Telangana TSBIE TS Inter 2nd Year Accountancy Study Material 4th Lesson Partnership Accounts Textbook Questions and Answers.

TS Inter 2nd Year Accountancy Study Material 4th Lesson Partnership Accounts

Very Short Answer Questions

Question 1.

What is partnership?

Answer:

- According to section 4, the Partnership Act 1932, partnership means “The relationship between persons who have agreed to share profits of the business carried on by all or any one of them acting for all”.

- The persons who have entered into partnership business are called individually as “partners” and collectively as “a firm” and the name under which their business is carried on is called the name of the firm.

Question 2.

What is a partnership deed?

Answer:

- It is a document that defines the rights and liabilities of partners of the firm besides containing other matters pertaining to the conduct and management of the firm.

- Partnership deed is signed by all the partners.

![]()

Question 3.

State the methods of preparing partners’ capital accounts.

Answer:

There are methods of preparing partners’ capital accounts.

They are: A) Fixed capital method; and B) Fluctuating capital method.

Question 4.

What is the fixed capital method?

Answer:

- Under fixed capital method, we prepare two accounts partner capital account and partners current account.

- All the adjustments such as drawings, interest on capital, salary or commission, share of profits will be recorded in a partners current account, and the partners capital account is remains unchanged. Because of this, it is called fixed capital method.

Question 5.

What is fluctuating capital method?

Answer:

- Under this method, all transactions relating to a partner such as capital contributed by partner, interest on capital, drawings, interest on drawings, salary, commission to partner, share of profit or loss are recorded in capital account only.

- Because of this, the balance in capital account keeps on changing every year. Hence, it is called fluctuating capital method.

Question 6.

What is partnership? State its features.

Answer: Definition: According to section 4, Partnership Act 1932, partnership means “The relationship between persons who have agreed to share profits of the business carried on by all or any one of them acting for all”.

Features:

- Agreement: The partnership is formed to make profits. It is an agreement entered between/among all the partners.

- Business: It must be of a lawful business. It includes trade, vocation and profession.

- Profit sharing: The partners share the profit and losses of the business as per the

agreement. - Management: Partnership business may be managed or carried on by all the partners or any one of the partners acting on behalf of all the other partners, f) Unlimited liability: The liability of a partner in partnership firm is not only unlimited, but also joint and several.

Question 7.

What is partnership deed? State its contents.

Answer:

Partnership deed; It is a document which defines the rights and liabilities of partners of the firm besides containing other matters pertaining to the conduct and management of the firm.

Contents of partnership deed: The written agreement can contain as much, or as little, as partners want. The law does not say what it must contain. The usual contents of partnership deed are listed as here under.

- Name of the partnership firm.

- Names, addresses and occupation of all the partners.

- Nature, object and duration of business.

- Amount of capital to be contributed by each partner.

- Drawings if any, allowed for private purposes.

- Sharing of profits and losses.

- Rate of interest on capital and drawings.

- Rights, duties and liabilities of each partner.

- Method of keeping books of accounts and audit.

- Mode of payment to retired partner’s share.

Question 8.

What is Profit and Loss appropriation account?

Answer:

- Profit and Loss appropriation account is prepared after ascertaining the net profit (or) loss through profit and loss account.

- Profit and Loss appropriation account is a normal account. It is an extension of profit and loss account.

This account is debited with interest on capital of partners, salary, commission remuneration to the partners, if allowed and profit transfer to general reserve and credited with the net profit, interest on drawings. - The balance if any, may be net profit or loss and will be distributed to the partners as per their profit sharing ratio.

Question 9.

State the provisions of partnership act in the absence of partnership deed,

Answer:

It is to be noted that if there is no partnership deed all the partners should abide by the provisions of partnership Act 1932.

In the absence of partnership deed, the partnership Act states that:

- All the profits and losses are to be shared equally.

- No interest is to be provided on capital.

- No interest is to be charged on drawings.

- No salary or commission is payable to managing partner.

- The partners who provided loan to firm are entitled to get interest @ 6% p.a. on the loan.

- Every partner shall take part in management of the business.

![]()

Textual Problems

Question 1.

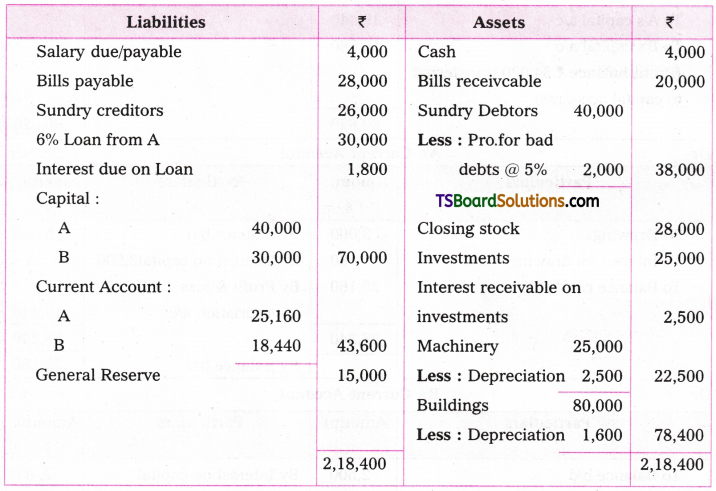

A, B and C are partners sharing profits and loss equally with share capital of Rs. 50,000, Rs. 40,000 and t 30,000 respectively. The profit for the year ended 31st March 2015 amounted to Rs. 56,000 before allowing interest on capital @ 8% p.a. and salary to A Rs. 6,000 and commission to C Rs. 4,000.

Prepare profit and loss appropriation account.

Answer:

Profit & Loss appropriation a/c

Question 2.

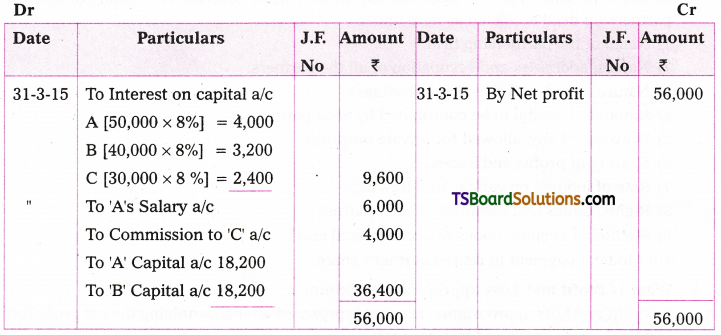

X,Y and Z are partners sharing profits and losses in the ratio of 2: 2: 1. Each partner withdraws the fixed sum of Rs. 4,000 per month for their personal use.

Mr. X, withdraws on 1st day of every month, Mr. Y withdraws on the last day of every month and Mr. Z withdraws on middle of every month. Calculate interest on drawings. Rate of interest is 6% p.a.

Answer:

Calculation of Interest on Drawings:

Total drawings 4000 x 12 = 48,000

Rate of interest 6%

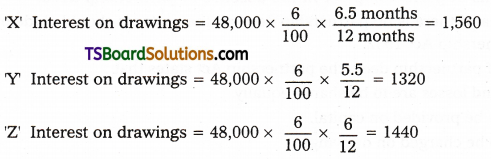

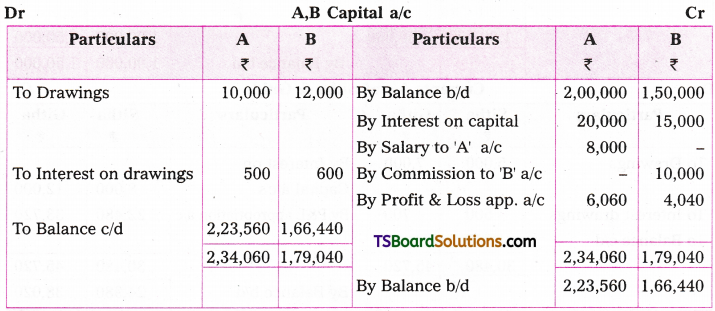

Question 3.

A and B are partners sharing profits and loss in the ratio of 3: 2 respectively. A contributed Rs. 2,00,000 and B contributed Rs. 1,50,000 towards their capital at the beginning of the year. Their drawings during the jfear amounted to Rs. 10,000 and 12,000 respectively. Mr. A is entitled to a salary of Rs. 8,000 and Mr. B to be given a commission of Rs. 10,000. Interest on capital to be provided @ 10% p.a. Interest on drawings amounted to t 500 for A and 1600 for B. Net profit before above adjustments amounted to Rs. 62,000.

Prepare profit or loss appropriation account and partners capital accounts under fluctuating capital method.

Answer:

Profit & Loss appropriation a/c

Fluctuation capital method

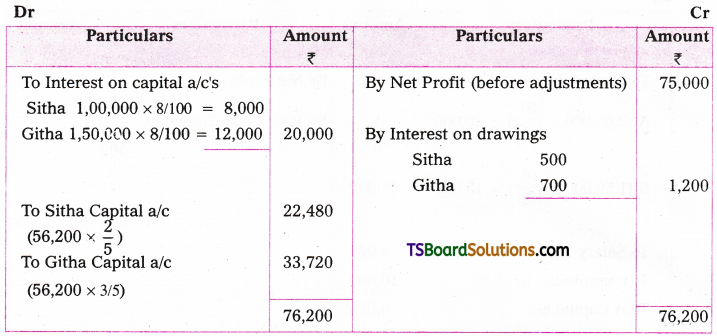

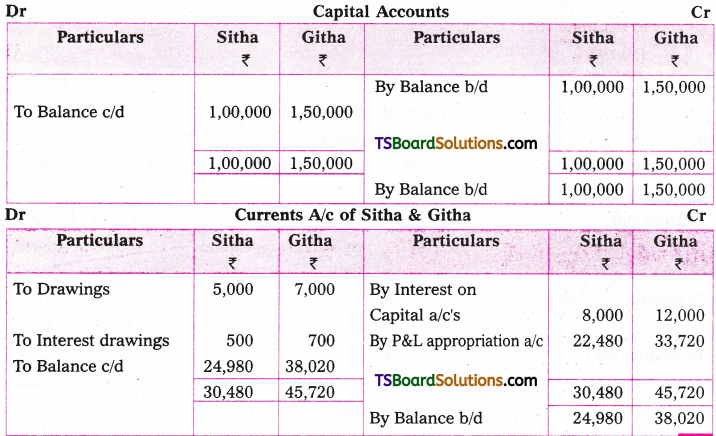

Question 4.

Sitha and Githa are partners sharing profits and losses in the ratio of 2: 3. Their capital accounts showed a balance of Rs. 1,00,000 and Rs. 1,50,000 respectively as on 1st April 2014. During the year, Sitha and Githa withdraw Rs. 5,000 and Rs. 7,000 respectively for personal use. Interest on capital to be provided @ 8% p.a. Interest on drawings amounted to Rs. 500 and Rs. 700 respectively. Profit for the year ended 31st March 2015, before making above adjustments amounted to Rs. 75,000.

Prepare: (a) Profit & Loss Appropriation account, (b) Partners capital accounts under (i) Fixed capital method, (ii) Fluctuation capital method.

Answer:

Profit & Loss appropriation a/c

Fixed capital method:

Fluctuations capital method:

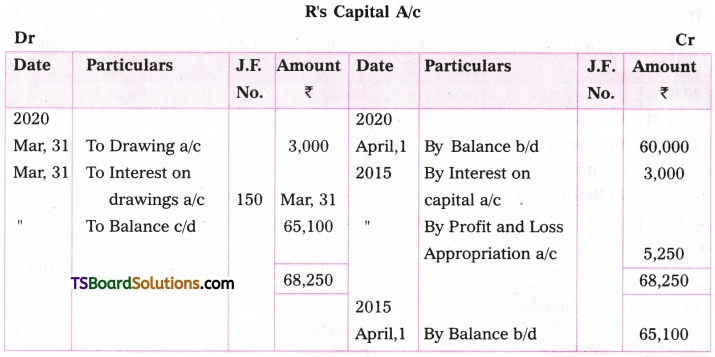

![]()

Question 5.

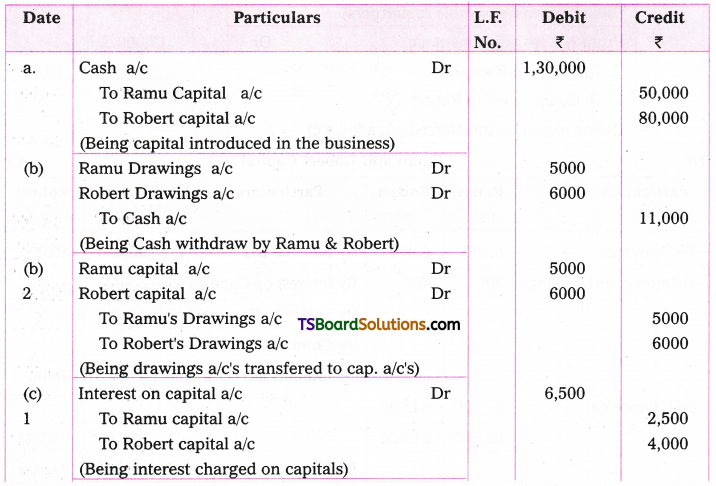

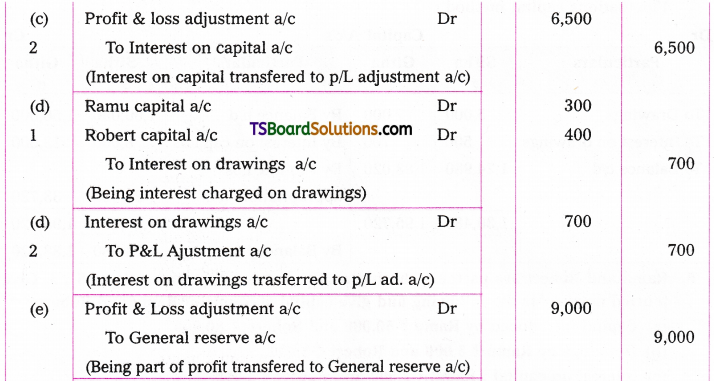

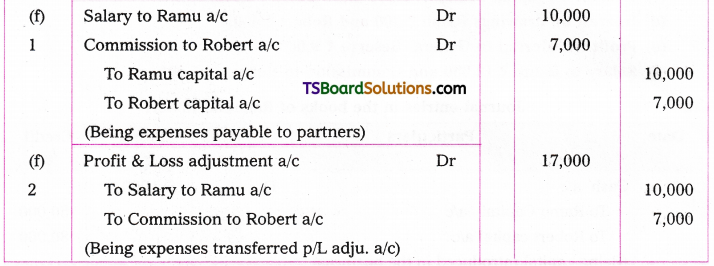

Ramu and Robert are partners sharing profits and losses in the ratio of 5: 3. Give journal entries for the following and give capital accounts of Ramu and Robert.

(a) Capital introduced by Ramu Rs. 50,000 and Robert Rs. 80,000.

(b) Drawings by Ramu Rs. 5,000 and Robert Rs. 6,000.

(c) Interest on capital: Ramu Rs. 2,500 and Robert Rs. 4,000.

(d) Interest on drawings Ramu Rs. 300 and Robert Rs. 400.

(e) Profit transferred to General Reserve Rs. 9,000.

(f) Salary to Ramu Rs. 10,000 and Commission to Robert Rs. 7,000.

Answer:

Journal entries in the books of Ram and Robert

Question 6.

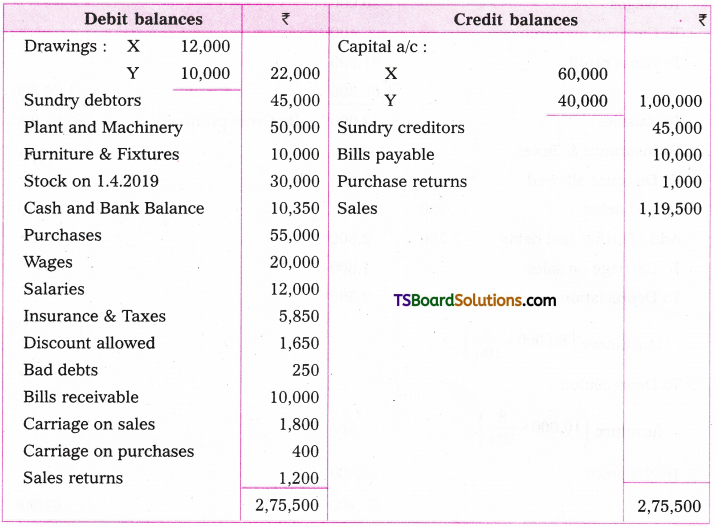

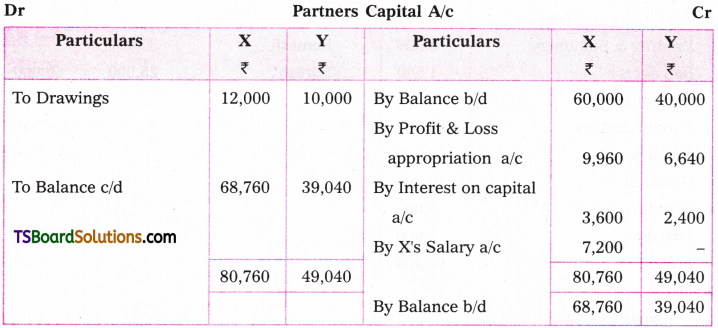

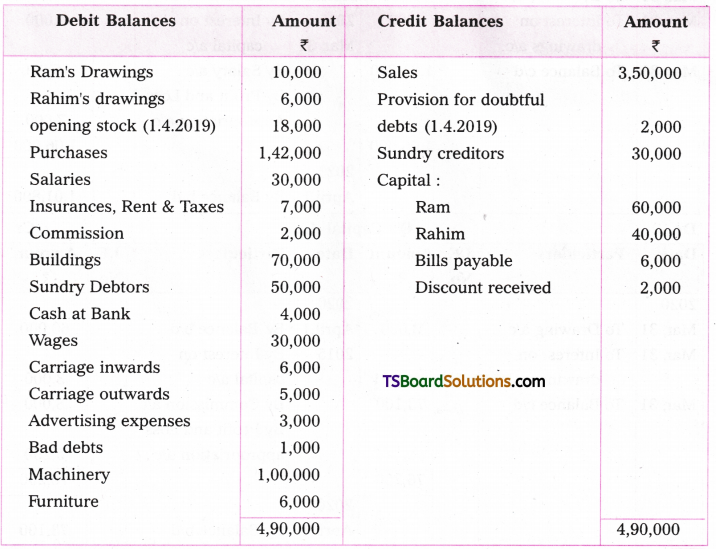

X and Y are partners sharing profits and losses in the ratio of 3: 2. Their trial balance as on 31 March, 2020 was as under.

You are required to prepare Trading, Profit and loss account, Profit and loss appropration account for the year ended 31 March 2020 and balance sheet as on that date after considering the following.

a) Closing stock value at t 48,000.

b) Interest on capital allowed at 6% p.a.

c) X is allowed a salary of Rs. 600 per month.

d) Depreciate machinery by 5% and Furniture by 8%.

e) Provide for bad debts @ 5% on debtors.

f) Transfer of general Reserve Rs. 5,000.

Answer:

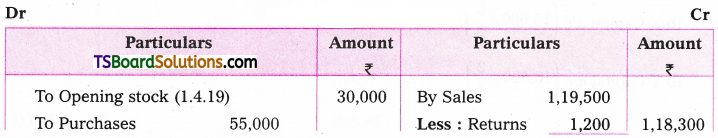

Trading & Profit and loss a/c of X & Y for the year ended 31.03.2020

Balance Sheet of X & Y as on 31-03-2020

![]()

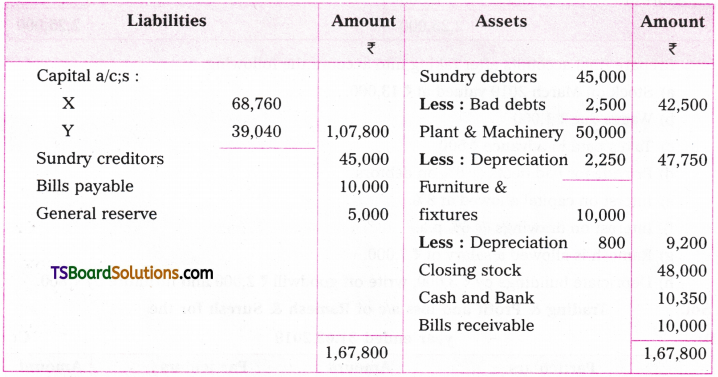

Question 7.

The following is the trial balance of Rarnesh and Suresh as on 31 March 2019. They share profit and losses in the ratio of 1: 3 respectively.

Prepare final accounts after taking into account the following.

a) Stock on March 2019 valued at Rs. 13,000.

b) Wages due Rs. 1,000

c) Taxes paid in advance Rs. 500

d) Provide for bad debts @ 6% on debtors.

e) Interst on capital allowed at 8%.

f) Interest on drawings @ 6% p.a.

g) Ramesh is allowed a salary of Rs. 7,000.

h) Depriciate buildings by Rs. 3,000, write off goodwill Rs. 2,000 and furniture by Rs. 800.

Answer:

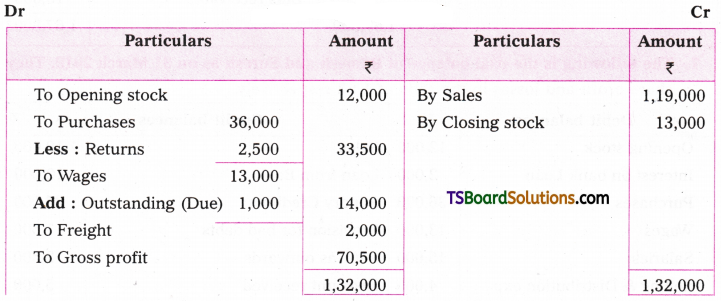

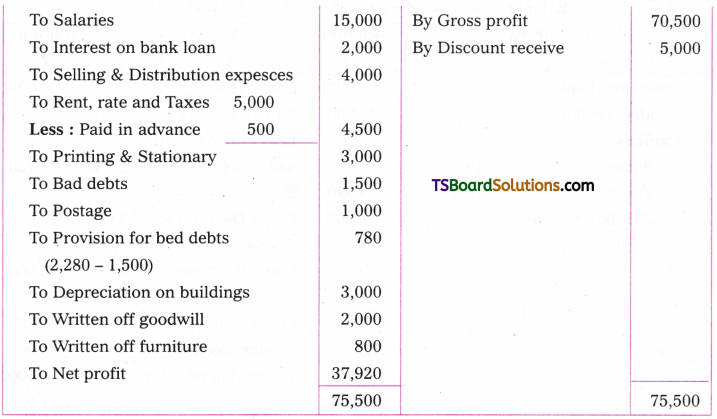

Trading & Profit and loss a/c of Ramesh & Suresh for the year ended 31.03.2019

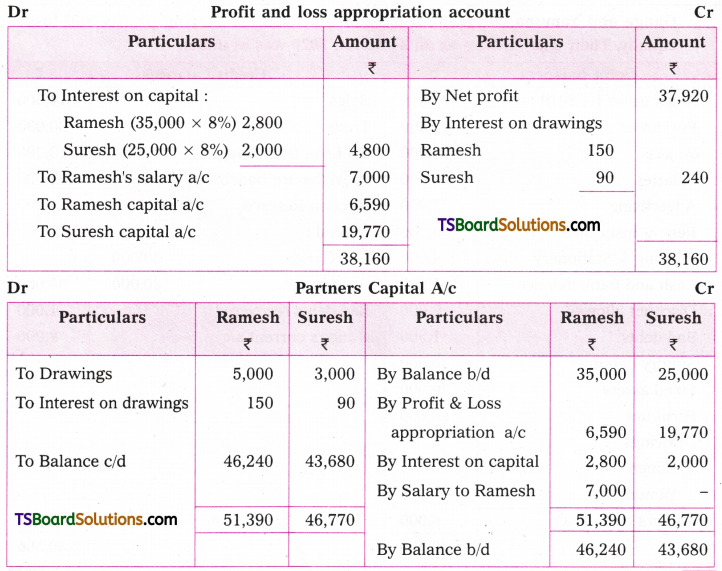

Balance Sheet of Ramesh & Suresh as on 31-03-2019

Question 8.

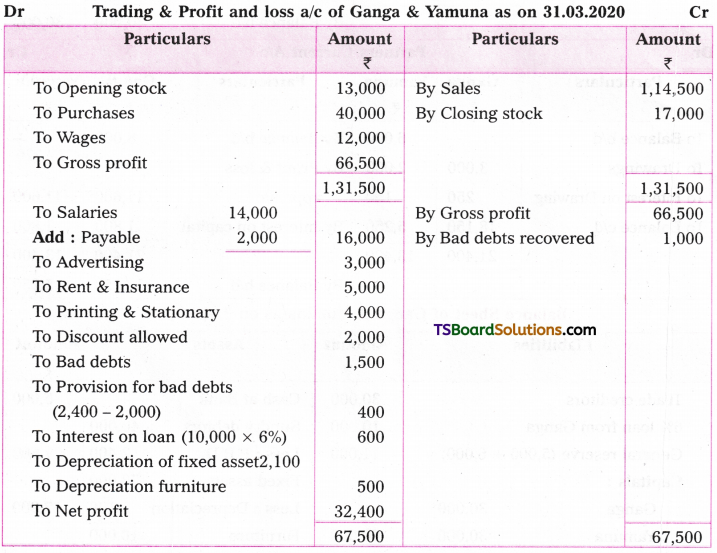

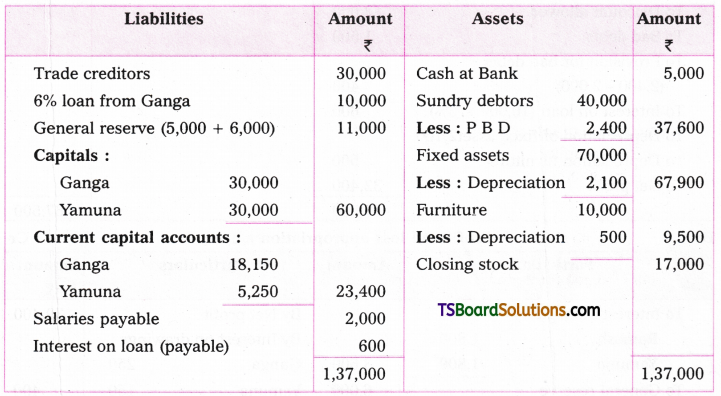

Ganga and Yamuna carrying on partnership business sharing profits and losses equally. Their trial balance as on 31 March 2020 was as under.

Additional information:

a) Closing Stock valued at Rs. 17,000.

b) Salaries payable Rs. 2,000.

c) Provide for bad debts @ 6% on debtors.

d) Interest on Loan to be provided.

e) Depreciate Fixed assets by 3% and furniture by Rs. 500.

f) Interest allowed on capital at 6%. No interest required on current accounts.

g) Interest on drawings Ganga Rs. 250, Yamuna Rs. 150.

h) Transfer to general Reserve Rs. 6,000.

Answer:

Balance Sheet of Ganga & Yamuna as on 31-03-2020

![]()

Textual Examples

Question 1.

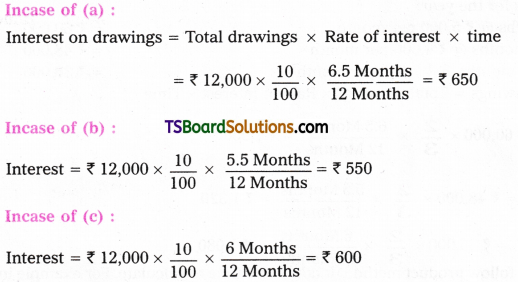

Mr. Ram withdraws Rs. 1000 per month for his personal use. The rate of interest islO % per annum. Calculate interest on drawings in the following cases;

(a) When the amount (drawings) is taken on 1st day of every month.

(b) When the amount is drawn on last day of every month.

(c) When the amount is drawn in the middle of every month.

Answer:

Ram’s total drawings for the year Rs. 12,000

(12 months @ Rs. 1000 per month)

Rate of interest 10% per annum.

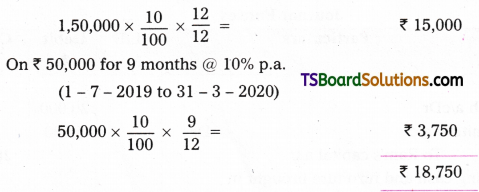

Question 2.

Mr. Ravi and Mohan are partners in a firm on 1st April 2019 with a capital of Rs. 1,50,000 and Rs. 2,00,000 respectively. On 1st July 2014 Mr. Ravi introduced Rs. 50,000 as an additional capital. Rate of it interest on capital is 10% p.a. Calculate interest on capital. Books are closed on 31st March, 2020.

Answer:

Calculation of interest on Capital On Ram’s capital

On Rs. 1,50,000 for one year @ 10% p.a.

(1 – 4-2019 to 31 – 3-2020)

On Mohan’s capital

On Rs. 2,00,000 @ 10% p.a. for one year

(1-4-2019 to 31 -3 – 2020)

Question 3.

Ram, Laxman and Hanuman are partners in a firm sharing profits and loss in the ratio of 2: 2: 1 respectively. Ram withdraw Rs. 5,000 per month on 1st day of every month. Laxman withdraw Rs. 4,000 per month on last day of every month. Hanuman withdraw^ Rs. 3,000 per month at the middie of every month. Rate of interest on drawings is 6% per annum. Calculate interest on drawings.

Answer:

Calculation of interest on Drawings:

Total drawings for the year;

Ram: 12 months @ t 5,000 per month = Rs. 60,000

Laxman: 12 months @ Rs. 4,000 per month = Rs. 48,000

Hanuman: 12 months @ Rs. 3,000 per month = Rs. 36,000

Interest on drawings = Total drawings x Rate of interest x Time

Note: (Student may follow product method. It take more time to calculate. For example in case of Ram’s Drawings interest is to calculated for 12 times, i.e., on 1st Rs. 5,000 drawn, interest is for 12 months and 2nd Rs. 5,000 drawn, interest is for 11 months so on. If we take average of this we get 6.5 months (time). So, calculate interest for 6.5 months on total drawings for the year. Therefore, student is advised to remember the above formula for each mode of drawings).

Question 4.

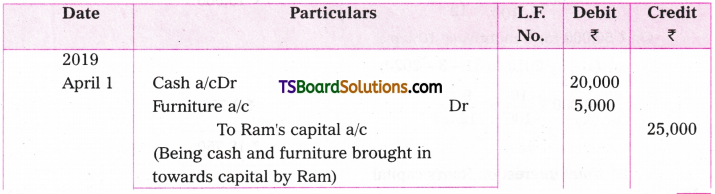

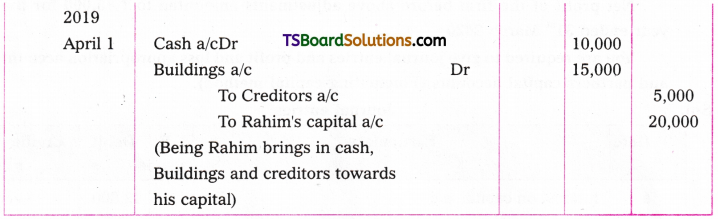

Ram and Rahim commenced a business on 1st April 2019. Ram brings in Rs. 20,000 in cash and Furniture worth Rs. 5,000 towards his capital. Mr. Rahim brings Rs. 10,000 in cash and Rs. 15,000 worth of building and creditors Rs. 5,000 towards his capital. Give journal entries and capital account of Ram and Rahim.

Answer:

Journal Entries

Ledger Accounts:

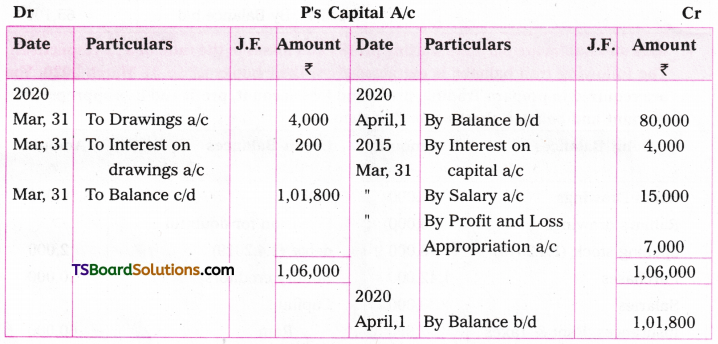

Question 5.

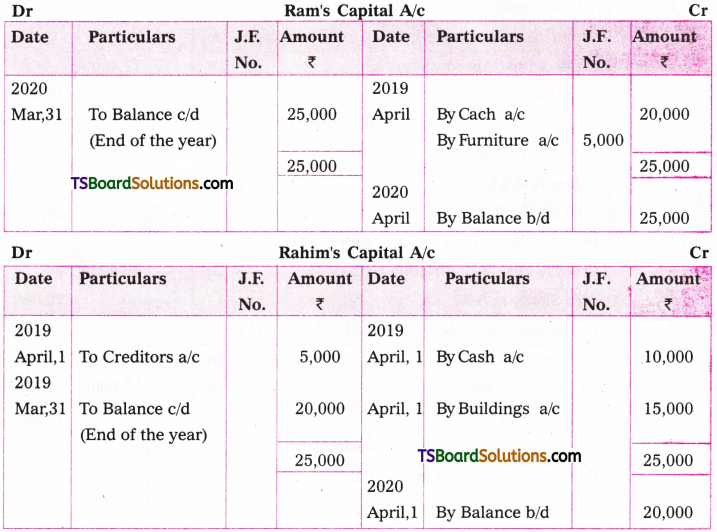

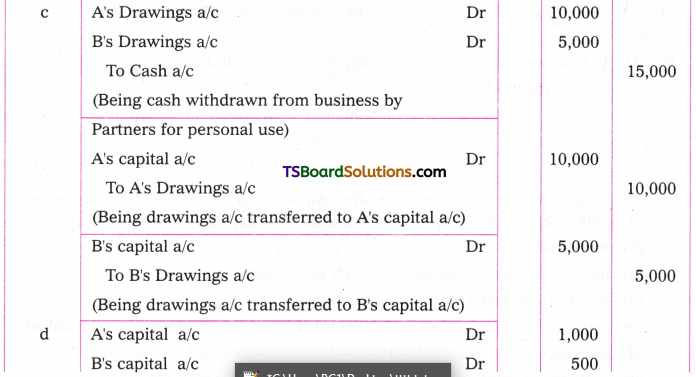

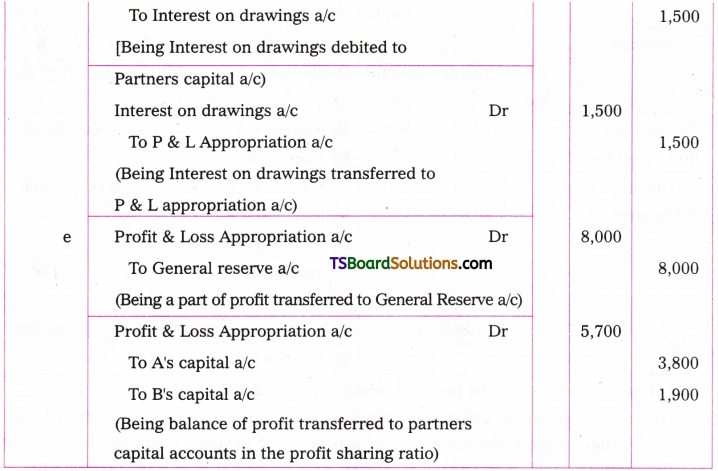

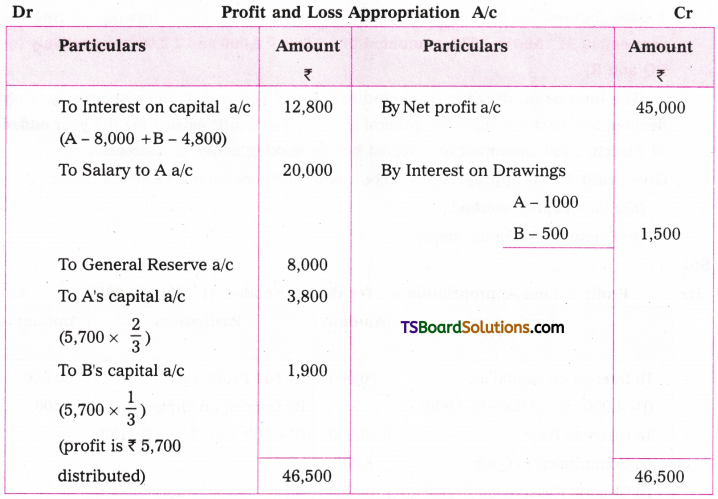

Mr. A and B are partners sharing profits and losses in the ratio of 2:1 have contributed Rs.1,00,000 and Rs. 60,000 respectively towards their capital. The partnership agreement provides that;

(a) Interest is allowed on capital @ 8% per annum.

(b) Mr. A is allowed a salary of Rs. 20,000 p.a.

(c) During the year A takes t 10,000 and B takes Rs. 5,000 towards personal use.

(d) Interest on drawings amounted to Rs. 1,000 for A and Rs. 500 for B.

(e) Partners decided to transfer Rs. 8,000 to general reserve a/c.

Net profit of the firm before above adjustments amounted to Rs. 45,000 for the year ended 31st March 2020.

You are required to give journal entries and profit and loss appropriation account and partners capital accounts (Fluctuating capital method).

Answer:

Journal entries

Note: Capital accounts may be prepared separately for A and B.

![]()

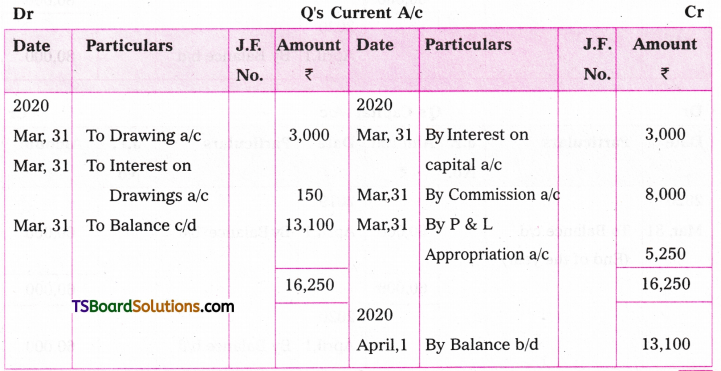

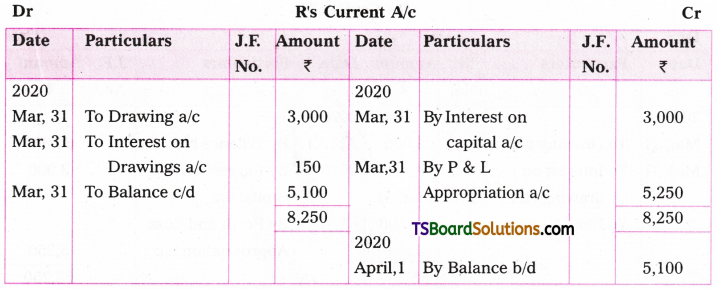

Question 6.

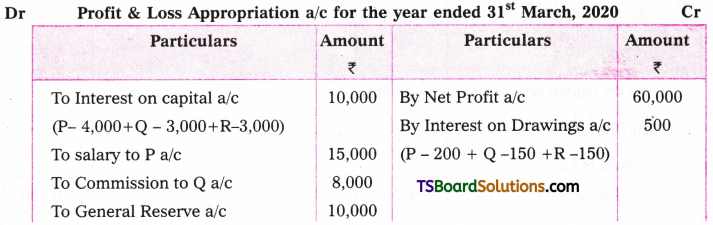

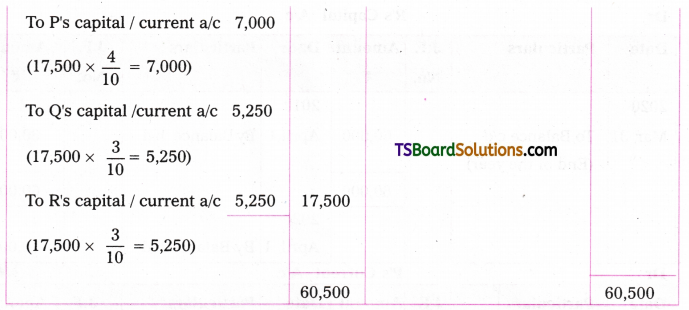

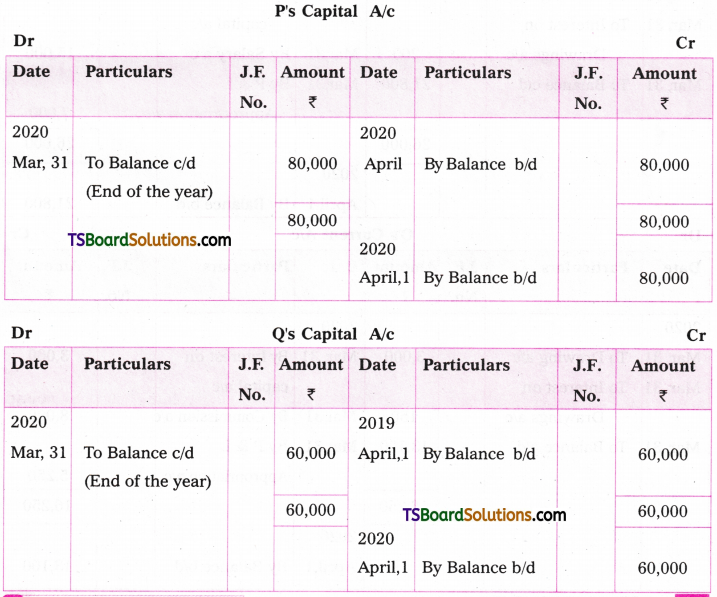

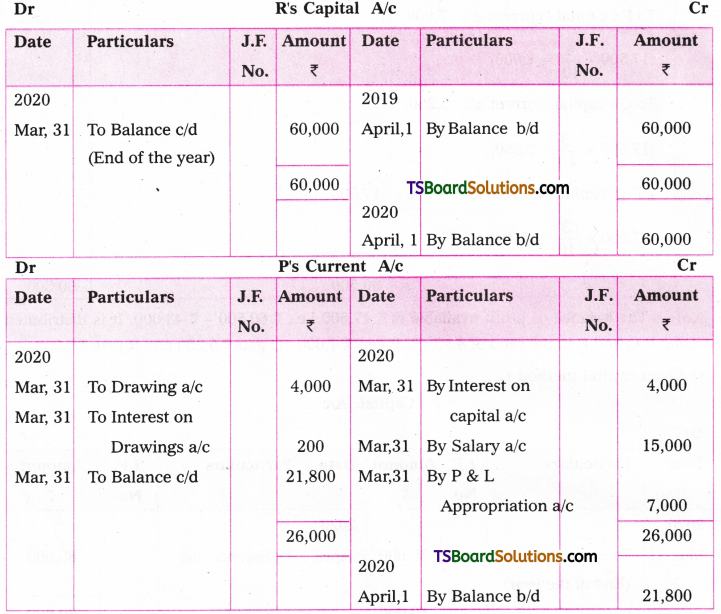

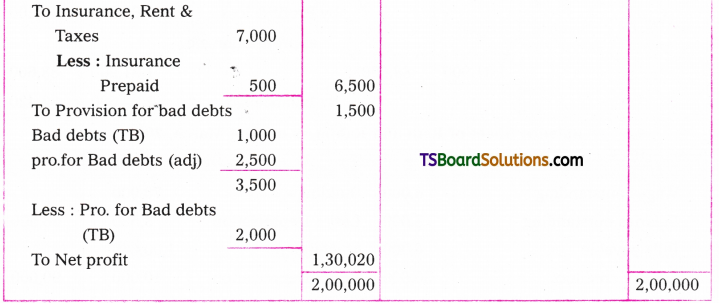

P, Q and R are partners sharing profits and losses in the ratio of 4: 3: 3. On 1st April 2019, their capital accounts showed a balance Rs. 80,000, Rs. 60,000 and Rs. 60,000 respectively. P is entitled to a salary of Rs.15,000 and Q is to get a commission of Rs. 8,000. Interest on capital is allowed @ 5% per annum. Their drawings during the year ended 31st March 2020, amounted to Rs. 4,000, Rs. 3,000 and Rs. 3,000 respectively for P,Q and R.

The interest on drawing amounted to Rs. 200, Rs. 150 and Rs. 150 respectively They decided to transfer Rs. 10,000 to general reserve. The profit earned for the year ended 31 March, 2020 amounted to Rs. 60,000 before making above adjustments.

Give profit & loss appropriation account and partners capital accounts under

(a) Fixed capital method

(b) Fluctuation capital method,

Answer:

Note: The balance of profit available is Rs. 17,500 i.e., Rs. 60,500 – Rs. 43,000. It- is distributed among P, Q and R in the ratio of 4: 3: 3. P gets Rs. 7,000: Q gets Rs. 5,250 and R gets Rs. 5,250.

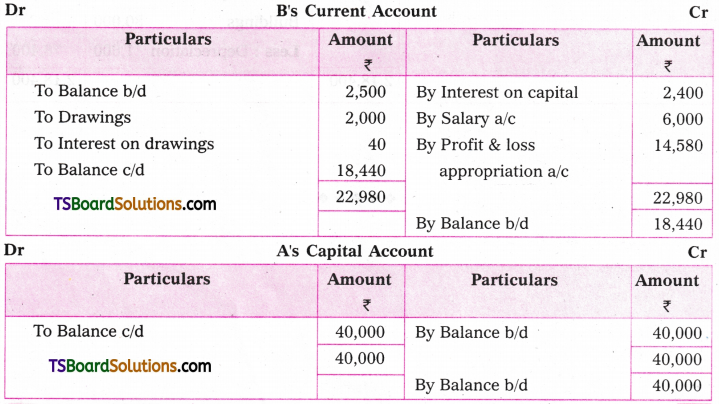

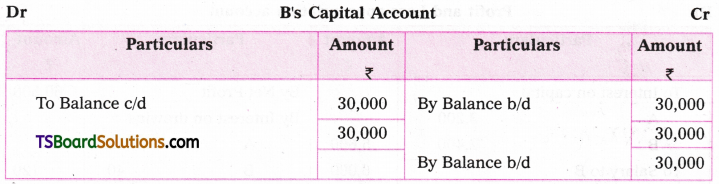

(a) Fixed capital method:

(b) Fluctuating capital method:

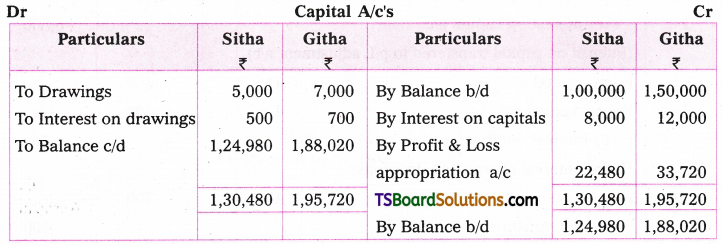

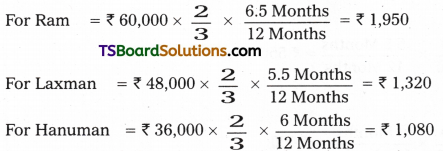

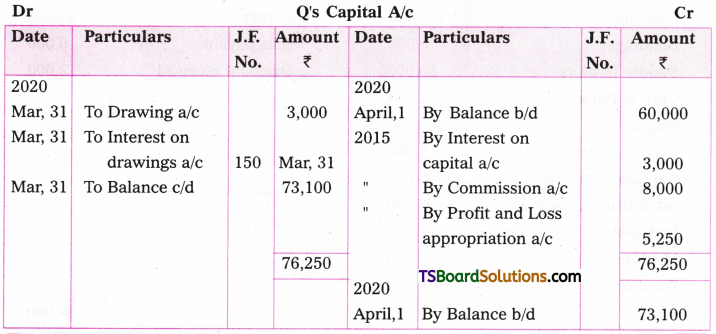

Question 7.

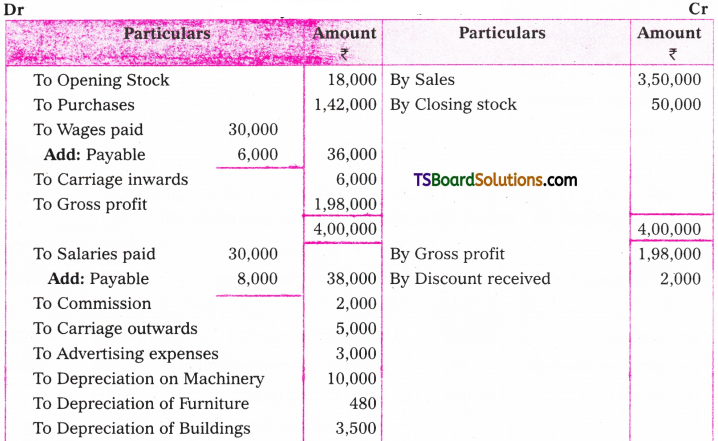

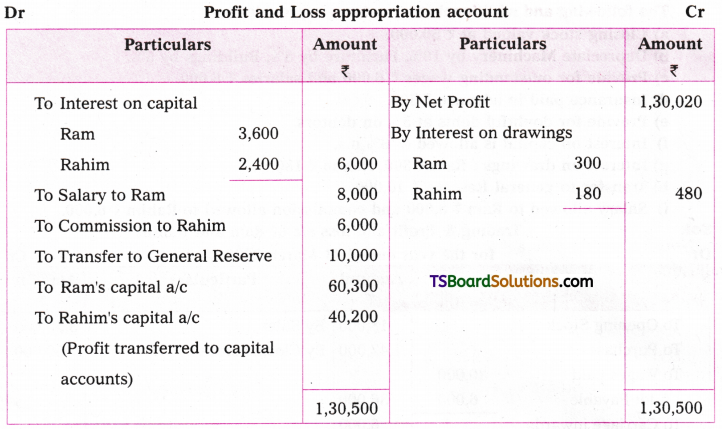

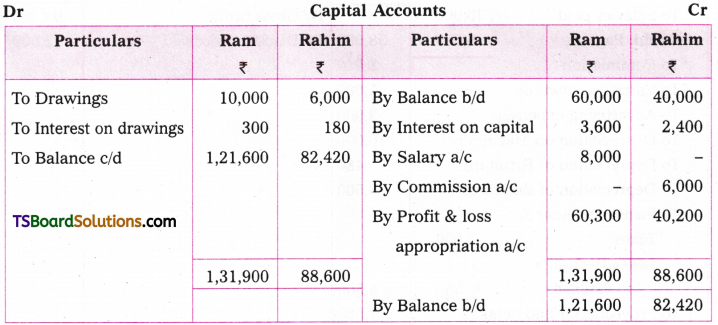

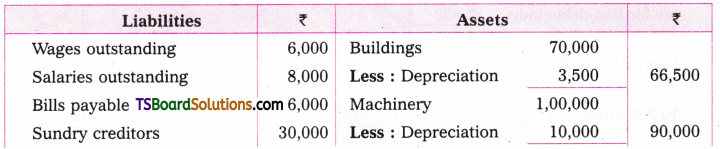

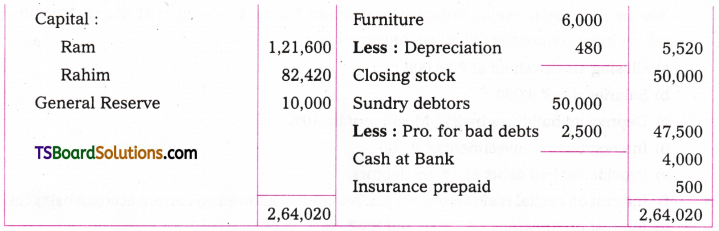

Ram and Rahim are partners sharing profits and losses in the ratio of 3: 2 respectively. The following trail balance is extracted from their books as on 31 March 2020. You are required to prepare Trading, profit and loss account, profit and loss appropriation account and balance sheet as on that date.

The following and additional Informations is provided:

a) Closing stock valued at T 50,000.

b) Depreciate Machinery by 10%, Furniture by 8%, Buildings by 5%.

c) Provide for outstanding wages Rs. 6,000 and salaries Rs. 8,000.

d) Insurance paid in advance Rs. 500.

e) Provide for doubtful debts at 5% on debtors.

f) Interest on capital is allowed @ 6% p.a.

g) Interest on drawings: Ram Rs. 300, Rahim Rs. 180.

h) Transfer to general Reserve t 10,000.

i) Salary allowed to Ram Rs. 8,000 and commission allowed to Rahim Rs. 6,000.

Answer:

Trading & Profit and loss a/c of Ram and Rahim for the year ended 31 March, 2020

Note: Profit is Rs. 1,00,500 (ie., 1,30,500 – 30,000) transferred to capital accounts of Ram 3/5 of 1,00,500 ie., Rs. 60,300 and to Rahim 2/5 of 1,00,500 ie., 40,200.

Balance Sheet of Ram and Rahim as on 31st March, 2020

Note: Capital accounts age maintained under fluctuating capital method. Hence, all adjustments relating to interest on capital, drawings, salary and commission to partners, drawings, general reserve are recorded in capital accounts of partners concerned.

![]()

Question 8.

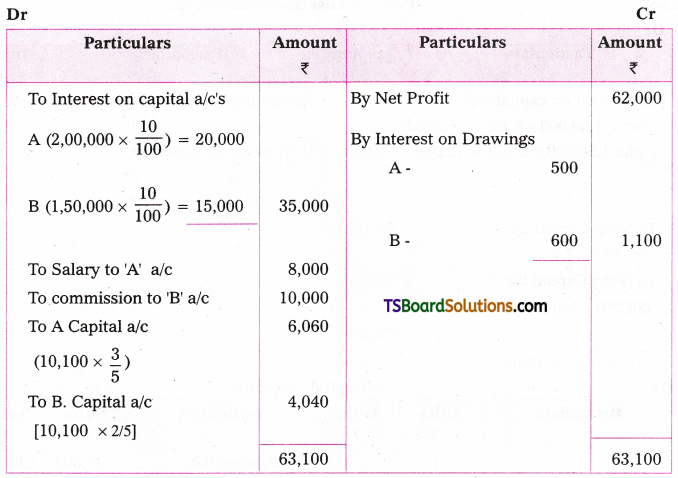

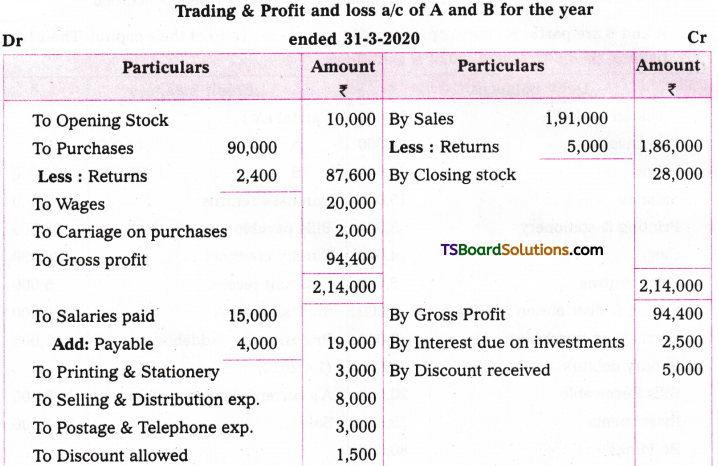

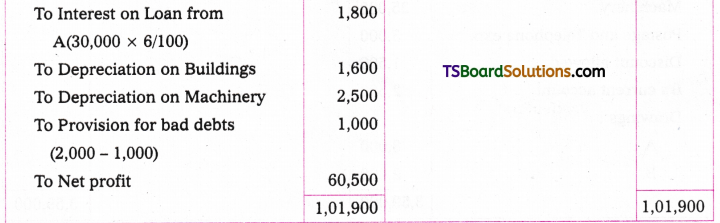

A and B are partners sharing profits and losses in the ratio of their capital. Their trial balance as on 31 March, 2020 is as follows.

You are required to prepare financial statements for the year ending 31 March 2020 after taking into account the following adjustments.

a) Closing stock valued at Rs. 28,000.

b) Salaries due Rs. 4,000.

c) Depreciate buildings by 2%, Machinery by 10%.

d) Interest due on investments Rs. 2,500.

e) Provide for bad debts at 5% on debtors.

f) Interest on capital is allowed at 8% p.a. No interest allowed on current account balances.

g) Interest on drawings: A – Rs. 80 and B – Rs. 40.

h) Salary allowed to B * Rs. 6,000.

i) Transfer to general Reserve Rs. 15,000.

Answer:

Balance Sheet of A and B as on 31 March, 2020