Telangana TSBIE TS Inter 2nd Year Accountancy Study Material 7th Lesson Computerised Accounting System Textbook Questions and Answers.

TS Inter 2nd Year Accountancy Study Material 7th Lesson Computerised Accounting System

Very Short Answer Questions

Question 1.

What is Computerized Accounting?

Answer:

- Computerised Accounting is the maintaining of accounts through computers by use of special software.

- computerized accounting is an accounting system formed by computer (Automation) and accounting rules and procedures.

Computerised accounting = Computer (Automation) + Accounting (Rules & Procedures)

![]()

Question 2.

What is the need for using Computerized Accounting?

Answer:

- Computerized accounting system provides various services to business concerns to meet all the purposes.

- A computerized accounting system automates the accounting process by improving efficiency and cutting down the cost.

- A computerized accounting system saves time, and effort, considerably reduces/ eliminates mathematical errors and allows for much more timely information.

- Data within the computerized accounting system is accurate and upto date. Management can request online report in real-time and make decisions more reliable and timely.

Question 3.

How can you say that computerized accounting Is useful than Manual Accounting?

Answer:

Computerized Accounting is more useful than manual accounting because it have unique features and several advantages over then manual accounting. They are:

- Fast, Simple and Integreated.

- Accuracy and error free.

- Reliability, scalability and security.

- Upto date information and helps to make Quick Decisions.

Question 4.

What is the Feature of Scalability?

Answer:

- Computerized Accounting has the flexibility to record transactions with the changing volume of business.

- Computerized Accounting is designed to meet the current and future needs of the companies irrespective of their size and style.

Question 5.

Write about the following features of Computerized Accounting.

Answer:

1. Total Visibility: Computerized Accounting provides enough time to plan to increase the customer base and enhance customer satisfaction. Companies will have greater visibility into the day-to-day business operations and access to very important information.

2. Supremacy: Computerized Accounting is capable of storing huge volumes of transactions with greater retrieval capacity and efficiency.

3. Accuracy and Spread: Computerized accounting has customized templates for users which allow fast and accurate data entry. Thus, after recording the transactions it generates the information and reports automatically and it is very simple to operate with a greater speed.

4. Simple and Integrated: Computerized Accounts helps all business by automating and integrating all business activities. Such activities may be sales, finance, purchase, inventory, and manufacturing etc. At also facilitates the arrangement of accurate and up-to-date business information in a readily usable form.

![]()

Question 6.

Write any two of the limitations of Computerized Accounting.

Answer:

1. Cost of Training: The computerized accounting packages generally require specialized staff personnel. As a result, huge training costs are incurred to understand the use of hardware and software on a continuous basis because newer types of hardware and software are acquired to ensure efficient and effective use of computerized accounting systems.

2. Health Issues: The extensive use of computer systems may lead to the development of various health problems such as bad backs, eyestrain, muscular pains, etc. This affects adversely the working efficiency of accounting staff on one hand and increased medical expenditure on such staff.

Question 7.

Write any two of the differences between Manual and Computerized Accounting.

Answer:

| Manual Accounting System | Computerized Accounting System |

| 1. Definition/Meaning: Manual Accounting is the system which physical register is maintained for keeping the records. | In Computerized Accounting system where we use computer and different accounting software to maintained for digital records. |

| 2. Measurements/Calculations: All Calculations of adding, subtracting and balancing are done manually. | All the calculations are done by computer system. |

Question 8.

What do you know about the following software?

Answer:

1. Profit Book:

- This software offers complete inventory management and detailed tax reports that help in stabilized controlling of the business.

- Whether, the firm is a manufacturing unit, wholesaler, or retailer, Profit Books offers a steady platform to track management process and file tax returns.

- From managing income and expense statements to tracking the entire cash flow, Profit Books serve as the best accounting and inventory management solution.

2. Giddh:

- It is an all-inclusive, modern accounting software in India, which uses local database and delivers custom reports for the successful growth of the business. The software is not only for financial management, but also deals in inventory, stock management and handles bank accounts with high-level security.

- Giddh is GST compliance and delivers insight reports for better analysis of accounting stability. The software supports multi-currency features that enable to manage globalized departments form one place.

3. Vyapar:

- This accounting software is a free platform that allows maintaining invoice, getting inventory records, managing books of accounts, and tracking daily business activities while focusing on business growth rate.

- Since, most of the small sector business needs a digital upgrade, Vyapar acts as an effective solution.

- Vyapar is GST compliant and allows error-free tax returns while eliminating errors occurred with manual calculations.

- Vyapar takes-charge to control individual units of the business, creates customizable invoices, and automates payment reminders.

4. Logic:

- It is an online accounting software in India that satisfies the demand of having a strategic ERP system in the accounting and financial module.

- Logic is advanced computerized software that facilitates error-free financial management, budgeting and planning, assists forecasting, renders efficient performance analysis and integrates general ledger and accounting data.

- Business management can hold cross-communication with different departments and facilitate collaborations across business delegates using comprehensive data offered by Logic.

5. myBooks:

- This software is an excellent accounting solution for entrepreneurs, accountants, small IT and financial companies and free lancers. myBooks GST Accounting Software designed for all small business owner.

- my books designed from the small business owners’ perspective, kept easy user experience as the central objective in designing product. So, there will not be any need for formed training.

6. Zoho Books:

- This is popular online accounting software in India, which acts as an integrated platform for end-to-end financial solutions. Zoho Books is GST compliant, automates business workflow, and manages financial accounting and help in managing departments collectively from one single source.

- Right from maintaining sales orders and invoicing, Zoho Books mundane GST invoices, bookkeeping, huge, ledgers, and various accounting tasks.

- Zoho Books is feature-packed to manage cash receivables, payables, banking, inventory, timesheets, and business contacts and generate reports.

![]()

Short Answer Questions

Question 1.

Explain the importance of Computerized Accounting.

Answer:

A computerized accounting system is a system used by businesses for recording their financial information.

The importance of computerized accounting is given belows:

1) Time and Cost Savings: The use of computers makes in putting accounting information so simple. Business transactions are entered into the system and the system posts transactions accordingly. Thus, a computerized accounting system saves time and money,

2) Organization: A computerized accounting system help business to stay organized when information is entered into the system. It makes finding the information easy. Employees can see any financial information whenever it is needed.

3) Storage: In a Computerized accounting system data can be stored quickly after the information is entered into the system and the information is stored indefinitely. Companies perform backups on the system regularly to avoid loss of any information.

4) Distribution: Computerized accounting systems allows companies to distribute financial information easily. Financial statements are printed directly from the system and are distributed internally and externally to those needs the information.

5) Management Reports: Data within the computerized accounting system is accurate and up-to-date. Management can request online report in real-time and that makes management decisions more reliable and timely.

6) Regulatory Compliance: Reports are required on a regular basis from various government Agencies. A computer system can organize their data and reports to comply with these statutory requirements.

Question 2.

What are the features of Computerized Accounting?

Answer:

1) Accuracy and Speed: Computerized accounting has customized templates for users which allow fast and accurate data entry. Thus, after recording the transactions it generates the information and reports automatically and it is very simple to operate with a greater speed.

2) Quick Decision Making: This system generates real-time, comprehensive Management Information System (MIS) reports and ensures access to complete and critical information, instantly.

3) Scalability: It has the flexibility to record transactions with the changing volume of business. It is designed to meet the current and future needs of the companies irrespective of their size and style.

4) Security: Secured data and information can be kept confidential as compared to the „ . traditional accounting system.

5) Simple and Integrated: Computerized Accounting helps all businesses by automating and integrating all the business activities. Such activities may be sales, finance, purchase, inventory and manufacturing etc. it also facilitates the arrangement of accurate and up-to-date business information in a readily usable form.

6) Supremacy: Computerized Accounting is capable of storing huge volumes of transactions with greater retrieval capacity and efficiency.

Question 3.

Explain the five Advantages of Computerized Accounting.

Answer:

1) Accuracy: The possibility of error is eliminated in a computerized accounting system, because the primary accounting data is entered once for all the subsequent usage and processes in preparing the accounting reports.

2) Automation: Most of computerized accounting systems have standardized, user-defined formats of accounting reports that are generated automatically. The accounting reports such as Cash book, Trial balance, and Statement of accounts are obtained just by click of a mouse in a computerized accounting environment.

3) Efficiency: The computer-based accounting systems ensure better use of resources and time. This brings about efficiency in generating decisions, useful information and reports.

4) Management Information System Reports: The computerized accounting system facilitates the real-time production of management information reports, which will help management to monitor and control the business effectively.

Question 4.

Write any five limitations of Computerized Accounting.

Answer:

1) Cost of Training: The computerized accounting packages generally require specialized staff personnel. As a result, huge training costs are incurred to understand the use of hardware and software on a continuous basis because newer types of hardware and software are acquired to ensure efficient and effective use of computerized accounting systems.

2) Health Issues: The extensive use of computer systems may lead to development of various health problems such as bad backs, eyestrain, muscular pains, etc. This affects adversely the working efficiency of accounting staff on one hand and increased medical expenditure on such staff.

3) Reduction of Manpower: The introduction of computers in accounting work reduces the number of employees in an organization. Thus, it leads to greater amount of unemployment.

4) Security Issues: Computer-related crimes are difficult to detect. The alteration of records in a manual accounting system is easily detected. Fraud and embezzlement are usually committed on a computerized accounting system by alteration of data or programs. Hacking of passwords or user rights may change the accounting records.

5) Staff Resistance: Whenever the accounting system is computerized, there is a Significant degree of resistance from the existing accounting staff, partly because of the fear that they shall be made redundant and largely, because of the perception that they shall be less important to the organization.

6) System Failure: The danger of the system crashing due to hardware failures and the subsequent loss of work is a serious limitation of the computerized accounting system. Software damage and failure may occur due to attacks by viruses. No full proof solutions are available as of now to tackle the menace of attacks on software by viruses.

7) Unanticipated Errors: Since, the computers lack capability to judge, they cannot detect unanticipated errors as human beings commit.

![]()

Question 5.

Explain the difference between Manual and a Computerized Accounting system.

Answer:

| Basis | Manual Accounting System | Computerized Accounting System |

| Definition | Manual Accounting is the system in which physical register of Journal and Ledger is maintained for keeping the records of each transaction. | In this system of accounting, computer and different accounting software are maintained for digital record of each transaction. |

| Identification | Based on application of Accounting Principles. | Based on application of Accounting Principles software is designed. |

| Measurement | All calculations of adding, subtracting and balancing are done manually. | All the calculations are done by computer system. |

| Recording | Recording of financial transactions is through Journal (book of original entry). | Data content of these transactions is stored in well-designed database. |

| Adjustments | Adjustment Entries are to be made in Journal and Ledger. | We create Ledgers for adjustment record voucher entry. |

| Rectification of Errors | Rectification of Errors requires recording of adjustment entries. | Easy to rectify by deleting the wrong entry and record correct entry or correcting the figure. |

| Backup | Incase of fire or other miship, it is not possible to backup and save the paper records, unless many copies of all pages are made and stored in different places. | All transactions can be saved and backed up in Computerized Accounting. |

| Speed and Accuracy | User can flip to the pages to the needed, and even spread the books out of a table if needed. | Quicker as far as entering the transactions is concerned. |

Question 6.

What are the different factors influencing the selection of Prepackaged Accounting Software?

Answer:

1) Cost of installation: The choice of the software obviously requires consideration of organization’s ability to afford the hardware and software. A simple guideline to take such a decision is the cost-benefit analysis of the available options and the financing opportunities available to the firm. Sometimes, certain software which appears cheap to buy, involve heavy maintenance and alternation costs.

2) Data Facility:The transfer of database to other systems or other software is sometimes expected from the accounting software. Organizations may need to transfer information directly from the ledger into spreadsheet software such as Lotus or Excel for more flexible reporting. The software should allow the hygienic, untouched data transfer.

3) Ease of Adaptation: The software consider must be capable of attracting users and, if it requires simple training, should be able to motivate its potential users.

4) An important consideration before sourcing accounting software is flexibility, viz., data entry and the availability and design of various reports expected from it. The user should be able to run the software on a variety of platforms and machines.

5) MIS Reports: The MIS reports and the degree to which they are used in the organization also determine the acquisition of software. For example, software that requires simply producing the final accounts or cashflow or ratio analysis may be ready-to-use software. However, the software, which is expected to produce cost records, needs to be customized as per user requirements.

6) Security Features: Another consideration before buying accounting software is the security features, which prevent unauthorized personnel from accessing and/or manipulating data in the accounting system.

7) Size of Organisation: The size of the organization and the volume of business transactions do affect the software choices. Small organizations, e.g., in non-profit organizations, where the number of accounting transactions are not so large, may opt for simple, single-user operated software. While, a large organization may require sophisticated software to meet the multiuser requirements, geographically scattered and connected through complex networks.

8) Vendors Reputation: Another important consideration is the reputation and capability of the vendor. This depends upon how long has been the vendor is in business of software development, whether there are other users of the software.

Question 7.

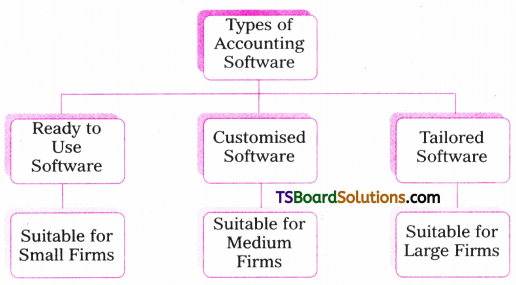

Explain the types of Accounting Packages.

Answer:

Every Computerized Accounting System is implemented to perform the accounting activity. Accounting Software is are an integral part of the computerized accounting system such as recording and storing of accounting data and generate reports as per the requirements of the user. As per this, accounting software is classified into three categories. They are:

1) Read-to-Use Software:

- This software is suited for organizations running small or conventional business where the frequency or volume of accounting transactions is very low.

- The cost of installation is low and number of users is limited. It is relatively easier to learn and accountant adaptability is very high.

- This implies that level of secrecy is relatively low and the software is prone to data frauds. The training needs are simple and sometimes the supplier of software offers the training on the software free.

![]()

2) Customized Software:

- This may be customized to meet the special requirement of the business orginizations. Customized software is suited for medium businesses and can be linked to the other information systems.

- The cost of installation and maintenances is relatively high because the high cost is to be paid to the vendor for customization.

- Secrecy of data and software can be better maintained in this software.

3) Tailored Software:

- The accounting software is generally tailored in large business organizations such as multi-national companies with multi-users and geographically scattered locations.

- This software requires specialized training to the users.

- The secrecy and authenticity checks are robust in such type of software and they offer high flexibility in terms of number of users.