

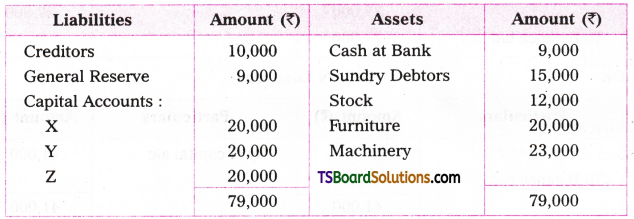

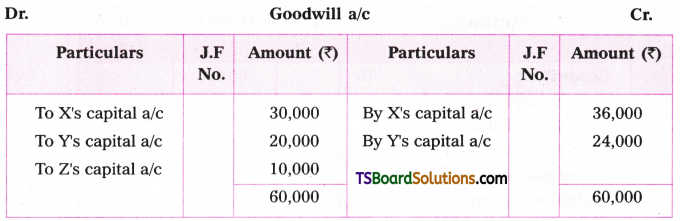

X, Y and Z are partners sharing profits and losses equally. Their balance sheet as on 31 March 2020 was as under;

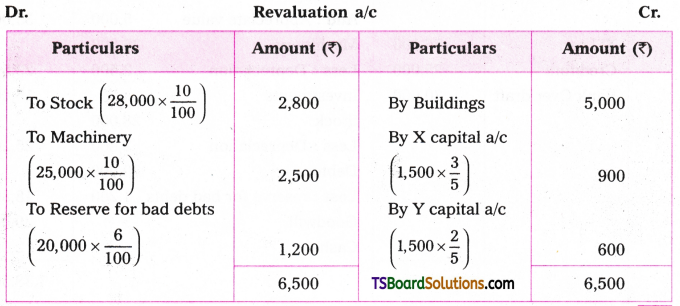

On the above date, Z retires from the business on the following conditions;

a) Stock and Machinery to be depreciated by 10%.

b) Provided for bad debts @ 5% on debtors.

c) Land revalued at Rs. 35,000.

d) Goodwill of the firm valued at Rs. 60,000.

Give necessary journal entries, ledger accounts and opening balance sheet of X and Y.

Answer:

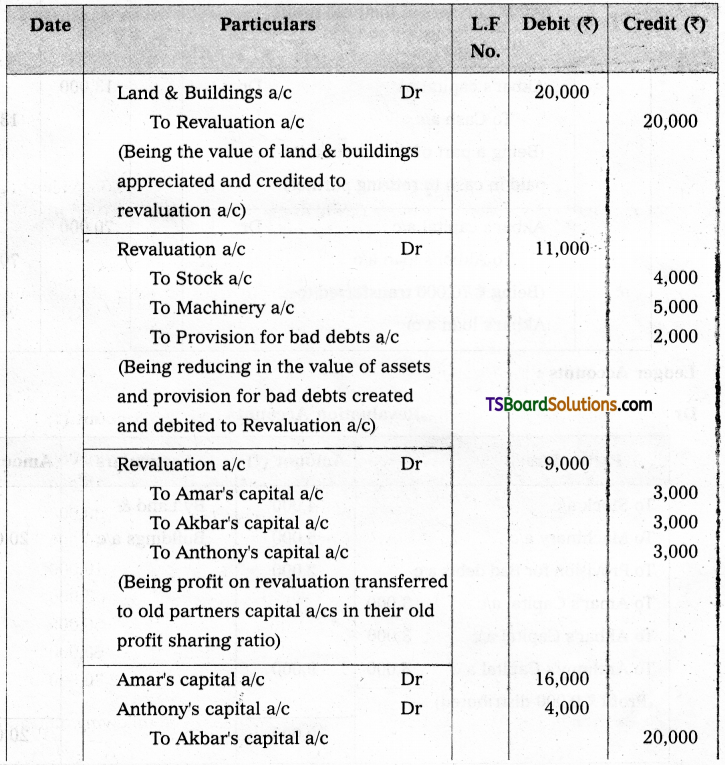

Journal entries in the books of X, Y, Z partnership firm.

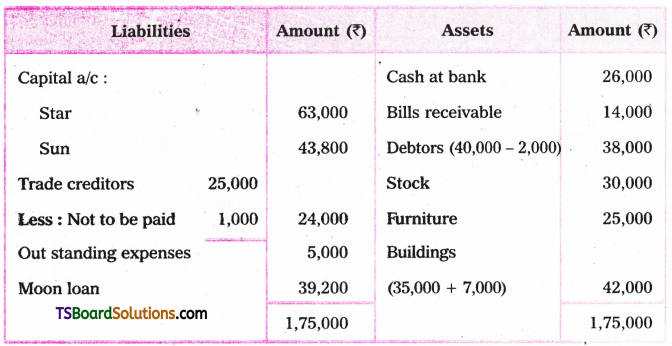

X and Y Balance Sheet as on 31 – 3 – 2020

![]()

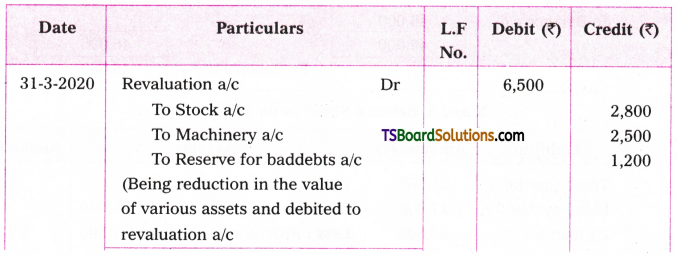

Question 2.

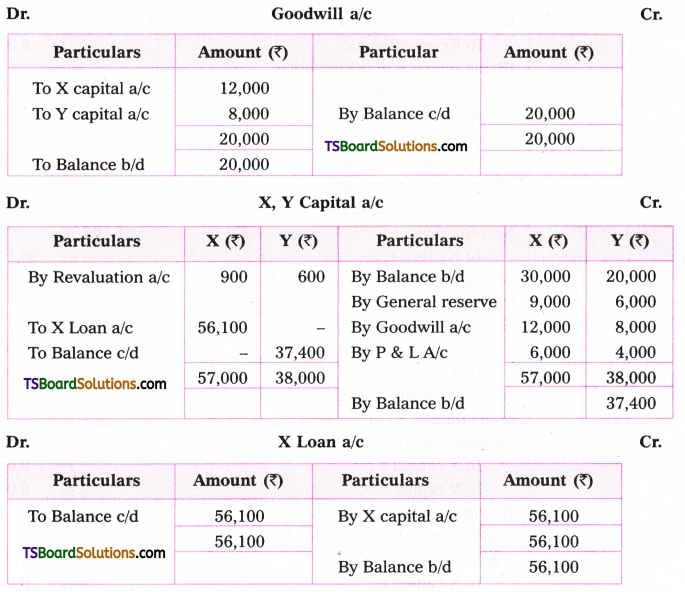

X and Y are partners sharing profits and losses in the ratio of 3: 2. Their balance sheet as on 31 March, 2020 was as follows;

X retires from the business on the following terms:

a) Goodwill is valued at Rs. 20,000.

b) Depreciate stock and machinery by 10%.

c) Provide for bad debts at 6%.

d) Buildings are valued at Rs. 35,000.

Give Journal entries, necessary Ledger accounts and the Balance sheet.

Answer:

Journal entries in the books of X, Y, Z partnership firm.

Balance Sheet of Y as on 31 – 3 – 2015

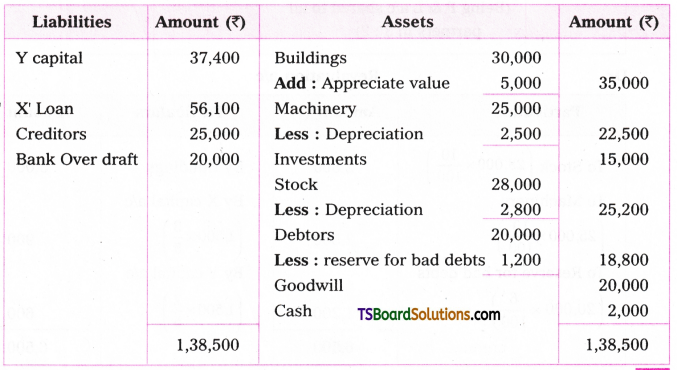

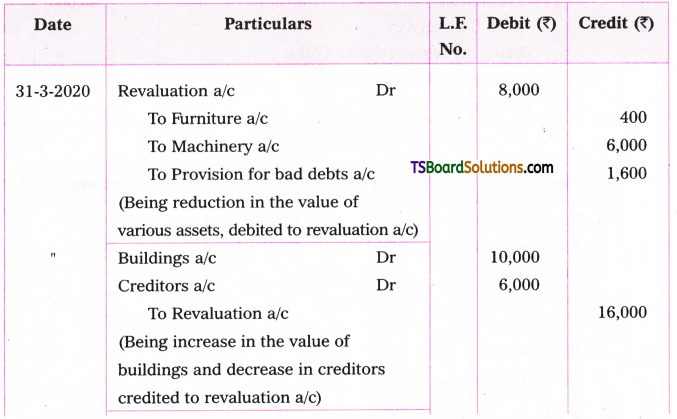

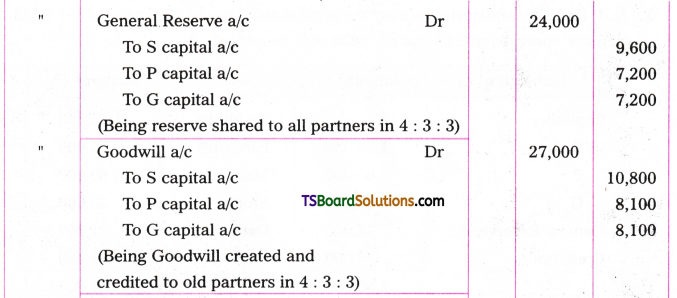

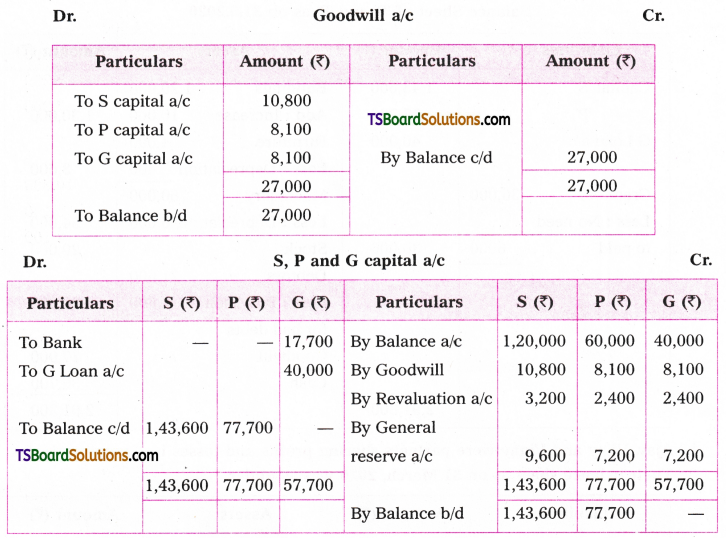

Question 3.

S, P and G were partners sharing profits and loss in the ratio of 4: 3: 3. Their balance sheet as on 31st March, 2020 was as under;

G Retires from the business on the following terms:

a) Buildings valued at Rs. 1,30,000.

b) Depreciate Furniture and Machinery by 10%.

c) Provide for bad debts at Rs. 1,600.

d) Creditors Rs. 6,000 need not be paid.

e) Goodwill valued at Rs. 27,000.

f) G will be paid Rs. 17,700 immediately and the balance is transferred to his loan account. Give journal entries, ledger accounts and balance sheet of S and R

Answer:

Journal entries in the books of S, P & G Partnership firm.

Balance Sheet of ‘S’ and P’ as on 31.3.2020

![]()

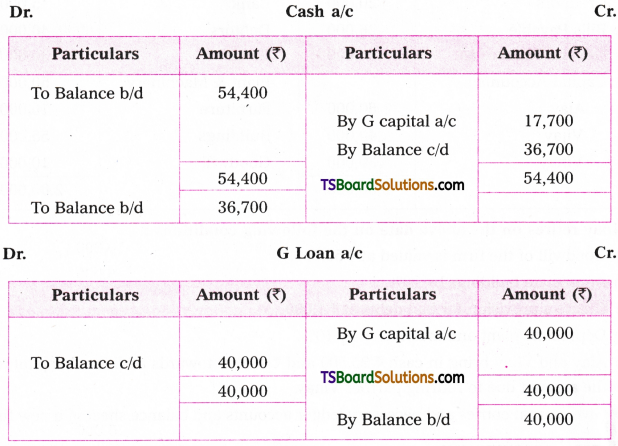

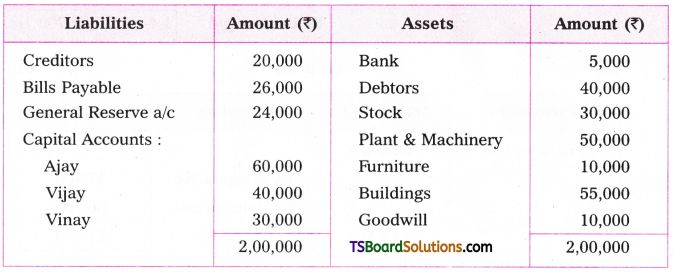

Question 4.

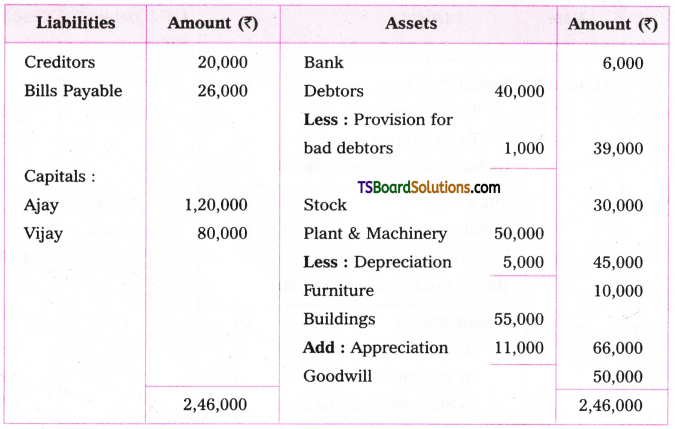

Ajay, Vijay and Vinay were partners sharing profits and losses in the ratio of 5:3:2. Their balance sheet as on 31 March, 2020 was as under.

Vinay retires on the above date on the following conditions:

a) Goodwill of the firm is valued at Rs. 50,000.

b) Appreciate buildings by 20%.

c) Create a provision for bad debts at Rs. 1,000.

d) Depreciate plant and machinery by 10%.

e) Ajay and Vijay bring in cash Rs. 25,500 and Rs. 19,300 towards additional capital to pay the amount due to retiring partner Vinay.

Give journal entries and necessary ledger accounts and balance sheet of a new firm.

Answer:

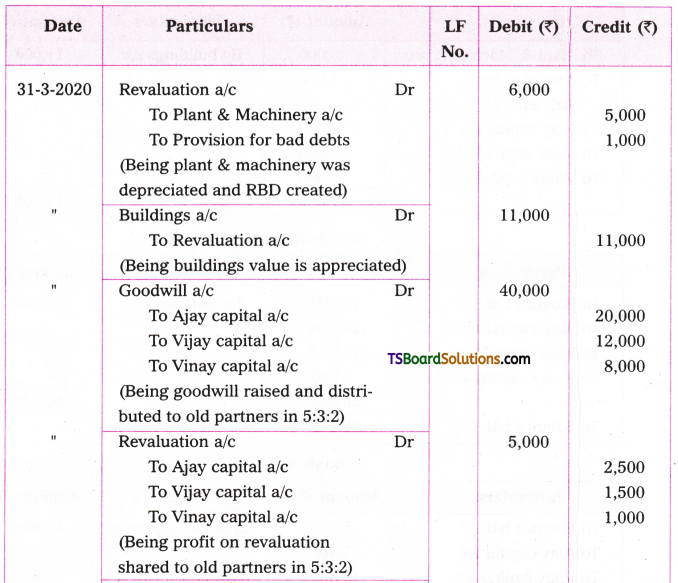

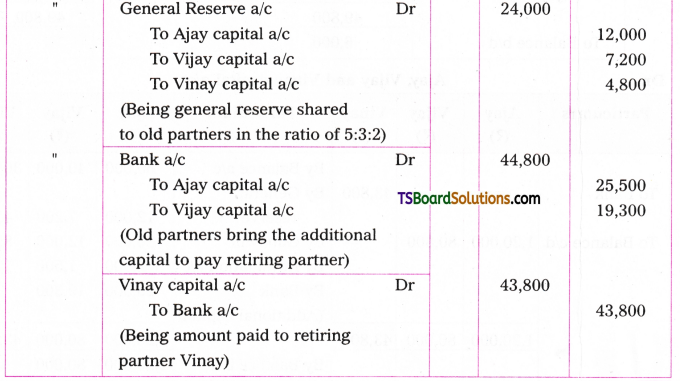

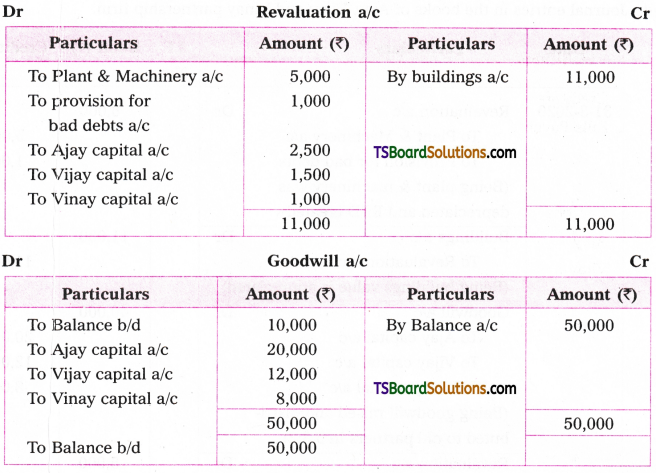

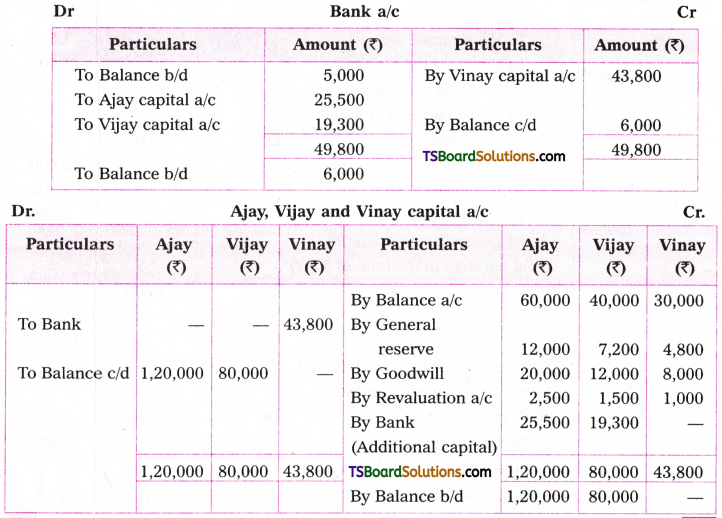

Journal entries in the books of Ajay, Vijay and Vinay partnership firm.

Ajay, Vijay Balance Sheet as on 31-3-2020

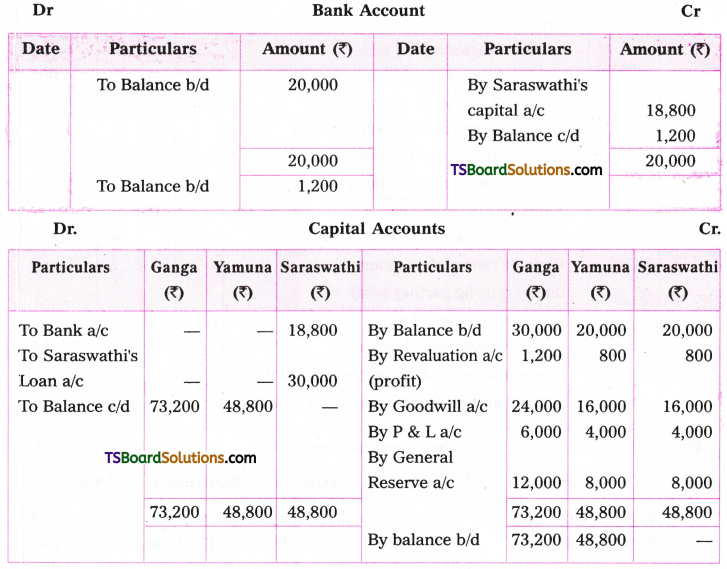

Question 5.

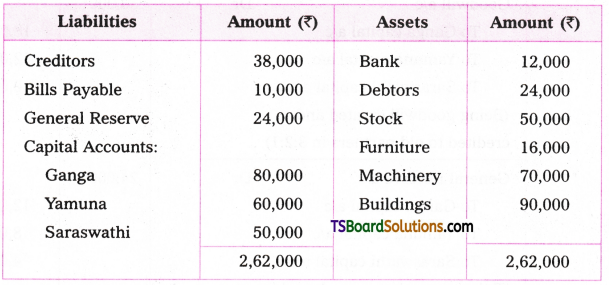

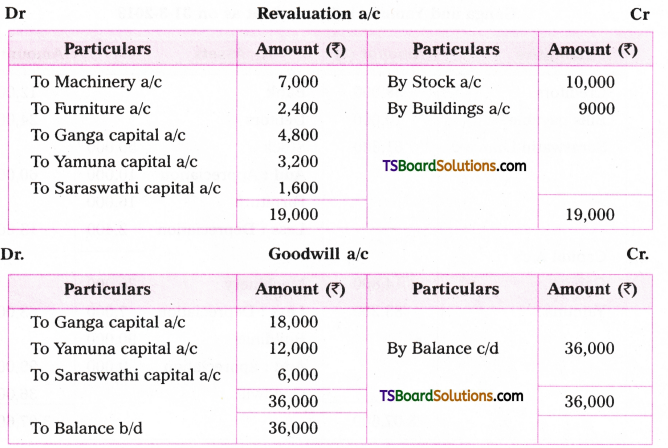

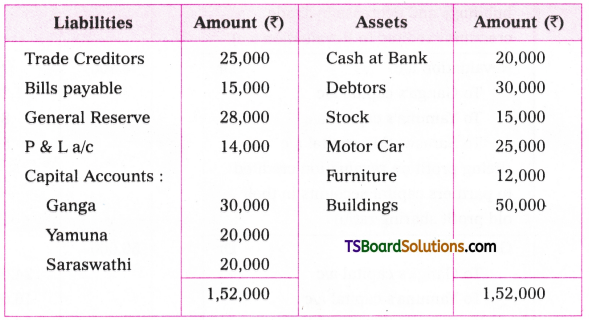

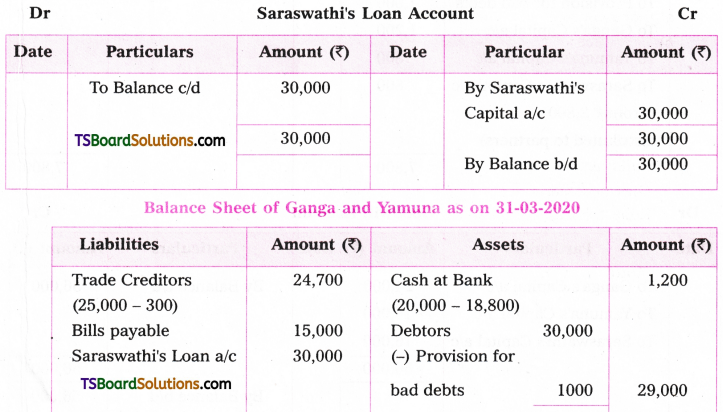

Ganga, Yamuna and Saraswathi are partners sharing profits and losses in the ratio of 3:2:1 respectively. Their balance sheet as on 31st March 2019 was under.

Saraswathi retired from the business on the following conditions:

a) Depreciate machinery by 10% and furniture by 15%.

b) Stock to be appreciated by 20%.

c) Buildings are to be appreciated by 10%.

d) Goodwill of the firm is valued at Rs. 36,000.

Write up necessary Journal entries, ledger accounts and balance sheet of new firm.

Answer:

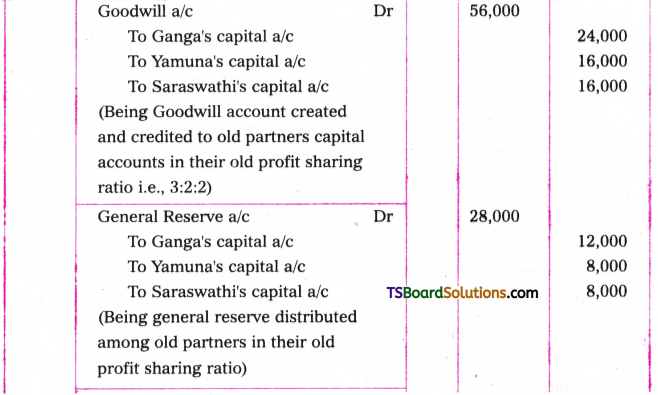

Journal entries in the books of Ganga, Yamuna and Saraswathi partnership firm.

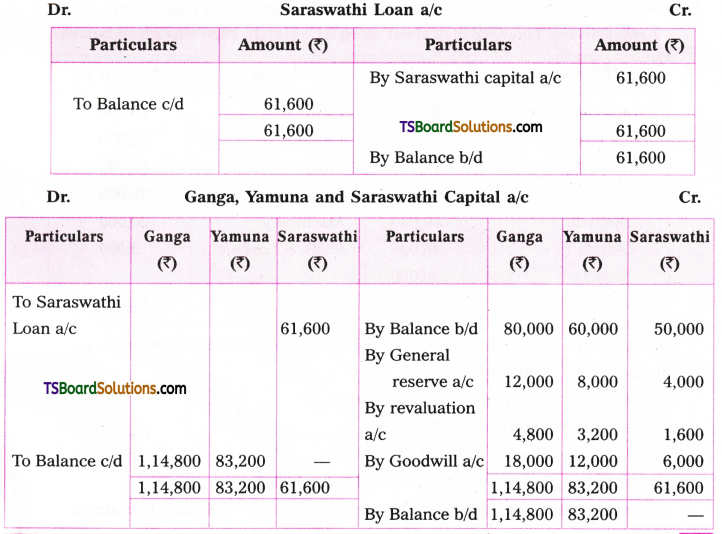

Ganga and Yamuna balance sheet as on 31-3-2019

![]()

Question 6.

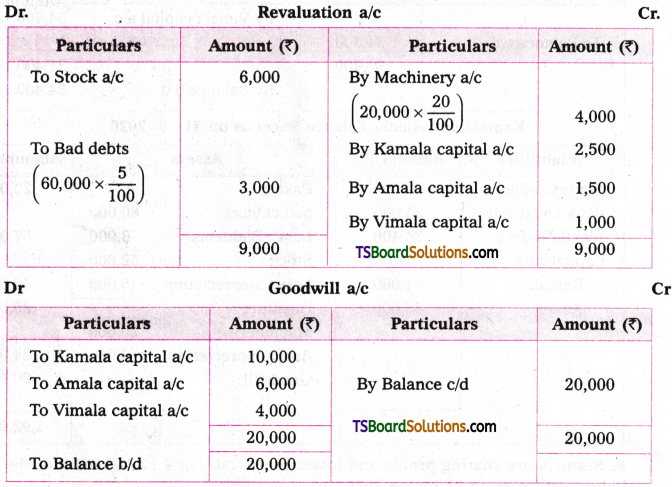

Kamala, Amala and Vimala were partners sharing profits and losses in the ratio of 5: 3: 2 respectively. Their balance sheet as on 31st March, 2020 was given below;

On the above date Vimala retired from the business on the following terms:

a) Appreciate Machinery by 20%.

b) Provide for Bad Debts @ 5% on debtors.

c) Stock to be depreciated by Rs. 6,000.

d) Goodwill is valued at Rs. 20,000.

e) Amount payable to Vimala transferred to her loan a/c.

Prepare necessary ledger accounts and balance sheet of Kamala and Amala.

Answer:

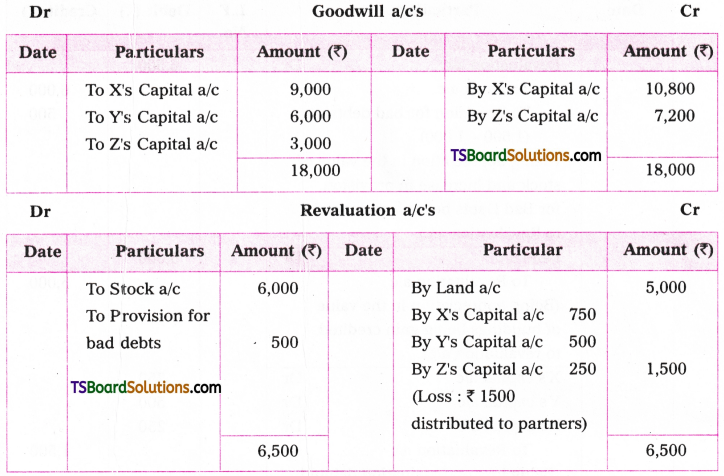

Ledger a/c’s in the books of Kamala, Amala and Vimala

Partnership firm as on 31-3-2020

Question 7.

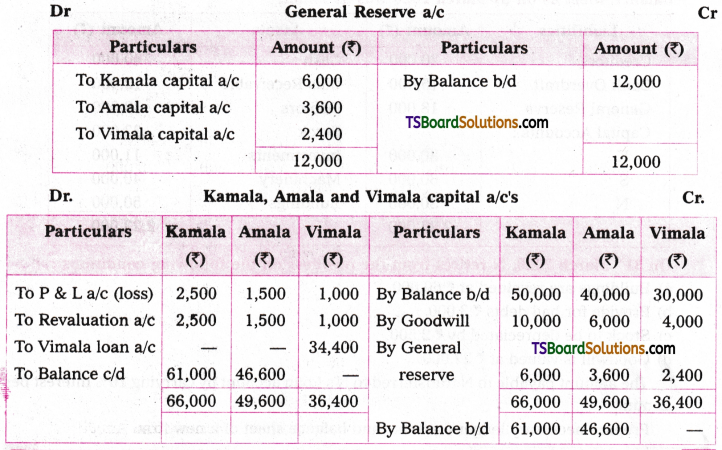

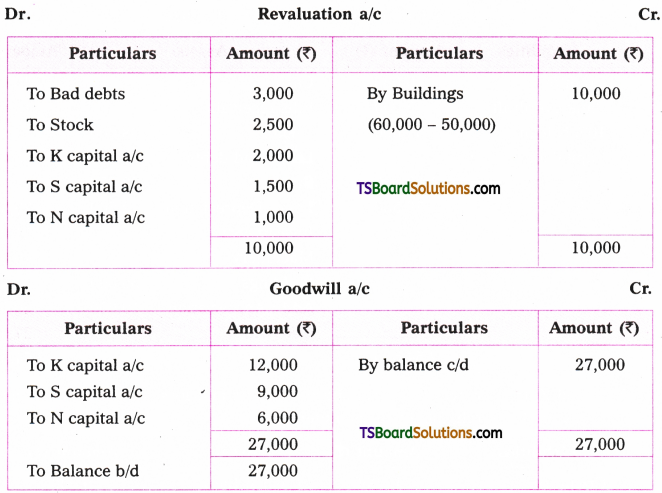

K, S and N are sharing profits and losses in the ratio of 4: 3: 2 respectively. Their balance sheet as on 31 March 2020 was as under;

On 31st March 2020, N retires from the business on the following conditions:

a) Buildings are revalued at Rs. 60,000.

b) Provide for bad debts Rs. 3,000.

c) Stock to be depreciated by Rs. 2,500.

d) Goodwill is valued at Rs. 27,000.

The amount payable to N transferred to N’s Loan account by carrying 10% Interest per annum.

Prepare necessary ledger accounts and balance sheet of a new firm.

Answer:

K, S Balance Sheet as on 31 – 3 – 2020

![]()

Question 8.

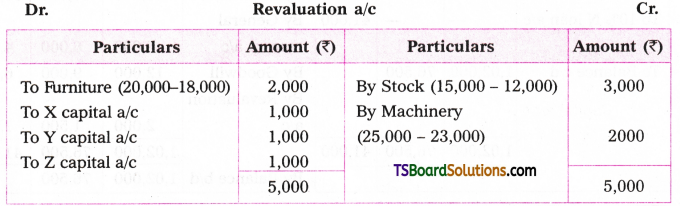

X, Y and Z are partners in a firm sharing profits and losses equally. Their balance sheet as on 31 March, 2020 was as under;

On the above date Mr. Z decided to retire from the business on the following terms:

a) The assets are to be revalued as under;

Stock Rs. 15,000; Furniture Rs. 18,000; Machinery Rs. 25,000.

b) Goodwill of the firm valued at Rs. 30,000.

Give necessary ledger accounts and balance sheet of X and Y.

Answer:

When Goodwill is created and written off:

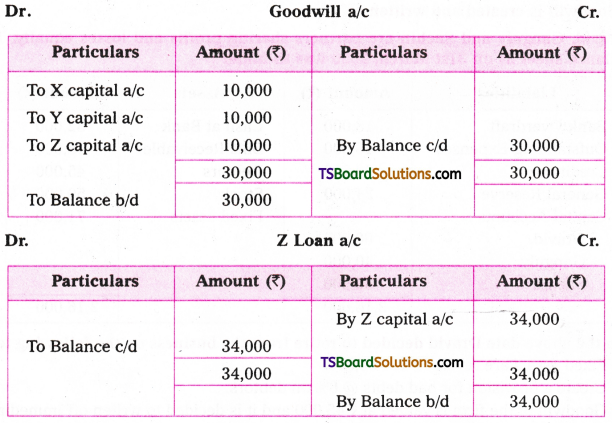

Question 9.

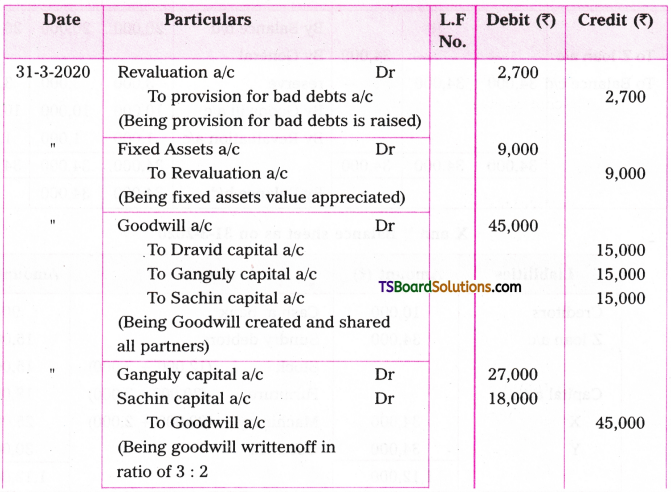

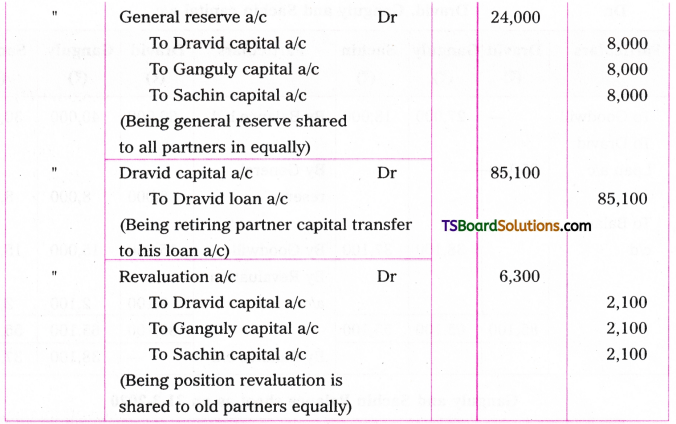

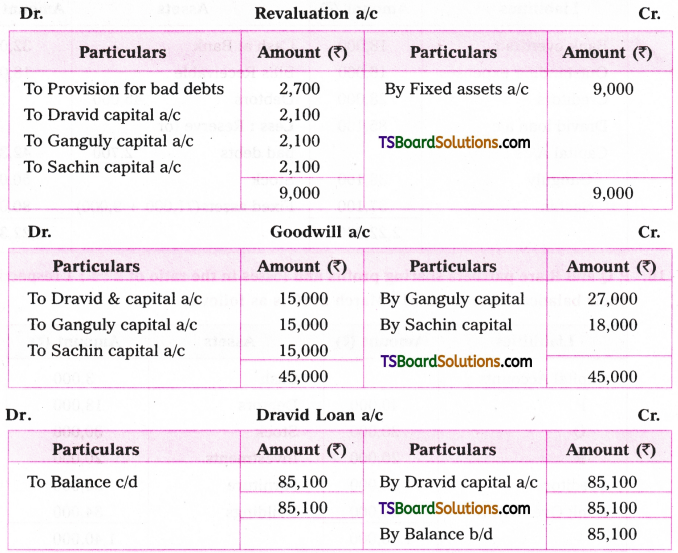

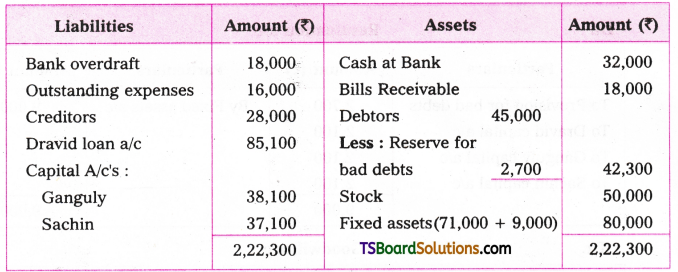

Dravid, Ganguly and Sachin are partners sharing profits and losses equally. Their balance sheet as on 31st March, 2020 was as under:

On the above date Dravid decided to retire from the business on the following terms.

a) Fixed assets are revalued at Rs. 80,000.

b) Create a provision for bad debts @ 6% on debtors.

c) Goodwill of the firm is valued at Rs. 45,000 and it is decided to writen off immediately.

d) Ganguly and Sachin will share future profits in the ratio of 3: 2 respectively.

Give necessary journal entries and ledger accounts and balance sheet of new firm.

Answer:

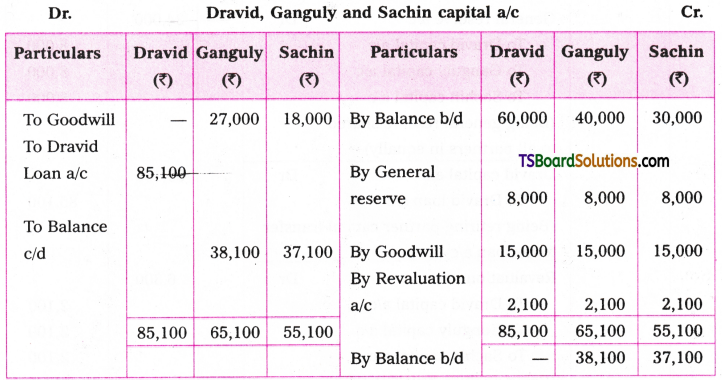

Journal entries in the books of Dravid, Ganguly and Sachin partnership firm.

Ganguly and Sachin Balance sheet as on 31-3-2020

![]()

Question 10.

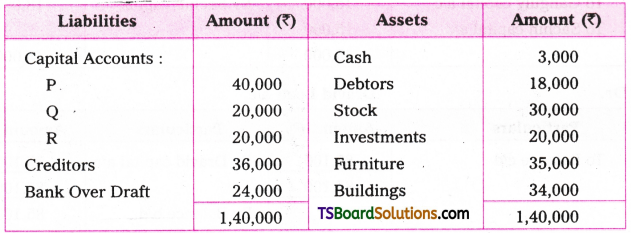

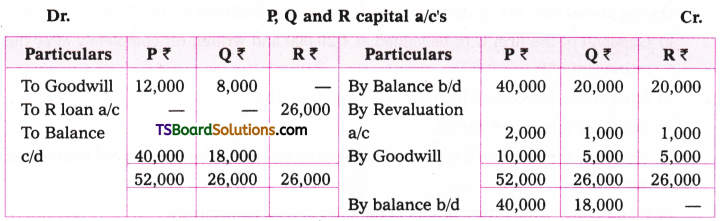

P, Q and R are partners sharing profits and losses in the ratio of 2: 1: 1 respectively. Their balance sheet as on 31st March 2020 is as follows;

On the above date Mr. R decides to retire from the business on the following terms;

a) Goodwill of the firm is to be valued at Rs. 20,000 and written off completely after the retirement of R.

b) Stock to be depreciated by 5% and Furniture by 10%.

c) Buildings valued at Rs. 43,000.

d) The amount payable to R is to be transferred to his loan a/c by carrying 6% interest per annum.

e) P and Q share the future profits in the ratio of 3: 2 respectively.

Give necessary ledger accounts and balance sheet of new firm.

Answer:

PQ Balance Sheet as on 31-3-2020

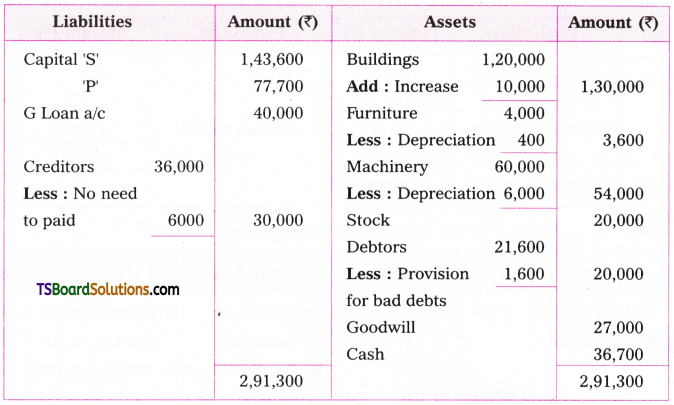

Question 11.

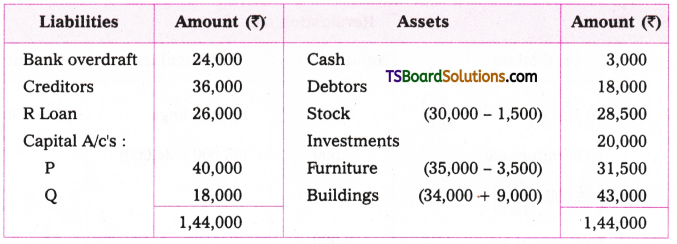

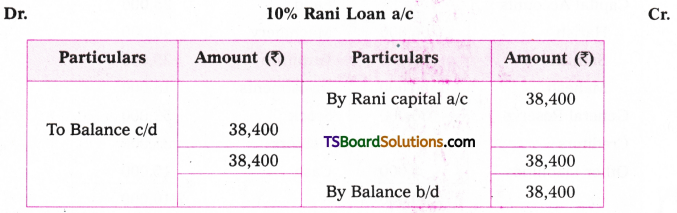

Raju, Rani and Prince are partners sharing profits and losses in the ratio of their capitals. Their balance sheet as on 31st March, 2020 was as under.

On the above date Rani retired from the business and Raju, Prince decided to continue the business sharing profits and losses in the ratio of 3: 2 respectively. The following are agreed;

a) Value of buildings to be appreciated by Rs. 10,000.

b) Depreciate machinery by Rs. 5,000 and stock by Rs. 2,000.

c) Goodwill of the firm valued at Rs. 10,000 and decided to write off immediately.

d) The amount due to Rani is to be transferred to her loan a/c by carrying 10% interest per annum.

Give necessary ledger accounts and balance sheet.

Answer:

Raju, Rani, Prince profit sharing ratio 50,000: 30,000: 20,000 5:3:2

Raju and Prince Balance Sheet as on 31-3-2020

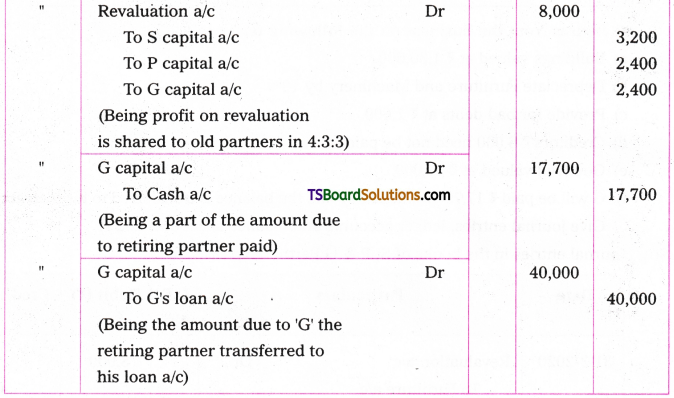

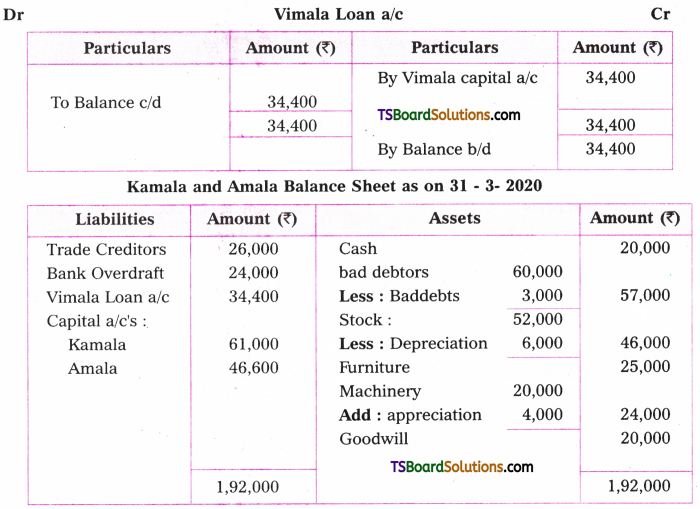

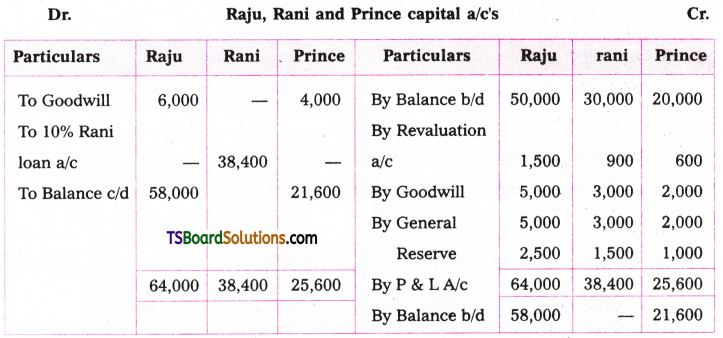

Question 12.

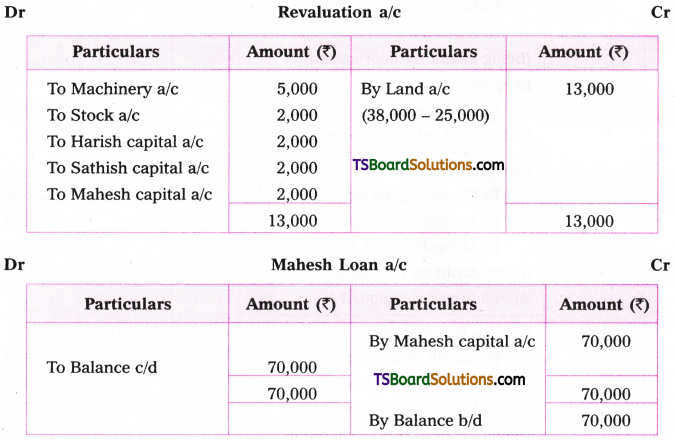

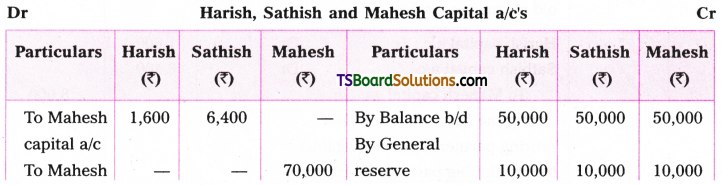

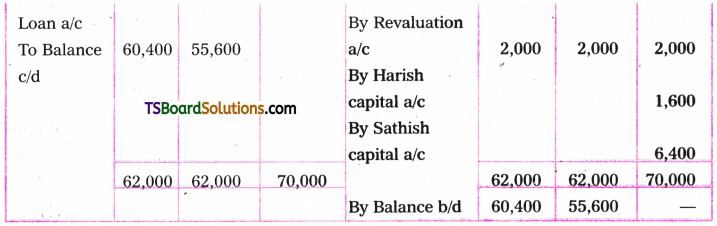

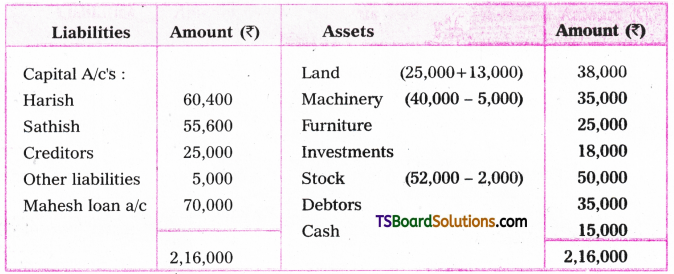

Harish, Sathish and Mahesh are partners sharing profits and losses equally. Their balance sheet as on 31 March 2020 was as under;

On the above date Mahesh retired from the business on the following terms;

a) Land is valued at Rs. 38,000.

b) Depreciate machinery by Rs. 5,000 and Stock by Rs. 2,000.

c) Goodwill of the firm valued at Rs. 24,000 and decided to give the Mahesh’s share of goodwill without raising goodwill in the books.

d) Harish and Sathish share future profits in the ratio of 2: 3 respectively.

Give necessary journal entries and ledger accounts and balance sheet.

Hint: Goodwill payable to retiring partner is Rs. 8,000, contributed in the ratio of gaining i.e., 1:4 between Harish and Sathish.

Answer:

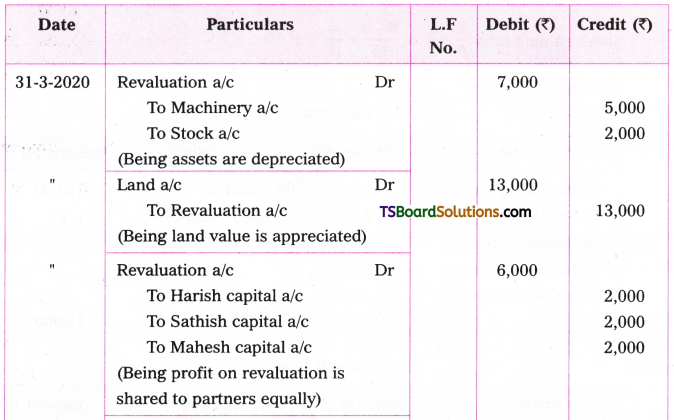

Journal entries in the books of Harish, Sathish and Mahesh partnership firm as on 31-3 2020.

Working Notes:

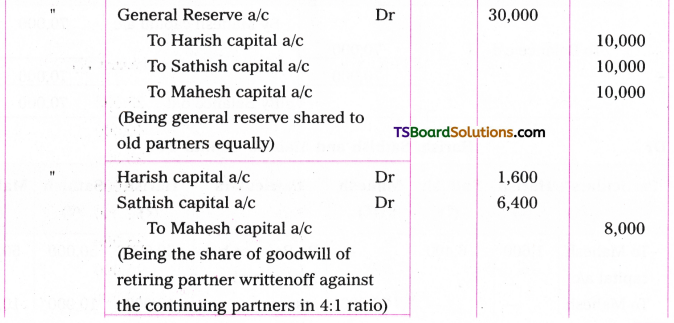

Calculation of Gaining Ratio = (New Ratio – Old Ratio)

Old ratio 1:1:1

Harish, Satish new Raju 2:3.

Gaining ratio =1:4.

Harish and Sathish Balance Sheet as on 31-3-2020

![]()

Question 13.

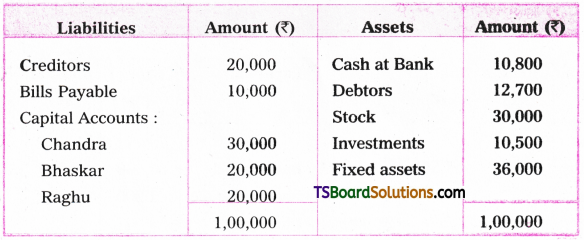

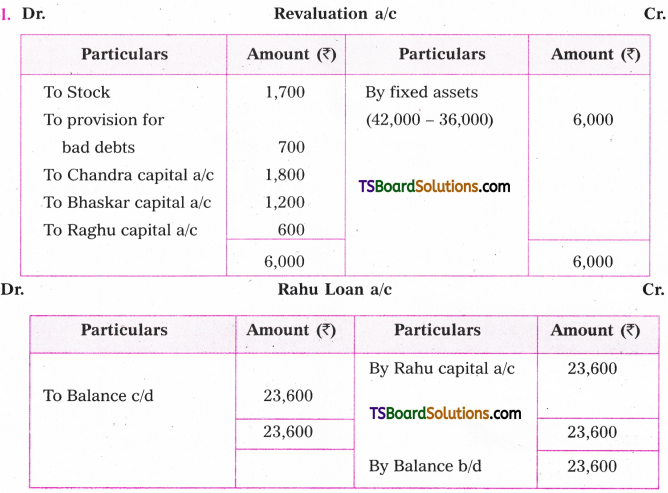

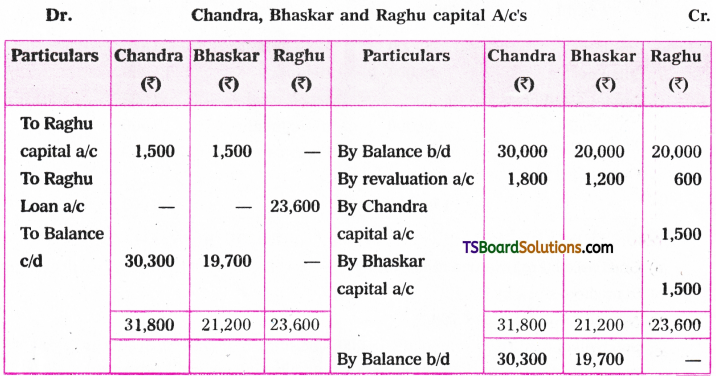

Sit Chandra, Bhaskar; Rah a are partners sharing profits and losses in the ratio oRs. 3:2: 1 respectively. Their balance sheet as on 31st March, 2013 IMS as under ;

On the above date Raghu retired from the business on the following’ conditions:

a) Fixed assets are revalued at Rs. 42,000.

b) Depreciate stock by Rs. 1,700.

c) Provide for Bad Debts Rs. 700.

d) Goodwill of the firm is valued at Rs. 18,000. The share of goodwill payable to Raghu will be contributed by continuing partners without raising goodwill account.

e) Ratio of gaining of Chandra and Bhaskar is 1:1 respectively.

Show necessary ledger accounts and balance sheet of Chandra and Bhaskar.

[Hint: Raghu’s share of goodwill Rs. 3,000 contributed by Chandra and Bhaskar in their ratio of gaining i.e., 1: 1 i.e., Rs. 1,500 each]

Answer:

Chandra and Bhaskar Balance sheet as on 31-3-2015

Working Note:

Value of Goodwill of the firm is Rs. 18,000

Raghu’s Share in Goodwill = 18,000 x 1/6 = 3,000

Raghu’s share of goodwill Rs. 3,000 is contributed by Chandra and Bhaskar in ratio of gaining i.e., 1: 1 i.e., Rs. 1,500 each.

Question 14.

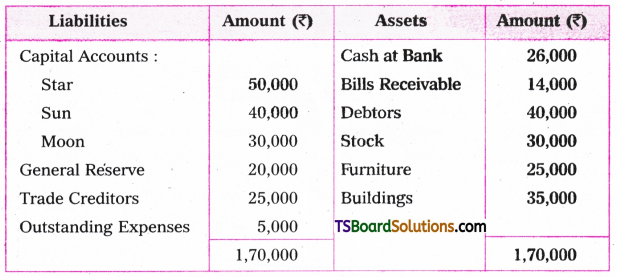

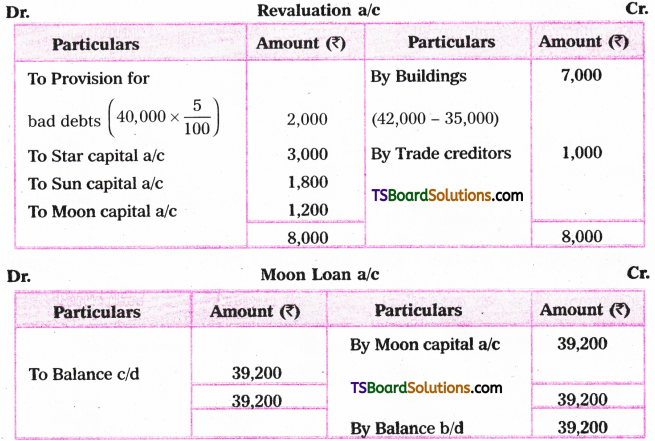

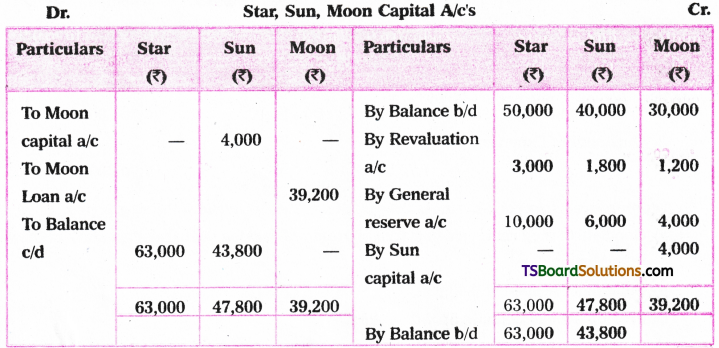

Star, Sun and Moon are partners sharing profits and losses in the ratio of 5: 3: 2 respectively. Their balance sheet as on 31st March 2020 was as under;

Moon retired from the business on the above date with the following terms;

a) Goodwill of the firm is valued at Rs. 20,000 and it is decided not to raise goodwill account in the books.

b) Buildings revalued at Rs. 42,000.

c) Provide for bad debts @ 5% on debtors.

d) Trade creditors Rs. 1,000 need not be paid.

e) Star and Sun share future profits equally.

f) Amount due to Moon will be transferred to his loan account with 12% interest per annum.

Prepare necessary ledger accounts and Balance sheet of new firm.

[Hint: On retirement of Moon, Sun alone gaining star is not gaining anything. So, the share of goodwill of Moon Rs. 4,000 given by Sun only.

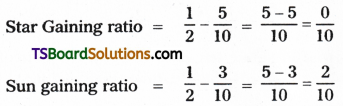

Answer:

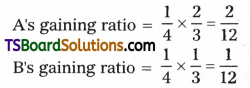

Working Mole:

Calculation of Gaining ratio of star & sun (New ratio – old ratio)

Old Ratio = 5:3:2, New 1: 1

Gaining ratio = 0:2 (Means star not gaining anything) So, total share of moon is contributed by sun.

Star and Sun Balance Sheet as an 31-3-2015

Textual Examples

Question 1.

X, Y and Z are partners sharing profits and losses in the ratio of 3:2:1 respectively the find out the new profit shaiiag ratio in the case of;

a) X retires from the business.

b) Y retires from the business.

c) Z retires from the business.

Answer:

The old profit sharing ratio of X, Y and Z is 3:2:1 respectively.

a) If X retires from the business, Y and Z share the profits in the ratio of 2:1 i.e., 2/3 and 1/3

b) If Y retires from business X and Z share the profits in the ratio of 3:1 respectively i.e., 3/4 and 1/4.

c) If Z retires from the business, X and Y share the profits in the ratio of 3: 2 respectively, i.e., 3/5 and 2/5 respectively.

Question 2.

A, B and C are partners sharing profits and losses in the ratio of 2:1:1 respectively. Mr. C retires from the business. Calculate new profit sharing ratio of A and B.

Answer:

Elimination Method:

The old profit sharing ratio of A, B and C is 2:1:1.

Eliminate C’s share of profit from old profit sharing ratio.

The new profit sharing ratio of continuing partners A and B is 2:1 respectively i.e., 2/3: 1/3.

Alternative Method:

Alternatively, the new profit-sharing ratio may be calculated as follows:

Profit sharing ratio of A, B and C is 2:1:1 respectively = 2/4: 1/4: 1/4.

Retiring partner C’s share is 1/4.

Retiring partner’s share is acquired in the old ratio by A and B i.e., 2:1. This is also called gaining ratio.

Gaining ratio of A and B is 2:1 (or) 2/3: 1/3.

Gaining ratio = Retiring partners share x Partners gaining ratio.

New profit sharing ratio = Old share + Share gained

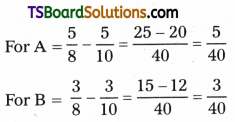

Question 3.

P, Q and R partners sharing profits and losses in the ratio of 5:4:3 respectively. R Retires from the business and his share of profit purchased by P and Q in the ratio of 2:1 respectively. Calculate the new profit sharing ratio of P and Q,

Answer:

Old profit sharing ratio of P, Q and R is 5:4:3 = 5/12: 4/12: 3/12

R’s share of profit 3/12 being purchased by P and Q in the ratio of 2:1 = 2/3 : 1/3 respectively.

New profit sharing ratio of P = P’s old share + proportion of R’s share purchased

New profit sharing ratio Q = Q’s old share + proportion of R’s share purchased

![]()

The new profit-sharing ratio of P and Q is 7:5 respectively i.e., 7/12 and 5/12.

Question 4.

X, Y and Z are partners sharing profits and losses in the ratio of 2:4:3 respectively. Mr. X retires from the business. Y and Z share future profits in the ratio of 3:2. respectively. Calculate the ratio of gaining.

Answer:

Ratio of gaining = New profit sharing ratio – Old profit sharing ratio

Old ratio of X, Y and Z is 2:4:3.

New ratio of Y and Z is 3:2.

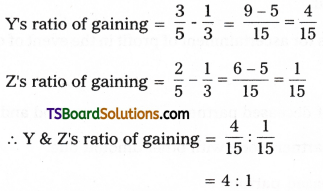

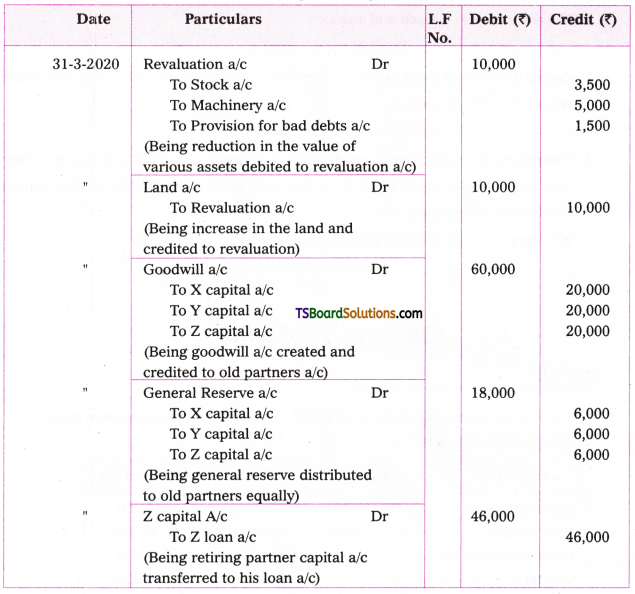

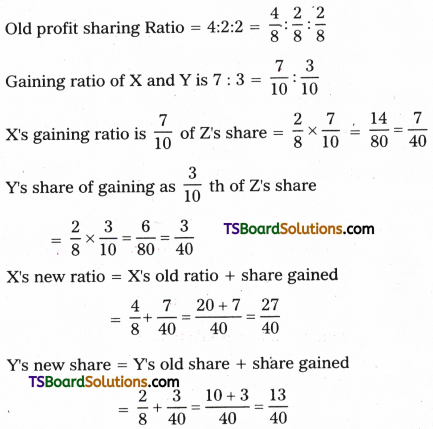

Question 5.

A, B and C are partners sharing profits and losses in the ratio of 5:3:2 respectively. C retires from the business. Calculate ratio of gaining and new profit Sharing ratio of A and B.

Answer:

In this problem, new profit sharing ratio is not given. Hence, after eliminating C’s share of profit from old ratio, whatever that is left will be the new profit sharing ratio of A and B. Old ratio, of A, B and C is 5:3:2

New ratio of A and B is 5:3 i.e., 5/8 and 3/8 (C’s share eliminated).

In the absence of new ratio given in the problem, the continuing partners gain in the same ratio in which, they were sharing earlier. Even, it is calculated it will be the same.

Ratio of gaining = New ratio – Old ratio

The ratio of gain between A and B is 5:3 respectively.

In other words, the continuing partners are gaining in the same ratio in which they are sharing profits earlier after eliminating C’s share.

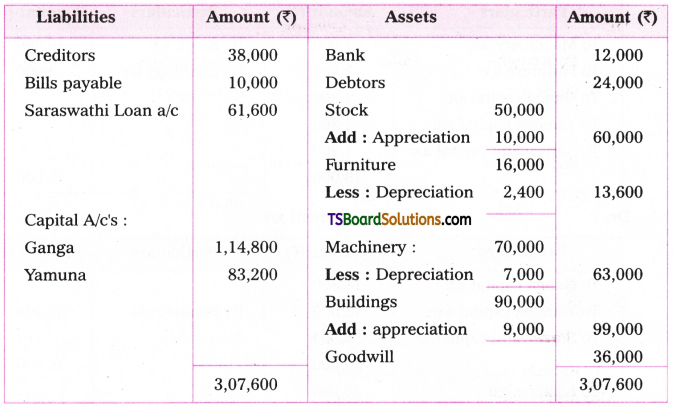

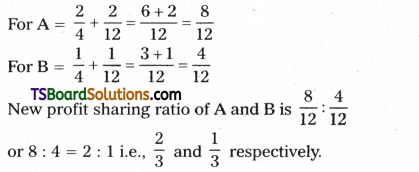

![]()

Question 6.

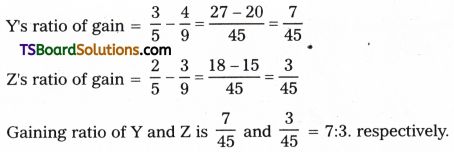

X, Y and Z are partners sharing profits or losses in the ratio of 4:2:2. Mr. Z retires from the business. X and Y will gain in the ratio of 7:3 respectively. Calculate new profit sharing ratio of X and Y.

Answer:

New profit sharing ratio of X and Y is 27/40 and 13/40 = 27 : 13 respectively.

Question 7.

X, Y and Z are partners sharing profits and losses in the the ratio of 3:2:1. Goodwill Of the firm is valued at Rs. 60,000. Mr. Z retires from the business, X & Y decided to continue the business shearing profits and losses in the ratio of 3:2 respectively

Give journal entries and prepare the goodwill account when;

a) Goodwill is raised in the books for full value.

b) Goodwill is raised and writtenoff in the books.

Answer:

a) Journal entries when goodwill is raised

Note: In this case, goodwill appear at Rs. 60,000 on the assets side of the balance sheet of new firm.

b) Journal Entries when goodwill is raised and writtenoff.

Note: In this case, the goodwill account is closed, so it will not appear in balance sheet of new firm in which X and Y are partners.

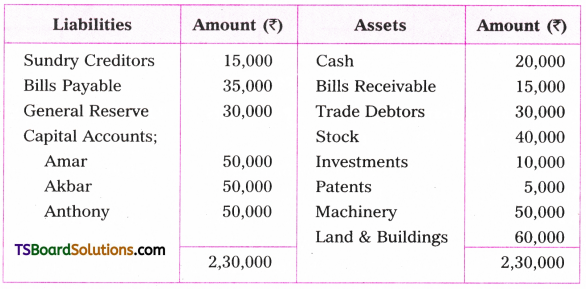

Question 8.

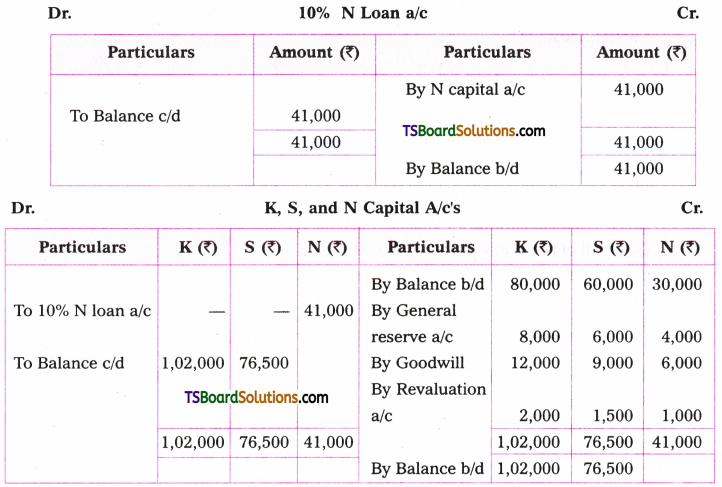

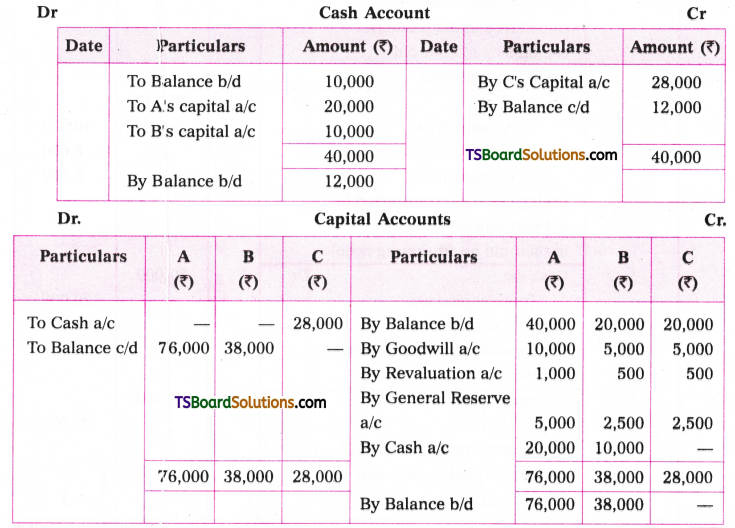

A, B and C are partners sharing profits and losses in the ratio of 2:1:1 respectively. Their balance sheet as on 31-3-2020 was as under;

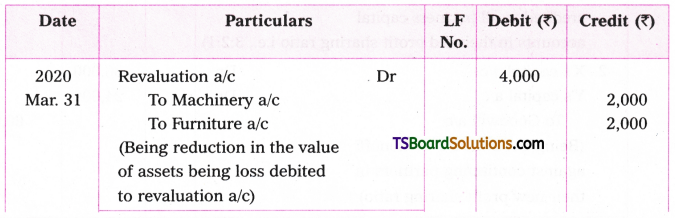

On the above date Mr. C retired from the business. The following are agreed among partners;

a) Machinery revalued at Rs. 23,000 and Buildings at Rs. 40,000.

b) Depreciate furniture by 10%.

c) Outstanding expenses Rs. 1,000 need not be paid.

d) Goodwill of the firm valued at Rs. 20,000.

e) A should bring Rs. 20,000 and B Rs. 10,000 as additional capital to pay the amount due to retiring partner, Mr. C.

Give journal entries and necessary ledger accounts and new balance sheet.

Answer:

Journal Entries

Ledger Accounts:

Balance Sheet of A and B as on 31-03-2020

![]()

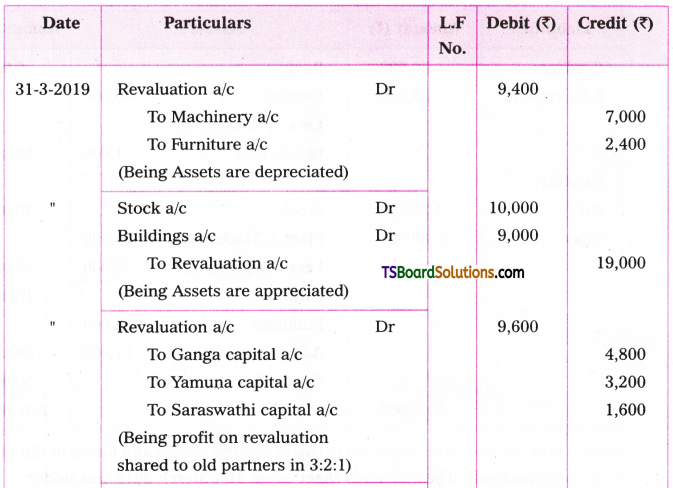

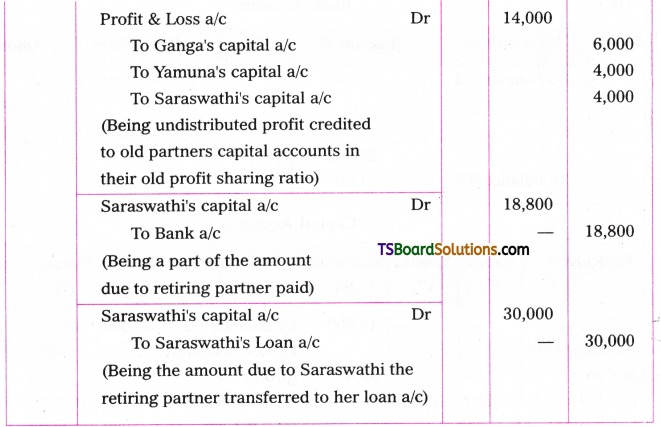

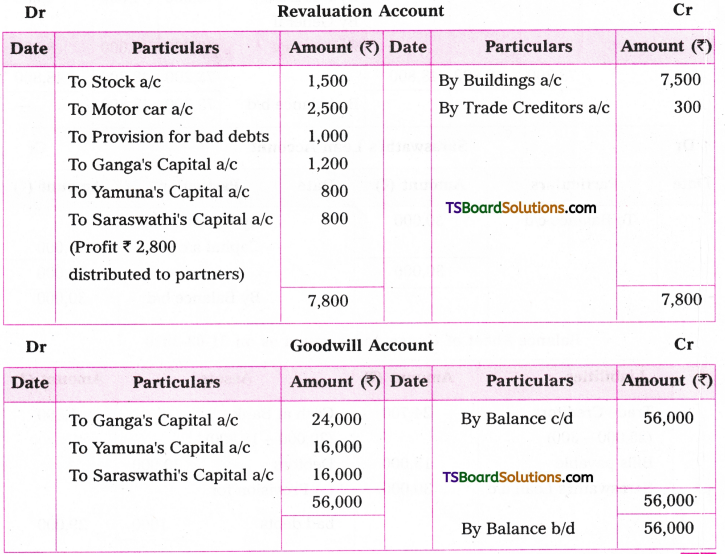

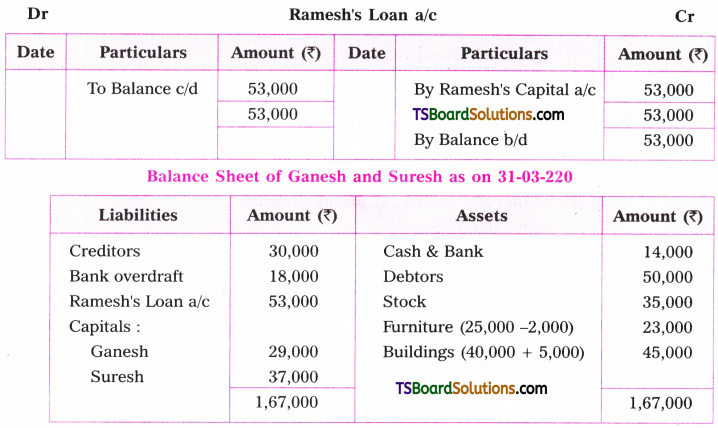

Question 9.

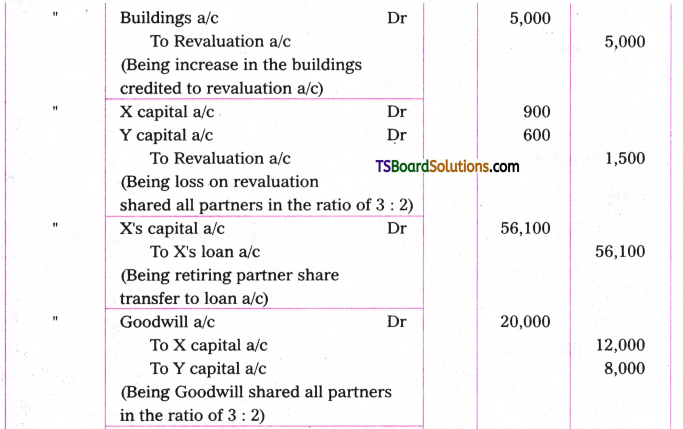

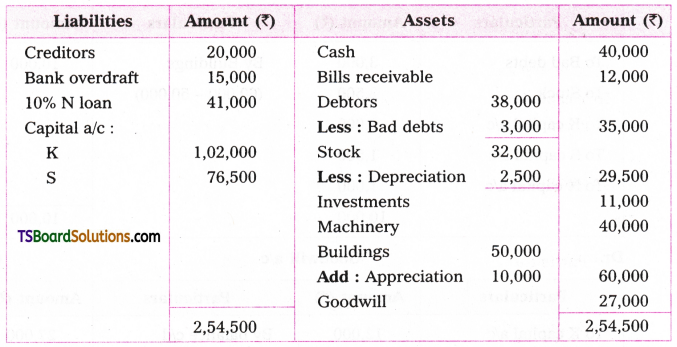

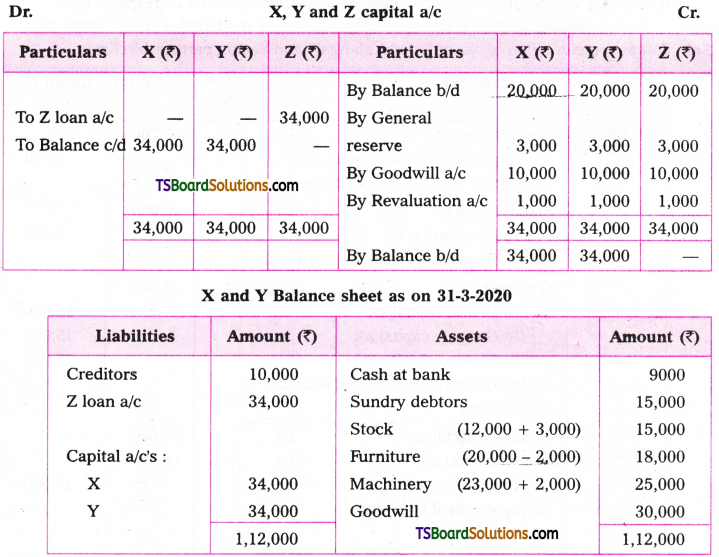

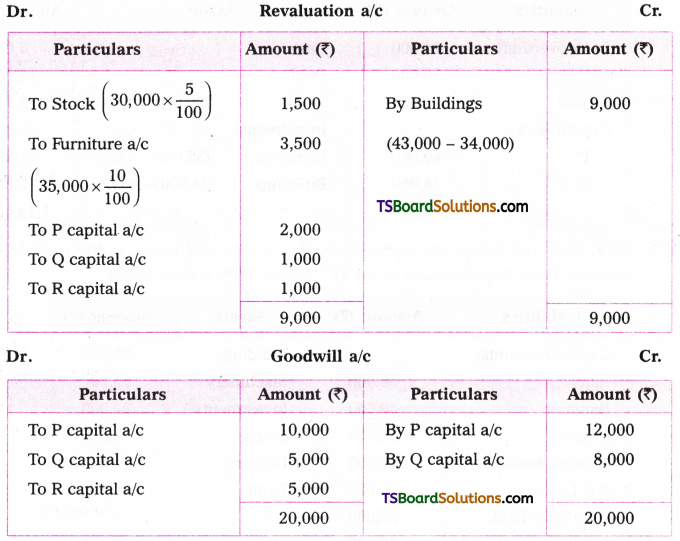

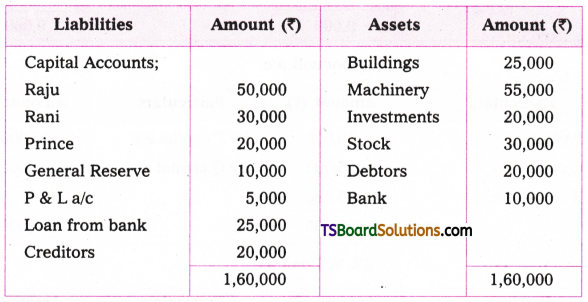

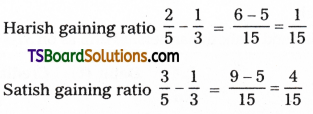

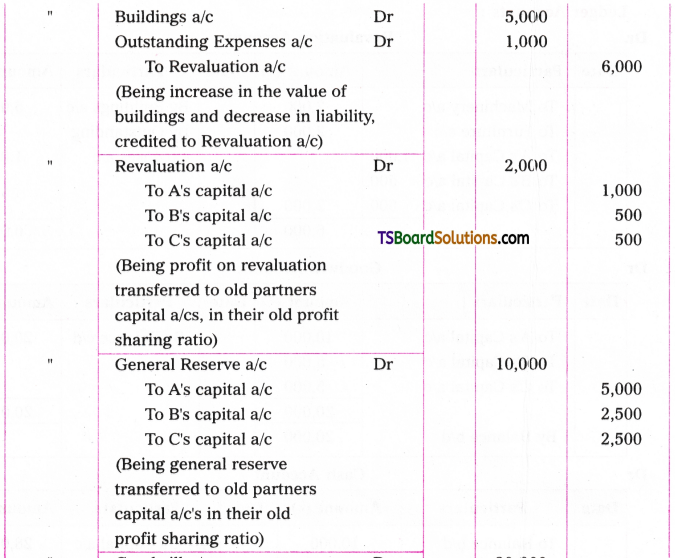

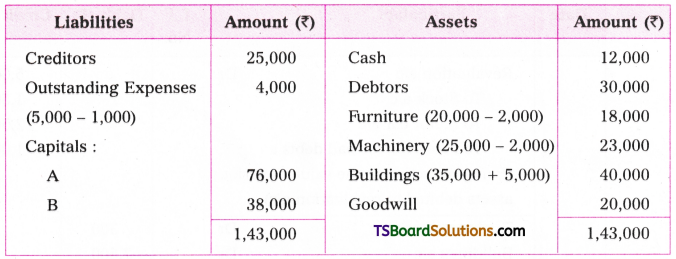

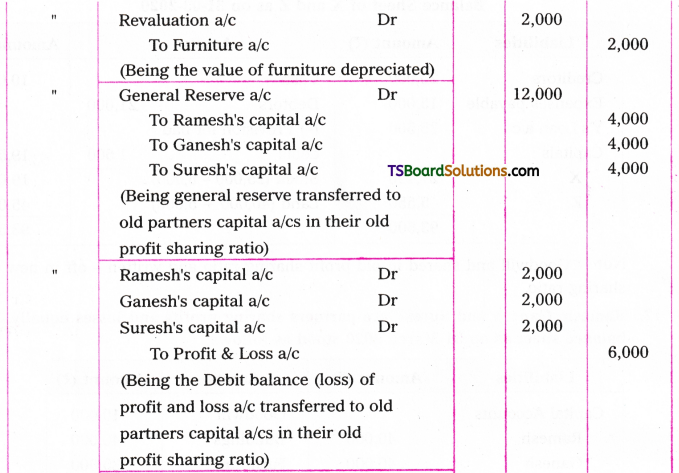

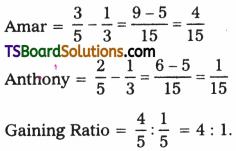

Ganga, Yamuna and Saraswathi are partners sharing profits and losses in the ratio of 3:2:2 respectively. Their balance sheet as on 31 March 2020 was under.

On the above date Saraswathi retired from the business. Ganga and Yamuna decided to continue the business. The following were agreed among partners;

a) Goodwill of the firm is valued at Rs. 56,000.

b) Stock and Motor car to be depreciated by 10%.

c) Provide for bad debts Rs. 1,000.

d) Buildings appreciated byl5%.

e) Trade creditors reduced by Rs. 300.

It is decided to pay Rs. 18,800 to Saraswathi and transfer the balance in her capital account to her loan account.

Give necessary Journal entries and ledger accounts and opening balance sheet of Ganga and Yamuna.

Answer:

Journal entries

Note: Goodwill created in the books. Hence, it appears on assets side of the balance sheet.

![]()

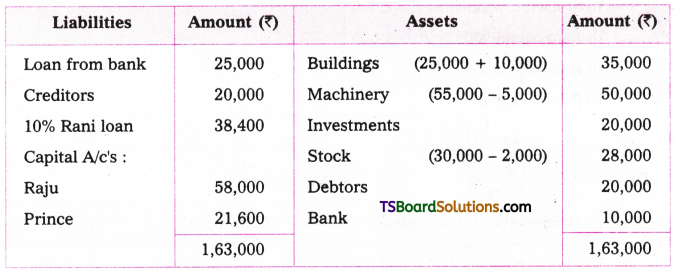

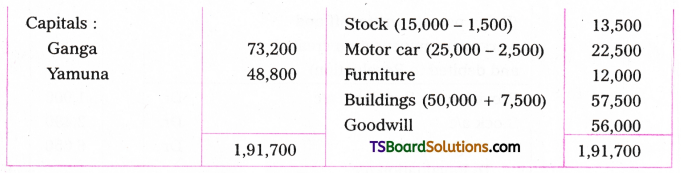

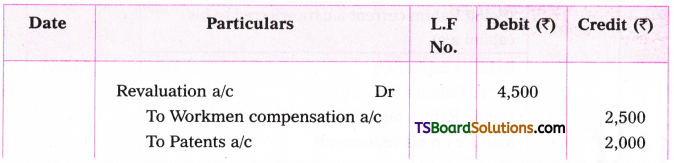

Question 10.

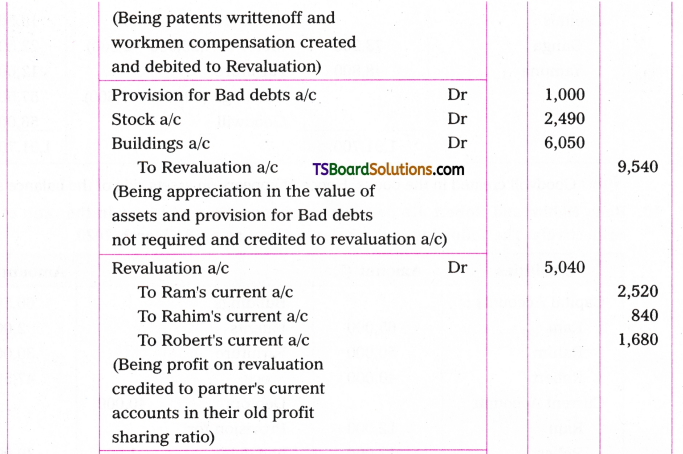

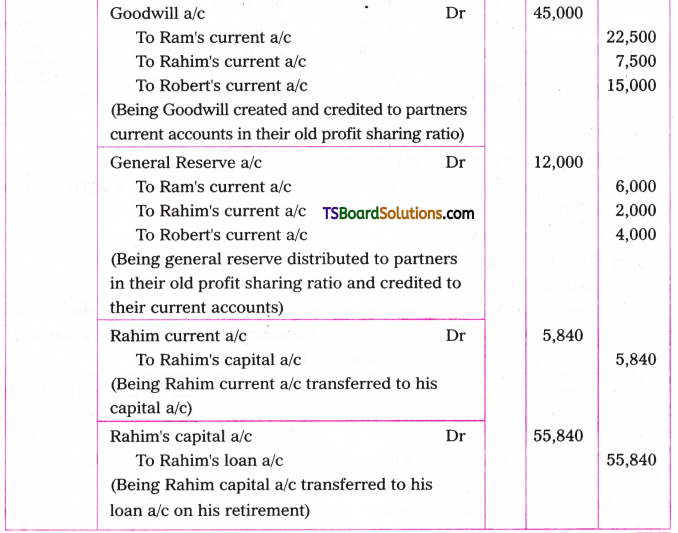

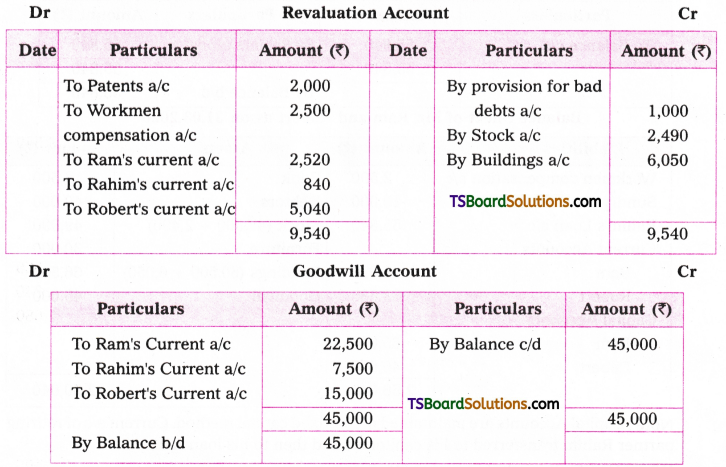

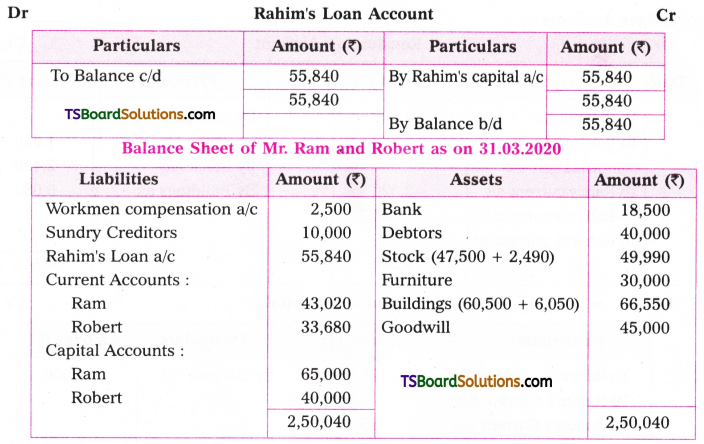

Ram, Rahim and Robert are partners sharing profits and losses in the ratio of 3:1:2 respectively. The following is the balance sheet as on 31 March 2020.

Mr. Rahim Retires on the above date on the following conditions;

a) Goodwill of the firm be valued at Rs. 45,000.

b) Provision for bad debts not necessary.

c) An outstanding liability in respect of workmen compensation Rs. 2,500 to be brought into books.

d) Patents have no value.

e) Stock to be appreciated by Rs. 2,490.

f) Buildings be appreciated by 10%.

Give necessary Journal entries and ledger accounts and balance sheet of Ram and Robert. Partners capital accounts are maintained under fixed capital method.

Answer:

Journal Entries

Ledger Accounts:

Note: Capital Accounts are maintained under fixed capital method. Current a/c of retiring partner Rahim transferred to his capital a/c and then to his loan A/c.

When Goodwill is created and written off:

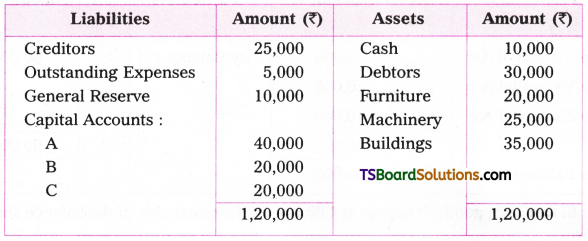

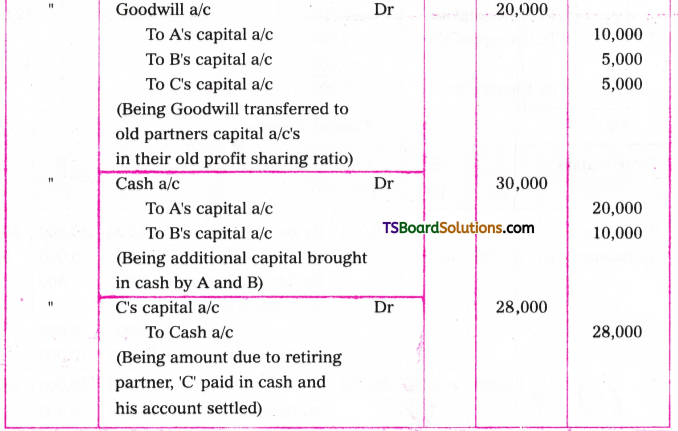

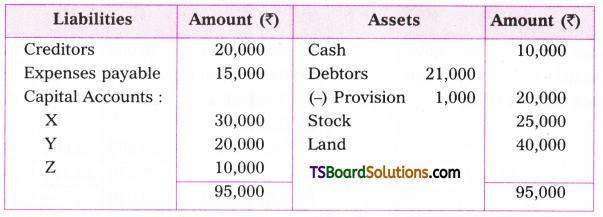

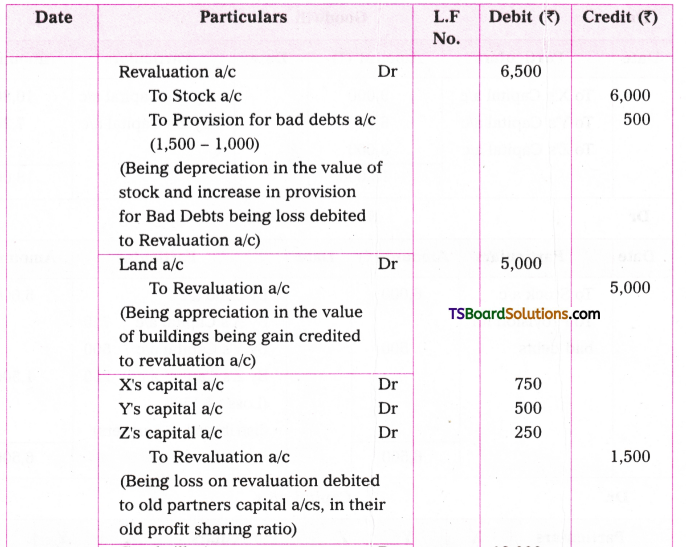

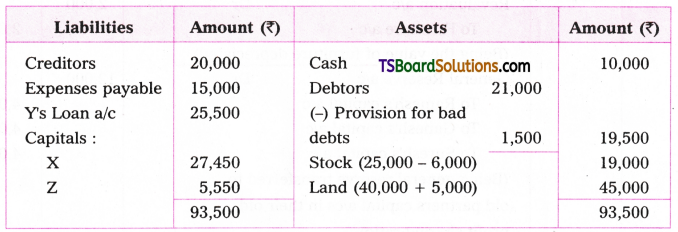

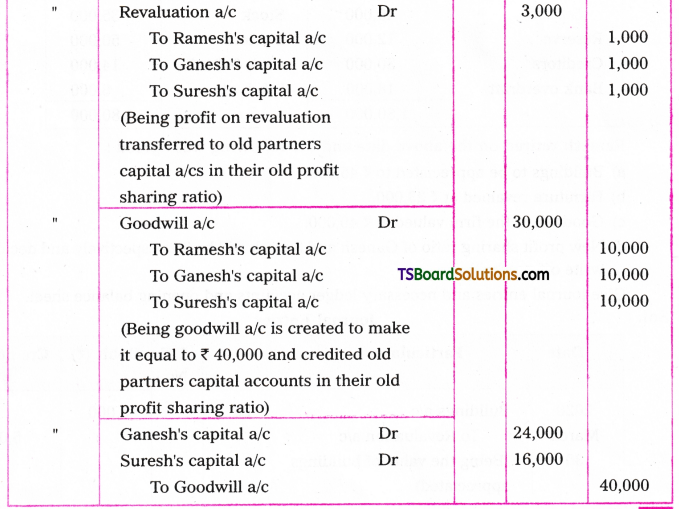

Question 11.

X, Y and Z are partners sharing profits and losses in the ratio of 3:2:1 respectively. Their balance sheet as on 31 March 2015 was as follows;

On the above date Mr. Y retires from the business. X and Z decided to continue the business with the following terms;

a) Goodwill of the firm is valued at Rs. 18,000.

b) Provision for bad debts required is Rs. 1,500.

c) Stock to be depreciated by Rs. 6,000.

d) Land to be appreciated by Rs. 5,000.

e) It is decided to write off goodwill in the new firm.

f) New profit-sharing ratio of X and Z will be 3:2.

Give journal entries and necessary ledger accounts and opening balance sheet of X and Z.

Answer:

Journal Entries

Ledger Accounts:

Balance Sheet of X and Z as on 31-03-2020

Note: Goodwill and shared in old profit sharing ratio and written – off in new profit sharing ratio.

![]()

Question 12.

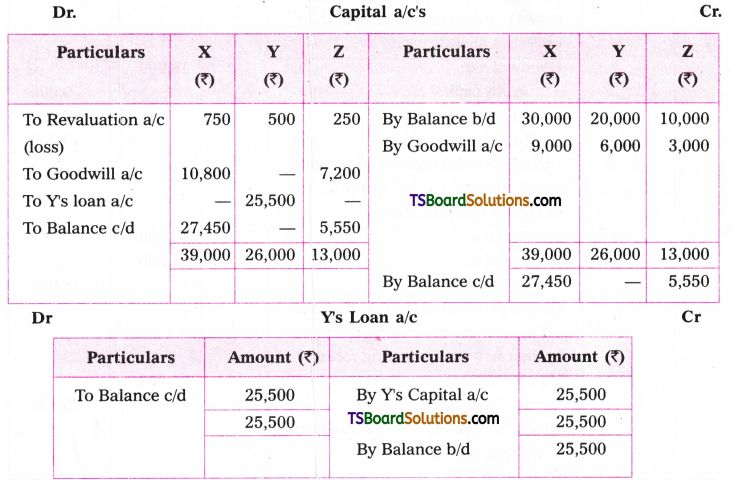

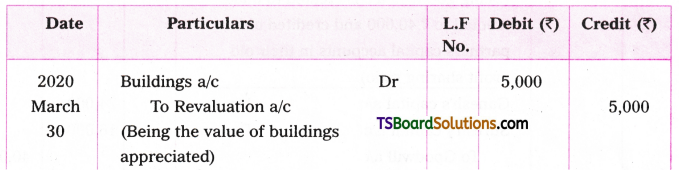

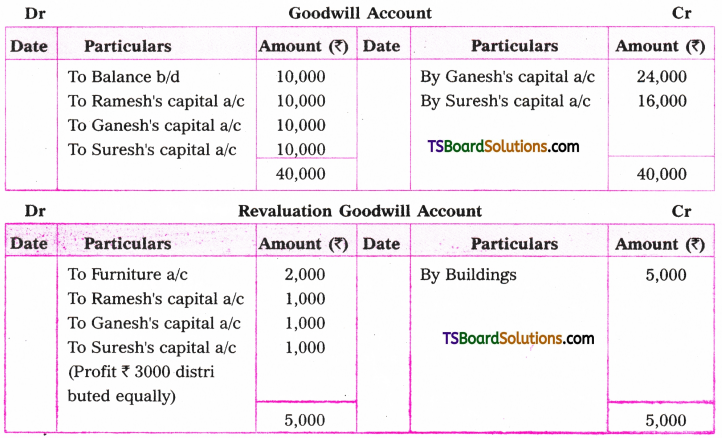

Ramesh, Ganesh and Suresh are partners sharing profits and losses equally. Their balance sheet as on 31 March 2020 stood as follows;

a) Buildings to be appreciated to Rs. 45,000.

b) Furniture revalued at Rs. 23,000.

c) Goodwill of the firm valued at Rs. 40,000.

d) New profit sharing ratio of Ganesh and Suresh will be 3:2 respectively and decided to write off goodwill.

Give journal entries and necessary ledger accounts and opening balance sheet.

Answer:

Journal Entries

Ledger Accounts:

Note:

- Goodwill created to the extent of Rs. 30,000 because already Rs. 10,000 value of goodwill appears in the books. Now the goodwill of the firm will be 40,000 i.e., 10,000 + 30,000 created.

- P & L a/c Dr. balance (loss), transferred to old partners capital a/cs.

- The amount payable to Ramesh, the retiring partner, after all the adjustments are transferred to his loan account.

![]()

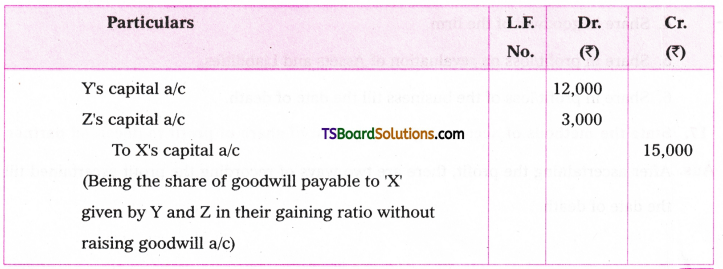

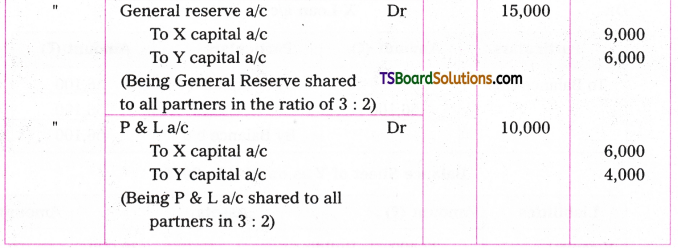

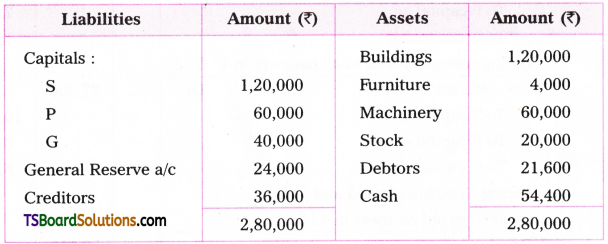

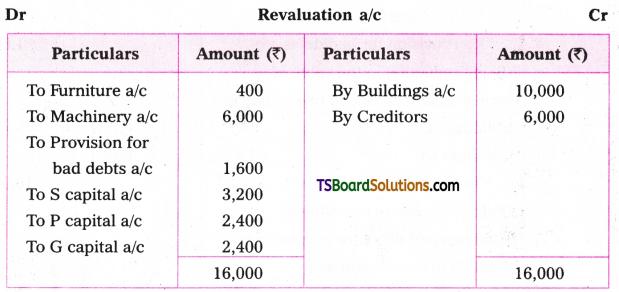

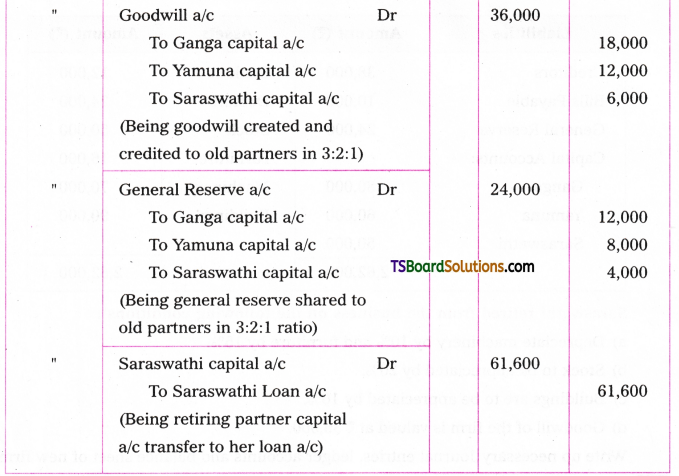

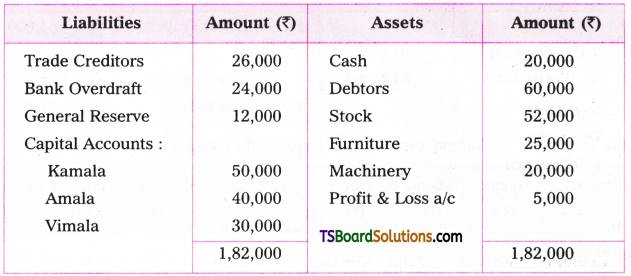

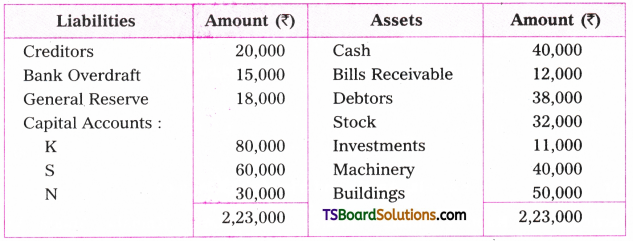

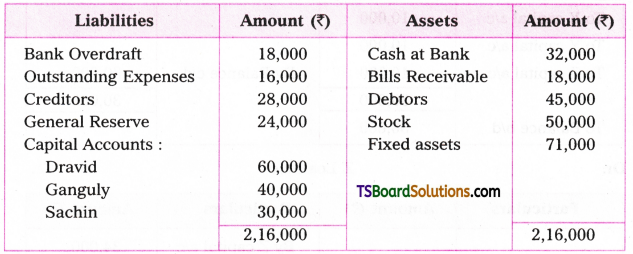

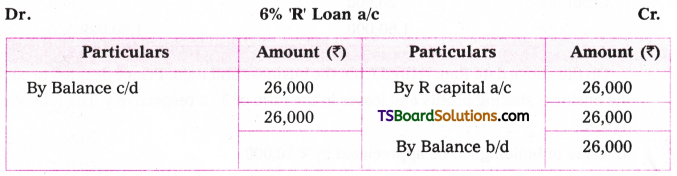

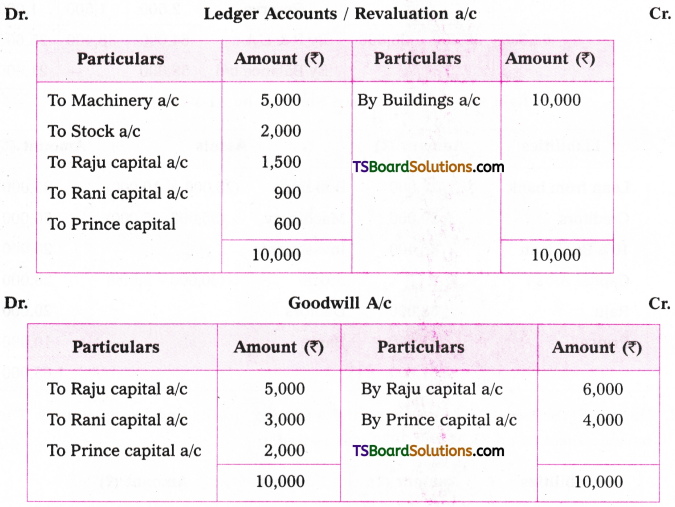

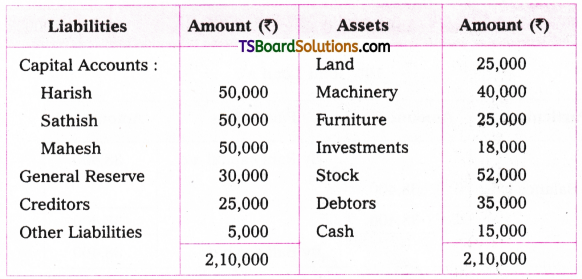

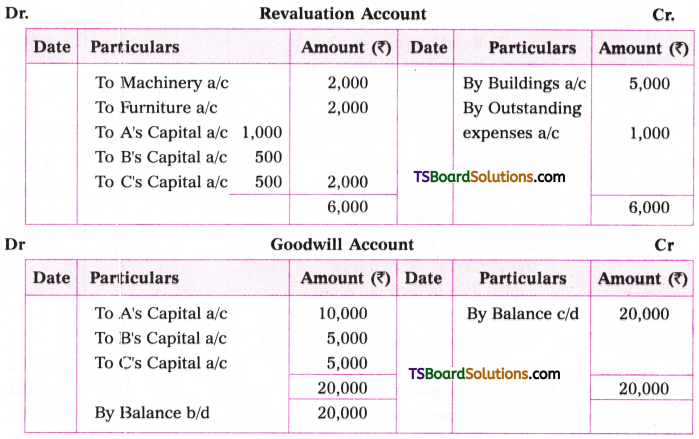

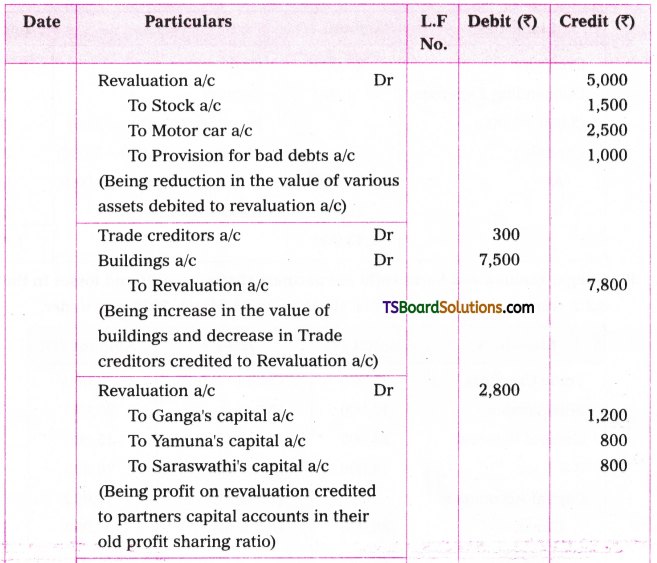

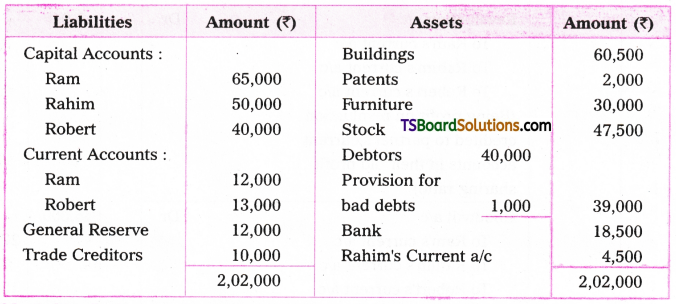

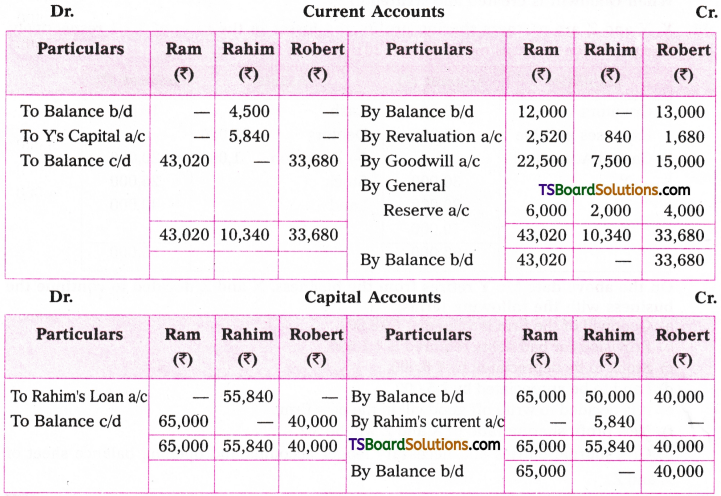

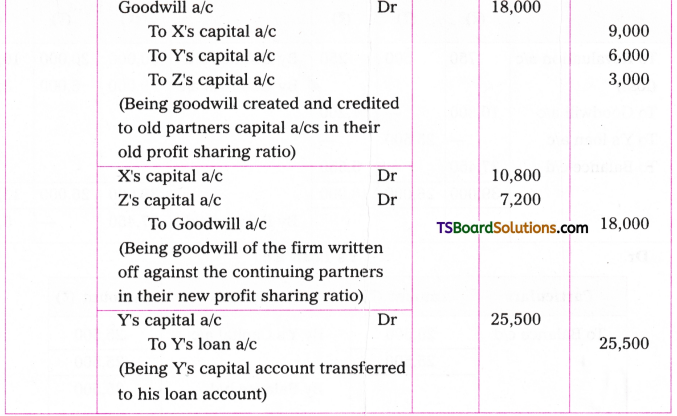

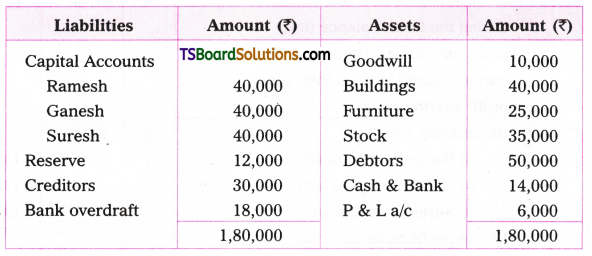

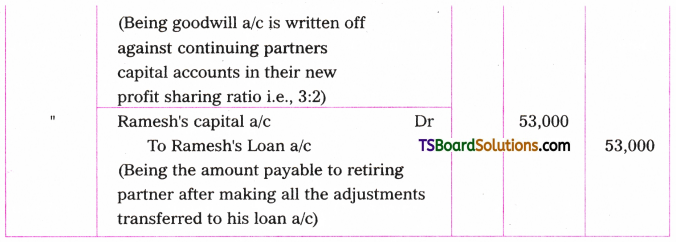

Question 13.

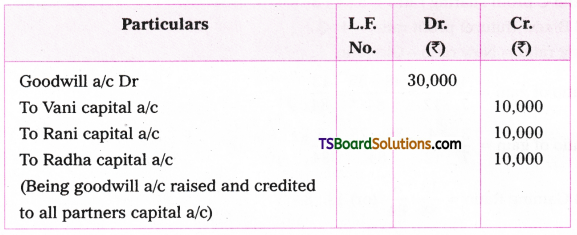

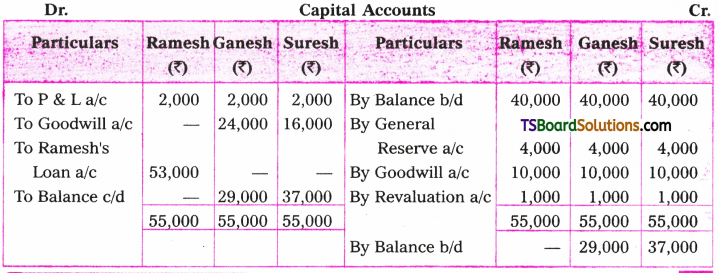

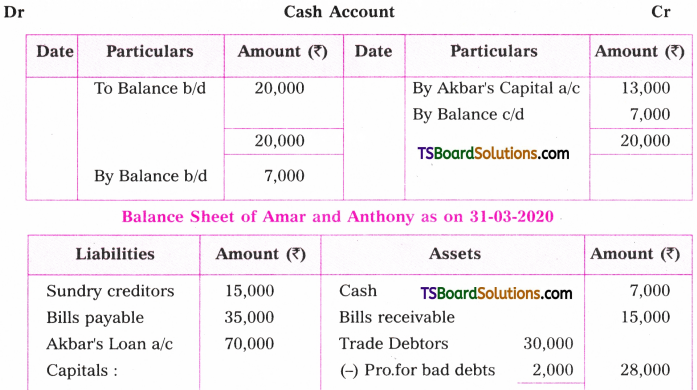

Amar, Akbar, and Anthony are partners sharing profits and losses equally. Their balance sheet as on 31s1 March 2020, was as follows;

On the above date Mr. Akbar retired from the business. The following adjustments are agreed.

a) Land & Buildings appreciated by Rs. 20,000.

b) Stock and Machinery are to be depreciated by 10%.

c) Provide for Bad debts Rs. 2,000.

d) Goodwill of the firm is valued at Rs. 60,000 and it is decided to pay the share of Goodwill of retiring partner by continuing partners without raising goodwill account in the books.

e) Rs. 70,000 to be sharing ratio of Amar and Anthony is 3 : 2 respectively.

f) New profit sharing ratio of Amar and Anthony is 3:2 respectively.

Give journal entries and necessary ledger accounts and opening balance sheet of Amar and Anthony.

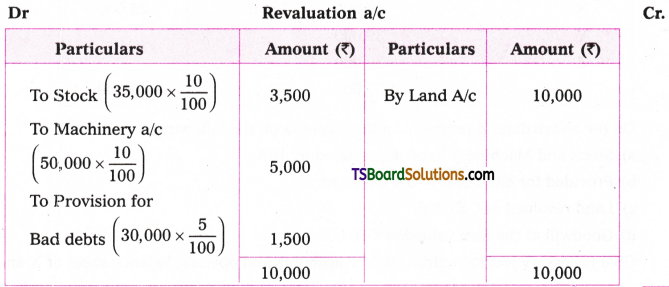

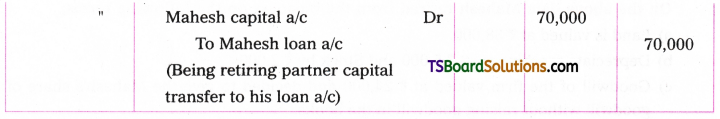

Answer:

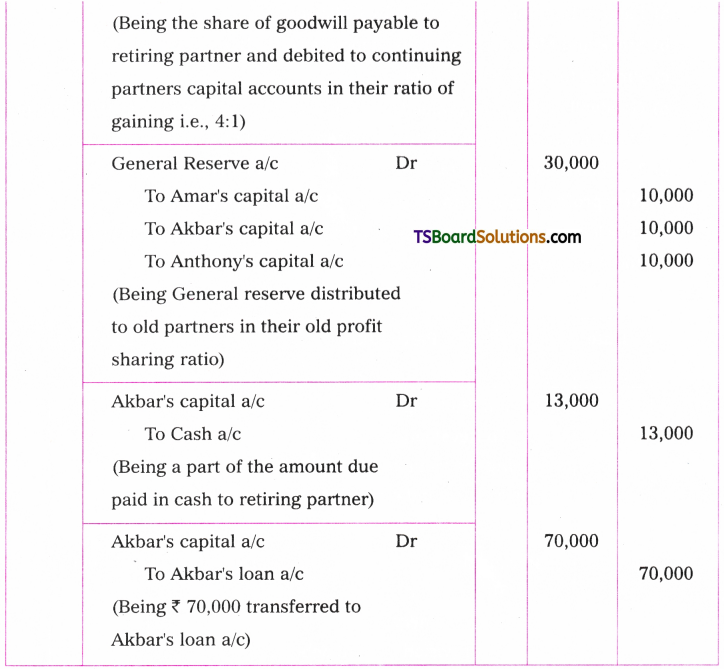

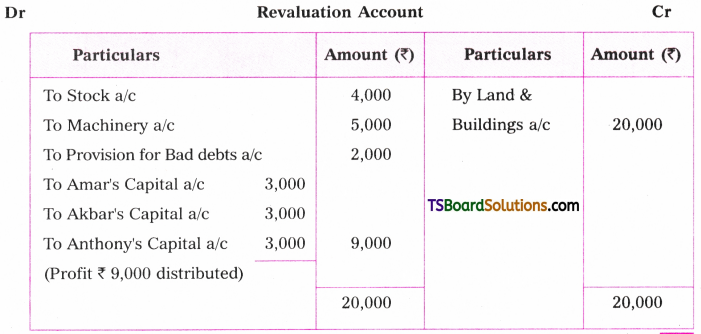

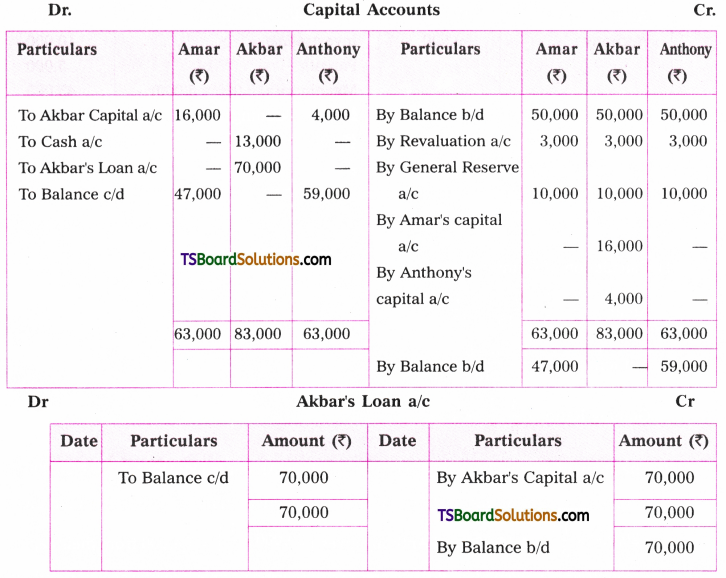

Journal Entries

Ledger Accounts:

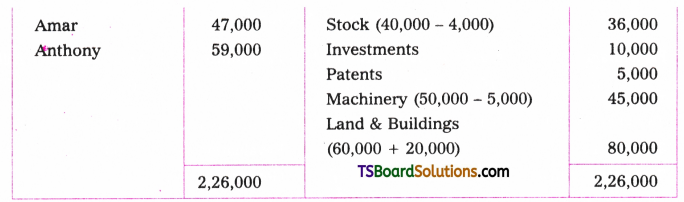

Notes:

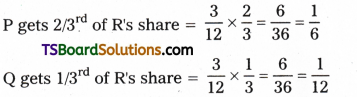

1) Calculation of Gaining ratio:

![]()

2) The share of goodwill payable to retiring partner, Ameer is (60,000 x 1/3 ) = Rs. 20,000. It

is given by continuing partners in their respective share of gaining. Amar gives (20,000 x 1/5) = 16,000 and Anthony gives (20,000 x 1/5) = Rs. 4,000 from their capital accounts and the same (i.e., 20,000) credited to retiring partner’s capital account, without raising goodwill a/c in the books.