Telangana TSBIE TS Inter 2nd Year Accountancy Study Material 2nd Lesson Consignment Accounts Textbook Questions and Answers.

TS Inter 2nd Year Accountancy Study Material 2nd Lesson Consignment Accounts

Short Answer Questions

Question 1.

Distinguish the differences between the consignment and sales.

Answer:

Consignment Sending of goods from the owner to his agents for sale on a commission basis is called consignment. The agent only sells the goods on behalf of the owner for the sake of commission at the risk of the owner.

| Point of difference | Consignment | Sale |

| 1) Parties | There are two parties here consignor and consignee. | There are two parties here : Seller and buyer. |

| 2) Ownership of goods | The ownership of the goods does not transfer from consignor to consignee. | The ownership of the goods transferred from the seller to the buyer. |

| 3) Relationship | Relationship is that of a principal and an agent. | Relationship is that of a buyer and seller i.e., debtor and creditor |

| 4) Account sales | Consignee sends the account sales to the consignor. | Buyer need not send the account sales to the seller. |

| 5) Return of goods | Consignee may return the goods, if they are not sold. | In normal condition, goods once sold cannot be returned. |

| 6) Risk of loss of goods | Incase the goods are destroyed, the consignor has to bear the loss, bear loss.) | Incase the goods are destroyed after sale, the buyer has to |

| 7) Profit/Loss | The profit/loss belongs to the consignor. | The profit or loss on sales belongs to seller |

| 8) Commissiion | The consignor gives commission to the consignee for the sale of goods. | The seller does not give any commission to the buyer. But, sometimes seller may give discount to the buyer. |

Question 2.

How the unsold stock is valued in consignment?

Answer:

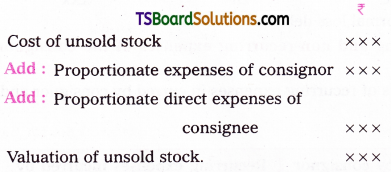

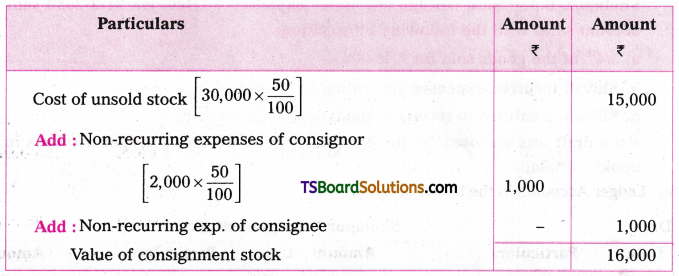

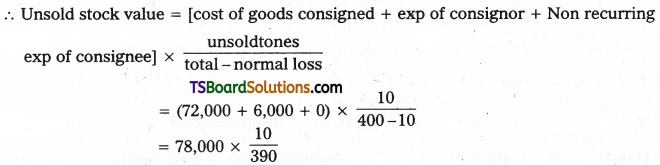

At the end of the accounting period, the unsold goods should be valued properly. Other wise, the true profit cannot be ascertained. The value of unsold stock includes the purchasing price of unsold stock and proportionate direct expenses or nonrecurring ex¬penses incurred by the consignor and consignee.

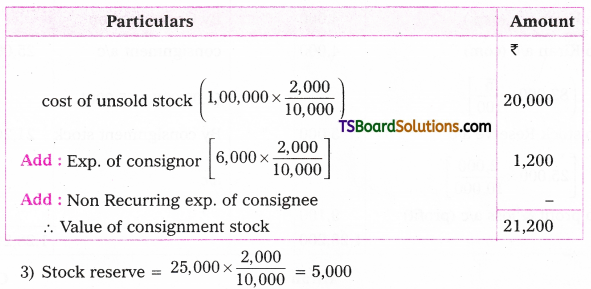

Valuation of unsold stock.

Question 3.

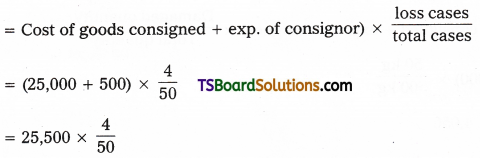

How the abnormal loss is valued in consignment?

Answer:

I. Introduction:

1) Abnormal loss is a loss which arises due to fire, accidents, riot, flood, theft, pilfer¬age, sabotage, negligence, inefficiency etc.

2) It is unnatural and unexpected. This loss is beyond the control of human being. This loss can be insured.

3) Sometimes, insurance company admits the claim in part or full. The value of abnor¬mal loss is ascertained and it is taken on the credit side of consignment account.

4) The method of calculation of abnormal loss is to the method of calculation of clos¬ing stock.

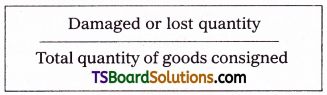

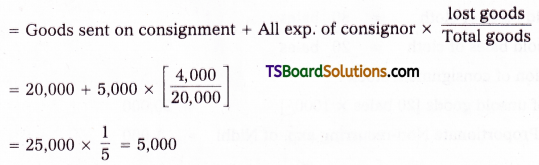

Abnormal loss = Cost of goods sent on consignment + Expenses of consignor x

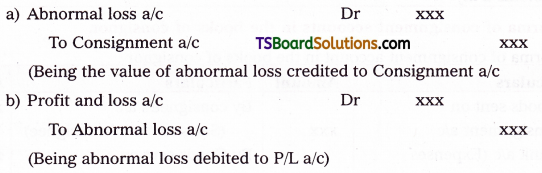

II. Entries:

1. When there is no insurance claim: –

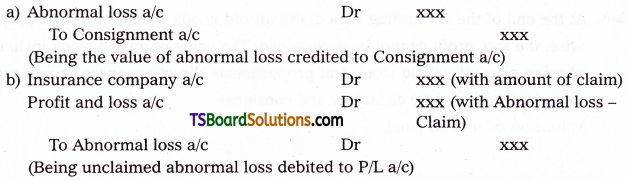

2. When insurance claim is admitted by insurance company:

Question 4.

List out some of the recurring and non-recurring expenses of the consignor and consignee.

The following table gives details of recurring expenses in curred by consignor and consignee:

Recuring Expenses:

| Recurring expenses incurred by consignor | Recurring expenses incurred by consignee |

| 1) Bank charges for discounting the bills or cheque received. 2) Expenses incurred on damaged goods. |

1) Godown rent 2) Godown insurance 3) Salary to sales men 4) Advertisement charges 5) Selling expenses 6) Salesmen commission |

Non-Recuring Expenses:

| Non recurring expenses incurred by consignor | Non recurring expenses incurred by consignee |

| 1) Freight 2) Carriage or cortage 3) Insurance 4) Packing 5) Dock Dues 6) Loading Charges 7) Customs Duty |

1) Unloading Charges 2) Freight 3) Dock Dues 4) Customs Duty 5) Octroi 6) Carriage to his place upto godown |

Question 5.

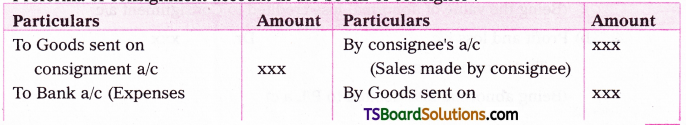

Proforma of consignment accounts in the books of consignor.

Answer:

Proforma of consignment account in the books of consignor:

Very Short Answer Questions

Question 1.

What is consignment?

Answer:

The process of sending goods by consignor to a consignee for the purpose of sale on commission basis is called consignment.

Question 2.

Parties in consignment.

Answer:

There are two parties in consignment They are: A) consignor B) consignee.

A) Consignor: The person who send the goods on consignment is called consignor (or) principal.

B) Consignee: The person to whom goods are sent is called consignee or agent.

Question 3.

Proforma Invoice.

Answer:

- The statement which is prepared by the consignor and send to the consignee stating that the details of the goods consigned is called proforma Invoice.

- It contains quantity, weight, expenses incurrred, mode of transportation and minimum price at which the goods are to be sold.

Question 4.

Account sales.

Answer:

- Consignee has to inform its consignor about the amount of sales and expenses in¬curred by him for making sales. For this purpose, the consignee has to prepare a state¬ment which is known as account Sales.

- Account sales is a statement showing that the amount of sales, other expenses in¬curred, advance remitted by him and amount payable by him to the consignor.

Question 5.

Delecredere commission.

Answer:

- It is the extra commission than the ordinary commission which is allowed by the consignor to the consignee for bearing the risk of bad debts arising out of credit sales made by him.

- When this commission is allowed to the consignee, the consignee has to bear the loss due to the bad debts.

Question 6.

Over-riding commission.

Answer:

- It is an additional commission paid by the consignor to the consignee to enhance the sales or for selling goods at prices higher than prices fixed by the consignor or boost up the sales of new products.

- This commission is also calculated on gross proceeds of sales.

Question 7.

Invoice price.

Answer:

- The consignor, instead of sending the goods on consignment at cost price, may send it at a higher price than the cost price. This price is known as Invoice price or selling price.

- The intention of the consignor is that to hide or conceal the actual profit earned by him from the consignee.

Question 8.

Loading.

Answer:

- The difference between the cost price and the invoice price of goods is known as “Loading”.

- It also called as “Excess price over the Loading = Invoice price – Cost price

- Loading = Invoice price – Cost price

Question 9.

Normal loss.

Answer:

- Normal loss is a loss that arises due to evaporation, leakage and breaking the bulk material into small pieces.

- It is a natural, unavoidable and inherent in the nature of goods sent on consignment.

Question 10.

Abnormal Loss.

Answer:

- Abnormal loss is a loss which arises due to fire, accidents, riot, flood, theft, pilferage, sabotage, negligence, inefficiency etc.

- It is unnatural and unexpected. This loss is beyond the control of human being. This loss can be insured.

- Sometimes, insurance company admits the claim in part or full. The value of abnor¬mal loss is ascertained and it is taken on the credit side of consignment account.

- The method of calculation of abnormal loss is to the method of calculation of closing stock.

Abnormal loss = Cost of goods sent on consignment + Expenses of consignor x

(Damaged or lost quantity/Total quantity of goods consigned)

Practical Problems

A) Short Problems:

1. The cost of price of goods is 20,000. But the invoice price of the goods is 24,000. Find the loading?

Answer:

Given:

Cost of price of goods = 20,000

The invoice price of goods = 24,000

Rs. Loading = Invoice Price – Cost price

Loading = 24,000 – 20,000 = 4,000.

Question 2.

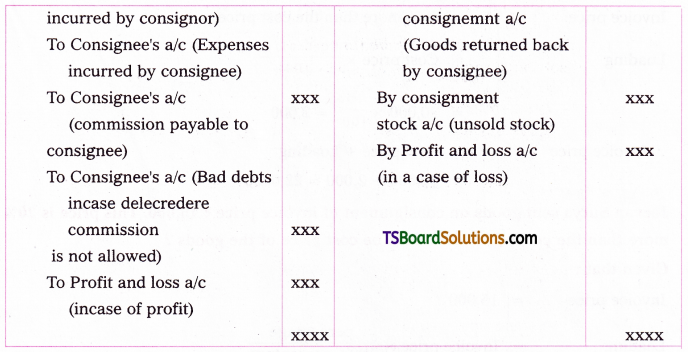

The cost of the goods sent on consignment is Rs. 20,000 but the invoice price i sl0% more than the cost price, what will be the invoice price of the goods?

Answer:

Method (1):

Given:

Cost of goods consign = 20,000

Invoice price = 10% more than the cost price

= cost price + 10% on cost price (i.e., loading)

= 20,000 + [20,000 x 10/100]

= 20,000 + 2000

Rs. Invoice price = 22,000

Method (2)

Given:

Cost of goods consign = 20,000

Question 3.

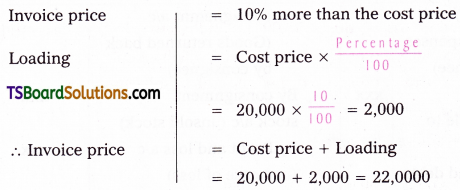

Jeevan Surya sent goods on consignment of invoice price Rs. 15,000. This price is 20% more than the cost price. What will be cost price of the goods?

Answer:

Given that:

Invoice price = 15,000

Cost of goods = Invoice price – Loading

= 15,000 – 2,500

= 12,500

Question 4.

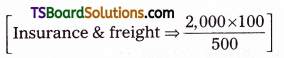

500 cases of goods were consigned at a cost of Rs. 150 each. The consignor paid Rs. 2,000 towards insurance and freight. The consignee paid t 2,000 for carriage and Rs. 1,000 for salaries Consignee sold only 400 cases of goods. Find the value of unsold goods?

Answer:

Total cases of goods consigned = 500 cases

(-) Consignee sold = 400 cases

unsold goods = 100 cases

Valuation of unsold stock of consignment:

Cost of unsold goods (100 cases x 150/-)= 15,000

Add roportionate non recurring expenses of consignor = 400

Proportionate non recurring expenses of consigner = 400

value of unsold goods = 15,800

Question 5.

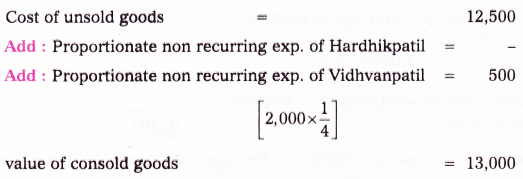

Hardhikpatil consigned goods costing Rs. 50,000 to Vidhvanpatilwhose recurring and non-recurring expenses on the same amounted to Rs. 5,000 and t 2,000 respectively. Vidhvanpatil sold 3/4th of the goods. Find the value of unsold goods?

Answer:

Cost of goods consigned = 50,000

Given that vidhvanpatil sold ¾th goods

unsold goods = ¼th goods = 50,000 x ¼ = 12,500

Value of unsold goods :

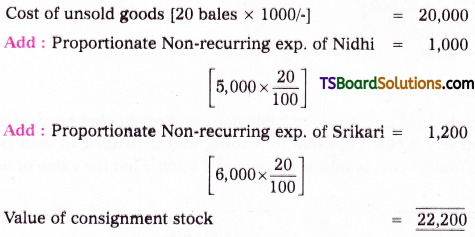

Question 6.

Nidhi consigned 100 bales of cloth to Srikari at Rs. 1,000 per bale. Nidhi incurred the expenses Rs. 5,000. Srikari incurred Rs. 6,000 for packing and Rs. 2,000 for rent. Srikari sold 80 bales of cloth at the rate Rs. 1,500 per bale. Ascertain the value of consignment stock?

Answer:

Total goods consiged = 100 bales of cloth

(-) Sold bales of cloth = 80 bales

.*. Unsold bales of cloth = 20 bales

valuation of consignment stock:

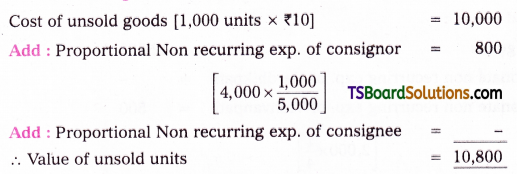

Question 7.

Ascertain the value of closing stock from the following information.

No. of Units consigned : 5,000

Cost of each unit Rs. 10

Expenses of consignor Rs. 4.000

Expenses consingee Rs. 1,000.

No. of units sold by the consignee : 4,000

Answer:

Total goods consigned = 5000

(-) Sold goods = 4000

.-. Unsold goods = 1000

Value of consignment stock :

Question 8.

Anisa consigned goods consting Rs. 20,000 to Prasanna on consignment basis. Anisa paid Rs. 5,000 for carriage and cartage. On the way l/5th of the consignment was lost by fire. Ascertain the amount of abnormal loss.

Ans Total cost of goods consigned = 20,000

Cost of goods loss by fire = 1/5 on 20,000

The amount of Abnormal loss = = 20,000 x 1/5 = 4,000

The abnormal loss value is Rs. 5,000.

Question 9.

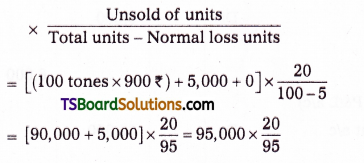

100 tons of coal is consigned at the rate of Rs. 900 per ton. Freight charges paid by the consignor amounted to Rs. 5,000. Loss due to loading and unloading of coal is estimated at 5 tones. 75 tons of coal is sold at the rate of Rs. 1,200. Find the value of unsold stock.

Answer:

Completion of unsold stock :

Value of unsold stock

Unsold stock value = 20,000

B) Long Problems

Question 1.

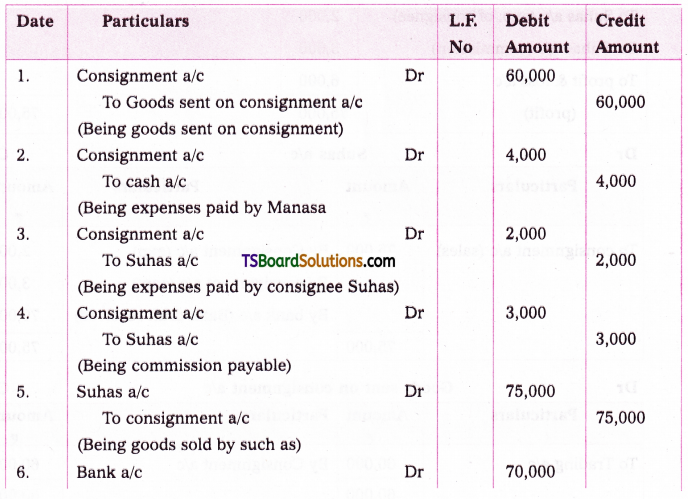

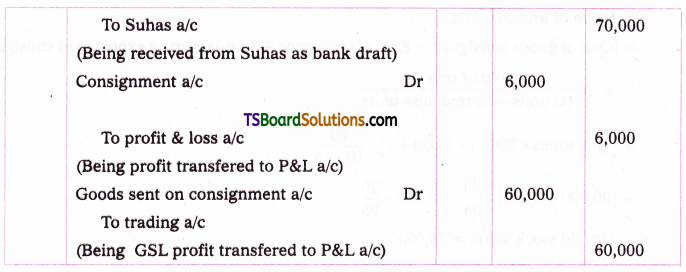

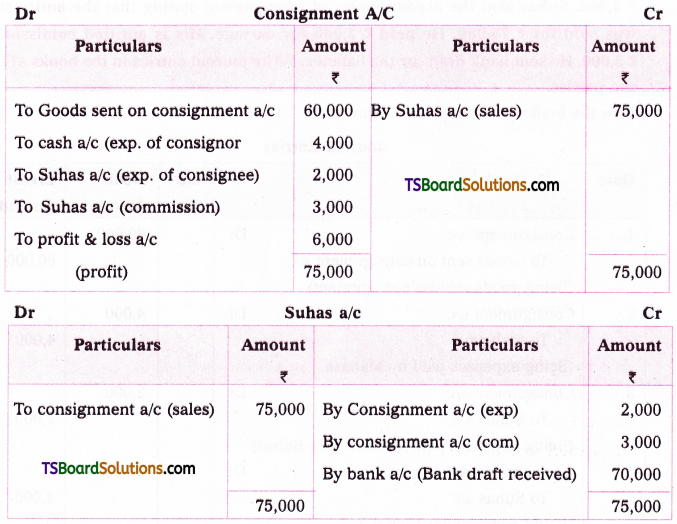

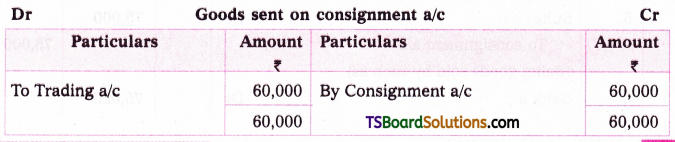

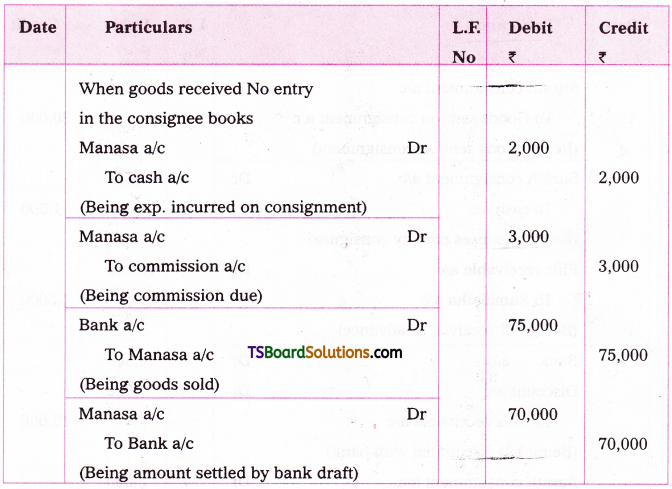

Manasa consigned goods value of Rs. 60,000 to Suhas. Manasa paid transport charges Rs. 4,000. Suhas sent the account sales of consignment stating that the entire stock was sold for Rs. 75,000. He paid Rs. 2,000 for cartage. His is entitled comission of Rs. 3,000. He sent bank draft for the balance. Write journal entries in the books of both the parties.

I. In the books of Manasa (consignor) :

Ledger Accounts in the books of consignor Manasa

Journal Entries

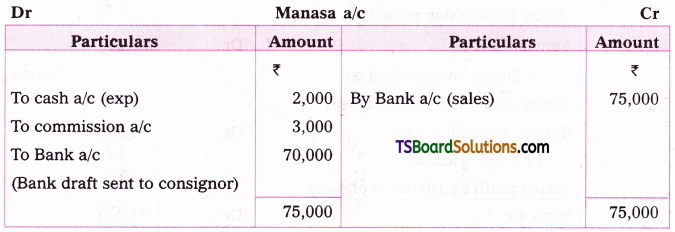

II. In the books of Suhas (Consignee) :

Journal Entries

Ledger Accounts :

Question 2.

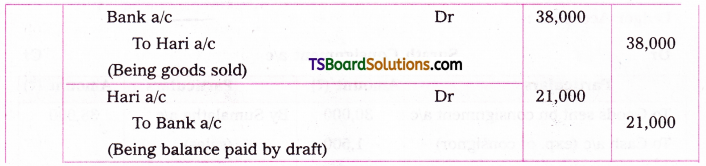

Hari of Hyderabad consigned goods value Rs. 30,000 to Sumaiatha of Surath. Ilari paid for forwarding charges Rs. 1,500 and drew a bill of two months on sumaiatha for Rs. 15,000. The bill was discounted for Rs. 14,500. Sumaiatha sent account sales of consignment stating that the entire stock was sold for Rs. 38,000, agent commission Rs. 2,000 and sent bank draft for the balance. Write journal entries in the books of both the parties.

Answer:

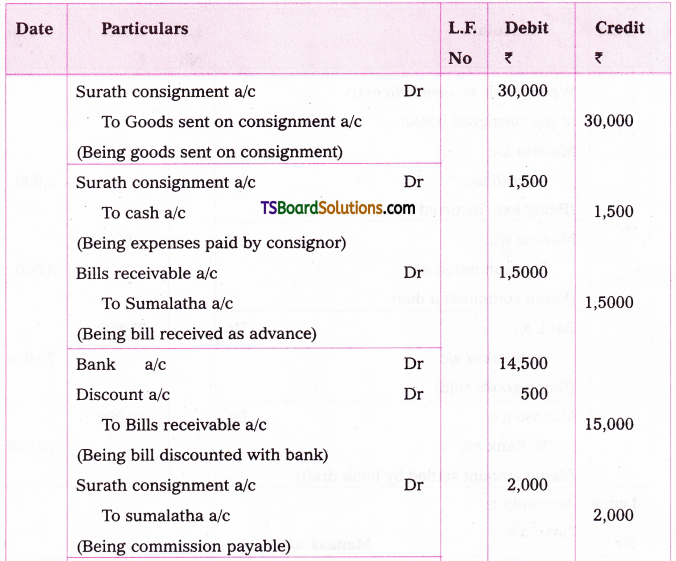

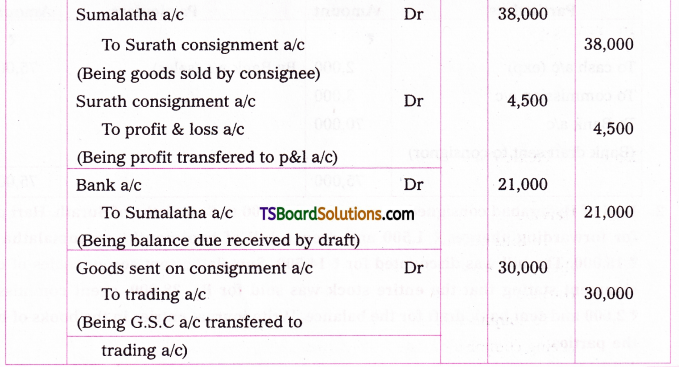

In the books of Hari consignor :

Journal Entries

Ledger Accounts

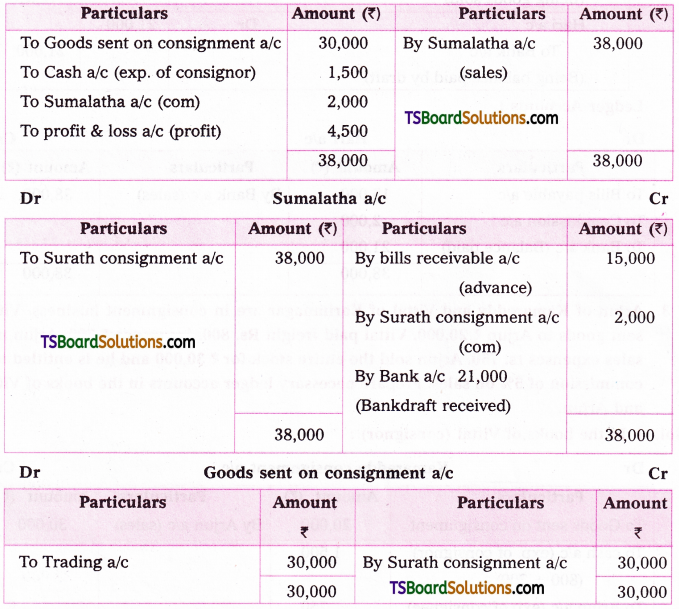

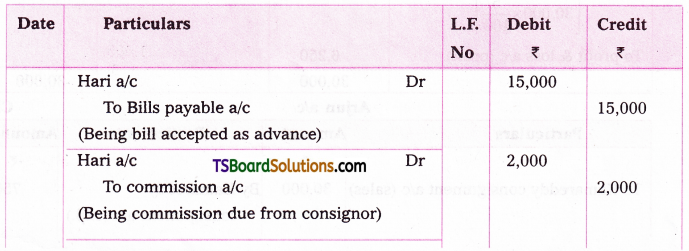

II. In the books of Sumalatha consignee :

Journal Entries

Ledger Accounts

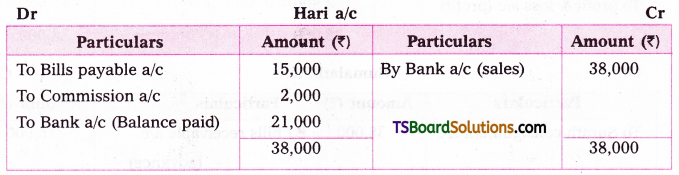

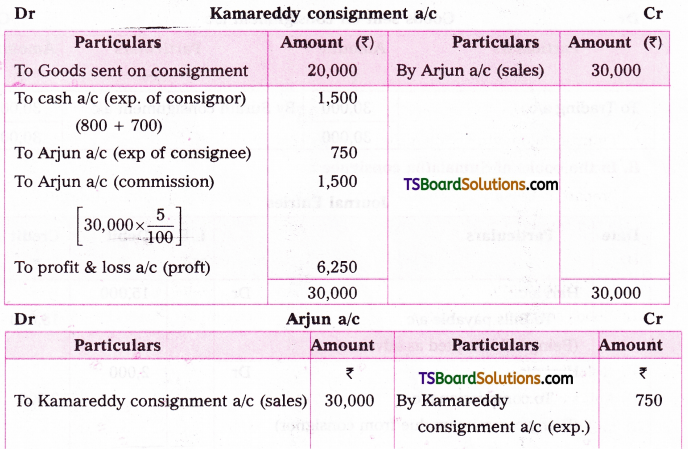

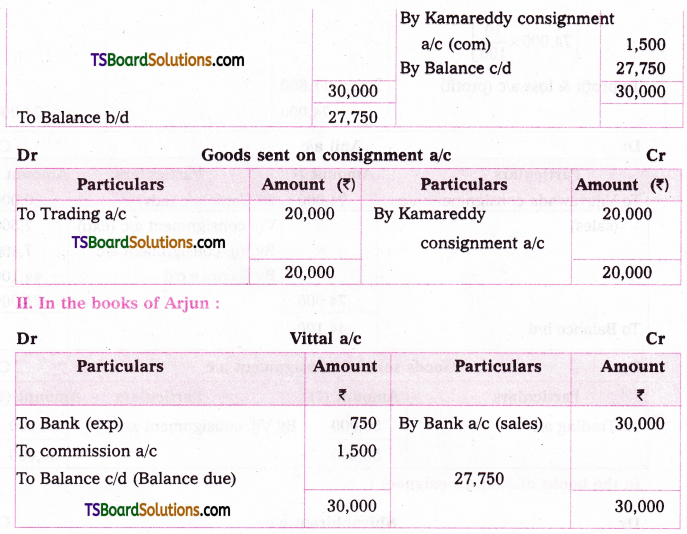

Question 3.

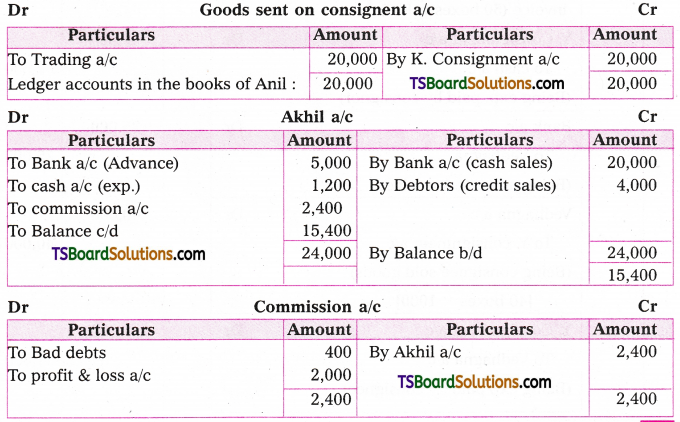

Arjun of Kamareddy and Vittal of Karimnagar are in consignment business. Vittal sent goods to Arjun Rs. 20,000. Vittal paid freight Rs. 800, insurance Rs. 700. Arjun met sales expenses rs. 750. Arjun sold the entire stock for Rs. 30,000 and he is entitled to a commission of 5% on sales. Prepare necessary ledger accounts in the books of Vittal and Arjun.

Answer:

1. in the books of Vittal (consignor) :

Question 4.

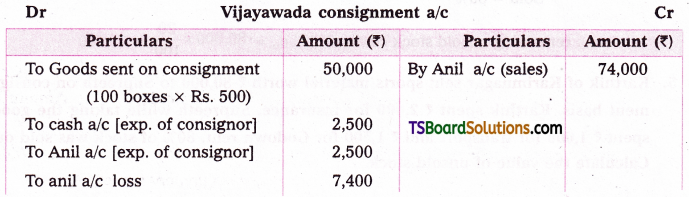

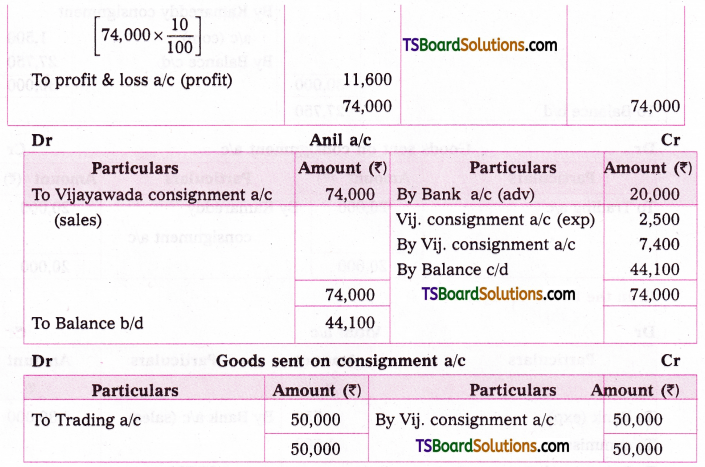

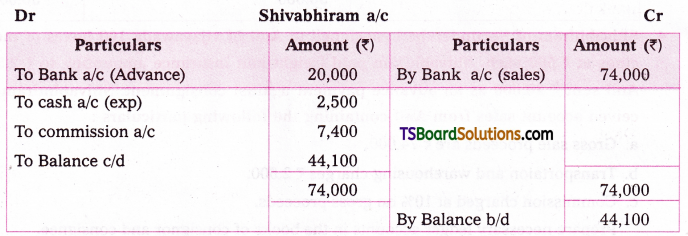

Shivabhiram of Secunderabad consigned to Anil of vijavawada 100 boxes of medi¬cines at Rs. 500 each. Shivabhiram paid freight and insurance amounting to Rs. 2,500. Anil sent Rs. 20,000 as an advance payment against consignment. Shivabhuiram received account sales from Anil containing the following particulars :

a. Gross sale proceeds are Rs. 74,000.

b. Transportaion and warehousing charges Rs. 2,500.

c. Commission charged at 10% on gross proceeds.

Prepare necessary ledger accounts in the books of consignor and consignee.

Answer:

I. In the books of Shivabhiram (consignor) :

In the books of Anil (Consignee) :

Given : Total stock = 80,000

Sold = 80%

remaining unsold stock cost = 20% i.e., = 80,000 x 20/100 = 16,000

Question 5.

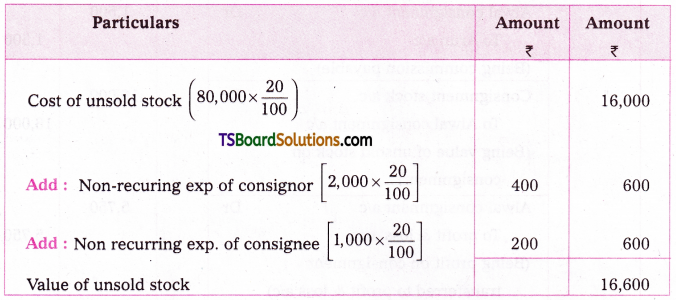

Karthik of Karimnagar sent sports material worth Rs. 80,000 to Supreeth on a consign¬ment basis. Karthik spent Rs. 2,000 for insurance. Supreeth while taking the goods spent Rs. 1,000 for transport and Rs. 1,500 for Godown rent. 80% of stock was sold out. Calculate the value of unsold stock.

Answer:

Valuation of Unsold stock

Question 6.

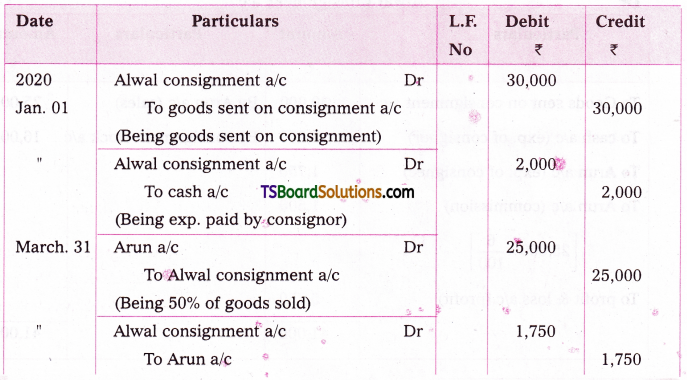

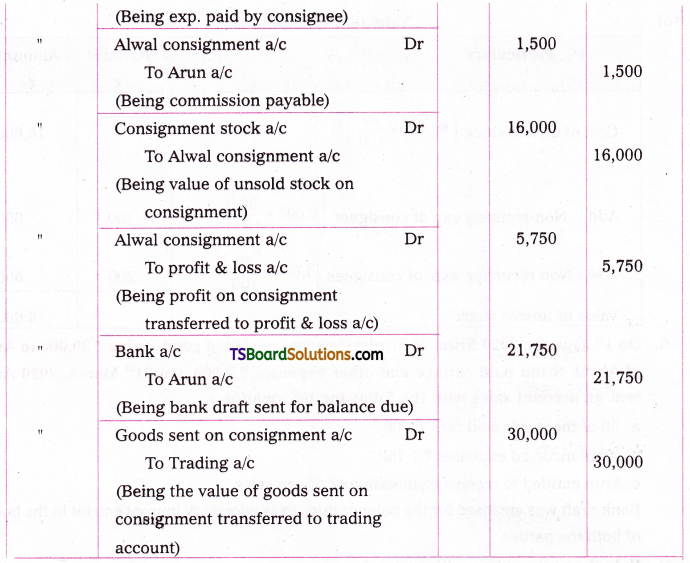

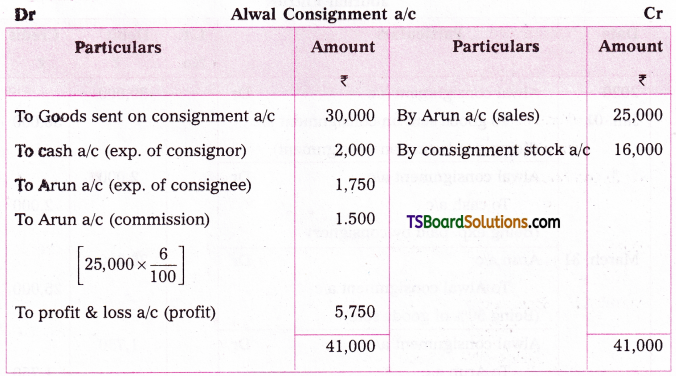

On 1st January, 2020 Srinu of Srinivasanagar consigned goods value Rs. 30,000 to Arun of Alwal. Srinu paid cartage and other expenses Rs. 2,000. On 31st March, 2020 Arun sent an account sales with the following information :

a. 50 of the goods sold for Rs. 5,000.

b. Arun incurred expenses Rs. 1,750.

c. Arun entitled to receive commission @ 6% on sales.

Bank draft was enclosed for the balance due. Pass necessary journal entries in the books of both the parties.

Answer:

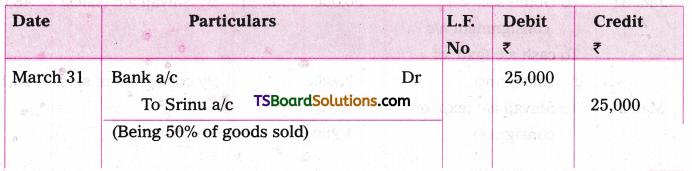

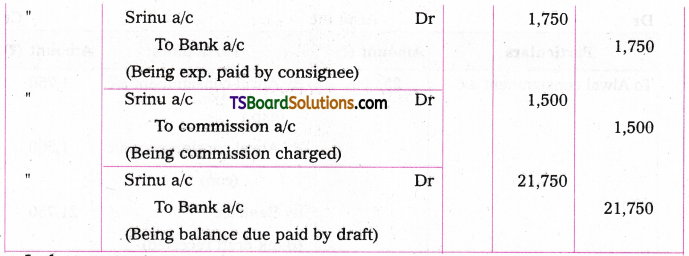

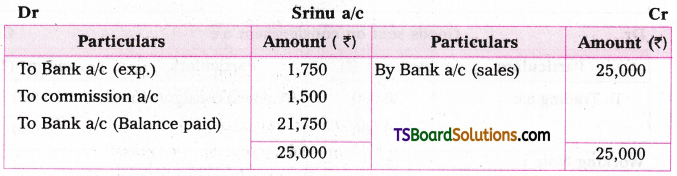

II. In the books of Srinu (Consignee)

Journal Entries

Ledger accounts :

Working Note :

Valuation of Unsold stock

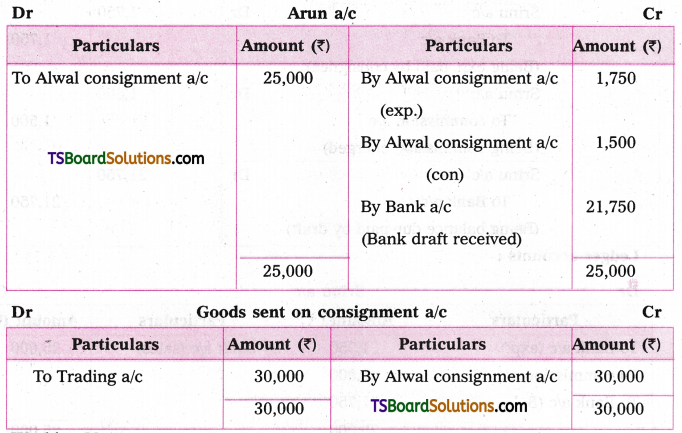

II. In the books of Aran (Consignee) :

Journal Entries

Ledger accounts:

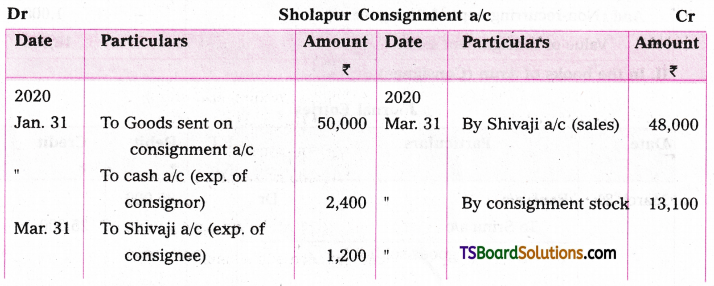

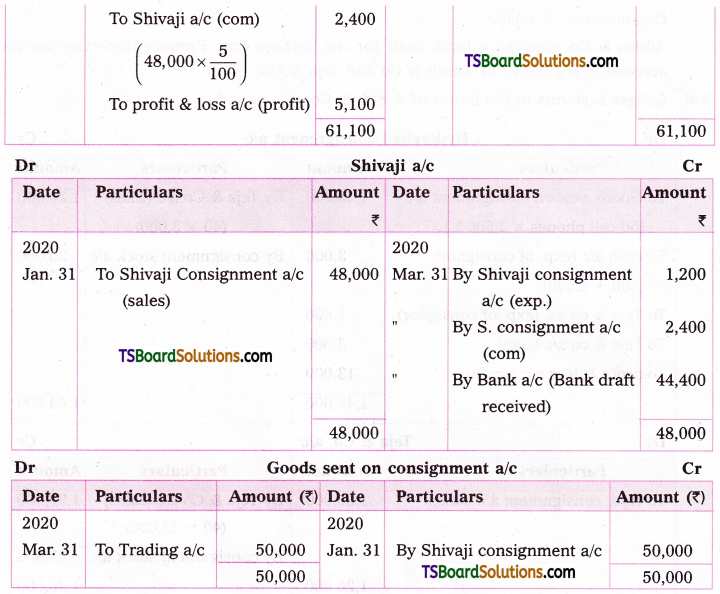

Question 7.

On 1-1-2020 Bajaji of Hyderabad consigned goods valued at Rs. 50,000 to Shivaji of Sholapur. Balaji paid cartage and other expenses Rs. 2,400. On 31-3-2020 sent the account sales with the following information.

a. 3/4th of the goods sold for Rs. 48,000

b. Shivaji incurred expenses amounting to Rs. 1,200.

c. Shivaji is entitled to receive commission @ 5% on sales.

Bank draft was enclosed for the balance. Prepare necessary ledger accounts in the books of Balaji.

Answer:

Ledger Accounts in the books of Balaji

Working Note :

Valuation of Consignment stock (unsold stock)

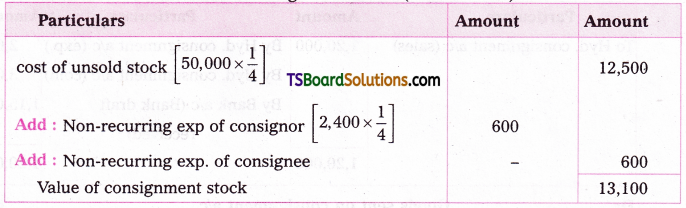

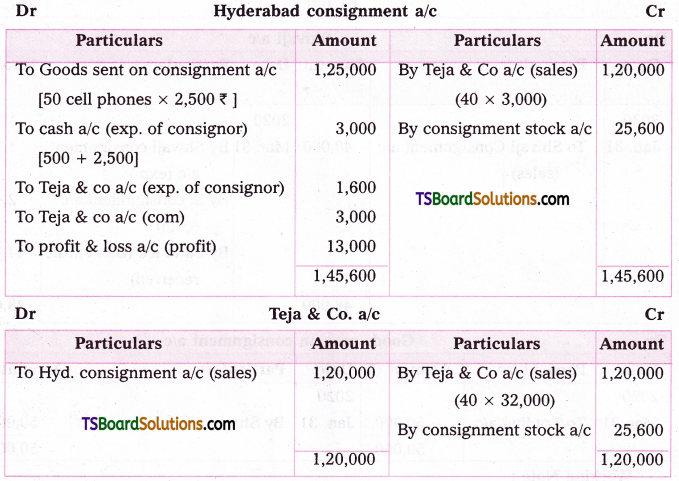

Question 8.

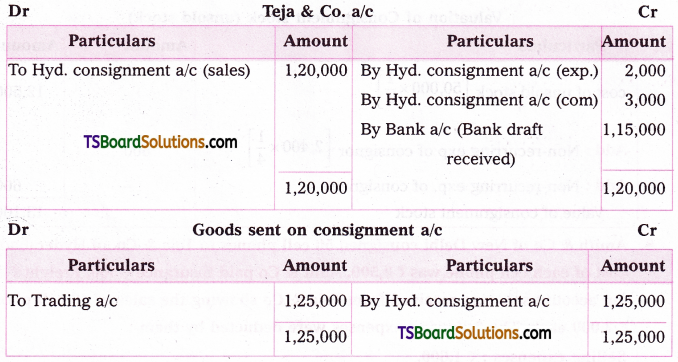

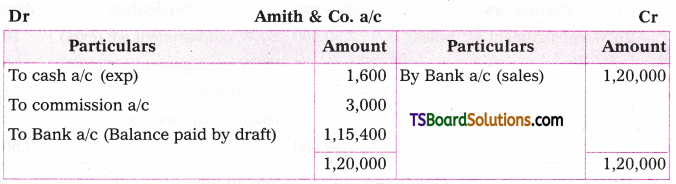

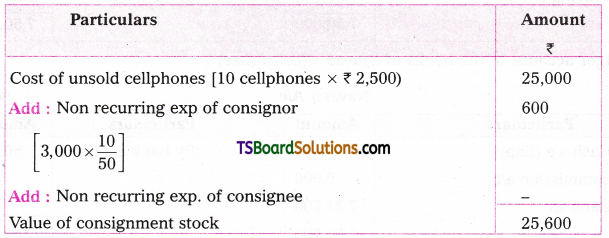

Amith & Co of New Delhi consigned 50 cell phones to Teja & Co. of Hyderabad. The cost of each cell phone was Rs. 2,500. Amit & Co paid Insurance Rs. 500, Freight Rs. 2,500/ am account sale was received from Teja & Co showing the sales of 40 cell phones a Rs. 3.000 each. The following expenses were deducted by them :

Selling expenses : Rs. 1.600. Commission : Rs. 3,000. Amith & Co received a bank draft for the balance due. Prepare important ledger account in the books of Amith & Co and Teja & Co.

Answer:

Ledger accounts in the books of Amith & Co (consignor) :

II. In the books of Teja and Co consignee :

Working Note :

Valuation of closing stock

Question 9.

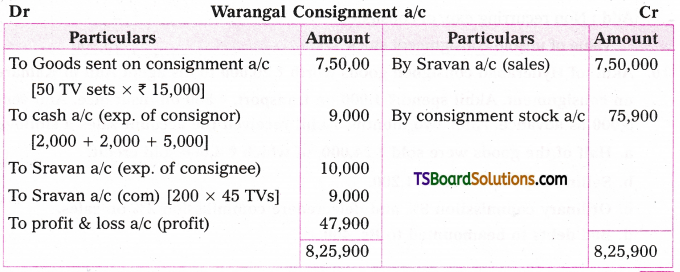

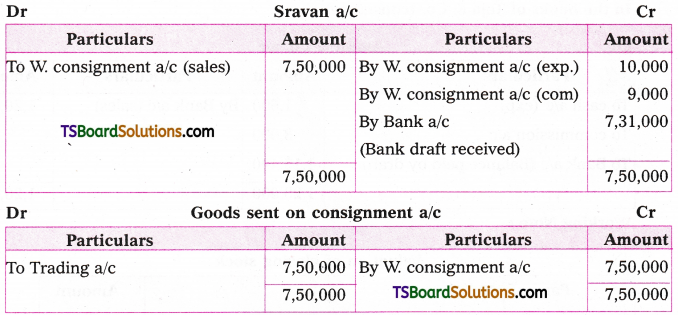

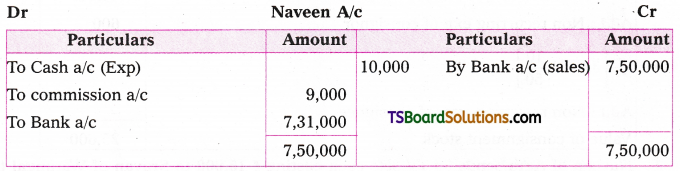

Naveen of Agra sends 50 IV sets each costing Rs. 15,000 to Sravan of Warangal to be on a consignment basis. He incured the following expenses ; freight Rs. 2,000 and insurance X 5,000. Sravan sold 45 TVs for Rs. 7,50,000 and paid X 10,000 as shop rent, which is borne by Naveen as per terms and conditions of the consignment. Consignee is entitled for a commission of X 200 per TV sold. Assuming that, Sravan settled the account by sending the bank draft to Naveen. Prepare necessary ledger accounts in the books of Naveen and Sravan.

Answer:

Ledger accounts in the books of Naveen (consignor) :

Ledger account in the books of Sravan : (consignee) :

Working Note :

Valuation of unsold stock

Question 10.

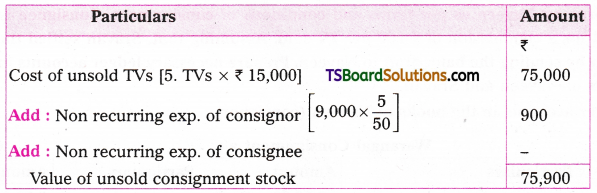

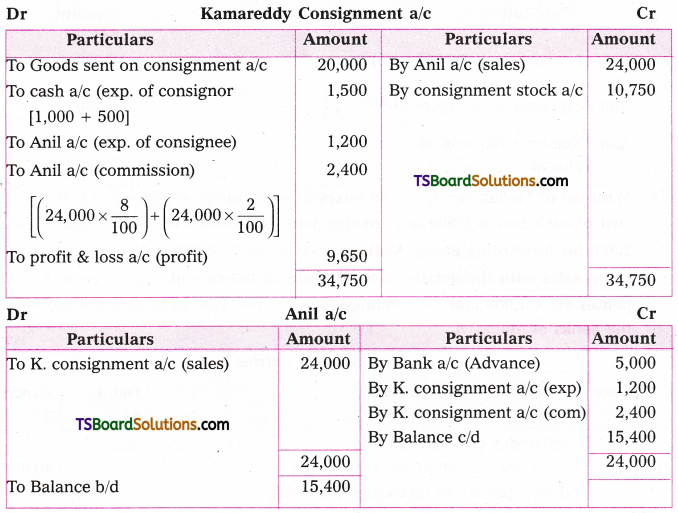

Akhil of Hyderabad consigned goods worth Rs. 20,000 to his agent Anil of Kamareddy on consignment. Akhil spend Rs. 1,000 on transport, Rs. 500 on insurance. Anil sent Rs. 5,000 as advance. After two months, Akhil received the account sales as follows:

a. Half of the goods were sold f 24,000, of which Rs. 4,000 sold credit.

b. Selling expenses were Rs. 1,200.

c. Ordinary commission 8% and delecredere commission 2% on sales.

d. Bad debts to beamounted to Rs. 400.

Give ledger accounts in the books of both the parties.

Answer:

Ledger accounts in the books of Akhil (consignor) :

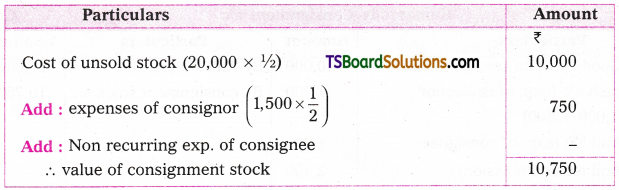

Working Note :

Valuation of consignment stock

Question 11.

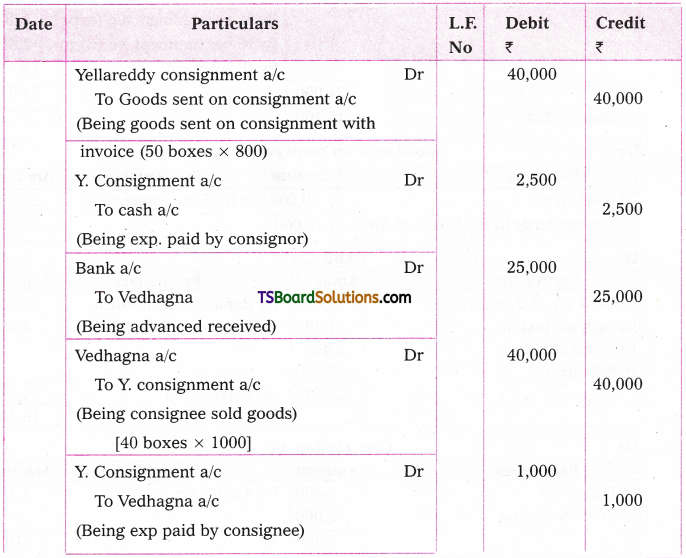

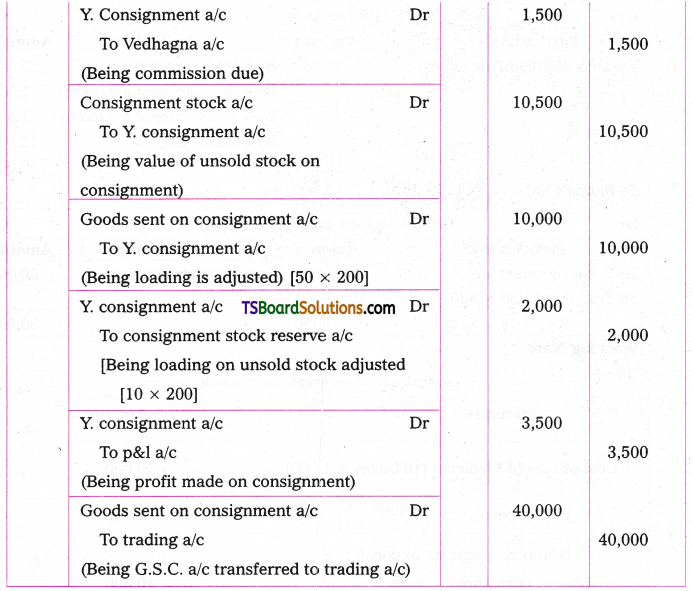

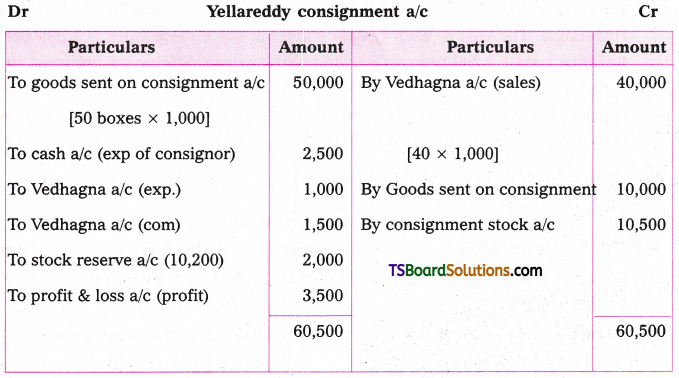

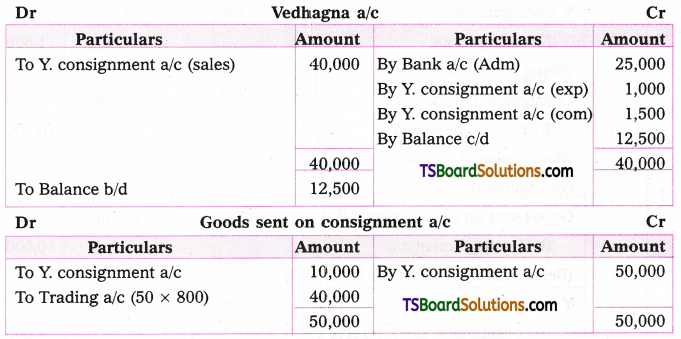

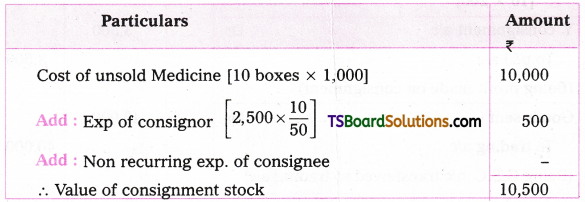

Manaswi of Medak consigned 50 boxes of medicine to Vedhagna of yellareddy. The cost of each box is X 800 and invoice price is X 1,000 each box. Manaswi paid Rs. 2,500 for forwarding goods. Vedhagna advanced X 25,000 to Vedhagna and sent ac¬count sales with the details sales 40 boxes at the rate of X 1,000 each. Selling expenses are X 1,000 and his commission is X 1,500. Pass necessary journal entries in the books of Manaswi.

Answer:

Journal Entries

Working Note :

Valuation of consignment stock

Question 12.

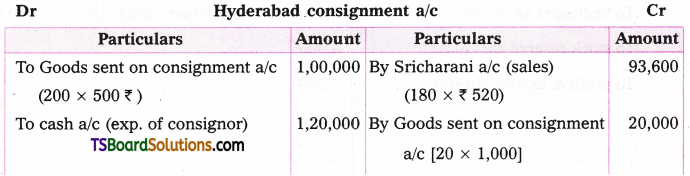

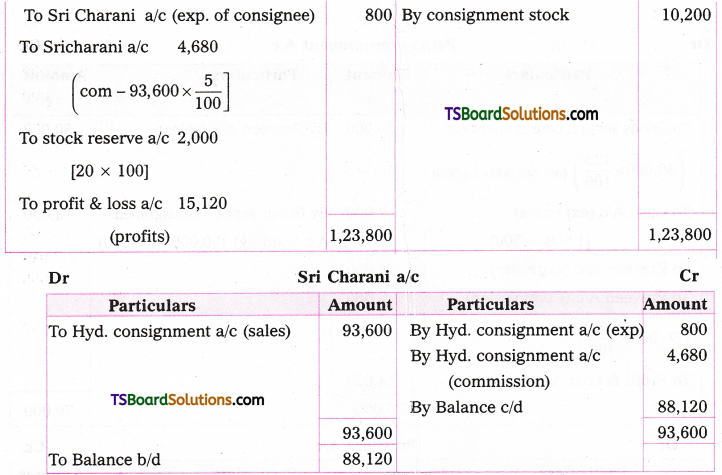

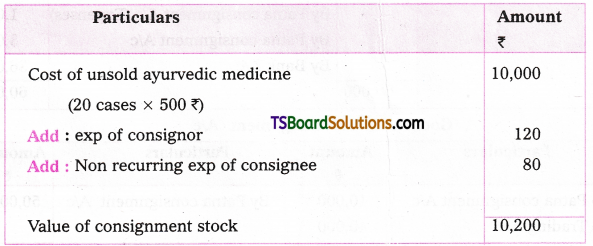

Ragamai of Kochin consigned 200 cases of ayurvedic medicines to Sricharani of Hyderabad. The cost of each case is Rs. 400 but the invoice price is Rs. 500 per case. Ragamai paid Rs. 1,200 towards packing sand carriage. Sricharani informed through account sales that 180 cases are sold at Rs. 520 each. Expenses paid by Sricharani were freight Rs. 800. Commission has to be calculated at 5% on sales. Prepare Consignment account and consignee’s account in the boooks of Ragami.

Answer:

Ledger accounts in the books of Ragamai

Working Note :

Valuation of unsold stock on consignment

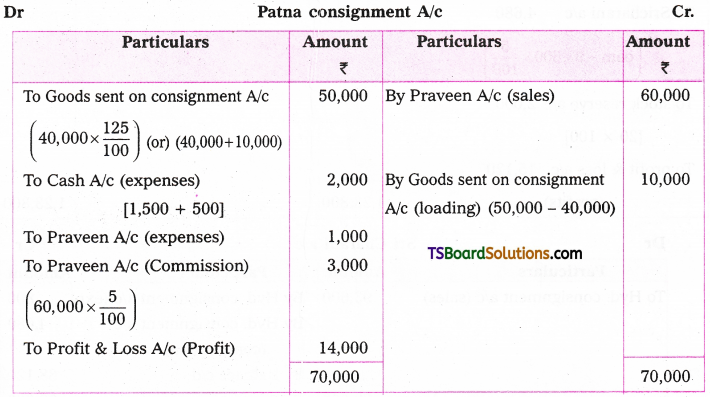

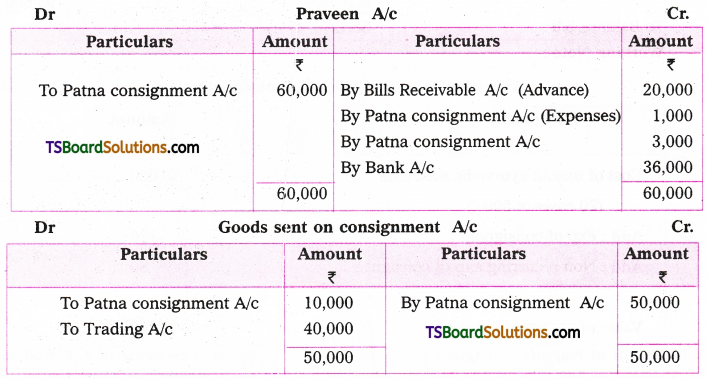

Question 13.

Rajani of Nagpur consigned goods to Praveen of Patna. The value of Rs. 40,000 in¬voiced at 25% above the cost. Rajani paid Rs. 1,500 for carriage and Rs. 500 for insur¬ance. Rajau drew a bill on Praveen for Rs. 20,000 payable after 3 months and received Praveen’s acceptance. Later, Rajani received account sales from Praveen stating the following : Total goods sold for Rs. 60,000 and the sales expenses Rs. 1,000 and his commission 5% on sales.

Praveen deducted all the above and sent a cheque for remaining balance. Prepare necessary accounts in the books Rajani and Praveen.

Answer:

Working Note :

Given cost of the goods = 40,000

Invoice price = cost + loading

= 40,000 + 25% on cost

= 40,000 + [ 40,000 x 25/100 ]

= 40,000 + 10,000 = Invoice price = 50,000

Question 14.

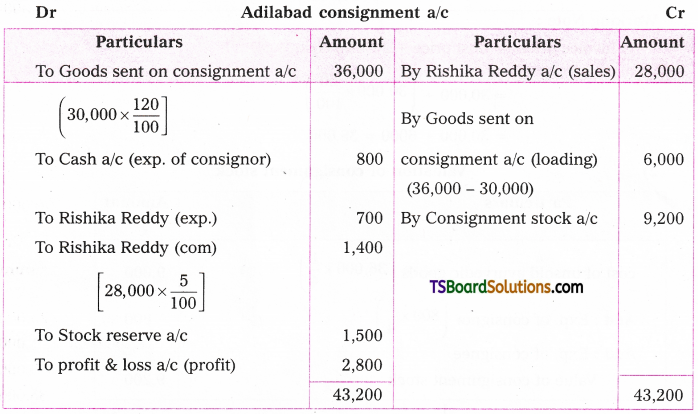

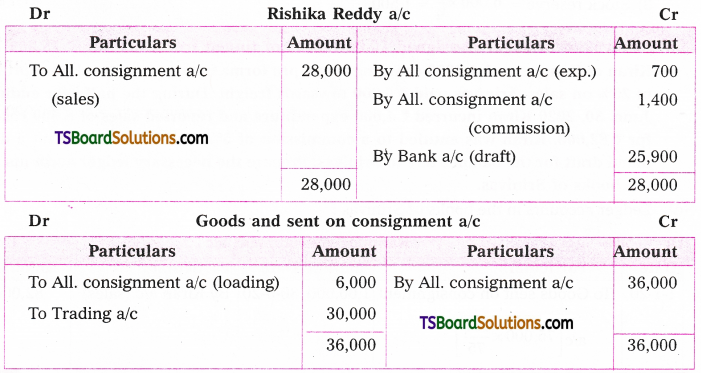

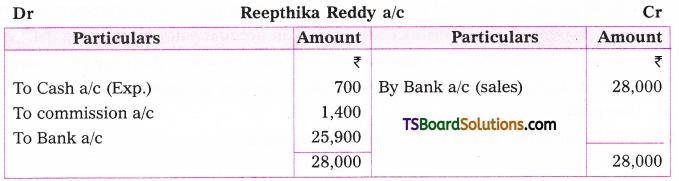

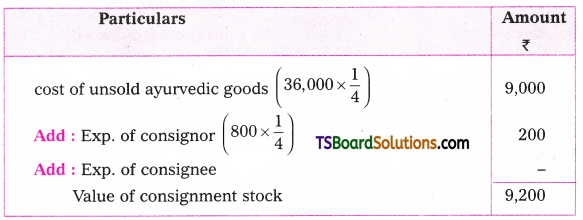

Reepthika Reddy sent goods to Rishika Reddy of Adilabad on consignment worth Rs. 30,000 at invoice price of cost plus 20%. Reepthika Reddy paid transport and insurance charges of Rs. 800. Rishika Reddy sent an account sales by showing 3\4th goods are sold for Rs. 28,000 and sales expenses Rs. 700. She sent a draft for an amount due after deducting 5% commission. Give the necessary accounts in the books of both the parties.

Answer:

Ledger accounts in the books of Reepthika Reddy :

In the books of Rishika Reddy a/c:

Working Note :

1) Invoice price = Cost price + 20% on cos

= 30,000 + [30,000 x 20/100]

= 30,000 + 6000 = 36,000

2) Valuation of consignment stock

3) Stock reserve = 6,000 x 1/4 = 1,500

Question 15.

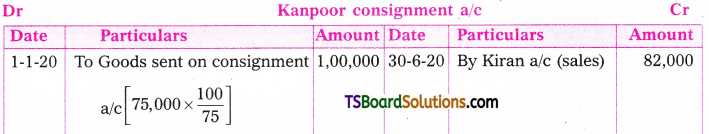

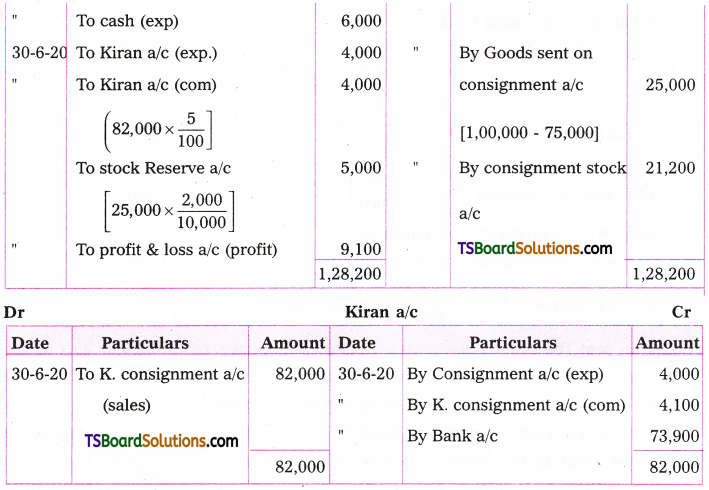

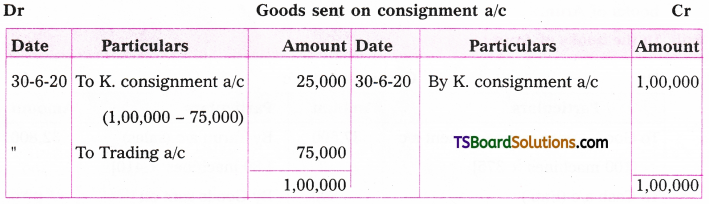

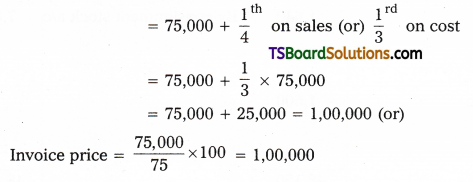

Srinivas of Srinagar consigned 10,000 cases of tinned fruits costintg Rs. 75,000 to Kiran of Kanpur on 1-1-2020 charging him a pro forma invoice price to show a profit of 25% on sales. Srinivas paid Rs. 6,000 towsards freight. During the half year ending June. 30, 2020 Kiran incurred Rs. 4,000 in expenditure and reported sales of 8,000 cases for Rs. 82,000. Kiran was entitled to a commission of 5% on sales. He has sent a demand draft for the balance due to Srinivas. Prepare the necessary ledger accounts in the books of Srinivas.

Answer:

Ledger accounts in the books of Srinivas :

Working Note :

1) Invoice price = cost + profit [ie., 25% on sales]

2) Valuation of unsold stock :

Question 16.

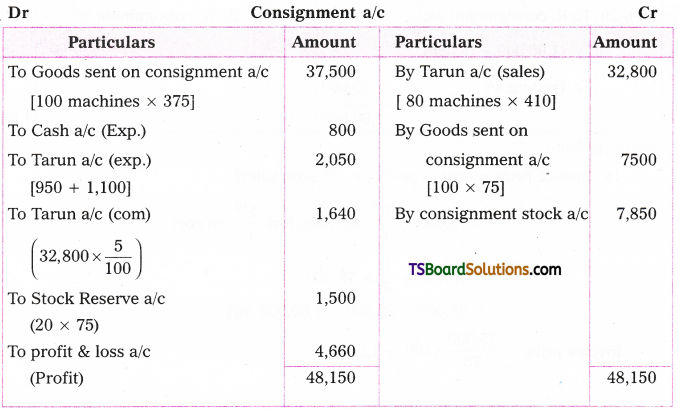

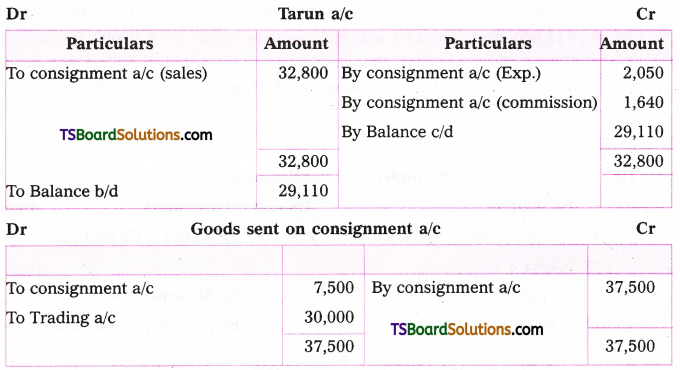

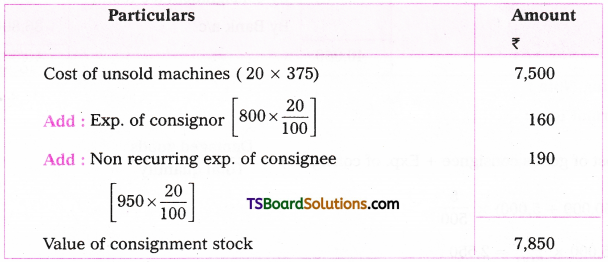

Arun sent 100 sewing machines on consignment basis to Tarim. The cost of each machine was Rs. 300, but the consignor prepared the proforma invoice at 25% abobe the cost. The company spent Rs. 800 on various expenses.

After receiving the machines, Tarun had to spend Rs. 950 for freight and Rs. 1,100 for godown rent. By the end of the year Tarun sold 80 Machines @ 1410 per machine. He was entitled to a commission of 5% on sales. Prepare necessary accounts in the books of Arun,

Answer:

In the books of Arun :

Working Note :

1) Invoice price = cost + 25% on cash

= 30,000 + 30,000 x 25/100

= 30,000 + 7,500 = 37,500.

2) Valuation of unsold stock of consignment

3) Stock Reserve = 20 x 75 = 1,500

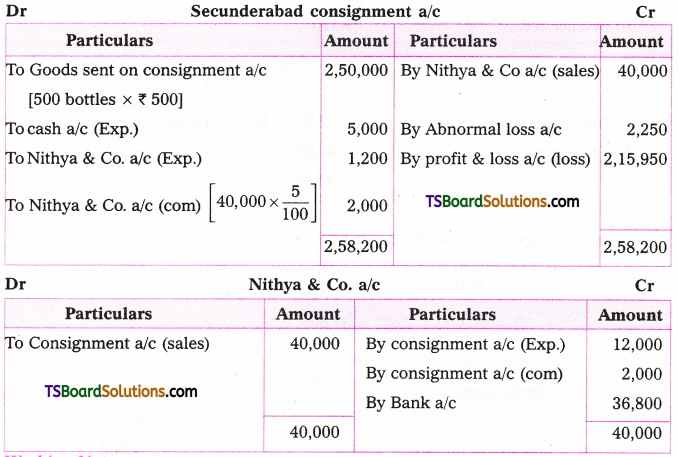

Question 17.

500 sanitizer bottles were consigned by Anuhya and co. Hyderabad to Nithya and co. Secunderabad costing Rs. 500 each. Expenses incurred by Anuhya and co. amounted to Rs. 5,000. On the way 5 sanitizer bottles were completely damaged due to bad han¬dling and insurance company admitted the calim to the extent of Rs. 2,500.

Nithya and co, took delivery of the remaining sanitizer bottles and incurred ex¬penses Rs. 12,000. Nithya and co. sold 495 sanitizer bottles for Rs. 40,000, It is entitled to a commission of 5% on sales. Prepare Consignment account, Nithya and co. a/c in the books of Anuhya and co. assuming that Nithya and co. remitted amount due by them.

Answer:

In the books of Anuhya and Co :

Working Note :

Abnormal loss :

Question 18.

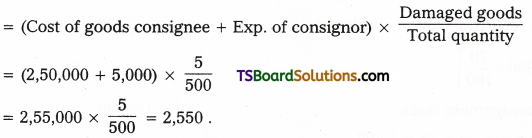

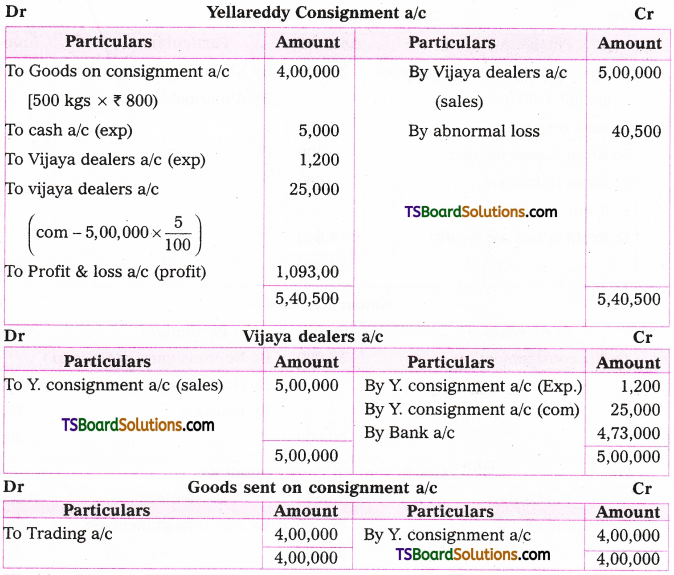

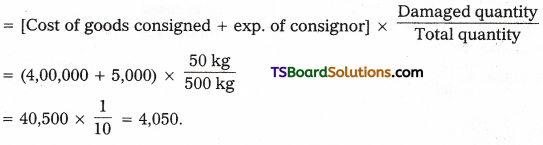

Raja oil mills, kamareddy consigned 500 kgs of ghee to the Vijay dealers of Yellareddy. Cost of each Kg. is 800. Raja oil mills paid Rs. 5,000 for various expenses. During the transit, 50 kgs of ghee were accidentally destroyed.

Vijay received remaining stock of ghee and reported that entire ghee is sold for Rs. 5,00,000 and his expenses are 12,000. He is entitled to a 5% commission on sales. Prepare necessary accounts in the books of Raja oil mills assuming that Vijay remitted amount due by them.

Answer:

Working Note:

Question 19.

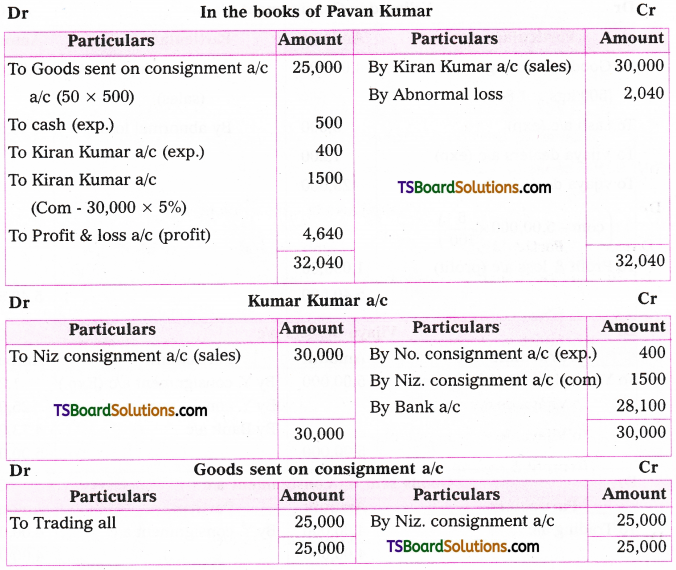

Pavan Kumar of Hyderabad consigns to Kiran Kumar of Nizamabad 50 eases of goods at a cost of Rs. 500 per case, Pavan Kumar incurred the expenses Rs. 500. Kiran Kumar paid Rs. 400.4 cases were destroyed in transit. t

Kiran Kumar received remaining stock and sold entire stock for Rs. 30,000. He is entitled for a commission of 5% on sales and sent the bank draft for full settlement of account. Show necessary accounts in the books of Pavan Kumar.

Answer:

Working Note:

= 2,040

Question 20.

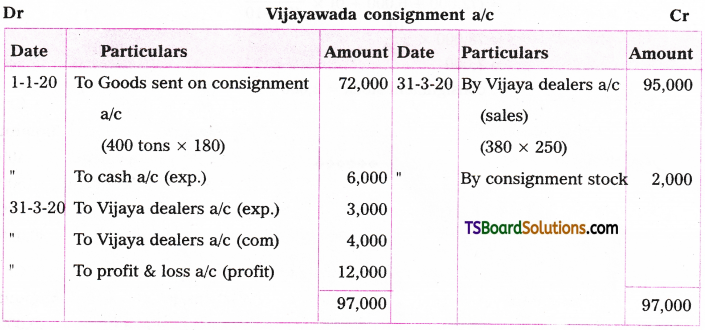

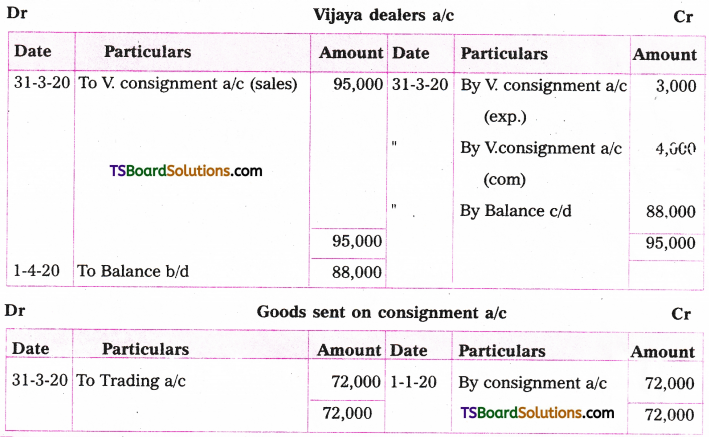

On 1 January, 2020 Bharat coal company Ltd. Consigned to Vijay dealers, vijayawada. 400 tons of coal cost of the coal being Rs. 180 per ton. The company had paid Rs. 6,000 towards freight and insurance.

Vijay took delivery of the goods consigned on 10th January, 2020. On 31st March, 2020 the consignee reported that :

1. There was a shortage of 10 tons due to loading and unloading of the coal, (Treated as normal loss)

2. 380 tons were sold @ Rs. 250 per ton.

3. He had paid Rs. 3,000 towards godown rent and selling expenses.

Vijay dealers were entitled to a commission of Rs. 4,000. Show the necessary accounts in the books of Bharath Coal Company Ltd.

Answer:

In the books of Bharath Ltd. coal company :

Working Note :

1) Valuation of unsold stock :

Unsold coal tons = total – Normal loss – sold .

= 400 tons – 10 tons – 380 tons unsold =10 tons

= 2,000

consignment stock = 2,000