Telangana TSBIE TS Inter 2nd Year Accountancy Study Material 1st Lesson Depreciation Textbook Questions and Answers.

TS Inter 2nd Year Accountancy Study Material 1st Lesson Depreciation

Short Answer Questions

Question 1.

Write the need or significance of depreciation.

Answer:

Need or significance or providing depreciation:

1. To ascertain true results of business operations: As depreciation is treated as expenditure, it must be charged to profit and loss account against income to assess the real profit/loss of the business.

2. To show the fixed asset at their original worth in the balance sheet: If depreciation is not provided, the value of the asset shown in the balance sheet is not correct. Hence, the real value of the asset must be shown in the balance sheet after deducting depre¬ciation from its book value.

![]()

Question 2.

Briefly explain different methods of providing depreciation.

Answer:

The various methods pf providing depreciation are given below:

1) Fixed Instalment method: Fixed instalment method is also called as equal instalment method or original cost method or straight-line method under this method depreciation is charged on the original cost of the asset every year. In this method annual depreciation is fixed or uniform.

2) Diminishing Balance method: Diminishing balance method is also called as written down value method (WDU) or reducing balance method under this method deprecia¬tion is calculated at a fixed percentage on the diminishing value of the asset.

3) Annuity method: This method takes into account the interest lost on the acqisition of an asset. Interest is calculated on the book value of the asset in the beginning of every year, and is debited to asset account. The amount of depreciation to be charged is uniform and is calculated on the basis of annuity tables.

4) Depreciaton fund method: This method provides funds for replacement of assets. The amount writtenoff as depreciation is kept aside and that amount is invested in certain securities. When the life of the asset expires, the securities are sold and a new asset is purchased with the help of sale proceeds. Depreciation amount is calculated with the help of Sinking Fund Tables.

5) Depletion method: Under this method total quantity of output likely to be available is estimated. Depreciation rate is calculated by dividing the cost of the asset by the esti-mated quantity of product likely to be available.

Suitability: It is used for mines and quarries.

6) Machine Hour Bate method: In this method the life of asset is estimated in hours. In order to calculate depreciation the actual number of hours in a particular year is multiplied by the hourly rate.

Suitability: This method is Used for Machines.

Question 3.

Write the merits and demerits of straight-line method.

Answer:

Merits:

- This method is very easy to understand.

- It is very simple to calculating depreciation & rate of depreciation.

- Under this method, assets can be written off completely. That is upto zero, so the value of asset is equally spread out over the useful life of the asset.

- This method is suitable for small businesses.

- This method is useful to those assets having lower value and fixed life.

Demerits:

- The method is illogical, because, depreciation is charged on original cost every year, but to the balance of asset is declining every year.

- This method is not recognised by the income tax authorities.

- This method is not useful incase any additions and expansions made to assets.

- In put pressure on the asset in the slack years, in the end of the asset’s life, it bears more repairs and maintence charges but the depreciation charge is equal for all years.

Question 4.

What are the advantages and limitations of the diminishing balance method?

Answer:

Advantages:

- This method is easy to calculate depreciation when there are no additions to the asset.

- It equalises the burden on profit and loss account in respect of repairs and deprecia¬tion put together.

- This method is accepted by income tax authorities under the income tax Act 1961.

- This method is logical in the sence that as the asset value decreases the amount of depreciation also goes on decreasing.

- This method can be used where obsolescence rare is high.

Limitations:

- It is very difficult to determine the appropriate rate of depreciation.

- In this method the value of the asset cannot be reduced to zero. Some balance will be left at the end of its useful life.

- This method is not suitable for the assets which have shorter life.

- It does not provide for the replacement of the asset.

Question 5.

Distinguish between stright line method and diminishing balance method.

Answer:

| Basis | Fixed instalment Method | Diminishing Balance Methods |

| Meaning | A method of depreciation in which the cost of the asset is spread uniformly over the life years by writing off a fixed amount every year. | A method of depreciatiion in which a fixed rate of depreciation is charged on the book value of the asset, over its useful life. |

| Calculation of Depreciation | On the original cost of the asset. | On the written-dOwn value of the asset |

| Annual Depreciation Charge |

Remains fixed during the useful life of the asset. | Reduces every year. |

| Value of Asset | Completely written-off. | Not completed written-off. |

| Impact on P&L A/c | Increasing trend. | Remains constant. |

| Recognition by income tax law | It is not recognized by the Income Tax Department. | It is recognized by the Income Tax Department. |

| Balance of the Asset Account | The value of the asset can be reduced to zero or scrap value. | The value of the asset cannot be reduced to zero. |

![]()

Very Short Answer Questions

Question 1.

Define the term Depreciation.

Answer:

- Depreciation is a permanent, continuous and gradual shrinkage in the value of fixed asset.

- Depreciation means a fell in the value or quality of an asset.

- According to companies Act 2013, “Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life”.

Question 2.

What is obsolescene?

Answer:

- Obsolescene means diminution in the value of fixed asset due to new inventions, new improvements, change in fashions, change in customer’s tastes and preferences.

- For Example: Invention of computer made typewriters becomes obsiete or out dated.

Question 3.

What are the causes of depreciation?

Answer:

Causes of depreciation are:

- Wear and Tear,

- Depletion,

- Accidents,

- Obsolescence,

- Effluxion of time/passage of time, 6) Fluctuations.

Question 4.

What is Depletion?

Answer:

- Depletion means loss of natural resources mineral wealth due to extraction of raw material from mines, quarries, oil wells etc.

- It refers to the physical deterioration by the exhaustion of natural resources like oil wells, mines quarries etc.

Question 5.

What is the straight-line method?

Answer:

- The method under which, the same amount of depreciation is charged on the original cost of the asset every year throughout the life of the asset, is called straight line method.

- Straight line method is also known as “Fixed Instalment Method” or Equal Instalment method” or original cost method”.

Question 6.

What is diminishing Balance Method?

Answer:

- A method under which depreciation is calculated at a fixed percentage on the original cost of the asset in the first year and on written down value in the subsequent year is called dininishing balance method.

- It is also called reducing balance method (or) written down value method.

Question 7.

Distinguish depletion from depreciation.

Answer:

| Depredation | Depletion; |

| 1) Depreciation means decrease in the value of asset due to its usage or passage of time. | 1) Depletion means loss of natural resources mineral wealth due to extraction of raw material. |

| 2) Depreciation charged on fixed assets like Machinery, furniture etc. | 2) Depletion is charge on mines, quarries, oil wells etc. |

![]()

Textual Problems

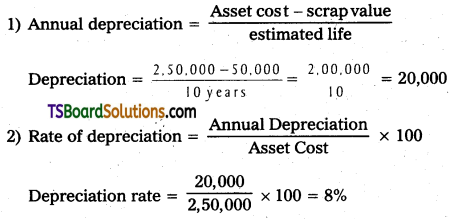

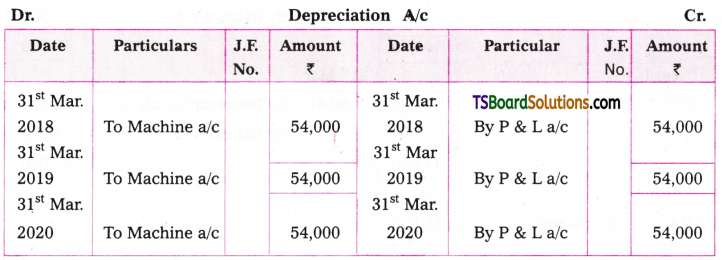

Question 1.

Straight Line Method:

Sri sai & Co purchased a machine for Rs. 2,50,000 on 1st April 2009. Estimated life of the machine is 10 years. The scrap value at the end of its life is Rs. 50,000. Calculate the annual depreciation and rate of depreciation assuming that accounts are closed on 31st March every year. Show the machinery a/c for the first three years under fixed instalment method.

Answer:

Calculation of depreciation and rate of depreciation:

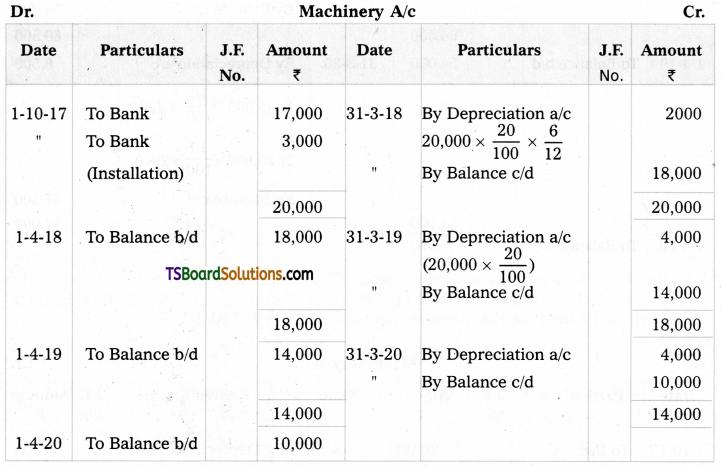

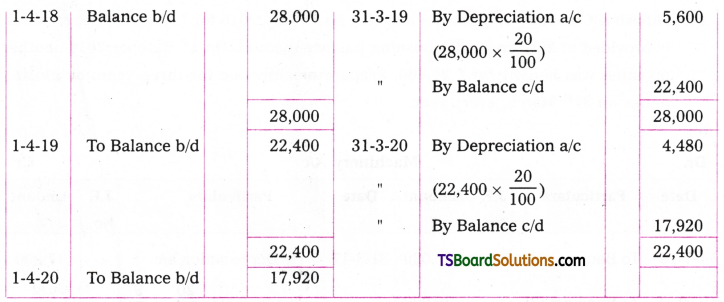

Question 2.

Ganesh bought a machine or Rs. 17,000 and paid for its installation Rs. 3,000 on 30th Sept. 2017. Depreciation is provided at 20% under the straight-line method. Prepare machine a/c up to 31st March, 2020.

Answer:

![]()

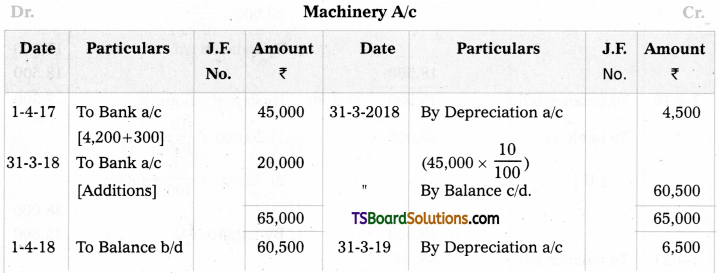

Question 3.

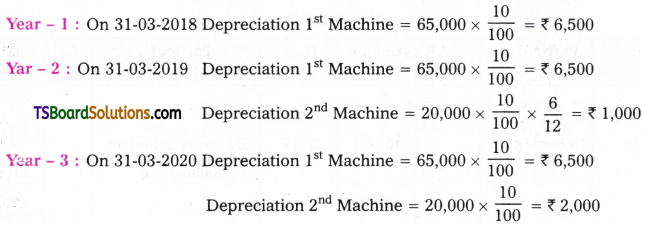

Kiran & Sons purchased a machine for 142,000 and paid Rs. 3,000 for its erection on 1st April 2017. Additions are made to the machine on 31st March 2018 for Rs. 20,000. Accounts are closed at the end of financial year. Depreciation is allowed at 10% under fixed instalment method. Prepare machine a/c for three years.

Answer:

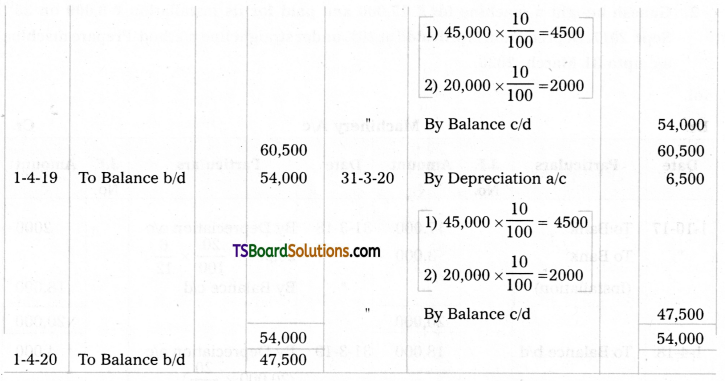

Question 4.

Rajesh & Sons purchased a machine on 1st October, 2017 for Rs. 20,000. Depreciation is provided at 15% on original cost method. Another machine was bought on 1st April, 2019 for Rs. 30,000. Prepare machine a/c upto 31st March, 2020.

Answer:

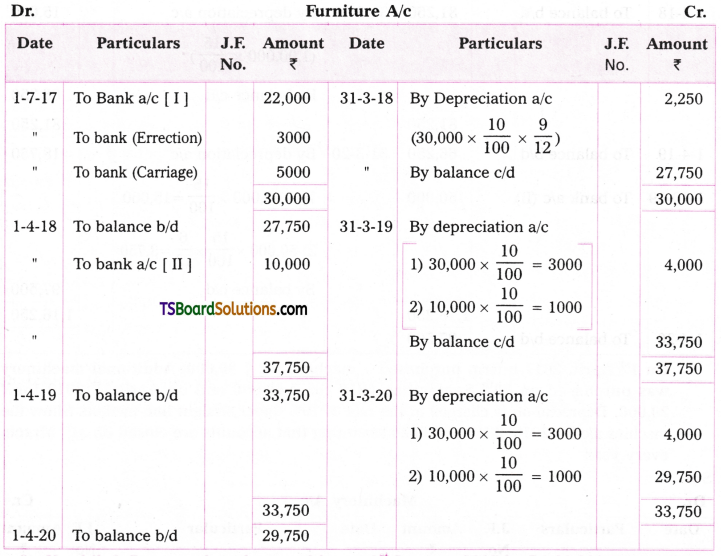

Question 5.

Ramana & Brothers purchased furniture for Rs. 22,000 on 1st July 2017. Errection charges paid for Rs. 3,000 and paid for carriage Rs. 5,000. Depreciation is to be charged at the rate of 10% on original cost method. Additions are made to the asset for Rs. 10,000 on 1st April 2018. Show the furniture a/c for three years assuming that accounts are closed on 31st March every year.

Answer:

![]()

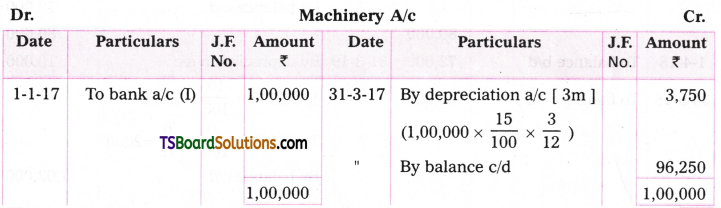

Question 6.

Karthik & Company bought a machine on 1st January, 2017 for Rs. 1,00,000. Depreciation is provided at 15% under straight line method. Another machine was purchased on 1st October 2019 for Rs. 50,000. Company closes its accounts every year at the end of the financial year. Prepare machine a/c for four years.

Answer:

Question 7.

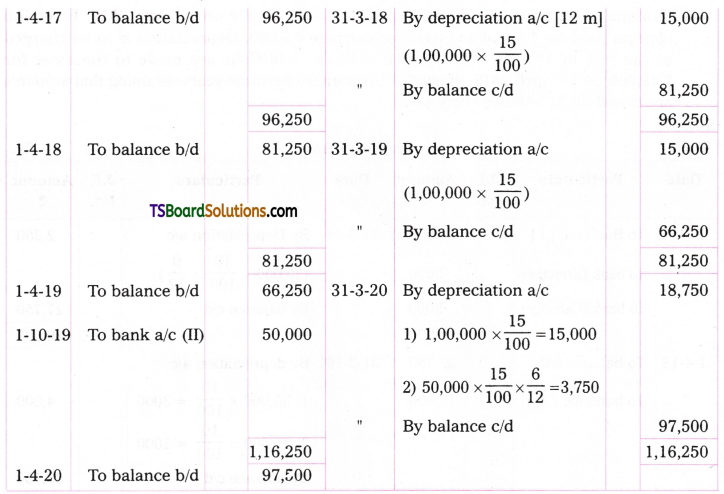

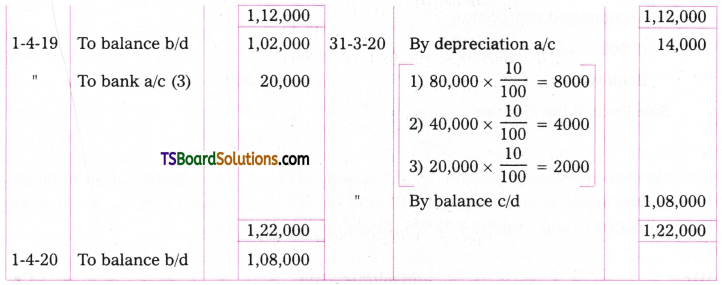

On 1st April, 2017 a firm purchased a machine for Rs. 80,000. Additional machinery was purchased on 30th September, 2018 for Rs. 40,000 and on April 1st 2019 for Rs. 20,000. Depict iation is charged at the rate of 10% under straight line method. Show the machine a/c for 2018, 2019 and 2020 assuming that accounts are closed on 31st March,

Answer:

Question 8.

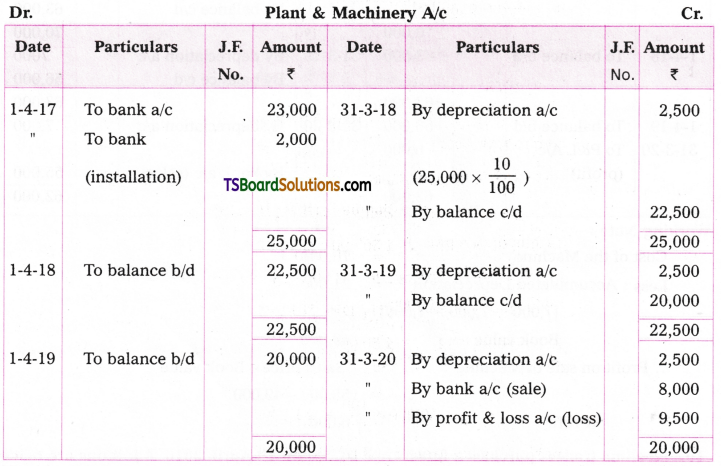

Raghava bought a plant and machine on 1st April, 2017 for Rs. 23,000 and paid Rs. 2,000 for its installation. Depreciation is to be allowed at 10% under straight line method. On 31st March 2020 the plant was sold for Rs. 8,000. Assuming that the accounts are closed at the end of the financial year. Prepare plants machine a/c.

Answer:

Working Note:

Cost of the plant & machine = 25,000

Loss calculation on the date of sale of machine:

Accumulated depreciaton = 7,500

(2,500 + 2,500 + 2,500)

Bank value = 17,500

Sale Price of the Machine = 8,000

Loss = 9,500

![]()

Question 9.

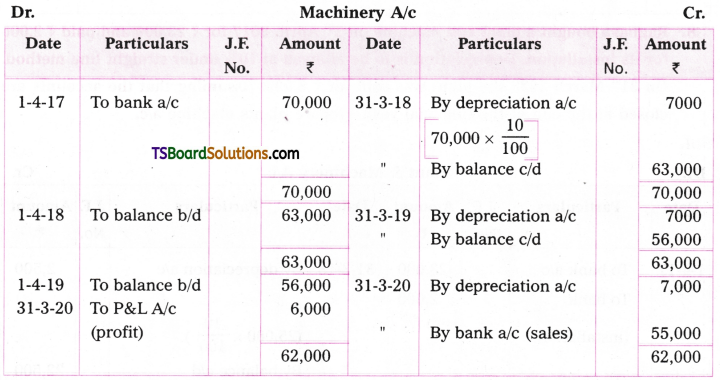

Vardhan purchased a machine on 31st March 2017 for Rs. 70,000. Depreciation is charged at 10% under original cost method. After three years he found that the machine was not suitable and sold for Rs. 55,000. Show the machine a/c.

Answer:

Working Note:

Cost of the Machine = 70,000

Less: Accumulated Depreciation = 21,000

[7,000 + 7,000 + 7,000]

Book value = 49,000

Profit on sale of Machine = Sales price – Book value

= 55,000 – 49,000

= 6,000

Question 10.

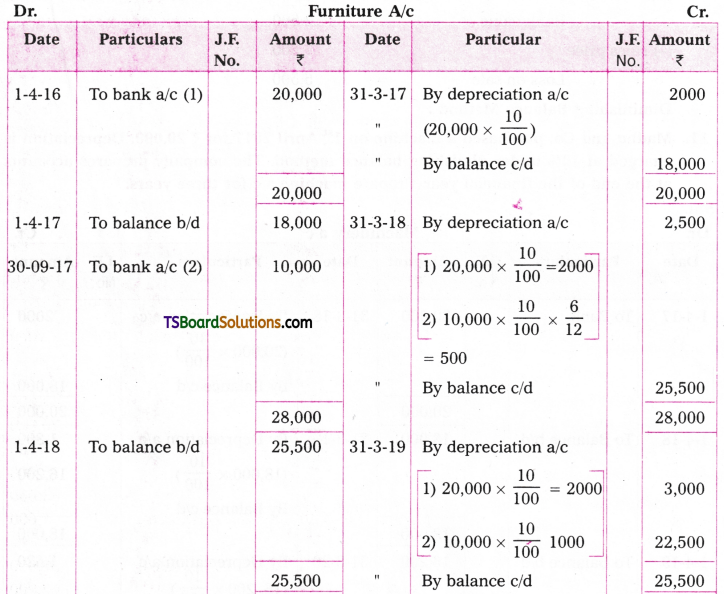

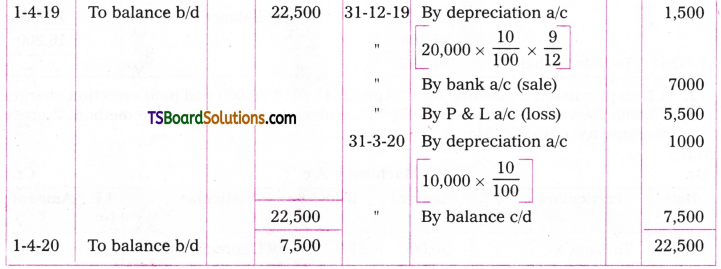

Neelima traders purchased furniture Rs. 20,000 on 1st April, 2016. Additions are made to the furniture on 30th September, 2017 for Rs. 10,000. On 31st December, 2019, the furniture purchased on 1st April 2016 was sold for Rs. 7,000. Depreciation is charged at 10% on fixed instalment method. The firm closes its books at the end of financial year. Prepare furniture a/c for four years.

Answer:

Working Note:

Calculation of profit / loss on sale of Furniture:

Cost of the furniture = 20,000

Diminishing Balance Method:

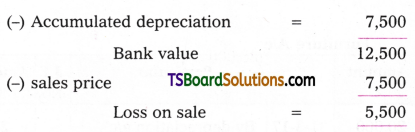

Question 11.

Madhu and Co. purchased a machine on 1st April 2017 for Rs. 20,000. Depreciation is charged at 10% under dimishing balance method. The company prepares accounts at the end of the financial year. Prepare machine a/c for three years.

Answer:

![]()

Question 12.

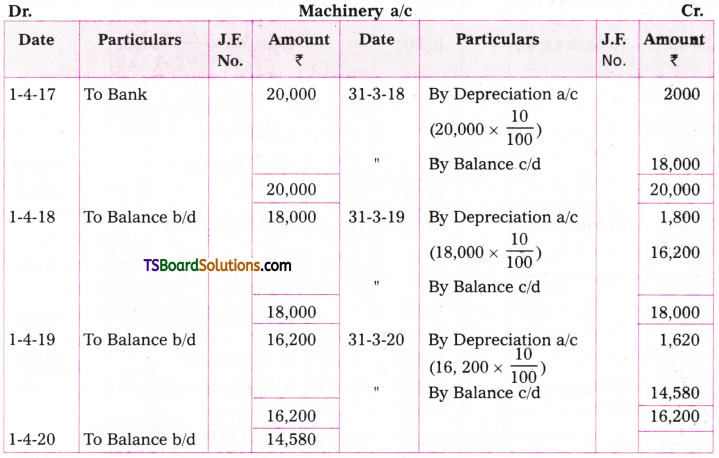

A firm purchased a machine on 1st April 2017 for Rs. 30,000 and paid errection charges Rs. 5,000. Depreciation is provided at 20% under diminishing balance method. Prepare machine a/c upto 31st March, 2020.

Answer:

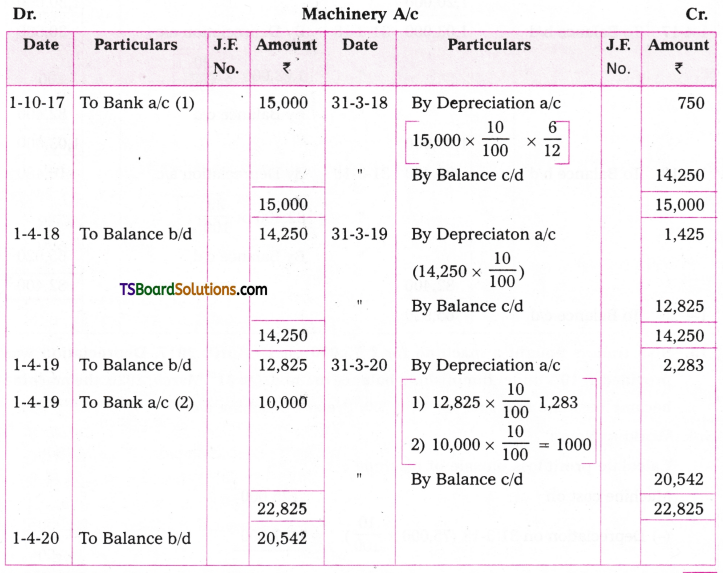

Question 13.

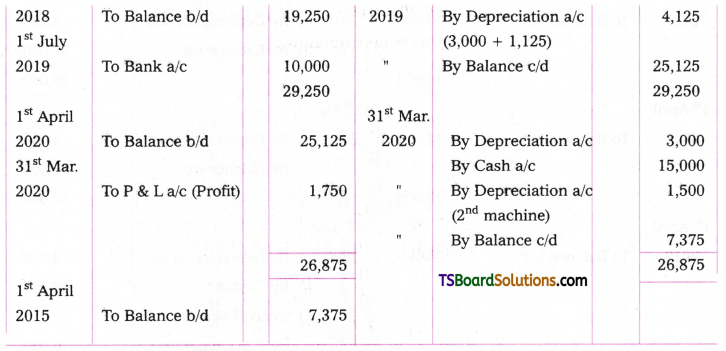

On 1st October 2017, Raju traders bought a machine for Rs. 15,000. Additions made to the machine on 1st April, 2019 were Rs. 10,000. Depreciation is charged at 10% under reducing balance method. Prepare machine a/c for three years assuming that accounts are closed on 31st March, every year.

Answer:

![]()

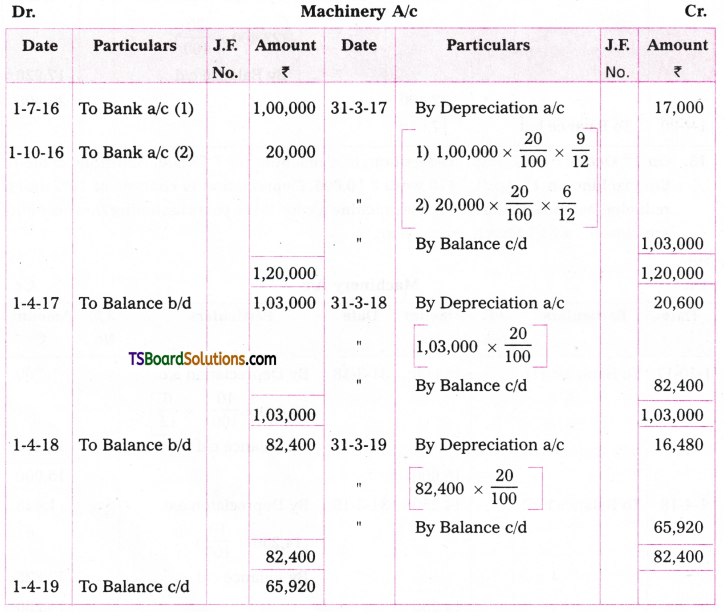

Question 14.

Dinesh & Company purchased a machine on 1st July, 2016 for Rs. 1,00,000. Depreciation is provided at 20% under diminishing balance method. On 1st October 2016 another machine was bought for Rs. 20,000. Prepare machine a/c for three years by closing books on 81st March, every year.

Answer:

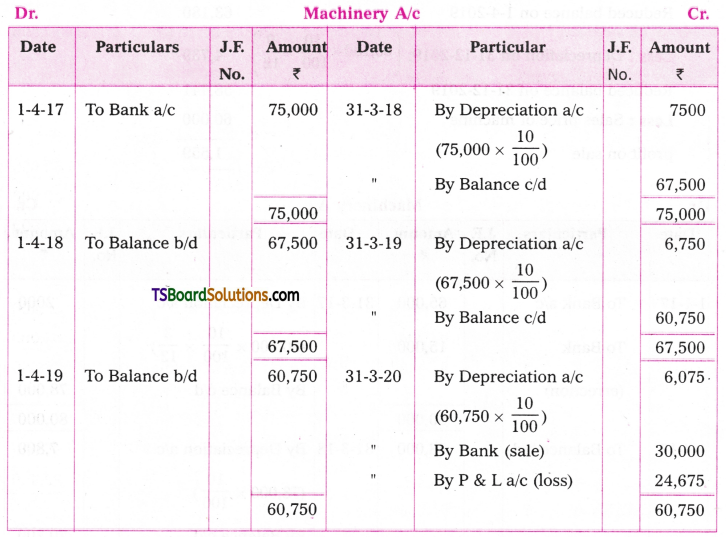

Question 15.

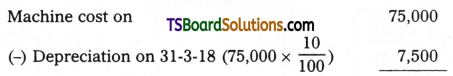

Siva traders bought a machine for Rs. 75,000 on 1st April, 2017. Depreciation was provided at 10% under diminishing balance method. On 31st March, 2020, the machine became obsolute and sold for t 30,000. Prepare machine a/c.

Answer:

Working Note:

Calculate profit/loss on sale of machine:

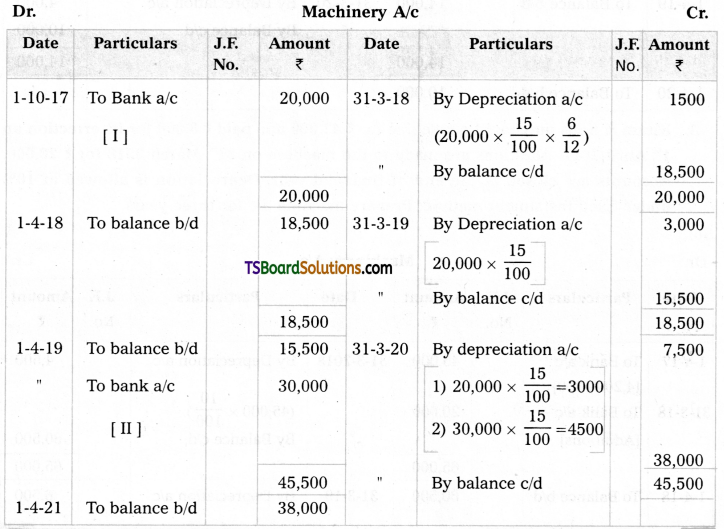

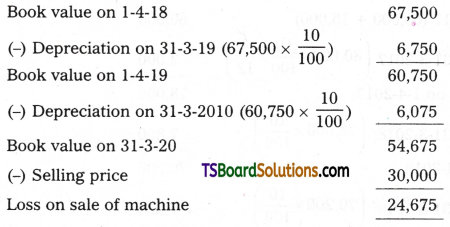

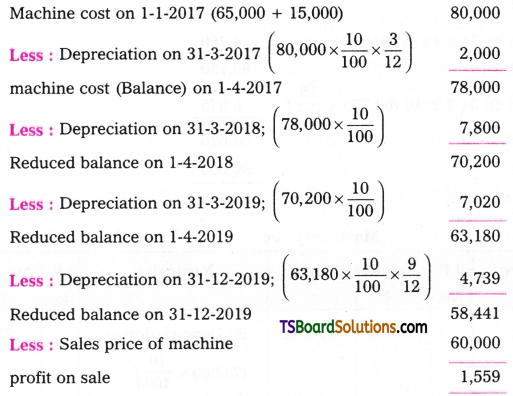

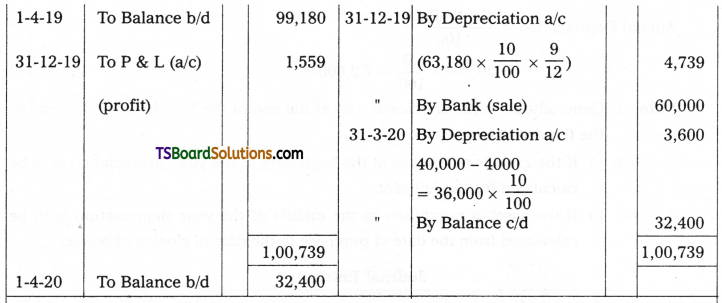

16. On January 1st 2017 Krishna & Company purchased a second hand machine for Rs. 65,000 and paid Rs. 15,000 for errection. Depreciation is provided at 10% under diminishing balance method on 31st March every year. Another machine was bought on 1st April 2018 for Rs. 40,000. On 31st December 2019, the machine bought on January 1st 2017 was sold for Rs. 60,000. Prepare machine a/c.

Answer:

Working Note:

Calculation of profit/loss on sale of I machine:

![]()

Textual Examples

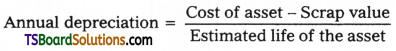

Question 1.

Sri Raghavendra Traders purchased machinery costing Rs. 25,000 on 01-04-2020. Depreciation is provided annually under (equal) fixed instalment method. Estimated life of the machine is 10 years. The residual value at the end of its life is Rs. 5,000. Calculate annual depreciation and rate of depreciation assuming that accounts are closed on 31st March every year.

Answer:

Cost of the machine = Rs. 25,000

Residual scrap value = Rs. 5,000

Life of the Asset =10 years.

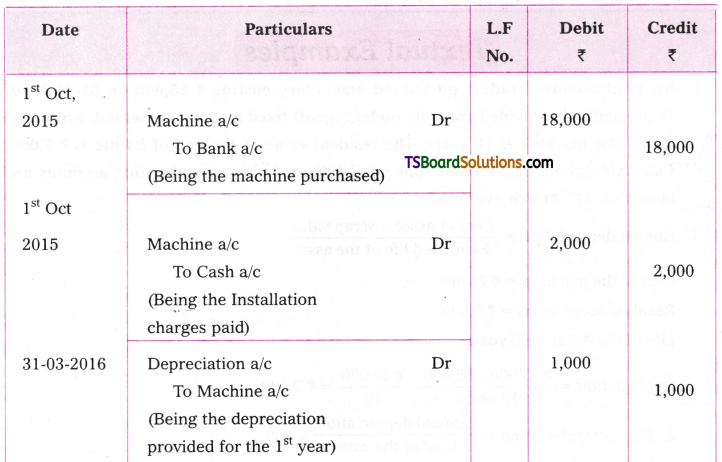

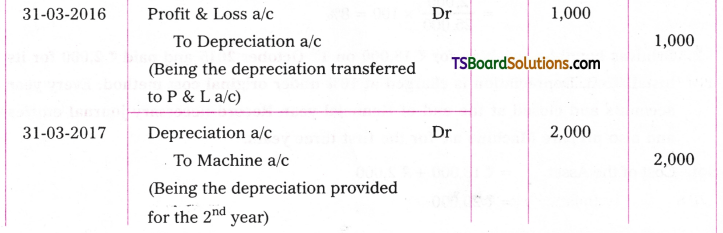

Question 2.

Srinivas bought a machine for Rs. 18,000 on 1st October 2015 and paid Rs. 2,000 for its installation. Depreciation is charged at 10% under original cost method. Every year accounts and closed at the end of financial year. Record necessary journal entries and also prepare Machine a/c for the first three years.

Answer:

Cost of the Asset = Rs. 18,000 + Rs. 2,000

= Rs. 20,000

Note: 1. Generally, accounts are closed only at the end of the March, that is the end of the financial year.

2. a) If the asset is purchased at the beginning of the year, depreciation is to be calculated for the full year.

b) If the asset is purchased in the middle of the year, depreciation is to be calculated from the date of purchase to the date of closing of books.

![]()

Question 3.

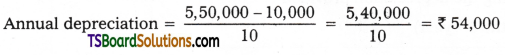

Sharada & Sons acquired a machine for Rs. 5,00,000 on 1st April, 2017 and spent 150,000 for its installation. The scrap value of the plant after is useful life of 10 years is Rs. 10,000. Prepare Machine a/c, Depreciation a/c for the first four years assuming that depreciation is provided under straight line method. Accounts are closed every year on 31st March.

Answer:

Cost = Rs. 5,00,000 + 50,000 = Rs. 5,50,000

Question 4.

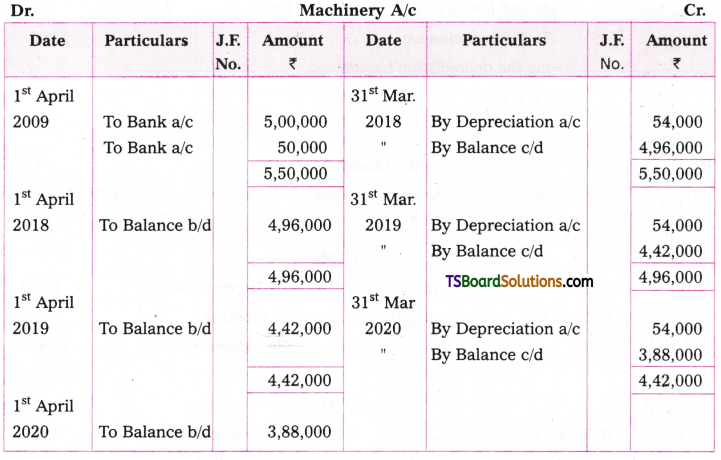

Rama and Company purchased machine for Rs. 60,000 on 1st April, 2017 and spent Rs.5,000 for its errection. Depreciation is charged at the rate of 10% under straight line method. Additional machinery purchased on 1st Oct. 2018 for Rs. 20,000. Prepare Machine a/c for first three years assuming that accounts are closed at the end of March 31st every year.

Answer:

Working Notes:

Cost of the asset = Rs. 60,000 + Rs. 5,000 = Rs. 65,000

Rate of Depreciation = 10%

Note: For the calculation of depreciation, one must be careful about the following dates

(i) Date of purchase of asset,

(ii) Date of commencement of the year and

(iii) Date of closing of books.

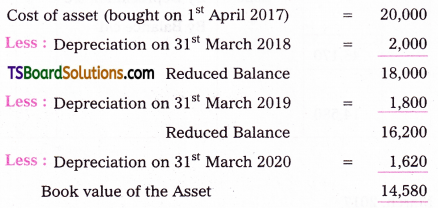

Example: A machine is purchased on 1st April 2015 for Rs. 20,000. Depreciation is to be , provided th<; rate of 10% under straight line method. The machine was sold on 31st March 2019 for Rs. 9,000. Find out the profit or loss on sale of asset.

Cost of the Machine = 20,000

Depreciation rate = 10%

(a) Depreciation for the year 2015-2016 = 20,000 x 10/100 = Rs. 2,000

(b) Depreciation for the year 2016-2017 = 20,000 x 10/100 = Rs. 2,000

(c) Depreciation for the year 2017-2018 = 20,000 x 10/100 = t 2,000

(d) Depreciation for the year 2018-2019 = 20,000 x 10/100 = Rs. 2,000

Total Depreciation = Rs. 8,000

Book value of the asset on the date of sale:

= Cost – Total Depreciation (Accumulated Depreciation)

= 20,000 – (2,000 + 2,000 + 2,000 + 2,000) = 12,000

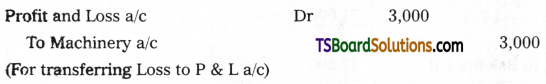

Loss on Sale of Asset:

= Book value – Selling price of the machine = 12,000 – 9,000 = 3,000.

Journal Entry:

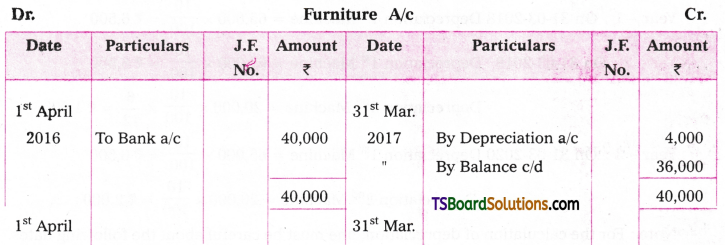

5. Raghu & Company purchased furniture on 1st April, 2016 for Rs. 40,000. Depreciation is provided at the rate of 10% under straight fine method. On 31st March, 2020 the scrap of the furniture was sold for Rs. 18,000. Prepare Furniture a/c.

Answer:

Working Notes:

Cost of the asset = Rs. 40,000

Accumulated Depreciation = 4,000 + 4,000 + 4,000 + 4,000 = 16,000

Book value of the asset = Cost – Total Depreciation

= Rs. 40,000 – Rs. 16,000 = Rs. 24,000

Loss on Sale of Asset = Book value – Selling Price of the Furniture

= Rs. 24,000 – Rs. 18,000 = Rs. 6,000.

![]()

Question 6.

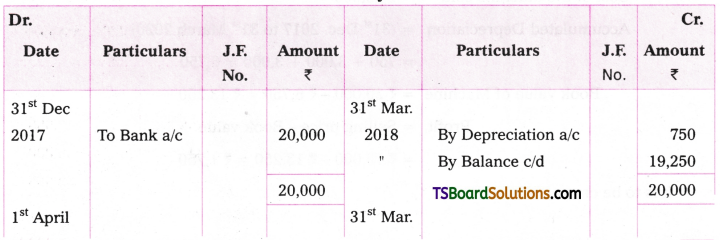

Dinesh & Co. Purchased a Machine on 31-12-2017 for Rs. 20,000. Depreciation provided at the rate of 15% under straight line method. On 1st July 2018 another machine was purchased for Rs. 10,000. On 31st March 2020, the machine purchased on 31st December 2017 was sold for Rs. 15,000. Prepare Machine a/c upto 31st March 2020.

Answer:

Working Notes:

Cost of the asset = Rs. 20,000

Rate of Depreciation = 15%

Depreciation (31-12-2017 to 31-03-2018) on 1st Machine = 20,000 x 15/100 x 3/12 = Rs. 750

Depreciation on 1st Machine (01-04-2018 to 31-03-2019) = 20,000 x 15/100 = Rs. 3,000

Depreciation on 2nd Machine 1st July, 2018 to 31st March 2019

Depreciation on 2nd Machine from 1st April, 2019 to 31st March 2020

= 10,000 x 15/100 = Rs. 1,500

Profit on Sale of Machine:

Cost of the Machine sold = Rs. 20,000

Accumulated Depreciation = (31st Dec. 2017 to 31st March 2020)

= 750 + 3,000 + 3,000 = 6,750

Book value of Machine = Rs. 20,000 – Rs. 6,750 = Rs. 13,250

Profit value = Selling price – Book value

= Rs. 15,000 – Rs. 13,250 = Rs. 1,750

It is to be credited to P & L a/c

Journal Entry:

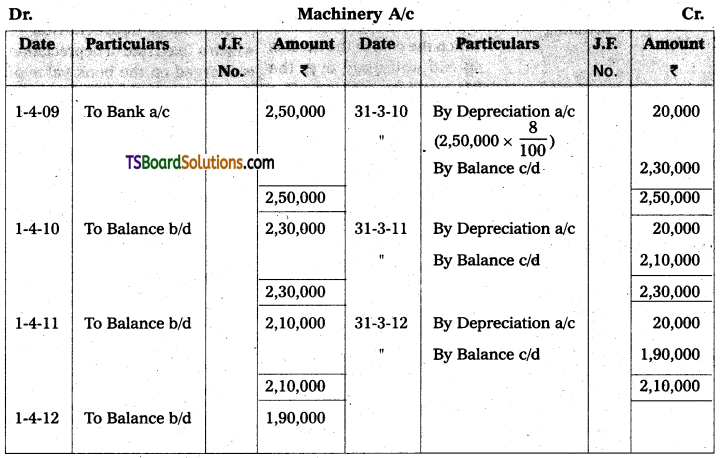

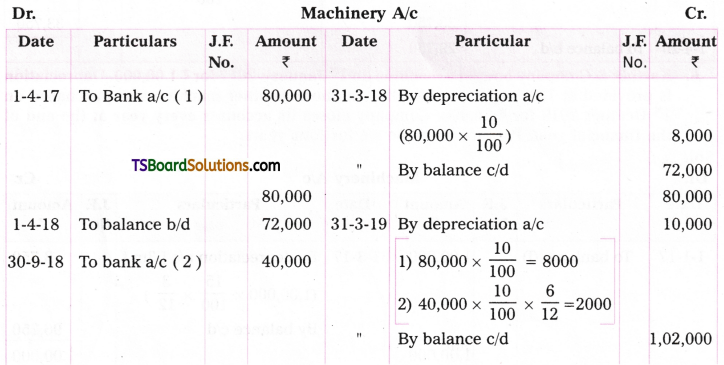

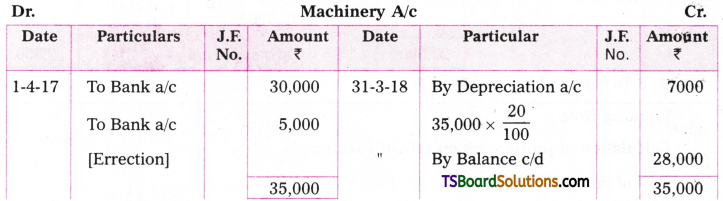

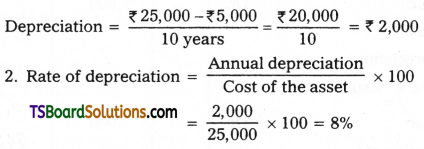

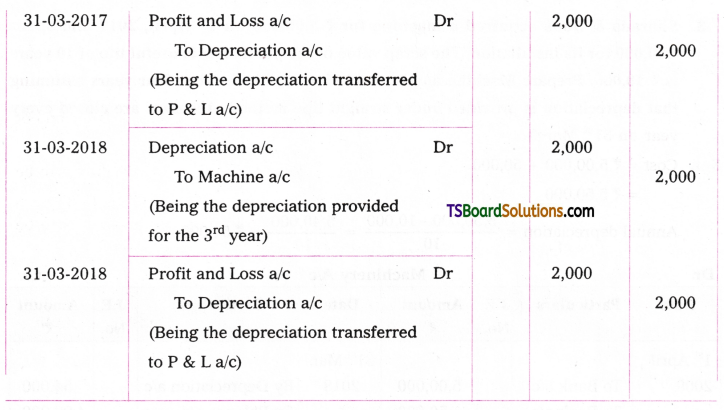

Question 7.

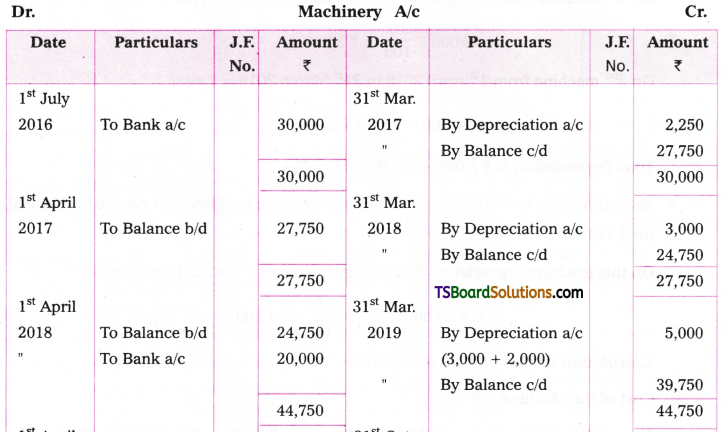

Kiran Traders bought machinery on 1st July 2016 for Rs. 30,000. Depreciation is to be provided at the rate of 10% under straight line method. On 1st April. 2018, additional machinery was purchased for Rs. 20,000. On 1st Oct 2019 the machinery bought on 1st July, 2016 became obsolute and sold for Rs. 12,000. Prepare machinery a/c for four years assuming that books are closed every year on 31st March.

Answer:

Working Notes:

Cost of the asset = Rs. 30,000 Rate of Depreciation = 10%

1. Depreciation on 31-03-2017 = (July 1st, 2016 to March 31st, 2017 = 9 months)

![]()

2. Depreciation on 31 1 March 2018 = 30,000 x 10/100 = Rs. 3,000,

(1st April 2017 to March 31st, 2018 = 1 year)

3. Depreciation on 31st March 2019.

On 1st machine from 1st April 2018 to 31st March 2019 = 1 year

= 30,000 x 10/100 = Rs. 3,000

On 2nd machine from 1st April 2018 to 31st March 2019 = 1 year

= 20,000 x 10/100 = Rs. 2,000

Total Depreciation = Rs. 3,000 + Rs. 2,000 = Rs. 5,000.

4. Sale of Asset: On 1st Oct. the (1st Machine) machine bought on 1st July 2016 was sold for Rs. 12,000

On this machine depreciation from 1st April 2019 to 1st Oct 2019 (6 months)

Calculation of loss on sale of Machine:

Cost of the Machine = Rs. 30,000

Accumulated Depreciation = Rs. 2,250 + Rs. 3,000 + Rs. 3,000 + Rs. 1,500 = Rs. 9,750

Book value of the Asset = Rs. 30,000 – Rs. 9,750 = Rs. 20,250

Loss = Book value – Selling Price

= 20,250 – 12,000 = Rs. 8,250.

5. Depreciation 31st March 2020 Since, the first machine is sold depreciation is to be calculated only on the second machine.

i.e., 20,000 x 10/100 = Rs. 2,000

![]()

Question 8.

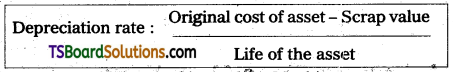

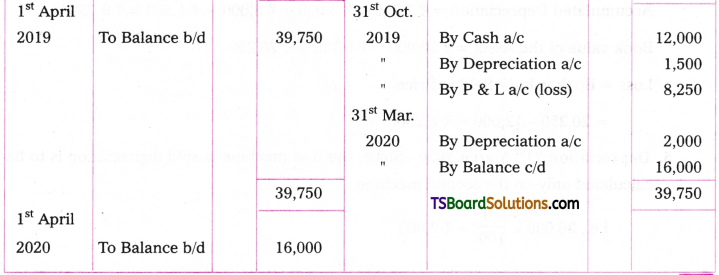

The Original cost of the asset is 9,00,000 and its scrap value is 50,000, expected working life is 16 years. Then the rate of depreciation is calculated as

Answer:

Illustrations on the Diminishing Balance Method:

Question 9.

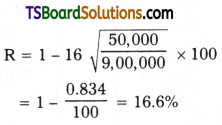

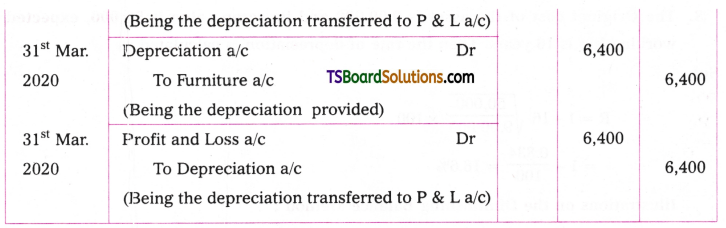

On 1st April, 2017 Santhosh Brothers purchased furniture for Rs. 40,000. Installation charges paid by them Rs. 10,000. Depreciation is provided at 20% under diminishing balance method. Pass journal entries and prepare Furniture a/c for the first three years assuming that accounts are closed on 31st March every year.

Answer:

Journal entries in the Books of Santhosh Brothers.

Journal Entries

Working Notes:

Cost of the Furniture = Rs. 40,000 + Rs. 10,000 = Rs. 50,000

1. Depreciation on 31st March, 2011 = 50,000 x 20/100 = 10,000

2. Depreciation on 31st March, 2012 = 40,000 x 20/100 = Rs. 8,000

3. Depreciation on 31st March, 2013 = 32,000 x 20/100 = 6,400

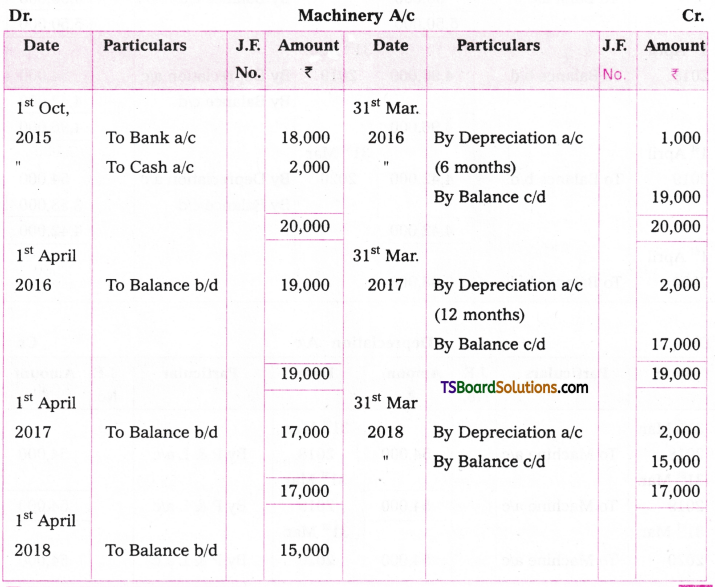

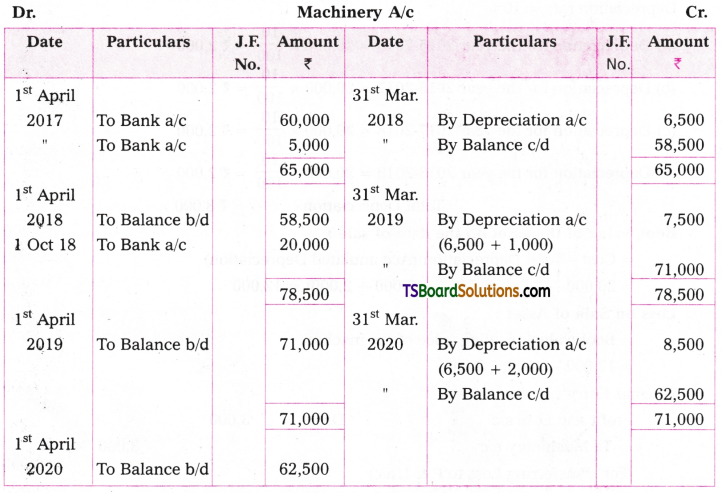

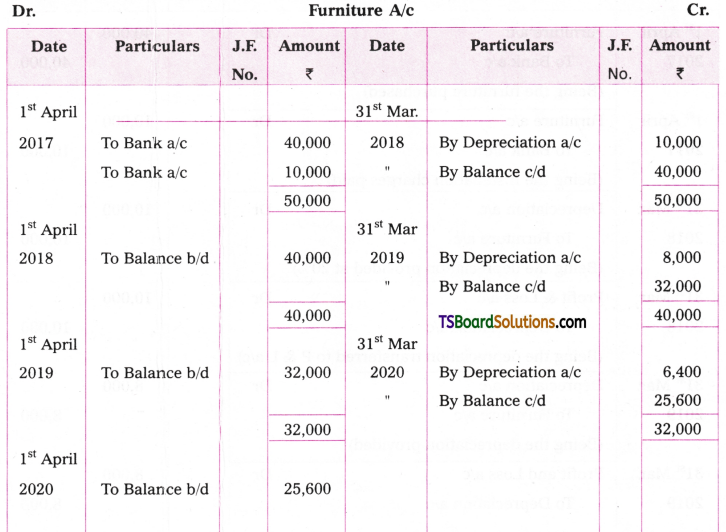

Question 10.

Jagadesh & Co. purchased a machine on 1st July 2017 for Rs. 28,000. They spent Rs. 1,000 for carriage and Rs. 1,000 for installation. The machine is depreciated by 15% every year on written down value basis. Prepare machine a/c upto March 31st, 2020.

Answer:

Working Note:

Cost of the asset = Purchase price 4- Carriage + Installation charges

= Rs. 28,000 + Rs. 1,000 + Rs. 1,000 = Rs. 30,000

1. Depreciation on 31st March, 2018 = 30,000 x 15/100 x 9/2 = Rs. 3,375 (July 1st 2017 to 31st March 2018 = 9 months)

Write down value on 31st March 2018 = Rs. 30,000 – Rs. 3,375 = Rs. 26,625

2. Depreciation on 31st March 2019 = 26,625 x 15/100 = Rs. 3,994

Written down value on 31st March 2019 = Rs. 26,625 – Rs. 3,394 = Rs. 22,631

3. Depreciation on 31st March 2020 = Rs. 22.631 x 15/100 = Rs. 3,395

![]()

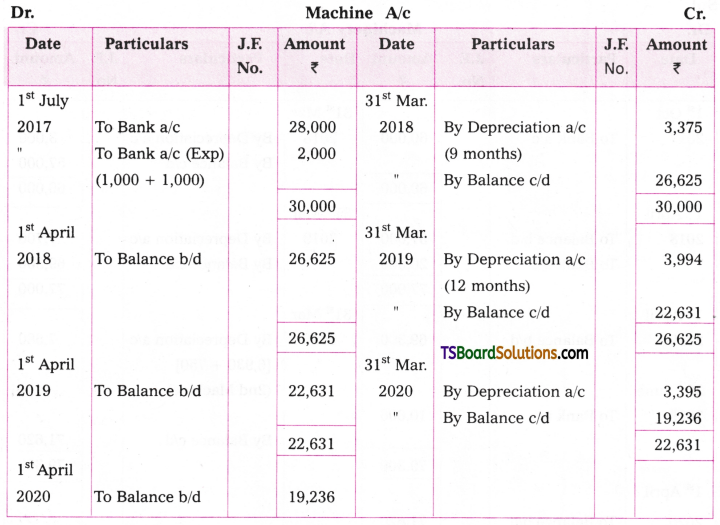

Question 11.

Ramesh & Company purchased a machine for Rs. 60,000 on 1st October 2017. Additions are made to the machine on 1st April 2009, for Rs. 20,000 and on 30th June 2019 for Rs. 10,000. Depreciation is provided at 10% under reducing balance method. Prepare machine a/c from 1st Oct. 2017 to 31st March 2020.

Answer:

Working Notes:

Year – 1: Depreciation on 31st March, 2018 = 60,000 x 10/100 x 6/12 = Rs. 3,000

Reduced Balance = Rs. 60,000 – Rs. 3,000 = Rs. 57,000

Year – 2: Depreciation on 31st March 2019:

Depreciation on 1 Machine = 57,000 x 10/100 = Rs. 5,700

Depreciation on 2nd Machine = 20,000 x 10/100 = Rs. 2,000

Total Depreciation = Rs. 7,700

Reduced Balance = Rs. 77,000 – Rs. 7,700 = Rs. 69,300

Year – 3: Depreciation on 31st March 2020:

On the reduced Balance of 1st and 2nd Machines

Depreciation = 69,300 x 10/100 = Rs. 6,930

Depreciation on 3rd machine from 2019 June 30th to 2020 March 31st. Since, it is bought on 30th June 2019 only for 9 months depreciation is to be calculated.

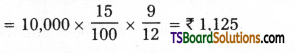

Question 12.

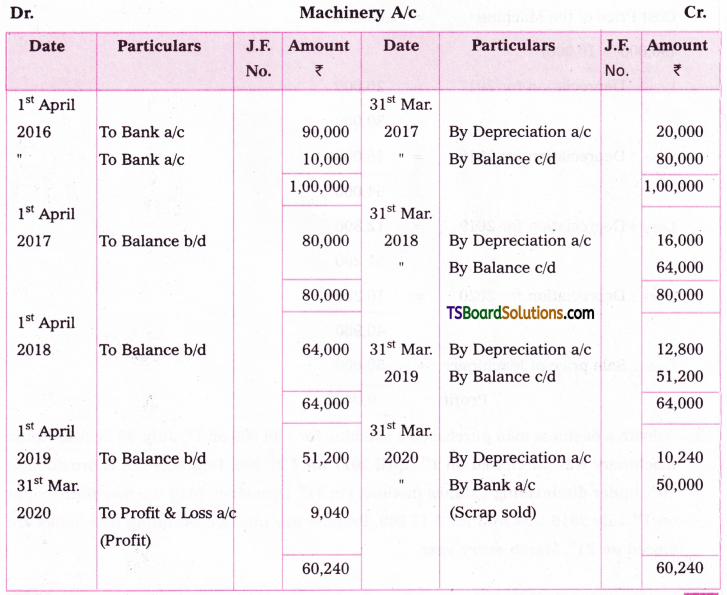

Sripathi traders bought a Machine on 1st April 2016 for Rs. 90,000. They paid for installation Rs. 10,000. Depreciation is to be provided at 20% on the diminishing balance method. On 31st March 2020, scrap of the Machine was sold for Rs. 50,000. Show the Machine a/c assuming that books are closed at the end of the financial year.

Answer:

Cost of the Machine = Rs. 90,000 + Rs. 10,000 = Rs. 1,00,000

a) Depreciation on 31st March 2017 = 1,00,000 x 20/100 = Rs. 20,000

Written down value on 31st March 2017 = Rs. 1,00,000 – Rs. 20,000 = Rs. 80,000

b) Depreciation on 31 * March, 2018 = 80,000 x 20/100 = Rs. 16,000

Written down value on 31st March 2018 = Rs. 80,000 – Rs. 16,000 = Rs. 64,000

c) Depreciation on 31st March, 2019 = 64,000 x 20/100 = Rs. 12,800

Written down value on 31st March 2019 = Rs. 64,000 – Rs. 12,800 = Rs. 51,200

d) Depreciation on 31st March, 2020 = 51,200 x 20/100 = Rs. 10,240

Calculation of Profit on Sold Machine:

![]()

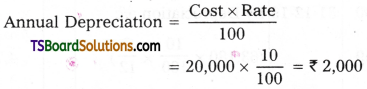

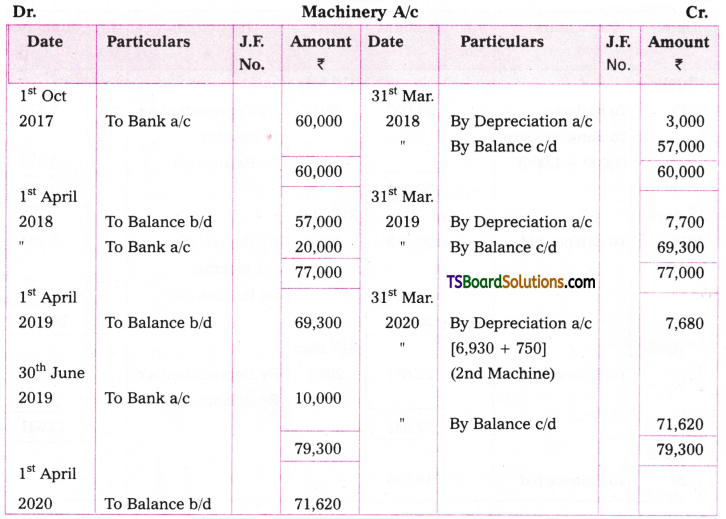

Question 13.

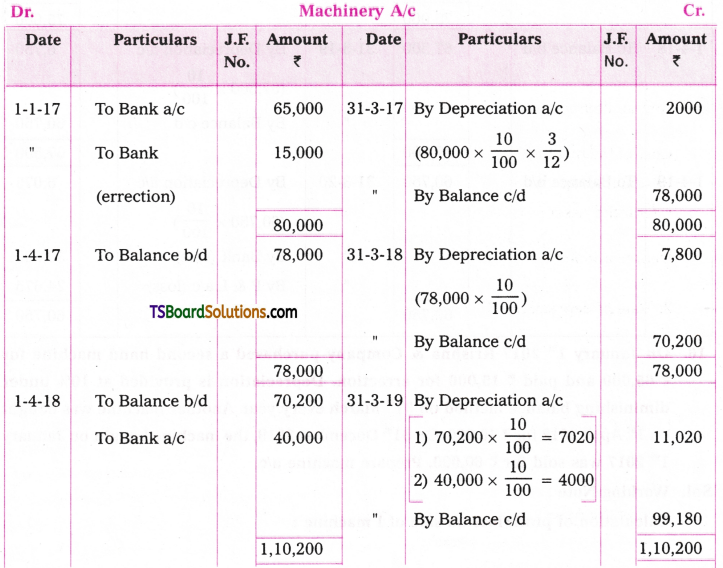

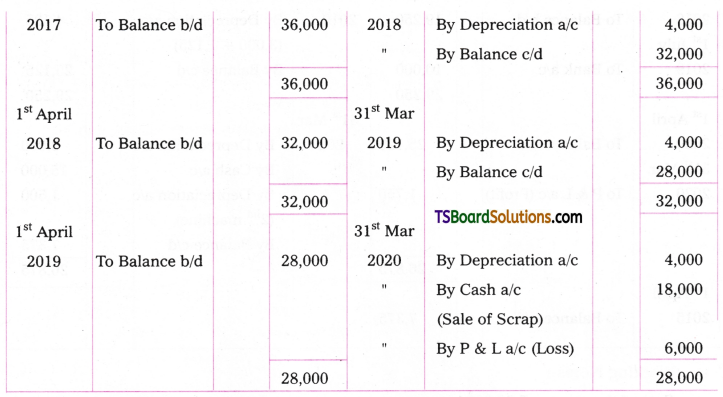

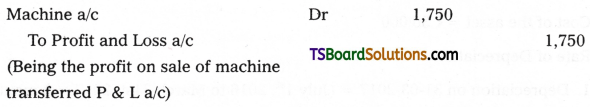

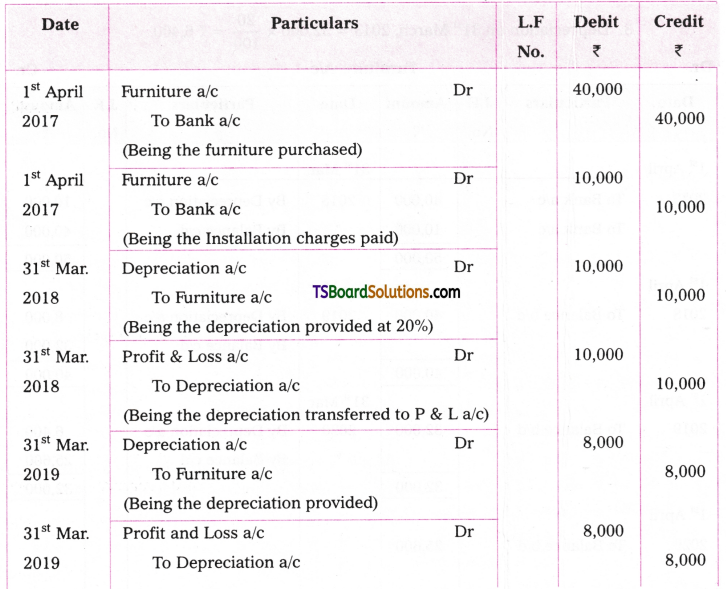

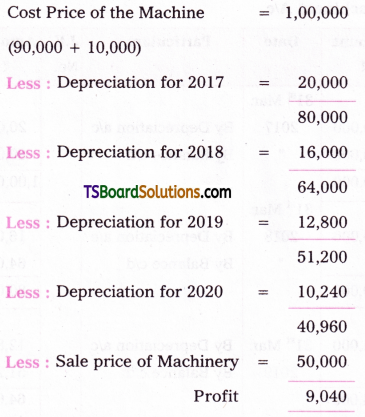

Ashrith a business man purchased a machine for Rs. 40,000 on 1st, July, 2016. Additional machinery was purchased on 1st April 2017 for Rs. 20,000. Depreciation is provided at 10% under diminishing balance method. On 31st December 2019 the machine bought on 1st July 2016 was sold for Rs. 17,000. Prepare machine a/c assuming that books are closed on 31st March every year.

Answer:

Working Notes:

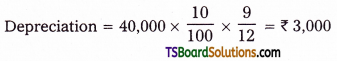

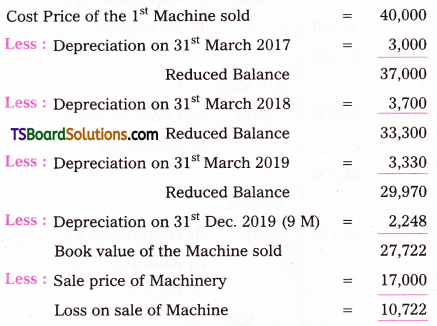

a) Depreciation on 31st March, 2017

Cost = Rs. 40,000,

Rate = 10%, Machine was bought on July 1st, 2016

Depreciation period from July 1st 2016 to March 31st 2017 is 9 months

b) Depreciation on 31st March, 2018

Written down value of the 1st Machine = Rs. 40,000 – Rs. 3,000 = Rs. 37,000

Depreciation on 1st Machine = 37,000 x 10/100 = Rs. 3,700

Depreciation on 2 d Machine = 20,000 x 10/100 = Rs. 2,000

c) Depreciation on 31st March, 2019

Written down value of the both machines = Rs. 57,000 – Rs. 5,700 = Rs. 51,300

Depreciation = 51,300 x 10/100 = Rs. 5,130

d) Calculation of loss on sale of Machine:

![]()

e) Depreciation on the second machine: