Telangana TSBIE TS Inter 2nd Year Accountancy Study Material 5th Lesson Admission of a Partner Textbook Questions and Answers.

TS Inter 2nd Year Accountancy Study Material 5th Lesson Admission of a Partner

Very Short Answer Questions

Question 1.

What are the aspects which require attention when a new partner is admitted?

Answer:

The following Adjustments are to be made in the books of accounts at the time of admission of a new partner. They are:

- Calculation of new profit sharing ratio.

- Revaluation of assets and liabilities.

- Accounting treatment of goodwill.

- Distribution of reserves and undistributed profits/losses.

- Adjustment of capital in proportion to profit sharing ratio.

Question 2.

What is a Revaluation account?

Answer:

An account prepared with the specific purpose of recording changes in the value of assets and liabilities of a partnership firm. It is called a Revaluation account.

![]()

Question 3.

Why Revaluation account is prepared?

Answer:

- When the new partner is admitted, it becomes necessary to revalue the assets and liabilities of the firm in order to ascertain and record their true values.

- The revaluation account is prepared to see that the new partner should not be benefitted or suffered from any appreciation or depreciation in the value of assets and liabilities.

Question 4.

What is goodwill?

Answer:

- Goodwill is the reputation or good name associated with the name of firm.

- Goodwill is an intangible asset. It is the force of attracting customers. It helps to earn more profits than the normal profits in feature.

- Firm which have goodwill will enjoy continuous patronage of customers.

Question 5.

State the essential features of goodwill.

Answer:

Features of goodwill:

- It is an intangible asset.

- It is inseparable from the business. It exists with the business. It cannot be separated and sold like other tangible assets.

- It helps in generating more profits than normal profits.

Question 6.

What is Ratio of sacrifice?

Answer:

- The ratio in which old partners agree to sacrifice their share of profits in favour of the incoming new partner is called Ratio of Sacrifice.

- Ratio of sacrifice can be get by deducting new profit-sharing ratio from old profit-sharing ratio.

Ratio of sacrifice = Old profit sharing Ratio – New profit sharing Ratio.

Question 7.

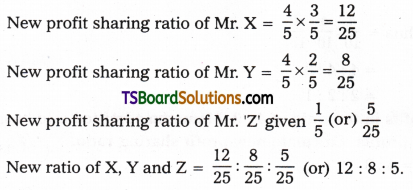

X and Y are partners sharing profits and losses in the ratio of 3: 2. They decided to admit Mr. Z for 1/5 share in profit. Calculate new profit-sharing ratio of X, Y and Z.

Answer:

Old ratio of X and Y = 3: 2

Assume total profit = 1

Share of Z = 1/5

The remaining profit is 1 – 1/5 = 4/5 will be given to X and Y in their old profit-sharing ratio

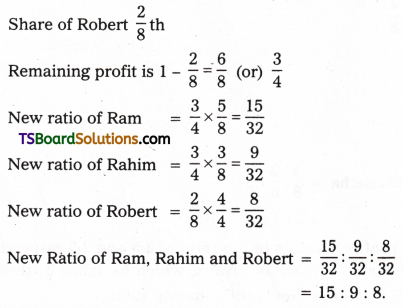

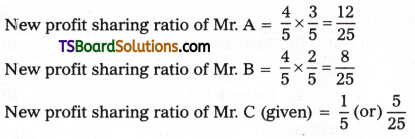

Question 8.

Ram and Rahim are partners sharing profits and losses in the ratio of 5: 3. They decided to admit Robert by giving him a 2,8th share in the profits. Calculate new profit-sharing ratio.

Answer:

Old ratio of Ram and Rahim 5 : 3

Assume total profit = 1

Share of Robert 2/8 th

![]()

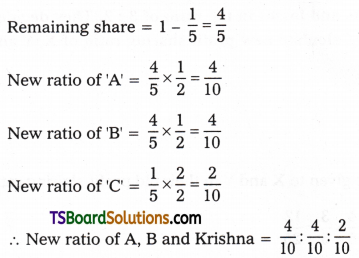

Question 9.

A and B are partners sharing profits and losses equally. They decided to admit Krishna for 1/5th share of profit in the business. Calculate New profit-sharing ratio of A, B & C.

Answer:

Old ratio of A and B is 1 : 1

Assume total profit = 1

Krishna share (given) = 1/5

= 4 : 4 : 2

= 2 : 2 : 1.

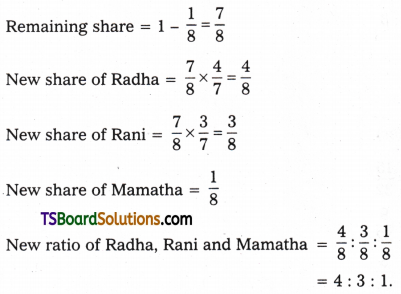

Question 10.

Radha and Rani share profits in the ratio of 4: 3. Mamatha admitted into business for l/8th share in the future profits. Calculate new profit-sharing ratio.

Answer:

Old ratio of Radha and Rani = 4 : 3

Give share to Mamatha 1/8 th

Total profits assumed ‘1’

Question 11.

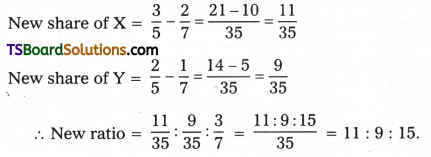

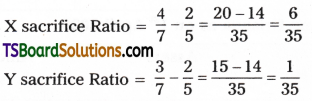

X and Y are partners sharing profits & losses in the ratio of 3/5 and 2/5 respectively. They decided to admit Mr. Z for 3/7th share in profits, which he takes 2/7th share from X and 1/7th share from Y. Calculate New profit sharing ratio.

Answer:

Profit sharing ratio of X and Y = 3/5 : 2/5

Give to Z = 3/7th

New Profit shares ratio = Old profit sharing ratio – Share profit given to new partner

Question 12.

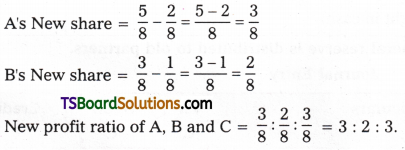

A and B are partners sharing profits and losses in the ratio of 5: 3 respectively. Mr. C is admitted for 3/8th share of profit, which he takes 2/8th from Mr. A and 1/8th from Mr. B. Calculate new profit sharing ratio.

Answer:

Old ratio of A and B = 5/8 : 3/8

C’s New share 3/8th

New Profit shares ratio = Old profit sharing ratio – Share profit given to new partner

Question 13.

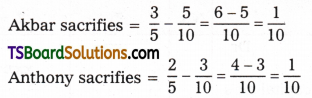

Akbar and Anthony are partners sharing profits and losses in the ratio of 3 : 2 respectively. Mr. Amar is admitted into partnership. The new profit sharing ratio of Akbar, Anthony and Amar is 5 : 3 : 2 respectively. Calculate Ratio of sacrifice of old partners.

Answer:

Akbar and Anthony old ratio = 3:2

Akbar and Anthony old ratio = 3:2

Ratio of Akbar, Anthony and Amar is 5: 3: 2

Sacrifice of old partners = Old ratio – New ratio

Ratio of sacrifice 1 : 1.

Question 14.

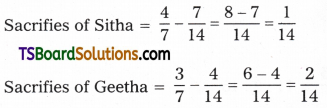

Sitha and Geetha are partners sharing profits and losses in the ratio of 4: 3 respectively. Kavitha joined as new partner. The new profit sharing ratio of Sitha, Geetha and Kavitha is 7: 4: 3. Calculate Ratio of sacrifice of Sitha and Geetha.

Answer:

Sitha and Geetha profit sharing ratio = 4:3

Sitha, Geetha, Kavitha New profit sharing ratio = 7 : 4 : 3

Sacrifies Raju = Old ratio – New ratio

Ratio of sacrifice Sitha and Geetha = 1 : 2.

Question 15.

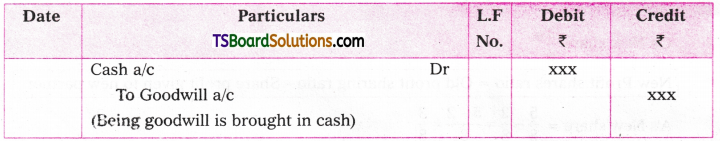

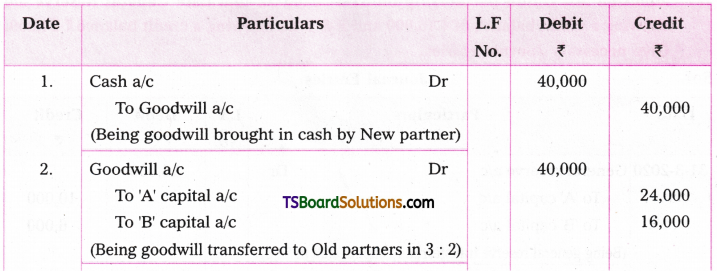

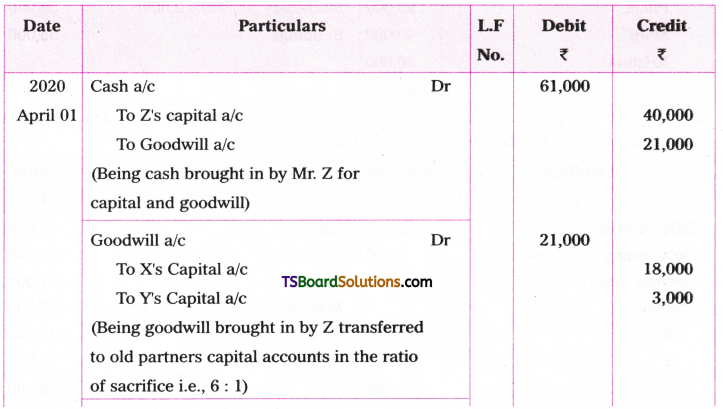

Give journal entry when goodwill is brought in cash.

Answer:

Journal Entry

Question 16.

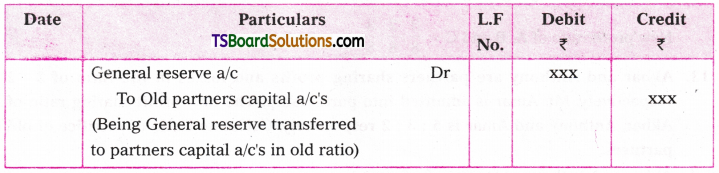

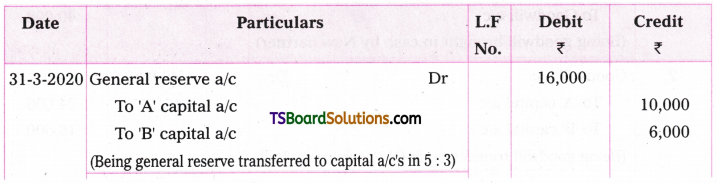

Give journal entry when general reserve is distributed to old partners.

Answer:

Journal Entry

Question 17.

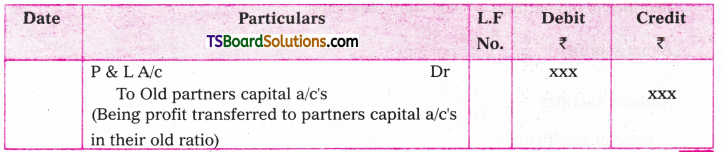

Give journal entry for distribution of undistributed profit among old partners.

Answer:

Journal Entry

Question 18.

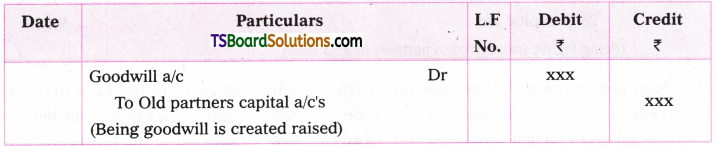

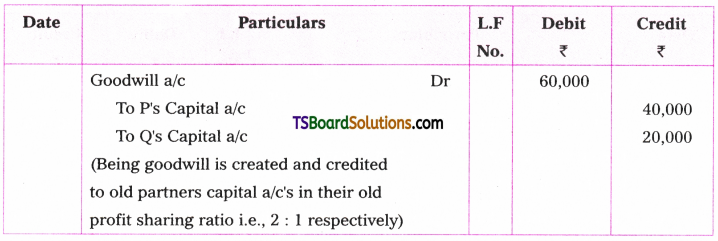

Give journal entry when goodwill is created/raised in the books.

Answer:

Journal Entry

Question 19.

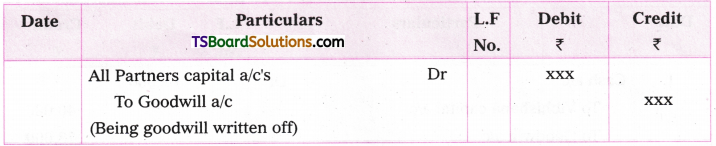

Give journal entry when goodwill is written off in the books.

Answer:

Journal Entry

Question 20.

X and Y are partners sharing profits and losses in the ratio of 2: 3 respectively. They admitted Mr. Z into partnership for l/4th share. For the purpose of admission of Mr. Z, Goodwill is valued at 3 years purchase of average profits of last 5 years. The profits of last 5 years were X 30,000, Rs. 40,000, Rs. 35,000, Rs. 45,000 and Rs. 50,000 respectively. Calculate the value of Goodwill.

Answer:

![]()

Goodwill = Average profit x Purchase of 3 years

= 40,000 x 3

Goodwill = Rs. 1,20,000.

![]()

Question 21.

A and B are partners sharing profits and losses in the ratio of 5: 3 respectively. They admitted Mr. C into the partnership on 31-3-2020. On that date General Reserve a/c showing a credit balance of Rs. 16,000 and P & L a/c showing a credit balance t 24,000. Give necessary Journal entries.

Answer:

Journal Entries

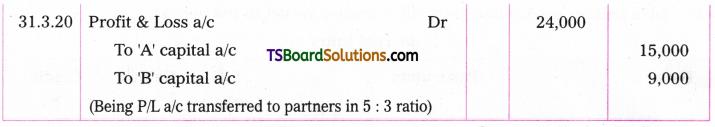

Question 22.

Ram and Ravan are in partnership sharing profits and losses in the ratio of 4: 3. They admitted, Vibhishana for 1/4 share in profits, Vibhishana brings Rs. 40,000 for capital and Rs. 28,000 for goodwill in cash. Goodwill is retained in the business. Give necessary journal entries.

Answer:

Journal Entries

Question 23.

A and B are partners sharing profits and losses in the ratio of 3: 2 respectively. They admitted Mr. C as new partner. He brings Rs. 40,000 as goodwill in cash. The goodwill is withdrawn by A and B from the business. Give necessary Journal entries.

Answer:

Journal Entries

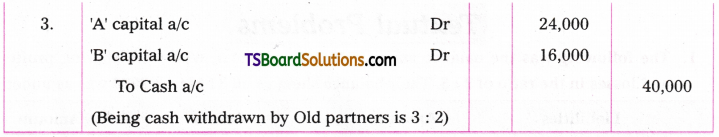

Question 24.

Ram and Sitha are in partnership sharing profits and losses in the ratio of 5: 3. They admitted Laxman as new partner for 1/5 share of profit. The Goodwill of the firm is valued at Rs. 80,000. Pass necessary Journal entry to raise goodwill.

Answer:

Journal Entries

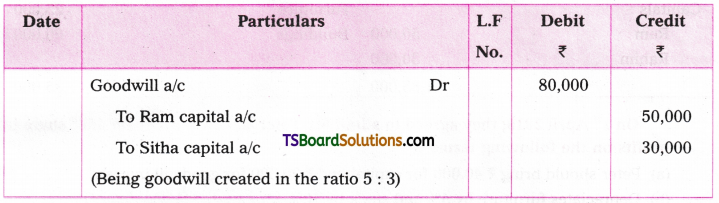

Question 25.

Saritha and Kavitha are sharing profits and losses equally. They admitted Lalitha as new partner. Their new profit sharing ratio would be 2: 2: 1 respectively. The goodwill of the firm is valued at Rs. 1,00,000. The partners decided to create and write off goodwill completely. Pass necessary Journal entries.

Answer:

Journal Entries

Textual Problems

Question 1.

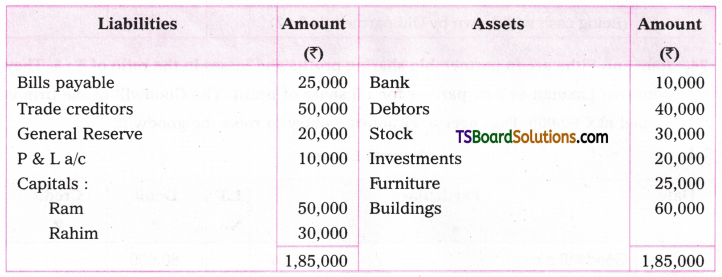

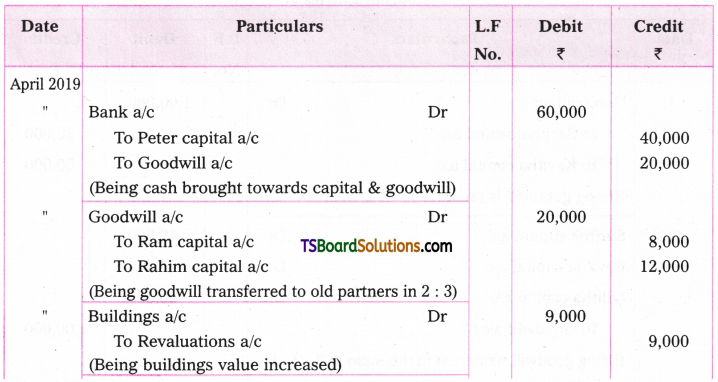

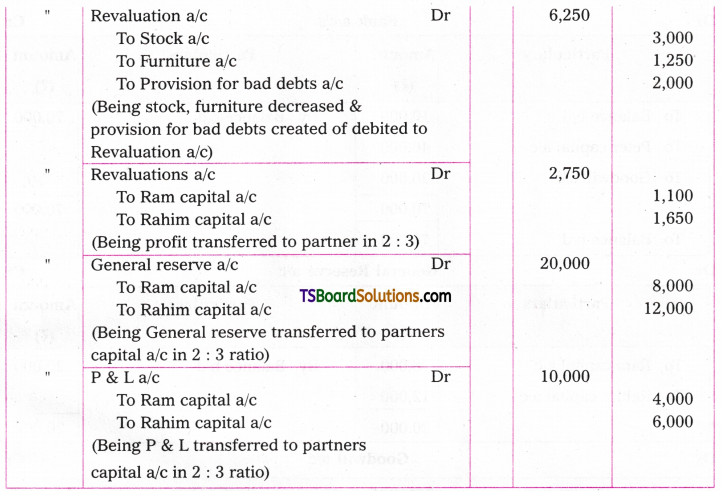

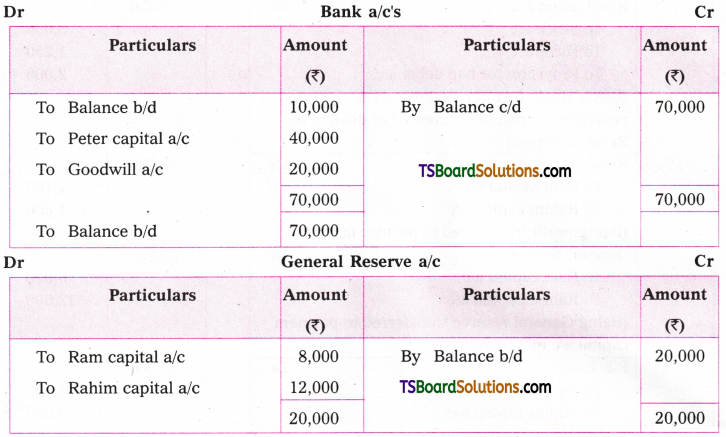

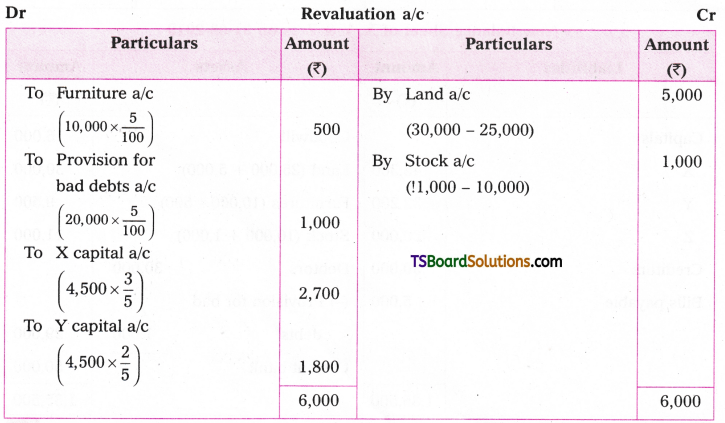

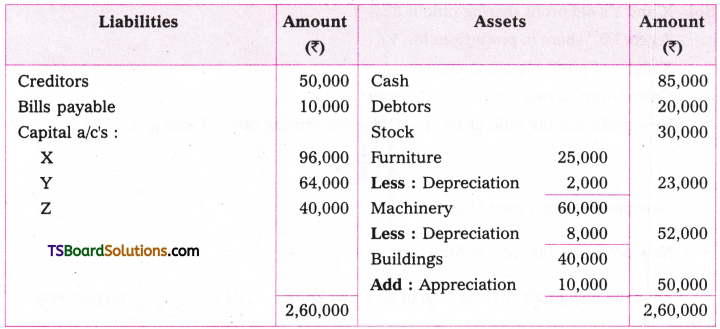

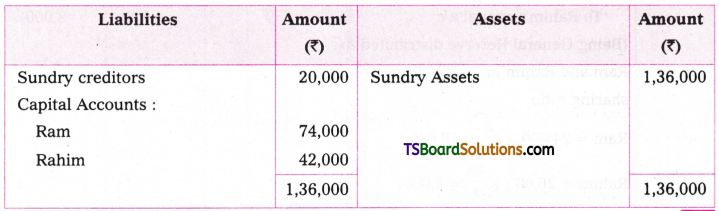

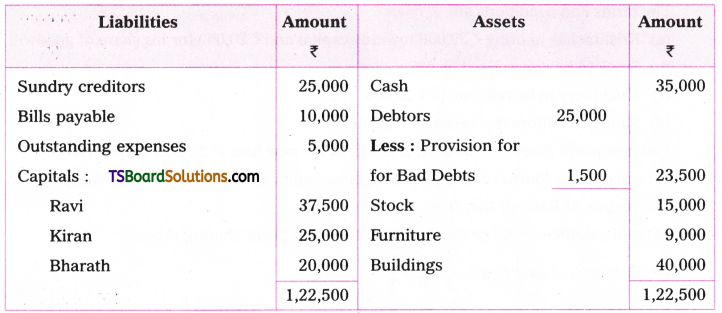

The following was the Waianae sneer oi Jttam ana nanim, who were sharing profits and losses in the ratio of 2: 3. Their balance sheet as on 31 March 2019 was as under.

On 1st April 2019, they agreed to admit Mr. Peter as new partner for l/5th share in profits on the following terms:

(a) Peter should bring Rs. 40,000 for capital and Rs. 20,000 for goodwill in cash.

(b) Depreciates furniture by 5% and stock by 10%.

(c) Appreciate building value by 15%.

(d) Provide for bad debts at 5% on debtors.

Give necessary journal entries and ledger accounts and opening the balance sheet of new firm.

Answer:

Journal Entries

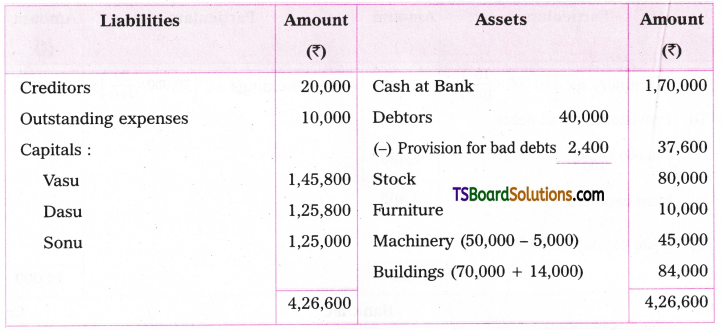

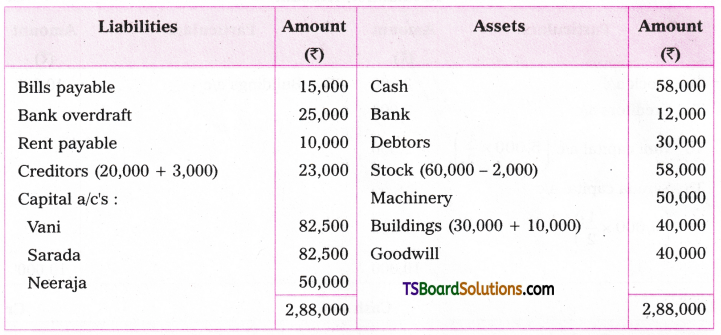

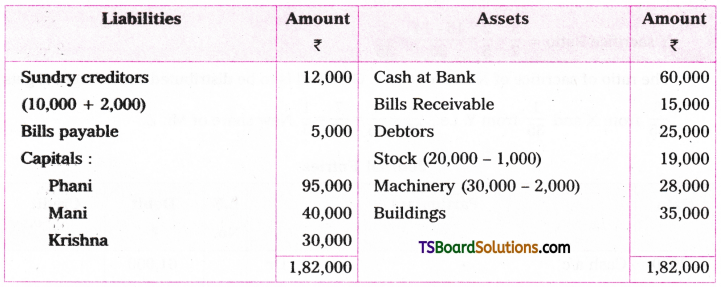

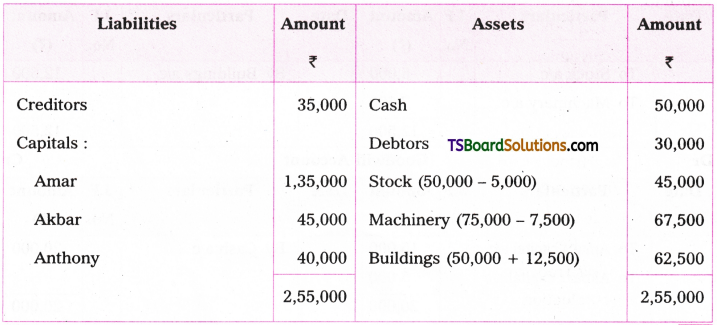

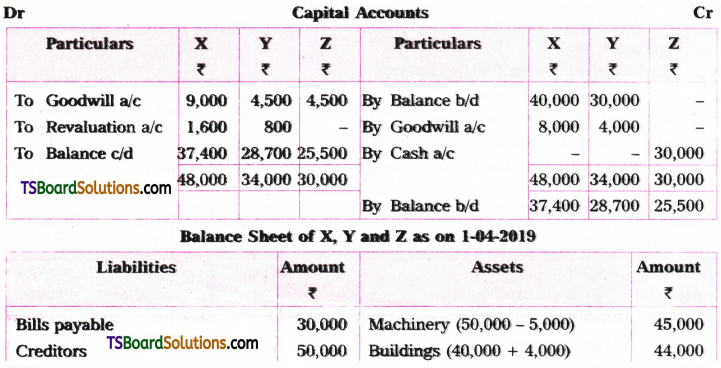

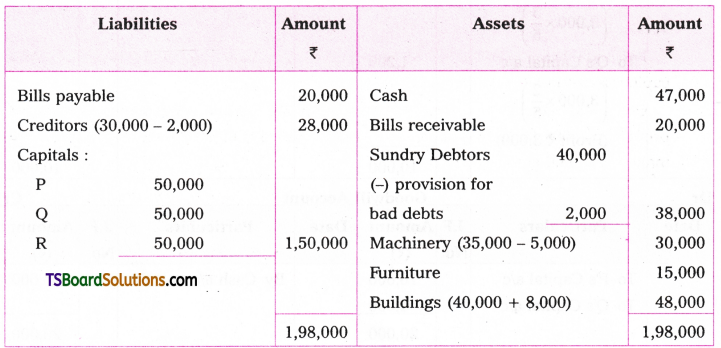

Balance sheet of Ram, Rahim, Peter as on 01-04-2019

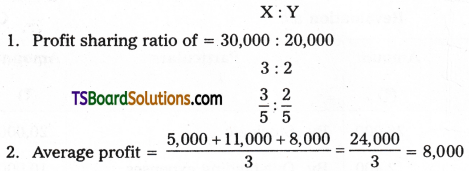

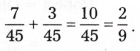

Question 2.

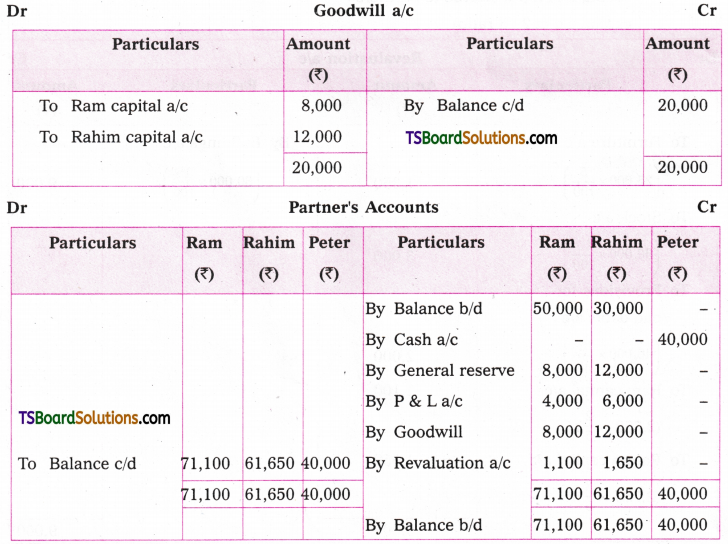

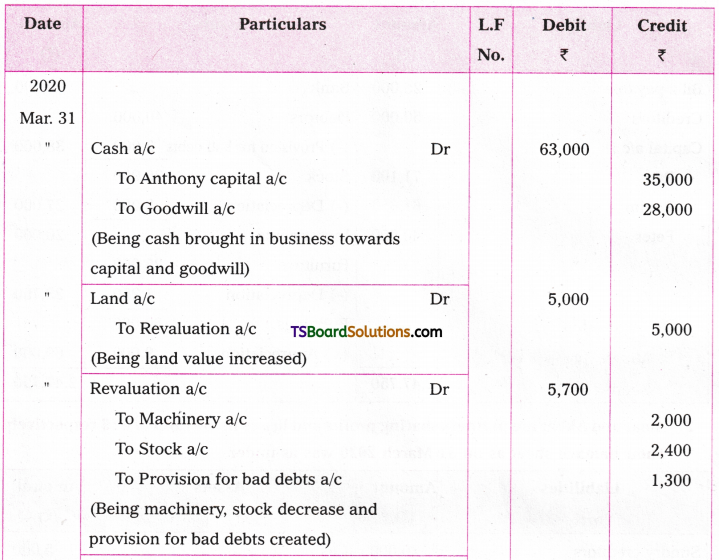

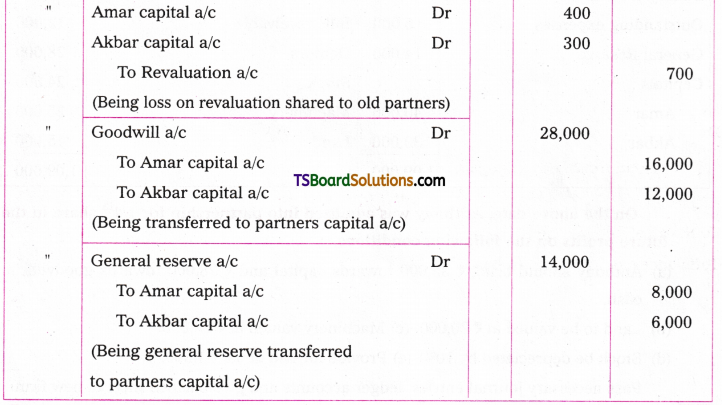

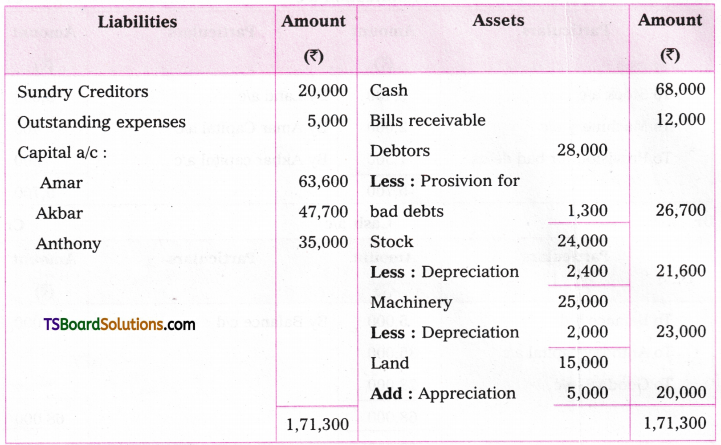

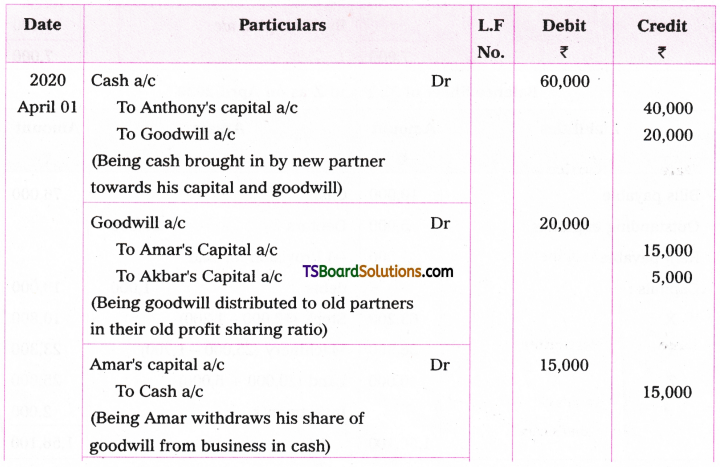

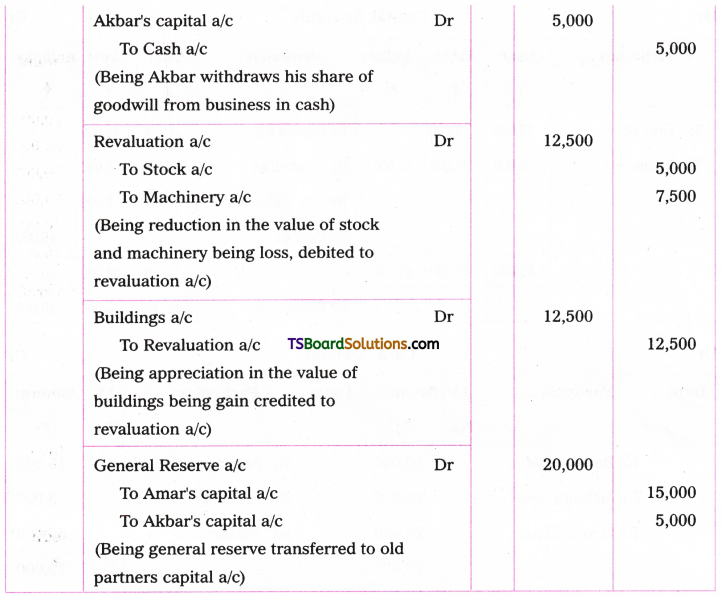

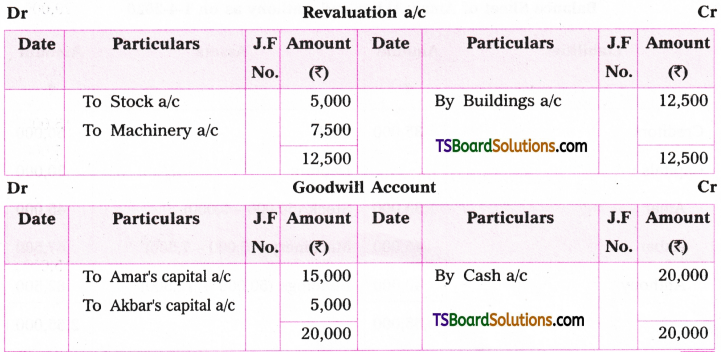

Amar and Akbar are partners sharing profits and losses in the ratio of 4: 3 respectively. Their balance sheet as on 31 March 2020 was as under.

On the above date, Anthony was admitted into partnership for 1/4 share in the future profits on the following conditions:

(a) Anthony should bringRs. 35,000 towards capital andRs. 28,000 towards goodwill in cash.

(b) Land to be valued atRs. 20,000.

(c) Machinery valued atRs. 23,000.

(d) Stock be depreciated by 10%.

(e) Provide for bad debtsRs. 1,300.

Pass necessary journal entries, ledger accounts and give balance sheet of new firm.

Answer:

Journal Entries

Amar, Akbar, Anthony Balance Sheet as on 31.03.2020.

![]()

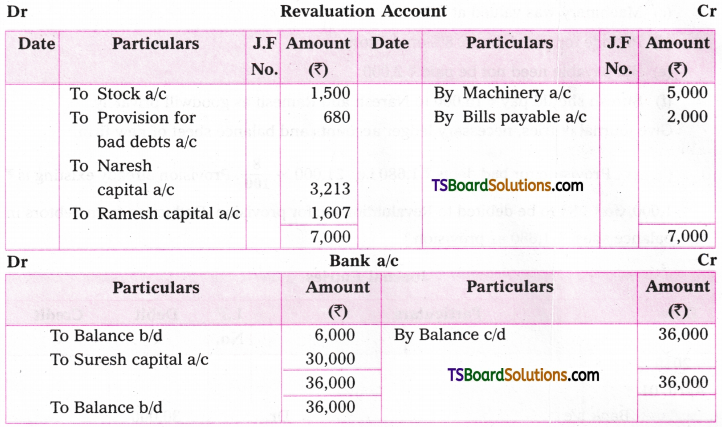

Question 3.

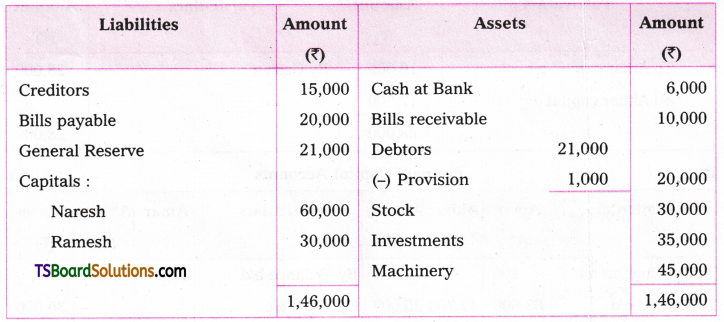

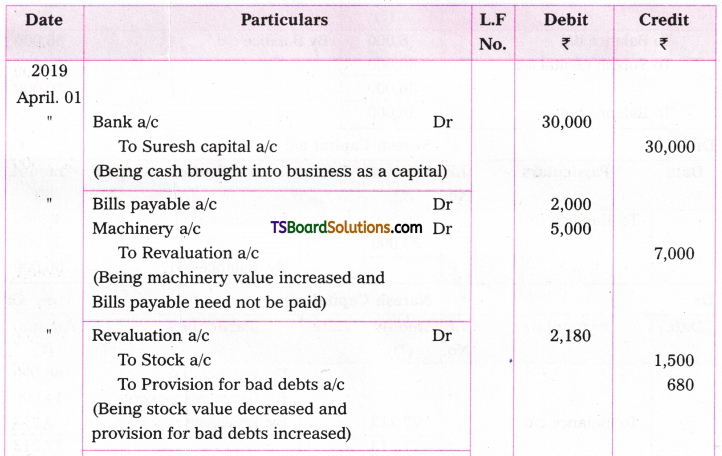

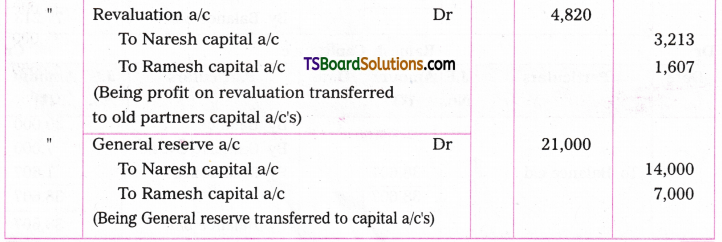

Naresh and Ramesh are partners in a firm sharing profits and losses in the ratio of 2: 1. Their balance sheet as on 31 March 2019 was as under.

On 1st April 2019, Suresh was admitted into partnership for 1/6th share in the profits of the business. The terms of admission are:

(a) Suresh should bring Rs. 30,000 as his capital.

(b) Stock be depreciated by 5%.

(c) Machinery was valued at Rs. 50,000.

(d) Provide for bad debts @ 8% on debtors.

(e) Bill payable need not be paid Rs. 2,000.

(f) Suresh should pay Rs. 15,000 to Naresh and Ramesh as goodwill privately.

Give journal entries, necessary ledger accounts and balance sheet of new firm.

[Hints: Provision for bad debtsRs. 1,680 i.e., 21,000 x 8/100. Provision already existing is Rs. 1,000. So Rs. 680 to be debited to Revaluation a/c for provision. Deduction from debtors in balance sheetRs. 1,680 as provision.]

Answer:

Journal Entries

Balance Sheet as on 1-04-2019

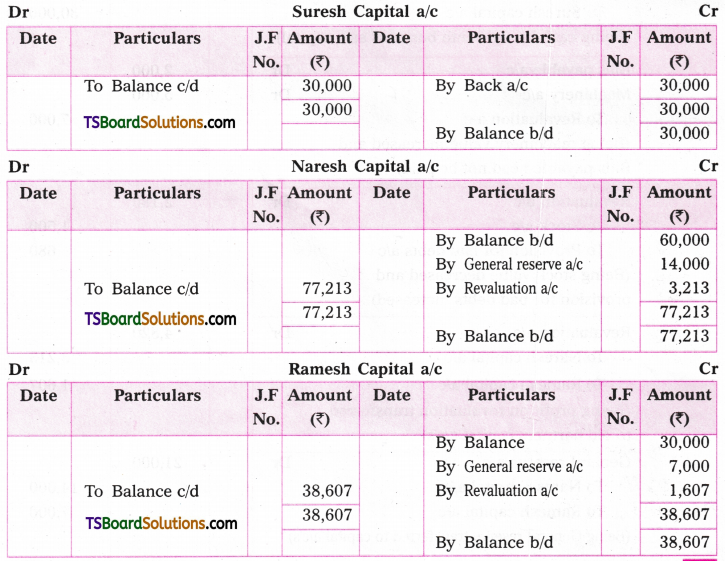

Question 4.

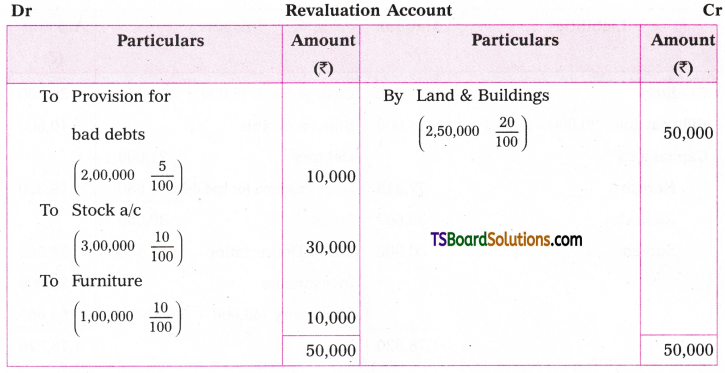

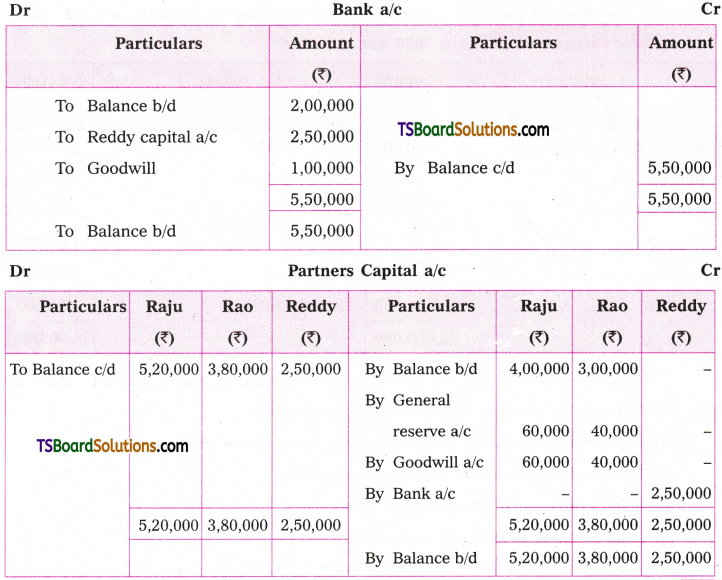

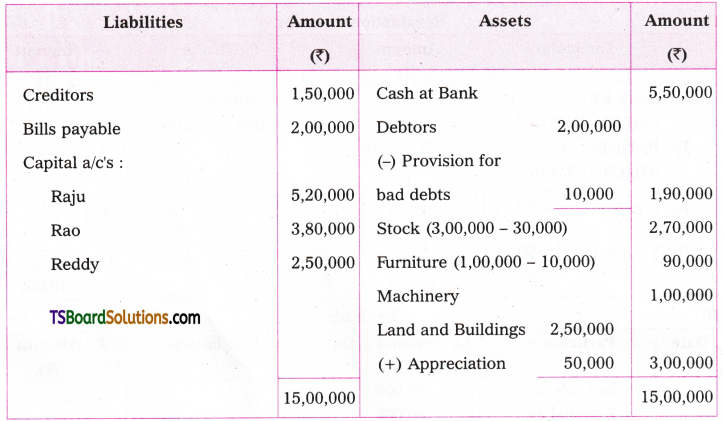

Raju and Rao are partners sharing profits and losses in the ratio of 3: 2. Their balance sheet as on 31 March 2020 was as under.

They decided to admit Mr. Reddy into partnership by giving him l/4th share in future profits of the firm the following conditions:

(a) Reddy is to bring ^ 2,50,000 as capital andRs. 1,00,000 as goodwill in cash.

(b) Stock and Furniture to be depreciated by 10%.

(c) Make a provision of 5% on Sundry debtors.

(d) Land & Buildings are to be appreciated by 20%.

Prepare necessary ledger accounts and show the new balance sheet.

Answer:

Balance Sheet of Raju, Rao & Reddy as on 31-3-2020

Question 5.

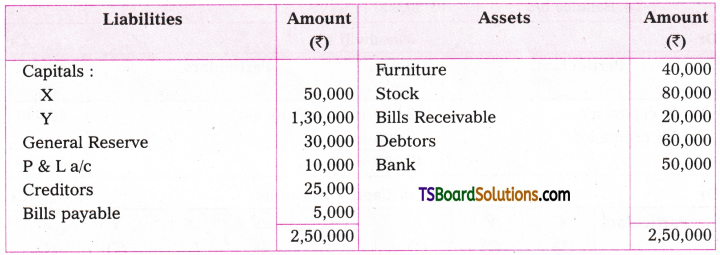

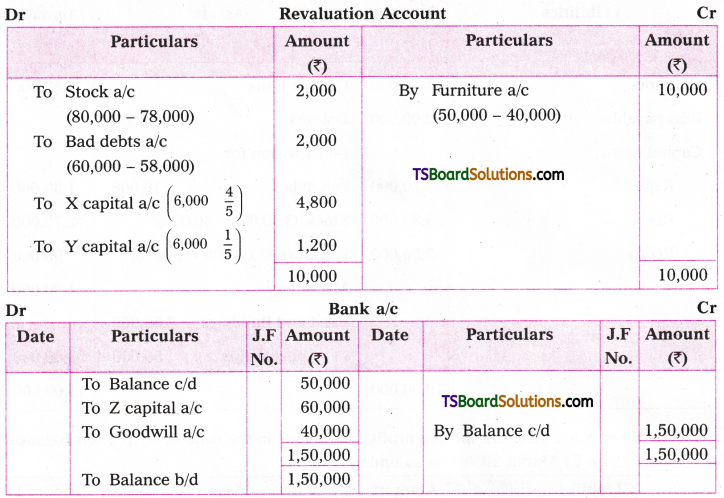

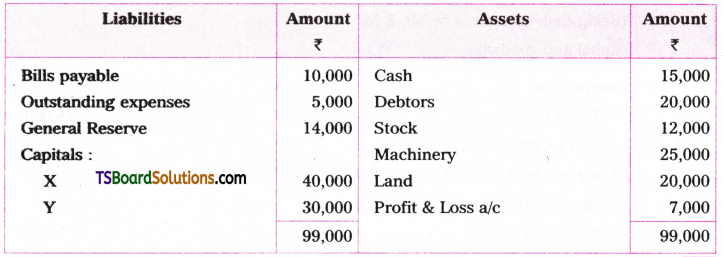

Mr. X and Y are partners sharing profits and losses in the ratio of 4: 1. Their balance sheet as on 31 March 2020 was as under.

They agreed to take Mr. Z into partnership with effect from 1st April 2020 on the following terms:

(a) Mr. Z brings Rs. 40,000 towards goodwill and Rs. 60,000 as capital.

(b) The assets are revalued as under:

Furniture — Rs. 50,000

Stock — Rs. 78,000

Debtors — Rs. 58,000.

(c) The goodwill will be retained in the business.

Prepare necessary ledger accounts and prepare balance sheet of new firm.

Answer:

Balance Sheet of X, Y, Z as on 31-3-2020

Question 6.

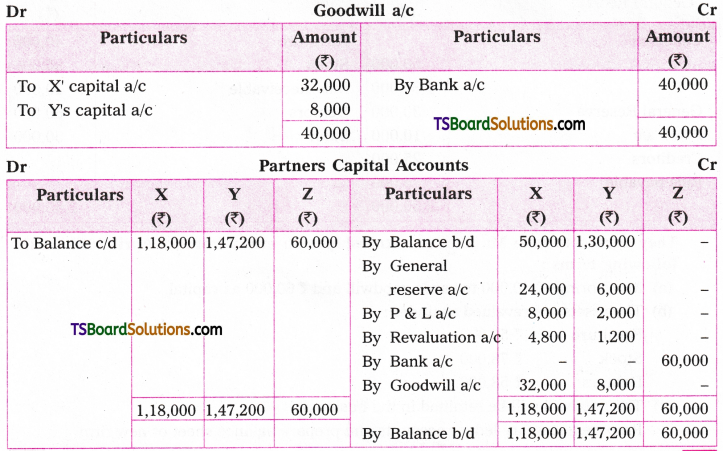

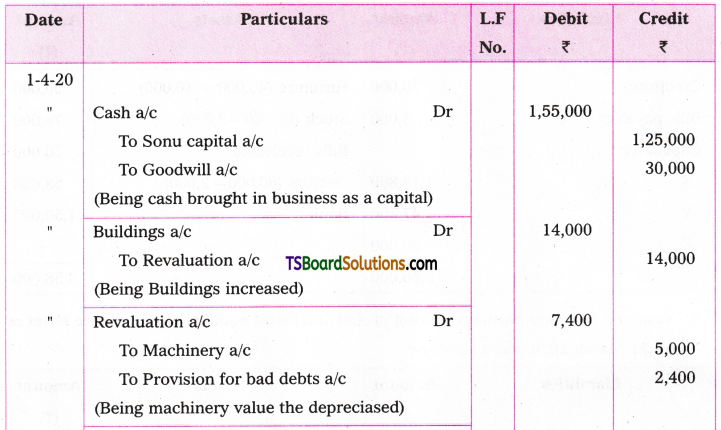

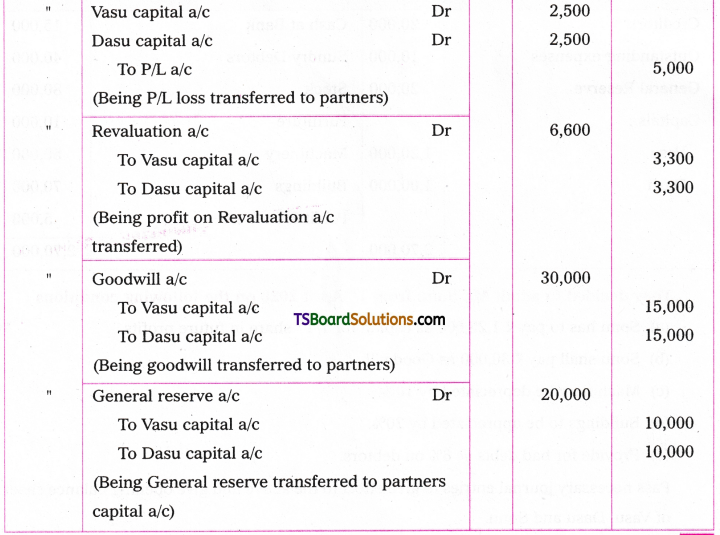

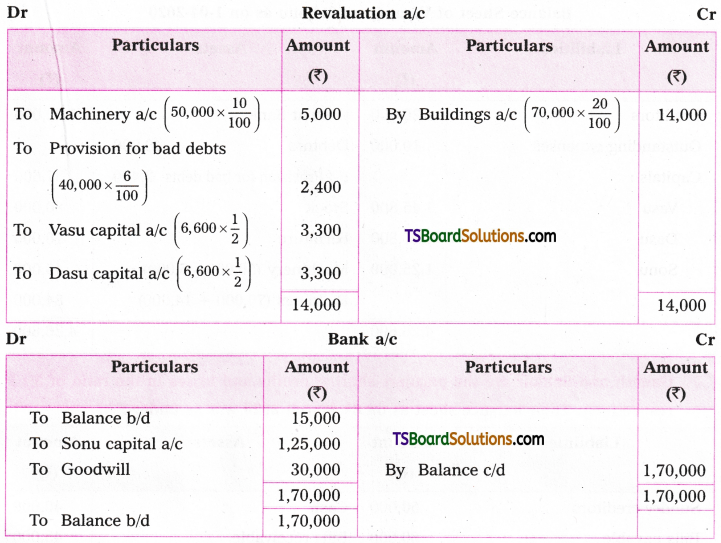

Vasu and Dasu are partners sharing profits and losses equally. Their balance sheet as on 31 March 2020 was as under:

They decided to admit Mr. Sonu from 1st April 2020 on the following conditions:

(a) Sonu has to pay Rs. 1,25,000 as capital for 1/4th share in future profits.

(b) Sonu shall pay Rs. 30,000 as Goodwill.

(c) Machinery be depreciated by 10%.

(d) Buildings to be appreciated by 20%.

(e) Provide for bad debts @ 6% on debtors.

Pass necessary journal entries to give effect to the above and give opening balance sheet of Vasu, Dasu and Sonu.

Answer:

Journal Entries

Balance Sheet of Vasu, Dasu & Sonu as on 1-04-2020

![]()

Question 7.

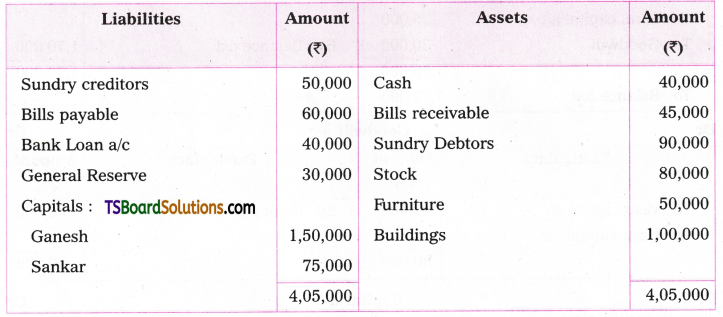

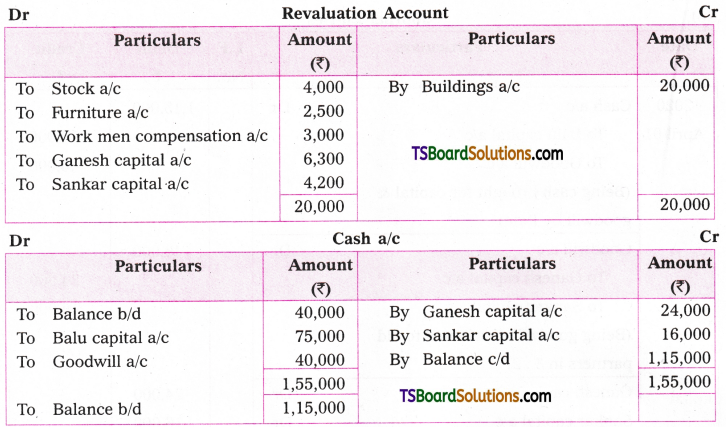

Ganesh and Sankar are the partners sharing profits and losses in the ratio of 3: 2 respectively. Their balance sheet as on 31 March 2020 was as under:

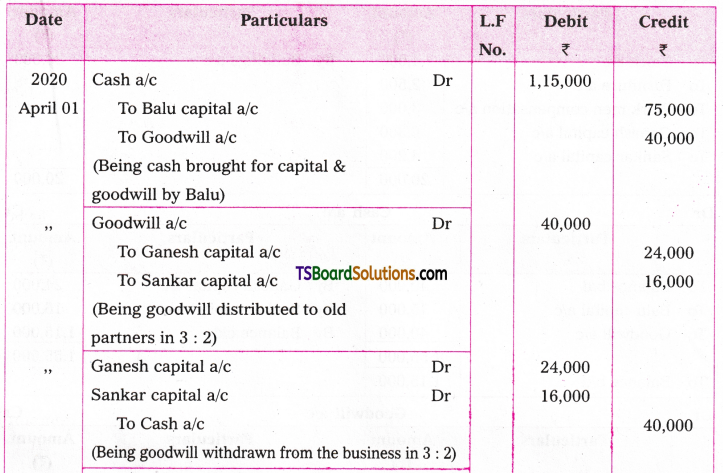

On 1st .April 2020, they decided to admit Mr. Balu, for 1/4 share in the future profits. The conditions of admission are:

(a) Balu should bring Rs. 75,000 as capital and Rs. 40,000 as goodwill.

(b) The amount of goodwill is withdrawn from the business by old partners.

(c) Buildings be appreciated by 20%.

(d) Furniture and stock to be depreciated by 5%.

(e) There is an unrecorded liability in respect of workmen compensation Rs. 3,000.

Give journal entries, necessary ledger accounts and balance sheet of new firm.

Answer:

Journal Entries

Question 8.

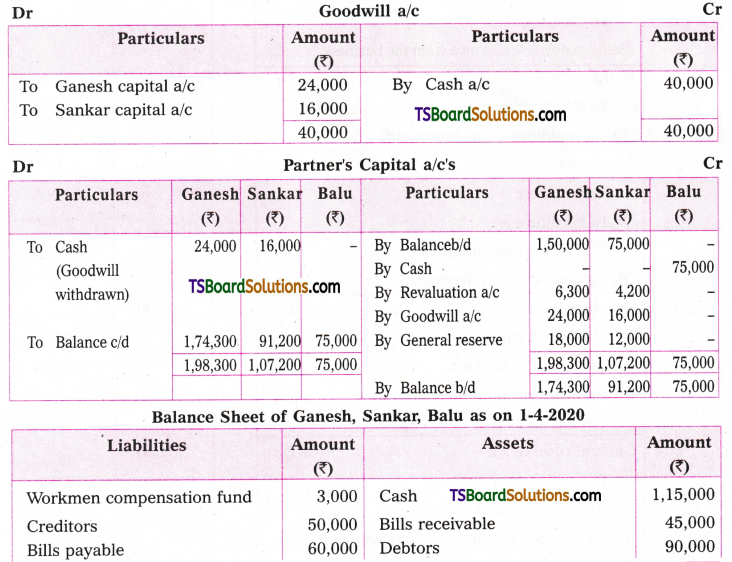

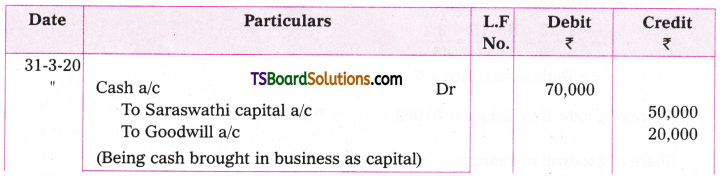

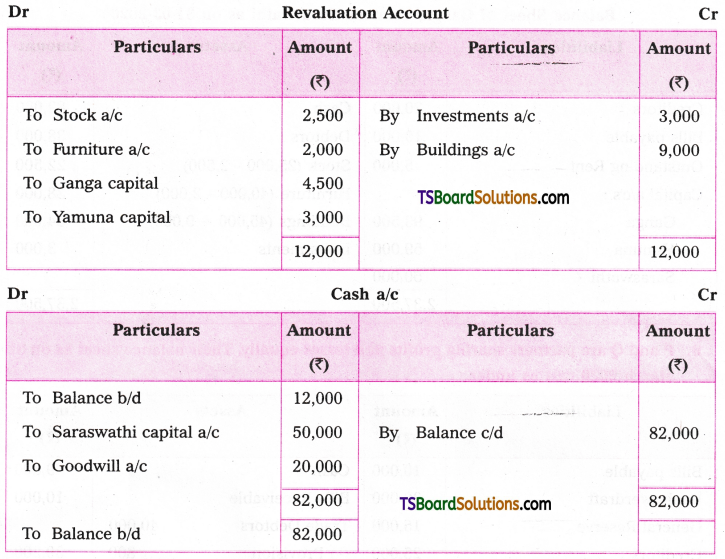

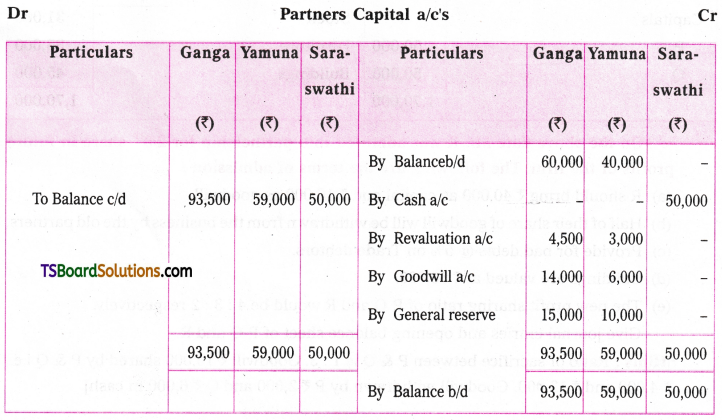

Ganga and Yamuna are partners sharing profits and losses in the ratio of 3: 2 respectively. Their balance sheet as on 31st March 2020 was as follows.

On the above date they decided to admit Saraswathi for 2/9“ share in profits of business. The conditions of admission are:

(a) Saraswathi should bringRs. 50,000 as capital andRs. 20,000 as goodwill.

(b) Land & Buildings be appreciated by 20%.

(c) Furniture be depreciated by 5% and stock by 10%.

(d) There is an unrecorded Investments valued atRs. 3,000 to be brought into books.

(e) Goodwill be retained in the business. New profit sharing of Ganga, Yamuna and Saraswathi is 4: 3: 2.

Give journal entries, Ledger accounts and Balance sheet of Ganga, Yamuna and Saraswathi.

[Hint: Ratio of sacrifice between Ganga and Yamuna is 7: 3 GoodwillRs. 20,000 distributed accordingly i.e.,Rs. 14,000 andRs. 6,000 Unrecorded InvestmentsRs. 3,000 credited to Revaluation a/c and appear on assets side of New Balance Sheet.]

Answer:

Journal Entries

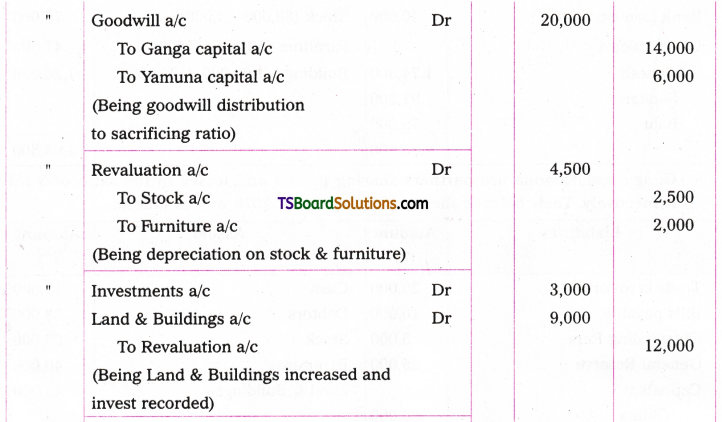

Working Notes:

Old ratio = 3 : 2,

New ratio = 4 : 3 : 2

Sacrificing ratio:

Ganga = Old ratio – New ratio

Balance Sheet of Ganga, Yamuna, Saraswathi as on 31-03-2020

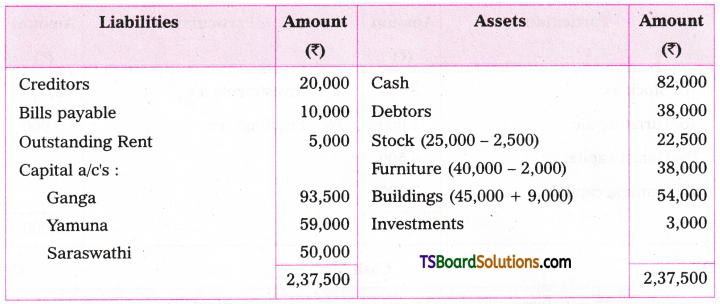

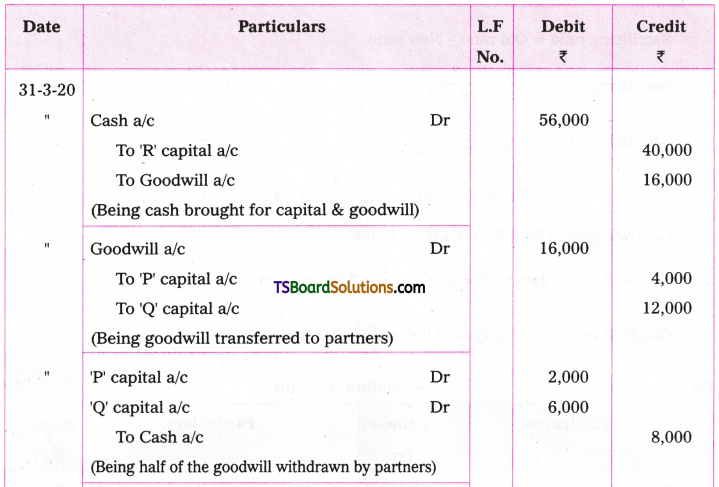

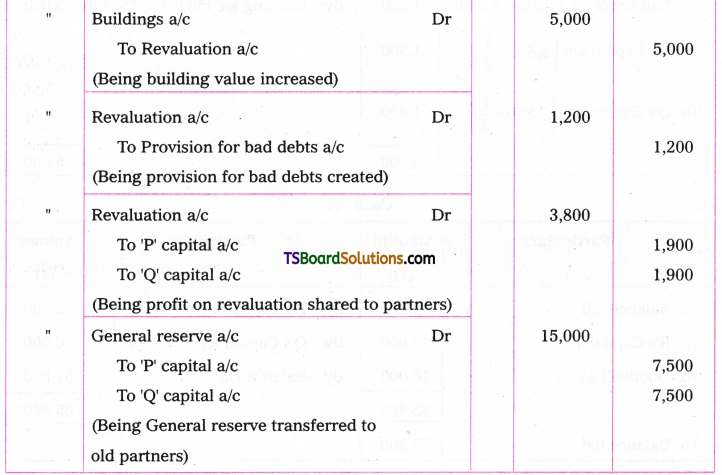

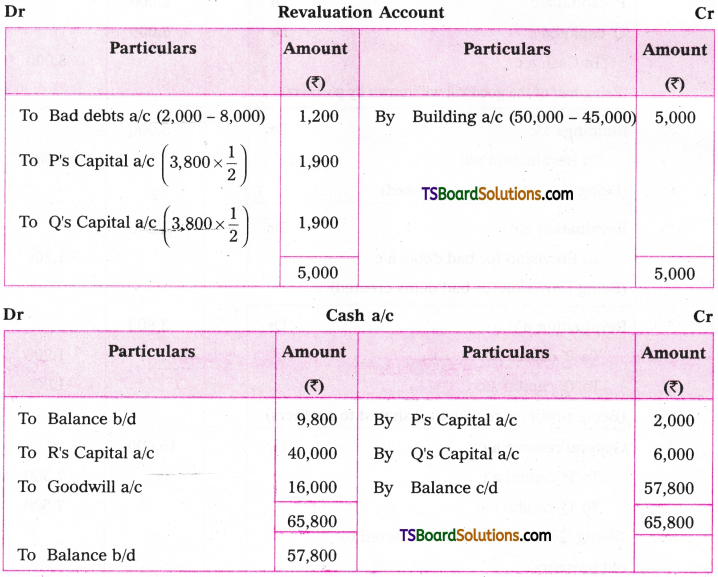

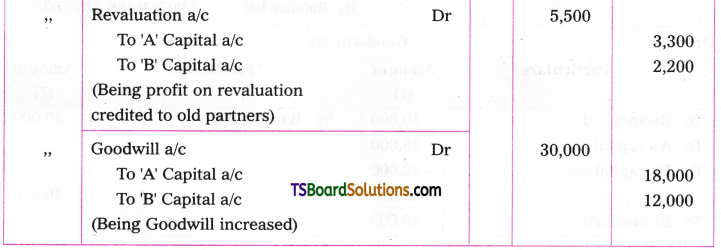

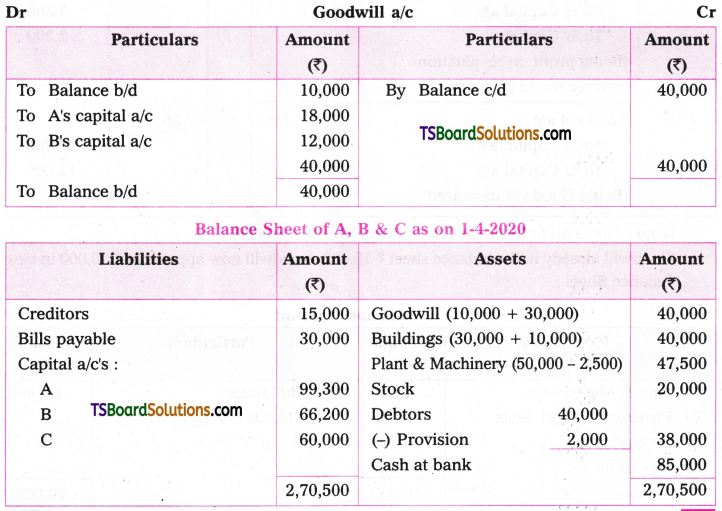

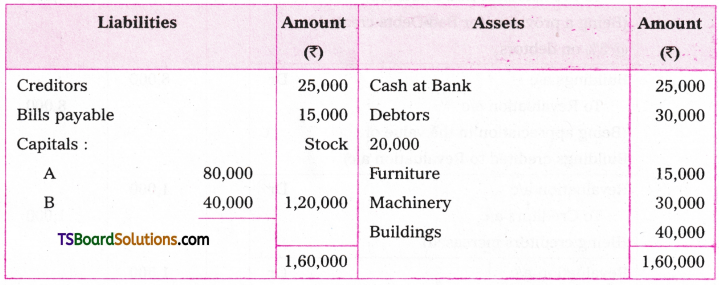

Question 9.

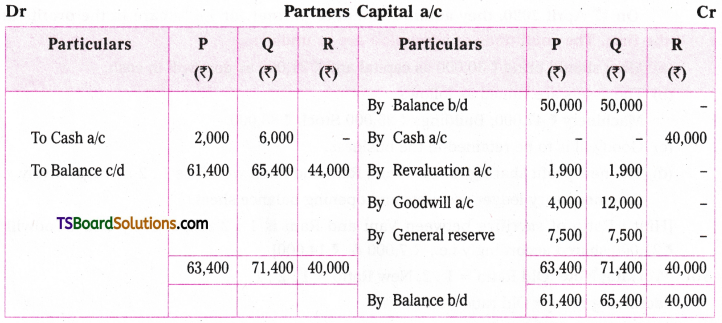

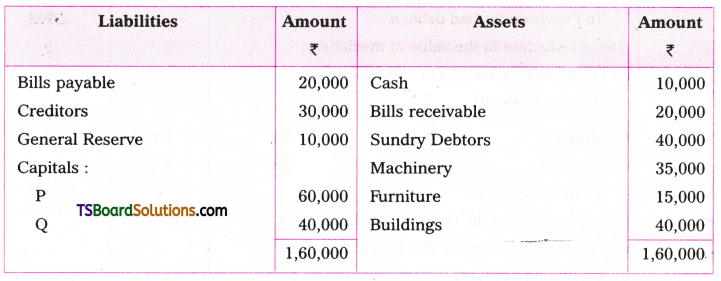

P and Q are partners sharing profits and losses equally. Their balance sheet as on 31 March 2020 was as under.

On the above date Mr. R was admitted into partnership for 2/9th share in future profits of the firm. The following are the terms of admission:

(a) R should bring Rs. 40,000 as capital andRs. 16,000 as goodwill.

(b) Half of their share of goodwill will be withdrawn from the business by the old partners.

(c) Provide for bad debts @ 5% on Trade debtors.

(d) Buildings are valued at Rs. 50,000.

(e) The new profit-sharing ratio of P, Q and R would be 4: 3: 2 respectively.

Give journal entries and opening balance sheet of P, Q and R.

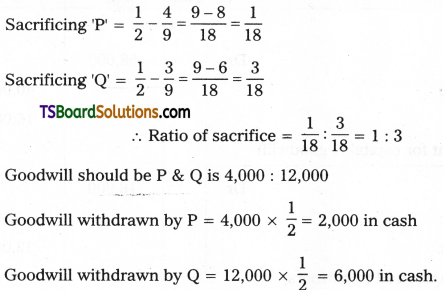

[Hints: Ratio of sacrifice between P & Q is 1: 3. Goodwill Rs. 16,000 shared by P & Q i.e., Rs. 4,000 and Rs. 12,000. Goodwill withdrew by Rs. 2,000 and Q Rs. 6,000 in cash]

Answer:

Journal Entries

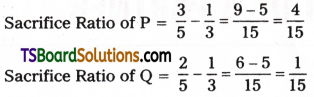

Working Note:

Old ratio = 1 : 1,

New ratio = 4 : 3 : 2

Sacrificing ratio = Old ratio – New ratio

Balance Sheet as on 31-03-2020

![]()

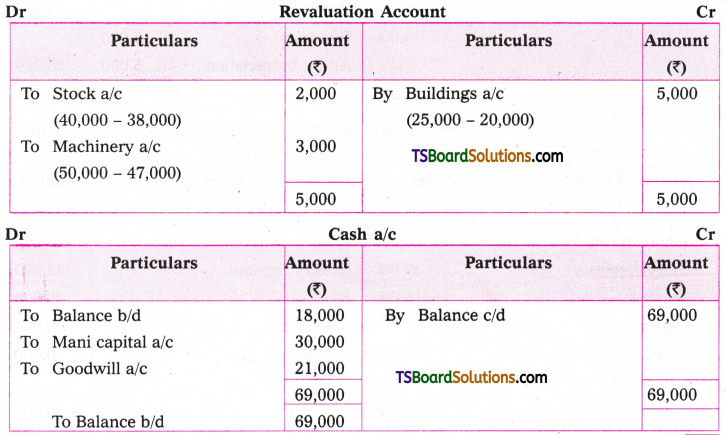

Question 10.

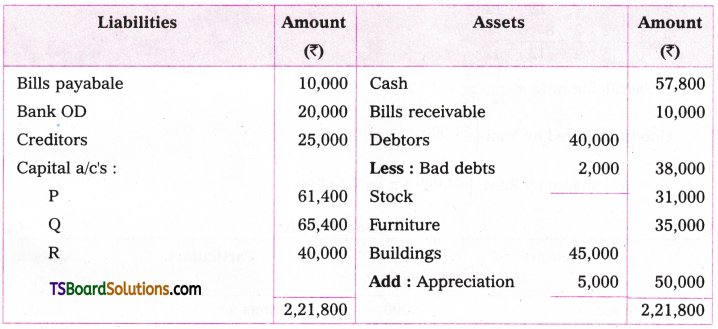

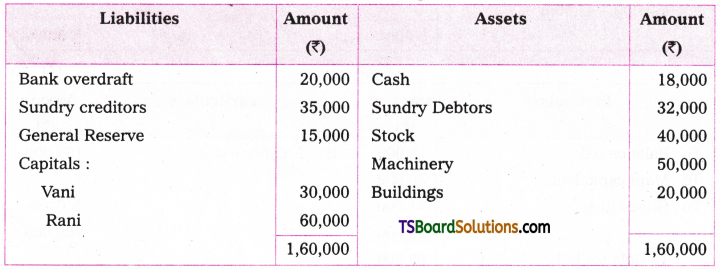

Vani and Rani are partners sharing profits and losses in the ratio of 1: 2 respectively. Their balance sheet as on 31 March 2020 was given below:

On 1st April 2020, they admitted Mani as partner for 1/4th share in the profits of the firm. The conditions of admission are as under:

(a) Mani should bring Rs. 30,000 as capital and Rs. 21,000 as goodwill in cash.

(b) The assets are valued as follows:

Machinery Rs. 47,000; Buildings Rs. 25,000 Stock Rs. 38,000.

(c) Goodwill is to be retained in the business.

(d) The new profit-sharing ratio of Vani, Rani and Mani would be 1: 2: 1 respectively. Give necessary ledger accounts and opening balance sheet.

[Hint: Ratio of sacrifice between Vani and Rani is 1: 2 respectively and Goodwill Rs. 21,000 shared accordingly i.e., Rs. 7,000 & Rs. 14,000]

Answer:

Working Note: Old Ratio =1:2,

New Ratio =1:2:1

Sacrificing ratio = Old ratio – New ratio

Balance Sheet of Vani, Rani & Mani as on 1-4-2020

Balance Sheet of Vani and Rani & Mani as on 1-4-2020

Problems on Creation of Goodwill

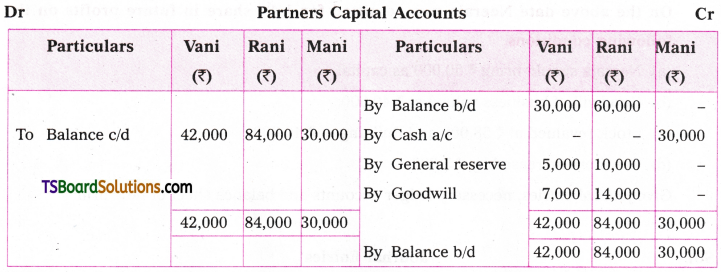

Question 11.

Vani and Sarada are partners sharing profits and losses equally. Their balance sheet was as under as on 31 March 2020.

On the above date Neeraja was admitted for 1/4th share in future profits on the following conditions.

(a) Neeraja should bring Rs. 50,000 as capital.

(b) Goodwill of business valued at Rs. 40,000.

(c) Stock revalued at Rs. 58,000 and Building at Rs. 40,000.

(d) Creditors increased by Rs. 3,000.

Give journal entries, necessary ledger accounts and balance sheet of new firm.

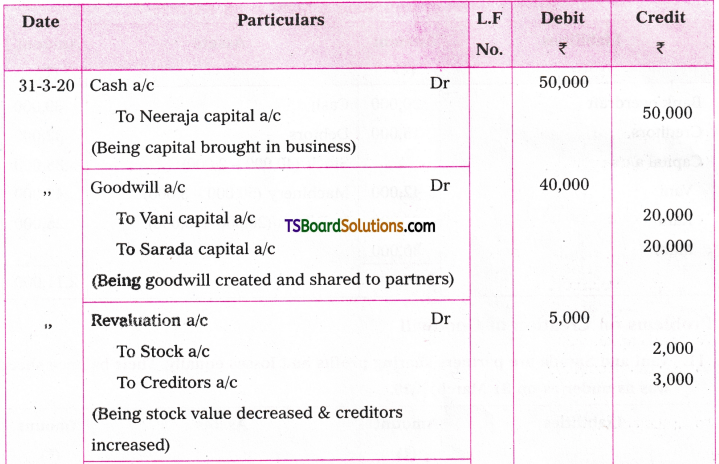

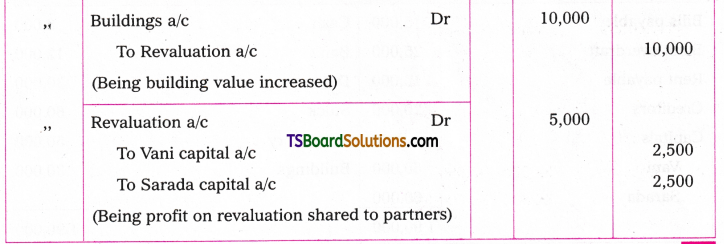

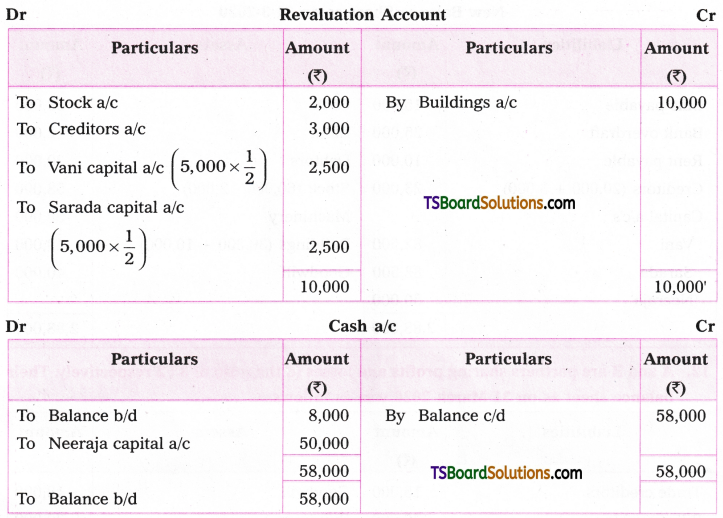

Answer:

Journal Entries

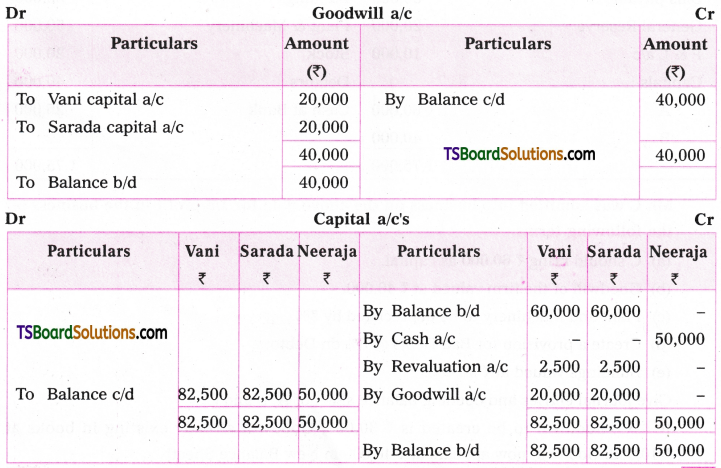

New Balance Sheet as on 31-3-2020

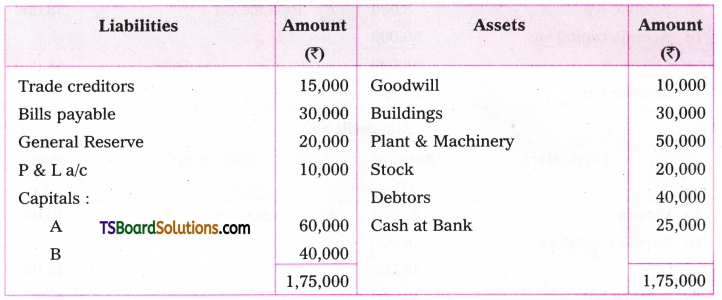

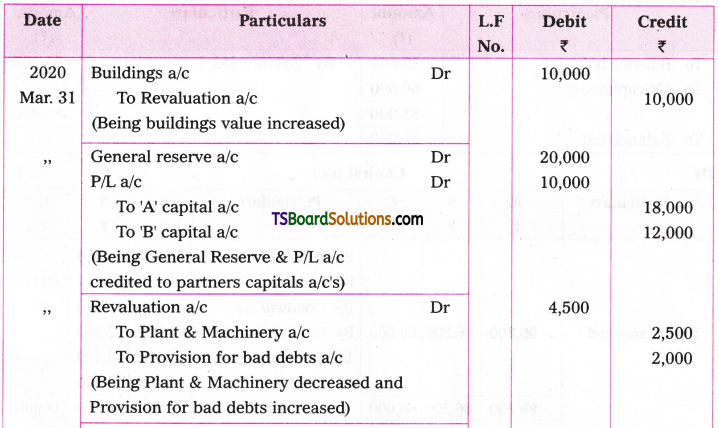

Question 12.

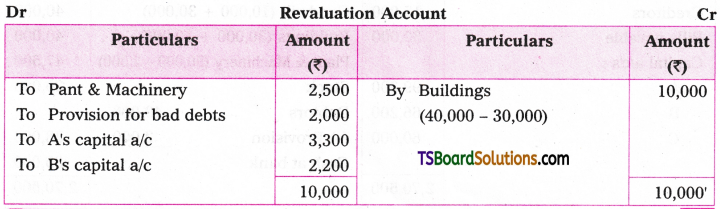

A and B are partners sharing profits and losses in the ratio of 3: 2 respectively. Their balance sheet as on 31 March 2020 was as follows.

Mr. C was admitted into business on the above date for 1/5 profit in the business on the following terms.

(a) C should bring Rs. 60,000 as capital.

(b) Goodwill of the firm valued at Rs. 40,000.

(c) Plant and Machinery to be depreciated by 5%.

(d) Create a provision for Bad Debts @ 5% on Debtors.

(e) Buildings valued at Rs. 40,000.

Give journal entries and opening balance sheet of A, B and C.

[Hint: Goodwill to be created is Rs. 30,000, Goodwill already exists in books at Rs. 10,000. Goodwill now appears at Rs. 40,000 in New Balance Sheet]

Answer:

Journal Entries

Note: Goodwill to be created is 40,000 – 10,000 = 30,000

Goodwill already in the balance sheet 1 10,000. Goodwill now appears atRs. 40,000 in new Balance Sheet.

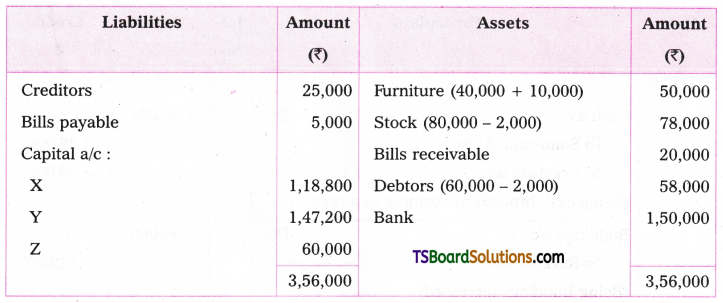

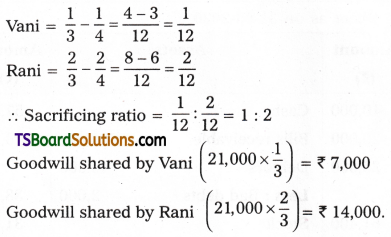

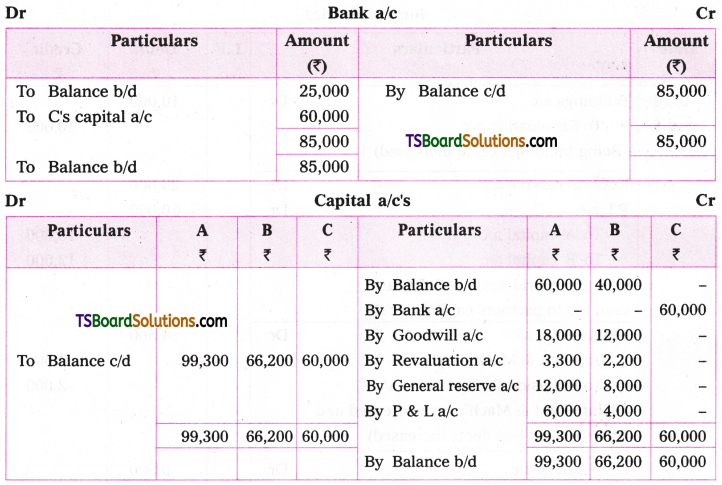

Question 13.

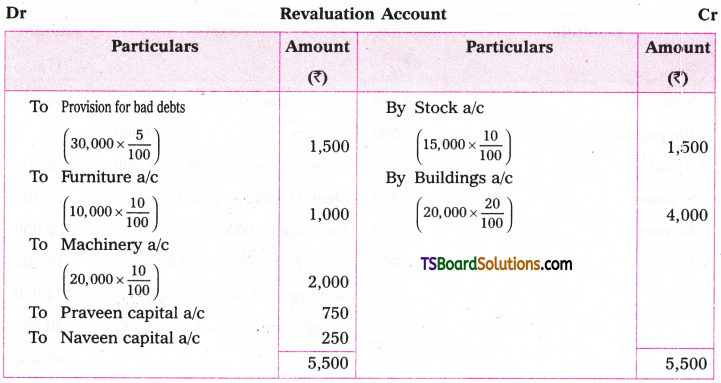

Praveen and Naveen are partners sharing profits and losses in the ratio of 3: 1 respectively. Their balance sheet as on 31st March 2020 was as follows.

They decided to admit Kiran into partnership on the following conditions.

(a) Kiran has to bring Rs. 25,000 as capital for 1/5th share in profits.

(b) Machinery and furniture to be depreciated by 10%.

(c) Buildings to be appreciated by 20% and stock by 10%.

(d) Goodwill of the firm valued at Rs. 20,000.

(e) Create a provision for bad debts at 5% on Trade Debtors.

Show necessary accounts and balance sheet of new firm.

Answer:

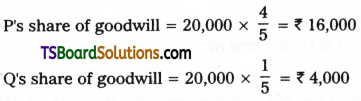

New Balance Sheet as on 1-4-2020

![]()

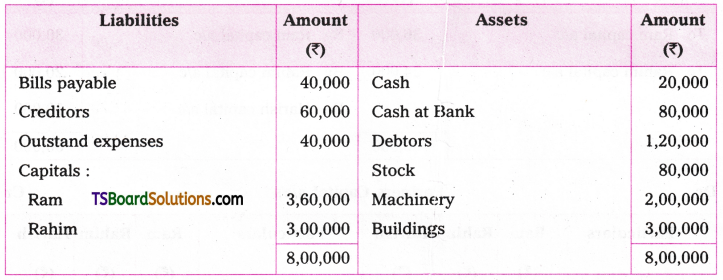

Question 14.

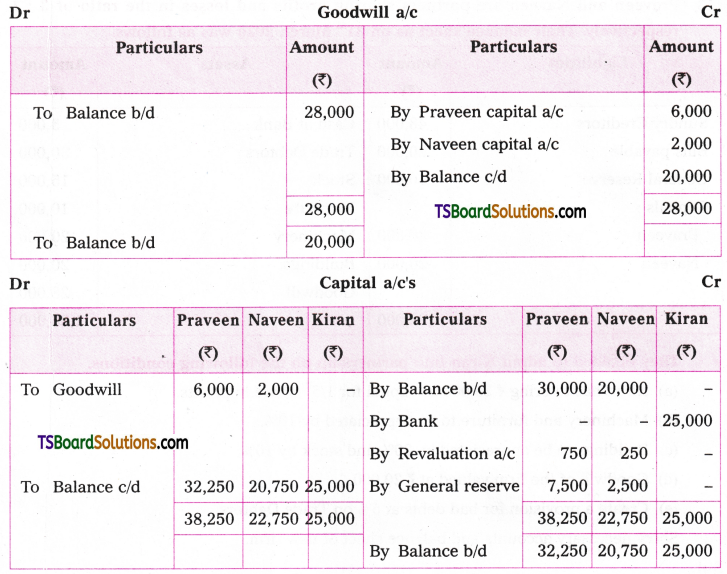

X and Y are partners sharing profits and losses in the ratio of their capitals. Their balance sheet as on 31 March 2019 was as under.

They admitted Z as new partner for 1/3rd share in the profits. The conditions of admission are:

(a) Z should bring t 20,000 as capital.

(b) Stock valued at t 11,000 and Land at Rs. 30,000.

(c) Depreciate furniture by 5%.

(d) Provide for bad debts @ 5% on debtors.

(e) Goodwill of the firm is valued at 2 years purchase of average profit of last 3 years. The profit for last 3 years was Rs. 5,000,1 11,000 and t 8,000. Prepare necessary ledger accounts and balance sheet of X, Y and Z.

Answer:

X, Y profit sharing Ratio = 30,000: 20,000 = 3:2

Working Notes:

Goodwill = Average profit x purchase of 2 years

= 8,000 x 2

= 16,000.

Goodwill created and written off:

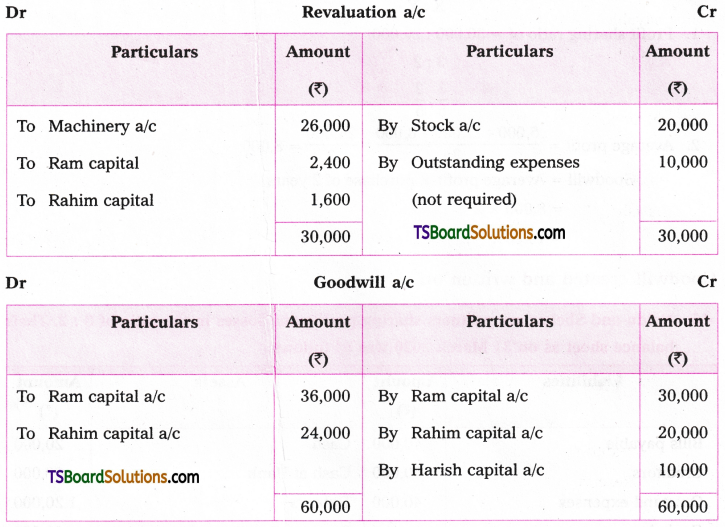

Question 15.

Naidu and Shekar are partners sharing profits and losses in the ratio of 3: 2. Their balance sheet as on 31 March 2020 was as follows.

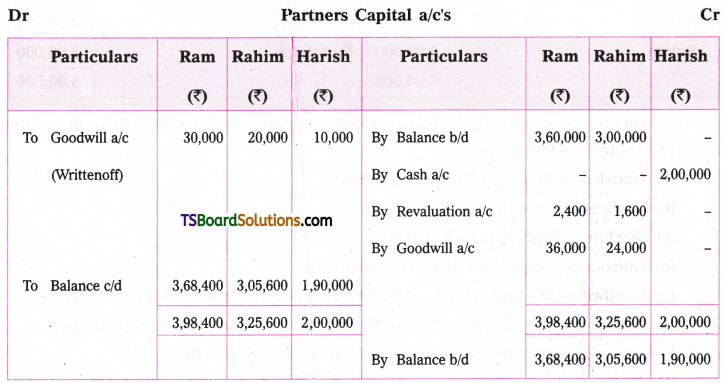

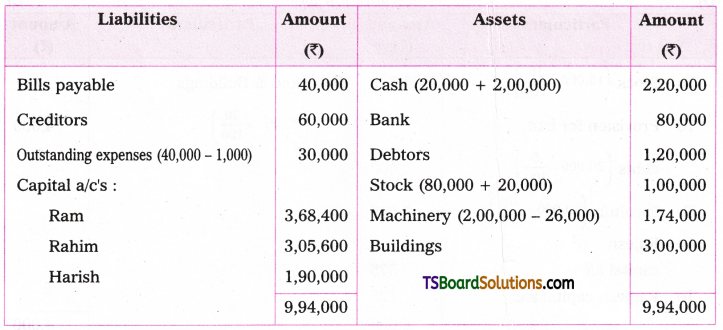

On the above date, Harish was admitted into partnership for 1/6 share in profits. The terms of admission are:

(a) Harish should bring Rs. 2,00,000 as capital.

(b) Stock appreciate by Rs. 20,000.

(c) Machinery depreciate by Rs. 26,000.

(d) Outstanding expenses Rs. 10,000 not required.

(e) Goodwill of the firm valued at Rs. 60,000. This is to be written off immediately.

(f) New profit sharing ratio of Naidu, Shekar and Harish is 3: 2: 1 respectively. Prepare necessary Ledger accounts and Balance sheet of new firm.

[Hint: Goodwill a/c will not appear in New Balance Sheet as it is written off]

Answer:

Balance Sheet of Ram, Rahim, Harish as on 31-03-2020

Problems on Capital Adjustments:

Question 16.

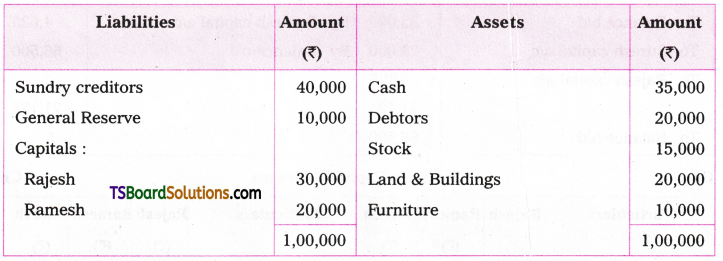

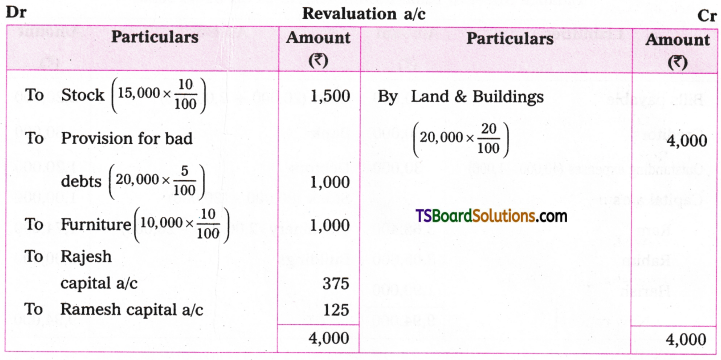

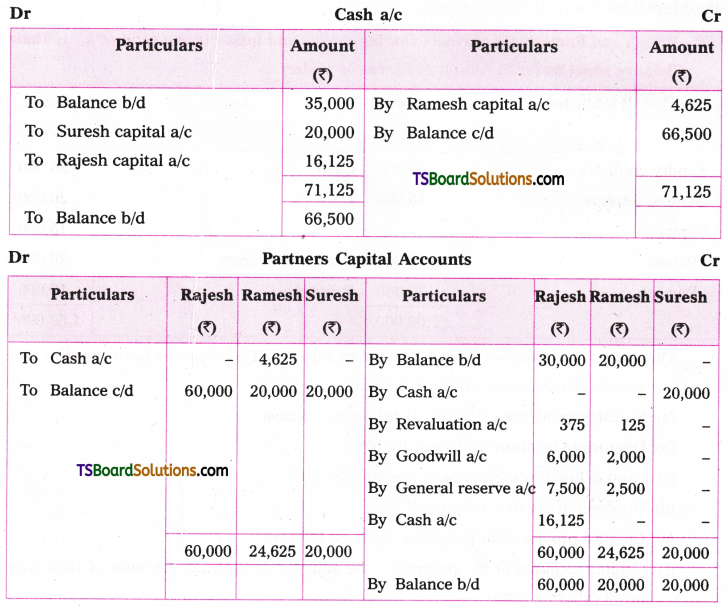

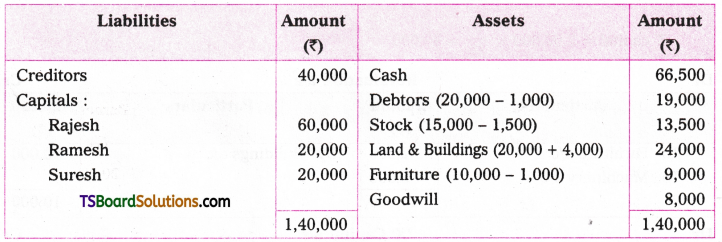

Rajesh and Ramesh are partners sharing profits and losses in the ratio of 3: 1. Their Balance sheet as on 31 March 2020 was as under.

They decided to take Mr. Suresh into partnership for 1/5th share in future profits. The conditions of admission are as follows.

(a) Suresh should bring Rs. 20,000 as his capital in cash.

(b) Depreciate furniture and stock by 10%.

(c) Land & Buildings are to be appreciated by 20%.

(d) Goodwill of the firm valued at Rs. 8,000.

(e) Create a provision for bad debts @ 5% on Debtors.

(f) Capital accounts of the partners to be adjusted in cash on the basis of their new profits sharing ratio.

Answer:

Working Notes:

Calculation of New profit sharing ratio.

Old ratio = 3:1

Question 17.

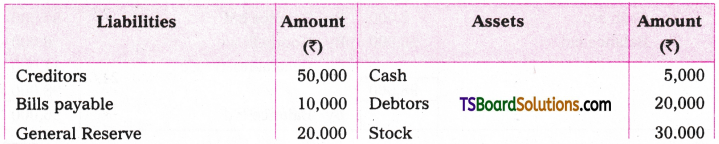

X and Y are partners sharing profits and losses in the ratio of 3: 2 respectively. Their balance sheet as on 31 March 2015 was as under.

On the above date Mr. Z is admitted into the partnership for 1/5th share in profits. The conditions of admission are as follows.

(a) Z should bring Rs. 40,000 as capital and Rs. 10,000 for goodwill in cash.

(b) Appreciate buildings by Rs. 10,000.

(c) Depreciate machinery by Rs. 8,000 and furniture by Rs. 2,000.

(d) New profit sharing ratio of X, Y and Z is 12: 8: 5 respectively.

(e) Capital accounts of partners to be adjusted in cash on the basis of new profit-sharing ratio. Give necessary ledger accounts and balance sheet of X, Y, Z.

Answer:

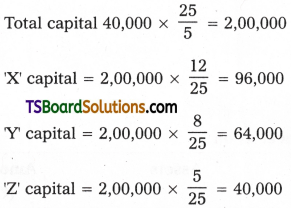

Working Notes:

New ratio of X: Y: Z = 12 : 8 : 5

Balance Sheet of X, Y, Z as on 31-3-2020

![]()

Textual Examples

Question 1.

A and B are partners sharing profits and losses in the ratio of 3: 2. They admitted Mr. C. into partnership firm for l/5th share in future profits. Calculate new profit-sharing ratio of A, B and C.

Answer:

Total profit of the business is 1 out of this 1/5 share given to Mr. C. Remaining profit is 4/5 (i.e., 1-1/5). The remaining profit of 4/5th will be given to Mr. A and B in their old profit sharing ratio, i.e., 3: 2 respectively.

New profit sharing ratio of existing partners = Remaining Profit Share x Old Profit Sharing Ratio.

So, new profit sharing ratio of A, B and C is 12: 8: 5 respectively, (or) 12/25 : 8/25 : 5/25

(Note: It is to be understood that the 1/5 share given to new partner C is contributed/ sacrificed by A & B in their old profit sharing ratio, i.e., 3: 2. Even we calculate the ratio of sacrifice by A and B it will be same i.e., 3: 2 respectively.

The ratio of sacrifice = Old profit sharing ratio – New profit sharing ratio).

Question 2.

X and Y are partners sharing profits and losses in the ratio of 2 : 3. They agreed to adimit Z into partnership for l/5,h share in profits. Z’s entire share is given by Mr. Y alone. Calculate new profit sharing ratio.

Answer:

X and Ys old profit sharing ratio is 2: 3

Z gets 1/5th share in profit from Mr. Y

X share of profit remain unchanged.

Calculation of new profit sharing ratio:

New profit sharing ratio of Mr. Y = Old profit sharing ratio – Profit given to Z

New profit sharing ratio of Mr. X = 2/5

New profit sharing ratio of Mr. Z (given) = 1/5

Thus the new profit sharing ratio of X, Y and Z are 2 : 2 : 1 i.e., 2/5, 2/5, 1/5 respectively.

Question 3.

A and B are partners sharing profits and losses in the ratio of 3: 2. Mr. C is admitted into partnership business for 1/5th share, Mr. C purchases his share as to 2/25 th from A and 3/25 from B. Calculate new profit sharing ratio of A, B and C.

Answer:

New profit sharing ratio = Old profit sharing ratio – Share of profit given to new partner.

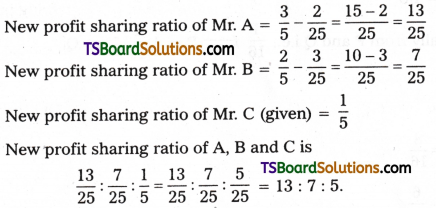

Question 4.

Ram and Robert are partners sharing profits and losses in the ratio of 7: 3. Rahim admitted as new partner. Ram and Robert decided to surrender in favour of Rahim 1/ 7 and 1/3 of their share respectively.

Calculate New Profit sharing Ratio of the partners.

Answer:

Old profit sharing ratio of Ram and Robert = 7 : 3 (or) 7/10 and 3/10 respectively.

Ram gives/surrenders 1/7th in his share of profit.

Robert surrenders 1/3rd of his share of profit.

Sacrificing ratio to Ram and Robert are

New profit sharing ratio or Ram, Robert and Rahim is 6/10 : 2/10 : 2/10 or 6: 2: 2 (or) 3:1:1.

Question 5.

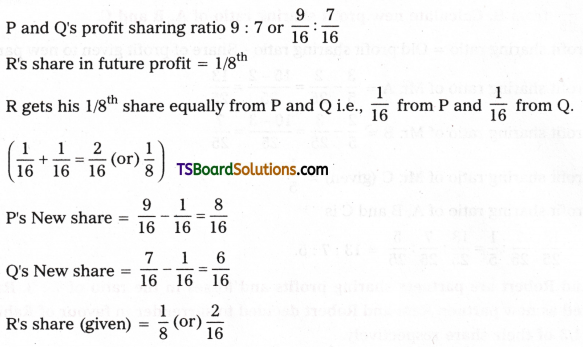

P and Q are partners sharing profits and losses in the ratio of 9: 7. They agreed to admit R into partnership who gets 1/8th share equally from P and Q. Calculate new profit sharing ratio of P, Q and R.

Answer:

Now, the new profit sharing ratio of P, Q and R is 8: 6: 2 (or) 8/16: 6/16: 2/16 respectively.

Question 6.

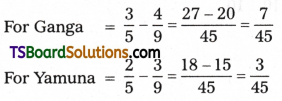

Ganga and Yamuna are partners sharing profits and losses in the ratio of 3: 2. They admitted Saraswathi as new partner. Hereafter, they share profits and losses in the ratio of 4: 3: 2 by Ganga, Yamuna and Saraswathi respectively. Calculate the ratio of sacrifice.

Answer:

The old profit sharing ratio of Ganga and Yamuna is

3:2 (or) 3/5 : 2/5

The new profit sharing ratio of Ganga, Yamuna and Saraswathi is 4: 3: 2 respectively.

Ratio of sacrifice = Old ratio – New ratio

The ratio of sacrifice between Ganga and Yamuna is 7: 3 respectively. It means loss to old partners Ganga and Yamuna and is a gain new partner Saraswathi i.e.,

[Note: Ratio of sacrifice is to be calculated, when both old profit sharing ratio and new profit sharing ratio of all the partners, including new partner, are given in the problem. Otherwise, no need to calculate the ratio of sacrifice. Because, it is assumed that old partners sacrifice in their respective old profit sharing ratio.]

Question 7.

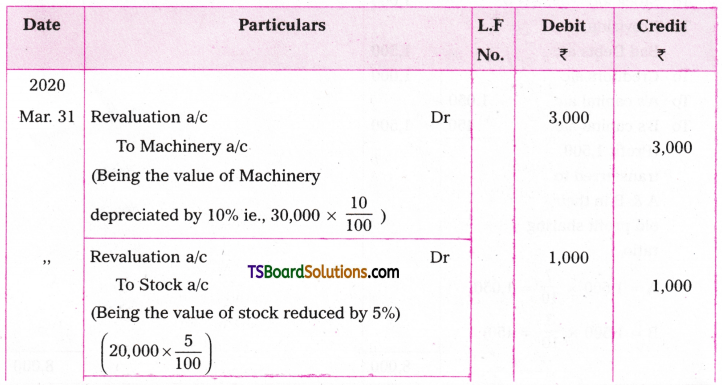

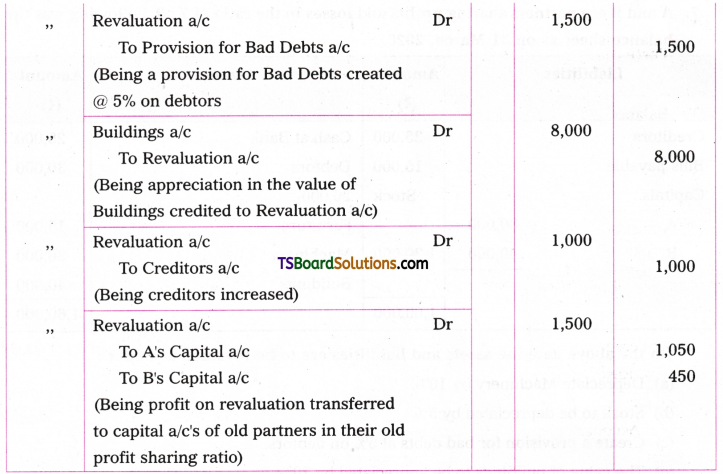

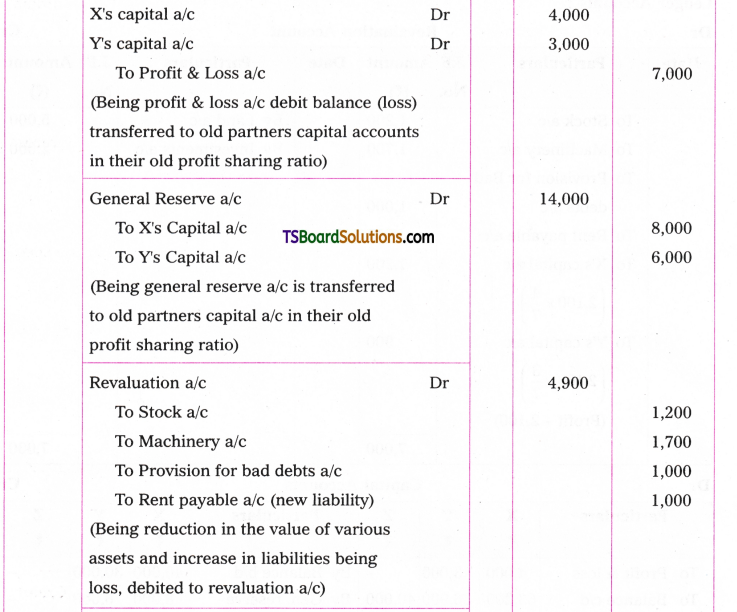

A and B are partners sharing profits and losses in the ratio of 7: 3. Following was the balance sheet as on 31 March, 2020.

On the above date the assets and liabilities are to be revalued as under:

(a) Depreciate Machinery by 10%.

(b) Stock to be depreciated by 5%.

(c) Create a provision for bad debts at 5% on debtors.

(d) The value of buildings to be appreciated by 20%.

(e) Creditors are to be increased byRs. 1,000.

Give necessary journal entries to record the changes in the value of assets & liabilities and Prepare the Revaluation account and Partners capital accounts.

Answer:

Journal Entries in the Books of A and B

Question 8.

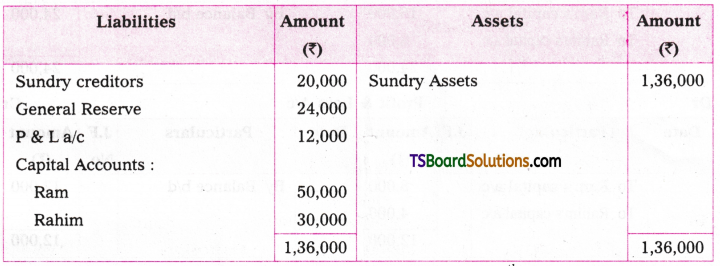

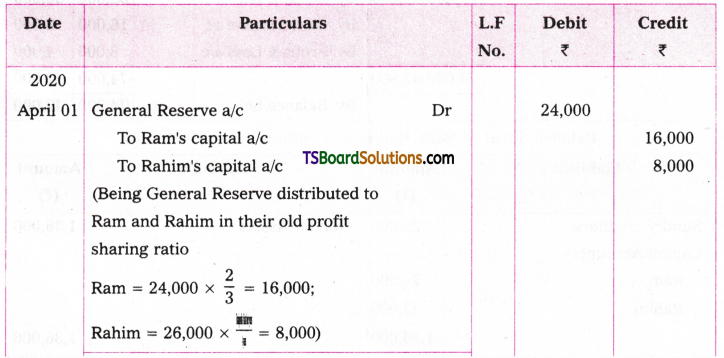

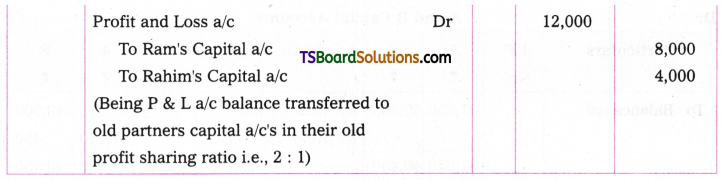

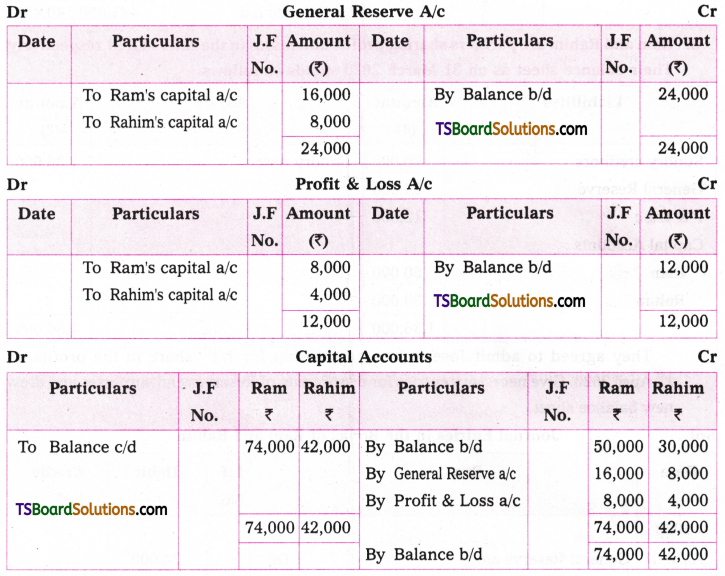

Ram and Rahim are partners sharing profits and losses in the ratio of 2: 1 respectively. Their balance sheet as on 31 March 2020 stands as follows.

They agreed to admit Joseph into partnership for 1/4th share in the profits on 1st April 2020. Give necessary entries for distribution of Reserves and surpluses and draw new balance sheet.

Answer:

Journal Entries in the Books of Ram and Rahim

Balance Sheet of Ram, Rahim and Joseph as on 01-04-2020

Question 9.

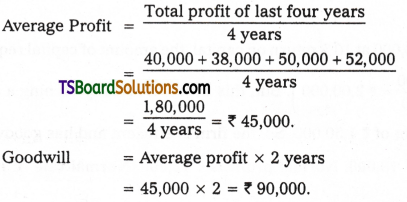

The Net profit of a firm for last four years was Rs. 40,000, Rs. 38,000, Rs. 50,000 and Rs. 52,000 respectively. The goodwill is to be taken as 2 years purchase of average profits of last four years. Calculate the value of Goodwill.

Answer:

Goodwill = Average profit x 2 years = 45,000 x 2 =Rs. 90,000.

Question 10.

The normal of rate of return on the capital employed (Investment) in the industry is 20%. The investment/or capital employed in the firm isRs. 2,00,000. Actual average profit of the firm isRs. 60,000. Goodwill of the firm is valued at 4 years purchase of super profit. Calculate the value of goodwill.

Answer:

Capital employed = Rs. 2,00,000

Rate of return/profit on capital employed = 20%

Actual average profit = 7 60,000

Normal profit/retum = Capital employed x Return on capital employed.

Normal profit/return =Rs. 2,00,000 x 20/100 = Rs. 40,000

Super profit = Actual average profit – Normal profit on capital employed.

Super profit =Rs. 60,000 -Rs. 40,000

Super profit =Rs. 20,000

Goodwill = Super profit x 4 years purchase of super profit.

Goodwill = Rs. 20,000 x 4 years =Rs. 80,000.

Question 11.

Average profits of a firm areRs. 20,000, the normal rate of return expected on capital from similar business is 10%. The actual capital employed/or net tangible assets of the business isRs. 1,50,000. Calculate the value of goodwill as per capitalisation of average profit method.

Answer:

Actual capital employed/Net assets (given) = Rs. 1,50,000

Goodwill = Capitalised value of business – Actual capital employed / or Net tangible assets.

= Rs. 2,00,000 – Rs. 1,50,000

Goodwill = Rs. 50,000.

Notes: To earn a profit of Rs. 20,000 at 10% return on capital, the amount of capital required is Rs. 2,00,000 i.e., 20,000 x 100/10 = Rs. 2,00,000. But, this firm is actually earning a profit of Rs. 20,000 with an investment of Rs. 1,50,000. So, the firm is efficient and has goodwill.

Question 12.

Average profit of a firm is Rs. 18,000. Normal profit is Rs. 12,000. Normal rate of return is 12%. Calculate Goodwill.

Answer:

Super profit = Average profit – Normal profit

= Rs. 18,000 – Rs. 12,000 = Rs. 6,000

Goodwill = Rs. 6,000 x 100/2 = Rs. 50,000.

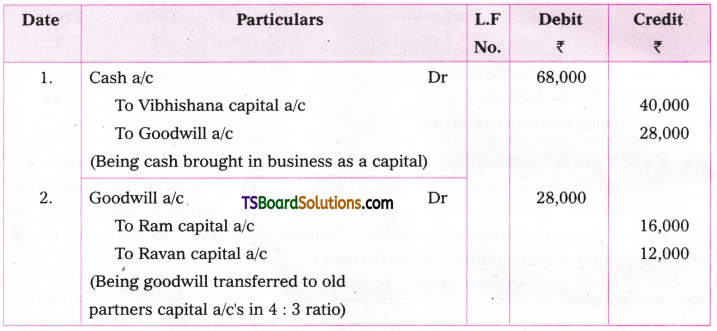

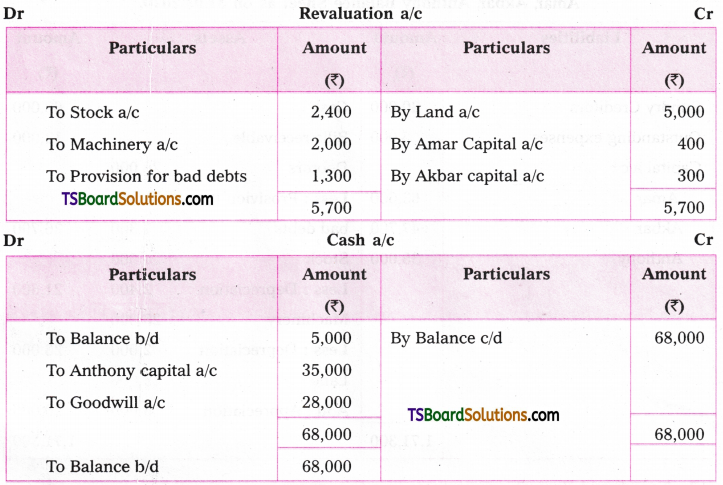

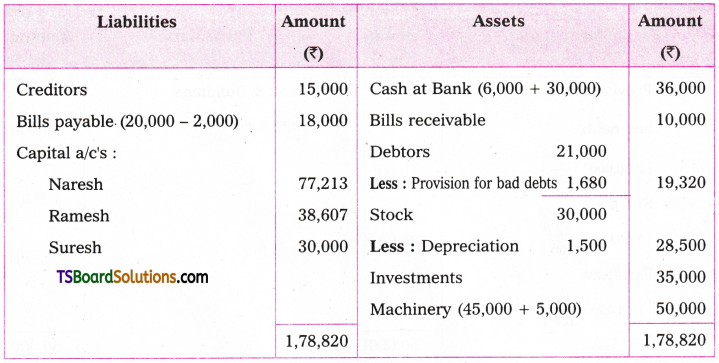

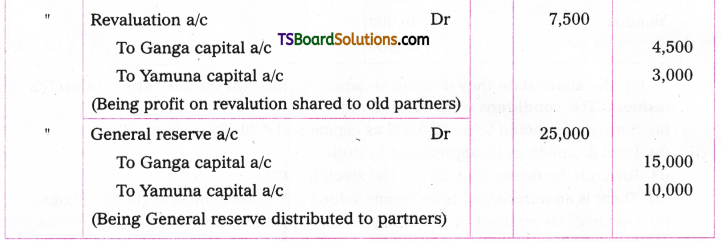

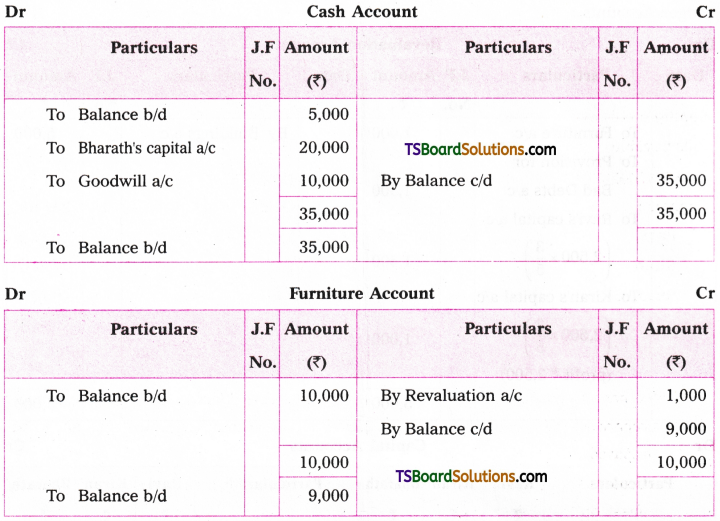

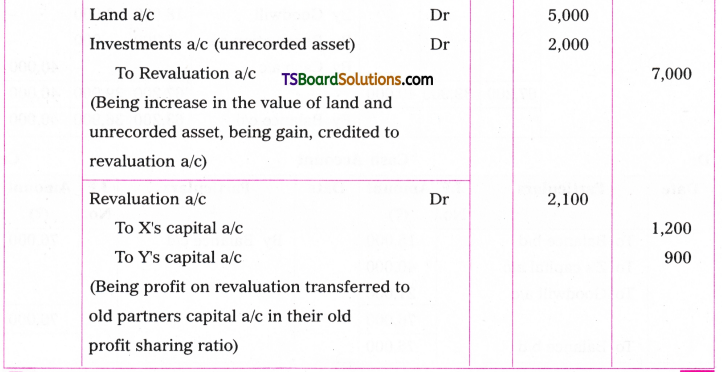

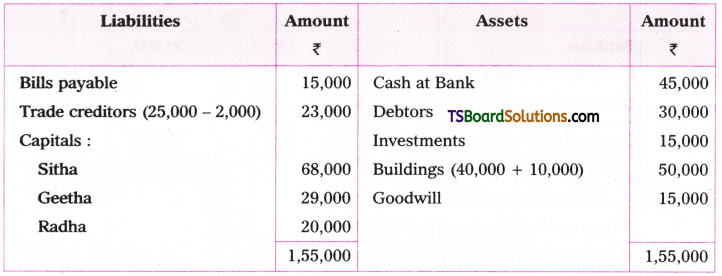

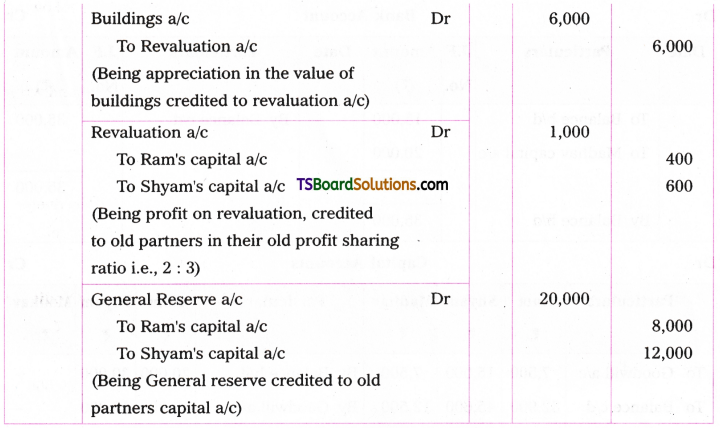

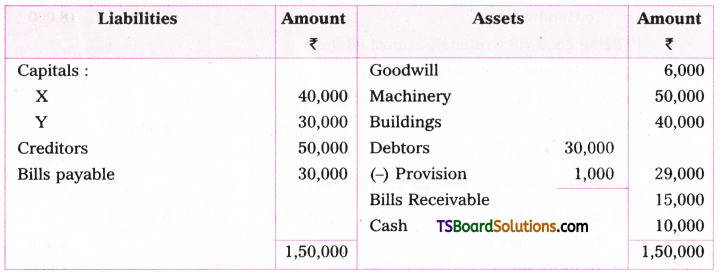

Question 13.

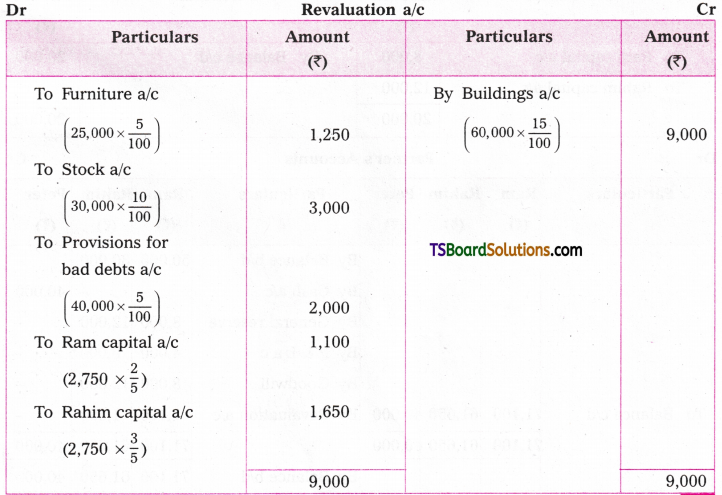

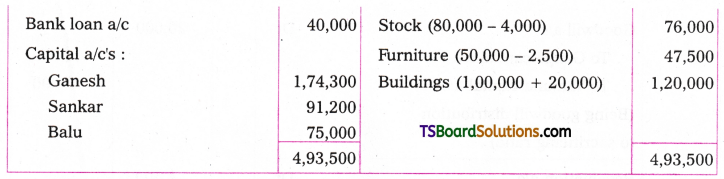

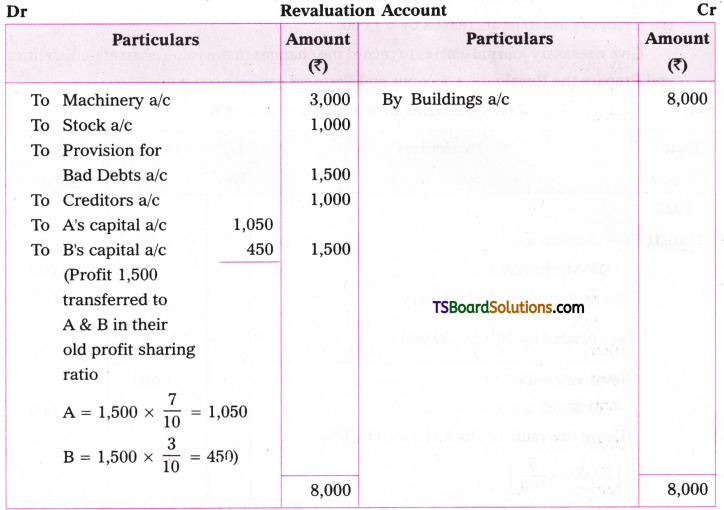

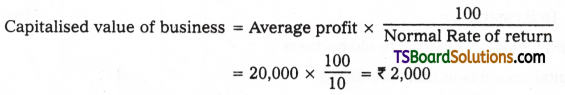

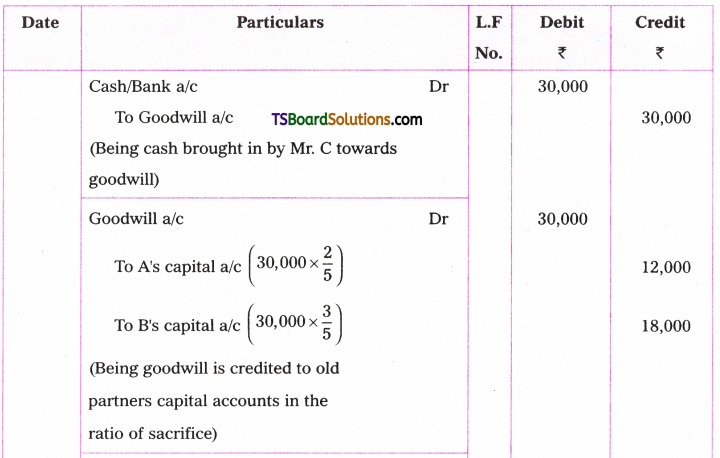

A and B are partners sharing profits and losses in the ratio of 2: 3 respectively. They admitted Mangal as new partner for 1/5th share in profits. He brings in 7 30,000 towards goodwill in cash. The share of profit of Ramu and Somu remains same as earlier. Give Journal Entries.

Answer:

Journal Entries

![]()

Question 14.

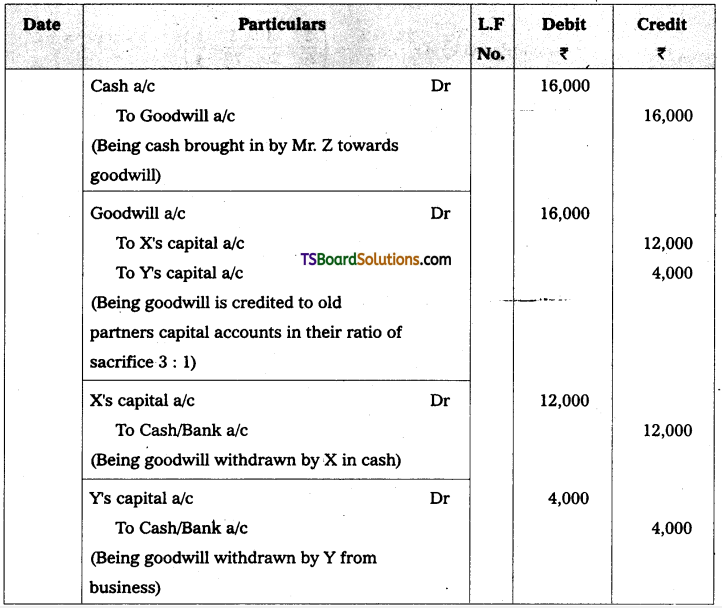

X and Y are partners sharing profits in the ratio of 3: 1 respectively. They decided to admit Mr. Z as new partner for 1/4 share in profits given by X and Y in their old profit sharing ratio. Mr. Z brings inRs. 16,000 towards goodwill. X and Y withdraw their entire share of goodwill from the business. Give Journal entries.

Answer:

Journal Entries

Note: The above last two entries may be combined.

Question 15.

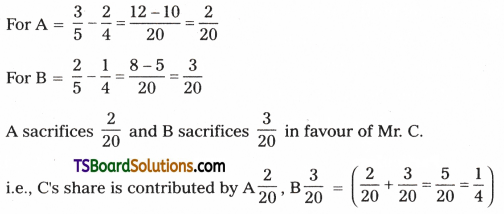

A & B are partners sharing profits and losses in the ratio of 3: 2 respectively. They admitted C into partnership for l/4th share in profits foFwhich Mr. C brings inRs. 30,000 towards his share of goodwill. The old partners withdrew half of their share of goodwill from the business. Here after, they share profits and losses in the ratio of 2:1:1 among A, B and C respectively . Give journal entries.

Answer:

Calculation of Ratio of sacrifice.

Ratio of sacrifice = Old profit sharing ratio – New profit sharing ratio.

Therefore, goodwill brought in by new partner shared by A and B in their respective share of sacrifice ratio i.e., 2: 3.

Journal Entries

Question 16.

P and Q are partners sharing profits and losses in the ratio of 2: 1. They admitted Mr. R into partnership for 1/5th share in future profits. For the purpose of admission, the value of goodwill agreed at Rs. 60.000. Give Journal entries.

Answer:

Note: When goodwill is created, the value of goodwill appears on assets side of the balance sheet of new firm.

Question 17.

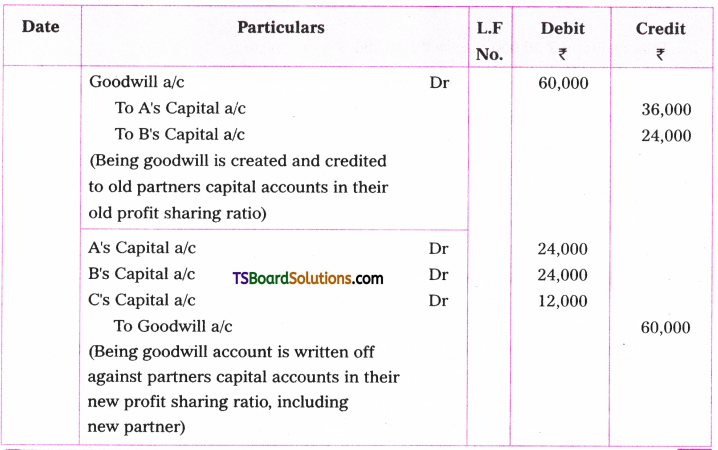

A and B are partners sharing profits and losses in the ratio of 3: 2. They decided to admit Mr. C into partnership for 1/5 share in the profit. Mr. C is unable to bring goodwill in cash, it is decided to create goodwill and writeoff immediately. The new profit sharing ratio of A, B and C is 2: 2: 1 respectively. The value of goodwill is Rs. 60,000. Give necessary Journal entries.

Answer:

Journal Entries

Question 18.

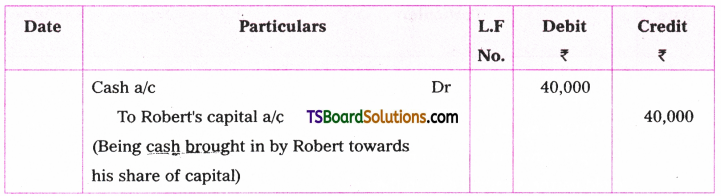

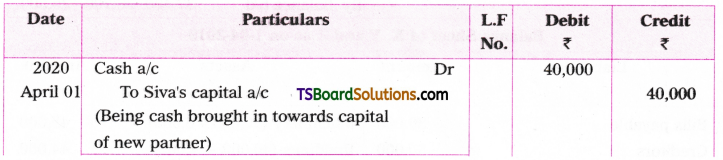

Ram and Rahim are partners sharing profits and losses in the ratio of 2: 1 respectively. They admitted Robert as a new partner for 1/4th share in profit. He brings in Rs. 40,000 towards his capital. Give Journal entry.

Answer:

Journal Entry

Question 19.

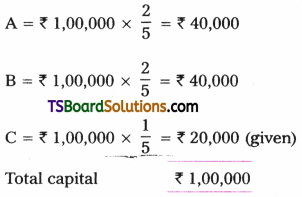

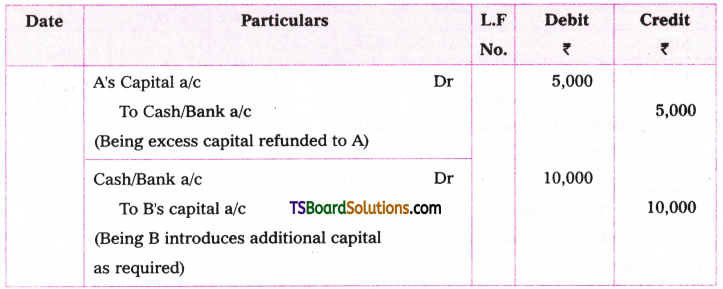

A and B are partners sharing profits and losses in the ratio of 3: 2 respectively. They admitted Mr. C into partnership for 1/5th share in profits, for which he has to contributeRs. 20,000 for his share of capital. The capital accounts of A and B stood atRs. 45,000 andRs. 30,000 respectively on that date. As per the partnership agreement, the partners capital is to be adjusted in accordance with their new profit sharing ratio. The new profit sharing ratio of A, B and C is 2: 2: 1 respectively. Excess or deficiency of capital of old partners be adjusted in cash. Give Journal entries.

Answer:

Calculation of total capital of the firm:

For C’s 1/5 share of profit, the capital is Rs. 20,000

Total capital =Rs. 20,000 x 5/1 =Rs. 1,00,000

This total capitals is to be contributed by all the partners in their new profit sharing ratio. Capital to be contributed by:

A’s capital balance is Rs. 45,000, but he has to contribute Rs. 40,000 towards capital. So he is having excess capital of Rs. 5,000. So Rs. 5,000 to be returned to A.

Incase of B capital to be contributed is Rs. 40,000, but his capital a/c balance is Rs. 30,000. He has to bring into business Rs. 10,000 in cash.

The entries are:

Journal Entries

Now, the following illustrations help in understanding accounting treatment of all issues/ transactions pertaining to admission of a new partner;

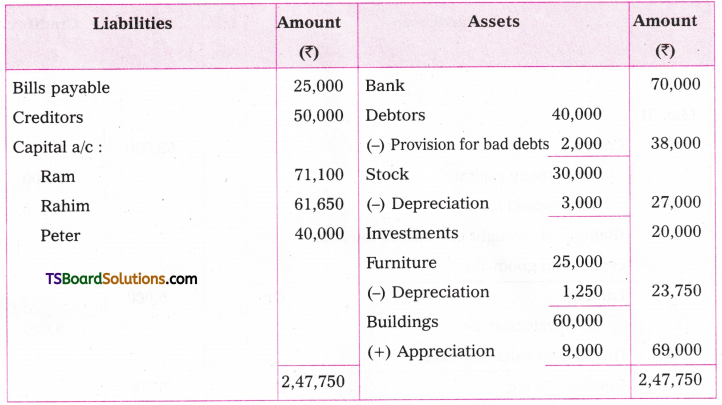

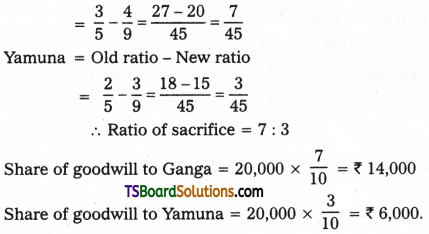

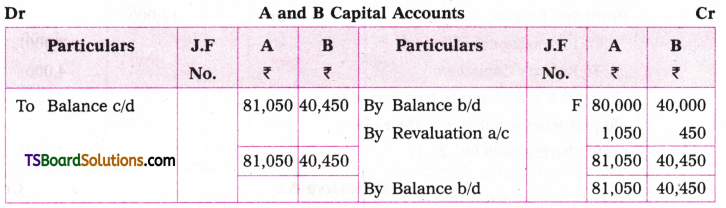

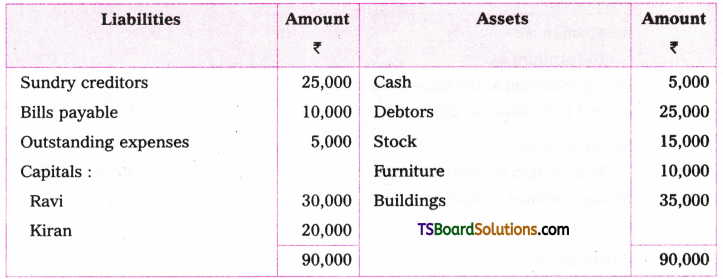

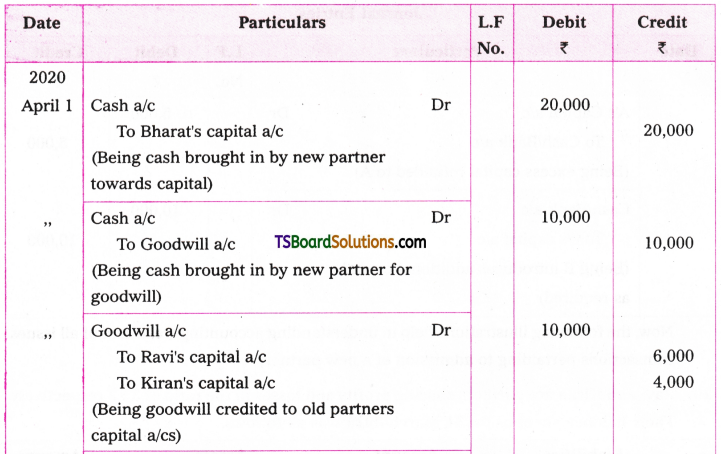

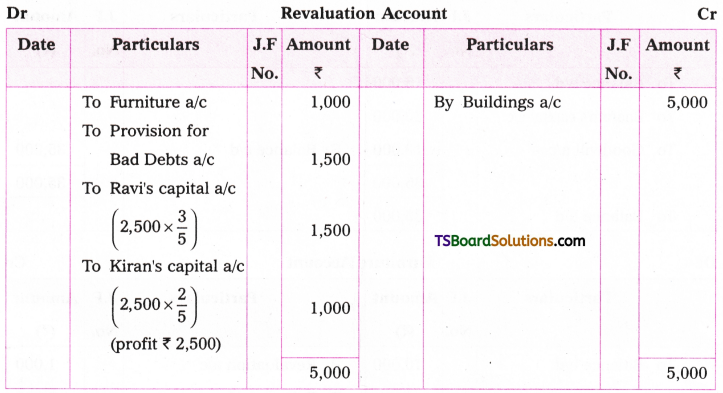

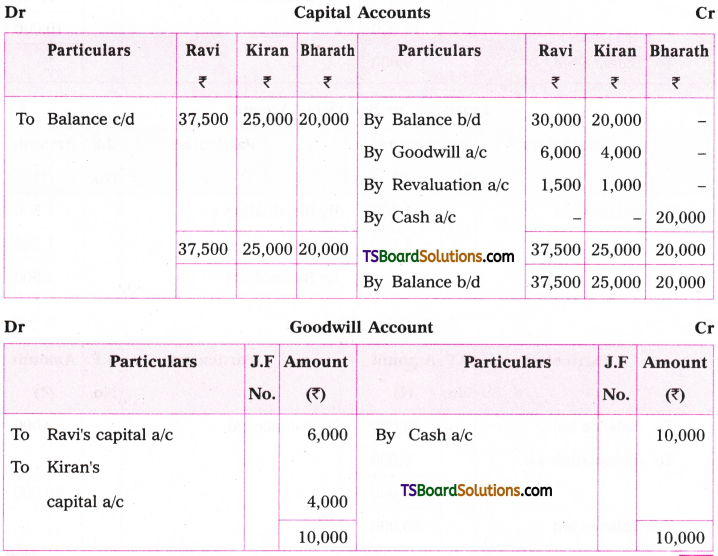

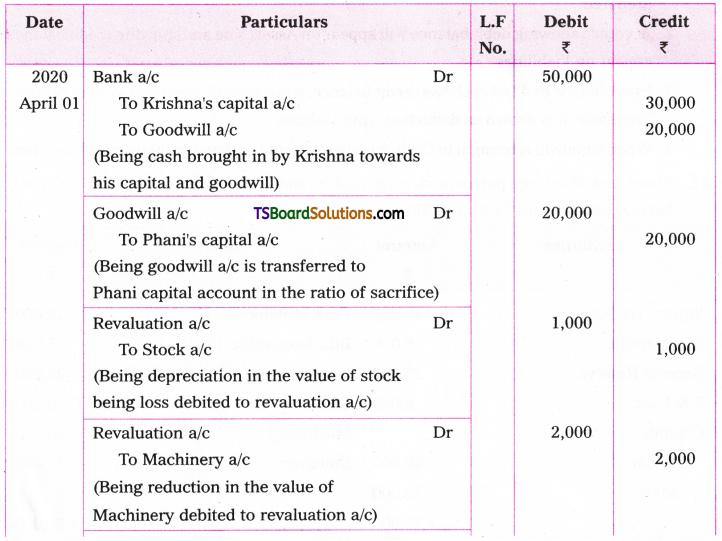

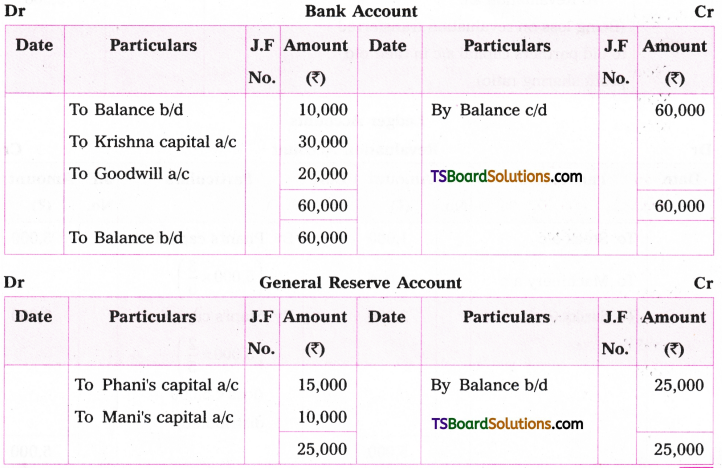

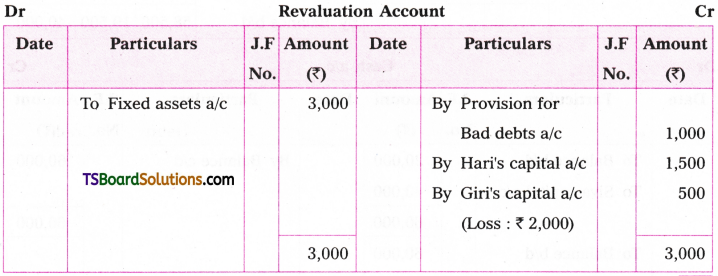

Question 20.

Ravi and Kiran are partners sharing profits and losses in the ratio of 3: 2 respectively. Their balance sheet as on 31 March 2020 was as follows.

On 1st April 2020, they decided to admit Mr. Bharath for 1/5th share in profits. The terms of admission are:

(a) He has to bring Rs. 20,000 towards capital and Rs. 10,000 towards goodwill in cash.

(b) Furniture is to be depreciated by Rs. 1,000.

(c) Create a provision on Rs. 1,500 for Bad Debts on Debtors.

(d) Appreciate the value of Buildings by Rs. 5,000.

Give necessary Journal entries, ledger accounts and opening balance sheet of new firm.

Answer:

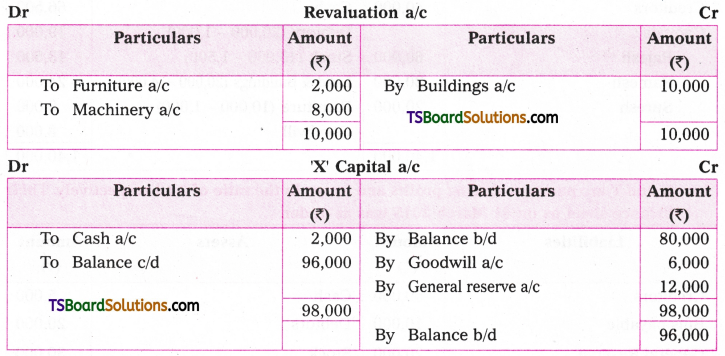

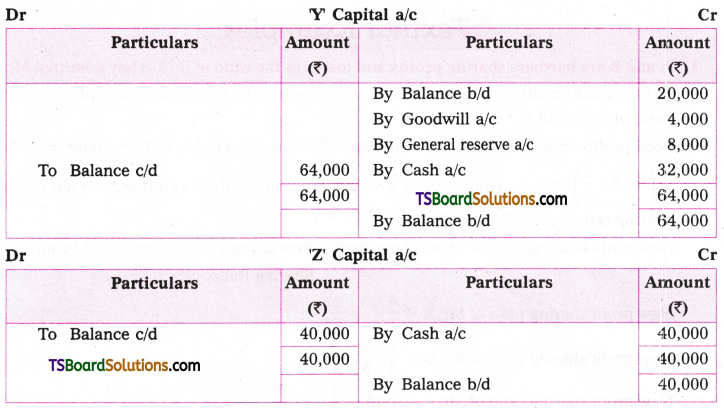

Journal Entries

Ledger Accounts:

Balance Sheet of Ravi, Kiran and Bharath as on 1st April 2015

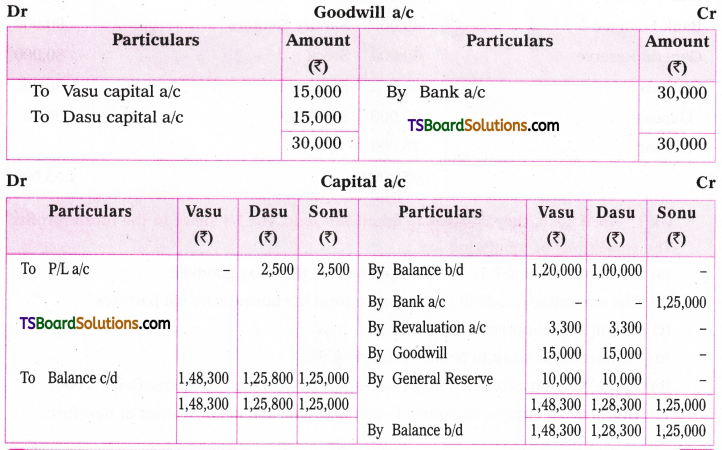

Note:

- We have to prepare all the accounts which are being effected. However, we cannot prepare all the accounts due to time factor, but important ledger accounts are to be prepared.

- Accounts showing debit balance will appear on Assets side and showing credit balance appear on Liabilities side.

- Provision for Bad Debts shows credit balance, it is a specific provision against debtors. Therefore, it is shown as deduction from Debtors.

- When Goodwill is brought in Cash, it is shared by old partners in their ratio of sacrifice.

![]()

Question 21.

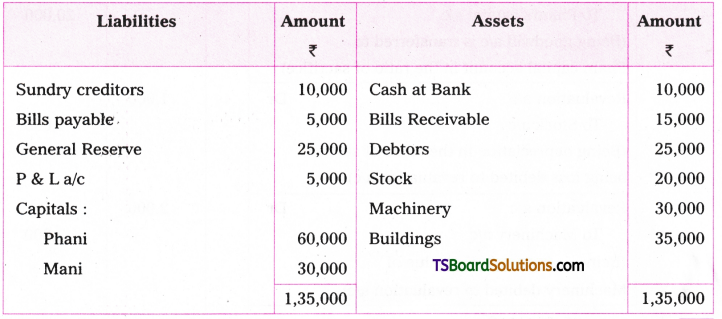

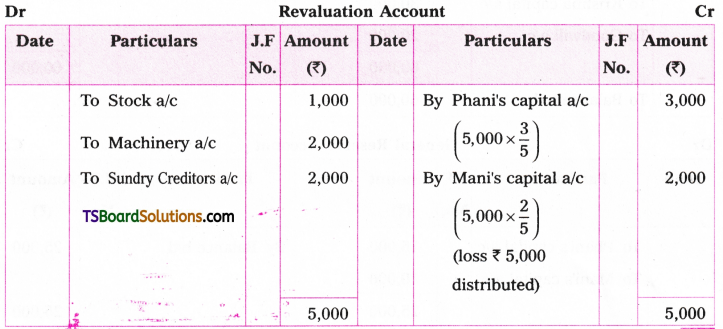

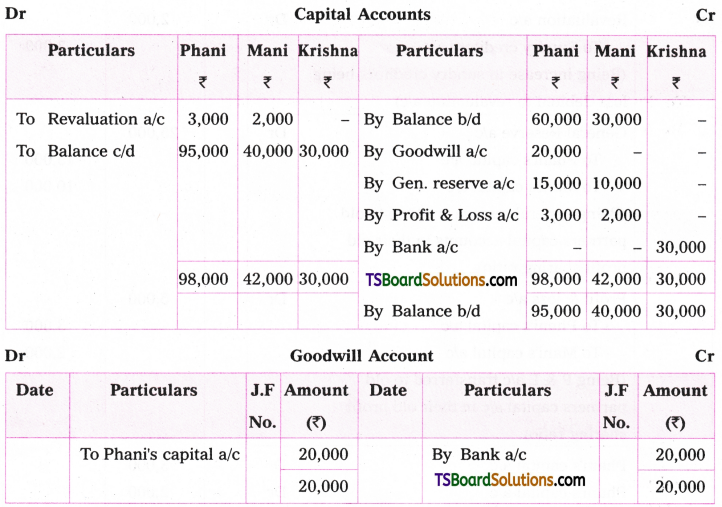

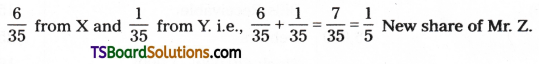

Phani and Mani are partners sharing profits and losses in the ratio of 3: 2. Their balance sheet as on 31 March 2020 is as under.

On 1st April 2020 Mr. Krishna is admitted into the partnership for 1/5th share in profits. The terms and conditions are

(a) Krishna has to bring Rs. 30,000 towards capital andRs. 20,000 for his share of goodwill.

(b) Stock to be depreciated by 5%.

(c) Machinery to be reduced to Rs. 28,000.

(d) Sundry creditors increased by Rs. 2,000.

The new profit-sharing ratio of A, B and C in the new firm is 2: 2: 1 respectively.

Give necessary Journal entries and Ledger accounts and opening Balance sheet.

Answer:

Calculation of Ratio of sacrifice.

Ratio of sacrifice = Old profit sharing ratio – New profit sharing ratio.

On admission of Mr. Krishna as a new partner, Phani alone losing/sacrificing, hence the entire amount brought in by Krishna for goodwill to be given to Phani only.

Journal Entries

Ledger Accounts

Balance Sheet of Phani, Mani and Krishna as on 1st April 2020

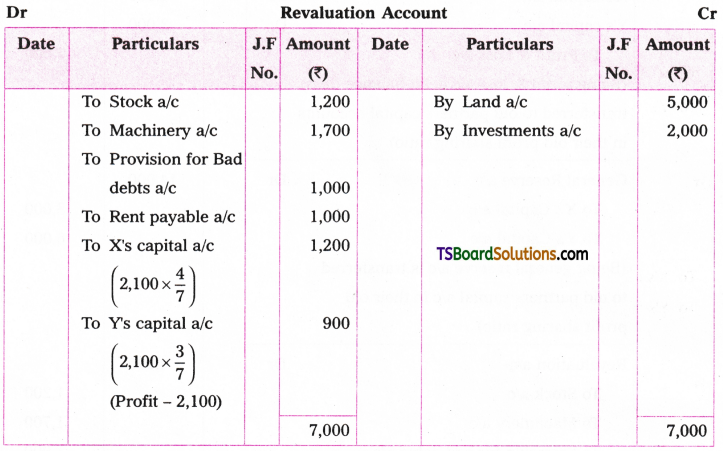

Question 22.

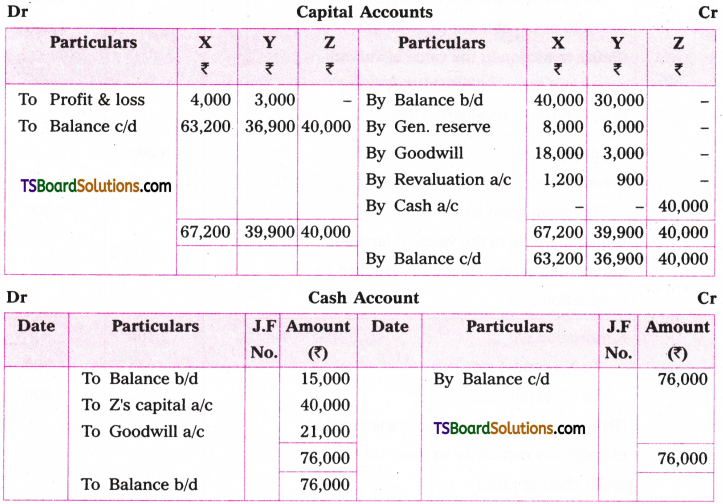

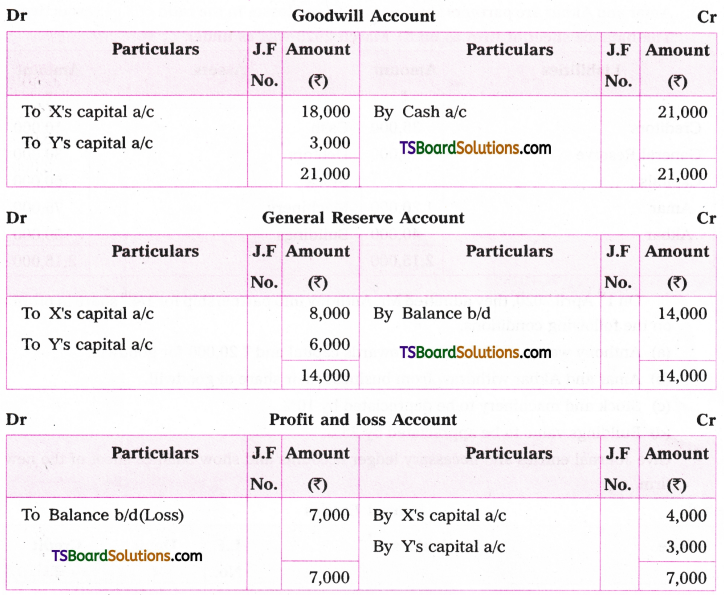

X and Y are partners sharing profits and losses in the ratio of 4: 3. Their balance sheet as on 31 March 2020 stood as follows.

On 1st April 2020 Mr. Z is admitted into partnership for 1/5th share in future profits on the following terms.

(a) He has to bring Rs. 40,000 as capital Rs. 21,000 for goodwill.

(b) Stock to be reduced by 10% and machinery by Rs. 1,700.

(c) Create a provision for Bad Debts @ 5% on Debtors.

(d) There is an unrecorded liability in respect of rent due Rs. 1,000 and an unrecorded investments (asset) of Rs. 2,000. Both are to be brought into Books.

(e) Land is valued at Rs. 25,000.

(f) New profit sharing ratio of X, Y and Z will be 2: 2: 1 respectively.

Give necessary Journal entries and Ledger accounts and the opening balance sheet of new firm.

Answer:

Calculation of Ratio of sacrifice:

Ratio of sacrifice = Old profit sharing ratio – New profit sharing ratio.

The ratio of sacrifice of X and Y is 6: 1. Goodwill is to be distributed accordingly. Z gets

Journal Entries

Ledger Accounts:

Balance Sheet of X, Y and Z as on April 2020

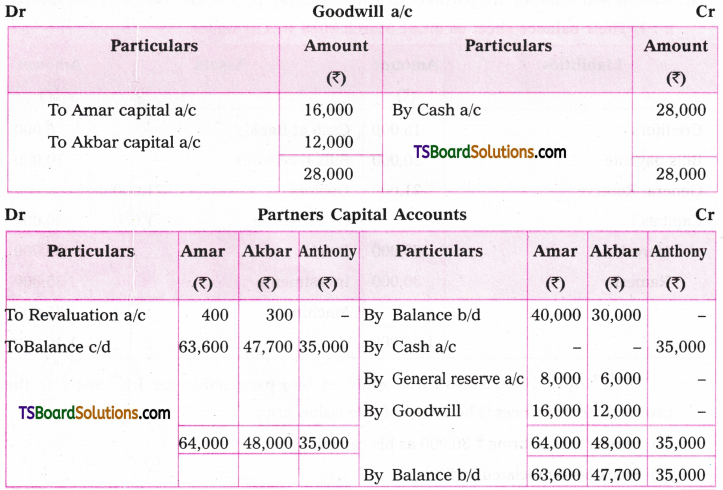

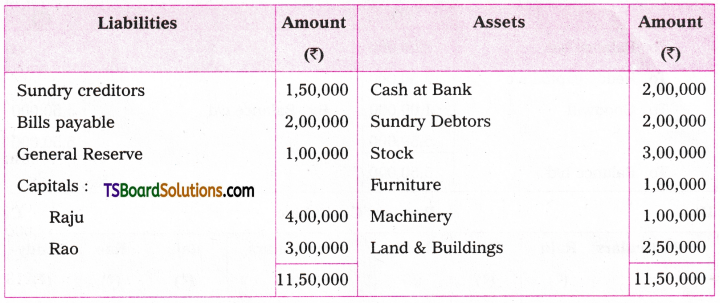

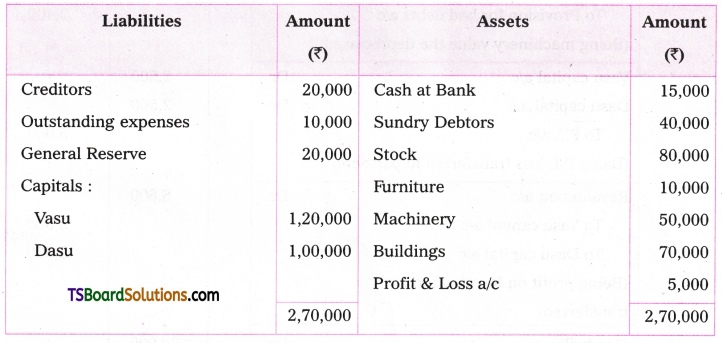

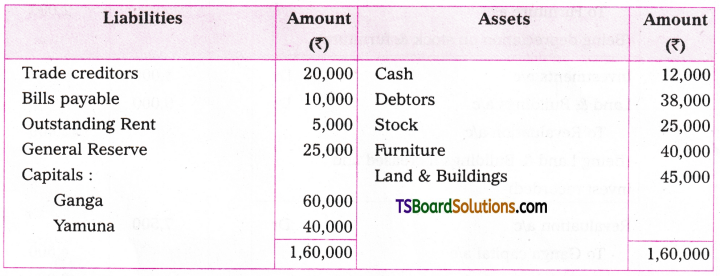

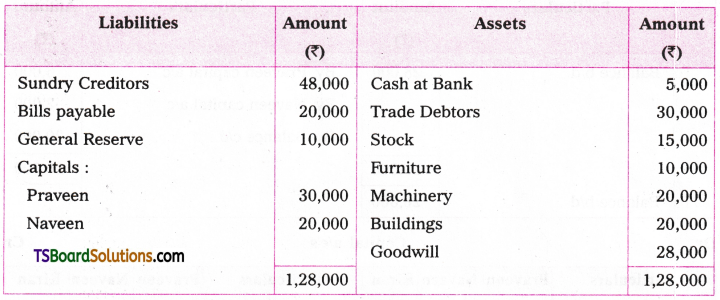

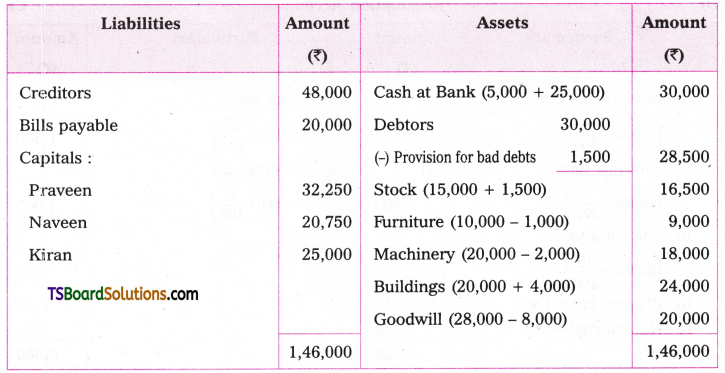

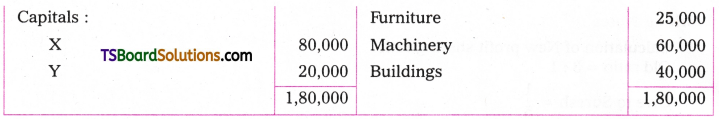

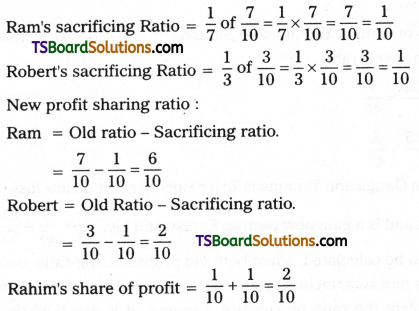

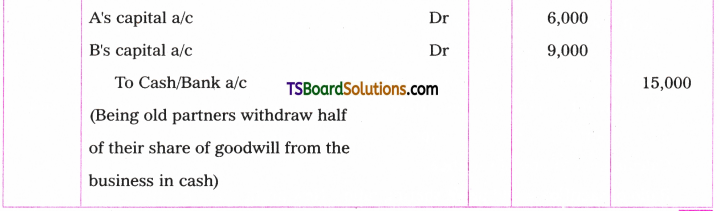

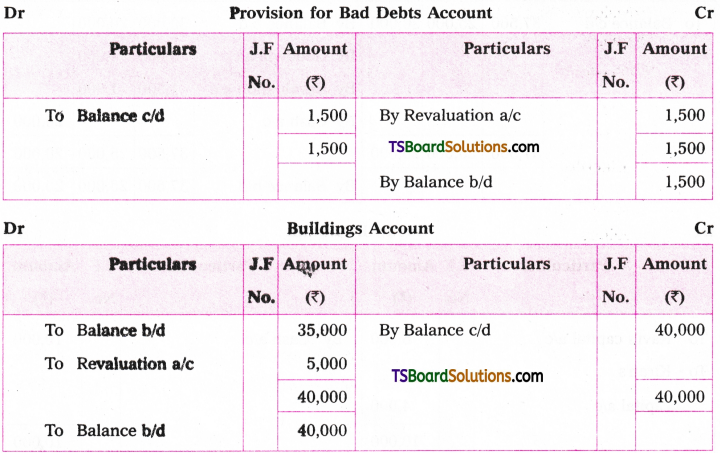

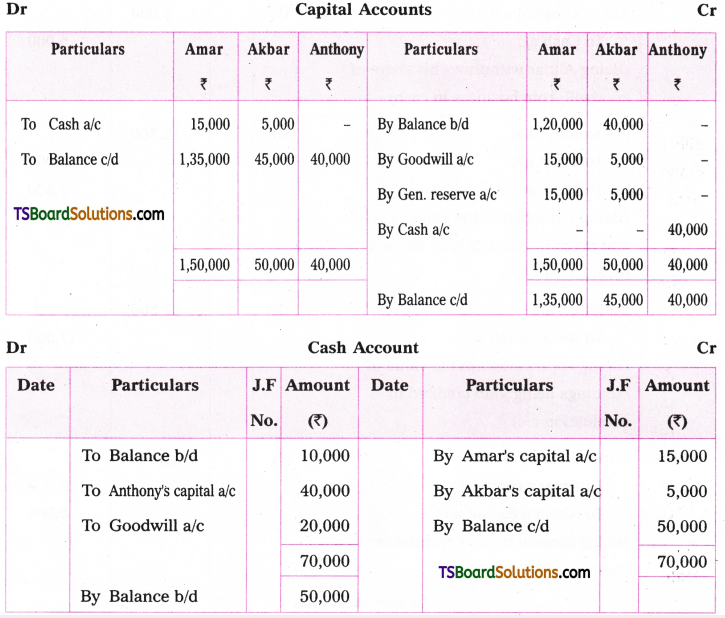

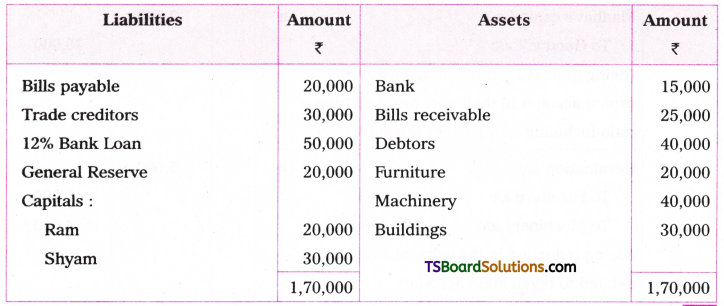

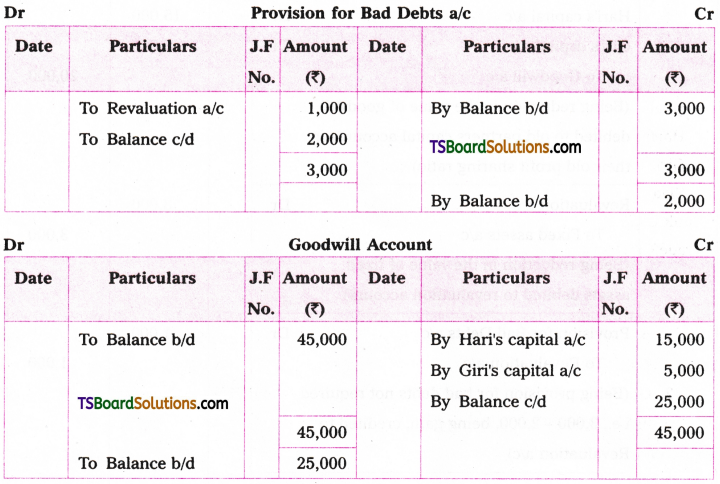

Question 23.

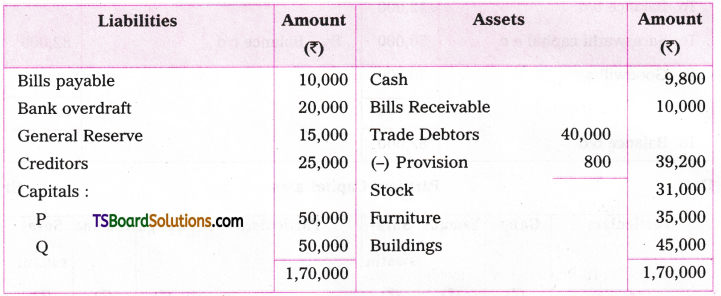

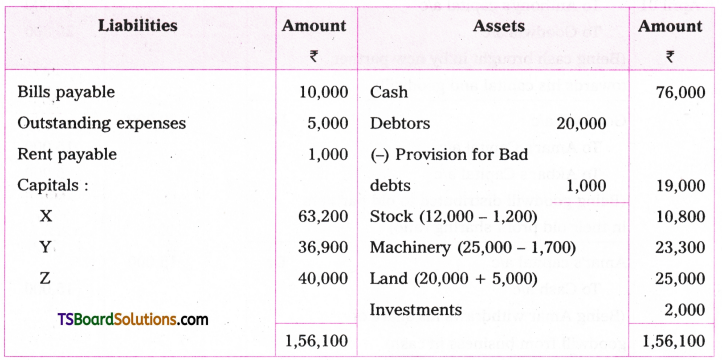

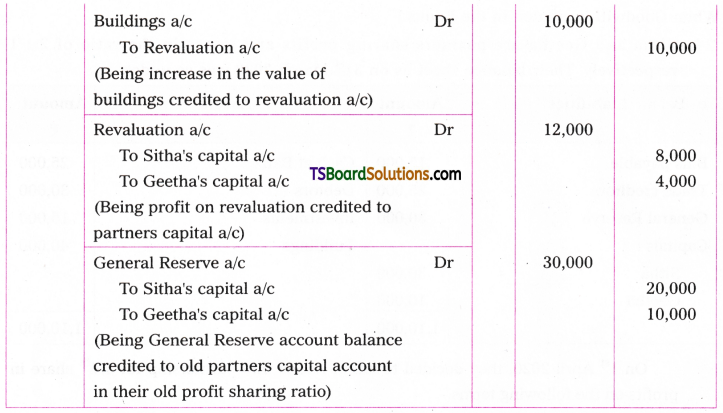

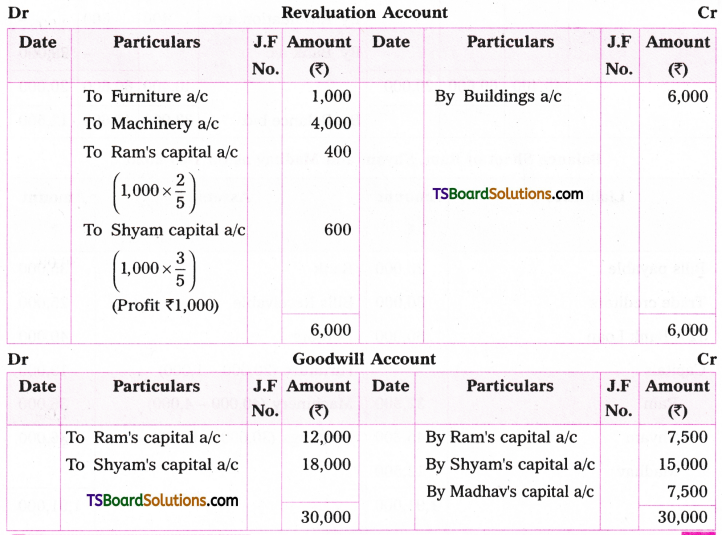

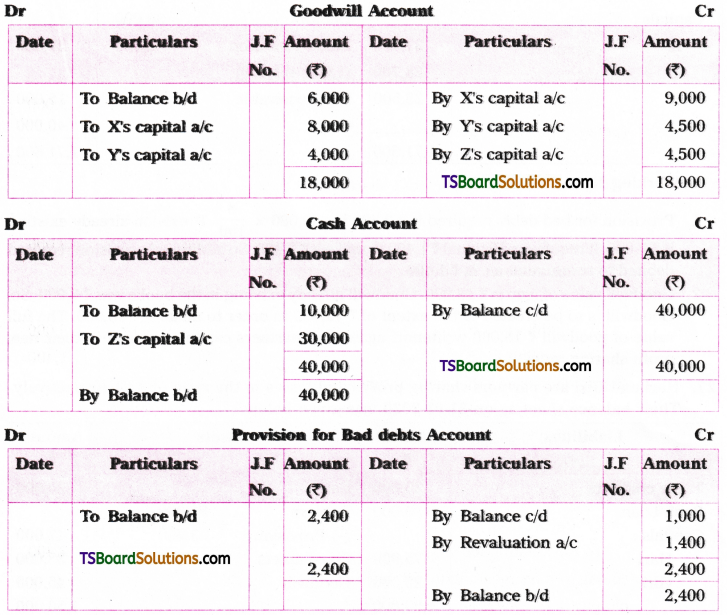

Amar and Akbar are partners sharing profits and losses in the ratio of 3:1 respectively. The balance sheet of firm as on 31 March 2020 was as under.

On 1st April 2020, they admitted Mr. Anthony into partnership for 1/4th share in profits on the following conditions.

(a) Anthony was to bring Rs. 40,000 towards capital and Rs. 20,000 for goodwill.

(b) Amar and Akbar withdraw from business their share of goodwill.

(c) Stock and machinery to be depreciated by 10%.

(d) Buildings value to be appreciated by 25%.

Give Journal entries and necessary ledger accounts and show balance sheet of the new firm.

Answer:

Journal Entries

Ledger Accounts

Balance Sheet of Amar, Akbar and Anthony as on 1-4-2020

![]()

When Goodwill is created in the Books:

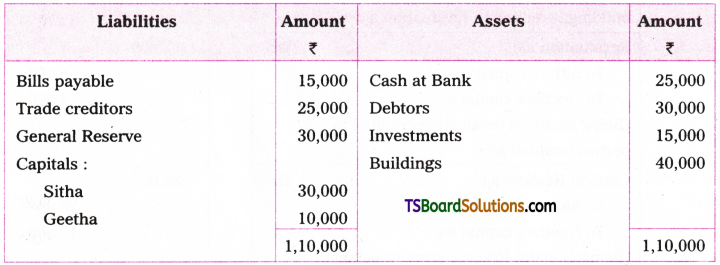

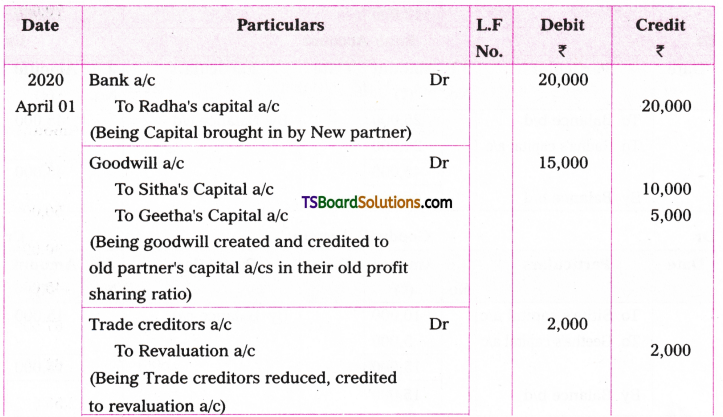

Question 24.

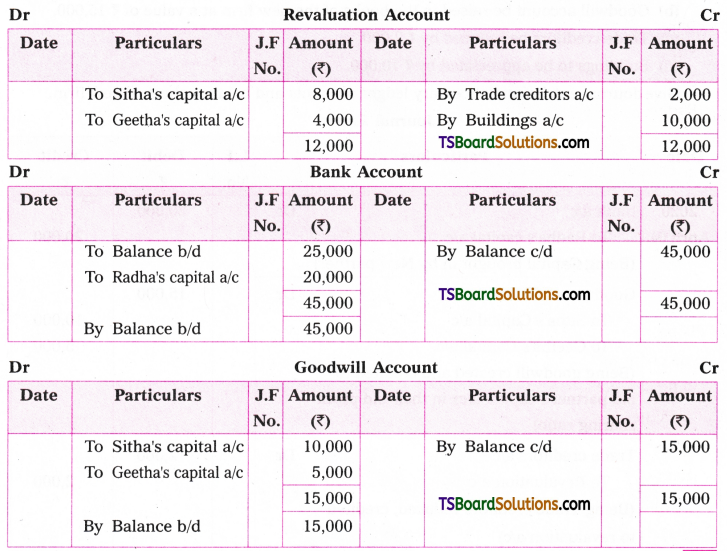

Sitha and Geetha are partners sharing profits and losses in the ratio of 2: 1 respectively. Their balance sheet as on 31st March 2020 was as under.

On 1st April 2020, they decided to admit Radha into partnership for 1/4th share in profits on the following terms.

(a) Radha should bring Rs. 20,000 towards capital.

(b) Goodwill account be raised in the books of the new firm at a value of Rs. 15,000.

(c) Trade creditors be reduced by Rs. 2,000.

(d) Buildings to be appreciated by Rs. 10,000.

Give Journal entries and necessary ledger accounts and balance sheet of new firm.

Answer:

Journal Entries

Ledger Accounts

Balance Sheet of Sitha, Geetha and Radha as on 1-4-2020

When Goodwill account created and writtenoff:

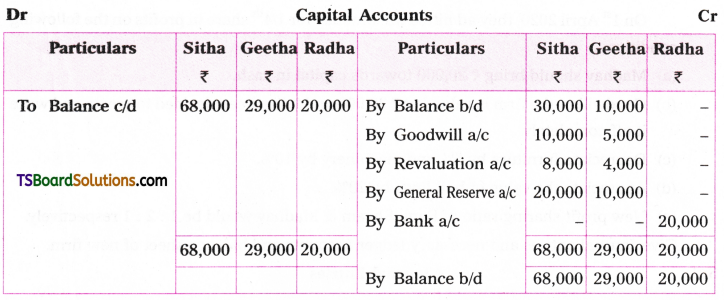

Question 25.

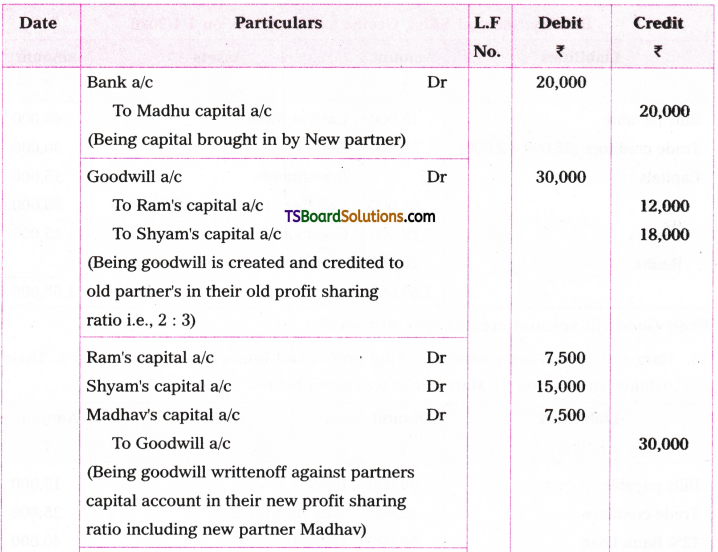

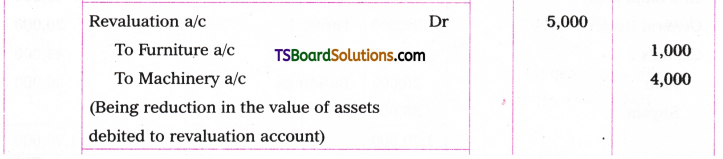

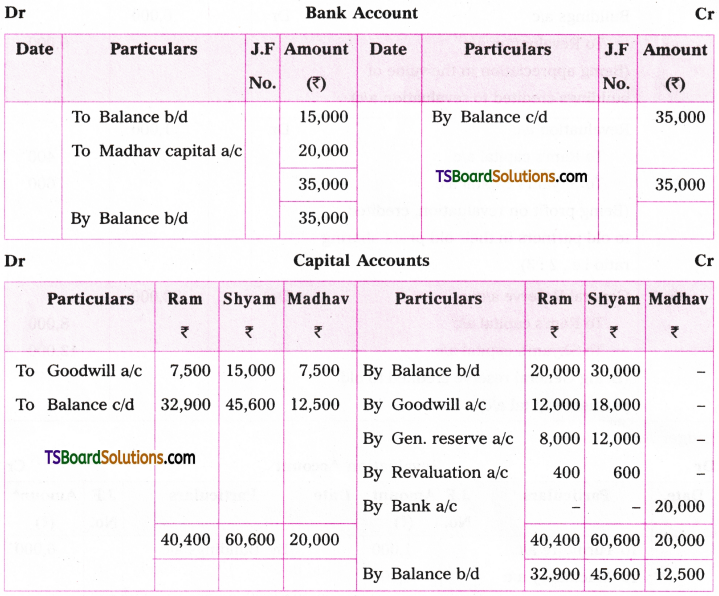

Ram and Shyam are partners sharing profits and losses in the ratio of 2: 3. Their balance sheet as on 31 March 2020 was given below.

On 1st April 2020, they admitted Mr. Madhav for 1/4th share in profits on the following conditions.

(a) Madhav should bring Rs. 20,000 towards capital in cash.

(b) Goodwill of the firm is valued atRs. 30,000 and it has been decided to create and write it off completely.

(c) Depreciate furniture by 5% and machinery by 10%.

(d) Appreciate the value of buildings by 20%.

(e) New profit-sharing ratio of Ram, Shyam & Madhav would be 1: 2: 1 respectively. Give Journal entries and necessary ledger accounts and balance sheet of new firm.

Answer:

Journal Entries

Ledger Accounts:

Balance Sheet of Ram, Shyam and Madhav as on 1-04-2020

When Goodwill is already existing in the books:

Question 26.

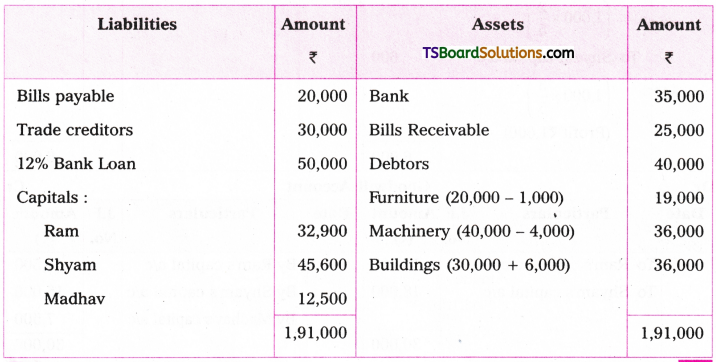

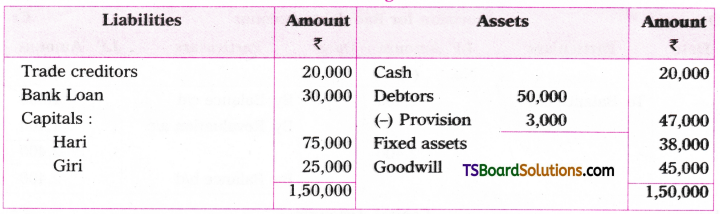

X and Y are partners sharing profits and losses in the ratio of 2: 1 respectively. Their balance sheet as on 31 March 2019 was given below.

On 1st April 2019, they decided to admit Mr. Z into partnership for 1/4th share in future profits on the following conditions.

(a) Z should bring Rs. 30,000 towards his capital.

(b) Goodwill of the firm is valued at Rs. 18,000 and decided to write it off immediately.

(c) Buildings to be appreciated by 10%.

(d) Create a provision for bad debts @ 8% on Debtors.

(e) Depreciate machinery by Rs. 5,000.

(f) New profit sharing ratio of X, Y and Z would be 2: 1: 1 respectively in the new firm. Give Journal entries and necessary ledger accounts and balance sheet of new firm.

Answer:

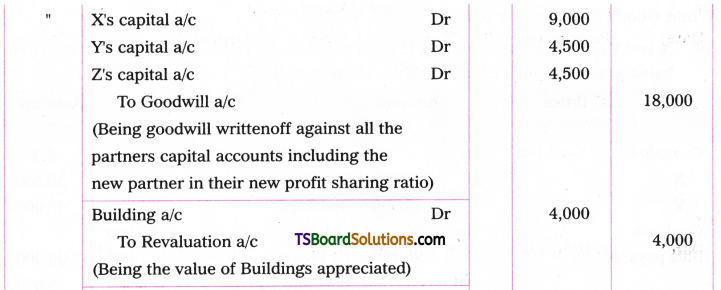

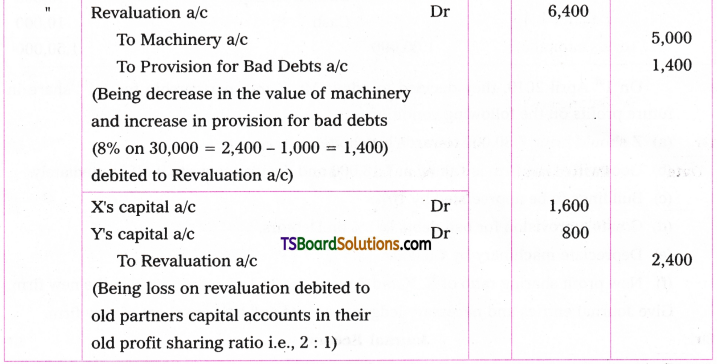

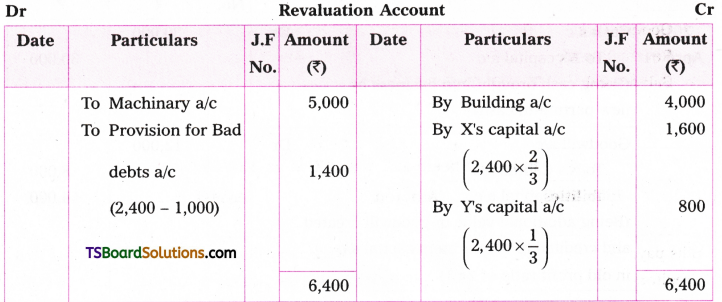

Journal Entries

Ledger Accounts:

Working Notes:

1. Provision for bad debts required isRs. 2,400 ie., 30,000 x 8/100. Provision already existing is Rs. 1,000. It requires additional Rs. 1,400 to make it Rs. 2,400. So additional provision required debited to revaluation a/c is Rs. 1,400.

2. Goodwill value of firm is Rs. 18,000. Goodwill already existing in the books was Rs. 6,000. So, Goodwill is to be created to the extent of Rs. 12,000 in order to make it Rs. 18,000. Hie full value of goodwill Rs. 18,000 writtenoff against all partners capital accounts in their new profit sharing ratio.

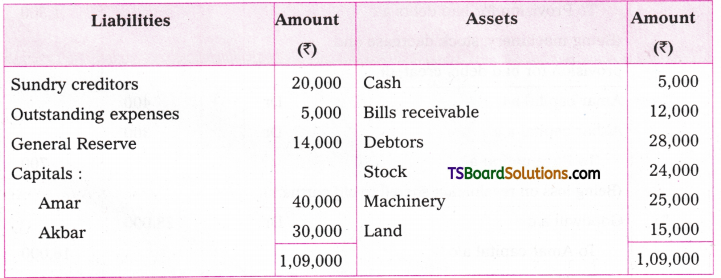

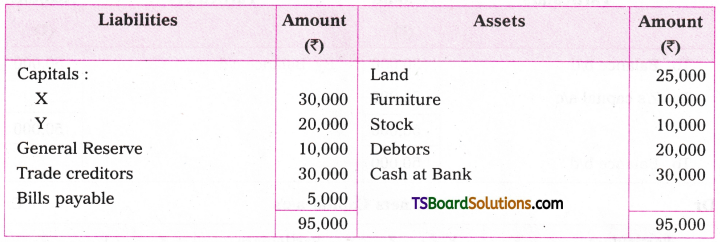

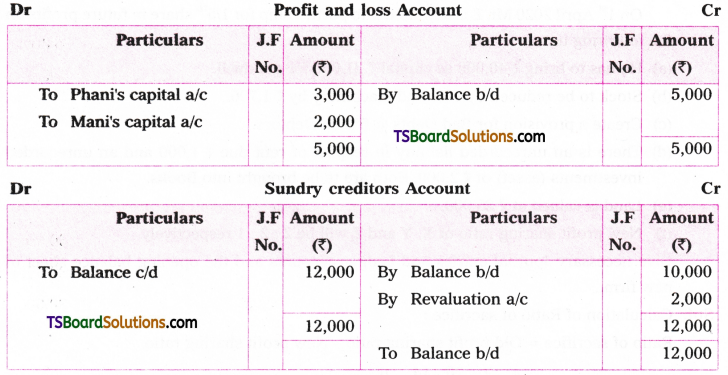

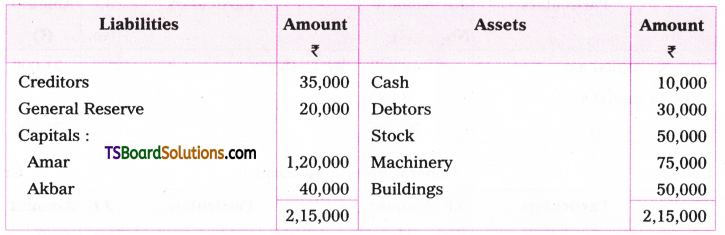

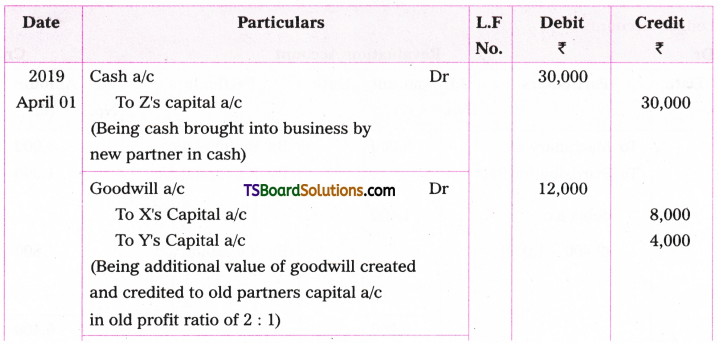

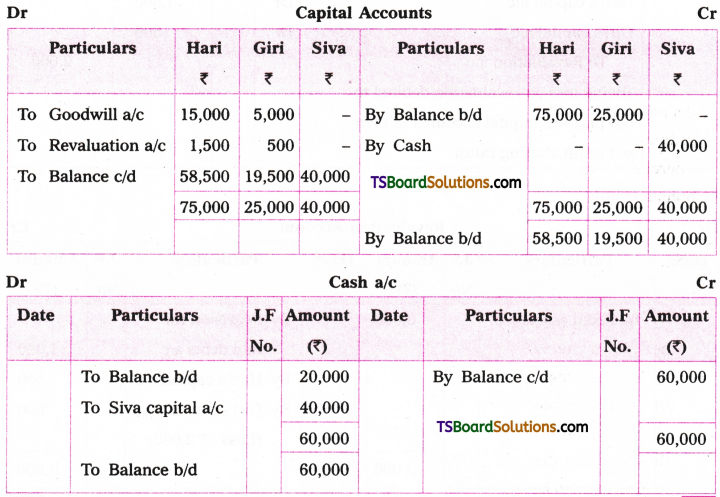

Question 27.

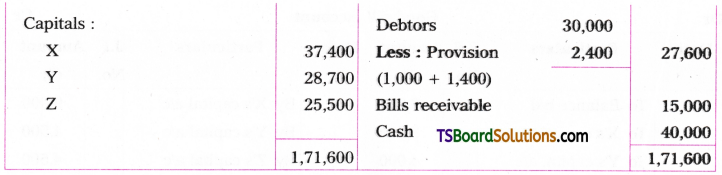

Hari and Giri are partners sharing profits and losses in the ratio of 3: 1 respectively. Their balance sheet as on 31-03-2020 was given below.

On 1st April 2015 Mr. Siva is admitted for 2/5th share in profits. The terms of admission are:

(a) Siva should bring Rs. 40,000 towards capital.

(b) Fixed assets are valued at Rs. 35,000.

(c) Goodwill of the firm valued at Rs. 25,000.

(d) Provision for bad debts required is Rs. 2,000.

Give Journal entries, Ledger accounts and opening balance sheet.

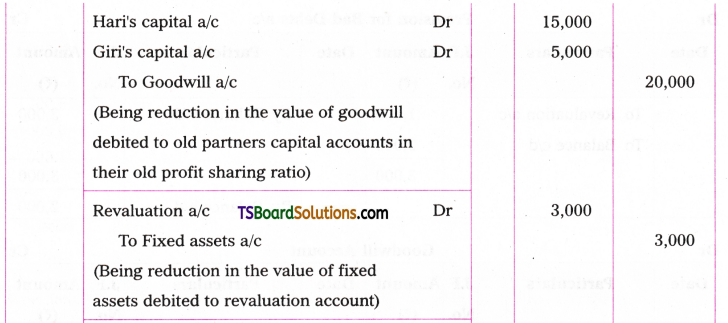

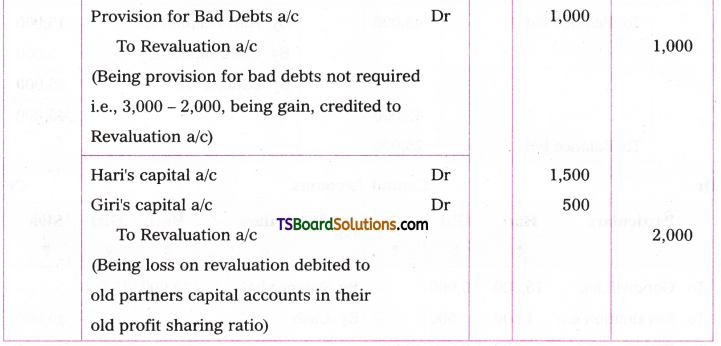

Answer:

Journal Entries

Ledger Accounts:

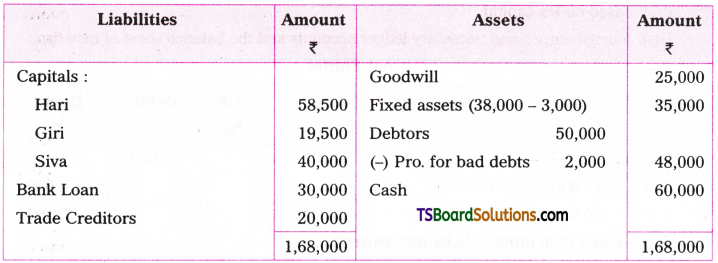

Balance Sheet of Hari, Giri and Siva as on 1-04-2020

Working Notes:

1. Provision for bad debts required isRs. 2,000, but the provision existing is Rs. 3,000, so, Rs. 1,000 is in excess, credited to revaluation.

2. Goodwill value reduced by Rs. 20,000 (45,000 – 25,000) debited to old partners capital a/cs in their old profits sharing ratio.

![]()

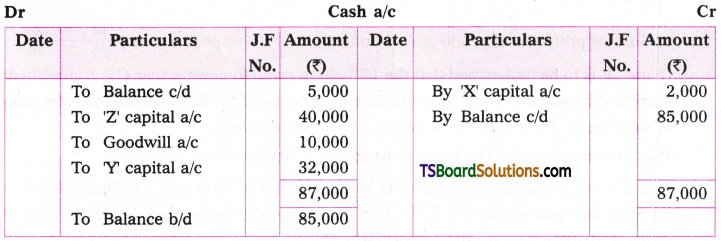

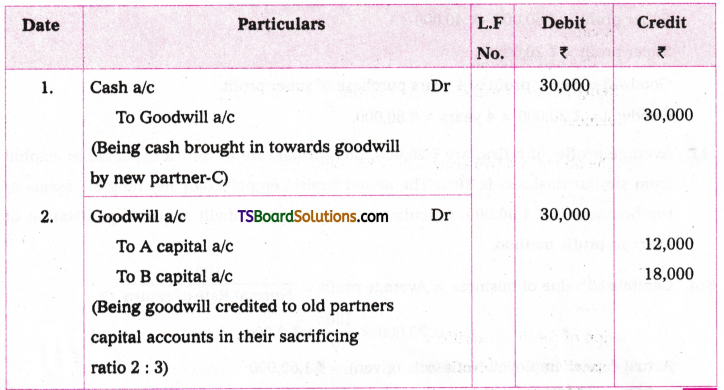

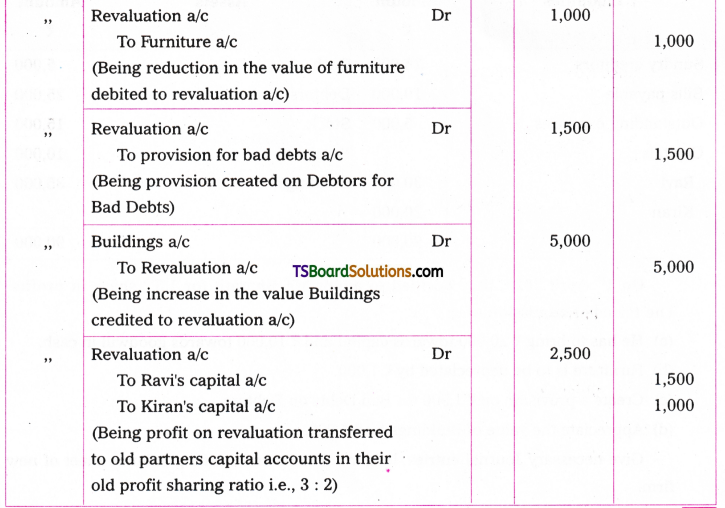

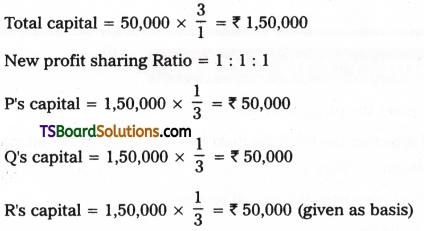

Adjustment of capitals based on New Profit sharing Ratio:

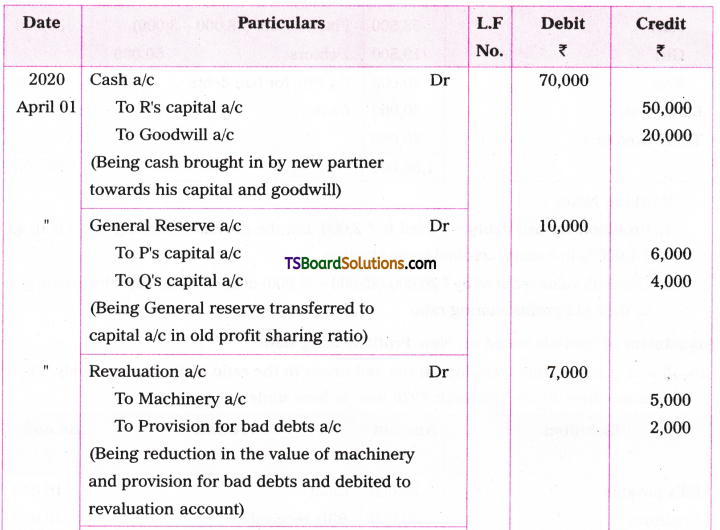

Question 28.

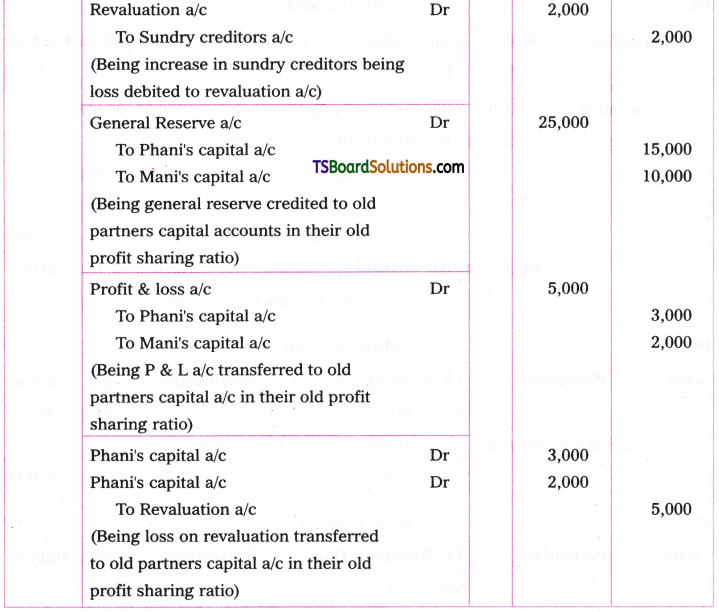

P and Q are partners sharing profits and losses in the ratio of 3: 2 respectively. Their balance sheet as on 31 March 2020 was as here under.

On 1st April 2020, Mr. R is admitted into partnership 1/3rd share in future profits on the following terms.

(a) R shall bring Rs. 50,000 towards capital andRs. 20,000 towards goodwill in cash.

(b) Depreciate machinery by t 5,000.

(c) Provide for bad debts @ 5% on Debtors.

(d) Appreciate the value of Buildings by 20%.

(e) Creditors to be reduced by Rs. 2,000.

P, Q and R will share the profits and losses equally. P and Q capitals are to be adjusted in cash based on R’s capital.

Give Journal entries and necessary ledger accounts and the balance sheet of new firm.

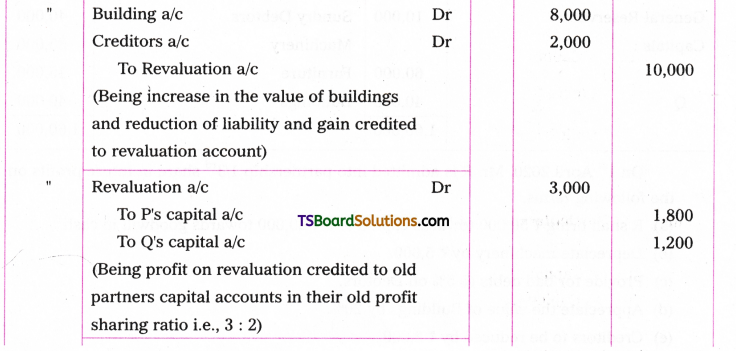

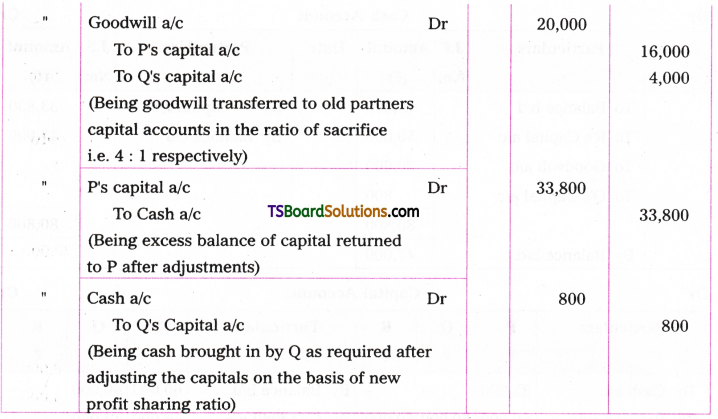

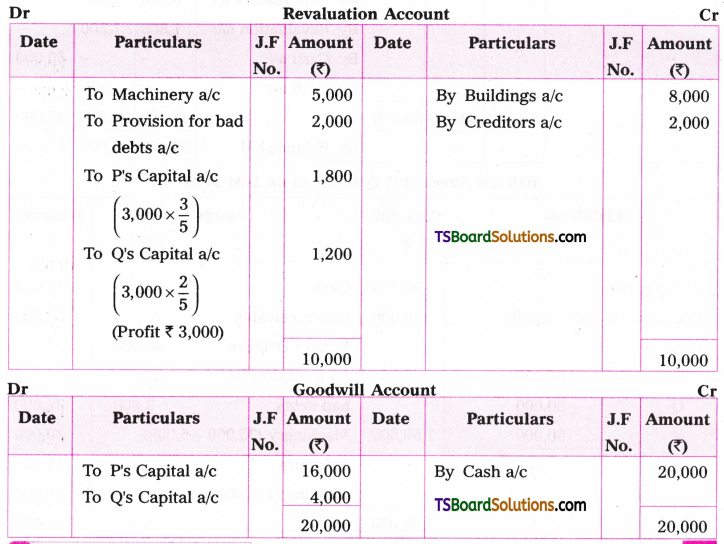

Answer:

Journal Entries

Ledger Accounts:

Balance Sheet of P, Q and R as on 1-04-2020

Working Notes:

1. Calculation of Ratio of sacrifice:

Ratio of sacrifice = Old Ratio – New Ratio

Ratio of sacrifice = 4:1

So, goodwill Rs. 20,000 transferred to P & Q’s capital accounts in their ratio of sacrifice.

2. Ascertainment of total capital of the firm:

For 1/3 share of profit capital =Rs. 50,000

P’s capital balance is Rs. 83,800 and required to contribute Rs. 50,000. He is having excess capital, so refunded Rs. 33,800 (83,800 – 50,000).

Q’s capital balance after all adjustments is Rs. 49,200 his share of capital for 1/3 share of profit is 7 50,000. There is a shortage Rs. 800 (50,000 – 49,200). So, he brings cash 7 800 to make his capital equal to Rs. 50,000.